Global Bromadiolone Market By Type (Powder, Liquid, Other Types), By Application(Mother liquor, Pellets/Bait Blocks, Other Applications), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

37684

-

June 2023

-

179

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

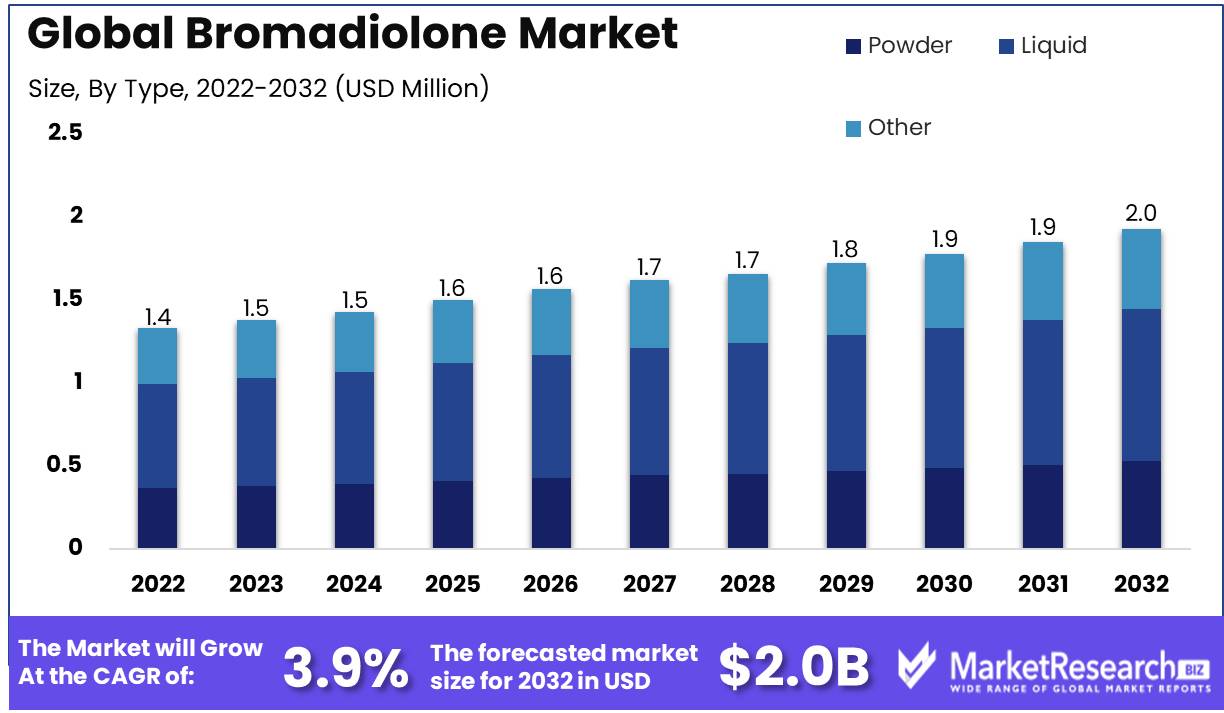

Global Bromadiolone Market size is expected to be worth around USD 2.0 Bn by 2032 from USD 1.4 Bn in 2022, growing at a CAGR of 3.9% during the forecast period from 2023 to 2032.

In the global bromadiolone market report, the market for the potent rodenticide Bromadiolone is subjected to a comprehensive analysis. This report delves into the market's complexities, presenting an exhaustive analysis of its current state, recent ground-breaking innovations, key market participants, and promising growth avenues. In addition, the significant variables propelling this market forward and the profound ethical concerns surrounding the utilization of Bromadiolone are highlighted.

The bromadiolone market has witnessed a plethora of innovative developments over the years, most notably the introduction of more effective formulations. These formulations encompass a wide variety of product variants, spanning from wax blocks to highly concentrated liquid concoctions. The market has witnessed an increase in the adoption of natural and organic pest control methods, paving the way for the emergence of bromadiolone-based products that prioritize safety and environmental benevolence.

In recent years, a multiplicity of prominent corporations have made substantial investments in the bromadiolone market. Syngenta, BASF, and FMC Corporation spearheaded the development of a plethora of bromadiolone-based products that have successfully penetrated the market under various brand names, such as Talon, Contrac, and Final.

While the agriculture and pest control industries are the primary drivers of the bromadiolone market, other industries, such as food processing, livestock farming, and transportation, have also embraced the utilization of this potent compound for pest management, thereby fueling its demand across a variety of domains.

However, the use of bromadiolone presents a number of ethical dilemmas that require cautious consideration. Priority among these concerns is the potential damage it poses to non-targeted wildlife, for which unintentional exposure can have disastrous effects. In addition, the risk of accidental ingestion by vulnerable populations such as children and animals lurks menacingly. Manufacturers and users of bromadiolone must imbue their operations with a firm commitment to transparency, explainability, and accountability in order to promote responsible practices.

Driving factors

Pest Control Demand is on the Rise

The increased demand for pest control solutions, particularly in urban areas where rodents and other pests can become a significant problem, is one of the most influential factors. Bromadiolone has been shown to be extraordinarily effective at eradicating rodent populations, which has increased demand for this substance.

Market Stability for Bromadiolone

No significant regulatory changes are anticipated to impact the global bromadiolone market at this time, which is excellent news for industry participants. However, there are still prospective changes that may occur in the future; therefore, it is essential for companies to remain informed about any regulatory changes that may affect their operations.

Innovations that promote Bromadiolone

Emerging technologies, such as new delivery methods and more advanced formulations, may have an impact on the global bromadiolone market in the future. These innovations may increase the efficacy and efficiency of pest control solutions, thereby boosting the demand for bromadiolone.

The competition posed by natural options

The emergence of new, natural pest control solutions, as well as a growing trend toward eco-friendliness and sustainability in pest control, are potential disruptors in the competitive landscape of the global bromadiolone market. As more consumers become aware of the environmental impact of their pest control solutions, industry participants will need to adjust and provide more sustainable alternatives or risk losing market share.

Influential Consumer Trends on Bromadiolone

Last but not least, changes in consumer behavior and emerging trends, such as a growing preference for do-it-yourself pest control solutions, may have an impact on the global bromadiolone market. To accommodate these shifting consumer preferences, businesses may need to modify their marketing strategies and product lineups. Overall, the global bromadiolone market is on an upward trend, with robust demand and no impending significant regulatory disruptions.

Restraining Factors

Restrictions on the Use of Bromadiolone

In the future years, the global bromadiolone market is expected to expand. However, there are a number of factors that could inhibit its growth. Regulations are one of the primary restraints on the Bromadiolone market's growth. Governments worldwide strictly regulate the use of chemicals in agriculture to ensure their safety for human consumption and their environmental impact. In recent years, the government has tightened restrictions on the use of rodenticides in an effort to minimize exposure to non-target animals, including humans.

Bromadiolone Non-Target Risks

Bromadiolone is a second-generation anticoagulant rodenticide that poses significant non-target hazards when misused. Wildlife such as birds, mammals, and reptiles that ingest Bromadiolone by accident can develop toxicity and even die. Domestic animals and pets can be exposed to the poison if they consume rodents that have ingested Bromadiolone bait, in addition to wildlife.

Bromadiolone Hinders Resistance

The development of resistance is an additional factor that hinders the growth of the bromadiolone market. In recent years, rodent populations, including bromadiolone, have developed resistance to rodenticides. When resistance develops, it becomes more difficult for farmers and pest control specialists to control rodent populations that cause extensive damage to agriculture, buildings, and other infrastructure.

Shift Away from Chemical Rodenticides by Consumers

Consumer preference for non-chemical methods of rodent control is increasing. As environmental degradation becomes increasingly apparent, there is a general reluctance to use chemical rodenticides for rodent control. This shift in consumer preference has prompted the development of non-chemical solutions, including biological control agents, physical barriers, and mechanical traps.

Type Analysis

The market for bromadiolone is dominated by the liquid segment, which has assumed the lead for a variety of reasons. The liquid segment is more popular due to its simplicity of application, rapid absorption, and efficacy. The rising demand for liquid segments is influenced by a number of factors, including their chemical and physical properties.

In the future years, the global bromadiolone market is anticipated to expand, with the liquid segment exhibiting the highest growth rate. The expansion of the market is directly related to the economic developments in emerging economies. Due to their increased need for agricultural crops and animal husbandry, these nations are propelling the adoption of the liquid segment and other forms of bromadiolone.

The market sales of bromadiolone are influenced directly by consumer trends and behavior. As a result of their fast action and usability, consumers are gravitating toward liquid product segments. Additionally, they are willing to pay a premium for the added convenience that the liquid segment offers.

In addition to impulsiveness, perplexity, creativity, and other mental processes, human-like factors that influence market trends and outcomes also include volatility. These factors play a substantial role in determining the future of the bromadiolone market, specifically the liquid segment.

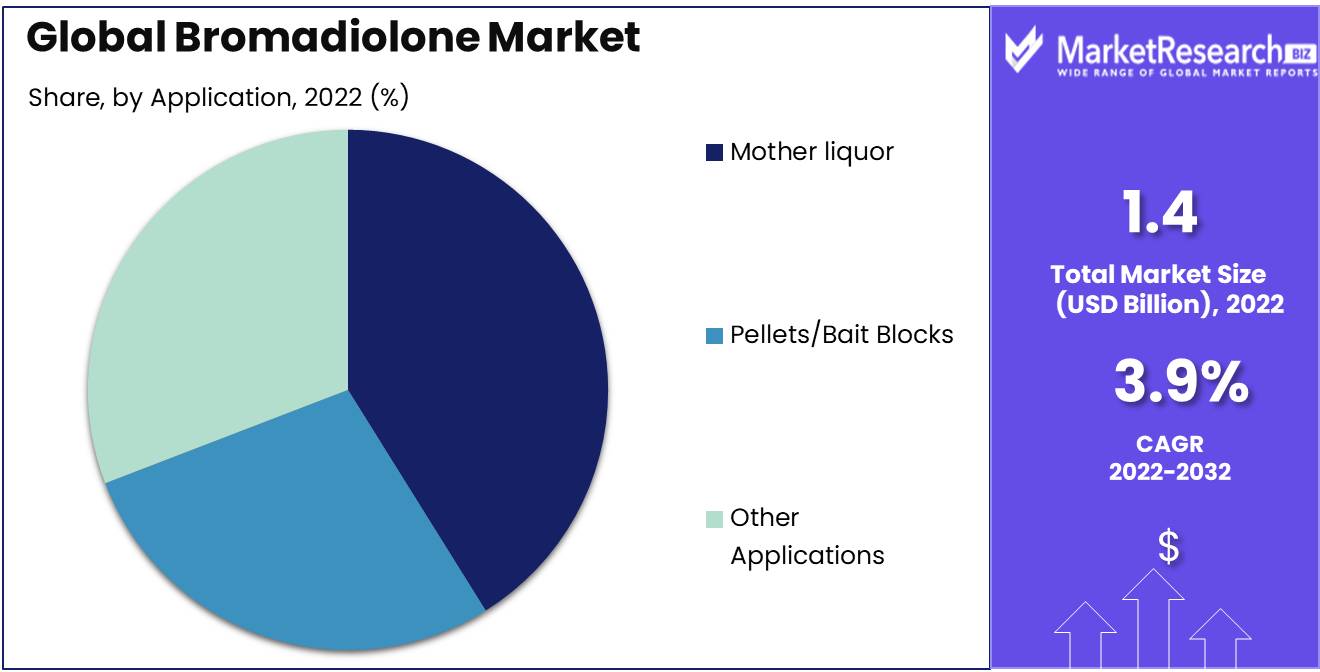

Application Analysis

The segment of mother liquor dominates the global bromadiolone market for a variety of reasons. The mother liquor segment is a byproduct of crystallization consisting of concentrated refuse mixtures. It is comparatively more affordable and readily accessible in large quantities, making it a popular option among farmers.

The economy of emerging economies is a significant factor in the expansion of the mother liquor segment and other bromadiolone formulations. Feeding an expanding population increases the demand for efficient agricultural and animal husbandry goods. These markets are viewed as growth opportunities for the mother liquor application segment.

In the future years, the consumer trend toward mother liquor segments is also anticipated to increase. Consumers seek cost-effective products that deliver the same level of efficacy as other market segments. As a consequence, it is anticipated that the mother liquor segment will exhibit the highest growth rate in the global bromadiolone market.

The dynamism, complexity, and originality of human-like mental processes also play a significant role in the development of the mother liquor market segment. This segment's development will be determined by the availability of raw materials, market demand, and technological progress.

Key Market Segments

By Type

- Powder

- Liquid

- Other Types

By Application

- Mother liquor

- Pellets/Bait Blocks

- Other Applications

Growth Opportunity

Bromadiolone Demand Rising in Rodenticide Market

Due to the necessity for effective pest control, the worldwide rodenticides market has grown significantly. The market for bromadiolone, an anticoagulant rodenticide, is predicted to rise significantly in the future years. The development of safer rodenticides, rising market expansion, integrated pest management, and a growing focus on sustainable pest control collaboration all contribute to this growth potential.

Safer Alternatives Grow Bromadiolone's Market

Traditional rodenticides have environmental and health risks. Manufacturers are focusing on the development of safer alternatives to meet these issues. This tendency has led to increased demand for bromadiolone, a safer choice due to its reduced toxicity levels. The increased focus on public health and safety has led to tougher pest management rules and guidelines, further driving the growth of safer rodenticides like bromadiolone.

Emerging Markets Prefer Bromadiolone

Emerging markets have led to a rise in bromadiolone demand. The market for pest control solutions has increased as developing countries face rapid urbanization and infrastructure development. Bromadiolone is popular in growing economies like India, China, and Brazil because it kills rodents and is low-toxic. These markets offer bromadiolone manufacturers and suppliers tremendous growth prospects.

Integrated Pest Management Increases Bromadiolone Demand

In agriculture, integrated pest control (IPM) approaches have increased. IPM uses biological control, insecticides, and rodenticides like bromadiolone. IPM's environmental and crop productivity benefits are driving demand for rodenticides like bromadiolone.

Bromadiolone Rises from Sustainable Pest Control Collaboration

The environmental impact of pest control has led to increased sustainability in pest control approaches. This has led to collaboration between manufacturers, regulators, pest control service providers, and end-users. This collaboration seeks to develop and implement safer and more effective rodenticides like bromadiolone.

Latest Trends

Tamper-Resistant Bromadiolone Market

Global bromadiolone market expansion is driven by many market trends. The shift toward tamper-resistant formulations is one of the primary market trends in the bromadiolone sector. Due to the growing issue of inadvertent consumption by non-target animals, which might have serious health effects. Tamper-resistant formulations are designed to avoid inadvertent ingestion and non-target toxicity. These new bait station formulations are designed to prevent tampering, making them safer for non-target species.

Rodent Control Increases Bromadiolone Demand

The trend toward targeted rodent control is another market shift in the bromadiolone sector. This is due to growing worry over rodent infestations' health implications, including disease transmission and damage to buildings and crops. Bromadiolone-targeted rodent control is more effective and selective.

Food & Agriculture Bromadiolone

The adoption of bromadiolone in agriculture and food facilities is the third market trend. Bromadiolone controls rodents that threaten crops and produce at these facilities. The adoption of bromadiolone in such facilities is driven by the requirement for efficient rodent control.

Remote Monitoring Changing Bromadiolone Market

Integration of remote monitoring is the fourth trend influencing the bromadiolone market. Remote monitoring uses technology to track rodent activity and monitor bait stations. For successful rodent control, this technology offers real-time data collecting and analysis. The efficiency of rodent monitoring is being driven by the demand for more efficient and effective rodent control strategies, especially in large-scale businesses.

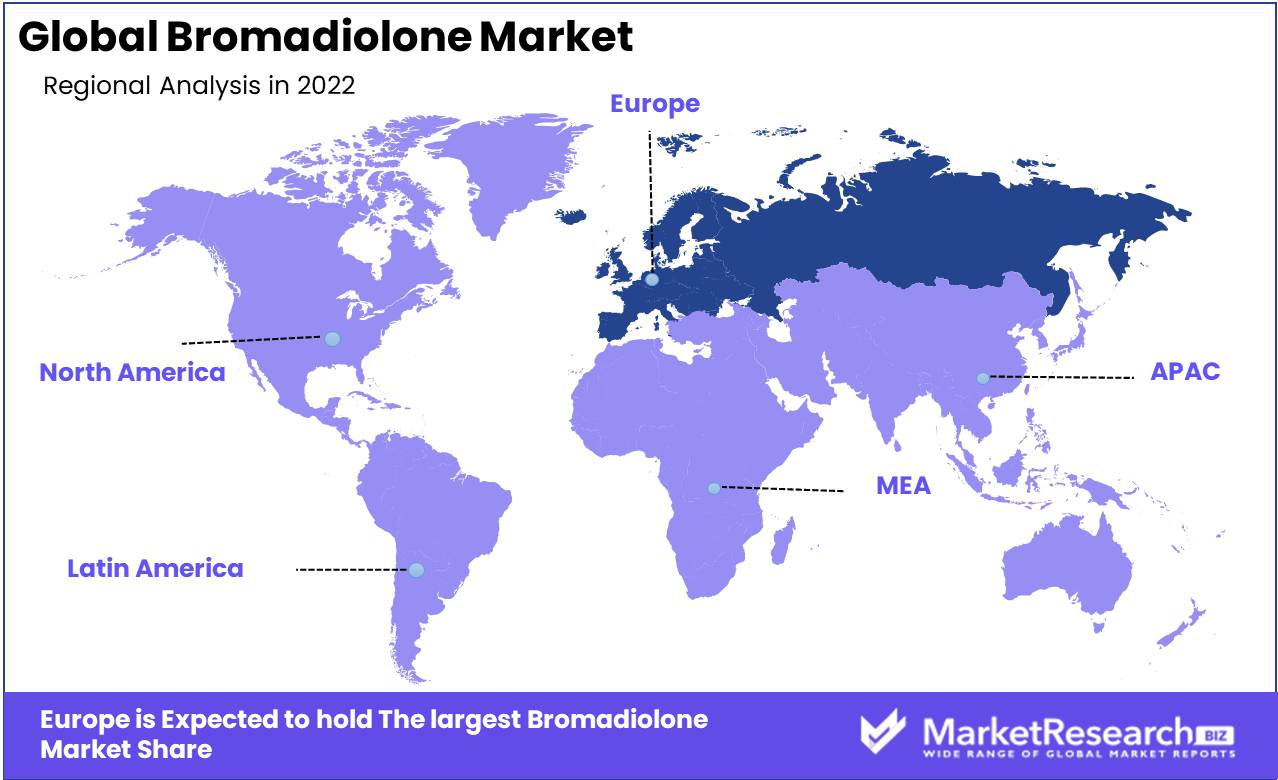

Regional Analysis

Market for Bromadiolone Dominates in Europe, Bromadiolone is considered to be one of the most effective rodenticides. It has been used worldwide for decades to regulate rodent populations. Recent years, however, have seen Europe emerge as the leading market for this chemical.

Bromadiolone is a second-generation anticoagulant that prevents rodents' blood from clotting. It is highly potent and effective at very modest doses. It also has a long-lasting effect, making it useful for controlling rodent populations for extended periods.

Europe has utilized bromadiolone for many years, and the demand for this chemical has increased consistently. This trend is attributable to a number of factors, including the increase in urbanization and agricultural practices that have led to a rise in rodent populations. Europe has been able to effectively manage rodent populations with bromadiolone, thereby preventing disease outbreaks and crop and property damage.

In order to guarantee public safety and environmental protection, the European Union (EU) has also been proactive in regulating bromadiolone use. Due to the fact that bromadiolone can be detrimental to non-target species, such as birds of prey and other wildlife, the EU has established stringent usage guidelines. These guidelines ensure that only licensed professionals use bromadiolone and that they adhere to specific protocols designed to minimize risks to non-target species.

In addition, the EU has passed legislation prohibiting the use of certain rodenticides that endanger non-target species, such as red kites and other birds of prey. This has led to a rise in demand for bromadiolone, a safer alternative.

Europe is not only a considerable consumer of bromadiolone, but also a major producer. Several European nations produce bromadiolone, with France and Italy being the main manufacturers. This has established a stable supply chain, ensuring that there is always enough bromadiolone to meet demand.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global bromadiolone market is extremely fragmented, with a large number of companies competing for market share. Syngenta, Bayer CropScience AG, BASF SE, Sanonda, Liangyou Chemical, Exosect Ltd, FMC Corporation, JT Eaton, Bell Laboratories Inc, and Liphatech Inc. are market leaders.

Syngenta is a prominent agricultural company based in Switzerland that focuses on the development and marketing of crop protection solutions. In 2018, Syngenta announced the launch of the bromadiolone-containing rodenticide Talon-G in the United States.

Bayer CropScience AG is a German multinational company that offers innovative crop protection, seed, and non-agricultural insect control solutions. In 2019, the company acquired Monsanto, a leader in the agricultural industry, substantially expanding its product line.

BASF SE is a multinational chemical company with headquarters in Germany that operates in a wide range of industries, including agriculture, chemicals, and plastics. The company announced in 2019 the launch of Selontra, a highly effective rodenticide containing bromadiolone.

Sanonda is a Chinese company that manufactures and distributes agrochemicals. Pesticides, herbicides, and fungicides are just a few of the products in the company's range.

Top Key Players in the Bromadiolone Market

- BASF SE

- TTCC

- Siyang Rodenticide Factory

- Diwei

- Syngenta AG

- Bayer AG

- Liphatech Inc.

- UPL Limited

- Neogen Corporation

- JT Eaton & Co., Inc.

- Other Key Players

Recent Development

- In 2023, international collaboration among stakeholders was more important than ever to ensure responsible bromadiolone use. Manufacturers, regulators, professionals in pest control, and environmental organizations collaborated to develop guidelines and best practices for the safe and sustainable application of bromadiolone.

- In 2022, The use of bromadiolone was significantly influenced by technological advancements. Remote monitoring systems and clever bait stations were introduced, enabling real-time rodent activity data collection and analysis.

- In 2021, The use of bromadiolone in organic farming practices increased significantly. Organic farmers recognized bromadiolone's efficacy as a targeted rodent control method that is consistent with organic farming principles when confronted with rodent infestations that threatened their crops.

- In 2020, To address concerns about accidental ingestion by non-target animals, manufacturers of bromadiolone introduced next-generation formulations.

- In 2019, Concerns about the environmental impact and potential hazards to non-target animals led to an increase in regulatory scrutiny of bromadiolone.

Report Scope:

Report Features Description Market Value (2022) USD 1.4 Bn Forecast Revenue (2032) USD 2.0 Bn CAGR (2023-2032) 3.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Powder, Liquid, Other Types), By Application (Mother liquor, Pellets/Bait Blocks, Other Applications) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BASF SE, TTCC, Siyang Rodenticide Factory, Diwei, Syngenta AG, Bayer AG, Liphatech Inc., UPL Limited, Neogen Corporation, JT Eaton & Co., Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- BASF SE

- TTCC

- Siyang Rodenticide Factory

- Diwei

- Syngenta AG

- Bayer AG

- Liphatech Inc.

- UPL Limited

- Neogen Corporation

- JT Eaton & Co., Inc.

- Other Key Players