Global Cider Market By Product(Flavored, Unflavored), By Distribution Channel(On-trade, Off-trade, Others), By Packaging(Draught, Cans, Glass Bottles, Plastic Bottles, Others) By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

5153

-

May 2023

-

161

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

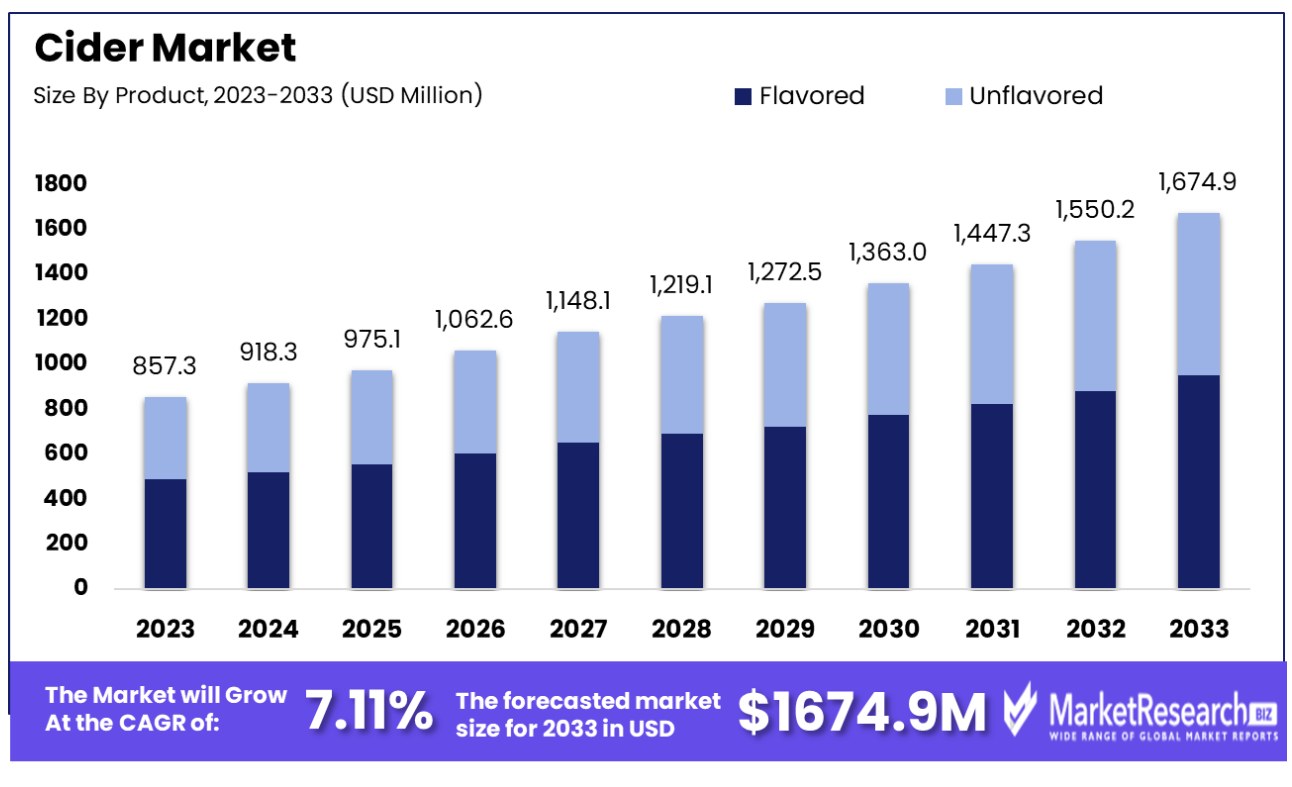

The Cider Market was valued at USD 857.37 million liters in 2023. It is expected to reach USD 1675.9 million liters by 2033, with a CAGR of 7.11% during the forecast period from 2024 to 2033.

The surge in demand for food and beverages as well as change in customer preferences are some of the main key driving factors for the cider market. Cider has gained much fame in the last few decades and many of the customers are inclined to it as a better and healthier choice than beer or any other alcoholic beverages. According to an article published by Morning Advertiser in November 2023, cider has accelerated its growth category within the on-trade by reaching 8.6% market value sales growth, which values to pound 1.9 billion in values sales and 2.5 hectolitres within the channel every year. Moreover, according to an article published by Beverage Daily in February 2023, Showering Triple Vintage has introduced a new category that signifies luxury ciders. These triple vintage are available in online platforms for purchase via Showering official website for pound 45 for a case of 12 x 375ml bottles.

Apple cider is one of the most commonly used health drinks. It is made from fermented apple juice which is a delicious drink that provides a broad range of health advantages that can enhance overall health quality. It is packaged with important nutrients and beneficial elements. Apple cider is also used as a natural remedy for various medical health conditions. For example, it is predominately used for digestion and to enhance gut health. Apple cider consists of enzymes and organic acids that support to breaking down of foods and improve the absorption of nutrients in the body. This also helps in detoxification which aids in purifying the body from any harmful or toxic toxins and impurities. It has several other advantages such as controlling blood sugar levels, decreasing inflammation, regulating oxidative stress, and augmenting immunity.

Many consumers are inclined towards cider drinks as they help them to lose weight. Currently, many individuals are dealing with overweight and obesity. The presence of acetic acid in apple cider enhances metabolism and promotes fat burning. Moreover, this also helps curb appetite and decreases food calorie intake which makes this product an ideal choice for a weight loss diet. Cider is a nutritional powerhouse that can substantially contribute to enhancing health and wellness. The incorporation of apple cider drinks into the daily routine work will unlock more health benefits that will lead to a healthier lifestyle. The demand for cider will increase due to its several health benefits that will help in market expansion in the coming years.

Driving Factors

Flavor Innovation Sparks Cider Market Expansion

The cider market is experiencing dynamic growth, fueled by innovative flavor diversification beyond traditional apple and pear varieties. Cider makers are venturing into exotic fruit flavors such as cherry, lime, and pineapple, broadening the market's appeal. This strategy effectively attracts new consumer segments eager for novel taste experiences. In 2023, Heineken's launch of Inch's cider in the UK, made exclusively from British apples and committed to sustainability, exemplifies this trend. Such innovations not only refresh the cider category but also resonate with younger, environmentally conscious consumers, significantly contributing to market growth.

Gluten-Free Appeal Bolsters Cider Demand

With approximately 23% of Americans routinely opting for gluten-free products, cider's natural gluten-free characteristic gives it a competitive edge, particularly over gluten-containing beers. This attribute aligns with the dietary preferences of a growing health-conscious consumer base, positioning cider as a desirable alternative in the alcoholic beverage market. The increasing demand for gluten-free options amplifies cider's market presence and appeal, driving its growth.

On-Premise Distribution Enhances Cider Accessibility

The availability of cider in bars and restaurants plays a crucial role in its market growth. On-premise distribution, especially draught ciders, introduces the beverage to a broader audience, encouraging trial among new consumers. The social setting of bars and restaurants, coupled with the convenience of draught offerings, makes cider an attractive choice for social drinkers. This exposure significantly contributes to cider's market penetration and consumer acceptance, propelling its overall growth in the beverage industry.

Restraining Factors

Intense Competition from Beer Market Limits Cider Growth

The cider market faces significant growth constraints due to the high competition from the beer industry, which continues to hold the largest share of alcoholic beverage sales. Big beer companies, with their substantial marketing budgets, dominate the market and retail spaces. Furthermore, consumer preferences play a crucial role; for instance, 16% of alcoholic beverage consumers exclusively drink beer, compared to lower percentages for wine and spirits. This dominance in both market presence and consumer preference creates a challenging environment for cider to gain market share and visibility, particularly in traditional retail settings and amidst heavy marketing campaigns by large beer companies.

Seasonal Sales Variability Challenges Year-Round Cider Market Stability

The cider market is significantly impacted by the seasonality of sales, which poses a major challenge to achieving year-round sales consistency. Cider sales typically peak during warmer months, with a notable average increase of 16% in the United States as days grow longer during the summer. However, these sales see a corresponding decline in colder months, dropping by a similar figure in winter, with January often being the lowest in terms of sales. This seasonal fluctuation contrasts with the more stable demand seen for beer and wine throughout the year, making it difficult for cider producers to maintain consistent sales and revenue streams across different seasons.

Cider Market Segmentation Analysis

By Product:

Flavored Cider dominates the market for cider, especially the apple-flavored category which had the largest market share of 51% by 2022. The popularity of flavored cider is driven by consumer demand for diverse and innovative taste profiles. Apple-flavored cider, being the traditional choice, continues to appeal to a wide audience due to its classic, familiar taste. However, the introduction of new flavors, such as berries, cherries, and tropical fruits, has broadened the market, attracting new consumers looking for alternative alcoholic beverages.

Unflavored cider, while also popular, caters to a more traditional market segment that prefers the authentic taste of cider without additional flavorings. the inventiveness and variety of flavors available in the market for cider, especially the apple-flavored variety has led to its dominance in the market.

By Distribution Channel :

Off-trade channels, including Supermarkets & Hypermarkets, Specialist Retailers, and Convenience Stores, represent the dominant distribution channel in the cider market. The growth in sales of ready-to-drink alcoholic beverages in off-trade channels, which increased by over five percent in 2022 in the UK, reflects a broader trend. Supermarkets and Hypermarkets offer a wide range of cider brands and flavors, catering to diverse consumer preferences. Specialist Retailers provide a curated selection, often including artisanal and craft ciders, while Convenience Stores offer easy access and quick purchase options.

The On-trade channel, comprising bars, pubs, and restaurants, also plays a significant role but is surpassed by the convenience, variety, and competitive pricing offered in the Off-trade channel. The shift towards home consumption, accelerated by recent global events, has further solidified the Off-trade channel's position in the cider market.

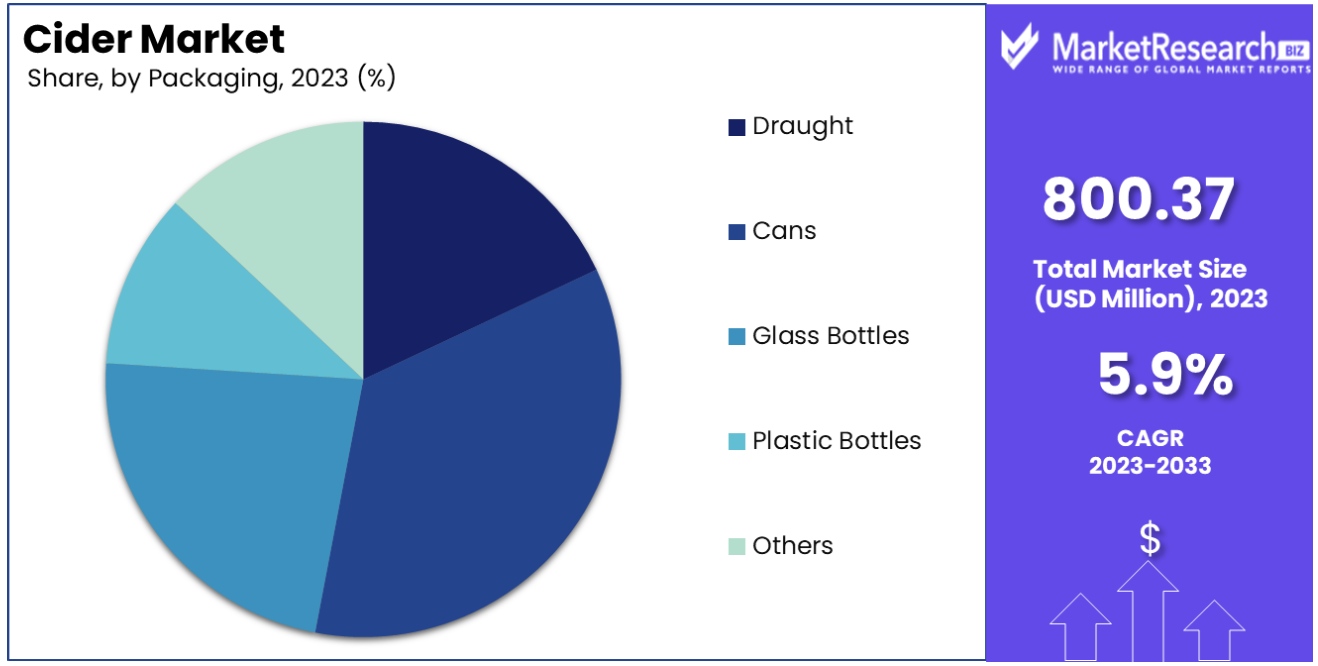

By Packaging :

Cans are the predominant packaging style for the cider market.The popularity increase of canned cider is due to its portability, convenience as well as its environmental benefits. Cans are lightweight, easy to transport and chill faster than other packaging formats. They also offer protection from light and air, preserving the cider's quality. The trend towards outdoor and on-the-go consumption has further propelled the demand for canned cider.

Other packaging formats like Draught, Glass Bottles, Plastic Bottles, and Others also contribute to the market. Draught cider is popular in the On-trade channel, Glass Bottles are preferred for premium and traditional ciders, and Plastic Bottles offer an economical packaging option. However, the ease of use and increasing demand from consumers for environmentally friendly packaging options have led to Cans being the top choice on the market for cider.

Industry Segments

By Product

- Flavored

- Unflavored

By Distribution Channel

- On-trade

- Off-trade

- Others

By Packaging

- Draught

- Cans

- Glass Bottles

- Plastic Bottles

- Others

Growth Opportunities

Functional Ingredients Propel Cider as a Health Beverage Choice

Integrating functional ingredients like probiotics and antioxidants into cider presents a substantial growth opportunity within the cider market. This strategy caters to the increasing number of health-conscious consumers who are seeking beverages that not only taste good but also offer health benefits. Positioning cider as a functional health beverage can significantly widen its appeal, particularly among those who are attentive to their dietary choices. The added health benefits make cider a more attractive option for a segment of the market that prioritizes wellness, potentially driving higher demand and market expansion.

Creative Packaging Drives Consumer Interest in the Cider Market

The use of distinctive and innovative packaging for the cider market is a successful method to attract the attention of consumers in retail stores. Innovative can and bottle designs can differentiate cider products on crowded shelves, appealing to consumers' aesthetic preferences and curiosity. Attractive packaging not only enhances the visual appeal of the product but can also communicate brand identity and values, making a memorable impression on consumers. As packaging creativity becomes an increasingly important factor in purchase decisions, cider brands that invest in distinctive and appealing packaging designs are likely to see increased consumer interest and market growth.

Cider Market Regional Analysis

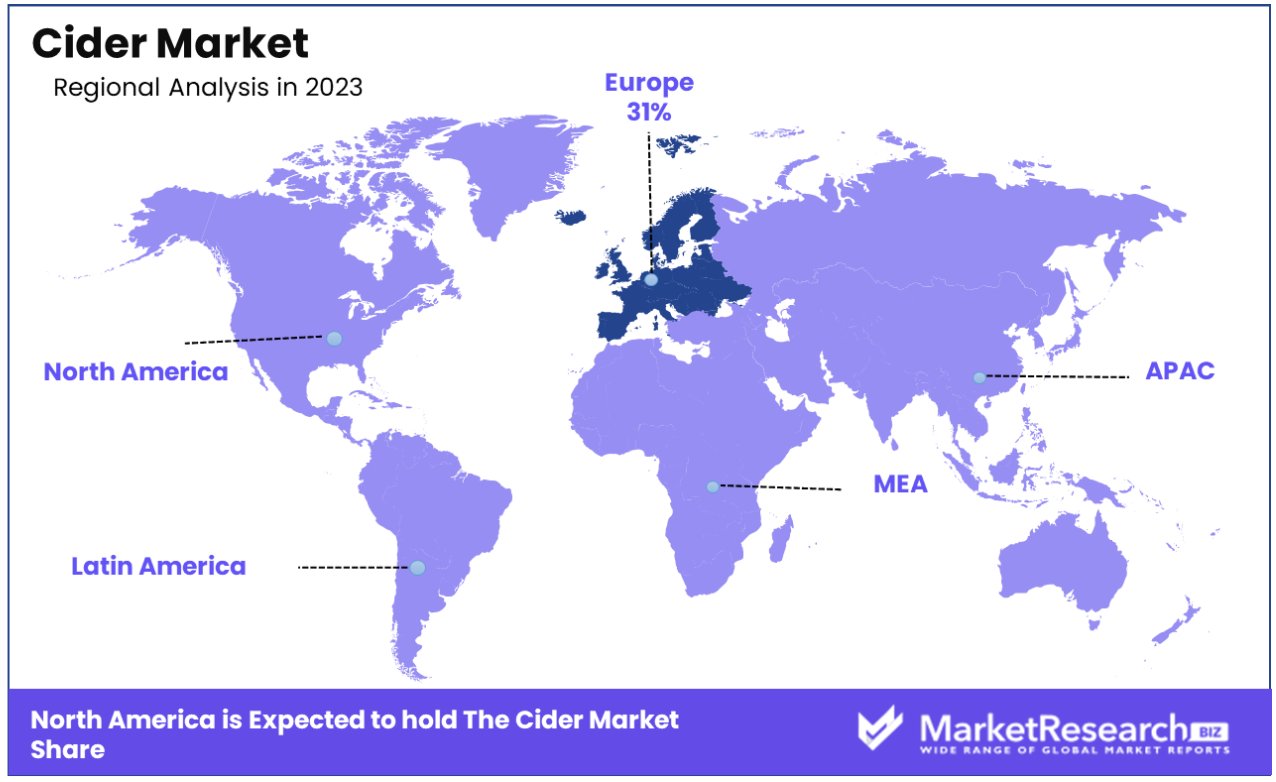

Europe Dominates with 31% Market Share in the Cider Market

Europe's significant 31% market share in the global cider industry is largely attributed to the region’s long-standing tradition and culture of cider production and consumption. The United Kingdom, France, and Spain are key contributors to this market dominance. These countries have a rich history in cider making, with companies like Bulmers and Strongbow in the UK, and Asturias in Spain leading the production. There is a belief that the European market for cider is driven by the growing demand for a variety of cider flavors as well as the rising demand for craft and ciders made by hand.

The market for cider across Europe can be distinguished by a wide range of production and a large range of flavor profiles. The region’s favorable climatic conditions for apple cultivation contribute significantly to cider production. Additionally, the growing trend of organic and locally sourced ingredients has led to an increase in small-scale craft cider producers. The European market is also witnessing an expansion in export activities, with European ciders gaining popularity in North America and other regions. Regulatory support for cider production and the promotion of regional specialties further enhance market dynamics.

North America: Growing Market with a Focus on Innovation

North America’s cider market is rapidly growing, driven by the United States and Canada. The region is experiencing a surge in craft cider production with companies like Angry Orchard and Woodchuck leading the way. The market is marked by the latest innovations in the production of flavors and techniques. The increasing consumer interest in gluten-free and alternative alcoholic beverages is also a key driver of market growth.

Asia-Pacific: Emerging Market with Expanding Consumer Base

In Asia-Pacific, the cider market is emerging, with countries like Australia and New Zealand making significant contributions. The market is driven by the growing middle class, increased urbanization, and the rising popularity of Western-style alcoholic beverages. Companies like Little Green and Mercury Cider are gaining prominence in the region. Markets are expected to expand as awareness among consumers and the access to cider rise.

Cider Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

Cider Market Key Player Analysis

Within the Cider Market, which is a diverse and growing sector of the beverage industry The companies listed play a significant part in shaping the preferences of consumers and trends in the market.The Molson Coors Brewing Company and Anheuser-Busch Companies LLC are industry giants with a strong presence in the global market. Their strategic positioning emphasizes broad product ranges and strong distribution networks, significantly influencing the cider market's landscape.

Heineken UK Limited and Carlsberg Breweries A/S, known for their extensive beverage portfolios, have made significant inroads in the cider market, offering a variety of flavors that cater to evolving consumer tastes. Their focus on brand development and marketing strategies underscores the industry's shift towards catering to a wider audience.

C&C Group plc and Carlton & United Breweries (CUB) are key players in regional markets, known for their strong foothold in traditional cider-drinking regions. Their expertise in crafting authentic ciders reflects the market's value for heritage and quality. Distell and Aston Manor, with their focus on quality and innovation, play crucial roles in driving the premium segment of the cider market.

Industry Key Players

- Anheuser-Busch Companies LLC

- Asahi Premium Beverages

- Aston Manor

- C&C Group plc

- Carlsberg Breweries A/S

- Carlton & United Breweries (CUB)

- Distell

- Halewood

- Heineken UK Limited

- The Boston Beer Company

- Angry Orchard

- Brannland Cider

- Smith & Forge

- Stella Artois Cidre

- Strongbow

- Woodchuck

- The Molson Coors Brewing Company

- Seattle Cider Company

- Vander Mill

- Celtic Marches Beverages Ltd

- Armagh Cider Company

- Cider Ireland

Market Recent Development

- In January 2024, Burnt Faith, the British brandy producer, secured £2 million in funding for its global expansion plans

- In January 2024, Jacqui and Dan Heavens, owners of Quartz Rock Vineyard in Marlboro, acquired Glorie Winery in 2019 and rebranded it as Quartz Rock. Despite the challenges posed by the pandemic, Quartz Rock has flourished, winning awards for its wines. The winery recently launched Bedrock Ciders, upgrading equipment and expanding its cider production.

- In December 2023, Tata Consumer Products is set to expand its range of innovative products, focusing on new growth engines for the business. The company has introduced various innovative products, including Apple Cider Vinegar, Simply Better Cold Pressed Oils, and Soulfull Ragi Bites Choco Sticks. It aims to tap into new categories for branded penetration.

Report Scope

Report Features Description Market Value (2023) USD 857.37 Million Forecast Revenue (2033) USD 1675.9 Million CAGR (2024-2032) 7.11% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Flavored, Unflavored), By Distribution Channel(On-trade, Off-trade, Others), By Packaging(Draught, Cans, Glass Bottles, Plastic Bottles, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Anheuser-Busch Companies LLC, Asahi Premium Beverages, Aston Manor, C&C Group plc, Carlsberg Breweries A/S, Carlton & United Breweries (CUB), Distell, Halewood, Heineken UK Limited, The Boston Beer Company, Angry Orchard, Brannland Cider, Smith & Forge, Stella Artois Cidre, Strongbow, Woodchuck, The Molson Coors Brewing Company, Seattle Cider Company, Vander Mill, Celtic Marches Beverages Ltd, Armagh Cider Company, Cider Ireland Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Anheuser-Busch Companies LLC

- Asahi Premium Beverages

- Aston Manor

- C&C Group plc

- Carlsberg Breweries A/S

- Carlton & United Breweries (CUB)

- Distell

- Halewood

- Heineken UK Limited

- The Boston Beer Company

- Angry Orchard

- Brannland Cider

- Smith & Forge

- Stella Artois Cidre

- Strongbow

- Woodchuck

- The Molson Coors Brewing Company

- Seattle Cider Company

- Vander Mill

- Celtic Marches Beverages Ltd

- Armagh Cider Company

- Cider Ireland