Cold Milling Machine Market By Type(Crawler, Wheel, Small Cold Milling Machine, Medium Cold Milling Machine, Large Cold Milling Machine), By Milling Width:(Below 2ft, 2ft - 5ft, Above 5ft), By Engine Power:(Low, Medium, High), By Application:(Concrete Pavement, Asphalt Pavement) By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

43151

-

Jan 2024

-

176

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Driving Factors

- Restraining Factors

- Cold Milling Machine Market Segmentation Analysis

- Cold Milling Machine Industry Segments

- Growth Opportunities

- Cold Milling Machine Market Regional Analysis

- Cold Milling Machine Industry By Region

- Cold Milling Machine Market Key Player Analysis

- Cold Milling Machine Market Key Players

- Recent Development

- Report Scope

Report Overview

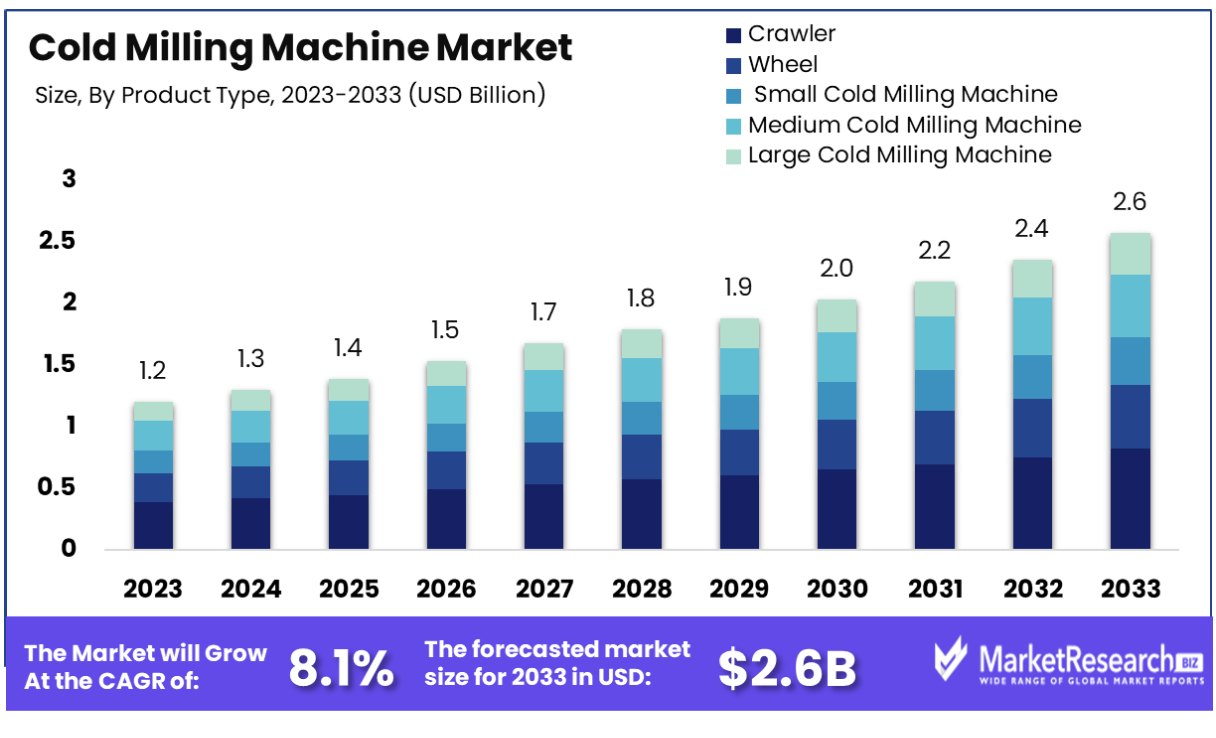

The cold milling machine market was valued at USD 1.2 billion in 2023. It is expected to reach USD 2.6 billion by 2033, with a CAGR of 8.11% during the forecast period from 2024 to 2033.

The surge in demand for road and infrastructure construction is one of the main driving factors for the cold milling market expansion. Millings are the most commonly used recycling techniques which are well-analyzed.

Cold milling methods are also used for material recycling in the road construction process. Milled road construction works have to be scoured up and reused in asphalt and concrete highway construction works. By applying such methods, cold milling methods can build a level basis with the detailed width and depth that is needed for making the new surface covers of uniform thickness. When the roads are milled in layers, the milled products can be removed distinctly and selectively recovered.

In the coming five decades, there will be a rise in spurts of cold milling products related to recycling products in India. Cold millings involve the controlled removal of top layers from an asphalt road to reach the WMM layer beneath. Furthermore, it also supports evening out several hurdles and offers a smooth road to repave, which makes a good quality riding surface for the vehicles. Milling equipment is used for the heavy-duty piece of equipment that will help pavement gradually removed from the surface. Cold milling machines offer many benefits, including the removal of products required in road construction.

The recycling of the resources removes the greenhouse gasses from the construction of these resources which can be 50-60% higher. It also saves up to 60% in the HMA plant and 100% in other methods by developing RAP for the recycling of the present road construction materials. It saves time by safeguarding rails, overpasses, and many more, at the very same height about the roadway by removing the requirement to adjust their heights.

It extends the life of the road pavement constructions by correcting for supporting smooth issues, and damage problems and eliminating some of the big outrageously and traveling. Due to road construction requirements, cold milling will become increasingly essential over the coming years.

Driving Factors

Infrastructure Development Boosts Cold Milling Machine Market

the cold milling machine market is significantly propelled by the growing need for infrastructure development and maintenance, especially in emerging economies. Rapid urbanization and industrialization in these regions demand robust infrastructure, leading to extensive road construction and maintenance projects.

Cold milling machines play a crucial role in these activities, being essential for asphalt and concrete pavement removal. As these economies continue to expand and urbanize, the need for new roads and the refurbishment of existing ones will sustain the demand for cold milling machines. This trend is expected to continue, making these machines indispensable in infrastructure development, thereby ensuring consistent market growth.

Wheeled Cold Milling Machines Gain Popularity

The rising demand for wheeled cold milling machines, driven by road and highway construction activities, is a key growth factor in the market. These machines are preferred for their mobility and ease of transport, making them ideal for projects that require frequent relocation. Their design allows for more efficient pavement milling on various terrains, meeting the diverse needs of road construction projects. As global infrastructure development continues, especially in developing nations, the requirement for versatile and mobile milling solutions like wheeled machines will increase, significantly contributing to market growth.

Technological Innovations Propel Market Evolution

Ongoing technological advancements in cold milling machines, such as the introduction of smaller, more efficient models, are driving the market's growth. These innovations cater to a broader range of applications, from large-scale industrial projects to smaller urban tasks. The development of machines with enhanced performance, lower emissions, and improved operator comfort is making them more attractive to a variety of users. These advancements also allow for more precise and efficient milling, leading to better project outcomes and increased productivity. As technology continues to evolve, these machines will become more capable and versatile, further driving market expansion.

Restraining Factors

High Initial Investment Costs Limit Cold Milling Machine Market Growth

The high initial investment costs associated with the acquisition and operation of cold milling machines represent a significant barrier to market growth. Purchasing these machines requires substantial capital due to their complexity and the advanced technology they incorporate.

Additionally, operational costs, including maintenance, repairs, and fuel, contribute to the total cost of ownership. For many small to medium-sized construction firms or those in emerging markets, these costs can be prohibitive, making it difficult to justify the investment. This financial barrier limits the number of new entrants and can slow the rate of market expansion as potential buyers opt for more affordable alternatives.

Market Maturity and Limited Scope for Innovation Restrain Cold Milling Machine Market

The cold milling machine market is mature, and there is limited scope for new product development, which can restrain market growth. As a well-established industry, many of the technological advancements and efficiencies that could drive growth have already been realized. With fewer opportunities for groundbreaking innovations, manufacturers may find it challenging to differentiate their products and stimulate market demand.

Additionally, the saturation of the market means that most potential buyers already possess or have access to cold milling equipment, reducing the frequency of new purchases. This maturity leads to increased competition over a finite customer base and may result in slower growth rates for the market overall.

Cold Milling Machine Market Segmentation Analysis

By Type:

In the cold milling machine market, Crawler cold milling machines have established themselves as the dominant segment. Their dominance is largely due to the superior stability, traction, and performance they offer, especially on uneven and rough surfaces. Crawler types are preferred for large-scale milling operations due to their ability to handle extensive areas and tougher milling tasks.

While Crawler machines lead the market due to their adaptability and efficiency in diverse conditions, Wheel, Small, Medium, and Large Cold Milling Machines also hold significant positions. Wheel cold milling machines are chosen for their mobility and speed, particularly in urban environments or where quick relocation is needed. Small, Medium, and Large Cold Milling Machines cater to various project sizes, from minor surface corrections to major road rehabilitation works, each with specific advantages depending on the scale and scope of the operation.

By Milling Width:

Cold milling machine market research shows that machines with milling widths below 2ft are prevalent. This size is highly versatile and suitable for a wide range of applications, including surface repairs, minor corrections, and edge work in both urban and rural settings. Its compactness allows for precision work in confined spaces, making it a popular choice for contractors.

While machines with Below 2ft width lead, those with a width of 2ft - 5ft and Above 5ft are also crucial, catering to larger-scale operations. The wider machines are particularly useful for major road works and large surface areas, providing efficiency and speed in completing extensive milling tasks.

By Engine Power:

Market segments for cold milling machines based on engine power include Low, Medium and High. Each caters to different operational needs and scales of work. Low-power machines are suitable for smaller, less demanding projects, while medium and high-power machines are required for more extensive and challenging milling operations.

The choice between low, medium, and high power typically depends on factors such as the milling depth required, the hardness of the material being milled, and the project's overall size.

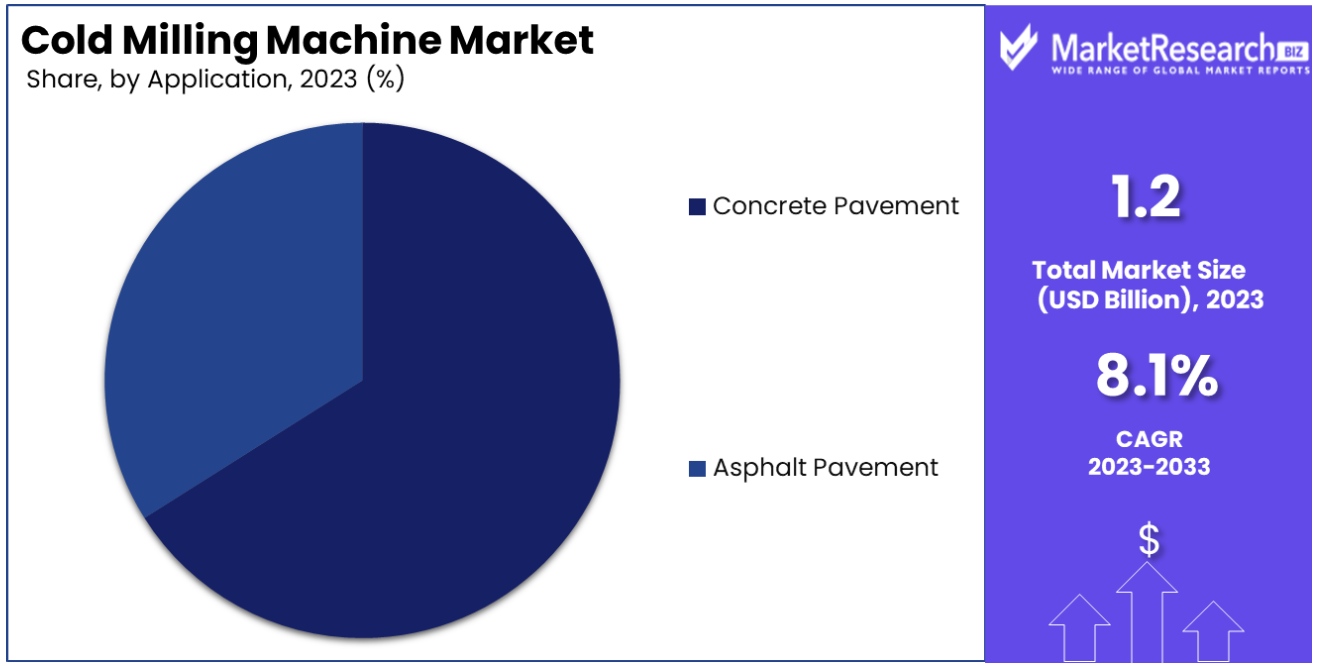

By Application:

Cold milling machines are widely used for milling applications involving concrete pavement and asphalt pavement surfaces, with the former used to remove surface layers for rehabilitation and maintenance purposes; their machines designed specifically to do this are known as Pavement milling.

Concrete Pavement milling involves extracting surfaces to be reused during rehabilitation projects or maintenance operations while Asphalt Pavement milling involves extracting layers from road maintenance projects for road resurfacing; cold milling machines capable of efficient asphalt removal are therefore vital tools in road construction and maintenance projects.

Cold Milling Machine Industry Segments

By Type

- Crawler

- Wheel

- Small Cold Milling Machine

- Medium Cold Milling Machine

- Large Cold Milling Machine

By Milling Width:

- Below 2ft

- 2ft - 5ft

- Above 5ft

By Engine Power:

- Low

- Medium

- High

By Application:

- Concrete Pavement

- Asphalt Pavement

Growth Opportunities

Road Rehabilitation Projects and Technological Advancements Fuel Cold Milling Machine Demand

The rising number of road rehabilitation projects, coupled with technological advancements, is fueling the demand for cold milling machines. As road networks age and their needs for repair and maintenance increase, cold milling machines become ever more essential for efficient pavement removal and surface preparation.

Technological advancements in these machines, such as improved efficiency, precision, and environmental performance, make them more attractive to contractors and governments alike. This trend signifies a growing market driven by the continual need for road refurbishment and the desire for more sophisticated, productive machinery.

Growing Preference for Diverse Cold Milling Machines Enhances Market Dynamics

The global cold milling machine market is witnessing increasing interest from both crawler track and wheeled machines, contributing to market expansion. Their versatility makes them suitable for various applications and conditions - with crawler track machines providing stability in challenging conditions while wheeled machines provide mobility and ease of transport.

This meets customer requirements for projects of various sorts, expanding market growth as users search out machines best suited to their operations and contributing to overall market expansion.

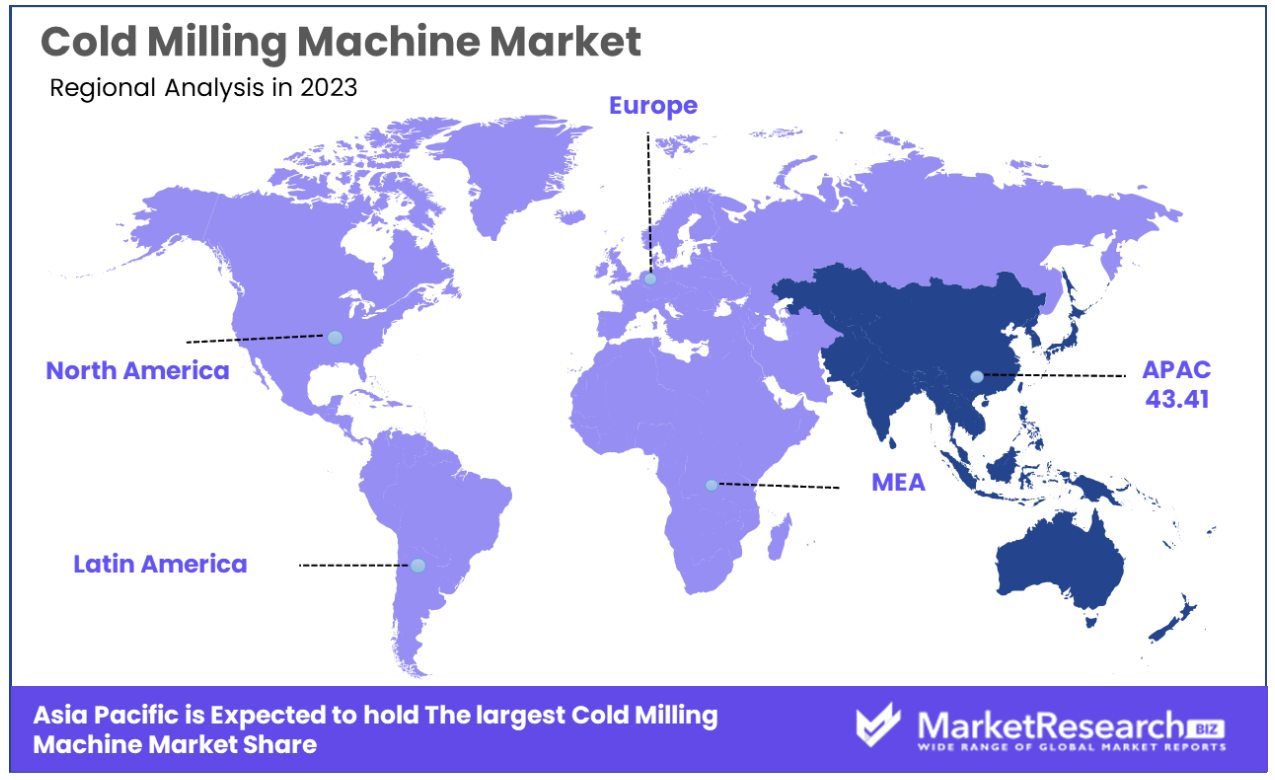

Cold Milling Machine Market Regional Analysis

Asia-Pacific Dominates with 43.41% Market Share in Cold Milling Machine Market

Asia-Pacific holds 43.41% of the cold milling machine market. This impressive share can be attributed to their extensive infrastructure development activities in rapidly emerging economies such as China and India, including road construction, maintenance, and expansion projects that support urbanization efforts as well as industrialization initiatives.

This creates significant demand for cold milling machines. Additionally, the presence of several major construction and manufacturing firms within the region, along with the availability of cost-effective labor and materials, bolsters the market growth.

The market dynamics in Asia-Pacific are influenced by the region's governmental focus on improving transportation networks and the increasing adoption of advanced construction techniques. The push for better road quality and the renovation of aging infrastructure requires precise and efficient milling, which cold milling machines provide. Due to an increasing focus on sustainability and recycling of road materials in construction projects, cold milling machines - machines capable of dismantling asphalt and concrete surfaces for reuse, have become more in demand than ever.

North America: Advanced Infrastructure and Technological Adoption

North America's cold milling machine market is driven by advanced infrastructure and strong focus on technological adoption. Road maintenance and renovation activities drive demand for cold milling machines while leading construction firms and their adoption of innovative construction solutions help support market expansion.

Europe: Stringent Regulations and Focus on Sustainability

Europe's cold milling machine market is defined by stringent regulations surrounding road construction and an emphasis on sustainability, with emphasis placed on reducing environmental impact and recycling construction materials as driving forces behind demand for these machines. Europe's well-established construction industry, combined with efficient road renovation techniques supporting its development further augmenting Europe's cold milling machine market growth. Commitment to maintaining high-quality infrastructure as well as increasing investment in transport projects are expected to keep propelling its market.

Cold Milling Machine Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

Cold Milling Machine Market Key Player Analysis

In the Cold Milling Machine Market, crucial for infrastructure development and road construction, the companies listed are instrumental in shaping industry dynamics. DEERE & COMPANY (Wirtgen Group) and Caterpillar Inc. are market leaders, renowned for their extensive product ranges and technological advancements. Their strategic positioning emphasizes durability, efficiency, and innovation, significantly influencing market trends and customer preferences.

Astec Industries Inc. and Fayat Group (Bomag GmbH) are key players known for their high-quality milling equipment, contributing to the market with a focus on performance and reliability. SANY Group and Komatsu Ltd., with their global presence, are pivotal in driving the adoption of cold milling machines across various construction projects, reflecting the industry's expansion and technological proliferation.

Cold Milling Machine Market Key Players

- DEERE & COMPANY (Wirtgen Group)

- Caterpillar Inc.

- Astec Industries Inc.

- SANY Group

- Fayat Group (Bomag GmbH)

- CMI Roadbuilding Limited

- Sakai Heavy Industries Limited

- Komatsu Ltd.

- CNH Industrial NV

- Simex srl

- Kubota Corporation

- Volvo Construction Equipment

- Liugong Machinery Co., Ltd.

- J C Bamford Excavators Ltd

Recent Development

- On March 14, 2023, Astec Industries, Inc. launched its most up-to-date asphalt cold planer at the CONEXPO-CON/AGG event in Las Vegas, Nevada, the U.S. RX-405 cold planer is suitable for contractors looking for smaller machines. The RX-405 machine is used for various applications due to its flexibility and versatility.

- On May 16, 2022, Bomag GmbH launched its new BM/65 series of cold planers. In this series, BM 2000/65 is the lightest planer in the 2m class, with a working load of 27 tons. This planer is highly efficient and easy to operate.

- On January 31, 2022, Wirtgen Group introduced three brand-new one-meter compact cold milling machine models for consumers in Europe. Working widths of 1.0 m, 1.2 m, and 1.3 m are available in the brand-new Wirtgen W100 Fi, W120 Fi, and W130 Fi models, respectively. A 265kW diesel engine from John Deere that complies with Stage V is included in each of the three models.

Report Scope

Report Features Description Market Value (2023) USD 1.2 Billion Forecast Revenue (2033) USD 2.6 Billion CAGR (2024-2032) 8.11% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Crawler, Wheel, Small Cold Milling Machine, Medium Cold Milling Machine, Large Cold Milling Machine), By Milling Width:(Below 2ft, 2ft - 5ft, Above 5ft), By Engine Power:(Low, Medium, High), By Application:(Concrete Pavement, Asphalt Pavement) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape DEERE & COMPANY (Wirtgen Group), Caterpillar Inc., Astec Industries Inc., SANY Group, Fayat Group (Bomag GmbH), CMI Roadbuilding Limited, Sakai Heavy Industries Limited, Komatsu Ltd., CNH Industrial NV, Simex srl, Kubota Corporation, Volvo Construction Equipment, Liugong Machinery Co., Ltd., J C Bamford Excavators Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-