Boric Acid Market By Purity Grade, By Application(Glass and Fiberglass , Medical, Flame Retardants, Pest Control, Nutritional Supplements, Others), By End-User(Fiberglass Industry, Ceramics, Others),By Distribution Channel(Wholesale and Retail, E-commerce), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

17549

-

Nov 2023

-

239

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

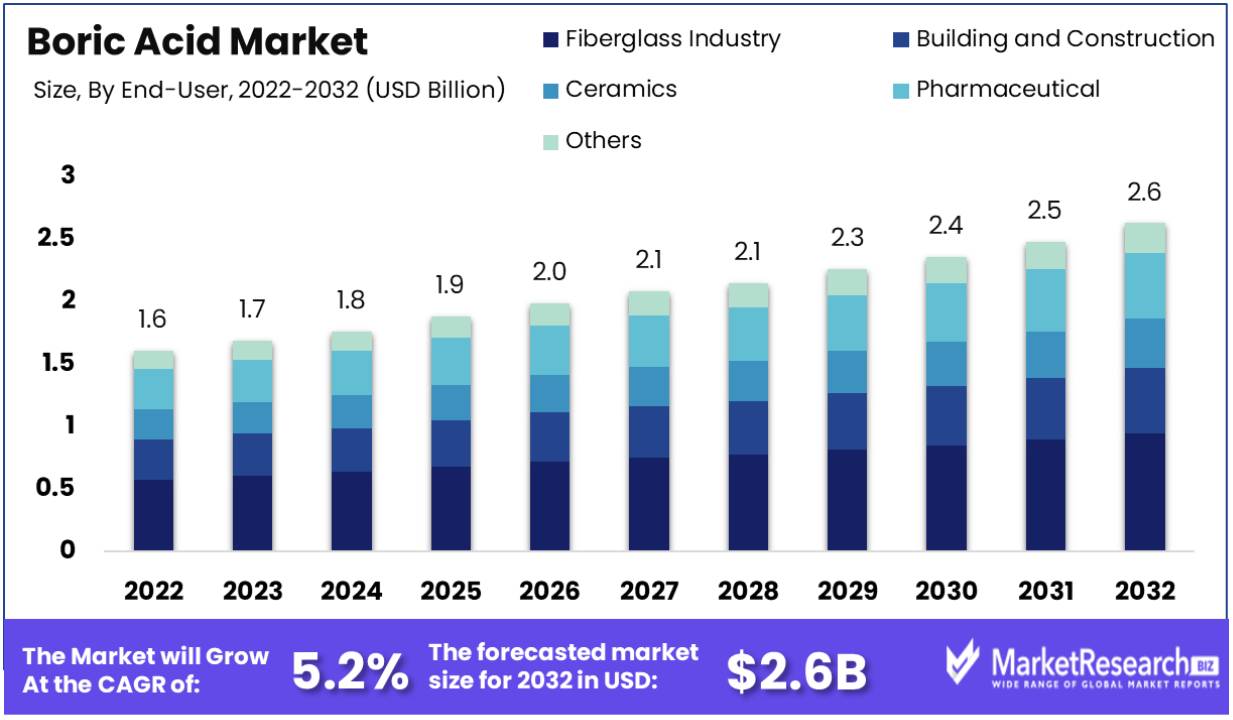

Boric Acid Market size is expected to be worth around USD 2.6 Bn by 2032 from USD 1.6 Bn in 2022, growing at a CAGR of 5.2% during the forecast period from 2023 to 2032.

The huge demand for boric acid in the industrial sector is one of the major driving factors in the boric acid market. Boric acid is mainly used for commercial and residential purposes. It generates oils, lubricants, textile fiber glasses, and welding procedures. It is also being used as a pesticide, antibacterial substance, antimicrobial, and flame retardant in plants.

For example, the Royal Society of Chemistry conducted a study on boric acid-modified walnut shell biochar (WAB4) to remove common pesticides from rice field water. WAB4 exhibited a high absorption capacity (>70%) for tricyclazole, propiconazole, imidacloprid, and thiamethoxam, across pH levels of 3-9, with specific capacities between 112.27 to 171.67 mg g−1.

The absorption process was then followed by pseudo-second-order kinetics and conformed to the Freundlich model. Mechanisms included H2O bonding, pore filling, hydrophobic effects, and π–π connections. WAB4 outcasted other adsorbents in real water samples and displayed no substantial harmfulness to Daphnia magna. This environmentally friendly tactic holds promise for efficient pesticide elimination, particularly in agricultural water management and environmental preservation.

The rise in demand for the renewable energy industry is a substantial element in the global boric acid market. Though the prices have dropped and more carbon restrained in the future for solar technology has been guaranteed, the need for renewable energy resources like solar energy has increased rapidly. The market is divided which gives advantages to the service provider who manufactures the glasses and makes it conceivable to use both inorganic and organic business growth procedures to get a benefit over the competitors.

The usage of boric acid in personal care items is constrained under European regulations, which have been categorized under the group of a carcinogenic compound and this is likely to delay the market growth. However, the upsurge in demand as an energy-efficient compound combined with the requirement for borosilicate glass in cookware and laboratory applications are likely to generate a potential market avenue. Thus helping in the expansion of market growth for boric acid.

Driving factors

Cross-Sectoral Applications Broaden Boric Acid's Market Scope

The demand for boric acid across various industries is a significant factor contributing to the expansion of its market. As a versatile chemical with antiseptic, antifungal agents, and insecticidal properties, boric acid finds applications in a multitude of sectors, ranging from glass and ceramics manufacturing to the production of pharmaceuticals and personal care products. Its role in the agricultural sector as a micronutrient and pest control agent further cements its importance across diverse industries.

The market is seeing an uptick in demand for boric acid, especially in industries focused on sustainable practices, as it is perceived as a safer alternative to more toxic chemicals. Additionally, the electronics industry fuels demand due to boric acid's use in the production of LCD displays. The ongoing trend indicates that as industries continue to innovate and seek out environmentally friendly inputs, boric acid will play an increasingly critical role, likely leading to market growth and expansion of production capacities to meet global demand.

Global Need for Insulating Materials Drives Boric Acid Market Growth

The global need for insulating materials, particularly in the construction and housing sectors, is driving the growth of the boric acid market. Boric acid is a key component in the production of fiberglass insulation, which is essential for energy-efficient buildings. As the world increasingly focuses on energy conservation, the demand for high-performance insulation materials is rising.

This trend is bolstered by stringent building regulations and the growing popularity of green buildings that prioritize thermal efficiency. As predictive analytics point to a continued emphasis on energy savings and carbon footprint reduction, boric acid is likely to maintain its importance in manufacturing insulating materials.

This sustained demand from the construction industry is expected to have long-term positive effects on the boric acid market, with potential increases in innovation within insulation products and expanded production of boric acid to meet global construction needs.

Relocation of Industrial Capacity Boosts Boric Acid Production

The shift in manufacturing units to different geographic regions is influencing the boric acid market. This shift, often towards countries with lower production costs, is creating new epicenters of manufacturing activity. As industries relocate, there is a corresponding demand for boric acid in these emerging industrial regions, driven by its use in various industrial processes.

The shift often aligns with the proximity to raw materials and targeted markets, reducing logistics costs and streamlining the supply chain for manufacturers. This relocation is anticipated to continue as companies seek to optimize production and capitalize on favorable trade agreements or tax incentives. The long-term implications for the boric acid market include the potential for a more decentralized and globally distributed network of production facilities, which could stabilize supply chains and price volatility.

Restraining Factors

Stringent Regulations and Restrictions Restrain Boric Acid Market Growth

The boric acid market is notably restrained by stringent regulations and restrictions related to its production and application. Boric acid, due to its classification as a hazardous substance, is subject to tight control by various international and regional regulatory bodies.

These regulations influence the handling, transportation, and usage of boric acid in industrial applications, leading to increased compliance costs for manufacturers and users. The rigorous safety protocols needed to manage the boric acid industry can also limit its use in consumer products, thus hindering market expansion as companies seek less regulated alternatives.

Fluctuating Prices of Boron Minerals Restrain Boric Acid Market Growth

Volatility in the prices of boron minerals, the raw materials for boric acid production, imposes a significant restraint on the industry. Fluctuations in the cost of these minerals, often driven by changes in international trade policies, availability, and mining costs, directly affect the stability of boric acid pricing.

Such unpredictability can challenge budgeting and financial planning for producers and downstream users, making it difficult to maintain consistent profit margins. Additionally, when the prices of boron minerals rise, the cost of producing boric acid increases, potentially decreasing its competitiveness compared to alternative products and limiting market growth.

Segmentation Analysis of Boric Acid Market

By Purity Grade Analysis

The ≥99% purity grade segment leads the boric acid market, due to its extensive application in industries that require high purity for product efficacy, particularly in glass and fiberglass production. The superior quality of this purity grade ensures optimal performance in end-products, which is crucial in applications with stringent quality requirements. The growth of this segment is driven by technological advancements in manufacturing processes that demand high-purity chemicals.

The <99% Purity grade segment finds utility in applications where the highest purity is not essential, such as in some forms of pest control and wood preservatives. Its role in market growth is tied to cost-sensitive applications where the benefits of lower purity material balance the performance requirements.

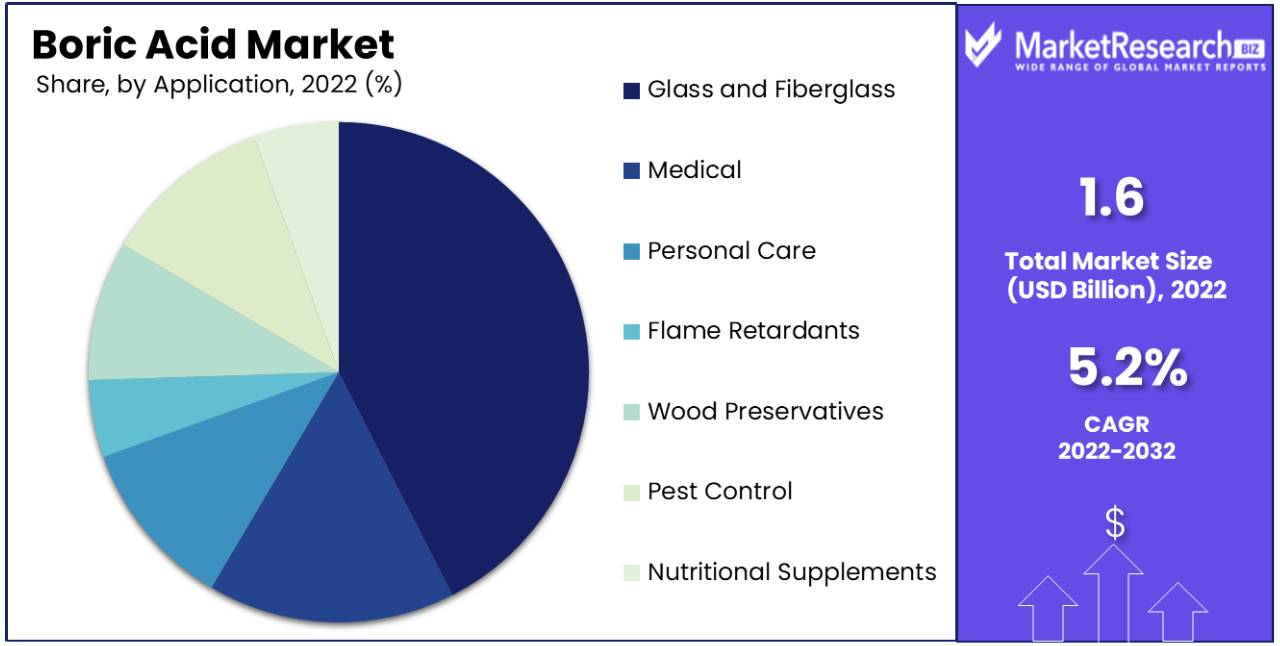

By Application Analysis

Glass and fiberglass production is the most significant application for boric acid, leveraging its properties to enhance heat resistance and strength. As the fiberglass industry expands, driven by demand in the construction and automotive sectors, the need for boric acid intensifies. Its role in producing insulation materials also aligns with the global push for energy efficiency.

While medical and personal care applications represent a smaller share, they are growing due to boric acid's antiseptic and buffering properties. Flame retardants and wood preservatives are vital for safety and durability in construction materials, and pest control applications are driven by the need for effective insecticidal solutions. Nutritional supplements are a niche but growing segment due to boric acid's role in plant nutrition.

By End-User Analysis

The fiberglass industry dominates the end-user market segmentation of the boric acid market, as boric acid is a critical component in fiberglass production, which is integral to a multitude of industries, including automotive and construction. This sector's growth is underpinned by the increasing demand for lightweight and durable composite materials.

Ceramics utilize boric acid for its fluxing properties, improving the quality and durability of ceramic products. In pharmaceuticals, boric acid's antiseptic properties are valued for medical preparations. The 'others' category captures diverse industrial applications that bolster the overall demand.

By Distribution Channel Analysis

Wholesale and retail channels remain the primary means of distribution for boric acid, with large volumes being sold to industrial users and smaller quantities to consumers for various applications. The convenience of bulk purchasing and established supply chains supports the dominance of this channel.

The e-commerce segment, though not dominant, is gaining momentum as businesses and consumers seek the convenience of online ordering and direct-to-door delivery, especially for smaller quantity purchases.

The boric acid market is robust, with high-purity grade boric acid leading due to its critical role in glass and fiberglass applications. The fiberglass industry emerges as the primary end-user, indicative of its integral use in the construction and manufacturing sectors. Traditional wholesale and retail distribution channels continue to facilitate the majority of the market's supply chain, while e-commerce is poised for growth as purchasing patterns shift online.

Key Market Segments

By Purity Grade

- ≥99%

- <99%

By Application

- Glass and Fiberglass

- Medical

- Personal Care

- Flame Retardants

- Wood Preservatives

- Pest Control

- Nutritional Supplements

- Others

By End-User

- Fiberglass Industry

- Building and Construction

- Ceramics

- Pharmaceutical

- Others

By Distribution Channel

- Wholesale and Retail

- E-commerce

Growth Opportunity

Diverse Industrial Demand Offers Growth Opportunity for Boric Acid Market

The growing demand for boric acid across various industries, including glass and fiberglass, the agriculture sector, ceramics, and pharmaceuticals, suggests a broadened scope for market expansion. Boric acid's versatile properties, such as antiseptic and flame-retardant capabilities, make it a valuable commodity. Its use in LCD manufacturing is particularly notable, with the display market expected to grow in the coming years. The diversity of applications promises steady demand, fostering a robust growth environment for the boric acid market.

R&D Investment Offers Progressive Outlook for Boric Acid Market

Increasing research and development spending is a harbinger of growth for the boric acid market. Enhanced R&D investment leads to innovations in product application and efficiency, such as the development of new boric acid-based products for medical or agricultural use. This can result in the expansion of the market into new segments and increase the overall demand. Companies at the forefront of R&D are likely to pioneer these new applications, positioning them advantageously in the industry.

New Product and Acquisition Strategies Offer Expansion Opportunities in Boric Acid Market

The introduction of new products and strategic acquisitions are potent growth catalysts within the boric acid market. By expanding product lines and assimilating new technologies and resources, companies can enhance their market share and penetrate new segments. Acquisitions, particularly, can allow for rapid expansion and access to established customer bases. These strategies reflect an aggressive approach to capturing market opportunities and fostering organic growth through diversification and consolidation.

Regional Analysis

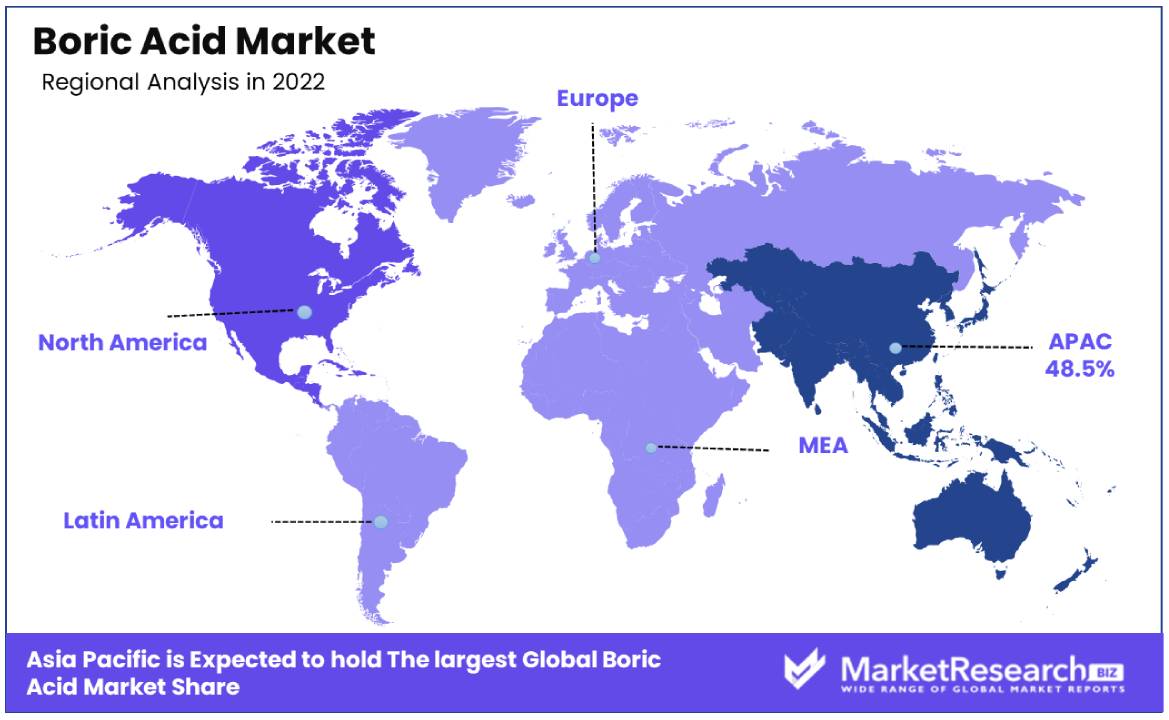

Asia-Pacific Dominates with 45.80% Market Share in the Boric Acid Market

Asia-Pacific leads the boric acid market with a significant 45.80% share, primarily due to the region's expansive industrial base and the pivotal role of agriculture. The high market share is driven by vast production and consumption rates in countries like China, which is not only the world's largest producer of boric acid but also the largest consumer, owing to its substantial industrial activities.

The region's market dynamics are bolstered by its extensive use of boric acid in a multitude of applications such as glass and fiberglass production, flame retardants, and agriculture, particularly as a fertilizer and pest control agent. Additionally, the expanding electronics industry in the region contributes to the demand for boric acid, used in the production of LCD screens.

Forecast implications suggest that Asia-Pacific's dominance is likely to continue, propelled by ongoing industrialization and the expansion of agricultural sectors. The industry could see further expansion with the growing demand for energy-saving appliances and electronics, which use boric acid-based materials.

North America: A Strong Player in the Boric Acid Market

In North America, the boric acid market is characterized by its use in key trends such as glass and fiberglass, wood preservation, and pharmaceuticals. The region's stringent regulations regarding pest control and flame retardants also contribute to the steady demand for boric acid.

The industry is driven by technological advancements in production and recycling processes, as well as a steady demand from the construction industry, where boric acid-based products are used for insulation and other applications. The presence of major boric acid producers in the region supports a resilient industry structure.

Europe: A Mature Market for Boric Acid

Europe's boric acid market benefits from its advanced industrial and agricultural sectors, with a well-established presence in glass manufacturing, ceramics, and as a micronutrient in agriculture. Environmental and health regulations in the region influence the use of boric acid, with an emphasis on sustainable and safe practices.

The European market is also marked by high environmental consciousness, which has led to the development of eco-friendly boric acid products. Furthermore, the pharmaceutical sector contributes to the demand, given boric acid's antiseptic and antifungal properties.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

Key Players Analysis

The boric acid market is marked by the strategic presence of global and specialized companies, each contributing to the sector's composition and direction. Rio Tinto Group and EtiMaden stand out as industry behemoths with substantial mining operations, positioning themselves as cornerstone suppliers with considerable influence over global pricing and supply dynamics. 3M Company's diverse industrial applications of boric acid extend its market reach, fortifying its role in influencing product innovation and end-use sectors.

Borax Inc. and American Borate Company leverage their focused product lines and regional strengths to cater to specific market demands, enhancing their strategic positioning in niche applications. Nirma Limited and NIPPON DENKO CO., LTD. have a strong presence in the Asia-Pacific region, pivotal for market penetration and regional market dynamics.

Promega Corporation and Southern Agricultural Insecticides Inc. illustrate the depth of the market's application range, from biochemical research to agrochemicals, demonstrating the versatility of boric acid. Quiborax S.A. and Minera Santa Rita S.R.L. (MSR) are key in the South American market, contributing to the market's geographic diversity.

Overall, these major players underscore the boric acid market's complexity, with their strategic roles ranging from raw material supply to specialized applications, each influencing the market's evolution in terms of supply security, application development, and regional market dynamics.

Top Key Players in Boric Acid Market

- Rio Tinto Group

- 3M Company

- Borax Inc.

- EtiMaden

- Nirma Limited

- NIPPON DENKO CO. LTD.

- Promega Corporation

- Southern Agricultural Insecticides Inc.

- Quiborax S.A.

- American Borate Company

- Minera Santa Rita S.R.L. (MSR)

- BASF SE

- Gujarat Boron Derivatives Pvt. Ltd.

- Russian Bor

- Searles Valley Minerals

Recent Developments

- In 2023, pH-D Feminine Health introduced the Boric Acid Vaginal Moisturizing Gel to address the discomfort experienced by women during various stages of their feminine health journeys.

- In 2023,Resolution and previous trade agreements between the US and India, India agreed to reduce tariffs on specific US products, including Boric Acid. This reduction in tariffs is expected to enhance economic opportunities for US agricultural producers and promote the export of US products to the Indian market.

- In January 2023, The use of acidic treatments, specifically a weak acid, boric acid (H3BO3), to eliminate surface impurity phases in layered nickel-rich materials. The treatment involves etching layered nickel-rich materials with a trace amount of boric acid.

Report Scope

Report Features Description Market Value (2022) USD 1.6 Bn Forecast Revenue (2032) USD 2.6 Bn CAGR (2023-2032) 5.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Purity Grade(≥99%, <99%), By Application(Glass and Fiberglass , Medical, Personal Care, Flame Retardants, Wood Preservatives, Pest Control, Nutritional Supplements, Others), By End-User(Fiberglass Industry, Building and Construction, Ceramics, Pharmaceutical, Others),By Distribution Channel(Wholesale and Retail, E-commerce) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Rio Tinto Group, 3M Company, Borax Inc., EtiMaden, Nirma Limited, NIPPON DENKO CO. LTD., Promega Corporation, Southern Agricultural Insecticides Inc., Quiborax S.A., American Borate Company, Minera Santa Rita S.R.L. (MSR), BASF SE, Gujarat Boron Derivatives Pvt. Ltd., Russian Bor, Searles Valley Minerals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Rio Tinto Group

- 3M Company

- Borax Inc.

- EtiMaden

- Nirma Limited

- NIPPON DENKO CO. LTD.

- Promega Corporation

- Southern Agricultural Insecticides Inc.

- Quiborax S.A.

- American Borate Company

- Minera Santa Rita S.R.L. (MSR)

- BASF SE

- Gujarat Boron Derivatives Pvt. Ltd.

- Russian Bor

- Searles Valley Minerals