Cable Connectors And Adapters Market Report By Product Type (HDMI Connectors, USB Connectors, VGA Connectors, DVI Connectors, Audio/Video Connectors, Ethernet Connectors, Others), By Application (Consumer Electronics, Automotive, Aerospace & Defense, Industrial, IT & Telecommunication, Healthcare, Others), By End-User (Residential, Commercial, Industrial), By Material (Metal, Plastic), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

50363

-

August 2024

-

321

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

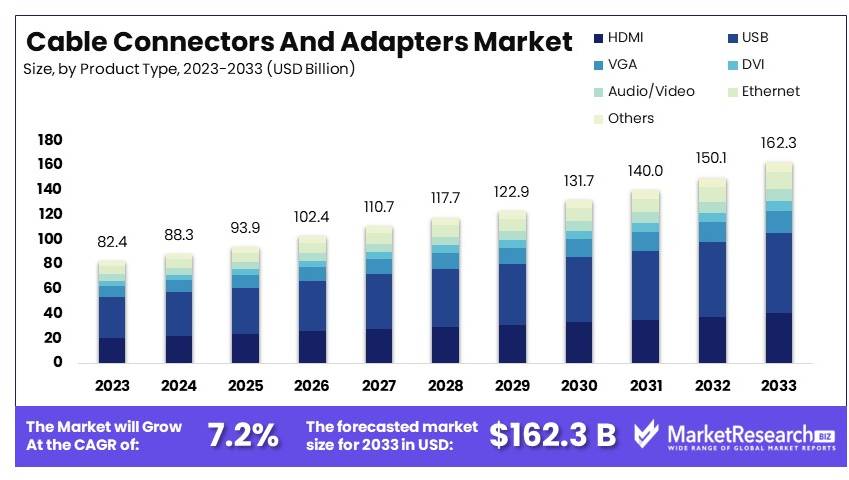

The Global Cable Connectors And Adapters Market size is expected to be worth around USD 162.3 Billion by 2033, from USD 82.4 Billion in 2023, growing at a CAGR of 7.2% during the forecast period from 2024 to 2033.

The Cable Connectors and Adapters Market involves the manufacturing and sales of devices used to connect and adapt cables for various electronic and electrical applications. This market serves sectors such as consumer electronics, telecommunications, automotive, and industrial automation.

Increasing demand for high-speed data transfer, miniaturization of electronic devices, and the rise of wireless connectivity influence market growth. Key innovations include USB-C, HDMI, and fiber optic connectors, which provide enhanced performance and compatibility. Manufacturers prioritize durability, ease of use, and compliance with international standards to meet diverse consumer and industrial needs.

The cable connectors and adapters market is experiencing significant growth, driven by the increasing integration of technology in workplaces and consumer electronics. IT professionals rely on various connectors, such as USB, HDMI, and Ethernet, to manage networks and connect devices.

The global usage of USB Type-C connectors has seen a substantial rise, with projections estimating 2,351.9 million units by the end of 2023. This reflects the widespread adoption of USB Type-C in modern devices, emphasizing its role in enhancing connectivity and efficiency.

In the consumer electronics sector, HDMI connectors remain a critical component due to their ability to transmit uncompressed high-definition video and audio. With over 4 billion HDMI-enabled devices in use globally, HDMI connectors are a staple in home entertainment and computing setups. Their prevalence underscores the sustained demand for high-quality, reliable connections in multimedia applications.

The market dynamics indicate a strong preference for versatile and high-performance connectors. The adoption of USB Type-C is driven by its reversible design and ability to support high-speed data transfer and power delivery. Similarly, the popularity of HDMI connectors is attributed to their compatibility with a wide range of devices and superior transmission capabilities.

To capitalize on these trends, companies in the cable connectors and adapters market should focus on innovation and expanding their product portfolios. Emphasizing the development of connectors that support advanced technologies and high-speed data transmission will cater to the evolving needs of both professional and consumer segments. The cable connectors and adapters market thus presents promising growth prospects, driven by technological advancements and increasing demand for efficient connectivity solutions.

Key Takeaways

- Market Value: The Cable Connectors and Adapters Market was valued at USD 82.4 billion in 2023, and is expected to reach USD 162.3 billion by 2033, with a CAGR of 7.2%.

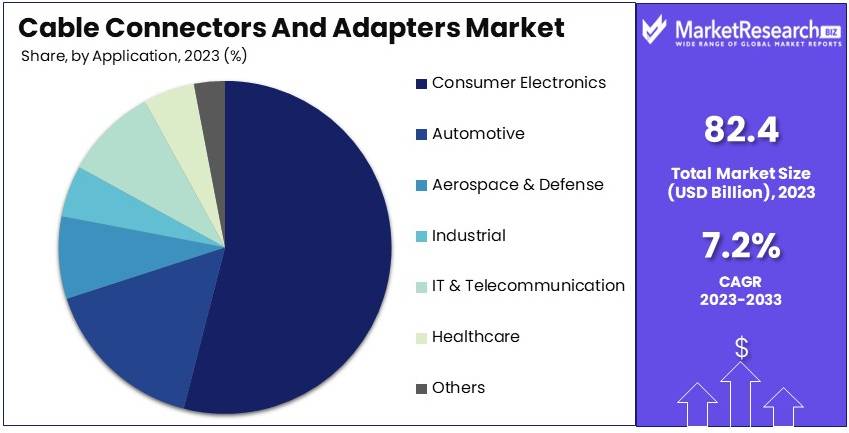

- Product Type Analysis: USB Connectors dominated the market with a 39.4% share, signifying their widespread use in various devices and applications.

- Application Analysis: Consumer Electronics led with 53.7% share, highlighting their extensive demand in the rapidly growing electronics sector.

- End-User Analysis: The Commercial segment dominated with a 64.6% share, reflecting high demand for connectors and adapters in commercial infrastructures.

- Material Analysis: Metal materials held a dominant share of 72.3%, underscoring their durability and reliability in various applications.

- Dominant Region: APAC held the dominant position with a 38.5% share, driven by strong industrial and consumer electronics markets in the region.

- High Growth Region: Another key region is expected to show significant growth, enhancing market opportunities for key players.

- Analyst Viewpoint: The market is moderately saturated with intense competition; however, future growth is expected due to the increasing adoption of advanced technologies and demand in emerging economies.

Driving Factors

Growing Demand for High-Speed Data Transmission Drives Market Growth

The increasing need for high-speed data transmission across various industries is a significant driver for the cable connectors and adapters market. As data-intensive applications such as cloud computing, data centers, and high-definition video streaming become more prevalent, the demand for reliable and efficient connectors and adapters has surged.

For example, the widespread adoption of USB-C connectors, which support faster data transfer rates and power delivery, exemplifies this trend. Companies like Apple have standardized USB-C ports in their devices to enhance performance and user convenience. The growth of high-speed internet and the expansion of 5G service further amplify the demand for advanced connectors that can handle large data volumes with minimal latency. This interconnected demand for high-speed data transmission fosters innovation and adoption of new connector technologies, driving market growth.

Proliferation of Consumer Electronics Drives Market Growth

The rapid growth of the consumer electronics market, including smartphones, laptops, gaming consoles, and wearable devices, has driven the demand for various types of cable connectors and adapters. These devices require a range of connectors for power, data transfer, and connectivity purposes.

An illustrative example is the increasing sales of HDMI cables and adapters needed to connect gaming consoles and streaming devices to televisions, driven by the rise in home entertainment and gaming activities. As consumers invest more in advanced electronics, the need for compatible and versatile connectors grows. The continuous upgrade cycles of consumer electronics ensure a steady demand for new and improved connectors, sustaining market expansion.

Technological Advancements and Innovations Drive Market Growth

Continuous advancements in technology, such as the development of more efficient and compact connectors, have fueled the growth of the cable connectors and adapters market. Innovations like magnetic connectors, which offer improved durability and ease of use, are gaining popularity.

A real-world example is the introduction of magnetic USB cables, which have become popular for their ability to reduce wear and tear on device ports, extending the lifespan of both the cable and the device. These advancements make connectors more user-friendly and reliable, encouraging widespread adoption. The integration of smart technologies and the Internet of Things (IoT) further drive the need for innovative connectors that can support various devices and applications, bolstering market growth.

Restraining Factors

Rapid Technological Changes Restrain Market Growth

The cable connectors and adapters market is subject to rapid technological changes, which can render existing products obsolete quickly. As new standards and technologies emerge, companies must continually innovate and update their product lines, which can be costly and challenging.

For instance, the transition from USB-A to USB-C connectors has required manufacturers to redesign and retool their products, leading to increased costs and potential inventory obsolescence. Keeping up with technological advancements demands substantial investment in research and development, as well as in new manufacturing processes. This constant need for innovation to stay relevant can strain resources and limit market growth, as companies struggle to keep up with rapid changes.

Price Sensitivity and Competition Restrain Market Growth

The market for cable connectors and adapters is highly price-sensitive and competitive, which can lead to thin profit margins. Numerous manufacturers produce similar products, leading to price wars and intense competition.

For example, the availability of low-cost connectors and adapters from manufacturers in countries like China has put pressure on established brands to lower their prices, impacting overall profitability and market sustainability. This high level of competition can make it difficult for companies to maintain their market position without sacrificing margins. The intense price sensitivity in this market thus restrains growth, as companies have to continuously lower prices to stay competitive.

Product Type Analysis

USB Connectors dominate with 39.4% due to their versatility and universal compatibility.

The cable connectors and adapters market is segmented by various product types including HDMI, USB, VGA, DVI, audio/video, Ethernet connectors, and others. USB connectors hold the largest market share, approximately 39.4%, due to their widespread use in multiple device connections ranging from consumer electronics to industrial equipment.

HDMI connectors are essential for high-definition video and audio transmissions, commonly used in home entertainment systems and professional media setups. VGA and DVI connectors, while older, are still relevant in certain legacy systems and applications requiring specific video connections. Audio/video connectors encompass a broad range of products catering to both professional and consumer audio/visual setups. Ethernet connectors are crucial for wired network connections, emphasizing the importance of secure and fast data transmissions in commercial and industrial environments. The "others" category includes specialized connectors and adapters that serve niche markets.

The dominance of USB connectors in the market is driven by their compatibility with a wide range of devices, including computers, smartphones, and peripherals, making them a staple in digital connectivity. Innovations such as USB-C have further solidified their market position by offering faster data transfer speeds, increased power flow, and reversible plug orientation. As technology evolves and consumer demand for efficient and reliable connectivity solutions increases, USB connectors are expected to maintain their lead, supported by continual advancements and integration into emerging tech products.

Application Analysis

Consumer Electronics dominates with 53.7% due to high demand for connectivity in personal devices.

Cable connectors and adapters find applications across diverse sectors, including consumer electronics, automotive, aerospace & defense, industrial, IT & telecommunications, healthcare, and others. Consumer electronics is the dominant sector, commanding a market share of 53.7%, driven by the ubiquitous need for connectivity solutions in devices such as smartphones, tablets, laptops, and other personal electronics.

The automotive sector relies on connectors for systems ranging from basic electrical wiring to advanced infotainment systems. Aerospace and defense applications demand highly reliable and rugged connectors for critical mission operations. Industrial applications include machinery, robotics, and factory automation, where connectors must withstand harsh environments and provide robust performance. IT & telecommunications require high-performance connectors to manage extensive data and network services. Healthcare uses specialized connectors for medical devices and equipment, emphasizing reliability and safety.

Consumer electronics' dominance in the application segment is underpinned by the continuous innovation in personal technology and the growing integration of connectivity features in everyday devices. With advancements in technology leading to more connected devices, the need for high-quality, reliable connectors is expected to grow, further driving the dominance of this sector in the market.

End-User Analysis

Commercial dominates with 64.6% due to the extensive use of connectivity solutions in business and IT infrastructures.

End-users of cable connectors and adapters are categorized into residential, commercial, and industrial segments. The commercial segment is the most significant, holding a 64.6% share of the market, driven by extensive use in offices, data centers, communication networks, and commercial businesses that require reliable and efficient connectivity solutions.

The residential segment uses these products for home electronics, computing, and entertainment systems, reflecting the growing trend of smart homes. The industrial segment includes applications in manufacturing, automation, and other heavy-duty environments where connectors need to be particularly robust and resistant to environmental factors.

The commercial sector's market dominance is fueled by the digital transformation trends in businesses, including the shift towards cloud computing, big data, and IoT, which all require effective connectivity solutions to function optimally. As businesses continue to evolve and integrate more technology into their operations, the demand for advanced cable connectors and adapters in the commercial sector is expected to remain strong, ensuring its continued dominance in the market.

Material Analysis

Metal dominates with 72.3% due to its durability and superior electrical conductivity.

Materials used in the manufacture of cable connectors and adapters include metal and plastic. Metal is the predominant material, accounting for 72.3% of the market, appreciated for its durability, reliability, and superior electrical conductivity, which are essential for high-performance connections.

Plastic connectors are valued for their cost-effectiveness and flexibility in various applications, particularly where weight and corrosion resistance are priorities, such as in consumer electronics and certain automotive applications.

The preference for metal in cable connectors and adapters is linked to its ability to provide secure, long-lasting connections in a wide range of environmental conditions, including those requiring shielding from electromagnetic interference (EMI) and physical stresses. This makes metal connectors especially valuable in industrial and aerospace applications. With ongoing developments in material science and the rising demand for sustainable and high-performance materials, the use of advanced metals and alloys in connectors is expected to continue, supporting the growth and dominance of this material in the market.

Key Market Segments

By Product Type

- HDMI Connectors

- USB Connectors

- VGA Connectors

- DVI Connectors

- Audio/Video Connectors

- Ethernet Connectors

- Others

By Application

- Consumer Electronics

- Automotive

- Aerospace & Defense

- Industrial

- IT & Telecommunication

- Healthcare

- Others

By End-User

- Residential

- Commercial

- Industrial

By Material

- Metal

- Plastic

Growth Opportunities

Growing Demand for High-Speed Data Transmission Offers Growth Opportunity

The increasing need for high-speed data transmission in various sectors, including IT, telecommunications, and entertainment, drives demand for advanced cable connectors and adapters. For example, the adoption of USB-C connectors, which support faster data transfer rates and power delivery, has grown significantly in recent years.

High-speed data transmission is crucial for modern applications, from cloud computing to streaming services. The efficiency and speed provided by advanced connectors like USB-C enhance user experiences and operational capabilities. This trend is expected to continue as technology evolves and the demand for faster and more reliable data transfer increases. Companies focusing on developing high-speed connectors and adapters can capitalize on this growing market need.

Expansion in Consumer Electronics Offers Growth Opportunity

The proliferation of consumer electronics such as smartphones, laptops, and gaming consoles creates a continuous demand for cable connectors and adapters. As new devices are launched, the need for compatible connectors and adapters increases. For instance, the widespread use of HDMI connectors for high-definition video and audio transmission in home entertainment systems drives market growth.

The consumer electronics market is dynamic, with frequent product updates and innovations. This constant evolution requires a steady supply of advanced connectors and adapters to ensure compatibility and enhance functionality. Companies that can swiftly adapt to the latest consumer electronics trends and provide reliable solutions will find significant growth opportunities in this sector.

Advancements in Industrial Automation Offer Growth Opportunity

The rise of industrial automation and the Internet of Things (IoT) presents significant growth opportunities for the cable connectors and adapters market. Industrial environments require robust and reliable connectors to ensure seamless communication between machines and systems. Companies like TE Connectivity develop industrial-grade connectors that meet the stringent requirements of automated manufacturing processes.

Industrial automation enhances productivity and efficiency in manufacturing and other sectors. Reliable connectors are essential for maintaining uninterrupted communication and control in these systems. As automation and IoT adoption expand, the demand for durable and high-performance cable connectors and adapters will grow. Companies investing in advanced industrial connectors can leverage this trend to drive market growth.

Trending Factors

Miniaturization of Connectors Are Trending Factors

The trend towards miniaturization in electronic devices is driving the demand for smaller, more compact connectors. This trend is particularly evident in the development of USB-C and micro-HDMI connectors, which provide high functionality in a smaller form factor. For example, the shift towards slimmer laptops and mobile devices necessitates the use of smaller connectors to save space and enhance design.

As electronic devices continue to shrink in size while increasing in capability, the need for miniaturized connectors grows. These smaller connectors enable manufacturers to design sleeker, more portable devices without sacrificing performance. This trend is expected to drive the growth of the cable connectors and adapters market as technology advances and consumer preferences lean towards more compact and efficient electronics.

Wireless Connectivity Alternatives Are Trending Factors

The growing popularity of wireless connectivity solutions such as Bluetooth and Wi-Fi can impact the demand for traditional cable connectors and adapters. While wireless technologies offer convenience, they also pose a challenge to the market for physical connectors. For instance, the increasing adoption of wireless charging technologies for smartphones reduces the need for traditional charging cables.

Despite the shift towards wireless solutions, there remains a demand for reliable and high-speed wired connections in many applications. The challenge for the cable connectors and adapters market is to innovate and adapt to changing consumer needs. By focusing on the unique advantages of wired connections, such as stability and speed, the market can continue to thrive alongside the rise of wireless alternatives.

Sustainability and Environmental Regulations Are Trending Factors

Environmental concerns and regulations regarding electronic waste are driving the trend towards sustainable and eco-friendly connectors and adapters. Manufacturers are focusing on developing products with recyclable materials and longer lifespans. Companies like Molex emphasize their commitment to sustainability by designing connectors that meet environmental standards and reduce electronic waste.

This shift towards sustainability is fueled by both regulatory pressures and consumer demand for eco-friendly products. As awareness of environmental issues grows, so does the market for sustainable solutions. The emphasis on sustainability is expected to drive innovation and growth in the cable connectors and adapters market, as manufacturers develop products that align with eco-friendly practices and regulations.

Regional Analysis

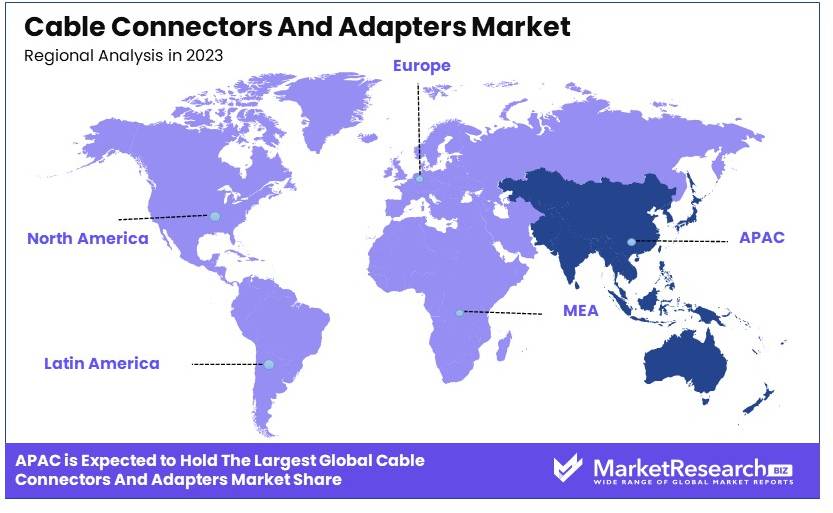

APAC Dominates with 38.5% Market Share in the Cable Connectors and Adapters Market

APAC's leading position with a 38.5% market share in the cable connectors and adapters sector is driven by its expansive electronics manufacturing base. High production capacities in countries like China, South Korea, and Japan, combined with increasing investments in telecommunications and information technology infrastructure, fuel this dominance. The region's cost-effective manufacturing and high export volumes also significantly contribute to its market share.

The regional dynamics in APAC are influenced by rapid industrial growth and the adoption of new technologies, which increase the demand for reliable and efficient connectivity solutions. The region's thriving consumer electronics market, supported by a large consumer base, further boosts demand for various types of cable connectors and adapters. Moreover, government initiatives aimed at enhancing technological capabilities are propelling market growth.

The future influence of APAC in the cable connectors and adapters market is projected to grow due to ongoing technological advancements and expanding digital networks. As digital transformation accelerates across the region, the demand for sophisticated connectivity solutions will likely increase, solidifying APAC's position in the global market. Continued focus on innovation and quality improvement in manufacturing processes may also enhance the region's competitiveness and market share.

Regional Market Share and Growth Projections:

- North America: North America holds around 27% of the market. The region's growth is driven by its robust technological infrastructure and high demand for advanced connectivity solutions in both the commercial and industrial sectors. With ongoing developments in technologies like 5G and IoT, the market share is expected to see steady growth.

- Europe: Europe accounts for about 25% of the market. Strong emphasis on industry 4.0 and automation technologies, coupled with stringent standards for product quality and safety, supports the European market. Growth is anticipated to continue as the region further integrates digital solutions across various industries.

- Middle East & Africa: MEA has a smaller share at approximately 5% but is experiencing rapid growth due to infrastructure developments and increasing penetration of technology in the region. As more countries focus on diversifying their economies, demand for connectivity solutions is expected to rise.

- Latin America: Holding 5% of the global market, Latin America is witnessing growth driven by improvements in telecommunications infrastructure and increasing technological adoption. As the region continues to embrace more digital and connected technologies, its market share is likely to increase.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Cable Connectors and Adapters market features leading companies like TE Connectivity and Amphenol Corporation, known for their high-quality products and extensive industry experience. Their strong market presence is driven by innovation and reliability.

Molex Incorporated and Delphi Automotive contribute significantly with their advanced engineering and broad product ranges, strengthening their market positions.

3M and Hirose Electric Co. Ltd. offer specialized connectors and adapters, enhancing their market influence with diverse applications.

Nexans and L-com Global Connectivity focus on high-performance solutions, catering to various industries and increasing their market impact.

Phoenix Contact and Corning Cable Systems provide innovative connectivity solutions, driving market growth through quality and performance.

Belden Inc. and Samtec are recognized for their robust product lines and customer-focused approaches, enhancing their strategic positioning.

Harting Technology Group and Weidmuller Interface GmbH & Co. KG contribute significantly with their reliable and durable products, catering to industrial applications.

ITT Cannon rounds out the key players with its extensive product portfolio and strong market presence. Collectively, these companies drive the Cable Connectors and Adapters market through innovation, quality, and strategic positioning.

Market Key Players

- TE Connectivity

- Amphenol Corporation

- Molex Incorporated

- Delphi Automotive

- 3M

- Hirose Electric Co. Ltd.

- Nexans

- L-com Global Connectivity

- Phoenix Contact

- Corning Cable Systems

- Belden Inc.

- Samtec

- Harting Technology Group

- Weidmuller Interface GmbH & Co. KG

- ITT Cannon

Recent Developments

- TE Connectivity and Molex formed a Dual Source Alliance (DSA) to co-develop high-speed I/O and backplane connectors, addressing the demand for high-performance data communications in data centers.

- TE Connectivity launched a new series of Heavy-Duty Connectors aimed at industrial and harsh environments, enhancing their portfolio for industrial machinery and aerospace & defense applications.

Report Scope

Report Features Description Market Value (2023) USD 82.4 Billion Forecast Revenue (2033) USD 162.3 Billion CAGR (2024-2033) 7.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (HDMI Connectors, USB Connectors, VGA Connectors, DVI Connectors, Audio/Video Connectors, Ethernet Connectors, Others), By Application (Consumer Electronics, Automotive, Aerospace & Defense, Industrial, IT & Telecommunication, Healthcare, Others), By End-User (Residential, Commercial, Industrial), By Material (Metal, Plastic) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape TE Connectivity, Amphenol Corporation, Molex Incorporated, Delphi Automotive, 3M, Hirose Electric Co. Ltd., Nexans, L-com Global Connectivity, Phoenix Contact, Corning Cable Systems, Belden Inc., Samtec, Harting Technology Group, Weidmuller Interface GmbH & Co. KG, ITT Cannon Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- TE Connectivity

- Amphenol Corporation

- Molex Incorporated

- Delphi Automotive

- 3M

- Hirose Electric Co. Ltd.

- Nexans

- L-com Global Connectivity

- Phoenix Contact

- Corning Cable Systems

- Belden Inc.

- Samtec

- Harting Technology Group

- Weidmuller Interface GmbH & Co. KG

- ITT Cannon