Chilled And Deli Foods Market Report By Product Type (Meat Products [Cooked Meats, Sausages, Ham, Bacon, Others], Cheese [Soft Cheese, Hard Cheese, Processed Cheese, Others], Prepared Salads, Prepared Meals, Sandwiches, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others), By End User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

48823

-

July 2024

-

325

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

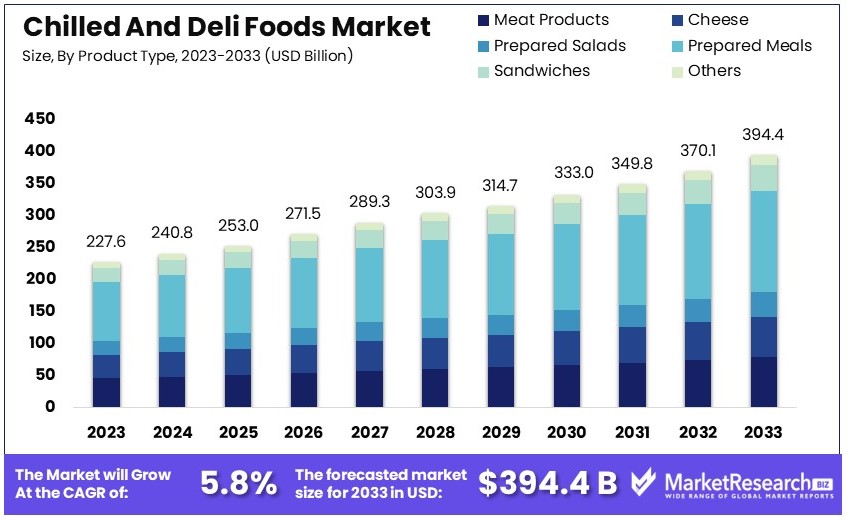

The Global Chilled And Deli Foods Market size is expected to be worth around USD 394.4 Billion by 2033, from USD 227.6 Billion in 2023, growing at a CAGR of 5.8% during the forecast period from 2024 to 2033.

The Chilled and Deli Foods Market encompasses a diverse range of ready-to-eat products including meats, cheeses, salads, sandwiches, and prepared entrees that are sold in a refrigerated or deli section of retail outlets. This market caters to consumers seeking convenience, quality, and variety in their daily meal choices.

The sector is driven by the growing demand for easy, quick meal solutions among urban, time-pressed consumers globally. Key trends shaping the market include the rising preference for healthier and premium quality products, as well as innovative packaging solutions that extend shelf life and preserve freshness. Retailers and manufacturers within this market are increasingly focusing on expanding product assortments and enhancing food safety standards to attract a broad customer base and adapt to changing dietary preferences.

The chilled and deli foods market is poised for significant growth, driven by the rising demand for convenience and quality. In recent years, consumer preferences have shifted towards ready-to-eat and easy-to-prepare meals, a trend that has been amplified by busy lifestyles and changing dietary habits. According to the International Food Information Council (IFIC), 87% of consumers in 2023 prioritized taste in their food and beverage purchases, up from 80% in 2022. This trend indicates a growing preference for products that offer both convenience and flavor, underscoring the importance of product quality in consumer decision-making.

Additionally, economic factors play a crucial role in shaping market dynamics. The IFIC report also highlights that the importance of price has increased significantly, with 76% of consumers considering it a critical factor in 2023, up from 68% in 2022. This rise reflects the economic pressures that influence purchasing decisions, compelling manufacturers to balance cost and quality effectively.

The market's expansion is further supported by advancements in packaging and preservation technologies, which enhance the shelf life and safety of chilled and deli foods. Innovations in this area are crucial for maintaining the freshness and appeal of these products, meeting consumer expectations for high-quality, convenient food options.

Moreover, the growing trend towards health and wellness has led to an increased demand for nutritious and minimally processed chilled and deli foods. Consumers are increasingly seeking products that align with their health goals, creating opportunities for manufacturers to innovate and differentiate their offerings.

Key Takeaways

- Market Value: The Chilled and Deli Foods Market was valued at USD 227.6 billion in 2023 and is expected to reach USD 394.4 billion by 2033, with a CAGR of 5.8%.

- Product Type Analysis: Prepared meals dominate at 40%, offering convenience and variety to consumers.

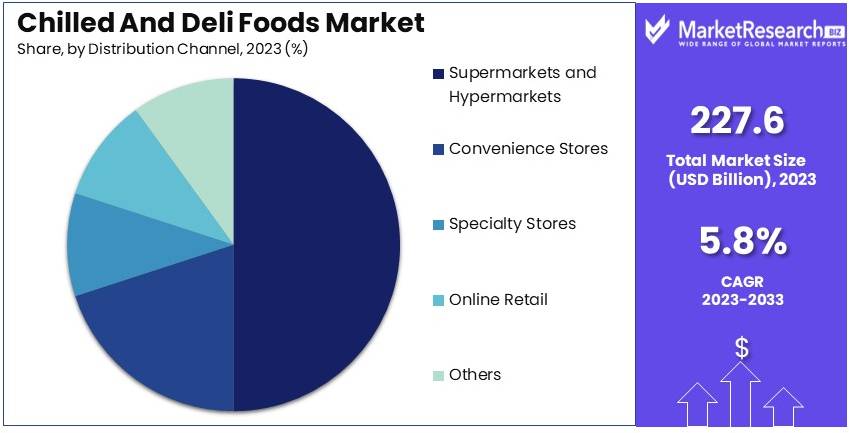

- Distribution Channel Analysis: Supermarkets and hypermarkets lead with 50%, providing widespread availability and variety.

- End User Analysis: Food service sector dominates at 45%, driven by high demand from hotels, restaurants, and cafes.

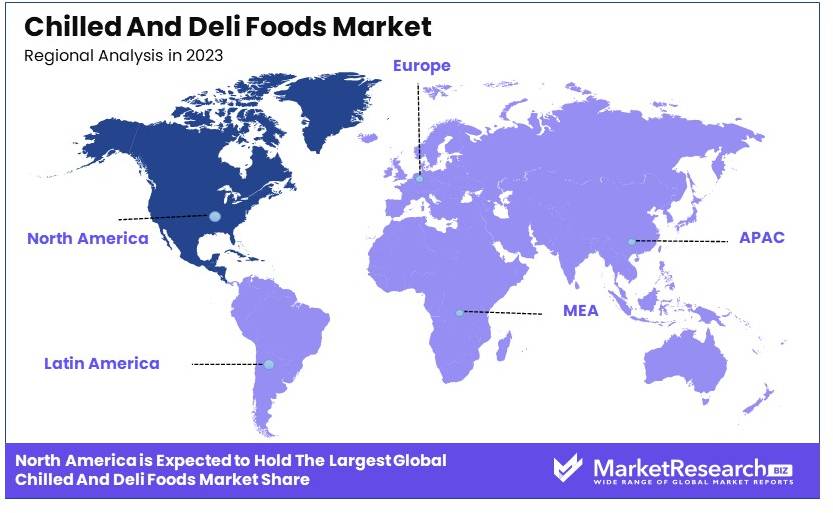

- Dominant Region: North America leads with approximately 30.6%, driven by high consumer demand for convenience foods.

- High Growth Region: Asia-Pacific is expected to witness significant growth, fueled by increasing urbanization and changing consumer preferences.

- Analyst Viewpoint: The chilled and deli foods market is poised for steady growth, driven by consumer demand for convenience and ready-to-eat meals. The market faces moderate competition with opportunities for innovation.

Driving Factors

Changing Consumer Preferences and Demand for Convenience Drives Market Growth

The shift in consumer behavior towards prioritizing convenience is a pivotal driver in the growth of the chilled and deli foods market. As urbanization increases and lifestyles become busier, there is a marked rise in demand for ready-to-eat foods that do not compromise on taste or nutrition. Chilled and deli foods, such as pre-packaged salads, sandwiches, and meal kits, directly cater to this need, offering quick meal solutions that fit into hectic schedules.

The popularity of these products is particularly high among urban professionals and families who have less time for traditional meal preparation. This trend not only boosts sales in supermarkets but also aligns with the growing trend of health-conscious eating, as these options often include fresher ingredients compared to canned or frozen alternatives.

Growth of the Foodservice Industry and Grab-and-Go Culture Drives Market Growth

The expansion of the foodservice industry, including quick-service restaurants, cafes, and convenience stores, has been a significant factor in the proliferation of chilled and deli foods. Establishments that offer fast and convenient meal options, like pre-made sandwiches, wraps, tortilla and salads, are thriving as consumers increasingly opt for quick and easy food solutions.

Major chains such as Subway and Pret A Manger have leveraged this trend to significant effect, often featuring an array of chilled and deli offerings that align with the fast-paced lifestyles of their customers. This growth in the foodservice sector not only increases the volume of chilled and deli foods sold but also reinforces the consumer's perception of these foods as both time-saving and tasty options, thereby supporting ongoing market growth.

Emphasis on Health and Wellness Drives Market Growth

Increasing health consciousness among consumers is significantly influencing the chilled and deli foods market. As more people seek out dietary options that support a healthy lifestyle, the demand for products characterized by fresh food and minimal processing has surged. This health-driven demand has prompted manufacturers to innovate and expand their product lines to include items with clean labels, natural ingredients, and clear nutritional benefits.

Such offerings appeal to health-conscious consumers who are wary of traditional fast foods and processed snacks, thus broadening the market base and fostering growth. Manufacturers who align their product development with these health trends not only cater to current consumer preferences but also position themselves favorably in a competitive market landscape.

Restraining Factors

Food Safety and Quality Concerns Restrain Market Growth

Chilled and deli foods have a shorter shelf life and are prone to bacterial growth. This raises significant food safety and quality issues, especially during transportation and storage. Maintaining proper temperature control and following strict food handling guidelines are essential to prevent spoilage and foodborne illnesses.

Recent listeria outbreaks linked to deli meats have increased consumer awareness and scrutiny. These concerns make consumers cautious about purchasing chilled and deli foods, limiting market growth. Companies must ensure high safety standards to regain consumer trust and encourage market expansion.

Perception of High Prices Restrains Market Growth

Chilled and deli foods are often seen as more expensive than shelf-stable products or home-prepared meals. This perception deters price-sensitive consumers, particularly in regions with lower disposable incomes.

The high cost of these products can be a significant barrier, reducing their appeal to a broader consumer base. Manufacturers need to find a balance between quality, convenience, and affordability to stay competitive. By addressing the price perception, companies can attract more customers and drive market growth.

Product Type Analysis

Prepared Meals dominate with 40% due to convenience and variety.

In the chilled and deli foods market, the segment by product type is crucial for understanding consumer preferences and industry dynamics. The dominant sub-segment within this category is Prepared Meals, which commands a 40% share of the market. This dominance is primarily due to the growing demand for convenience foods that require minimal preparation time. Consumers, especially those with busy lifestyles, prefer prepared meals because they offer a quick and easy solution for daily meals without compromising on taste or quality. Additionally, the variety in cuisines and dietary preferences catered to by prepared meals enhances their appeal.

Other significant sub-segments include Meat Products and Cheese. Meat Products, subdivided into cooked meats, hot dogs and sausages, ham, bacon, and others, are essential due to their traditional consumption patterns and innovations in product offerings. Cheese, categorized into soft cheese, hard cheese, processed cheese, and others, also holds a substantial market share, driven by its versatility and integration into various culinary traditions. Each of these sub-segments contributes to the market by meeting specific consumer needs and preferences, thereby supporting the overall growth of the chilled and deli foods sector.

Distribution Channel Analysis

Supermarkets and Hypermarkets dominate with 50% due to widespread accessibility and variety.

The distribution channel is a pivotal element in the chilled and deli foods market, with Supermarkets and Hypermarkets leading with a 50% share. This dominance is attributed to their ability to offer a wide range of products under one roof, coupled with the convenience of accessible locations. Consumers appreciate the ability to physically inspect products before purchase, which is particularly important for food items.

Other key distribution channels include Convenience Stores, Specialty Stores, Online Retail, and Others. Convenience Stores are crucial for quick purchases, whereas Specialty Stores cater to customers looking for specific brands or higher-quality options. Online Retail is growing rapidly, driven by the rise in e-commerce and consumer comfort with online shopping, offering a significant opportunity for market expansion. Each channel plays a unique role in making chilled and deli foods available to a diverse consumer base, thus supporting the overall market growth.

End User Analysis

Food Service dominates with 45% due to high demand in urban areas and diverse consumer offerings.

The chilled and deli foods market is also segmented by end user, where Food Service emerges as the dominant sector, holding a 45% share. This sector includes hotels, restaurants, cafes, bars, and catering services, which collectively consume a significant amount of chilled and deli products. The demand in this segment is primarily driven by urbanization, with more people dining out or ordering food online, and the diverse offerings that cater to various consumer tastes and dietary needs.

The Household segment is another crucial market, driven by the increasing need for convenience and quality in home-cooked meals. As lifestyles continue to evolve, more households are turning to chilled and deli foods to save time while ensuring nutritious and enjoyable meals. Each end-user segment—Food Service and Household—contributes differently to the market dynamics, with Food Service leading the growth due to its larger scale of operations and broader customer base.

Key Market Segments

By Product Type

- Meat Products

- Cooked Meats

- Sausages

- Ham

- Bacon

- Others

- Cheese

- Soft Cheese

- Hard Cheese

- Processed Cheese

- Others

- Prepared Salads

- Prepared Meals

- Sandwiches

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

By End User

- Household

- Food Service

- Hotels & Restaurants

- Cafes & Bars

- Catering Services

- Others

Growth Opportunities

Online Grocery Shopping and Delivery Services Offer Growth Opportunity

The rise of online food delivery services has significantly expanded the market for chilled and deli foods. Consumers appreciate the convenience of ordering high-quality, fresh deli items online, which is reflected in the increasing sales volumes reported by services like Instacart and Amazon Fresh.

This trend reduces the necessity for physical store visits and enhances consumer access to a wider variety of chilled and deli products. It also allows retailers and producers to reach a broader audience, including those who prioritize convenience and are willing to pay a premium for delivery services. The ongoing growth of e-commerce in the food sector suggests a steady increase in demand for these services, providing a robust growth trajectory for the chilled and deli foods market.

Expansion into Emerging Markets Offers Growth Opportunity

Urbanization and rising disposable incomes in emerging markets create fertile ground for the expansion of the chilled and deli foods industry. These markets present new consumer segments eager for premium and convenient food options. By catering to local tastes—such as offering regional flavors and adapting to cultural dietary preferences—manufacturers can significantly boost their market share.

Furthermore, maintaining high standards of quality and safety enhances brand reputation and consumer trust, key factors for success in new markets. As urban populations grow and global connectivity increases, these emerging markets are expected to contribute substantially to the global demand for chilled and deli foods, marking them as pivotal areas for potential market expansion.

Trending Factors

Clean Labeling and Transparency Are Trending Factors

The demand for transparency and clean labeling in food products is shaping consumer preferences in the chilled and deli foods market. Today's consumers, particularly the health-conscious, are scrutinizing product labels more than ever. They prefer foods with recognizable, minimally processed ingredients and clear nutritional information.

Companies that commit to clean labeling can differentiate themselves and build consumer trust, leading to increased loyalty and market share. This trend not only aligns with growing health awareness but also with regulatory trends favoring transparency, setting a standard that could redefine product offerings in the chilled and deli sector.

Plant-based and Flexitarian Diets Are Trending Factors

The shift towards plant-based and flexitarian diets has opened new avenues in the chilled and deli foods market. With more consumers reducing their meat consumption due to health, ethical, or environmental reasons, the demand for plant-based alternatives has surged. Innovative products such as plant-based deli slices, vegan cheese, and other meat-free options are gaining popularity.

Manufacturers that can effectively tap into this trend with tasty and high-quality alternatives are likely to capture a significant portion of this growing demographic. This adaptation not only caters to current consumer trends but also positions companies well for future growth as global dietary habits continue to evolve.

Regional Analysis

North America Dominates with 30.6% Market Share in the Chilled and Deli Foods Market

North America's significant 30.6% share of the chilled and deli foods market is driven by high consumer demand for convenience foods and a strong presence of retail chains offering diverse options. The region's fast-paced lifestyle promotes the consumption of ready-to-eat products. Additionally, the ongoing innovation in food preservation and packaging technology by key players enhances product quality and variety, attracting more consumers.

The chilled and deli foods sector in North America benefits from an established food processing industry and a well-developed distribution network that ensures wide product availability. Moreover, rising health consciousness among consumers has led to increased demand for high-quality, nutritious chilled and deli foods. These dynamics are supported by robust marketing strategies and brand loyalty, which help maintain high sales volumes.

The future of North America in the chilled and deli foods market appears robust. Anticipated trends include a shift towards organic and plant-based options, driven by evolving consumer preferences. As manufacturers continue to innovate and cater to health trends, North America’s market share may see further growth. Strategic expansions and partnerships are also likely to strengthen the region's market presence.

Regional Market Share Analysis:

- Europe: Accounts for about 35% of the market. Europe's market leadership is supported by a preference for gourmet and artisanal food products alongside stringent quality control standards that enhance consumer trust.

- Asia Pacific: Holds a 20% market share. Rapid urbanization and the increase in disposable incomes fuel the demand for convenient meal solutions, driving market growth in this region.

- Middle East & Africa: With an 8% market share, this region is experiencing gradual growth due to rising urbanization and the expanding influence of Western eating habits.

- Latin America: Represents 6.4% of the market. Growth in this region is spurred by urban growth and the increasing number of women in the workforce, which raises the demand for convenient food options.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The chilled and deli foods market is driven by prominent food industry leaders. Tyson Foods, Inc. and Hormel Foods Corporation are key players with strong product portfolios in meats and prepared foods. Nestlé S.A. and Danone S.A. dominate in dairy and plant-based alternatives. Kraft Heinz Company and Conagra Brands, Inc. are influential due to their vast range of convenience foods.

Kerry Group plc and Unilever plc contribute with their expertise in food ingredients and spreads. BRF S.A. and Sigma Alimentos, S.A. de C.V. are significant in processed meats and ready-to-eat meals. JBS S.A. leverages its global meat production capacity. Maple Leaf Foods Inc. focuses on sustainable and plant-based products. Greencore Group plc is notable for its prepared meals and sandwiches.

These companies shape the market through innovation in product offerings and sustainability practices. Strategic acquisitions and brand expansions enhance their market presence. The emphasis is on meeting consumer demand for convenience, quality, and healthier options.

Market Key Players

- Tyson Foods, Inc.

- Hormel Foods Corporation

- Nestlé S.A.

- Danone S.A.

- Kraft Heinz Company

- Conagra Brands, Inc.

- Kerry Group plc

- Unilever plc

- BRF S.A.

- Sigma Alimentos, S.A. de C.V.

- JBS S.A.

- Maple Leaf Foods Inc.

- Greencore Group plc

Recent Developments

- June 2024: Nomad Foods revealed findings from an 18-month study conducted with Campden BRI. The study suggested that increasing frozen food storage temperatures from -18°C to -15°C can cut energy consumption by 10% without compromising food safety. This initiative is part of Nomad Foods' drive towards more sustainable practices in frozen food storage.

- February 2024: Sysco announced its plan to invest $100 million in a new depot to serve London and the South East of England. This investment underscores Sysco's commitment to expanding its infrastructure and enhancing service delivery in the UK.

Report Scope

Report Features Description Market Value (2023) USD 227.6 Billion Forecast Revenue (2033) USD 394.4 Billion CAGR (2024-2033) 5.8% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Meat Products [Cooked Meats, Sausages, Ham, Bacon, Others], Cheese [Soft Cheese, Hard Cheese, Processed Cheese, Others], Prepared Salads, Prepared Meals, Sandwiches, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others), By End User (Household, Food Service [Hotels & Restaurants, Cafes & Bars, Catering Services, Others]) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Tyson Foods, Inc., Hormel Foods Corporation, Nestlé S.A., Danone S.A., Kraft Heinz Company, Conagra Brands, Inc., Kerry Group plc, Unilever plc, BRF S.A., Sigma Alimentos, S.A. de C.V., JBS S.A., Maple Leaf Foods Inc., Greencore Group plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Tyson Foods, Inc.

- Hormel Foods Corporation

- Nestlé S.A.

- Danone S.A.

- Kraft Heinz Company

- Conagra Brands, Inc.

- Kerry Group plc

- Unilever plc

- BRF S.A.

- Sigma Alimentos, S.A. de C.V.

- JBS S.A.

- Maple Leaf Foods Inc.

- Greencore Group plc