Cold Brew Coffee Market Report By Product Type (Ready-to-Drink, Concentrates, Quick Brew), By Distribution Channel (Supermarkets/Hypermarkets, Online Retail, Convenience Stores, Specialty Stores, Cafes & Coffee Shops), By Packaging (Glass Bottles, Plastic Bottles, Cans, Others), By Flavor (Original, Flavored (Vanilla, Mocha, Caramel, etc.), Decaf), By End-User (Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

50339

-

August 2024

-

321

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

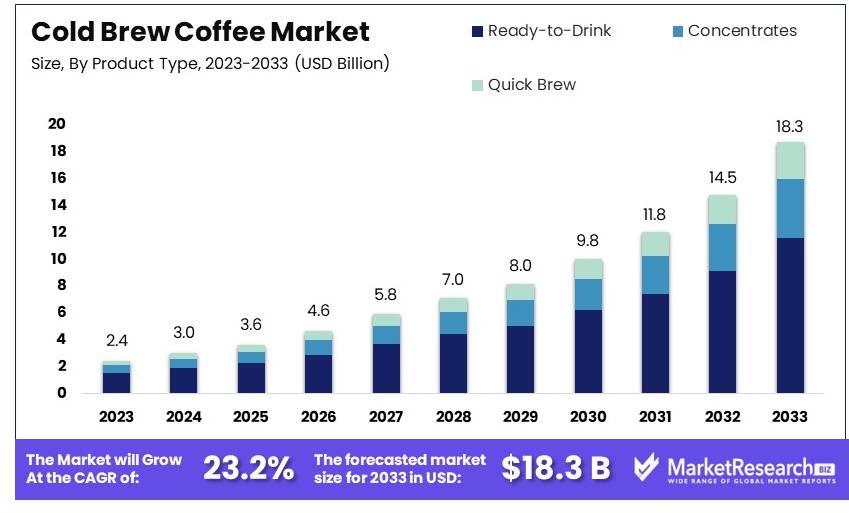

The Global Cold Brew Coffee Market size is expected to be worth around USD 18.3 Billion by 2033, from USD 2.4 Billion in 2023, growing at a CAGR of 23.2% during the forecast period from 2024 to 2033.

The Cold Brew Coffee Market includes the production and distribution of cold brew coffee products. This market caters to consumers seeking a smoother, less acidic coffee experience. Cold brew coffee is made by steeping coffee grounds in cold water for an extended period, resulting in a distinct flavor profile.

The market is expanding as more people explore unique and premium coffee options. Brands are innovating with ready-to-drink formats, various flavor infusions, and sustainable packaging solutions. Key players focus on quality, convenience, and catering to health-conscious consumers who prefer low-sugar, natural ingredient options.

The cold brew coffee market is experiencing notable growth, driven by evolving consumer preferences and demographic trends. Consumption of cold brew coffee among Americans increased from 16% in January 2022 to 20% in July 2022. This upward trend indicates a rising popularity of cold brew coffee, particularly among key demographic groups.

Millennials, aged 25-40, and younger adults, aged 18-24, are significant consumers in this market. Approximately 36% of Millennials prefer specialty drinks, including cold brew, highlighting their role as primary drivers of the trend towards gourmet and cold coffee beverages. This preference for specialty drinks among Millennials is reshaping the coffee market, pushing brands to innovate and expand their cold brew offerings.

The prevalence of single-cup brewers and ready-to-drink cold brew options in office settings further fuels market growth. These convenient formats cater to the modern consumer's demand for quick, high-quality coffee experiences. About 40% of Americans add milk or sweeteners to their coffee, and many office setups now accommodate these preferences, enhancing the appeal of cold brew coffee in professional environments.

The increasing popularity of cold brew coffee presents significant opportunities for market players. Companies should focus on product innovation, targeting the preferences of Millennials and younger adults. Additionally, expanding distribution in office settings and emphasizing ready-to-drink options can capitalize on current consumption trends. The cold brew coffee market thus offers substantial growth potential, driven by changing consumer behaviors and the demand for convenient, high-quality coffee solutions.

Key Takeaways

- Market Value: The Cold Brew Coffee Market was valued at USD 2.4 billion in 2023 and is expected to reach USD 18.3 billion by 2033, with a CAGR of 23.2%.

- By Product Type Analysis: Ready-to-Drink led with 63%; its convenience and growing consumer preference drive demand.

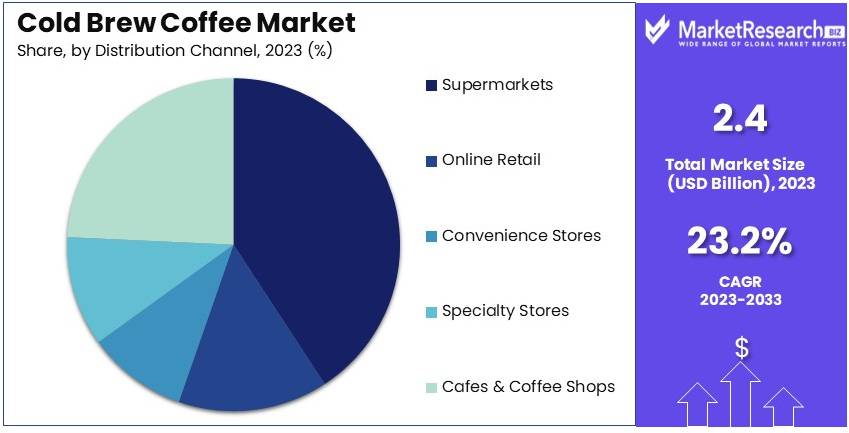

- By Distribution Channel Analysis: Supermarkets/Hypermarkets accounted for 42%; these outlets provide widespread access to products.

- By Packaging Analysis: Cans dominated with 58%; they offer convenience and longer shelf life, enhancing consumer appeal.

- By Flavor Analysis: Original flavors led with 54%; traditional taste preferences continue to drive sales.

- By End-User Analysis: Commercial segment held 67%; cafes and restaurants contribute significantly to market expansion.

- Dominant Region: North America led with 41.2%; the region's strong coffee culture and premium product demand support growth.

- Analyst Viewpoint: The Cold Brew Coffee Market is rapidly expanding with significant competition; innovation in flavors and packaging will be key to future growth.

Driving Factors

Rising Popularity of Specialty Coffee Drives Market Growth

The increasing consumer interest in specialty coffee beverages has significantly driven the cold brew coffee market. Consumers are seeking unique, high-quality coffee experiences, and cold brew coffee, known for its smooth, less acidic taste, meets this demand.

An example is the success of Starbucks' cold brew offerings, which have become a staple in their menu, reflecting the growing trend towards premium coffee options. The desire for artisanal and gourmet coffee experiences has pushed consumers to explore different brewing methods, with cold brew standing out due to its distinctive flavor profile. This trend aligns with the broader movement towards specialty coffee, where quality and unique characteristics are highly valued. The influence of specialty coffee culture encourages cafes and retailers to expand their cold brew selections, further driving market growth.

Health and Wellness Trends Drive Market Growth

The shift towards healthier beverage choices has contributed to the market's growth. Cold brew coffee is perceived as a healthier alternative due to its lower acidity and higher antioxidant levels compared to traditional hot coffee.

This health-oriented perception aligns with the broader wellness trends among consumers. Brands like Califia Farms have capitalized on this by marketing their cold brew coffee as a nutritious and energizing drink, catering to health-conscious consumers. The increasing awareness of health benefits associated with cold brew coffee encourages more consumers to choose it over other caffeinated beverages. This trend is supported by the growing demand for natural and minimally processed products, which are often seen as better for overall health. As the wellness movement continues to gain momentum, the cold brew coffee market benefits from its alignment with these consumer preferences.

Convenience and Ready-to-Drink Options Drive Market Growth

The demand for convenient, ready-to-drink coffee has fueled the cold brew coffee market. Busy lifestyles and the need for on-the-go options make RTD cold brew coffee an attractive choice for consumers.

Companies like Blue Bottle Coffee have expanded their product lines to include canned cold brew options, making it easier for consumers to enjoy high-quality coffee without the need for preparation, thus driving market growth. The convenience factor appeals to a wide range of consumers, from busy professionals to active individuals seeking a quick energy boost. The proliferation of RTD cold brew products in retail and grocery stores has made these beverages more accessible, further enhancing their popularity. This convenience-driven trend complements the rising demand for specialty and health-focused beverages, creating a synergistic effect that propels the cold brew coffee market forward.

Restraining Factors

High Production Costs Restrain Market Growth

The production of cold brew coffee involves higher costs compared to traditional hot coffee due to the extended brewing time and the need for specialized equipment. These higher production costs can translate into higher retail prices, which may deter price-sensitive consumers.

For instance, the cost of producing a batch of cold brew can be significantly higher due to the need for larger quantities of coffee beans and longer extraction times, leading to higher prices in cafes and retail outlets. This price premium can limit the market to more affluent consumers and slow down broader adoption. The financial barrier posed by high production costs thus restrains the market growth for cold brew coffee.

Limited Consumer Awareness and Preference Restrain Market Growth

Despite its growing popularity, cold brew coffee still faces limited consumer awareness and preference in many regions. Traditional hot coffee remains the dominant choice for many consumers, and the market for cold brew is still developing.

For example, in countries with strong traditional coffee cultures like Italy, the adoption of cold brew coffee has been slower, as consumers continue to prefer their customary espresso coffee and cappuccino. This cultural preference for hot coffee limits the potential market for cold brew. Additionally, lower awareness about the unique benefits and flavors of cold brew coffee can hinder its growth. This limited consumer awareness and preference thus significantly restrain the expansion of the cold brew coffee market.

Product Type Analysis

Ready-to-Drink dominates with 63% due to its convenience and widespread availability.

In the cold brew coffee market, the product types are segmented into ready-to-drink, concentrates, and quick brew. The ready-to-drink (RTD) segment is the most dominant, holding approximately 63% of the market share. This dominance is largely due to the convenience and accessibility of RTD cold brew products, which appeal to busy consumers seeking quick and hassle-free coffee solutions.

Concentrates offer a flexible option for those who prefer to customize the strength of their coffee and are typically favored by a niche group of coffee enthusiasts. Quick brew options are emerging, designed to reduce preparation time while maintaining the distinctive smooth and rich flavor that cold brew is known for.

The ready-to-drink cold brew has gained popularity for its ability to cater to the on-the-go lifestyle of modern consumers, being widely available in various settings such as supermarkets, convenience stores, and coffee shops. The segment's growth is bolstered by innovations in coffee packaging that extend shelf life and enhance portability, as well as by the expansion of offerings by major coffee brands and specialty coffee roasters. As consumer demand for convenience continues to rise, the RTD segment is expected to maintain its market dominance, further driven by increasing consumer awareness and the introduction of a variety of flavor profiles catering to diverse tastes.

Distribution Channel Analysis

Supermarkets/Hypermarkets dominate with 42% due to their extensive reach and consumer trust.

The distribution channels for cold brew coffee include supermarkets/hypermarkets, online retail, convenience stores, specialty stores, and cafes & coffee shops. Supermarkets/hypermarkets are the dominant channel, holding a 42% share of the market. This is attributed to their broad accessibility and the trust consumers place in purchasing from established retail environments.

Online retail is growing rapidly as consumers appreciate the convenience of home delivery and the availability of a wider range of products. Convenience stores are pivotal for impulsive buys and immediate consumption, whereas specialty stores cater to discerning consumers looking for premium and artisanal cold brew options. Cafes and coffee shops are essential for consumers looking to enjoy freshly prepared cold brew in a social setting.

The strength of supermarkets/hypermarkets in distributing cold brew coffee is driven by their ability to offer competitive pricing, promotional deals, and a wide assortment of products under one roof. With the growing trend of cold brew consumption, these outlets are increasingly dedicating more shelf space to cold brew products, which is expected to further their dominance in the market. As consumer purchasing habits evolve, the integration of cold brew offerings in these channels is likely to expand, supporting sustained growth in this segment.

Packaging Analysis

Cans dominate with 58% due to their portability and sustainability.

Packaging options for cold brew coffee include glass bottles, plastic bottles, cans, and others. Cans are currently the leading packaging format in the cold brew coffee market, accounting for 58% of the segment. Their dominance is primarily due to their convenience, recyclability, and efficient cooling properties, which make them ideal for on-the-go consumption.

Glass bottles are preferred for their aesthetic appeal and ability to preserve flavor, while plastic bottles offer lightweight benefits. The "others" category includes new innovations in packaging like cartons and pouches that are gaining traction due to their eco-friendly materials and unique designs.

The preference for cans is influenced by consumer demand for sustainable and convenient drinking solutions. Canned cold brew is often seen as more eco-friendly compared to plastic and is easier to transport and store. The segment's growth is further propelled by the ability of cans to protect the coffee from light and air exposure, preserving its freshness and flavor longer. As environmental concerns continue to rise, along with the demand for convenience, the dominance of cans in the cold brew coffee market is expected to grow, supporting broader market trends towards sustainable packaging.

Flavor Analysis

Original flavor dominates with 54% due to its wide appeal and versatility.

The flavor segment of the cold brew coffee market includes original, flavored (such as vanilla, mocha, caramel), and decaf. The original flavor holds the majority share, with 54%, favored for its versatility and broad appeal to both traditional coffee lovers and those new to cold brew.

Flavored cold brews are popular among younger demographics who seek variety and indulgence in their coffee experiences. Decaf options cater to those sensitive to caffeine or those desiring a coffee flavor without the stimulant effects, typically consumed in the evening.

The original flavor’s dominance in the market is due to its widespread acceptance as the authentic taste of coffee, often preferred for its pure and strong coffee profile, which serves as a base for both pure and mixed coffee beverages. As consumers continue to explore different flavor profiles, the original flavor remains a staple in the cold brew market, with its appeal likely to sustain as it serves as the foundation for innovation in other flavor categories.

End-User Analysis

Commercial dominates with 67% due to high consumption in office and foodservice settings.

The end-user market for cold brew coffee is segmented into residential and commercial uses. The commercial segment dominates the market, with a 67% share, driven by high consumption in office settings, restaurants, and cafes where cold brew is increasingly favored for its convenience and taste.

Residential usage is growing as consumers seek to recreate their favorite coffee shop experiences at home. This trend has been particularly accelerated by recent shifts in work patterns, with more people working from home and investing in premium coffee products to enhance their home coffee experience.

The commercial dominance is supported by the widespread availability of cold brew in foodservice establishments and its popularity in corporate environments, where it is valued for its convenience and ability to offer a high-quality coffee experience. As businesses continue to emphasize the importance of providing premium beverage options, the demand in commercial settings is expected to maintain its lead, fueled by innovations in cold brew offerings and the expansion of its availability in quick-service restaurants.

Key Market Segments

By Product Type

- Ready-to-Drink

- Concentrates

- Quick Brew

By Distribution Channel

- Supermarkets/Hypermarkets

- Online Retail

- Convenience Stores

- Specialty Stores

- Cafes & Coffee Shops

By Packaging

- Glass Bottles

- Plastic Bottles

- Cans

- Others

By Flavor

- Original

- Flavored (Vanilla, Mocha, Caramel, etc.)

- Decaf

By End-User

- Residential

- Commercial

Growth Opportunities

Expansion into Ready-to-Drink Segment Offers Growth Opportunity

The ready-to-drink (RTD) segment presents a significant growth opportunity for the cold brew coffee market. Consumers are increasingly seeking convenient beverage options that can be consumed on the go. For example, Starbucks' expansion into the RTD cold brew market with its bottled cold brew coffee has been successful, catering to busy consumers.

RTD cold brew coffee appeals to consumers looking for quick and convenient caffeine fixes. The growth of this segment is supported by changing consumer lifestyles and the increasing demand for portable, high-quality coffee options. Companies can capitalize on this trend by offering a variety of RTD cold brew products to meet diverse consumer preferences.

Introduction of Functional Ingredients Offers Growth Opportunity

Incorporating functional ingredients such as protein, vitamins, and adaptogens into cold brew coffee can attract health-conscious consumers. These enhanced beverages can offer additional health benefits, appealing to a broader audience. For instance, brands like Bulletproof have introduced cold brew coffee with added collagen protein and MCT oil for health benefits.

Functional ingredients enhance the nutritional profile of cold brew coffee, making it more appealing to consumers seeking health and wellness benefits. This trend reflects the growing interest in beverages that provide more than just refreshment. By innovating with functional ingredients, companies can differentiate their products and capture a segment of health-focused consumers.

Growth in Online Sales Channels Offers Growth Opportunity

The increasing popularity of e-commerce provides a growth opportunity for cold brew coffee brands to reach a wider audience. Direct-to-consumer sales through online platforms can enhance brand visibility and convenience for customers. Companies like Blue Bottle Coffee have successfully leveraged online sales channels to market their cold brew coffee products directly to consumers.

Online sales channels allow brands to connect with consumers who prefer shopping from home. This trend is driven by the convenience of online shopping and the ability to reach a broader market. By focusing on e-commerce strategies, cold brew coffee brands can expand their customer base and drive sales growth through direct and personalized marketing efforts.

Trending Factors

Sustainable and Eco-Friendly Packaging Are Trending Factors

There is a growing trend towards sustainable and eco-friendly packaging in the cold brew coffee market. Brands that adopt recyclable or biodegradable packaging materials are gaining favor among environmentally conscious consumers. For example, High Brew Coffee uses recyclable cans for its cold brew coffee, appealing to consumers who prioritize sustainability.

This shift is driven by increasing environmental awareness and the desire to reduce waste. Sustainable packaging solutions not only benefit the environment but also enhance brand image and attract a loyal customer base. As more consumers seek out eco-friendly options, companies that prioritize sustainability are likely to see increased demand for their products. The trend towards sustainable packaging is expected to support the expansion of the cold brew coffee market by aligning with broader consumer preferences for environmentally responsible products.

Health and Wellness Focus Are Trending Factors

The focus on health and wellness is significantly influencing the cold brew coffee market. Consumers are increasingly seeking beverages that offer natural ingredients and lower acidity. Cold brew coffee is perceived as a healthier alternative to traditional coffee due to its smoother taste and reduced acidity.

Brands like Califia Farms emphasize the health benefits of their cold brew products to attract health-conscious consumers. This trend is driven by the growing awareness of the importance of a healthy lifestyle and the desire for beverages that support well-being. As more consumers prioritize health and wellness, the demand for cold brew coffee is expected to rise. The emphasis on natural ingredients and health benefits is likely to contribute to the market’s growth, as it resonates with the preferences of a health-conscious audience.

Diverse Flavor Offerings Are Trending Factors

The trend towards diverse and unique flavor offerings is driving the cold brew coffee market. Consumers are exploring new and exotic flavors, leading brands to innovate with their product lines. For instance, Stumptown Coffee Roasters offers a variety of cold brew flavors, including coconut and chocolate, to cater to adventurous taste buds.

This trend is fueled by the desire for novel and exciting taste experiences. Offering diverse flavors allows brands to attract a wider range of consumers and stand out in a competitive market. The introduction of unique and exotic flavors is expected to drive the growth of the cold brew coffee market by appealing to consumers’ curiosity and willingness to try new products. As the market continues to evolve, the focus on flavor innovation will play a crucial role in its expansion and consumer appeal.

Regional Analysis

North America Dominates with 41.2% Market Share in the Cold Brew Coffee Market

North America's significant 41.2% share in the cold brew coffee market is primarily driven by the region's strong coffee culture and consumer preference for premium coffee products. The trend towards health-conscious lifestyles has also made cold brew a popular choice due to its perceived health benefits over traditional hot brewed coffee. Additionally, extensive distribution channels and innovative marketing strategies by leading coffee chains have effectively increased accessibility and awareness of cold brew products.

The market dynamics in North America are characterized by a high level of product innovation and customization, catering to a diverse consumer base with varying tastes and preferences. The region benefits from a well-established coffee industry infrastructure, including numerous specialty coffee shops and a robust retail sector that supports the wide availability of cold brew options. Furthermore, seasonal marketing campaigns and the introduction of ready-to-drink (RTD) cold brew products have significantly contributed to market growth.

The future influence of North America in the cold brew coffee market is expected to remain strong. Continued consumer interest in artisanal and craft beverages is likely to drive further growth. The expanding availability of cold brew in various formats, such as nitrogen-infused versions, is anticipated to attract even more consumers. Moreover, ongoing investments in brand development and product quality are projected to solidify the region’s market presence.

Regional Market Share and Growth Projections:

- Europe: Europe holds approximately 23% of the market. The region is experiencing a growing interest in cold brew due to changing consumer preferences towards specialty coffee drinks. With an increase in coffee shop culture across major European cities, the market share is expected to rise steadily.

- Asia Pacific: Asia Pacific accounts for about 20% of the global market. The region's rapid urbanization and the influence of Western dining trends have led to increased popularity of cold brew. Young consumers, particularly in Southeast Asia, are driving demand, with the market share potentially increasing as local coffee chains expand their offerings.

- Middle East & Africa: MEA represents a smaller portion of the market at around 8%. However, the adoption of Western food and beverage habits among the younger population is starting to impact the market positively, suggesting potential for future growth.

- Latin America: Latin America currently has a 8% share of the market. The region's own rich coffee-producing tradition and increasing urban lifestyle trends support a growing interest in innovative coffee products like cold brew, likely leading to an increase in its market share.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Cold Brew Coffee market is dominated by Starbucks Corporation and Nestle SA, known for their strong brand presence and extensive distribution networks. Their innovative product lines and marketing strategies enhance their market influence.

Tata Global Beverages and Keurig Dr Pepper Inc. contribute significantly with their diverse product portfolios and focus on quality, strengthening their market positions.

Peet's Coffee and The Coca-Cola Company leverage their well-known brands to offer premium cold brew options, increasing their market impact.

Stumptown Coffee Roasters and Heartland Food Products Group are recognized for their artisanal and high-quality cold brews, appealing to niche markets.

Califia Farms and La Colombe Coffee Roasters focus on dairy-free and ready-to-drink options, catering to health-conscious consumers and enhancing their market presence.

Slingshot Coffee Co. and Chameleon Cold-Brew offer organic and ethically sourced products, strengthening their market influence with sustainability-focused consumers.

High Brew Coffee and Wandering Bear Coffee are known for their innovative packaging and bold flavors, driving market growth with unique offerings.

Lucky Jack Coffee rounds out the key players with its premium organic cold brews, adding depth to the market. Collectively, these companies drive the Cold Brew Coffee market through innovation, quality, and strategic positioning.

Market Key Players

- Starbucks Corporation

- Nestle SA

- Tata Global Beverages

- Keurig Dr Pepper Inc.

- Peet's Coffee

- The Coca-Cola Company

- Stumptown Coffee Roasters

- Heartland Food Products Group

- Califia Farms

- La Colombe Coffee Roasters

- Slingshot Coffee Co.

- Chameleon Cold-Brew

- High Brew Coffee

- Wandering Bear Coffee

- Lucky Jack Coffee

Recent Developments

- Starbucks and Nestlé celebrated the five-year anniversary of their Global Coffee Alliance, reporting significant growth in Starbucks-branded product sales (+13% in 2022).

- Keurig Dr Pepper and Nestlé USA entered a long-term partnership to manufacture and distribute Starbucks-branded K-Cup pods in North America, tapping into the growing single-serve coffee market.

Report Scope

Report Features Description Market Value (2023) USD 2.4 Billion Forecast Revenue (2033) USD 18.3 Billion CAGR (2024-2033) 23.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Ready-to-Drink, Concentrates, Quick Brew), By Distribution Channel (Supermarkets/Hypermarkets, Online Retail, Convenience Stores, Specialty Stores, Cafes & Coffee Shops), By Packaging (Glass Bottles, Plastic Bottles, Cans, Others), By Flavor (Original, Flavored (Vanilla, Mocha, Caramel, etc.), Decaf), By End-User (Residential, Commercial) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Starbucks Corporation, Nestle SA, Tata Global Beverages, Keurig Dr Pepper Inc., Peet's Coffee, The Coca-Cola Company, Stumptown Coffee Roasters, Heartland Food Products Group, Califia Farms, La Colombe Coffee Roasters, Slingshot Coffee Co., Chameleon Cold-Brew, High Brew Coffee, Wandering Bear Coffee, Lucky Jack Coffee Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Starbucks Corporation

- Nestle SA

- Tata Global Beverages

- Keurig Dr Pepper Inc.

- Peet's Coffee

- The Coca-Cola Company

- Stumptown Coffee Roasters

- Heartland Food Products Group

- Califia Farms

- La Colombe Coffee Roasters

- Slingshot Coffee Co.

- Chameleon Cold-Brew

- High Brew Coffee

- Wandering Bear Coffee

- Lucky Jack Coffee