Coenzyme Q10 Market By Product Type (Ubiquinone, Ubiquinol), By Form (Tablets, Powder, Liquid), By End-User (Dietary Supplements, Pharmaceuticals, Cosmetics, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

47682

-

June 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

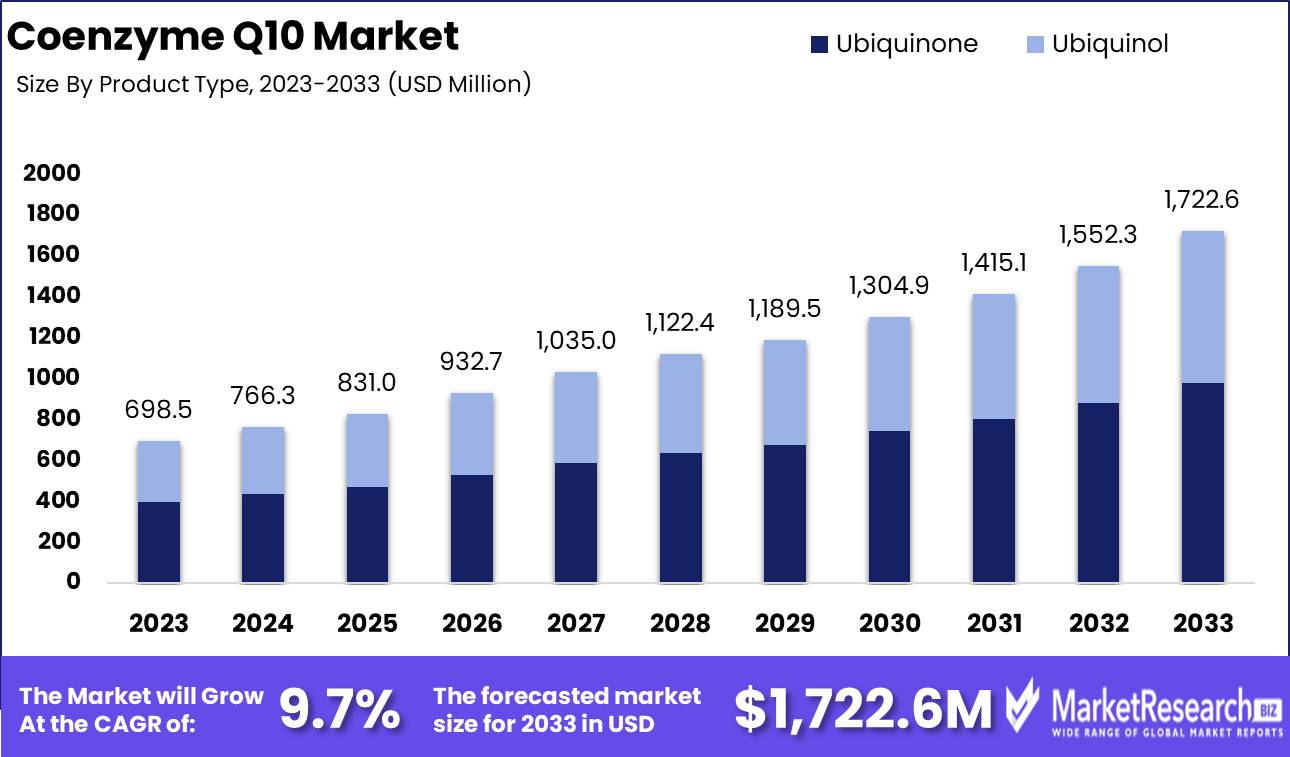

The Coenzyme Q10 Market was valued at USD 698.5 Million in 2023. It is expected to reach USD 1722.6 Million by 2033, with a CAGR of 9.7% during the forecast period from 2024 to 2033.

The Coenzyme Q10 (CoQ10) market encompasses the global industry for a vital antioxidant used in dietary supplements, pharmaceuticals, and cosmetics. This market is driven by rising consumer awareness of health benefits, including enhanced energy production and cardiovascular health. Key segments include ubiquinone and ubiquinol, with applications spanning nutraceuticals, anti-aging skincare, and therapeutic products. Technological advancements and increasing R&D investments are fostering product innovation, while regulatory frameworks and quality standards are shaping market dynamics.

The Coenzyme Q10 (CoQ10) market is poised for significant growth driven by an escalating prevalence of chronic diseases, particularly cardiovascular disorders. As a crucial component in cellular energy production and a potent antioxidant, CoQ10's therapeutic benefits are increasingly recognized, leading to heightened demand in the pharmaceutical and nutraceutical sectors.

However, the high cost of CoQ10 supplements and pharmaceuticals presents a substantial barrier to widespread adoption, particularly in price-sensitive markets. This cost factor underscores the need for ongoing advancements in biotechnology to optimize production processes and reduce costs. Concurrently, the market is witnessing a burgeoning interest in the application of CoQ10 in personalized nutrition and precision medicine, leveraging its potential to tailor health interventions to individual genetic profiles.

Advances in biotechnology are pivotal to the CoQ10 market’s evolution, with increased R&D activities aimed at enhancing both the production efficiency and the range of applications. Cutting-edge biotechnological methods are being developed to produce CoQ10 more sustainably and cost-effectively, addressing one of the primary challenges in the market. Furthermore, the integration of CoQ10 into personalized nutrition regimes highlights a significant trend toward precision medicine, where supplements and pharmaceuticals are customized to meet specific health needs, thereby enhancing therapeutic outcomes. As these technological and scientific advancements continue, they are expected to catalyze market growth, despite the existing cost constraints.

In summary, the CoQ10 market is on a promising trajectory, supported by scientific innovation and a growing recognition of its health benefits, particularly in managing chronic diseases.

Key Takeaways

- Market Growth: The Coenzyme Q10 Market was valued at USD 698.5 Million in 2023. It is expected to reach USD 1722.6 Million by 2033, with a CAGR of 9.7% during the forecast period from 2024 to 2033.

- By Product Type: Ubiquinone dominated with a 68.7% CoQ10 market share.

- By Form: Tablets dominated Coenzyme Q10 forms with a 58.4% market share.

- By End-User: Dietary Supplements dominated the CoQ10 market with a 62.3% share.

- Regional Dominance: North America dominates the CoQ10 market with a 35% largest market share.

- Growth Opportunity: The global CoQ10 market is set to grow significantly in 2024, driven by rising demand for dietary supplements and functional foods.

Driving factors

Growing Demand for Cosmetic Products: A Catalyst for Coenzyme Q10 Market Expansion

The escalating demand for cosmetic products is a primary driver of the Coenzyme Q10 (CoQ10) market. CoQ10, known for its antioxidant properties, is increasingly incorporated into skincare and anti-aging products. The global cosmetics market is projected to reach $758.4 billion by 2025, with anti-aging products constituting a significant segment. CoQ10's ability to reduce oxidative damage and improve skin elasticity has made it a preferred ingredient in premium skincare lines. As consumers seek advanced skincare solutions, the demand for CoQ10-enriched products is expected to surge, propelling the market's growth.

Increasing Prevalence of Chronic Diseases: Boosting Coenzyme Q10 Utilization

The rising prevalence of chronic diseases such as cardiovascular disorders, diabetes, and neurodegenerative conditions is significantly driving the CoQ10 market. According to the World Health Organization, chronic diseases account for approximately 71% of all deaths globally. CoQ10, known for its role in cellular energy production and its antioxidant properties, is being increasingly utilized in managing these conditions. Clinical studies have demonstrated CoQ10's efficacy in improving heart health, reducing oxidative stress, and enhancing mitochondrial function. As healthcare professionals and patients seek effective adjunct therapies for chronic disease management, the demand for CoQ10 supplements is anticipated to grow, thus fueling market expansion.

Growing Awareness of Health and Wellness: Driving Consumer Preference for CoQ10

The burgeoning awareness of health and wellness is another pivotal factor contributing to the growth of the CoQ10 market. Consumers are becoming more proactive about their health, leading to increased demand for dietary supplements and nutraceuticals that support overall well-being. The global dietary supplements market is expected to reach $230.73 billion by 2027, with a significant portion attributed to antioxidant supplements like CoQ10. The emphasis on preventive healthcare, coupled with the aging population's focus on maintaining vitality, has spurred interest in CoQ10. Marketing campaigns and educational initiatives highlighting CoQ10's benefits in energy production, antioxidant protection, and cardiovascular health are further accelerating consumer adoption, thereby enhancing market growth.

Restraining Factors

High Material Costs and Manufacturing Complexity: A Barrier to Market Expansion

The Coenzyme Q10 (CoQ10) market faces significant growth constraints due to the high costs of raw materials and the intricate manufacturing processes involved. CoQ10, a vital compound used in various health supplements and pharmaceuticals, requires precise and complex synthesis methods. The production process involves advanced biotechnological techniques that are cost-intensive, leading to elevated prices for the end product.

High material costs directly impact the affordability and competitiveness of CoQ10 products in the market. For instance, the extraction of CoQ10 from natural sources or its chemical synthesis involves expensive inputs and sophisticated technology, which adds to the overall production cost. This factor limits the ability of manufacturers to scale production efficiently, ultimately reducing the market's growth potential.

Regulatory Restrictions and Inconsistencies: Navigating a Complex Compliance Landscape

Regulatory restrictions and inconsistencies pose another significant challenge to the growth of the CoQ10 market. The production and sale of CoQ10 are subject to stringent regulatory scrutiny across different regions, which can vary significantly in terms of standards and enforcement.

For instance, the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have different regulatory frameworks for dietary supplements and pharmaceuticals, which include CoQ10. These regulations often involve rigorous testing, quality control, and compliance with specific labeling and health claim requirements. Inconsistent regulatory landscapes mean that manufacturers must navigate a complex web of compliance issues, which can be both time-consuming and costly.

Regulatory hurdles can delay the introduction of new products to the market, increase compliance costs, and limit the geographical expansion of CoQ10 products. In some regions, overly stringent regulations may hinder innovation by imposing restrictions that are difficult for manufacturers to meet. Conversely, in areas with lax regulations, the market can become flooded with substandard products, eroding consumer trust and potentially leading to market contraction.

By Product Type Analysis

In 2023, Ubiquinone dominated with a 68.7% CoQ10 market share.

In 2023, Ubiquinone held a dominant market position in the by-product type segment of the Coenzyme Q10 market, capturing more than a 68.7% share. This leadership can be attributed to ubiquinone's established efficacy in enhancing cellular energy production and its extensive application in dietary supplements, pharmaceuticals, and cosmetics. As the oxidized form of Coenzyme Q10, ubiquinone is widely recognized for its antioxidant properties, which play a crucial role in mitigating oxidative stress and supporting cardiovascular health. The compound's stability and proven benefits have fostered strong consumer trust and widespread adoption, driving its market dominance.

Conversely, ubiquinol, the reduced form of Coenzyme Q10, while occupying a smaller market share, is gaining traction due to its superior bioavailability. Ubiquinol is more readily absorbed by the body, making it an attractive option for individuals seeking immediate and potent antioxidant effects. This form is particularly beneficial for aging populations and those with specific health conditions that impair CoQ10 conversion processes. Despite its higher production costs, the growing awareness of its enhanced efficacy is expected to bolster ubiquinol's market share in the coming years, reflecting a dynamic shift towards more efficient CoQ10 supplementation options.

By Form Analysis

In 2023, Tablets dominated Coenzyme Q10 forms with a 58.4% market share.

In 2023, Tablets held a dominant market position in the By Form segment of the Coenzyme Q10 Market, capturing more than a 58.4% share. This prominent position is driven by tablets convenience, precise dosage control, and widespread consumer preference for easy-to-consume supplements. Tablets' extended shelf life and ease of distribution further solidify their market leadership.

Powder form also contributes significantly to the Coenzyme Q10 market. This form is favored for its versatility, enabling incorporation into various food and beverage products. It appeals to consumers seeking customizable dosage and diverse application methods, thus boosting its demand in health and wellness sectors, including sports nutrition and functional foods.

Liquid Coenzyme Q10, while holding a smaller market share compared to tablets and powder, is gaining traction due to its superior bioavailability and faster absorption rates. Liquid forms are particularly appealing to individuals with swallowing difficulties and those requiring rapid assimilation of nutrients. This form is increasingly popular in specialized health supplements and niche markets.

Overall, each form of Coenzyme Q10 caters to distinct consumer preferences and application needs, collectively driving the market's growth and diversification.

By End-User Analysis

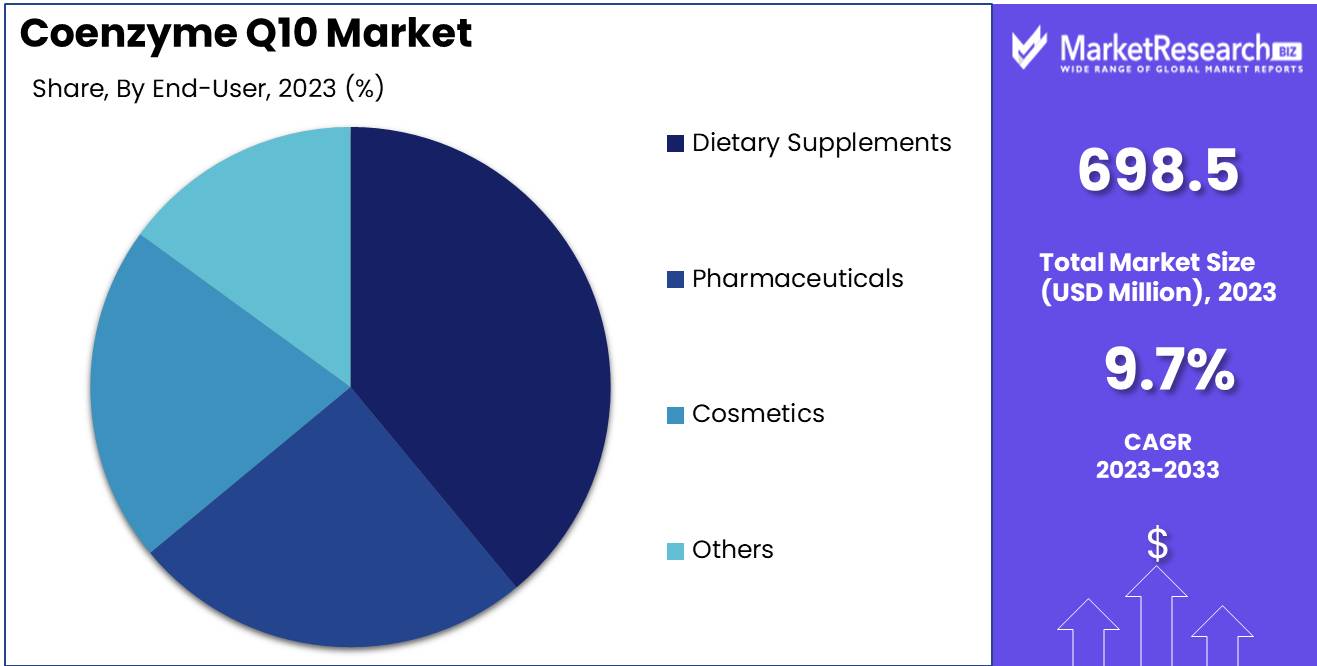

In 2023, Dietary Supplements dominated the CoQ10 market with a 62.3% share.

In 2023, Dietary Supplements held a dominant market position in the By End-User segment of the Coenzyme Q10 Market, capturing more than a 62.3% share. This substantial lead underscores the growing consumer inclination towards preventive healthcare and wellness. The efficacy of CoQ10 in enhancing energy levels, and supporting cardiovascular health, and its antioxidant properties have fueled its widespread adoption in dietary supplements.

Pharmaceuticals represent the second-largest segment, driven by CoQ10's applications in managing conditions such as heart failure, migraines, and statin-induced myopathy. The clinical validation of CoQ10's therapeutic benefits has reinforced its integration into pharmaceutical products, driving steady market growth.

Cosmetics, although a smaller segment, are gaining traction due to the anti-aging and skin-revitalizing properties of CoQ10. Its ability to combat oxidative stress and improve skin elasticity has led to its inclusion in premium skincare formulations, catering to a market increasingly focused on youthfulness and skin health.

The 'Others' category encompasses various niche applications such as veterinary products and functional foods, reflecting a broader diversification in CoQ10 utilization. These diverse applications illustrate the compound's versatile benefits, contributing to its overall market expansion.

Key Market Segments

By Product Type

- Ubiquinone

- Ubiquinol

By Form

- Tablets

- Powder

- Liquid

By End-User

- Dietary Supplements

- Pharmaceuticals

- Cosmetics

- Others

Growth Opportunity

Increasing Demand for Dietary Supplements

The global Coenzyme Q10 (CoQ10) market is poised for significant growth in 2024, primarily driven by the escalating demand for dietary supplements. As consumers become more health-conscious, there is a marked increase in the adoption of supplements that promote overall well-being. CoQ10, known for its antioxidant properties and role in cellular energy production, is gaining traction as a vital component in this market. The supplement sector is projected to experience robust expansion, with a compound annual growth rate (CAGR) of 8.5%, underscoring the growing preference for preventive healthcare measures.

Rising Popularity of Functional Foods and Beverages

Parallel to the dietary supplements trend, the functional foods and beverages market is witnessing an upswing. Products fortified with CoQ10 are becoming increasingly popular as consumers seek to integrate health benefits into their daily diets seamlessly. The functional foods sector is expected to expand at a CAGR of 9.2%, driven by the rising awareness of nutritional fortification. This trend presents a substantial opportunity for CoQ10 manufacturers to diversify their product offerings and capitalize on the health benefits associated with CoQ10, such as enhanced cardiovascular health and improved energy levels.

Latest Trends

Increasing Demand for Coenzyme Q10 Supplements

The Coenzyme Q10 (CoQ10) market is poised for significant growth, driven primarily by an escalating demand for dietary supplements. Consumers are becoming increasingly health-conscious, seeking out products that enhance energy levels, support cardiovascular health, and provide anti-aging benefits. CoQ10, recognized for its role in cellular energy production and as a potent antioxidant, is gaining traction among a broad demographic, including aging populations and fitness enthusiasts. The global trend towards preventive healthcare further propels this demand, with more individuals investing in supplements as a proactive approach to maintaining health and well-being. This surge is expected to catalyze a notable expansion in market size and product diversity.

Increasing Applications in Food, Beverage, and Cosmetics

Beyond the supplement sector, CoQ10 is witnessing growing applications in the food, beverage, and cosmetics industries. In food and beverages, manufacturers are incorporating CoQ10 to enhance the nutritional profile of their products, catering to the rising consumer preference for functional foods that offer additional health benefits. This integration aligns with the broader trend of fortification, where consumers seek added value in their daily diets.

In the cosmetics industry, CoQ10’s antioxidant properties make it a valuable ingredient for skincare formulations aimed at reducing the signs of aging and protecting the skin from oxidative stress. The demand for anti-aging products remains robust, driving innovation and new product development. Companies are increasingly formulating creams, serums, and lotions with CoQ10 to meet consumer desires for effective, science-backed skincare solutions.

Regional Analysis

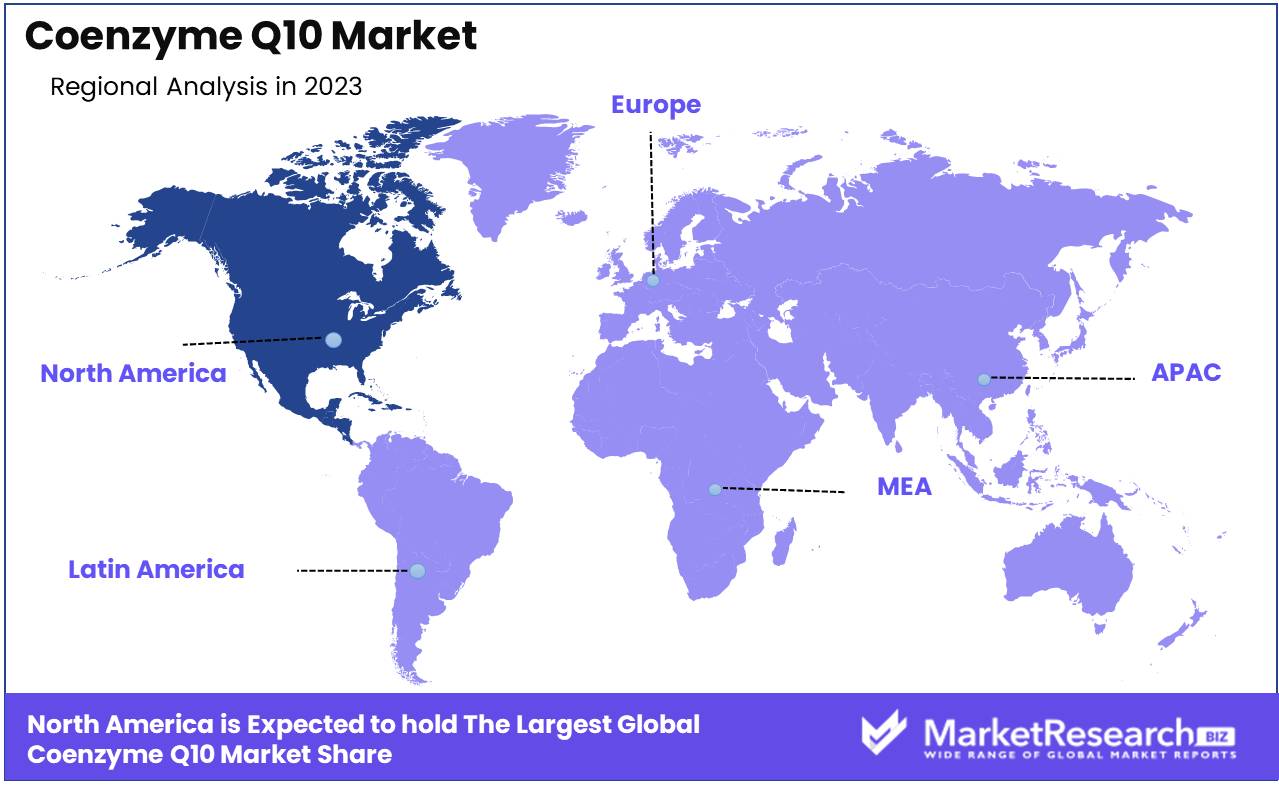

North America dominates the CoQ10 market with a 35% largest market share.

The Coenzyme Q10 (CoQ10) market exhibits varied growth patterns across different regions, influenced by regional health trends, consumer awareness, and regulatory landscapes. In North America, the market is significantly driven by the high prevalence of cardiovascular diseases and the rising geriatric population. The region dominates the global CoQ10 market, accounting for approximately 35% of the overall market share. The robust presence of key market players and extensive R&D activities further bolster market growth. Europe follows closely, with a market share of around 30%, propelled by increasing healthcare expenditure and strong consumer inclination towards dietary supplements, particularly in countries like Germany and the UK.

Asia Pacific is experiencing the fastest growth, driven by rising disposable incomes, an expanding middle-class population, and growing awareness of preventive healthcare in countries such as China, Japan, and India. The region holds a market share of about 25%. The Middle East & Africa, while smaller in comparison, are witnessing steady growth due to improving healthcare infrastructure and increasing consumer awareness. Latin America, led by Brazil and Mexico, accounts for roughly 5% of the market share, driven by the growing demand for dietary supplements and wellness products.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Coenzyme Q10 (CoQ10) market is poised for significant growth, driven by the increasing demand for dietary supplements, pharmaceuticals, and cosmetics. Key players in this market exhibit diverse strategies to capture market share and drive innovation.

Kyowa Hakko and Kaneka are leading the market with their extensive research and development capabilities, ensuring high-purity CoQ10 products. Their focus on technological advancements and product differentiation is a critical driver for their market dominance.

Gnosis and DSM Nutritional are leveraging their robust global distribution networks and strong brand equity to expand their presence in emerging markets. Their strategic collaborations and acquisitions further solidify their positions as market leaders.

Mitsubishi Gas Chemical Co and Hwail Pharmaceutical Co Ltd are investing heavily in biotechnological advancements to enhance production efficiency and product quality. This investment positions them well to meet the rising consumer demand for high-quality CoQ10.

Pharmaessentia Corporation and Zmc-Usa Llc are notable for their innovative approaches to CoQ10 production, focusing on sustainability and cost-effectiveness. Their ability to produce CoQ10 at scale while maintaining competitive pricing is a significant advantage.

Nisshin Seifun Group Inc. and Basic Nutrition emphasize the importance of comprehensive supply chain management to ensure consistent product availability and quality.

Rochem International Inc, Jai Radhe Sales, Anthem Biosciences, and Pharm-RX Chemical, while smaller in scale, are making strategic inroads through niche markets and customized solutions, catering to specific consumer needs.

Market Key Players

- Kyowa Hakko

- Gnosis

- Kaneka

- DSM Nutritional

- Mitsubishi Gas Chemical Co

- Hwail Pharmaceutical Co Ltd

- Pharmaessentia Corporation

- Zmc-Usa Llc

- Nisshin Seifun Group Inc

- Basic Nutrition

- Rochem International Inc

- Jai Radhe Sales

- Anthem Biosciences

- Pharm-RX Chemical

Recent Development

- In March 2024, DSM launched a new CoQ10 supplement aimed at addressing cardiovascular health. This product introduction is part of DSM's broader initiative to leverage CoQ10's antioxidant properties and its potential benefits in managing heart health and cellular energy production.

- In January 2024, Kaneka Corporation introduced their latest CoQ10-infused product, "Watashi no Chikara (My Energy) - Q10 Yogurt." This product is designed to provide consumers with a convenient way to incorporate the active form of CoQ10 (Ubiquinol) into their diets. This launch aligns with Kaneka's strategy to expand its product line in the functional food segment.

- In November 2023, Kaneka Corporation, a major player in the CoQ10 market, completed the acquisition of Japan Medical Device Technology Co., Ltd. (JMDT). This acquisition aims to leverage JMDT's expertise in coronary stents to expand Kaneka's presence in the coronary artery disease treatment market, enhancing its product portfolio in the medical sector.

Report Scope

Report Features Description Market Value (2023) USD 698.5 Million Forecast Revenue (2033) USD 1722.6 Million CAGR (2024-2032) 9.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Ubiquinone, Ubiquinol), By Form (Tablets, Powder, Liquid), By End-User (Dietary Supplements, Pharmaceuticals, Cosmetics, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Kyowa Hakko, Gnosis, Kaneka, DSM Nutritional, Mitsubishi Gas Chemical Co, Hwail Pharmaceutical Co Ltd, Pharmaessentia Corporation, Zmc-Usa Llc, Nisshin Seifun Group Inc, Basic Nutrition, Rochem International Inc, Jai Radhe Sales, Anthem Biosciences, Pharm-RX Chemical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Kyowa Hakko

- Gnosis

- Kaneka

- DSM Nutritional

- Mitsubishi Gas Chemical Co

- Hwail Pharmaceutical Co Ltd

- Pharmaessentia Corporation

- Zmc-Usa Llc

- Nisshin Seifun Group Inc

- Basic Nutrition

- Rochem International Inc

- Jai Radhe Sales

- Anthem Biosciences

- Pharm-RX Chemical