Coconut Milk Products Market By Category (Conventional, Organic), By Form (Liquid, Powder), By Packaging Type (Bottles, Cans, Pouches), By Distribution Channel (Store-based, Non-store-based), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

10671

-

June 2024

-

186

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

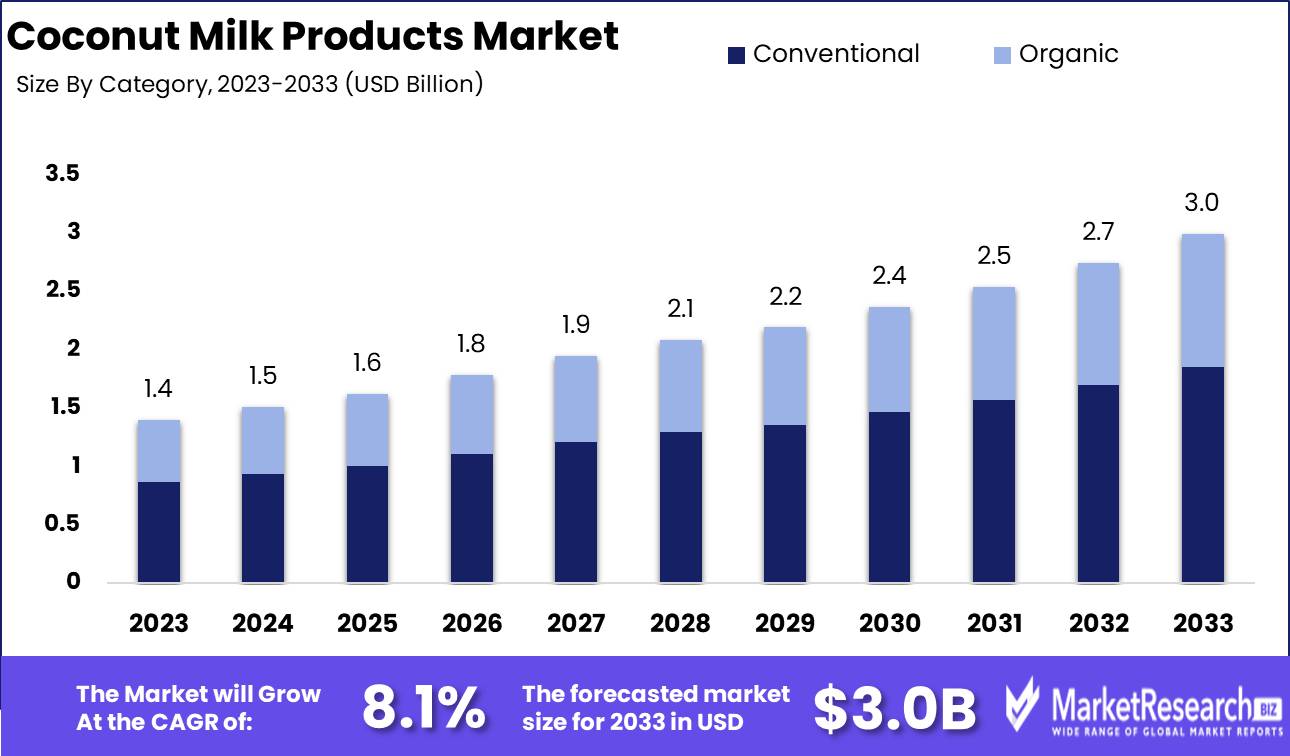

The Global Coconut Milk Products Market was valued at USD 1.4 Bn in 2023. It is expected to reach USD 3.0 Bn by 2033, with a CAGR of 8.1% during the forecast period from 2024 to 2033.

The Coconut Milk Products Market involves the production, distribution, and consumption of coconut milk and its derivatives, including beverages, culinary ingredients, and personal care items. This market is driven by the growing demand for plant-based alternatives, rising health consciousness, and increasing popularity of ethnic cuisines. Coconut milk products are valued for their nutritional benefits, rich flavor, and versatility in both food and non-food applications. Innovations in processing and packaging have expanded product offerings, catering to diverse consumer preferences.

The Coconut Milk Products Market is poised for robust growth, driven by rising consumer preferences for plant-based and natural products. This market has witnessed significant expansion due to the health benefits associated with coconut milk, such as its potential to improve blood sugar and A1C levels in diabetic individuals, as suggested by a 2021 study by a registered dietitian and owner of Harvest Table Nutrition. This underscores the increasing awareness and adoption of coconut milk as a healthier alternative in daily diets.

The Coconut Milk Products Market is poised for robust growth, driven by rising consumer preferences for plant-based and natural products. This market has witnessed significant expansion due to the health benefits associated with coconut milk, such as its potential to improve blood sugar and A1C levels in diabetic individuals, as suggested by a 2021 study by a registered dietitian and owner of Harvest Table Nutrition. This underscores the increasing awareness and adoption of coconut milk as a healthier alternative in daily diets.The market has also seen product innovation and diversification, exemplified by Vita Coco's recent launch of Vita Coco Treats, a coconut milk beverage with sweet strawberries, available exclusively at Target for $3.49 per 16.9-ounce container. This product launch highlights the trend of integrating coconut milk into a variety of consumer-friendly formats, catering to a broad audience seeking both health benefits and taste.

The culinary versatility of coconut milk products has bolstered their demand across multiple sectors, including food and beverage, personal care, and cosmetics. The popularity of ethnic cuisines, particularly Southeast Asian and Caribbean dishes, has further driven the consumption of coconut milk as a key ingredient. This is complemented by the broader trend towards organic and natural products, aligning with consumer preferences for clean-label and sustainable choices.

Key Takeaways

- Market Growth: The Global Coconut Milk Products Market was valued at USD 1.4 Bn in 2023. It is expected to reach USD 3.0 Bn by 2033, with a CAGR of 8.1% during the forecast period from 2024 to 2033.

- By Category: Conventional coconut milk products dominate the market with a significant market share of 62%.

- By Form: Liquid coconut milk products lead the market with a commanding 70% share, reflecting consumer preference for ready-to-use applications.

- By Packaging Type: Cans hold the largest market share at 48%, owing to their durability, long shelf life, and convenience in storage and transportation.

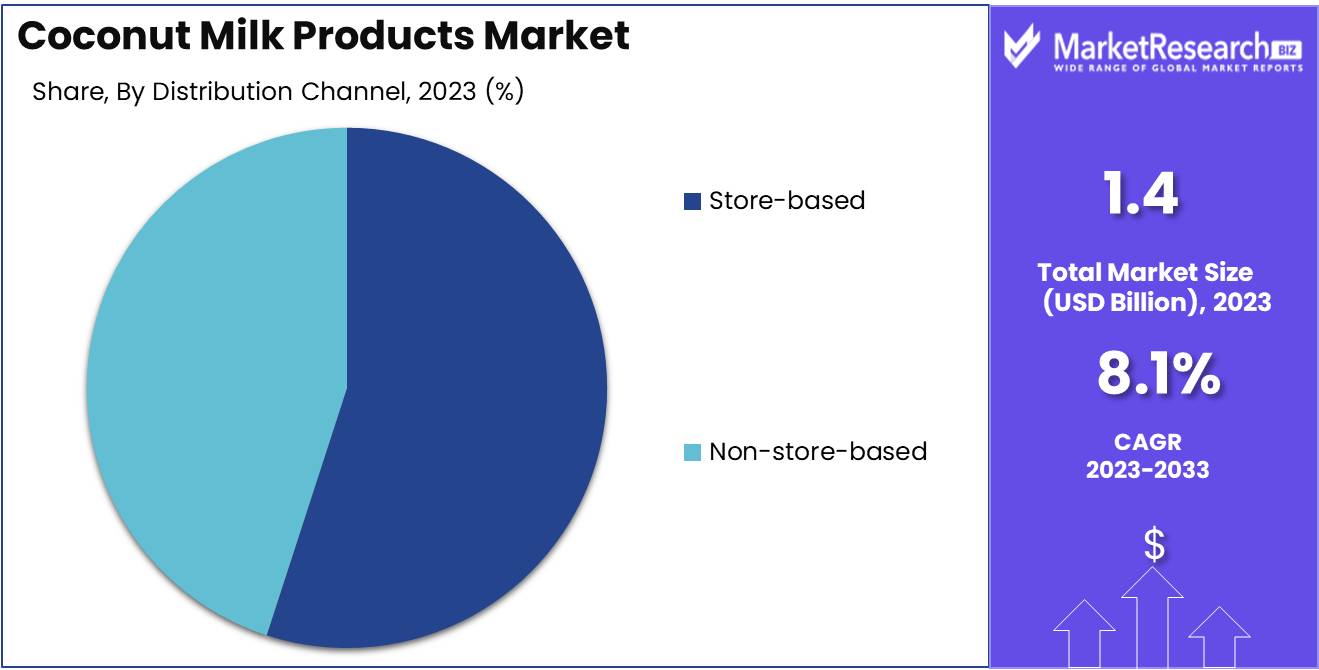

- By Distribution Channel: Store-based distribution channels are predominant, capturing 55% of the market, highlighting the preference for physical retail stores.

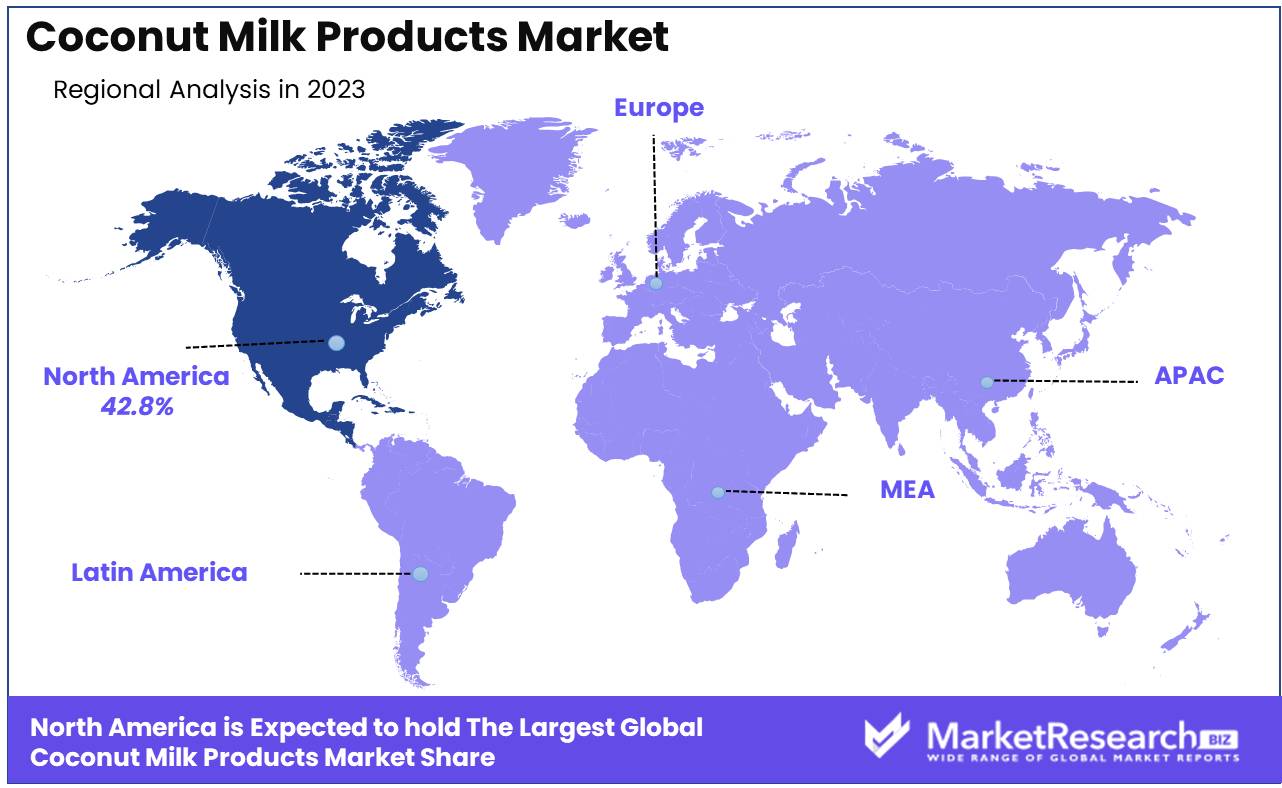

- Regional Dominance: North America leads the Coconut Milk Products Market with a robust 42.8% share, driven by increasing consumer preference for dairy alternatives.

- Growth Opportunity: Increasing consumer awareness of plant-based diets and lactose intolerance is expanding the market for coconut milk products globally.

Driving factors

Rising Demand for Plant-Based Products

The increasing consumer preference for plant-based products is a primary driver of the coconut milk products market. As more individuals adopt vegan and vegetarian lifestyles, the demand for plant-based alternatives to traditional dairy products has surged. Coconut milk, known for its creamy texture and versatility, has become a popular choice among consumers looking for non-dairy options.

This trend is supported by the growing awareness of environmental sustainability, as plant-based diets are considered more eco-friendly due to lower resource consumption and reduced greenhouse gas emissions compared to animal-based diets. The shift towards plant-based products is expected to continue, fueling the growth of the coconut milk products market.

Health Benefits of Coconut Milk

The health benefits associated with coconut milk significantly contribute to its market growth. Coconut milk is rich in vitamins, minerals, and healthy fats, making it a nutritious addition to various diets. It is particularly valued for its medium-chain triglycerides (MCTs), which are believed to aid in weight management, boost energy levels, and improve cognitive function.

Coconut milk is lactose-free, making it suitable for individuals with lactose intolerance or dairy allergies. The increasing focus on health and wellness has led consumers to seek out nutritious alternatives to traditional dairy products, further driving the demand for coconut milk products.

Dairy Alternatives

The growing popularity of dairy alternatives is another crucial factor propelling the coconut milk products market. As consumers become more aware of the potential health issues associated with dairy consumption, such as lactose intolerance and dairy allergies, the demand for non-dairy alternatives has risen. Coconut milk serves as a versatile and flavorful substitute in a wide range of applications, including cooking, baking, and beverages.

This versatility, combined with its health benefits, makes coconut milk an appealing choice for consumers looking to reduce or eliminate dairy from their diets. The rising trend of dairy-free lifestyles, supported by the availability of a variety of coconut milk products, is expected to continue driving market growth.

Restraining Factors

Other Plant Milks

The coconut milk products market faces significant competition from other plant-based milks, such as almond, soy, oat, and rice milk. Each of these alternatives offers unique nutritional profiles and benefits, attracting different segments of the consumer base. For example, almond milk is often favored for its low-calorie content, while soy milk is preferred for its high protein levels. The diverse array of plant-based milk options provides consumers with a variety of choices, which can dilute the market share of coconut milk products.

Coconut milk differentiates itself with its distinctive flavor and texture, which can be advantageous in specific culinary applications such as curries, desserts, and tropical beverages. To remain competitive, producers of coconut milk products must highlight these unique qualities and continue to innovate to meet diverse consumer preferences.

High-Fat Content Considerations

The high-fat content of coconut milk is a double-edged sword in its market dynamics. On one hand, the presence of medium-chain triglycerides (MCTs) in coconut milk is promoted for its potential health benefits, such as enhanced energy levels and metabolism. These benefits make coconut milk attractive to health-conscious consumers and those following ketogenic or low-carb diets.

The overall high-fat content can be a deterrent for individuals seeking low-fat or heart-healthy options, given that saturated fats have traditionally been linked to cardiovascular health concerns. To address this, the market has seen the introduction of light or reduced-fat versions of coconut milk, catering to consumers who are mindful of their fat intake but still wish to enjoy the benefits and flavors of coconut milk.

By Category Analysis

In 2023, Conventional held a dominant market position in the By Category segment of the Coconut Milk Products Market, capturing more than a 62% share. Conventional coconut milk products dominate the market, driven by their widespread availability and cost-effectiveness. These products are produced using standard agricultural practices, which typically result in higher yields and lower production costs compared to organic methods. The extensive use of conventional coconut milk in various applications, including cooking, baking, beverages, and cosmetics, contributes to its leading market position.

Organic coconut milk products, although holding a smaller market share compared to conventional products, are gaining traction due to the rising consumer preference for natural and environmentally friendly products. Organic coconut milk is produced using organic farming practices that avoid synthetic pesticides and fertilizers, making it a healthier and more sustainable option. The increasing awareness of health benefits and the demand for clean-label products are significant drivers for the growth of the organic segment.

By Form Analysis

In 2023, Liquid held a dominant market position in the By Form segment of the Coconut Milk Products Market, capturing more than a 70% share. Liquid coconut milk products dominate the market due to their versatility and ease of use. Liquid coconut milk is extensively used in various culinary applications, including cooking, baking, and beverages. Its ready-to-use nature makes it a convenient option for both consumers and food manufacturers. The widespread availability of liquid coconut milk in different packaging formats, such as cans, cartons, and pouches, further enhances its market penetration.

Powdered coconut milk, while holding a smaller market share compared to liquid form, offers several advantages that cater to specific consumer needs. Powdered coconut milk is favored for its longer shelf life, ease of storage, and portability. It is commonly used in dry mixes, confectioneries, and as a non-dairy creamer. The reconstitution flexibility of powdered coconut milk allows consumers to adjust the concentration according to their preference, making it a versatile ingredient.

By Packaging Type Analysis

In 2023, Cans held a dominant market position in the By Packaging Type segment of the Coconut Milk Products Market, capturing more than a 48% share. Cans dominate the coconut milk products market due to their durability, long shelf life, and protection against light and air. These attributes make cans a preferred choice for packaging coconut milk, ensuring the product's quality and freshness over an extended period. Canned coconut milk is widely used in the food and beverage industry, particularly in cooking and baking, due to its convenience and reliability.

Bottles, particularly glass and plastic, are used for packaging coconut milk products, catering to a niche market that values premium and aesthetically pleasing packaging. Glass bottles are often preferred for their eco-friendly and reusable nature, while plastic bottles offer convenience and cost-effectiveness. However, the fragility of glass and environmental concerns associated with plastic limit their widespread adoption compared to cans and pouches.

Pouches, including both stand-up and spout pouches, are gaining popularity in the coconut milk products market due to their lightweight and flexible packaging options. Pouches offer convenience in storage and transportation, reducing overall logistics costs.

By Distribution Channel Analysis

In 2023, Store-based held a dominant market position in the By Distribution Channel segment of the Coconut Milk Products Market, capturing more than a 55% share. Store-based distribution channels, including supermarkets, hypermarkets, convenience stores, and specialty stores, dominate the coconut milk products market. The prominence of store-based channels is driven by the convenience and accessibility they offer to consumers. Supermarkets and hypermarkets provide a wide range of coconut milk products, allowing consumers to compare different brands and packaging types in one place.

Non-store-based distribution channels, including online retail, direct sales, and subscription services, are gaining traction in the coconut milk products market. The convenience of online shopping, coupled with the growing trend of e-commerce, drives the adoption of non-store-based channels. Consumers benefit from the ease of browsing and purchasing products from the comfort of their homes, often with access to a wider variety of products than found in physical stores.

Key Market Segments

By Category

- Conventional

- Organic

By Form

- Liquid

- Powder

By Packaging Type

- Bottles

- Cans

- Pouches

By Distribution Channel

- Store-based

- Non-store-based

Growth Opportunity

Expansion of Vegan and Organic Products

The global coconut milk products market is poised to benefit significantly from the growing demand for vegan and organic products. As more consumers adopt plant-based diets for health, ethical, and environmental reasons, the demand for vegan alternatives continues to rise. Coconut milk, being a naturally vegan product, fits seamlessly into this trend. Furthermore, the increasing consumer preference for organic products enhances the market potential for coconut milk products that are certified organic.

Organic coconut milk products, free from pesticides and synthetic additives, appeal to health-conscious consumers looking for natural and wholesome food options. This dual trend of veganism and organic consumption is expected to drive significant growth in the coconut milk products market.

Demand for Clean Label Ingredients

Another critical opportunity for the coconut milk products market in 2024 is the rising demand for clean label ingredients. Consumers are increasingly seeking transparency in the food they consume, favoring products with simple, recognizable ingredients and no artificial additives. Coconut milk products, often marketed with clean label claims, align well with this consumer preference.

The simplicity of ingredients, typically consisting of coconut, water, and sometimes a natural stabilizer, makes coconut milk an attractive option for those prioritizing clean eating. As clean label trends continue to gain momentum, producers of coconut milk products can capitalize on this by emphasizing their commitment to natural and straightforward ingredient lists.

Latest Trends

Food & Beverage Industry Expansion

The expansion of the food and beverage industry is a pivotal trend influencing the global coconut milk products market in 2024. As the industry grows, there is an increasing demand for innovative and versatile ingredients. Coconut milk, known for its rich flavor and creamy texture, is being extensively used in a variety of applications, ranging from beverages and desserts to sauces and curries.

This trend is driven by both the growing popularity of Asian cuisine globally and the rising demand for plant-based alternatives in mainstream diets. As food manufacturers and restaurants seek to diversify their offerings, coconut milk is becoming a staple ingredient, enhancing the market’s growth prospects.

Coconut Milk Powder and Flour

Another significant trend shaping the market is the rising popularity of coconut milk powder and coconut flour. These products offer convenient, shelf-stable alternatives to fresh coconut milk, catering to the needs of consumers and businesses looking for longer-lasting, versatile ingredients. Coconut milk powder, in particular, is gaining traction due to its ease of use in a wide range of culinary applications, from beverages to baked goods.

Coconut flour is becoming a popular gluten-free alternative in baking, driven by the increasing prevalence of gluten intolerance and the demand for healthier baking options. The versatility and health benefits associated with these products are contributing to their growing adoption, thereby expanding the coconut milk product market.

Regional Analysis

North America leads the global coconut milk products market with a substantial share of 42.8%.

North America leads the coconut milk products market with a dominant share of 42.8%. The region's leadership is driven by increasing consumer preference for plant-based alternatives, health consciousness, and diverse culinary applications of coconut milk in food and beverage industries. Countries like the United States and Canada witness robust demand for coconut milk products across retail and foodservice sectors, supported by innovations in product formulations and packaging.

Europe represents another key market for coconut milk products, characterized by a growing vegan population and rising adoption of dairy alternatives. Countries such as the UK, Germany, and France are prominent consumers of coconut milk-based beverages and dairy substitutes. The market growth is further propelled by the introduction of premium coconut milk products catering to health-conscious consumers and culinary enthusiasts.

Asia Pacific holds significant potential in the coconut milk products market, driven by traditional culinary practices and widespread availability of coconuts across Southeast Asian countries like Thailand, Indonesia, and the Philippines. The region's cultural affinity towards coconut-based products fuels demand, with coconut milk being a staple ingredient in regional cuisines and beverages.

The Middle East & Africa region is witnessing a gradual uptake of coconut milk products, driven by shifting dietary preferences towards healthier alternatives and increasing awareness about lactose intolerance. Countries like Saudi Arabia, UAE, and South Africa are key markets for coconut milk-based beverages and culinary ingredients, supported by the growing trend of ethnic food consumption and health-conscious lifestyles.

Latin America showcases significant growth opportunities in the coconut milk products market, driven by the region's abundant coconut plantations and cultural affinity towards coconut-derived foods.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global Coconut Milk Products Market in 2024 is anticipated to experience robust growth, driven by key players such as McCormick & Company, Inc., Goya Foods, Inc., and Dabur India Ltd. These companies, along with Ducoco Produtos Alimentícios S/A, Vita Coco, and Celebes Coconut Corp., are strategically positioned to leverage the increasing consumer demand for plant-based and natural products.

McCormick & Company, Inc., known for its extensive range of food products, is expected to capitalize on its strong distribution network and brand recognition to expand its coconut milk product offerings. Goya Foods, Inc., with its established market presence in the Hispanic community, is likely to drive growth by introducing innovative coconut milk products that cater to diverse culinary preferences.

Dabur India Ltd, a leader in the natural and Ayurvedic product segments, is anticipated to further penetrate the market by leveraging its expertise in health and wellness. Ducoco Produtos Alimentícios S/A, a prominent player in the Latin American market, is expected to strengthen its market position through strategic alliances and product diversification.

Vita Coco, known for its coconut water, is likely to expand its product portfolio to include a wider range of coconut milk products, tapping into the health-conscious consumer segment. Celebes Coconut Corp. and Thai Agri Foods Public Co., Ltd. are expected to enhance their market share by focusing on high-quality, organic coconut milk products.

Danone SA, a global leader in dairy and plant-based products, is poised to drive market growth by integrating coconut milk products into its extensive portfolio, appealing to both dairy and non-dairy consumers. Theppadungporn Coconut Co., Ltd. and ThaiCoconut Public Company, with their strong production capabilities and expertise in coconut-based products, are expected to play significant roles in meeting the global demand.

Market Key Players

- McCormick & Company, Inc.

- Goya Foods, Inc.

- Dabur India Ltd

- Ducoco Produtos Alimentícios S/A

- Vita Coco

- Celebes Coconut Corp.

- Thai Agri Foods Public Co., Ltd.

- Danone SA

- Theppadungporn Coconut Co., Ltd.

- ThaiCoconut Public Company

Recent Development

- In May 2024, Thai Agri Foods launched a new organic coconut milk product line, emphasizing sustainability and health benefits to cater to the growing demand for organic food products.

- In April 2024, Goya Foods introduced a ready-to-drink coconut milk beverage, aiming to capture the convenience market segment and appeal to health-conscious consumers with natural, dairy-free options.

Report Scope

Report Features Description Market Value (2023) USD 1.4 Bn Forecast Revenue (2033) USD 3.0 Bn CAGR (2024-2033) 8.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Category (Conventional, Organic), By Form (Liquid, Powder), By Packaging Type (Bottles, Cans, Pouches), By Distribution Channel (Store-based, Non-store-based) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape McCormick & Company, Inc., Goya Foods, Inc., Dabur India Ltd, Ducoco Produtos Alimentícios S/A, Vita Coco, Celebes Coconut Corp., Thai Agri Foods Public Co., Ltd., Danone SA, Theppadungporn Coconut Co., Ltd., ThaiCoconut Public Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- McCormick & Company, Inc.

- Goya Foods, Inc.

- Dabur India Ltd

- Ducoco Produtos Alimentícios S/A

- Vita Coco

- Celebes Coconut Corp.

- Thai Agri Foods Public Co., Ltd.

- Danone SA

- Theppadungporn Coconut Co., Ltd.

- ThaiCoconut Public Company