Building Air Sealing and Insulation Market By Type(Foam Insulation, Caulking, Weatherstripping, Others), By Installation(New Building, Retrofit), By Location(Electrical Outlet, Fan and Vents, Windows, Doors, Plumbing, Fireplace, Ducts, Ceiling, Floors & Walls, Others), By End-use(Residential, Commercial, Industrial) By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

43311

-

Feb 2024

-

184

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Driving Factors

- Restraining Factors

- Building Air Sealing and Insulation Market Segmentation Analysis

- Building Air Sealing and Insulation Industry Segments

- Building Air Sealing and Insulation Market Regional Analysis

- Building Air Sealing and Insulation Industry By Region

- Building Air Sealing and Insulation Market Key Player Analysis

- Industry Key Players

- Building Air Sealing and Insulation Market Recent Development

- Report Scope

Report Overview

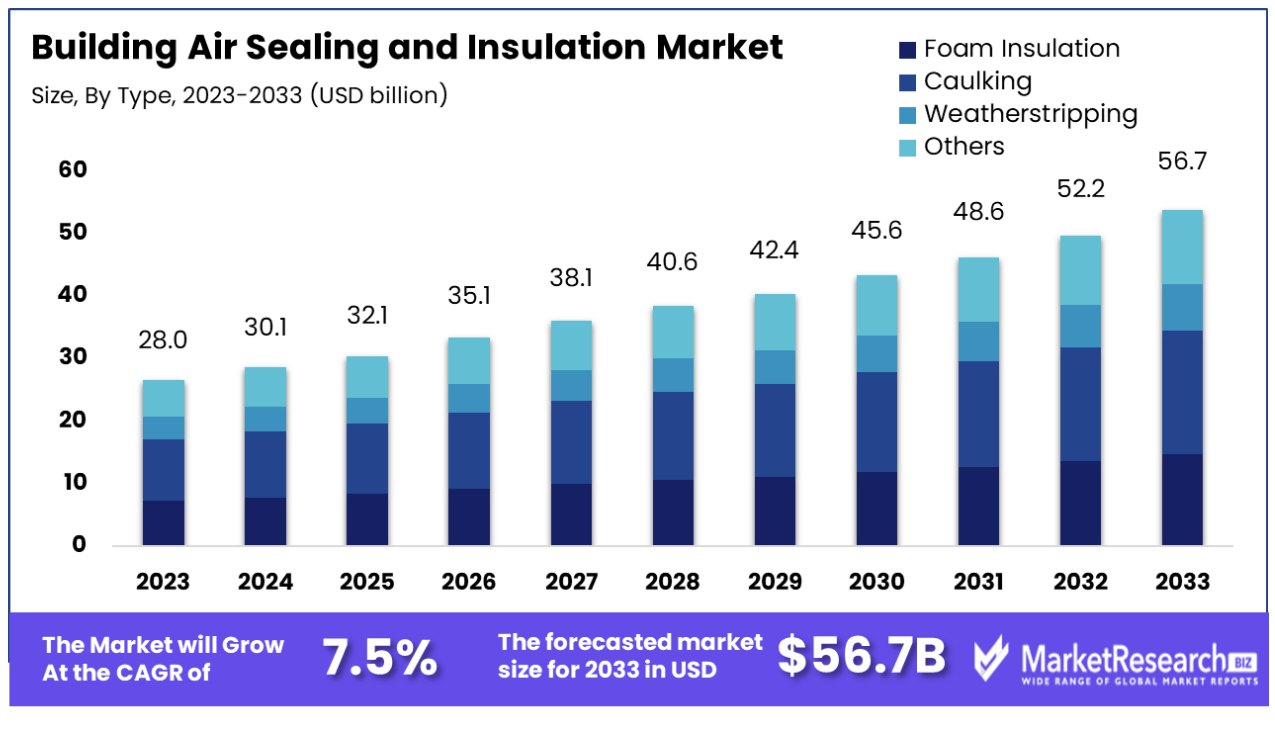

The Building air sealing and insulation market was valued at USD 28 billion in 2023. It is expected to reach USD 56.7 billion by 2033, with a CAGR of 7.5% during the forecast period from 2023 to 2032.

Building air sealing and insulation are crucial components of energy-efficient construction and remodeling. Properly sealing gaps and cracks in a building envelope with caulk, spray foam, or weatherstripping reduces air leakage, leading to better temperature control and energy savings. Insulation in walls, attics, and basements slows heat flow, helping maintain interior temperatures. Common insulation types like fiberglass batts, rigid foam boards, blown-in cellulose, and spray foam each have advantages and disadvantages regarding effectiveness, cost, and ease of installation.

According to the World Resources Institute (WRI), Globally, buildings and construction are responsible for 60% of electricity use, 12% of water use, 40% of waste, and 40% of carbon dioxide emissions. With buildings representing massive shares of global energy use, emissions, and resource consumption, air sealing and insulation can provide major environmental benefits.

The surging demand for energy efficiency in residential and commercial buildings is a substantial growth catalyst for the Building Air Sealing and Insulation Market. Rising energy costs and heightened environmental awareness are compelling homeowners, businesses, and governments to seek solutions that minimize energy consumption. This trend is not merely transient; data indicates a steady rise in energy prices and an enduring commitment to environmental sustainability.

In the past two decades, member countries of the International Energy Agency (IEA) have enacted measures aimed at enhancing energy efficiency in the buildings, industrial, and transportation sectors.

These initiatives are projected to have resulted in substantial cost savings for households and businesses. It is estimated that these measures have reduced the overall energy expenditures in 2022 by approximately 15%, equating to a reduction of around USD in the total energy bill, which stood at USD 4.5 trillion.

The vast presence of older, energy-inefficient buildings represents a significant market opportunity. These structures, often overlooked, are ripe for retrofitting with advanced air sealing and insulation solutions. Industry reports suggest a growing trend towards building renovations, driven by both regulatory mandates and the cost-effectiveness of energy savings. By targeting these buildings, companies can unlock a substantial revenue stream.

The advent of "smart" insulation materials—characterized by their adaptability to temperature fluctuations—presents a disruptive opportunity. These advanced materials, including carbon fiber and hemp, offer superior insulation compared to traditional options.

In September 2024, Thermalytica, a startup from Japan's National Institute of Materials Science, developed a groundbreaking silica-based thermal insulation material, TIISA. The material's unique structure and properties have vast applications, ranging from eco-friendly building exteriors to consumer electronics, offering potential solutions for energy efficiency and sustainability.

By spearheading the testing, certification, and installation of these innovative products, companies can establish themselves as market leaders in a burgeoning niche. Recent industry analyses highlight a growing appetite for such advanced materials, suggesting a significant market potential for early adopters and innovators in this space.

Driving Factors

Construction Boom Elevates Building Air Sealing and Insulation Market

As new buildings rise and existing structures undergo renovation, the demand for effective air sealing and insulation solutions increases.

This demand is driven by the need for durable, comfortable, and energy-efficient living and working spaces. In recent years, the construction industry has seen a surge, fueled by urbanization, population growth, and economic development. As this trend continues, it is expected to further amplify the need for air sealing and insulation products, ensuring continued market growth aligned with the global construction boom.

Innovation and Material Advancements Propel Market

Manufacturers are continuously developing more effective, sustainable, and user-friendly products. Innovations include eco-friendly materials, advanced insulation technologies, and integrated sealing solutions that offer better thermal performance and air quality.

These advancements are not only meeting the current market demand for higher efficiency but are also setting new industry standards. As material technology evolves, the market is expected to expand, driven by the ongoing pursuit of enhanced building performance and sustainability.

Energy Efficiency Regulations Drive Market Expansion

Energy efficiency regulations are a key driver for the Building Air Sealing and Insulation Market. Governments and regulatory bodies worldwide are implementing stricter guidelines to reduce energy consumption and greenhouse gas emissions. These regulations often mandate specific standards for building insulation and air tightness, compelling constructors and homeowners to adopt efficient sealing and insulation solutions.

As these regulations become more stringent, the demand for compliant air sealing and insulation products is expected to rise. This trend is not only promoting a more energy-efficient building stock but is also shaping a market increasingly driven by the need to meet regulatory requirements. The long-term market growth is anticipated to be sustained by the continuous evolution and enforcement of energy efficiency standards globally.

Restraining Factors

Market Fragmentation and Lack of Standardization Limit Building Air Sealing and Insulation Market Growth

The fragmentation is evident in the presence of numerous small players with varying product qualities and specifications. The absence of uniform standards across the industry can lead to inconsistencies in product performance and customer satisfaction.

For consumers and contractors, this lack of standardization makes it challenging to compare products and choose the best solutions. It also complicates the efforts of manufacturers to scale their operations and innovate, as they must navigate a diverse and non-uniform market landscape.

Lack of Consumer Awareness Restrains Building Air Sealing and Insulation Market Growth

Many homeowners and builders are not fully informed about the benefits of proper air sealing and insulation, such as energy efficiency, cost savings, and environmental impact.

This lack of knowledge can result in a lower prioritization of these solutions in construction and renovation projects. Additionally, the technical nature of air sealing and insulation products and their long-term benefits are not always easily understood or communicated effectively. Increasing consumer education and awareness is crucial for expanding the market, as informed consumers are more likely to invest in these energy-efficient solutions.

Building Air Sealing and Insulation Market Segmentation Analysis

By Type Analysis

Foam insulation, constituting 45% of the market, is the dominant type in the Building Air Sealing and Insulation Market. Its prevalence is due to its high efficiency in thermal insulation and air sealing. Foam insulation can expand to fill gaps, making it highly effective in reducing air leakage and improving energy efficiency in buildings. It is available in various forms, including spray foam and rigid foam boards, catering to diverse insulation needs. This segment's growth is fueled by increasing energy conservation regulations and the growing emphasis on reducing energy costs in buildings.

Caulking is used to seal joints and seams against air leakage. Weatherstripping is applied to movable components like doors and windows for sealing gaps. Other types include batt insulation and loose-fill insulation, each having specific applications based on building requirements.

By Installation Analysis

New building constructions represent the largest market share, with a 64% dominance in the installation of air sealing and insulation products. In new constructions, there is greater scope for integrating advanced insulation materials and techniques, making buildings more energy-efficient from the outset. The growing construction industry, coupled with stringent building codes emphasizing energy efficiency, drives this segment.

Retrofitting existing buildings with air sealing and insulation products is crucial for improving their energy performance. According to an independent study, energy savings ranging from 10 to 45% can be achieved in existing homes that are air-sealed and have insulation added in the ceiling and floors (and walls in very limited circumstances) to levels prescribed by the 2021 International Energy Conservation Code.

By Location Analysis

Insulation in ceilings, floors, and walls is the dominant region, accounting for 41% of the market. This area is crucial because a significant amount of heat is lost through these parts of a building. Effective insulation in these areas is essential for maintaining indoor temperature, resulting in lower heating and cooling costs.

Other important areas include electrical outlets, fans and vents, windows, doors, plumbing, fireplaces, and ducts. Each of these locations requires specific air sealing and insulation strategies to prevent air leakage and improve overall building efficiency.

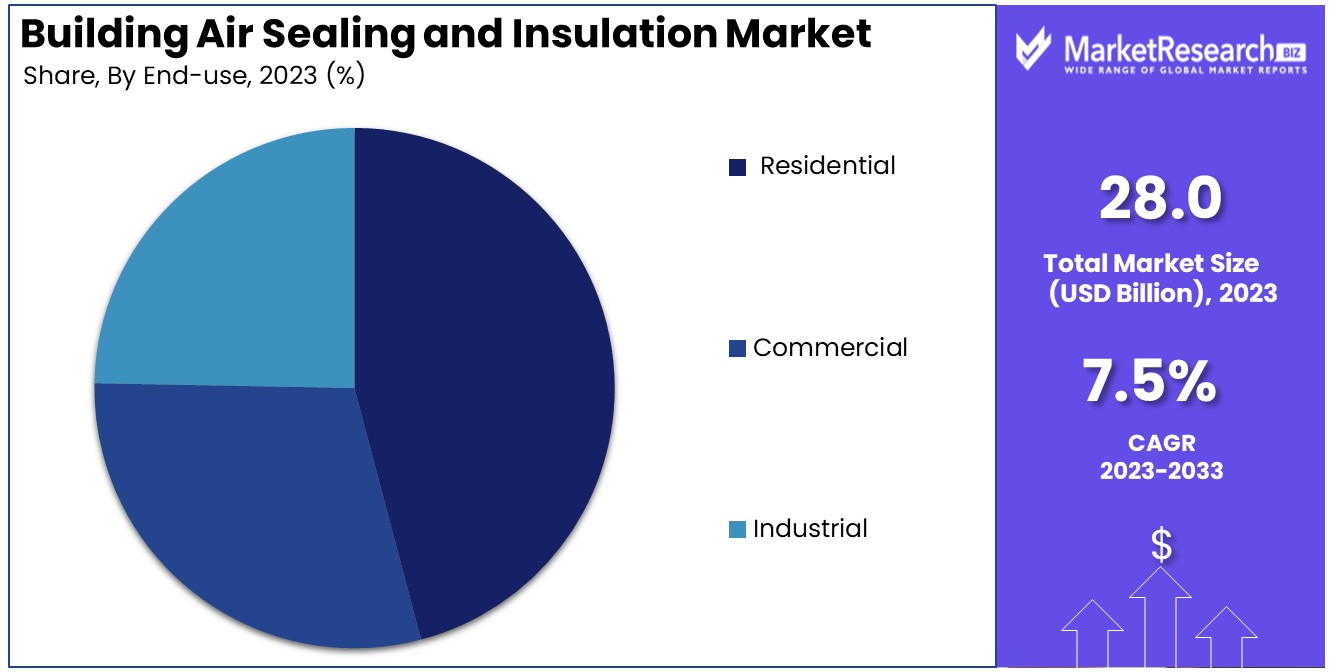

By End-use Analysis

The residential sector is the leading end-user of building air sealing and insulation products. This dominance is predominantly driven by the increasing demand for energy-efficient homes and the implementation of green building standards. According to the U.S. Department of Energy, proper insulation can save homeowners an average of 15% on heating and cooling costs. Additionally, increasing a home's insulation is one of the fastest and most cost-effective ways to reduce energy consumption, with potential savings ranging from 5% to 30% per year.

The commercial sector includes offices, retail spaces, and educational institutions, which require efficient insulation for energy management. The industrial sector also uses these products for maintaining controlled environments and reducing energy costs.

Building Air Sealing and Insulation Industry Segments

By Type

- Foam Insulation

- Caulking

- Weatherstripping

- Others

By Installation

- New Building

- Retrofit

By Location

- Electrical Outlet

- Fan and Vents

- Windows

- Doors

- Plumbing

- Fireplace

- Ducts

- Ceiling, Floors & Walls

- Others

By End-use

- Residential

- Commercial

- Industrial

Building Air Sealing and Insulation Market Regional Analysis

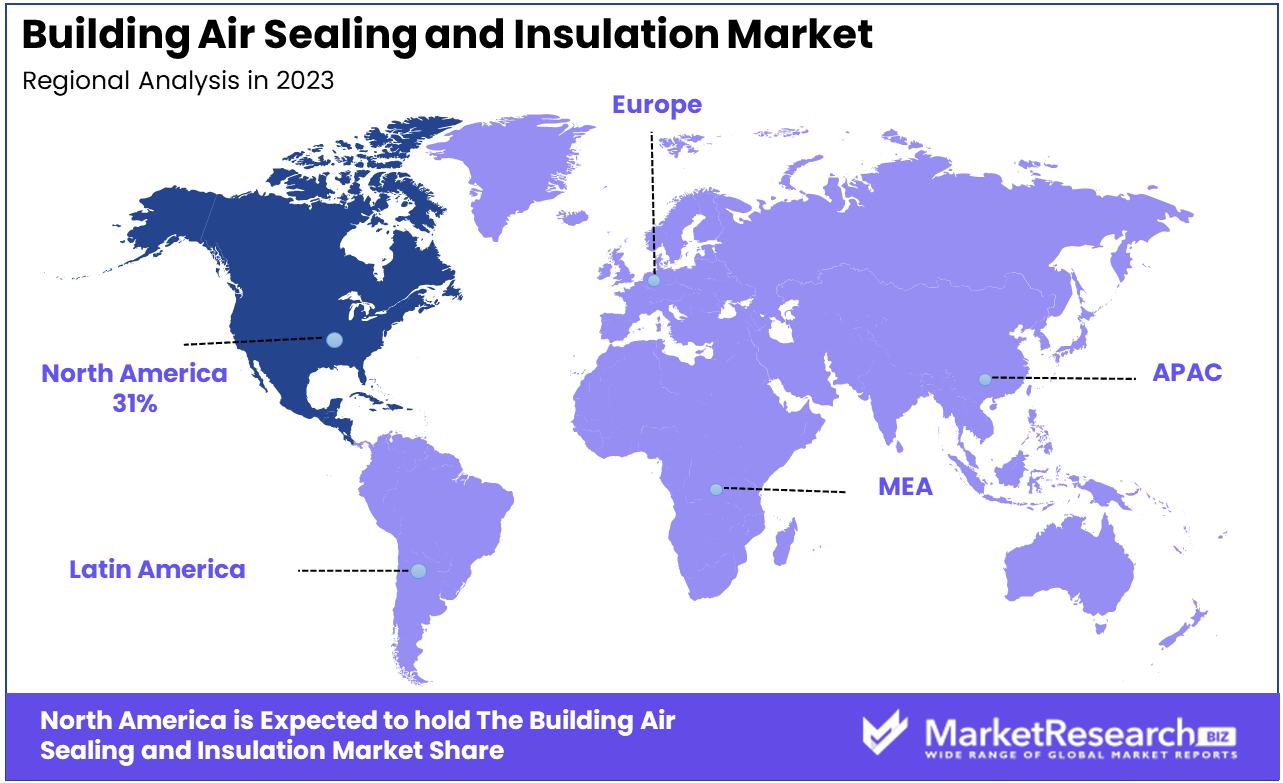

North America Dominates with 31% Market Share

North America’s 31% share in the Building Air Sealing and Insulation Market is largely driven by the region's increasing focus on energy efficiency and sustainable building practices. The United States and Canada have implemented stringent building codes that emphasize thermal efficiency, driving the demand for air sealing and insulation products. Additionally, the growing awareness among homeowners and builders about the cost savings and environmental benefits of energy-efficient buildings contributes to this market dominance.

The market dynamics in North America are influenced by technological advancements in insulation materials and air-sealing solutions. The region's well-established construction industry, combined with the push for retrofitting existing buildings to improve energy efficiency, further boosts the market. Moreover, governmental incentives for green building practices and the adoption of eco-friendly materials in construction projects enhance the demand. For example, the State of California and the federal government have proposed a variety of incentives, such as tax credits, tax deductions, and rebate programs, to encourage the implementation of green building practices.

Europe's Emphasis on Energy Efficiency and Sustainability

Europe’s building air sealing and insulation market is driven by the region's strong commitment to energy efficiency and sustainability. The European Union's energy directives and the increasing adoption of passive house standards play a significant role.

Asia-Pacific's Rapid Urbanization and Construction Growth

In Asia-Pacific, the region's booming economies, like China and India, are experiencing an increase in construction activities, both in residential and commercial sectors. The rising awareness of energy-efficient buildings and the need for thermal comfort in diverse climatic conditions drive the market in this region, positioning Asia-Pacific as a key emerging market.

Building Air Sealing and Insulation Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

Building Air Sealing and Insulation Market Key Player Analysis

Aeroseal stands out for its advanced air sealing technology, pivotal in enhancing building energy efficiency, highlighting the market's focus on innovative solutions for air leakage.

Yankee Thermal Imaging and Insta-Insulation, with their specialized services in thermal imaging and insulation installation, respectively, play crucial roles in improving building energy performance, reflecting the industry's shift towards comprehensive energy-saving solutions. Lone Star Insulation LLC and Spray-Tech Insulation, focusing on high-quality insulation materials and application techniques, contribute significantly to the market by catering to the growing demand for effective thermal management in residential and commercial buildings.

Hayes Company and Green Team LI., though smaller in comparison, make substantial contributions to the market by providing localized and customized insulation services, demonstrating the industry's diversity and adaptability to various climatic and construction needs. Eco Three and A-A Exteriors, with their focus on eco-friendly insulation solutions, underscore the market's trend towards sustainability and green building practices.

Southland Insulators, a significant player in the market, contributes to the sector through its extensive range of insulation services, catering to both new construction and retrofit projects, highlighting the market's comprehensive approach to building energy efficiency.

Collectively, these companies not only drive the Building Air Sealing and Insulation Market's growth but also represent diverse strategies, from advanced air sealing technologies to eco-friendly insulation solutions, crucial for enhancing energy efficiency and sustainability in the construction industry.

Industry Key Players

- Aeroseal

- Yankee Thermal Imaging

- Insta-Insulation

- Lone Star Insulation LLC

- Spray-Tech Insulation

- Hayes Company

- Green Team LI.

- Eco Three

- A-A Exteriors

- Southland Insulators

Building Air Sealing and Insulation Market Recent Development

- In 2023, Huber Engineered Woods introduced its ZIP System Peel and Stick Underlayment, which acts as a self-adhered waterproofing roof underlayment to prevent water intrusion due to ice dams or wind-driven rain.

- In 2022, DuPont introduced StyrofoamTM Brand ST-100 XPS Insulation, which marked a significant milestone in building insulation technology.

- In February 2021, AeroBarrier introduced a new air sealing technology called AeroBarrier Connect. This system is designed to make air sealing faster, more precise, and cost-effective. The modular design of AeroBarrier Connect simplifies setup, sealing, and cleanup, allowing builders, contractors, and energy raters to seal more buildings each day with precise and measured results.

Report Scope

Report Features Description Market Value (2023) USD 28 Billion Forecast Revenue (2033) USD 56.7 Billion CAGR (2024-2032) 7.5% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Foam Insulation, Caulking, Weatherstripping, Others), By Installation(New Building, Retrofit), By Location(Electrical Outlet, Fan and Vents, Windows, Doors, Plumbing, Fireplace, Ducts, Ceiling, Floors & Walls, Others), By End-use(Residential, Commercial, Industrial) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Aeroseal, Yankee Thermal Imaging, Insta-Insulation, Lone Star Insulation LLC, Spray-Tech Insulation, Hayes Company, Green Team LI., Eco Three, A-A Exteriors, Southland Insulators Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Aeroseal

- Yankee Thermal Imaging

- Insta-Insulation

- Lone Star Insulation LLC

- Spray-Tech Insulation

- Hayes Company

- Green Team LI.

- Eco Three

- A-A Exteriors

- Southland Insulators