Bone Densitometer Market By Technology (Dual Energy X-ray Absorptiometry (DEXA), Quantitative Ultrasound (QUS), and Others), By Application (Osteoporosis and Osteopenia Diagnosis, Cystic Fibrosis Diagnosis, and Others), By End User (Hospitals & Specialty Clinics, Diagnostic & Imaging Centers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

49217

-

July 2024

-

348

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

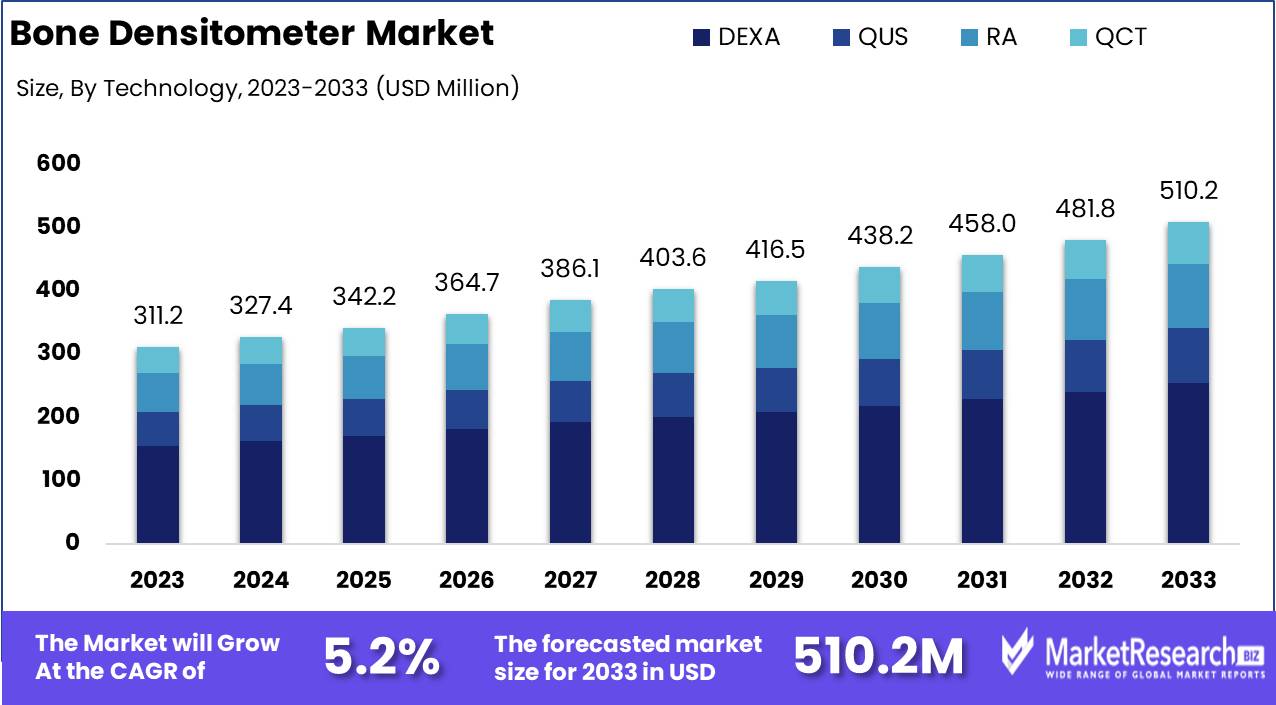

The Global Bone Densitometer Market was valued at USD 311.2 Mn in 2023. It is expected to reach USD 510.2 Mn by 2033, with a CAGR of 5.2% during the forecast period from 2024 to 2033.

The bone densitometer market comprises devices that measure bone mineral density (BMD) to diagnose and monitor conditions like osteoporosis and other bone-related diseases. These devices use various technologies, including dual-energy X-ray absorptiometry (DXA), quantitative computed tomography (QCT), and ultrasound, to assess bone health. Bone densitometers are critical tools in healthcare, aiding in the early detection and management of bone density issues. The market is driven by the increasing prevalence of osteoporosis, advancements in diagnostic technologies, and growing awareness of bone health's importance.

The bone densitometer market is poised for significant growth, driven by the increasing prevalence of osteoporosis and a growing focus on preventive healthcare. The evolution of bone densitometry can be traced back to the early 20th century when X-ray detectors was first employed to measure bone density. However, the commercial introduction of bone densitometers in the 1960s marked a pivotal advancement, making bone density assessment more accessible and accurate.

Technological innovations continue to drive the market forward. Notably, Echolight Medical's REMS (Radiofrequency Echographic Multi-Spectrometry) diagnostic technology represents a significant leap in bone health assessment. This radiation-free technology provides rapid and precise evaluations, including fracture risk assessments, enhancing patient safety and diagnostic accuracy.

The market is further bolstered by the rising incidence of osteoporosis and related fractures, particularly among the aging population. Increased awareness of bone health and the importance of early diagnosis is driving demand for advanced diagnostic tools. Additionally, advancements in imaging technologies and the integration of artificial intelligence are expected to enhance diagnostic capabilities and operational efficiency.

From a strategic perspective, companies in this market should focus on continuous innovation and the development of non-invasive, radiation-free technologies. Collaborations with healthcare providers and research institutions can facilitate the development of more effective diagnostic solutions and expand market reach. Furthermore, educating healthcare professionals and patients about the benefits and advancements in bone densitometry can drive adoption and market growth.

Key Takeaways

- Market Value: The Global Bone Densitometer Market was valued at USD 311.2 Mn in 2023. It is expected to reach USD 510.2 Mn by 2033, with a CAGR of 5.2% during the forecast period from 2024 to 2033.

- By Technology: Dual Energy X-ray Absorptiometry (DEXA) dominates, used in 50% of cases, known for its accuracy in measuring bone density.

- By Application: Osteoporosis and Osteopenia Diagnosis employs 60% of these devices, critical for early detection and management of bone loss.

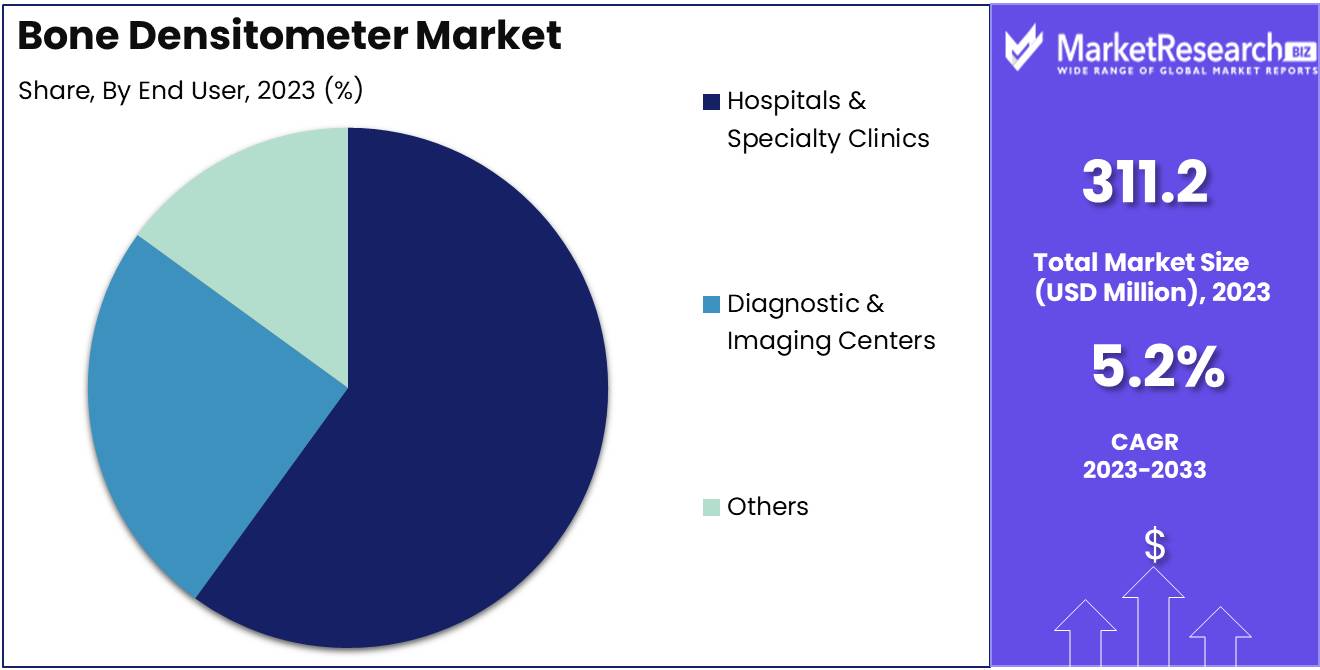

- By End User: Hospitals & Specialty Clinics use 60%, relying on these tools for diagnostic precision.

- Regional Dominance: North America leads with a 50% share, due to high prevalence of bone-related diseases and strong diagnostic infrastructure.

- Growth Opportunity: Increasing screenings and preventive measures for osteoporosis in aging populations present major growth potential.

Driving factors

Increasing Prevalence of Osteoporosis and Other Bone-Related Diseases

The rising incidence of osteoporosis and other bone-related diseases is a primary driver for the global bone densitometry market. Osteoporosis, characterized by weakened bones and an increased risk of fractures, affects millions worldwide. According to the International Osteoporosis Foundation, osteoporosis causes more than 8.9 million fractures annually, highlighting the urgent need for effective diagnostic tools. Bone densitometry, a crucial method for measuring bone mineral density (BMD), plays a vital role in diagnosing and managing these conditions, driving market growth.

Growing Aging Population

The global increase in the aging population significantly boosts the demand for bone densitometry. As people age, their risk of developing osteoporosis and other bone-related conditions rises. The United Nations projects that the number of people aged 65 and older will double by 2050, creating a substantial market for bone densitometry devices. This demographic shift underscores the importance of early detection and monitoring of bone health, further driving the market.

Technological Advancements in Densitometry

Technological innovations in densitometry are enhancing the accuracy, efficiency, and patient comfort of bone density measurements. Advances such as dual-energy X-ray absorptiometry (DEXA) and quantitative computed tomography (QCT) provide precise assessments of bone health. These technologies facilitate early diagnosis and treatment, improving patient outcomes and fueling market growth. Continuous R&D efforts are expected to introduce even more sophisticated devices, strengthening market expansion.

Restraining Factors

High Cost of Equipment

The high cost of bone densitometry equipment poses a significant barrier to market growth. Advanced densitometry devices, incorporating cutting-edge technology, are expensive, limiting their adoption, especially in smaller clinics and low-income regions. These high costs restrict the widespread availability of these crucial diagnostic tools, constraining market potential.

Limited Access in Developing Regions

Access to bone densitometry is limited in developing regions due to economic constraints and inadequate healthcare infrastructure. Many healthcare facilities in these areas cannot afford advanced diagnostic equipment, leading to underdiagnosis and poor management of osteoporosis and other bone-related diseases. This limited access hampers the market's global reach and growth prospects.

By Technology Analysis

Dual Energy X-ray Absorptiometry (DEXA) dominated the By Technology segment of the Bone Densitometer Market in 2023, capturing more than a 50% share.

In 2023, Dual Energy X-ray Absorptiometry (DEXA) held a dominant market position in the By Technology segment of the Bone Densitometer Market, capturing more than a 50% share. This significant market share is driven by DEXA's high accuracy, reliability, and efficiency in measuring bone mineral density (BMD). DEXA is considered the gold standard for diagnosing osteoporosis and assessing fracture risk, making it the preferred choice among healthcare providers.

Quantitative Ultrasound (QUS) is also utilized for bone density measurements, especially in peripheral sites such as the heel. QUS offers advantages like portability, lower cost, and no radiation exposure, making it suitable for initial screenings. However, its market share is smaller compared to DEXA due to its lower precision and limited diagnostic scope.

Radiographic Absorptiometry (RA) involves the use of standard radiographs to measure bone density in specific body sites. While RA can be useful in certain settings, its market share is less than DEXA because of its lower accuracy and higher susceptibility to variability.

Quantitative Computed Tomography (QCT) provides three-dimensional imaging and precise volumetric measurements of bone density. It is particularly useful for detailed assessments of the spine and hip. Despite its advanced capabilities, QCT holds a smaller market share due to higher costs, greater radiation exposure, and less widespread availability compared to DEXA.

By Application Analysis

Osteoporosis and Osteopenia Diagnosis dominated the By Application segment of the Bone Densitometer Market in 2023, capturing more than a 60% share.

In 2023, Osteoporosis and Osteopenia Diagnosis held a dominant market position in the By Application segment of the Bone Densitometer Market, capturing more than a 60% share. The high prevalence of osteoporosis and osteopenia, particularly among the aging population, drives the demand for bone densitometry. Early diagnosis and intervention are crucial for preventing fractures and managing bone health, making bone densitometers essential tools in clinical practice. The increasing awareness of bone health, coupled with routine screening programs, significantly contributes to the dominant market share of this application.

Cystic Fibrosis Diagnosis requires regular monitoring of bone density due to the high risk of bone disease associated with the condition. Although important, the market share for this application is smaller compared to osteoporosis and osteopenia diagnosis because of the lower incidence of cystic fibrosis.

Chronic Kidney Disease Diagnosis involves assessing bone health as part of the comprehensive management of patients with renal osteodystrophy. While bone densitometry is valuable in this context, its market share is relatively limited due to the specialized nature of the application and the smaller patient population.

Body Composition Measurement uses bone densitometers to assess body fat and lean mass in addition to bone density. This application is growing in popularity for its role in sports medicine, obesity management, and overall health assessments. Despite its potential, the market share is smaller compared to the primary focus on bone density.

Rheumatoid Arthritis Diagnosis includes the use of bone densitometry to monitor bone health in patients, as the disease and its treatments can affect bone density. Although critical for patient care, the market share for this application is less than that of osteoporosis and osteopenia diagnosis due to the narrower scope of use.

By End User Analysis

Hospitals & Specialty Clinics dominated the By End User segment of the Bone Densitometer Market in 2023, capturing more than a 60% share.

In 2023, Hospitals & Specialty Clinics held a dominant market position in the By End User segment of the Bone Densitometer Market, capturing more than a 60% share. This dominance is driven by the comprehensive range of diagnostic and treatment services provided by hospitals and specialty clinics, including advanced bone health assessments. These facilities are equipped with state-of-the-art bone densitometry equipment and staffed by skilled healthcare professionals, ensuring accurate diagnosis and effective management of bone-related conditions.

Diagnostic & Imaging Centers also play a crucial role in providing bone density assessments, offering specialized imaging services. These centers are often chosen for their expertise and quick turnaround times.

Others include various healthcare providers such as outpatient clinics and research institutions that utilize bone densitometers for specific applications. While important, the market share for this category is relatively modest compared to the dominant hospitals and specialty clinics segment due to the limited scope and specialized nature of their services.

Key Market Segments

By Technology

- Dual Energy X-ray Absorptiometry (DEXA)

- Quantitative Ultrasound (QUS)

- Radiographic Absorptiometry (RA)

- Quantitative Computed Tomography (QCT)

By Application

- Osteoporosis and Osteopenia Diagnosis

- Cystic Fibrosis Diagnosis

- Chronic Kidney Disease Diagnosis

- Body Composition Measurement

- Rheumatoid Arthritis Diagnosis

By End User

- Hospitals & Specialty Clinics

- Diagnostic & Imaging Centers

- Others

Growth Opportunity

Development of Portable and Affordable Devices

The development of portable and affordable bone densitometry devices represents a significant growth opportunity. Portable devices can be used in various settings, including home healthcare and remote areas, increasing accessibility and convenience. Affordable options will make bone densitometry more accessible to a broader population, particularly in developing regions. Innovations in this area are expected to drive market expansion by making bone health diagnostics more widely available.

Expansion in Home Healthcare and Telemedicine

The expansion of home healthcare and telemedicine services provides another promising avenue for market growth. Home-based bone densitometry devices enable patients to monitor their bone health conveniently, reducing the need for frequent clinic visits. Telemedicine platforms can facilitate remote consultations and data sharing between patients and healthcare providers, improving care coordination and patient outcomes. This trend aligns with the broader shift towards personalized and accessible healthcare solutions, boosting market growth.

Latest Trends

Integration with Digital Health Records

The integration of bone densitometry devices with digital health records is a key trend expected to enhance market growth. Digital integration allows seamless data sharing and comprehensive patient health monitoring, facilitating better clinical decision-making. Healthcare providers can access and analyze patient data more efficiently, leading to improved diagnosis, treatment planning, and patient management. This integration supports a more holistic approach to healthcare, driving demand for advanced densitometry solutions.

Use of AI for Improved Diagnostic Accuracy

The use of artificial intelligence (AI) in bone densitometry is revolutionizing the diagnostic landscape. AI algorithms can analyze densitometry data with high precision, identifying patterns and anomalies that might be missed by human observers. This technology enhances diagnostic accuracy, reduces the likelihood of errors, and speeds up the diagnostic process. AI-driven advancements are expected to improve patient outcomes and streamline clinical workflows, making AI integration a crucial trend in the bone densitometry market.

Regional Analysis

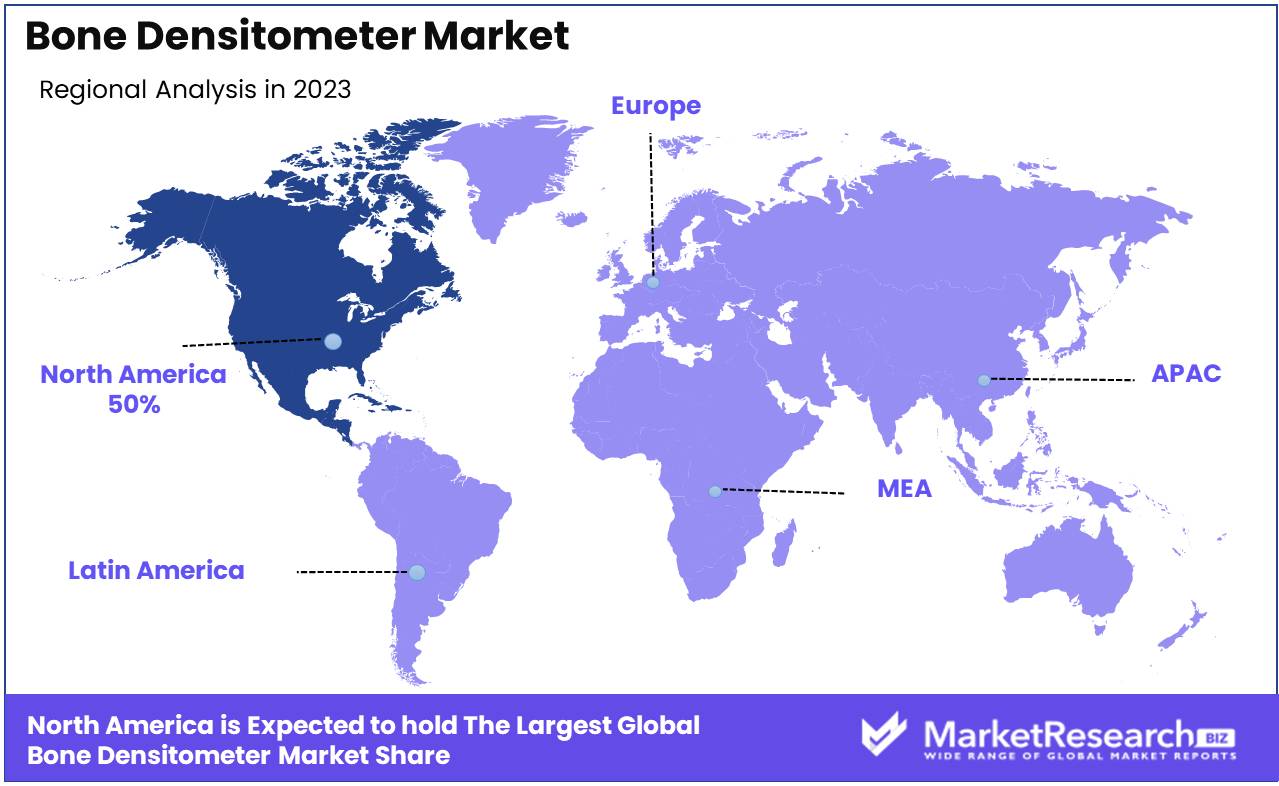

North America dominated the Bone Densitometer Market in 2023, capturing 50% of the market share.

In 2023, North America held a dominant position in the Bone Densitometer Market, capturing a substantial 50% share. This dominance is driven by a high prevalence of osteoporosis and other bone-related diseases, particularly among the aging population. The region benefits from advanced healthcare infrastructure, significant investment in medical research, and widespread adoption of advanced diagnostic technologies.

Europe holds a significant market share, driven by an aging population and the increasing incidence of bone disorders. Countries such as Germany, France, and the UK are leading adopters of bone densitometry technology due to robust healthcare systems and proactive screening programs for osteoporosis.

Asia Pacific is experiencing rapid growth in the bone densitometer market, fueled by rising healthcare investments, increasing awareness about bone health, and a growing elderly population. The region's expanding middle class and improving healthcare infrastructure contribute to the rising demand for bone densitometers.

Middle East & Africa show promising potential, supported by increasing investments in healthcare infrastructure and growing awareness of osteoporosis and bone health. The adoption of bone densitometry technology is gradually rising as access to healthcare services improves.

Latin America is emerging as a growing market for bone densitometers, with countries like Brazil and Mexico leading the demand. The region benefits from improving healthcare infrastructure and increasing awareness of the importance of bone health.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The bone densitometer market in 2024 is driven by the increasing prevalence of osteoporosis and other bone-related disorders, along with advancements in imaging technologies. Key players in this market include GE Healthcare, Hologic, Inc., OSI Systems, Inc., Diagnostic Medical Systems Group, Swissray Global Healthcare Holding, Ltd., BeamMed, Ltd., Echolight S.P.A., Scanflex Healthcare AB, Medonica Co., Ltd., and Eurotec Systems S.r.l.

GE Healthcare continues to dominate with its comprehensive range of bone densitometry systems. Their focus on integrating artificial intelligence and machine learning to enhance diagnostic accuracy and workflow efficiency is setting new industry benchmarks.

Hologic, Inc. remains a market leader with its advanced dual-energy X-ray absorptiometry (DEXA) technology. The company's commitment to innovation and precision in bone health diagnostics ensures its strong market position.

OSI Systems, Inc. leverages its expertise in security and medical imaging to offer robust bone densitometry solutions. Their systems are known for their reliability and advanced imaging capabilities.

Diagnostic Medical Systems Group focuses on delivering high-quality, cost-effective bone densitometers. Their emphasis on expanding accessibility to advanced diagnostics in emerging markets positions them well for growth.

Swissray Global Healthcare Holding, Ltd. is recognized for its innovative imaging solutions that enhance patient comfort and diagnostic accuracy. Their advanced DEXA systems are designed to meet the evolving needs of healthcare providers.

BeamMed, Ltd. specializes in portable bone densitometry devices, making bone health assessment more accessible in various healthcare settings. Their products are particularly valuable in point-of-care diagnostics.

Echolight S.P.A. is at the forefront with its unique REMS technology, offering radiation-free bone density assessments. This innovation addresses safety concerns and expands the applicability of bone health diagnostics.

Scanflex Healthcare AB provides state-of-the-art bone densitometers with a focus on user-friendly interfaces and precise measurements. Their commitment to quality and innovation drives their competitive advantage.

Medonica Co., Ltd. is gaining traction with its cost-effective and reliable bone densitometry solutions, catering to both developed and developing markets. Their focus on affordability without compromising quality is noteworthy.

Eurotec Systems S.r.l specializes in advanced bone density measurement technologies, offering products that ensure high accuracy and reliability. Their emphasis on research and development fuels continuous product enhancements.

Market Key Players

- GE Healthcare

- Hologic, Inc.

- OSI Systems, Inc.

- Diagnostic Medical Systems Group

- Swissray Global Healthcare Holding, Ltd.

- BeamMed, Ltd.

- Echolight S.P.A.

- Scanflex Healthcare AB

- Medonica Co., Ltd.

- Eurotec Systems S.r.l

Recent Development

- In June 2024, Hologic introduced a new high-precision bone densitometer, Horizon W, enhancing osteoporosis detection accuracy.

- In May 2024, GE Healthcare launched the Lunar iDXA system, offering advanced imaging capabilities for comprehensive bone health assessment.

Report Scope

Report Features Description Market Value (2023) USD 311.2 Mn Forecast Revenue (2033) USD 510.2 Mn CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Dual Energy X-ray Absorptiometry (DEXA), Quantitative Ultrasound (QUS), Radiographic Absorptiometry (RA), Quantitative Computed Tomography (QCT)), By Application (Osteoporosis and Osteopenia Diagnosis, Cystic Fibrosis Diagnosis, Chronic Kidney Disease Diagnosis, Body Composition Measurement, Rheumatoid Arthritis Diagnosis), By End User (Hospitals & Specialty Clinics, Diagnostic & Imaging Centers, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape GE Healthcare, Hologic, Inc., OSI Systems, Inc., Diagnostic Medical Systems Group, Swissray Global Healthcare Holding, Ltd., BeamMed, Ltd., Echolight S.P.A., Scanflex Healthcare AB, Medonica Co., Ltd., Eurotec Systems S.r.l Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Bone Densitometer Market Overview

- 2.1. Bone Densitometer Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Bone Densitometer Market Dynamics

- 3. Global Bone Densitometer Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Bone Densitometer Market Analysis, 2016-2021

- 3.2. Global Bone Densitometer Market Opportunity and Forecast, 2023-2032

- 3.3. Global Bone Densitometer Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 3.3.1. Global Bone Densitometer Market Analysis by By Technology: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 3.3.3. Dual Energy X-ray Absorptiometry (DEXA)

- 3.3.4. Quantitative Ultrasound (QUS)

- 3.3.5. Radiographic Absorptiometry (RA)

- 3.3.6. Quantitative Computed Tomography (QCT)

- 3.4. Global Bone Densitometer Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 3.4.1. Global Bone Densitometer Market Analysis by By Application: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 3.4.3. Osteoporosis and Osteopenia Diagnosis

- 3.4.4. Cystic Fibrosis Diagnosis

- 3.4.5. Chronic Kidney Disease Diagnosis

- 3.4.6. Body Composition Measurement

- 3.4.7. Rheumatoid Arthritis Diagnosis

- 3.5. Global Bone Densitometer Market Analysis, Opportunity and Forecast, By By End User, 2016-2032

- 3.5.1. Global Bone Densitometer Market Analysis by By End User: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End User, 2016-2032

- 3.5.3. Hospitals & Specialty Clinics

- 3.5.4. Diagnostic & Imaging Centers

- 3.5.5. Others

- 4. North America Bone Densitometer Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Bone Densitometer Market Analysis, 2016-2021

- 4.2. North America Bone Densitometer Market Opportunity and Forecast, 2023-2032

- 4.3. North America Bone Densitometer Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 4.3.1. North America Bone Densitometer Market Analysis by By Technology: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 4.3.3. Dual Energy X-ray Absorptiometry (DEXA)

- 4.3.4. Quantitative Ultrasound (QUS)

- 4.3.5. Radiographic Absorptiometry (RA)

- 4.3.6. Quantitative Computed Tomography (QCT)

- 4.4. North America Bone Densitometer Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 4.4.1. North America Bone Densitometer Market Analysis by By Application: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 4.4.3. Osteoporosis and Osteopenia Diagnosis

- 4.4.4. Cystic Fibrosis Diagnosis

- 4.4.5. Chronic Kidney Disease Diagnosis

- 4.4.6. Body Composition Measurement

- 4.4.7. Rheumatoid Arthritis Diagnosis

- 4.5. North America Bone Densitometer Market Analysis, Opportunity and Forecast, By By End User, 2016-2032

- 4.5.1. North America Bone Densitometer Market Analysis by By End User: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End User, 2016-2032

- 4.5.3. Hospitals & Specialty Clinics

- 4.5.4. Diagnostic & Imaging Centers

- 4.5.5. Others

- 4.6. North America Bone Densitometer Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Bone Densitometer Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Bone Densitometer Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Bone Densitometer Market Analysis, 2016-2021

- 5.2. Western Europe Bone Densitometer Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Bone Densitometer Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 5.3.1. Western Europe Bone Densitometer Market Analysis by By Technology: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 5.3.3. Dual Energy X-ray Absorptiometry (DEXA)

- 5.3.4. Quantitative Ultrasound (QUS)

- 5.3.5. Radiographic Absorptiometry (RA)

- 5.3.6. Quantitative Computed Tomography (QCT)

- 5.4. Western Europe Bone Densitometer Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 5.4.1. Western Europe Bone Densitometer Market Analysis by By Application: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 5.4.3. Osteoporosis and Osteopenia Diagnosis

- 5.4.4. Cystic Fibrosis Diagnosis

- 5.4.5. Chronic Kidney Disease Diagnosis

- 5.4.6. Body Composition Measurement

- 5.4.7. Rheumatoid Arthritis Diagnosis

- 5.5. Western Europe Bone Densitometer Market Analysis, Opportunity and Forecast, By By End User, 2016-2032

- 5.5.1. Western Europe Bone Densitometer Market Analysis by By End User: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End User, 2016-2032

- 5.5.3. Hospitals & Specialty Clinics

- 5.5.4. Diagnostic & Imaging Centers

- 5.5.5. Others

- 5.6. Western Europe Bone Densitometer Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Bone Densitometer Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Bone Densitometer Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Bone Densitometer Market Analysis, 2016-2021

- 6.2. Eastern Europe Bone Densitometer Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Bone Densitometer Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 6.3.1. Eastern Europe Bone Densitometer Market Analysis by By Technology: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 6.3.3. Dual Energy X-ray Absorptiometry (DEXA)

- 6.3.4. Quantitative Ultrasound (QUS)

- 6.3.5. Radiographic Absorptiometry (RA)

- 6.3.6. Quantitative Computed Tomography (QCT)

- 6.4. Eastern Europe Bone Densitometer Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 6.4.1. Eastern Europe Bone Densitometer Market Analysis by By Application: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 6.4.3. Osteoporosis and Osteopenia Diagnosis

- 6.4.4. Cystic Fibrosis Diagnosis

- 6.4.5. Chronic Kidney Disease Diagnosis

- 6.4.6. Body Composition Measurement

- 6.4.7. Rheumatoid Arthritis Diagnosis

- 6.5. Eastern Europe Bone Densitometer Market Analysis, Opportunity and Forecast, By By End User, 2016-2032

- 6.5.1. Eastern Europe Bone Densitometer Market Analysis by By End User: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End User, 2016-2032

- 6.5.3. Hospitals & Specialty Clinics

- 6.5.4. Diagnostic & Imaging Centers

- 6.5.5. Others

- 6.6. Eastern Europe Bone Densitometer Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Bone Densitometer Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Bone Densitometer Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Bone Densitometer Market Analysis, 2016-2021

- 7.2. APAC Bone Densitometer Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Bone Densitometer Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 7.3.1. APAC Bone Densitometer Market Analysis by By Technology: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 7.3.3. Dual Energy X-ray Absorptiometry (DEXA)

- 7.3.4. Quantitative Ultrasound (QUS)

- 7.3.5. Radiographic Absorptiometry (RA)

- 7.3.6. Quantitative Computed Tomography (QCT)

- 7.4. APAC Bone Densitometer Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 7.4.1. APAC Bone Densitometer Market Analysis by By Application: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 7.4.3. Osteoporosis and Osteopenia Diagnosis

- 7.4.4. Cystic Fibrosis Diagnosis

- 7.4.5. Chronic Kidney Disease Diagnosis

- 7.4.6. Body Composition Measurement

- 7.4.7. Rheumatoid Arthritis Diagnosis

- 7.5. APAC Bone Densitometer Market Analysis, Opportunity and Forecast, By By End User, 2016-2032

- 7.5.1. APAC Bone Densitometer Market Analysis by By End User: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End User, 2016-2032

- 7.5.3. Hospitals & Specialty Clinics

- 7.5.4. Diagnostic & Imaging Centers

- 7.5.5. Others

- 7.6. APAC Bone Densitometer Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Bone Densitometer Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Bone Densitometer Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Bone Densitometer Market Analysis, 2016-2021

- 8.2. Latin America Bone Densitometer Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Bone Densitometer Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 8.3.1. Latin America Bone Densitometer Market Analysis by By Technology: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 8.3.3. Dual Energy X-ray Absorptiometry (DEXA)

- 8.3.4. Quantitative Ultrasound (QUS)

- 8.3.5. Radiographic Absorptiometry (RA)

- 8.3.6. Quantitative Computed Tomography (QCT)

- 8.4. Latin America Bone Densitometer Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 8.4.1. Latin America Bone Densitometer Market Analysis by By Application: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 8.4.3. Osteoporosis and Osteopenia Diagnosis

- 8.4.4. Cystic Fibrosis Diagnosis

- 8.4.5. Chronic Kidney Disease Diagnosis

- 8.4.6. Body Composition Measurement

- 8.4.7. Rheumatoid Arthritis Diagnosis

- 8.5. Latin America Bone Densitometer Market Analysis, Opportunity and Forecast, By By End User, 2016-2032

- 8.5.1. Latin America Bone Densitometer Market Analysis by By End User: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End User, 2016-2032

- 8.5.3. Hospitals & Specialty Clinics

- 8.5.4. Diagnostic & Imaging Centers

- 8.5.5. Others

- 8.6. Latin America Bone Densitometer Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Bone Densitometer Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Bone Densitometer Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Bone Densitometer Market Analysis, 2016-2021

- 9.2. Middle East & Africa Bone Densitometer Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Bone Densitometer Market Analysis, Opportunity and Forecast, By By Technology, 2016-2032

- 9.3.1. Middle East & Africa Bone Densitometer Market Analysis by By Technology: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Technology, 2016-2032

- 9.3.3. Dual Energy X-ray Absorptiometry (DEXA)

- 9.3.4. Quantitative Ultrasound (QUS)

- 9.3.5. Radiographic Absorptiometry (RA)

- 9.3.6. Quantitative Computed Tomography (QCT)

- 9.4. Middle East & Africa Bone Densitometer Market Analysis, Opportunity and Forecast, By By Application, 2016-2032

- 9.4.1. Middle East & Africa Bone Densitometer Market Analysis by By Application: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Application, 2016-2032

- 9.4.3. Osteoporosis and Osteopenia Diagnosis

- 9.4.4. Cystic Fibrosis Diagnosis

- 9.4.5. Chronic Kidney Disease Diagnosis

- 9.4.6. Body Composition Measurement

- 9.4.7. Rheumatoid Arthritis Diagnosis

- 9.5. Middle East & Africa Bone Densitometer Market Analysis, Opportunity and Forecast, By By End User, 2016-2032

- 9.5.1. Middle East & Africa Bone Densitometer Market Analysis by By End User: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End User, 2016-2032

- 9.5.3. Hospitals & Specialty Clinics

- 9.5.4. Diagnostic & Imaging Centers

- 9.5.5. Others

- 9.6. Middle East & Africa Bone Densitometer Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Bone Densitometer Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Bone Densitometer Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Bone Densitometer Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Bone Densitometer Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. GE Healthcare

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Hologic, Inc.

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. OSI Systems, Inc.

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Diagnostic Medical Systems Group

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Swissray Global Healthcare Holding, Ltd.

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. BeamMed, Ltd.

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Echolight S.P.A.

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Scanflex Healthcare AB

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Medonica Co., Ltd.

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Eurotec Systems S.r.l

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- 1. Executive Summary

-

- GE Healthcare

- Hologic, Inc.

- OSI Systems, Inc.

- Diagnostic Medical Systems Group

- Swissray Global Healthcare Holding, Ltd.

- BeamMed, Ltd.

- Echolight S.P.A.

- Scanflex Healthcare AB

- Medonica Co., Ltd.

- Eurotec Systems S.r.l