Global Chickpea Protein Market By Type(Protein Isolates, Flour, Other Products), By Nature(Organic, Conventional), By Form (Solid, Liquid), By Processing Type (Wet Processing, Dry Processing), By End-User (Food Processing, Animal Feed, Other End-Users), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

37431

-

June 2023

-

179

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

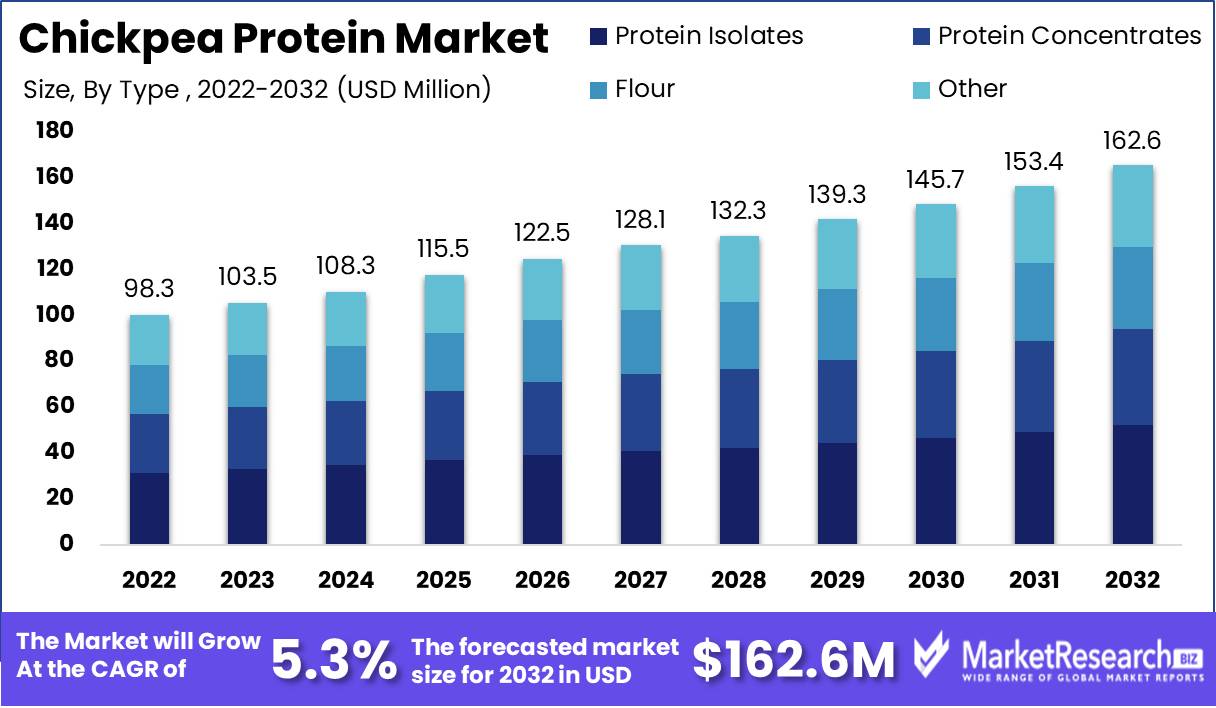

Global Chickpea Protein Market size is expected to be worth around USD 162.6 Mn by 2032 from USD 98.3 Mn in 2022, growing at a CAGR of 5.3% during the forecast period from 2023 to 2032.

The global chickpea protein market is growing exponentially and will soon reach a large market size. Chickpea protein, a plant-based protein made from chickpeas or garbanzo beans, bears the distinction of being sustainable and eco-friendly, cementing its market position.

The massive market report examines the global chickpea protein market's exceptional growth, intriguing trends, and futuristic estimates. The study methodically unravels the intricacies, illuminates key players who steer this dynamic market, investigates the major driving variables that fuel its evolution, and weighs the limits that may hinder its expansion.

This extensive discussion exposes chickpea protein production, consumption, supply, and demand across varied locations, creating a deep understanding of its global environment. This fascinating tour illuminates the ethical issues surrounding chickpea protein production and distribution, revealing its social impacts.

Chickpea protein is versatile and nutritious. This appealing plant-based protein attracts health-conscious people with its outstanding collection of amino acids, fiber, and necessary nutrients that work together to support human well-being. Its gluten-free, non-GMO, and nutritional qualities make it a favorite among holistic health and eco-friendly consumers.

Chickpea protein illustrates the symbiotic relationship between consumers and industry. Consumers are guaranteed a nutritious, plant-based protein supply that supports their holistic well-being. Manufacturers find an affordable and sustainable alternative to animal-based proteins by adding chickpea protein into a wide range of products, from delectable snacks to cool beverages and products from the bakery.

Innovation has flourished in the chickpea protein market. Chickpea protein isolates, which have more protein and less fat than chickpea flour, are a notable step in this trajectory. Excitingly, chickpea protein has transcended its traditional boundaries and found profound application in plant-based meat alternatives, including mouthwatering burgers and succulent sausages, as well as sports nutrition products.

Chickpea protein production and distribution have attracted several enterprises due to this market's growth. Food industry heavyweights Nestle and Danone have welcomed this trend by adding chickpea protein into their varied line of products to meet the rising demand for plant-based protein. Chickpea protein has a strong presence in dairy replacements, protein bars, and a variety of tasty snacks, influencing the industry.

The global chickpea protein market is expected to continue rising due to the rising demand for plant-based protein and the growing awareness of its health and environmental benefits. This marvel has applications in sports nutrition and animal feed, as well as food and beverages.

Key drivers support the amazing growth of the chickpea protein market. The growing vegan and vegetarian population's need for plant-based protein is driven by the understanding of plant-centric diets' unmatched benefits. Chickpea protein's eco-friendliness and sustainability drive market expansion to new heights.

Driving factors

Plant-Based Protein Demand Drives Chickpea Protein Market Growth

The global chickpea protein market is growing as demand for plant-based proteins rises. The market is likely to rise due to vegetarian and vegan diets. Chickpeas are versatile and nutritious, providing fiber, vitamins, and minerals. Consumers seeking healthier and more sustainable protein sources are driving market expansion.

Nutritional Benefits and Versatility Grow Chickpea Protein Market

Regulations are not likely to significantly impact the chickpea protein market. The industry is monitoring any changes. As demand for plant-based proteins rises, labels and claims may be regulated.

Industry Expects Potential Regulatory Changes as Plant-Based Protein Demand Rises

Emerging technology may boost the chickpea protein market. Chickpea protein may become more versatile in food applications as protein extraction and food processing improve. New technologies may improve chickpea protein flavor and texture, making it more appealing to customers.

The Potential of Chickpea Protein in the Food Industry is Improved by Advancements in Technology

Despite the market's bright outlook, disruptors may affect competition. Alternative protein sources like lab-grown beef are disruptors. These new sources may reduce the demand for plant-based proteins if they become more accessible and economical.

Alternative Proteins Threaten Chickpea Protein Market

Finally, consumer trends may affect the chickpea protein market. Consumers may prefer eco-friendly products as sustainability concerns grow. This may raise demand for plant-based proteins and decrease animal-based protein consumption. Demand for sustainable and healthful protein sources is driving growth in the chickpea protein market.

Restraining Factors

Challenges for the Chickpea Protein Market from Fluctuating Prices of Chickpeas

As demand for plant-based proteins continues to rise, the global market for chickpea protein is acquiring traction. However, like any other commodity market, this one faces its own set of obstacles. For the population, chickpeas are a crucial crop. Due to their high protein content and overall benefits, they are widely utilized in Middle Eastern, Indian, and Mediterranean cuisine. The price of legumes is fluctuating in the market as a result of the increasing demand from various regions.

Chickpea Protein Production is Hampered by the Limited Availability of Chickpeas

This rising price trend is one of the most significant market restraints for chickpea protein. Additionally, the limited availability of legumes is a significant problem for the industry. Unpredictable weather conditions have a significant impact on global chickpea production and can lead to decreased crop yield or crop failure. Therefore, chickpea prices can fluctuate by nearly 50 percent per kilogram depending on the year and harvesting season, posing a significant challenge for chickpea protein producers.

Competition from Other Plant Proteins Puts Chickpea Protein Under Pressure

Despite its high protein content, chickpea protein confronts stiff competition from other plant proteins. It contains numerous types of organic plant proteins, including soy protein, pea protein, and others. As the demand for plant-based proteins continues to rise, companies that rely on chickpea protein may compete with other plant protein companies for market share. Therefore, it is essential for companies to differentiate garbanzo protein-based products with distinctive value-added features.

Flavor and Texture Challenges Restrain the Growth of the Chickpea Protein Market

Flavor and texture issues are the third significant factor restraining the global market for chickpea protein. The flavor profile and texture of chickpeas are unique and distinct. Although chickpeas are an excellent meat substitute, their natural taste, and texture do not complement every dish. Some dishes are better adapted for plant proteins with a milder, more neutral flavor. This issue can be resolved by combining chickpea protein with other plant proteins; however, this may result in more complicated production processes and higher production costs.

By Type Analysis

The global chickpea protein isolates market is dominated. The market's fastest-growing segment is projected to maintain its dominance. Chickpea protein isolates are flexible and used in food and beverage, supplements, and animal feed. Chickpea protein isolates are becoming more popular due to market demand for plant-based protein.

The protein isolates segment is growing due to emerging economies' economic growth. Rising disposable income and changing customer preferences are boosting demand for high-quality protein products, growing the market. Indian and Chinese vegetarians are fuelling demand for chickpea protein isolates.

Consumers are becoming more health conscious, and the trend for plant-based protein products is rising rapidly. The protein isolate segment is popular with dieters due to its high protein, low fat, and carbohydrate content. Consumers are becoming more aware of the environmental impact of animal agriculture, driving demand for plant-based protein isolates like chickpea protein isolates.

By Nature Analysis

The organic segment of the global chickpea protein market currently dominates. The chickpea protein market is rising due to global demand for organic and natural products. Consumers choose organic chickpea protein because it is pesticide-free. The organic segment is predicted to develop quickest in the future years.

Emerging economies' rising disposable income is fueling global organic product demand. Health-conscious consumers are seeking organic and natural items without chemicals and pesticides. Due to growing knowledge of organic products' benefits, emerging economies' organic segment is predicted to increase rapidly.

Globally, the trend toward organic and natural products is expanding, and consumers are becoming more aware of the benefits of ingesting organic and natural products. Health-conscious consumers prefer organic chickpea protein because it is pesticide-free. The demand for organic products is also rising as people become more conscious of the negative environmental effects of current farming methods.

By Form Analysis

The solid chickpea protein segment dominates the global market. Solid chickpea protein is flexible and used in food, beverages, supplements, and animal feed. The solid segment is projected to maintain its market dominance during the next few years.

Global demand for solid chickpea protein is rising as a result of rising disposable income in emerging economies. Rising disposable income and changing customer preferences are boosting demand for high-quality protein products, growing the market. India and China have huge vegetarian populations, and growing knowledge of plant-based protein's health advantages is driving demand for solid chickpea protein.

Consumers are becoming more health conscious, and the trend for plant-based protein products is rising rapidly. Consumers favor the solid chickpea protein segment because of its high protein, low fat, and carbohydrate content. The demand for plant-based protein products, such as solid chickpea protein, is rising as consumers become more aware of the environmental impact of animal agriculture.

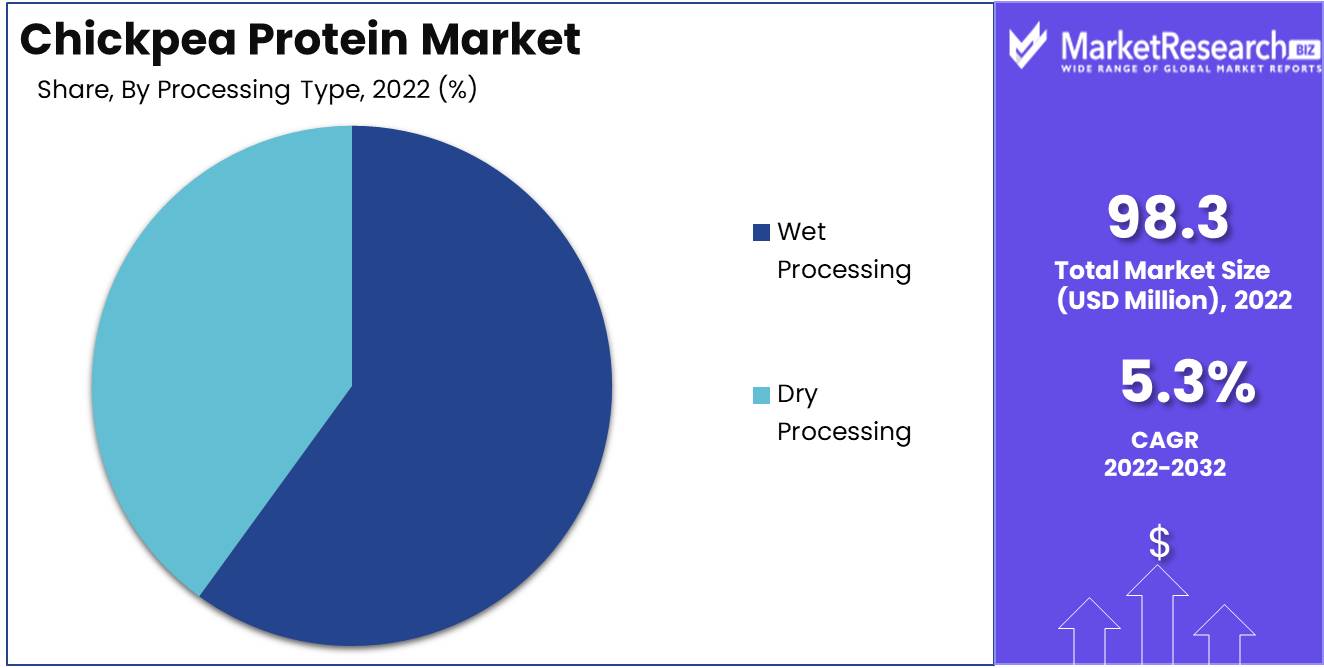

By Processing Type Analysis

The wet processing segment of the global chickpea protein market currently dominates. Wet processing chickpeas yields pure, natural protein. The market's fastest-growing segment, wet processing, is likely to maintain its dominance.

Global demand for wet-processed chickpea protein is rising as a result of rising disposable income in emerging economies. Rising disposable income and changing customer preferences are boosting demand for high-quality protein products, growing the market. The growing knowledge of the health benefits of plant-based protein is boosting demand for wet-processed chickpea protein in emerging nations like India and China, where there is a sizable vegetarian population.

Consumers are becoming more conscious of the components used in the items they consume, and there is a global trend toward natural and clean-label products. Health-conscious consumers like wet-processed chickpea protein because it is pure and natural. The demand for natural and clean-label products is also rising as people become more aware of the environmental effects of current farming practices.

By End-User Analysis

The global food protein segment dominates the chickpea protein market. Bakery, confectionery, snacks, and beverages employ chickpea protein in food processing. The market's fastest-growing segment, food processing, is projected to maintain its dominance.

The global demand for chickpea protein food processing applications is rising due to rising disposable income in emerging economies. Rising disposable income and changing customer preferences are boosting demand for high-quality protein products, growing the market. India and China have huge vegetarian populations, and growing knowledge of plant-based protein's health advantages is driving chickpea protein demand in the food processing business.

Plant-based diets and natural products are rising globally, and customers are becoming more health-conscious. In the food processing sector, health-conscious consumers favor chickpea protein because it is clean and natural. The market is also demanding plant-based protein products due to growing awareness of animal agriculture's environmental impact.

Key Market Segments

By Type

- Protein Isolates

- Protein Concentrates

- Flour

- Other Products

By Nature

- Organic

- Conventional

By Form

- Solid

- Liquid

By Processing Type

- Wet Processing

- Dry Processing

By End-User

- Food Processing

- Animal Feed

- Nutraceuticals

- Sports Nutrition

- Infant Nutrition

- Other End-Users

Growth Opportunity

Demand for Plant-Based Alternatives Drives Chickpea Protein Market

We are delighted to inform you that the global chickpea protein market has huge growth potential due to increased production, product innovation, plant-based meat alternatives, and producer-manufacturer alliances.

Production and Collaborations Grow Chickpea Protein

Plant-based diets are becoming increasingly popular as people become more health conscious and environmentally conscientious. Chickpea protein is in demand due to this. Chickpea protein is a good choice for vegetarians who seek protein and minerals.

Plant-Based Diets Draw Health-Conscious Consumers to Chickpea Protein

The rising production of chickpeas is one factor for this market growth. Chickpeas are adaptable, making them a favorite crop. India, Australia, and Pakistan also produce a lot of chickpeas.

Producers and Manufacturers Grow Chickpea Protein

Collaborations between producers and manufacturers are also driving the chickpea protein market growth. Manufacturers can use producers' skills to achieve high-quality ingredients through cooperation. Producers can increase their market and capitalize on chickpea protein demand.

Growing Awareness of Plant-Based Benefits Fuels Chickpea Protein Demand

Increasing awareness of the benefits of a plant-based diet is another factor driving the chickpea protein market growth. Health-conscious shoppers want meat alternatives with enough protein and nutrients. Chickpea protein meets all three criteria, making it popular among health-conscious and environmentally-conscious consumers.

Latest Trends

Chickpea Protein Surges in Dairy Alternatives

Global market trends affect all industries. The chickpea protein market is especially changing. Plant-based protein alternatives are in demand as more people choose vegan, vegetarian, or flexitarian. Chickpea protein has become a high-quality, sustainable alternative to animal protein. The global chickpea protein market is shaped by trends in dairy substitutes, clean-label products, gluten-free bakeries, and savory snacks.

Chickpea Protein is a Healthy and Transparent Ingredient

As more customers adopt a plant-based diet, Dairy-Free Alternatives have grown in popularity. Chickpea protein is a key element in dairy-free yogurt, cheese, and milk. Chickpea protein's fiber, vitamins, and minerals provide cow's milk products texture and creaminess. Health-conscious customers who embrace ethical and sustainable eating practices will drive demand for chickpea protein in dairy replacements in the coming years.

Chickpea Protein Gives Gluten-Free Bakery Nutrition

Clean-label additives dominate the chickpea protein market. Clean-label ingredients are healthful, natural, and transparent without preservatives or additives. Consumers that value transparency and authenticity in their food are very interested in chickpea protein, a clean-label ingredient. Chickpea protein is natural, non-GMO, gluten-free, and allergen-free.

Healthy and Delicious Chickpea Protein Snacks

The gluten-free bakery market is increasing quickly due to health concerns. To improve the nutritional profile of gluten-free bakery goods such as bread, cakes, cookies, and pastries, chickpea protein is being used more frequently. Chickpea protein is gluten-free, high in fiber, and low glycemic, making it suitable for gluten-free baking. Chickpea protein gives gluten-free baked goods structure, flavor, and protein.

Sustainable and Versatile Chickpea Protein

Chickpea protein, which is used in chips, crackers, and roasted snacks, is a potential market. Chickpea-protein-enriched savory snacks are low in calories and high in protein and fiber, making them a healthy snack option. Chickpea protein is nutritious and delicious, appealing to snackers.

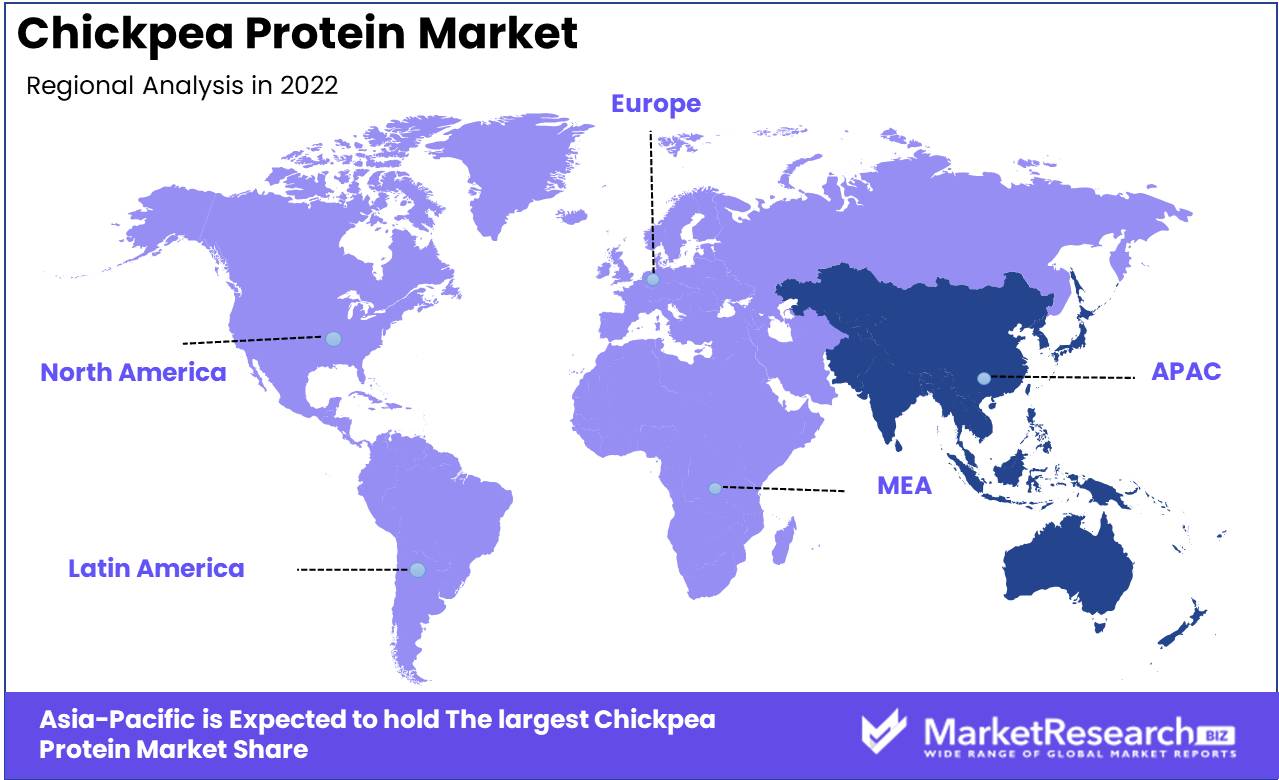

Regional Analysis

Asia-Pacific Dominates the Chickpea Protein Market. Plant-based protein sources are popular today due to demand from vegans and athletes. Thus, chickpea protein has become a protein market staple. Chickpea protein has gained popularity worldwide as a plant-based food choice.

The Asia-Pacific region now supplies chickpea protein to the US and Europe. Chickpea protein has taken off throughout Asia - Pacific, particularly India, and many other countries. The Asia-Pacific region is well-suited to produce chickpea protein, which is in high demand worldwide. Let's explore why this region supplies the most chickpea protein.

The Asia-Pacific region has distinct geographical advantages for chickpea protein production. In Asia-Pacific, chickpeas grow well and are pest-free due to the region's climate and humidity. Chickpea protein manufacturers have low manufacturing costs and a high-profit margin due to their geographical advantage.

Asia - Pacific countries like India are becoming vegan. Chickpeas are therefore abundant in the region. They make chana masala, chickpea curry, and other chickpea delicacies. Asia and the Pacific region can manufacture chickpea protein easily since they already have the infrastructure to grow and harvest these popular legumes. This agricultural region promotes chickpea protein production.

Due to its high amount of essential amino acids, chickpea protein is a great plant-based protein source. Gluten-free, it's good for gluten-intolerant people. Chickpea protein is high in fiber, which boosts metabolism. Asia N-Pacific has a high awareness of chickpea protein's health benefits.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global chickpea protein market is expanding significantly as demand for plant-based protein products increases. This market is dominated by a small number of key players who account for a substantial share of the global supply and demand for chickpea protein.

AGT Foods, a Canadian company that specializes in the sourcing, processing, and distribution of a variety of ingredients, including chickpeas, is one of the main players in the chickpea protein market. They are the largest supplier of chickpeas in North America and have a significant presence in global markets with their diverse product offerings.

Avena Foods, a Canadian company that produces a variety of plant-based proteins, including chickpea protein concentrate, is an additional key participant in this market. They are committed to producing high-quality, organic, non-GMO products and place a strong emphasis on sustainability.

ProEarth Nutraceuticals, The Scoular Company, and Barentz Group are additional notable players in the chickpea protein market. In addition to procuring, processing, and distributing chickpea protein and other plant-based protein products, these businesses are also involved in these activities.

The Chickpea Protein Company is another significant market participant. They specialize in producing high-quality chickpea protein isolate, which can be used in a variety of food and beverage applications.

Top Key Players in Chickpea Protein Market

- AGT Foods

- Avena Foods

- ProEarth Nutraceuticals

- Food Processing

- Bakery & Confectionery

- Meat Alternatives

- Functional Foods

- Dairy Replacements

- Infant Foods

- Other Food Applications

- Animal Feed

- Livestock

- Nutraceuticals

- Sports Nutrition

- Infant Nutrition

- Other Key Players

Recent Development

- In 2023, The company Puris launched a new line of meat substitutes made from chickpea protein. These products are made from plant-based ingredients but are designed to flavor and cook like traditional meat.

- In 2022, chickpea protein was discovered to help lower blood cholesterol levels in a study published in the journal "Food Science & Nutrition." This could make chickpea protein an effective weapon against cardiovascular disease.

- In 2021, A company called Ripple Foods launched a new plant-based milk made from chickpea protein. This product is gathering popularity as consumers seek more sustainable and vegan food alternatives.

- In 2020, Researchers at the University of Illinois at Urbana-Champaign will have developed a new method for extracting chickpea protein that is more efficient and environmentally favorable than traditional methods.

Report Scope:

Report Features Description Market Value (2022) USD 98.3 Mn Forecast Revenue (2032) USD 162.6 Mn CAGR (2023-2032) 5.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Protein Isolates, Protein Concentrates, Flour, Other Products), By Nature(Organic, Conventional), By Form (Solid, Liquid), By Processing Type (Wet Processing, Dry Processing), By End-User (Food Processing, Animal Feed, Nutraceuticals, Sports Nutrition, Infant Nutrition, Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape AGT Foods, Avena Foods, ProEarth Nutraceuticals, Food Processing, Bakery & Confectionery, Meat Alternatives, Functional Foods, Dairy Replacements, Infant Foods, Other Food Applications, Animal Feed, Livestock, Nutraceuticals, Sports Nutrition, Infant Nutrition, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- AGT Foods

- Avena Foods

- ProEarth Nutraceuticals

- Food Processing

- Bakery & Confectionery

- Meat Alternatives

- Functional Foods

- Dairy Replacements

- Infant Foods

- Other Food Applications

- Animal Feed

- Livestock

- Nutraceuticals

- Sports Nutrition

- Infant Nutrition

- Other Key Players