Car Wash Market By Type (Roll-Over/In Bay, Tunnels, Self-Service), By Process (Cloth Friction Car Washing, Touch Less Car Washing), By Component (Motors, Drivers, Foam System, Dryers and Pumps), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

37552

-

Aug 2024

-

179

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

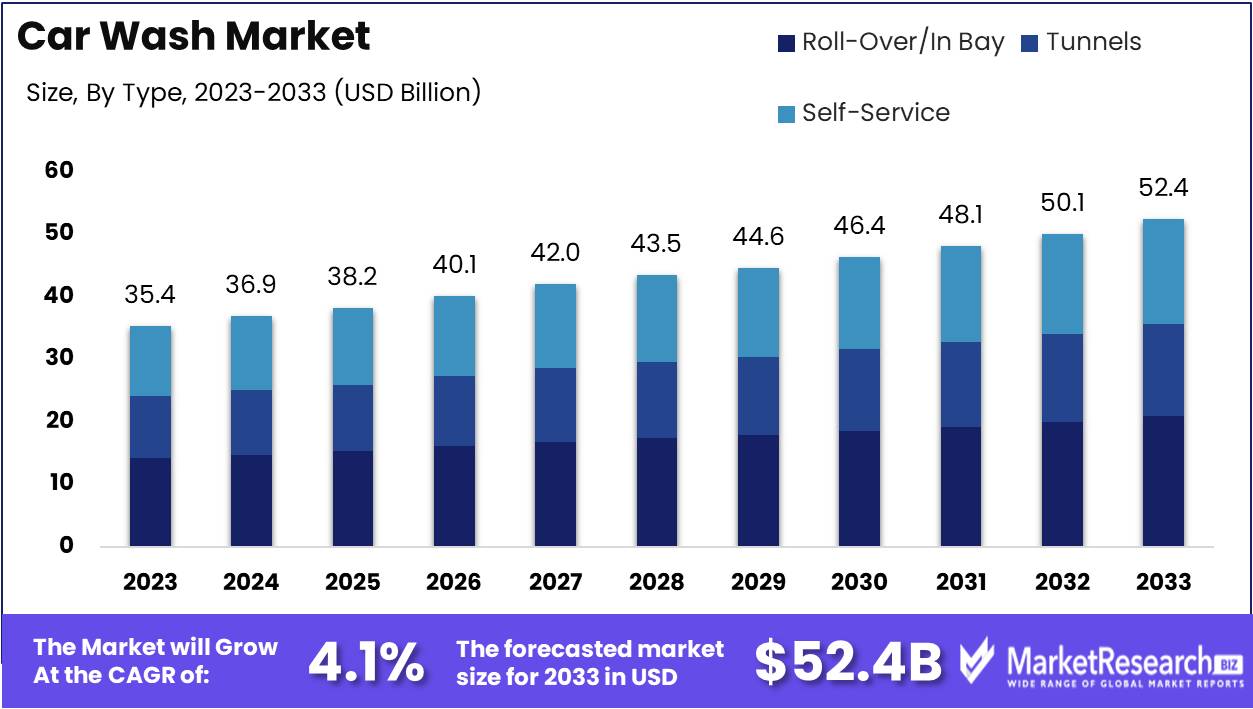

The Global Car Wash Market was valued at USD 35.4 Bn in 2023. It is expected to reach USD 52.4 Bn by 2033, with a CAGR of 4.1% during the forecast period from 2024 to 2033.

The car wash market encompasses various services and systems designed to clean and maintain vehicles, ranging from automated and touchless systems to traditional hand wash facilities. This market is driven by factors such as rising consumer awareness regarding vehicle maintenance, increasing disposable incomes, and technological advancements in car wash equipment. Market segments include self-service, in-bay automatic, tunnel car washes, and mobile detailing services. As urbanization and car ownership rates grow, particularly in emerging markets, the demand for efficient, eco-friendly car wash solutions is set to expand, presenting significant opportunities for innovation and investment in this industry.

The car wash market is undergoing a transformative phase, influenced by evolving consumer preferences and technological advancements. Touchless car wash systems, which now represent 10% of all car washes in the U.S., are gaining traction due to their convenience and reduced risk of surface damage. This segment is poised for growth as consumer demand for efficient and safe vehicle cleaning solutions increases.

The car wash market is undergoing a transformative phase, influenced by evolving consumer preferences and technological advancements. Touchless car wash systems, which now represent 10% of all car washes in the U.S., are gaining traction due to their convenience and reduced risk of surface damage. This segment is poised for growth as consumer demand for efficient and safe vehicle cleaning solutions increases.Brazil's market dynamics highlight a distinct preference for hand car wash services, with over 30,000 facilities making it the leader in South America. This indicates a substantial market for labor-intensive, personalized car wash services, driven by factors such as cost-effectiveness and cultural preferences.

The industry's growth is underpinned by urbanization and the rising middle class in emerging economies, which is expected to boost car ownership and, consequently, the demand for car wash services. Technological advancements, such as automated and eco-friendly systems, are also reshaping the market landscape, appealing to environmentally conscious consumers and offering cost savings over time.

Companies operating in this sector must navigate these trends by investing in innovative technologies and expanding service offerings to capture a broader customer base. As the market evolves, strategic partnerships and investments in advanced car wash solutions will be crucial for sustained competitive advantage and market share expansion.

Key Takeaways

- Market Value: The Global Car Wash Market was valued at USD 35.4 Bn in 2023. It is expected to reach USD 52.4 Bn by 2033, with a CAGR of 4.1% during the forecast period from 2024 to 2033.

- By Type: Roll-Over/In Bay systems make up 40% of the market, providing convenient and automated car washing solutions.

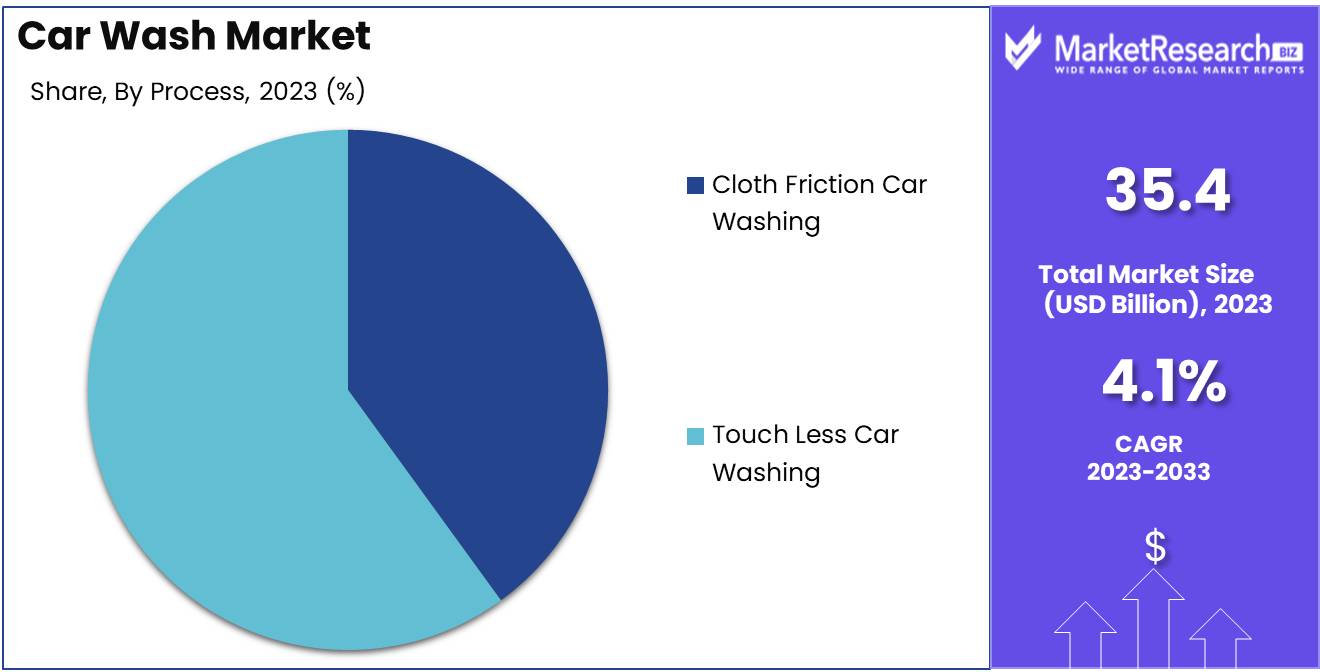

- By Process: Touch Less Car Washing dominates with 55%, favored for its gentle yet effective cleaning without physical contact.

- By Component: Motors constitute 30% of the market, essential for powering car wash systems.

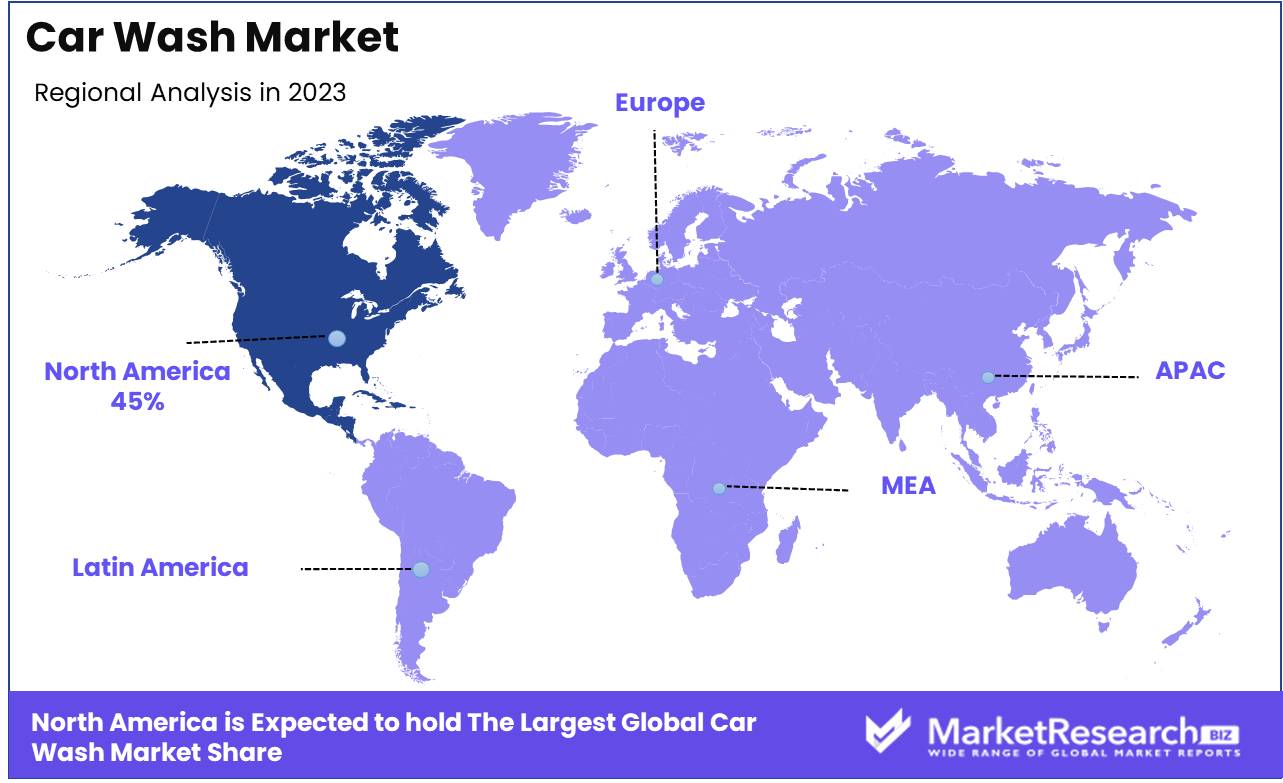

- Regional Dominance: North America holds a 45% market share, driven by high vehicle ownership and demand for automated services.

- Growth Opportunity: Developing eco-friendly and water-saving car wash technologies can attract environmentally conscious consumers and drive market growth.

Driving factors

Increasing Number of Vehicles on the Road

The expansion of the car wash market is significantly driven by the rising number of vehicles on the road. As urbanization and economic growth continue to boost car ownership globally, the demand for regular vehicle maintenance, including car washing, has escalated. The increased vehicle count creates a larger customer base, thereby directly contributing to the growth of the car wash industry.

This trend is observed in both developed and emerging markets, where the proliferation of vehicles necessitates more frequent and efficient cleaning solutions to maintain vehicle appearance and functionality.

Rising Consumer Demand for Convenient Car Maintenance

Modern consumers are increasingly seeking convenience in all aspects of their lives, including car maintenance. This demand for convenience is a crucial driver of the car wash market. Consumers prefer services that save time and effort, leading to a higher inclination towards professional car wash services over manual washing at home.

Car wash facilities, especially those offering quick and efficient services, cater to this need by providing on-demand and subscription-based services that fit seamlessly into busy lifestyles. The convenience factor not only attracts more customers but also fosters loyalty, encouraging repeat business and sustained market growth.

Growth in Automated and Touchless Car Wash Technologies

Technological advancements have revolutionized the car wash industry, with automated and touchless car wash systems emerging as pivotal growth drivers. These technologies offer several benefits, including enhanced efficiency, reduced labor costs, and improved cleaning quality. Automated car washes provide a faster and more consistent cleaning experience, appealing to time-conscious consumers.

Touchless systems minimize the risk of damage to vehicle surfaces, attracting owners of high-end and delicate cars. The integration of these advanced technologies meets the rising consumer expectations for high-quality, convenient, and safe car wash services, thereby propelling the market forward.

Restraining Factors

High Initial Setup and Operational Costs

The car wash market faces significant retraining factors, primarily stemming from the high initial setup and operational costs. Establishing a car wash facility requires substantial capital investment in land, infrastructure, equipment, and technology. Automated and touchless car wash systems, while efficient, add to the financial burden due to their high purchase and maintenance costs. These economic barriers can deter new entrants and limit expansion for existing businesses.

Ongoing operational expenses, including utilities, labor, and maintenance, further strain profitability. This financial challenge can slow market growth, as businesses may struggle to balance the initial expenditure with long-term returns, affecting their ability to scale and innovate.

Environmental Concerns Regarding Water Usage and Chemical Runoff

Environmental concerns present another significant retraining factor for the car wash market. The industry is often scrutinized for its high water consumption and the potential for chemical runoff, which can negatively impact local ecosystems. Increasing awareness and stringent regulations around environmental sustainability compel car wash operators to adopt more eco-friendly practices, such as water recycling systems and biodegradable cleaning agents.

While these measures are essential for compliance and environmental responsibility, they also incur additional costs and operational complexities. Balancing environmental sustainability with cost-effectiveness remains a critical challenge, potentially limiting the growth and profitability of the car wash market. Businesses must navigate these concerns carefully to maintain regulatory compliance and meet consumer expectations for environmentally conscious services.

By Type Analysis

Roll-Over/In Bay held a dominant market position in the By Type segment of the Car Wash Market, capturing more than a 40% share.

In 2023, Roll-Over/In Bay car washes dominated the By Type segment of the Car Wash Market, capturing over a 40% share. This segment's popularity is driven by its convenience and efficiency, allowing multiple vehicles to be washed quickly and effectively in a confined space. The technology is widely adopted in urban areas where space is limited, and time-saving is a priority for consumers. These car wash types are favored by both individual vehicle owners and commercial fleets due to their automated systems, which reduce the need for manual labor and enhance consistency in washing quality.

Tunnels are also significant in the market, known for their high throughput and ability to handle a large volume of vehicles. They are particularly popular in high-traffic areas and among commercial car wash businesses that prioritize speed and efficiency.

Self-Service car washes offer flexibility and cost-effectiveness for consumers who prefer a hands-on approach. While they capture a smaller market share compared to automated systems, they remain popular in residential areas and among cost-conscious customers.

By Process Analysis

Touch Less Car Washing held a dominant market position in the By Process segment of the Car Wash Market, capturing more than a 55% share.

In 2023, Touch Less Car Washing led the By Process segment of the Car Wash Market, capturing more than a 55% share. The preference for touchless systems is driven by their ability to minimize the risk of surface damage to vehicles, making them popular among owners of high-end and delicate paint finishes. These systems use high-pressure water and specialized cleaning agents to remove dirt and grime without physical contact, ensuring a thorough clean while preserving the vehicle's exterior integrity.

Cloth Friction Car Washing, which uses soft cloth or foam brushes to scrub the vehicle, remains a significant part of the market. This method is known for its deep cleaning capabilities and effectiveness in removing stubborn dirt and contaminants. However, concerns over potential surface scratches have led to a growing preference for touchless systems.

By Component Analysis

Motors held a dominant market position in the By Component segment of the Car Wash Market, capturing more than a 30% share.

In 2023, Motors held a dominant market position in the By Component segment of the Car Wash Market, capturing more than a 30% share. Motors are crucial for the operation of car wash machinery, powering various moving parts such as conveyors, brushes, and automotive pumps. The reliability and efficiency of motors directly impact the performance and operational cost of car wash systems, making them a critical component.

Drivers are also essential, playing a vital role in controlling the movement and operation of car wash equipment. They ensure smooth and precise functioning, contributing to the overall efficiency and effectiveness of the car wash process.

Foam Systems are significant for their role in applying cleaning agents and foam to vehicles. These systems help in the even distribution of soap and cleaning chemicals, enhancing the cleaning process.

Dryers and Pumps are important components, responsible for drying vehicles and managing water pressure, respectively. Efficient dryers ensure vehicles leave the wash without water spots, while powerful pumps maintain consistent water flow and pressure throughout the washing process. Both components are essential for delivering high-quality car wash services.

Key Market Segments

By Type

- Roll-Over/In Bay

- Tunnels

- Self-Service

By Process

- Cloth Friction Car Washing

- Touch Less Car Washing

By Component

- Motors

- Drivers

- Foam System

- Dryers and Pumps

Growth Opportunity

Expansion of Eco-Friendly and Water-Efficient Car Wash Solutions

The global car wash market in 2024 presents significant growth opportunities, primarily driven by the expansion of eco-friendly and water-efficient solutions. With increasing environmental regulations and rising consumer awareness, the adoption of green technologies in car washing is set to accelerate. Water recycling systems, biodegradable cleaning agents, and water-efficient processes not only address environmental concerns but also reduce operational costs in the long term.

Companies investing in sustainable practices are likely to attract environmentally conscious consumers, enhancing their market position and competitiveness. This shift towards eco-friendly solutions is expected to drive substantial growth, as it aligns with global sustainability goals and regulatory frameworks.

Development of Subscription-Based Service Models

Another promising opportunity in the car wash market is the development of subscription-based service models. These models cater to the growing consumer demand for convenience and cost-effective solutions. Subscription services offer customers the benefit of regular, hassle-free car maintenance, often at a lower cost than pay-per-wash options. This model ensures steady revenue streams for car wash operators and fosters customer loyalty.

By leveraging technology for seamless subscription management and personalized services, businesses can enhance customer satisfaction and retention. The predictable revenue from subscriptions also allows for better financial planning and investment in advanced technologies, further driving market growth.

Latest Trends

Integration of AI and IoT for Enhanced Service Efficiency

In 2024, the global car wash market is poised to witness transformative trends driven by the integration of Artificial Intelligence (AI) and the Internet of Things (IoT). These technologies are revolutionizing service efficiency and customer experience. AI-powered systems can optimize wash cycles, predict maintenance needs, and ensure resource optimization, leading to reduced operational costs and enhanced service quality.

IoT devices enable real-time monitoring of equipment and environmental conditions, allowing for proactive maintenance and minimizing downtime. The adoption of AI and IoT not only improves operational efficiency but also provides valuable data insights for continuous improvement and personalized customer experiences. This trend is expected to significantly enhance the competitiveness of car wash businesses.

Use of Mobile Apps for Booking and Payment

The use of mobile apps for booking and payment is another major trend shaping the car wash market in 2024. As consumers increasingly prefer digital solutions for convenience, car wash operators are leveraging mobile technology to streamline the customer journey. Mobile apps offer easy scheduling, cashless payments, and loyalty programs, enhancing customer satisfaction and engagement.

These apps also provide businesses with opportunities to gather customer data, enabling personalized marketing and service enhancements. The convenience of mobile apps is expected to drive higher customer retention and attract tech-savvy consumers, positioning businesses that adopt this trend at a competitive advantage.

Regional Analysis

North America dominated the Car Wash Market in 2023, capturing a 45% share.

In 2023, North America dominated the Car Wash Market, capturing a 45% share. This stronghold is driven by a high vehicle ownership rate and the widespread adoption of automated car wash services. The U.S. and Canada are key contributors, with numerous established car wash chains and advanced cleaning technologies enhancing customer convenience and service efficiency. The increasing consumer preference for professional car washing services due to busy lifestyles and the availability of membership schemes are further propelling market growth in this region.

Europe follows, with a well-established network of car wash facilities and a growing trend towards environmentally friendly car wash practices. Countries like Germany, the UK, and France lead in adopting water-saving technologies and eco-friendly cleaning agents, aligning with stringent environmental regulations.

The Asia Pacific region is experiencing rapid growth in the car wash market due to increasing urbanization and rising disposable incomes. Countries like China, Japan, and India are seeing a surge in demand for automated and semi-automated car wash services. The growing middle-class population and the increasing number of vehicle owners are significant drivers in this region.

In the Middle East & Africa, the car wash market is emerging, with growth driven by rising vehicle ownership and the expansion of car wash facilities in urban areas. The UAE and Saudi Arabia are notable markets due to high-income levels and the popularity of luxury vehicles, which require frequent and high-quality washing services.

Latin America is witnessing steady growth, with Brazil and Mexico being key markets. The expanding automotive sector and the growing trend of vehicle maintenance and care are supporting the market's development. Economic improvements and increasing consumer awareness about vehicle upkeep contribute to the growth in this region.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global car wash market is characterized by significant competition and technological advancement among key players. Autobell Car Wash Inc. and True Blue Car Wash, both U.S.-based, continue to leverage their expansive network and customer-centric services to maintain their market dominance. Their focus on sustainability and innovative service offerings, such as subscription-based models, keeps them ahead in a competitive landscape.

Magic Hand Carwash in Australia is notable for its emphasis on eco-friendly practices and superior customer service. This approach resonates well with environmentally conscious consumers, enabling the company to secure a robust market position. Similarly, Hoffman Car Wash and Hoffman Jiffy Lube in the U.S. benefit from their integrated service model, combining car wash and quick lube services, which enhances customer convenience and loyalty.

Washtec of Germany and Daifuku Co., Ltd. of Japan are leaders in car wash technology, offering state-of-the-art automated systems. Their focus on R&D and continuous innovation in car wash technology ensures they remain at the forefront of the market. National Carwash Solutions and D&S Car Wash Equipment Co. in the U.S. also stand out for their advanced equipment and comprehensive service solutions, catering to a broad spectrum of customer needs.

Zips Carwash and Quick Quack Car Wash have rapidly expanded their footprints across the U.S. Their aggressive acquisition strategies and focus on providing fast, high-quality service are key to their growth. Other notable players such as Wahworld, Inc. and various regional competitors continue to innovate and expand, contributing to a dynamic and evolving market landscape. Overall, the car wash market in 2024 is poised for growth, driven by technological advancements, strategic expansions, and a strong emphasis on sustainability.

Market Key Players

- Autobell car wash inc (U.S.)

- True blue car wash (U.S.)

- Magic hand carwash (Australia)

- Hoffman car wash and Hoffman jiffy lube (U.S.)

- washtec (Germany)

- Daifuku Co,ltd (Japan)

- National Carwash Solutions (U.S.)

- D&S Car Wash Equipment Co (U.S.)

- Wahworld, Inc (U.S.)

- Zips Carwash (U.S.)

- Quick Quack Car Wash (U.S.)

- Other

Recent Development

- In March 2024, Zips Carwash acquired a regional car wash chain to expand its presence in the Midwest. This acquisition is expected to increase their market share by 15%.

- In January 2024, Autobell Car Wash Inc. introduced an eco-friendly car wash service that uses 50% less water. This initiative aims to attract environmentally conscious customers.

Report Scope

Report Features Description Market Value (2023) USD 35.4 Bn Forecast Revenue (2033) USD 52.4 Bn CAGR (2024-2033) 4.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Roll-Over/In Bay, Tunnels, Self-Service), By Process (Cloth Friction Car Washing, Touch Less Car Washing), By Component (Motors, Drivers, Foam System, Dryers and Pumps) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Autobell car wash inc (U.S.), True blue car wash (U.S.), Magic hand carwash (Australia), Hoffman car wash and Hoffman jiffy lube (U.S.), washtec (Germany), Daifuku Co,ltd (Japan), National Carwash Solutions (U.S.), D&S Car Wash Equipment Co (U.S.), Wahworld, Inc (U.S.), Zips Carwash (U.S.), Quick Quack Car Wash (U.S.), Other Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Autobell car wash inc (U.S.)

- True blue car wash (U.S.)

- Magic hand carwash (Australia)

- Hoffman car wash and Hoffman jiffy lube (U.S.)

- washtec (Germany)

- Daifuku Co,ltd (Japan)

- National Carwash Solutions (U.S.)

- D&S Car Wash Equipment Co (U.S.)

- Wahworld, Inc (U.S.)

- Zips Carwash (U.S.)

- Quick Quack Car Wash (U.S.)

- Other