Global Carrier Services Market By Type Analysis (Common Carrier, Private Carrier, Others), By Offering Analysis (Mobile Phone Service, Tablets, Others), By Mode of Communication Analysis (Satellites, Wi-Fi), By End-User Analysis (Industrial, Commercial, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

37458

-

June 2023

-

179

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

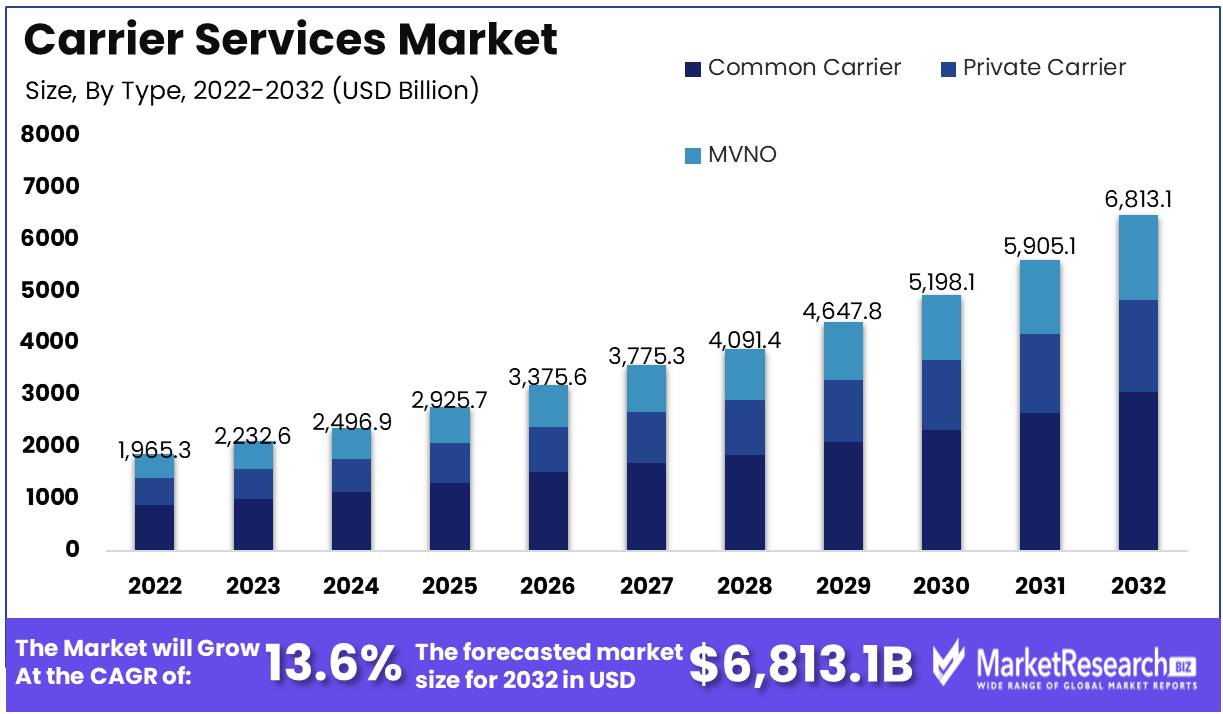

Global Carrier Services Market size is expected to be worth around USD 6,813.1 Bn by 2032 from USD 1965.3 Bn in 2022, growing at a CAGR of 13.6% during the forecast period from 2023 to 2032.

The dynamic global carrier services market emerges as an essential cog in the complicated machinery of the telecommunications industry, interweaving critical infrastructure and services into the fabric of enterprises worldwide. Its trajectory has recently undergone a parabolic rise, pushed by an insatiable need for lightning-fast internet and mobile offerings. The numerous benefits provided by carrier services, like cost-effectiveness, unshakable stability, and boundless scalability, are critical for enterprises navigating the maze of today's digital economy.

At the helm of the carrier services market, innovation reigns supreme as an all-powerful driving force. The technological marvels of software-defined networking and network functions virtualization have spawned a paradigm change in network management, giving service providers the ability to coordinate automation, smoothly expand networks, and effectively reduce operational costs. The epochal arrival of 5G technology has launched the industry to unprecedented heights, promising supersonic speeds, unprecedentedly low latency, and extravagant bandwidth.

The carrier services market, with its limitless development potential, shimmers on the horizon, spurred by the widespread deployment of 5G and a plethora of emerging technologies. This all-encompassing industry's far-reaching applications are flawlessly woven throughout a wide tapestry of sectors, including healthcare, banking, transportation, and entertainment. Carrier services emerge as the enablers of distant healthcare in the field of telemedicine, ushering in a new era of medical accessibility.

Secure communication is strengthened in the realm of financial transactions by the unfailing assistance of carrier services. The transportation and logistics industries stand to benefit enormously from carrier services, which optimize fleet management and provide unprecedented asset-tracking capabilities. The unwavering presence of carrier services resonates with thunderous significance in the enthralling arena of entertainment and media dissemination.

Recognizing the indispensability of carrier services, a diverse range of enterprises around the world have pledged to invest in this booming market. Telecom businesses go on a modernization journey to strengthen their networks, ready to embrace the untapped potential of upcoming technologies such as 5G.

The soaring trajectory of the carrier services market is being propelled aloft by a confluence of forces. The insatiable want for high-speed internet and mobile services, inextricably linked with the unwavering acceptance of future technologies such as 5G, serves as a veritable fuel for this ever-evolving industry. Furthermore, the ever-expanding frontiers of cloud computing and the Internet of Things need the construction of robust carrier services capable of seamlessly integrating a plethora of devices and applications.

Driving factors

Rapid Growth in the Carrier Services Market is Fueled by Booming Trade and E-Commerce.

Several main factors are fueling this increase, including brisk global trade and the explosive growth of e-commerce. As more businesses resort to online sales, the demand for effective logistics solutions is greater than ever. This has resulted in quick developments in transportation and tracking technology, which have propelled the carrier services market's expansion.

As Businesses Accept Online Sales, Efficient Logistics Solutions are in High Demand.

Another significant element driving the expansion of the global carrier services market is the development of more efficient and dependable transportation infrastructure. Many governments throughout the world have made significant investments in transportation infrastructure to enable the movement of goods across borders. These advancements have enabled carriers to operate more efficiently, resulting in faster delivery times and lower prices.

Growth in Carrier Services is Driven by Advances in Transportation Technology.

Furthermore, there are present and anticipated regulatory changes that may have a substantial impact on the Carrier Services Market internationally. Regulators are attempting to implement additional laws to address ongoing concerns about safety, data privacy, and environmental effect as the market becomes more international and competitive. To be compliant, organizations in this sector must stay up to date on the newest regulatory developments and adapt their operations accordingly.

Development of Reliable Transportation Infrastructure Increases Carrier Services

Several developing technologies are expected to have a big impact on the carrier services market in the coming years. Drones, self-driving cars, and artificial intelligence are just a few examples. These developments are intended to transform the way goods are moved by making them faster, safer, and more cost-effective.

Changing Regulations and Compliance Demands Shape Carrier Services Future

While the carrier services market appears to be on the rise, various possible disruptors could have an impact on the competitive landscape. The growing use of blockchain technology in logistics management is one such disruptor, with the potential to dramatically lower costs and boost transparency. Innovative startups that bring fresh and disruptive solutions to the market could also be potential disruptors.

Restraining Factors

Regulatory Complexity and Tariff Rates Pose a Challenge to the Carrier Services Market.

Regulatory complexities, infrastructural limits, price competitiveness, and trade disruptions have all been restricting factors in the global carrier services market over the years. These impediments have resulted in poor growth, low returns on investment, lower service quality, and significant losses for service providers.

Inadequate Infrastructure Stifles the Growth of Carrier Services.

One of the major challenges the carrier services market faces is regulatory complexities. These complexities are related to legislation governing the sort of services provided and how they are delivered. Regulation has expanded fast in recent years, making it difficult for carriers to navigate the market. Furthermore, regulatory agencies have raised tariff rates, making it difficult for service providers to maintain low costs while maintaining quality. Many service providers have found it difficult to survive as a result of these laws and the high cost of compliance.

Carrier Service Providers are Under Pressure as a Result of Intense Price Competition.

Another major issue affecting the carrier services market is infrastructure limits. This is especially noticeable in emerging areas, where infrastructure such as telephone towers, fiber networks, and data centers are insufficient. These constraints result in higher expenses and lower service quality. Furthermore, power may be scarce in emerging areas, making it difficult for service providers to power their facilities. Inadequate infrastructure is a significant impediment to the expansion of the carrier services market in emerging nations.

Trade Disruptions Endanger the Carrier Services Market

Price competitiveness is an increasingly difficult aspect affecting the carrier services market. Service companies confront fierce competition and struggle to keep prices stable while providing high-quality services to customers. New market entrants are entering at reduced prices, further lowering margins for established service providers. As a result, it becomes more difficult to differentiate products and services in the face of fierce competition.

Service Providers are Suffering Losses as a Result of Regulatory Complexities and Trade Disruptions.

Trade disruptions, which are frequently induced by geopolitical crises and natural disasters, are another impediment to the carrier services market. Such disruptions can result in network failures, server unavailability, and, in the worst-case situation, client data loss. Typically, these disruptions result in severe losses for service providers.

By Type Analysis

The carrier services market is a complicated ecology that adapts to consumer needs. The market is dominated by the common carrier segment, which has contributed to the growth of the carrier services market. This segment allows everyone to use carriers' transport services without discrimination.

Individuals and businesses choose the common carrier segment, which is predicted to grow faster than other categories. Due to the digital age, internet dependence, and the necessity for uninterrupted communication.

Economic growth in emerging economies has increased the demand for carrier services. Urban and rural communication needs to drive this increase. These economies have adopted the common carrier segment due to rising connectivity demand, which necessitates additional carrier services.

The common carrier segment provides reliable and economical services. This segment helps firms and individuals engage with stakeholders, which has enhanced client loyalty.

By Offering Analysis

In the carrier services market, the mobile phone service segment is dominant. The provision of voice and data services to mobile phones is what distinguishes this segment. Mobile phones are now crucial to daily life, and the mobile phone service segment is the backbone of communication services.

The adoption of mobile phones has increased in emerging economies due to economic growth. Mobile phones are more popular in certain regions. Emerging economies have increased demand for mobile phone service segment services.

Mobile phones are essential for communication and entertainment. Remote working has contributed to the use of mobile phones for commercial communication. Thus, the mobile phone service segment is predicted to remain popular.

Over the next few years, the mobile phone service segment is expected to increase the most. This is because mobile phones are becoming more popular and reliable and economical services are required. Technology will enable more innovative services for the segment.

By Mode of Communication Analysis

The satellite segment dominates the worldwide carrier services market. Satellite communication services define this segment. Satellites are now essential to communication networks, and the satellite segment supports communication services.

Communication services are in demand as emerging economies develop. Satellites provide communication services in these places. The satellite segment has increased in demand in emerging economies.

Satellites are crucial for communication and entertainment. Remote working has contributed to satellite use. Thus, the satellite segment should remain popular. The satellite segment is expected to grow the fastest. Due to the rising demand for communication services, the necessity for reliable and economical services, and the improvement of satellite technology.

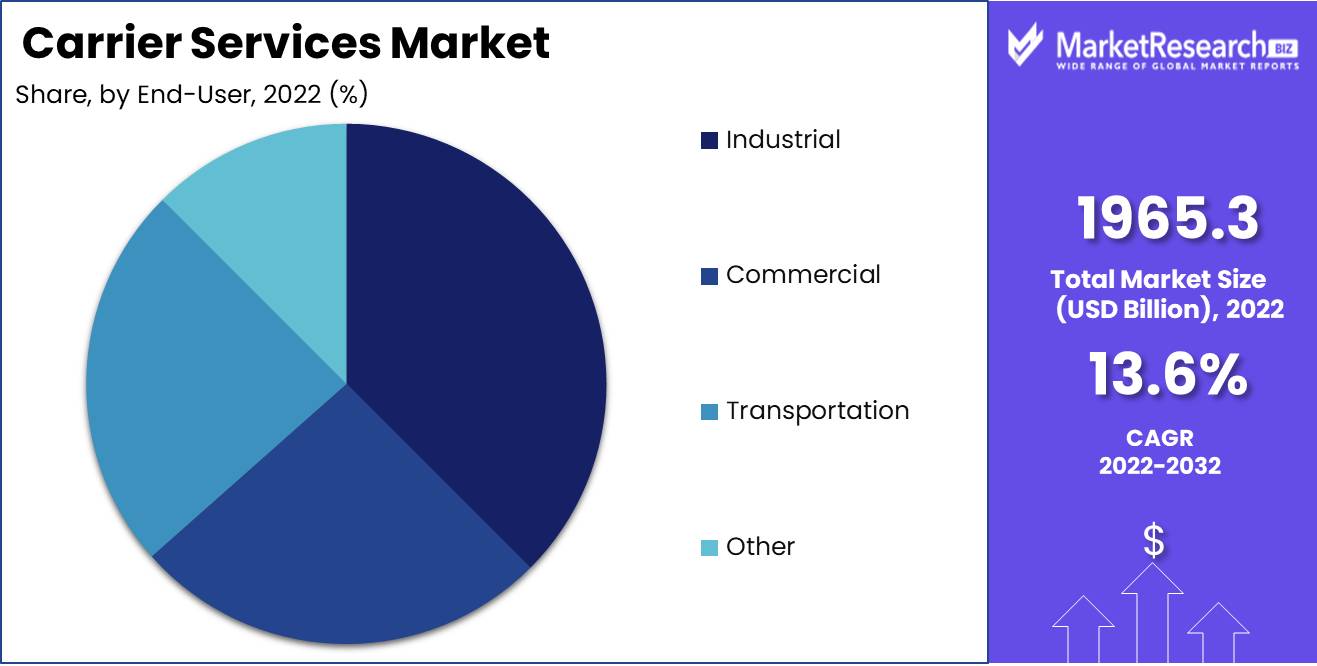

By End-User Analysis

The industrial segment dominates the global carrier services market. This segment provides communication services to manufacturing, utilities, and transportation. These industries rely on the industrial segment.

Industries have grown as emerging economies expand economically. Industry communication services depend on the industrial segment. As a result, demand in emerging economies has increased for the industrial segment.

Industries depend largely on the industrial segment. Digitalization and automation have increased the demand for industrial segment services. As a result, it is anticipated that firms would continue to choose the industrial segment.

Key Market Segments

By Type

- Common Carrier

- Private Carrier

- MVNO

By Offering

- Mobile Phone Service

- Fixed-Network Services

- Tablets

By Mode of Communication

- Satellites

- Telephones

- Wi-Fi

By End-User

- Industrial

- Commercial

- Transportation

- Other End-Users

Growth Opportunity

Demands for E-commerce and Logistics Drive Explosive Market Growth for Carrier Services

The exponential growth of e-commerce and the increasing demand for real-time logistics solutions have driven enormous growth and dynamic changes in the carrier services sector over the past decade. With the spread of COVID-19 further disrupting supply chain networks and increasing the need for a more robust logistics infrastructure to handle surging online orders, the global carrier services market has become a goldmine for businesses.

In the Midst of COVID-19's Disruption, Transformative Forces are Driving the Growth of Carrier Services.

The expanding global economy necessitates a robust logistics network capable of handling the ever-increasing volume of products shipped worldwide. The growth of e-commerce has led to an increase in parcel delivery and online fulfillment services. This trend has created an enormous opportunity in the market for carrier services, with new entrants producing a more competitive atmosphere.

Digitalization Transforms Carrier Services, Thereby Increasing Customer Satisfaction.

In the market for carrier services, the digitalization trend is fundamentally altering how businesses operate. In unprecedented ways, technology is driving the transformation of carrier services, from online ordering and real-time monitoring to automated updates and digital payment options. Greater transparency and traceability, real-time tracking, and enhanced supply chain visibility are all made possible by cutting-edge digital solutions, which are also increasing customer satisfaction.

Final-Mile Delivery OptionsCritical Success Factors for Competitive Carrier Services

The need for more effective last-mile delivery solutions is a result of customers' increasing demand for speedier delivery. To meet these demands, there must be a real-time connection between the various supply chain network nodes, from the warehouse to the ultimate delivery location. Those Carrier Service providers who can provide quicker, more dependable, and more efficient last-mile delivery logistics will enjoy a significant competitive advantage.

Growth and efficiency in the Carrier Services Industry are Driven by Strategic Partnerships.

As the market for carrier services becomes increasingly competitive, businesses are investigating growth-driving strategic partnerships with logistics providers. Partnerships can be used by Carrier Service Providers to improve their service offerings, gain access to more consumers, and more effectively utilize their existing resources.

Latest Trends

Real-Time Tracking Transforms the Logistics Industry, Ensuring Error-Free Shipments.

The logistics industry has been revolutionized by real-time monitoring. It enables shippers and carriers to monitor their shipments in real-time, eliminating any room for error or doubt. Using IoT (Internet of Things), GPS, and other location-based technologies, carriers can now monitor the location, temperature, and other parameters of their shipments in real-time.

Data Analytics Revolutionizes Logistics Big Data and AI Improve Business Operations

The transformation of the logistics industry has been made possible by Data Analytics. With the aid of Big Data, Machine Learning, and Artificial Intelligence, carriers can now analyze immense quantities of data and gain insight into inefficiencies in their operations.

Carrier Efficiencies and Expenses are Improved by Predictive Analytics.

Utilizing predictive analytics, carriers are able to predict the demand for future shipments, identify potential delivery issues, optimize routes, and reduce costs. By streamlining their operations, carriers can provide superior services to their clients and increase their profitability. Carriers that integrate data analytics into their operations can acquire a competitive edge and maintain market leadership.

Sustainability Takes Center Stage in Logistics Increasing Prevalence of Eco-Friendly Practices

In the logistics industry, sustainability practices are gaining ground. Customers are increasingly demanding sustainable and environmentally favorable logistics operations. In response to this trend, carriers are incorporating sustainable practices into their operations.

Electric Vehicles and Green Operations Contribute to the Success of Transport Companies.

Numerous carriers now utilize electric vehicles, enhancing the efficacy of their supply chain operations and reducing emissions. These practices not only benefit the environment, but also aid carriers in reducing costs, gaining consumer loyalty, and gaining a market advantage. The future belongs to carriers who implement environmentally friendly practices and operate in a socially responsible manner.

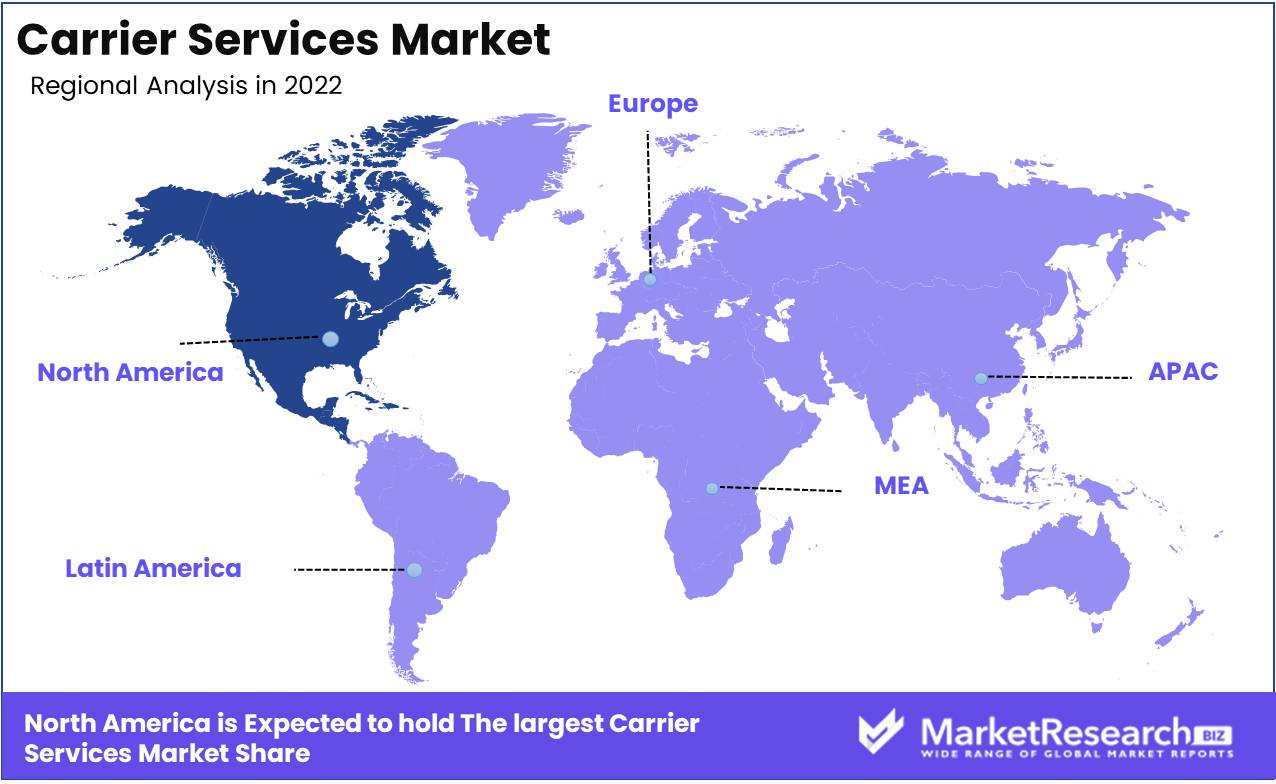

Regional Analysis

In recent times, the region of North America has made remarkable advances in dominating the carrier services market, surpassing Asia and Europe. Transport services have always been a vital component of the global economy. These services involve the transport of goods and packages from one location to another by transportation-specialized businesses. The markets for carrier services are vast, and various factors drive their growth in each region of the globe.

Multiple factors contributed to North America's ascent to international prominence. The region is distinguished by its exceptional infrastructure development, advanced transportation systems, and prospering global trade market. Numerous businesses offering carrier services have flourished as a result of the favorable environment created by these factors for the growth of the industry.

The carrier services industry is extremely competitive, with FedEx, UPS, and DHL operating in multiple global regions. These North American companies are the driving force behind the region's dominance and have been at the vanguard of this industry. These businesses have made substantial investments in technologies such as automated sorting systems and robotics to enhance the efficacy and effectiveness of their services.

However, the dominance of the North American carrier services market can only be maintained if the region's businesses continue to innovate and meet customer demands. The growth of e-commerce enterprises is a significant trend that is currently shaping the carrier market. In recent years, the proliferation of online retailers has increased the demand for carrier services. Therefore, North American carrier companies have had to develop innovative solutions to effectively meet these demands.

The emergence of sustainable practices is another significant trend that has affected the carrier services sector. In recent years, environmental concerns have risen to the forefront of consumers' minds worldwide.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Due to the emergence of new technologies and rising demand for communication services, the global carrier services market is undergoing robust growth. By implementing cutting-edge strategies like partnerships, mergers, and acquisitions to increase their market share and solidify their position, key players in the market are significantly influencing the dynamics of the sector.

AT&T, Verizon, China Mobile, NTT, Deutsche Telekom, Telefonica, Vodafone, Orange, BT Group, and China Telecom are among the leading competitors in the global carrier services market.

AT&T is one of the world's largest telecommunications corporations, offering a variety of services including wireless telephony, broadband, and media services. Verizon is a leading American telecommunications corporation that provides wireless, fiber-optic, and cable services, in addition to entertainment services. China Mobile is one of the country's largest telecom service providers, offering a variety of mobile communication services.

NTT is a Japanese multinational corporation that provides global solutions for information and communications technology. Deutsche Telekom is a German telecommunications corporation that provides fixed-line, mobile, and broadband communication services. The Spanish multinational telecommunications corporation Telefonica provides fixed-line, mobile, and broadband services. Vodafone is a British multinational telecommunications corporation that provides mobile and fixed communication services in multiple countries.

Orange is a multinational French telecommunications corporation that provides mobile and broadband services throughout Europe, Africa, and the Middle East. British multinational telecommunications provider BT Group offers fixed-line, mobile, and broadband services. China Telecom is a state-owned Chinese telecom company that provides mobile, broadband, and fixed-line communication services.

Top Key Players in Carrier Services Market

- AT&T intellectual property (U.S)

- Alphabet Inc. (U.S)

- Amazon.com Inc. (U.S)

- Apple Inc. (U.S)

- Baidu Inc. (China)

- Comverse Technology Inc. (Israel)

- Thales (France)

- Google LLC (U.S)

- InMobi (India)

- Kongzhong Corp (China)

- Comviva (India)

- Mobily (Saudi Arabia)

- Vodafone Group Plc (U.K)

- Cisco Systems Inc., (U.S.)

- ZTE Corporation (China)

- Huawei Technologies Co. Ltd. (China)

- SEQUANS (France)

- Other Key Players

Recent Development

- In 2023, the carrier services industry is anticipated to be revolutionized by the rise of 5G. 5G will offer faster speeds, lower latency, and greater capacity than 4G, enabling the development of new and innovative applications like augmented and virtual reality.

- In 2022, Carriers continued to invest in 5G networks with AT&T, Verizon, and T-Mobile all launching 5G services nationwide.

- In 2021, Carriers started deploying 5G networks in a few cities.5G-capable devices began to appear on the market.

- In 2020, To satisfy the growing demand for data, Carriers will invest heavily in network upgrades. 5G technology began to emerge as a potential industry game-changer.

- In 2019, Carriers continued to invest in network enhancements to boost data speeds and reliability. Increased competition among carriers resulted from a rise in mobile data usage.

Report Scope:

Report Features Description Market Value (2022) USD 6,813.1 Bn Forecast Revenue (2032) USD 7,034.2 Bn CAGR (2023-2032) 13.60% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type Analysis (Common Carrier, Private Carrier, MVNO), By Offering Analysis (Mobile Phone Service, Fixed-Network Services, Tablets), By Mode of Communication Analysis (Satellites, Telephones, Wi-Fi), By End-User Analysis (Industrial, Commercial, Transportation, Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape AT&T intellectual property (U.S), Alphabet Inc. (U.S), Amazon.com Inc. (U.S), Apple Inc. (U.S), Baidu Inc. (China), Comverse Technology Inc. (Israel), Thales (France), Google LLC (U.S), InMobi (India), Kongzhong Corp (China), Comviva (India), Mobily (Saudi Arabia), Vodafone Group Plc (U.K), Cisco Systems Inc., (U.S.), ZTE Corporation (China), Huawei Technologies Co. Ltd. (China), SEQUANS (France), Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- AT&T intellectual property (U.S)

- Alphabet Inc. (U.S)

- Amazon.com Inc. (U.S)

- Apple Inc. (U.S)

- Baidu Inc. (China)

- Comverse Technology Inc. (Israel)

- Thales (France)

- Google LLC (U.S)

- InMobi (India)

- Kongzhong Corp (China)

- Comviva (India)

- Mobily (Saudi Arabia)

- Vodafone Group Plc (U.K)

- Cisco Systems Inc., (U.S.)

- ZTE Corporation (China)

- Huawei Technologies Co. Ltd. (China)

- SEQUANS (France)

- Other Key Players