Biosimulation Market Report By Software Type (Pharmacokinetic [PK], Pharmacodynamic [PD], PBPK [Physiologically Based Pharmacokinetic], Toxicity Prediction, Trial Design, Others), By Service Type (In-house, Contract Services), By Modeling & Simulation Type (Physiological, Patient-centric, Mechanistic, Non-mechanistic, Others), By Application, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

48599

-

July 2024

-

325

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

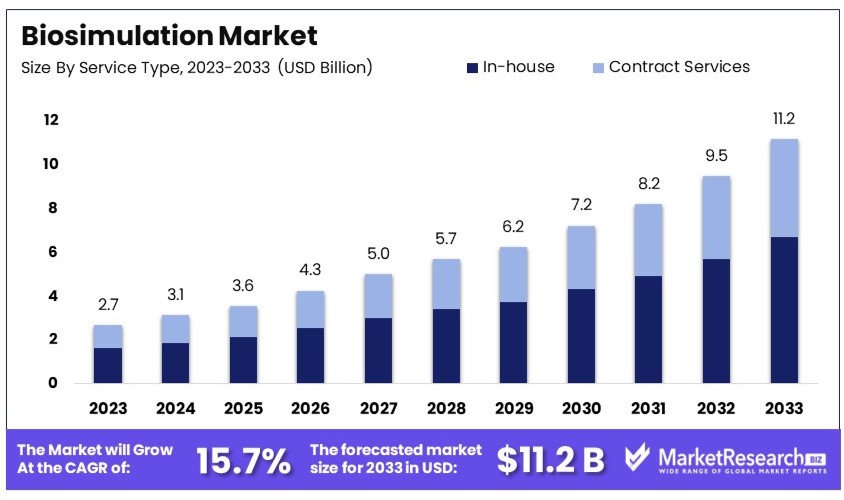

The Global Biosimulation Market size is expected to be worth around USD 11.2 Billion by 2033, from USD 2.7 Billion in 2023, growing at a CAGR of 15.7% during the forecast period from 2024 to 2033.

The Biosimulation Market comprises technologies used to simulate biological processes, aiding in drug development and model biological systems. This market is crucial for pharmaceutical and biotechnological research, reducing the need for extensive clinical trials by predicting drug efficacy and safety through computational methods.

Biosimulation tools include software for molecular modeling, simulation software, and databases. The growth in this market is fueled by the increasing demand for reducing drug development costs and the time to market, enhancing the effectiveness of pharmaceutical research with efficient, technology-driven solutions.

The biosimulation market is experiencing robust growth due to recent technological advancements and strategic industry moves. The release of new software, such as Simulations Plus's ADMET Predictor 11 in July 2023, exemplifies the innovation in machine learning modeling platforms aimed at enhancing drug discovery and development processes. Additionally, Cadence Design Systems' acquisition of OpenEye Scientific Software in 2022 has expanded its capabilities in computational molecular modeling and simulation, strengthening its position in pharmaceutical and biotechnology applications.

Government initiatives and regulatory frameworks significantly impact the adoption and development of biosimulation technologies. In Switzerland, the Swissmedic agency has expedited the regulatory process for innovative biotech products, bolstering the country's biotech sector. The Swiss biotech industry reported record revenues of CHF 6.8 billion (USD 7.5 billion) in 2022 and secured CHF 1.3 billion (USD 1.5 billion) in funding, underscoring the sector's resilience and growth potential.

The increasing complexity of drug development processes and the need for cost-effective solutions drive the demand for biosimulation technologies. These tools enable more accurate predictions of biological processes, reducing the time and cost associated with clinical trials. Furthermore, the integration of advanced computational methods and machine learning algorithms enhances the precision and efficiency of biosimulation, making it an indispensable tool in modern pharmaceutical research.

The biosimulation market is set for significant expansion, fueled by technological innovations, strategic acquisitions, and supportive regulatory environments. The continuous advancements in software capabilities and the proactive role of regulatory bodies highlight the promising future of this market. The growing emphasis on precision medicine and cost-efficiency in drug development further reinforces the critical role of biosimulation in the healthcare industry.

Key Takeaways

- Market Value: The Biosimulation Market was valued at USD 2.7 billion in 2023 and is expected to reach USD 11.2 billion by 2033, with a CAGR of 15.7%.

- Software Type Analysis: PBPK dominates with 35%, critical for precise pharmacokinetic modeling.

- Service Type Analysis: In-house services lead with 60%, reflecting preference for internal capabilities.

- Modeling Type Analysis: Mechanistic modeling dominates with 50%, emphasizing detailed biological system simulations.

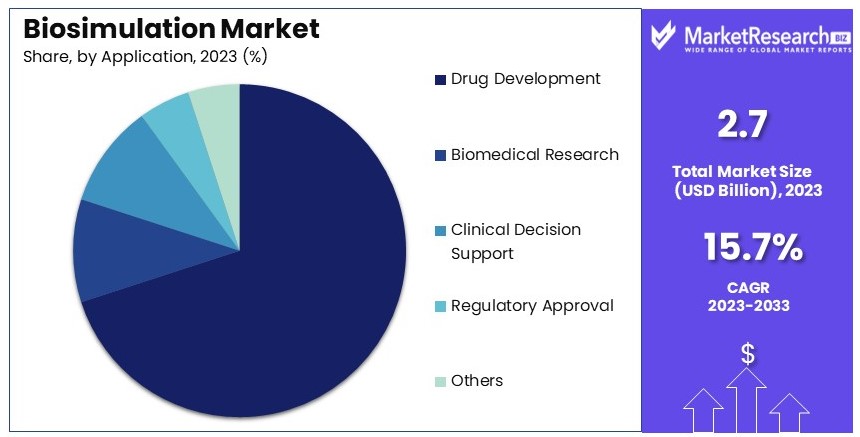

- Application Analysis: Drug Development leads with 70%, crucial for optimizing clinical trials and disease modeling.

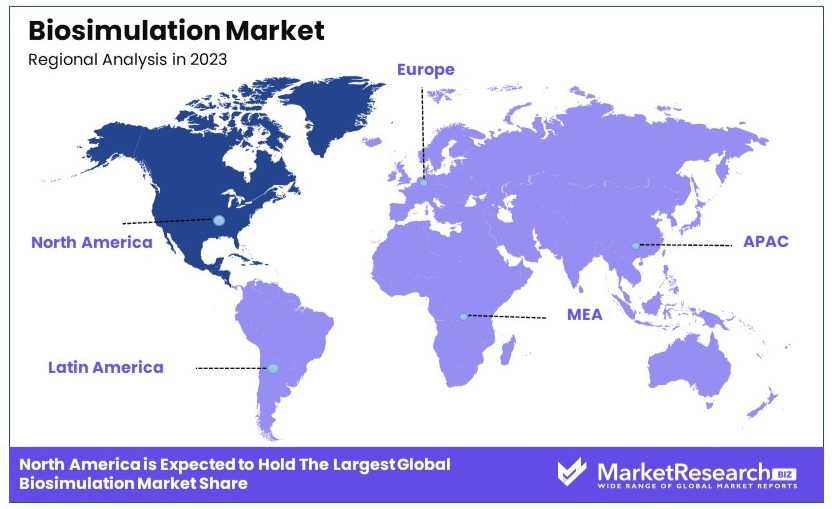

- Dominant Region: North America leads with ~45%, driven by advanced healthcare and research infrastructure.

- Analyst Viewpoint: The market is experiencing rapid growth with moderate competition, expected to expand with advancements in simulation technologies.

- Growth Opportunities: Key players can leverage AI-driven biosimulation and expand into emerging markets to enhance their competitive edge.

Driving Factors

Increasing Demand for Personalized Medicine Drives Market Growth

The shift towards personalized medicine significantly fuels the growth of the biosimulation market. As healthcare moves from a one-size-fits-all approach to one tailored to individual genetic profiles, lifestyles, and environmental factors, the demand for biosimulation intensifies. This technology is pivotal in developing personalized therapies by enabling the simulation of complex biological processes and assessing potential treatment outcomes.

For instance, biosimulation tools utilize computational models to simulate drug interactions at the molecular level, predicting pharmacokinetic and pharmacodynamic responses in various patient groups. This not only enhances the effectiveness of treatments but also elevates safety by anticipating adverse reactions before clinical trials. The integration of biosimulation in personalized medicine is becoming indispensable, as it supports the precision and customization that this modern approach to healthcare demands.

Advancements in Computational Power and Algorithms Enhance Market Capabilities

Recent strides in computational power and algorithmic innovation have markedly broadened the capabilities of biosimulation. The surge in high-performance computing and the adoption of cloud technologies allow for the efficient handling of complex simulations and large data sets. Moreover, the integration of artificial intelligence (AI) and machine learning (ML) has revolutionized biosimulation tools, increasing their accuracy and predictive capacities.

These technological advancements make biosimulation more accessible and reliable, encouraging broader use across research and pharmaceutical sectors. As a result, the enhanced computational infrastructure and smarter algorithms not only streamline drug development processes but also reduce costs and time to market, boosting the overall productivity of the biosimulation market.

Rising Adoption in Drug Discovery and Development Accelerates Market Expansion

Biosimulation is increasingly recognized as a crucial component in drug discovery and development, streamlining the process by reducing reliance on lengthy and costly experimental methods. By simulating drug-biological system interactions, researchers can swiftly identify promising drug candidates, refine formulations, and anticipate adverse effects or toxicity risks.

This capability significantly cuts down the time and financial investment needed to bring a drug to market. The growing reliance on biosimulation tools by pharmaceutical firms and research institutions underscores their value in improving efficiency and predictive accuracy in drug development. Consequently, this trend not only expedites the innovation cycle but also propels the expansion of the biosimulation market, as more entities integrate these tools into their development strategies.

Restraining Factors

Complexity and Data Limitations Restrain Biosimulation Market Growth

The complexity and data limitations in biological systems pose significant challenges to the biosimulation market. Developing accurate computational models is difficult due to incomplete understanding of many biological processes.

The quality and completeness of experimental data can vary, leading to inaccuracies in simulation results. Integrating diverse data sources and ensuring data compatibility are also major hurdles. These issues hinder the reliability and effectiveness of biosimulation tools. The inability to fully capture complex biological interactions in models slows the adoption and growth of the biosimulation market.

Lack of Skilled Professionals Restrains Biosimulation Market Growth

The shortage of skilled professionals hampers the growth of the biosimulation market. Biosimulation requires expertise in biology, computational modeling, mathematics, and computer science.

However, there are not enough professionals with the necessary skills and knowledge to develop and interpret biosimulation models. This lack of multidisciplinary expertise makes it challenging for industries to effectively utilize biosimulation tools. The gap in skilled workforce slows the adoption of these technologies, limiting the potential growth of the biosimulation market.

Software Type Analysis

PBPK (Physiologically Based Pharmacokinetic) dominates with 35% due to its comprehensive modeling capabilities across different biological systems.

The biosimulation market is segmented by software types such as Pharmacokinetic (PK), Pharmacodynamic (PD), PBPK, Toxicity Prediction, Trial Design, and others. PBPK models stand out as the dominant sub-segment due to their ability to simulate drug interactions within a physiologically accurate representation of human biology. This makes them invaluable in both drug development and regulatory submissions, where understanding the interactions of a drug with various biological systems is crucial.

Pharmacokinetic and Pharmacodynamic models also hold significant shares of the market. PK models are essential for understanding the drug's absorption and distribution within the body, while PD models focus on the drug's biological effects. Both are critical in the early stages of drug development.

Toxicity Prediction and Trial Design software are growing sub-segments that help reduce the cost and time of drug development by predicting adverse effects and optimizing trial parameters before actual clinical trials commence.

The "others" category includes emerging software types that address niche aspects of biosimulation, such as genetic and environmental factors influencing drug efficacy and safety. These are becoming increasingly important as personalized medicine continues to gain traction.

Service Type Analysis

In-house services dominate with 60% due to the control and confidentiality they offer to pharmaceutical companies.

In the biosimulation market, services are categorized into in-house and contract services. In-house services are preferred by many large pharmaceutical and biotech companies for their ability to maintain control over proprietary data and processes. The dominance of this segment is also driven by the significant investment these companies make in their own R&D facilities, which include sophisticated biosimulation tools and teams.

Contract services are essential for smaller firms and startups that do not have the resources to maintain extensive in-house capabilities. These services are growing as they offer flexibility and cost efficiency, especially for complex simulations that require specialized expertise not available internally.

The growth in contract services is a testament to the increasing complexity of drug development processes and the need for specialized knowledge that spans multiple disciplines, making these services critical for companies focusing on innovative therapies.

Modeling & Simulation Type Analysis

Mechanistic modeling dominates with 50% due to its ability to provide detailed insights into drug mechanisms and interactions.

Modeling and simulation types in the biosimulation market include physiological, patient-centric, mechanistic, non-mechanistic, and others. Mechanistic models are the most widely used due to their ability to simulate the biochemical pathways and mechanisms of action of drugs within an organism. This detailed insight is crucial for identifying potential drug targets and understanding the underlying mechanisms of disease.

Physiological and patient-centric models are important for personalizing drug therapies and understanding how different diseases affect various body systems. These models are increasingly used in the development of personalized medicine approaches.

Non-mechanistic models, which rely on statistical and computational methods to predict drug behaviors without detailed underlying biological mechanisms, are useful for large-scale screening and initial hypothesis testing.

The "others" category includes emerging models that integrate multi-scale modeling or machine learning techniques to enhance prediction accuracy and efficiency. These are increasingly important as the field of drug development moves towards more integrated and systemic approaches.

Application Analysis

Drug Development dominates with 70% due to its critical role in speeding up and enhancing the drug discovery process.

Applications of biosimulation are vast, but drug development holds the largest share. Within drug development, biosimulation is critical for lead optimization, clinical trial simulation, disease modeling, and other areas. Lead optimization uses biosimulation to predict the success of drug candidates before costly and time-consuming clinical trials. This not only speeds up the drug development process but also makes it more cost-effective.

Clinical trial simulation is another important area, allowing researchers to simulate different trial designs and predict outcomes before actual clinical trials, thereby optimizing both the design and the likelihood of success.

Disease modeling helps in understanding the disease mechanisms and the potential effects of drugs, which is crucial for targeted therapy development.

The "others" category in drug development includes applications such as formulation development and predicting drug-drug interactions, which are critical for ensuring the safety and efficacy of new drugs.

Key Market Segments

Software Type

- Pharmacokinetic (PK)

- Pharmacodynamic (PD)

- PBPK (Physiologically Based Pharmacokinetic)

- Toxicity Prediction

- Trial Design

- Others

Service Type

- In-house

- Contract Services

Modeling & Simulation Type

- Physiological

- Patient-centric

- Mechanistic

- Non-mechanistic

- Others

Application

- Drug Development

- Lead Optimization

- Clinical Trial Simulation

- Disease Modeling

- Others

- Biomedical Research

- Clinical Decision Support

- Regulatory Approval

- Others

Growth Opportunities

Integration of Omics Data and Systems Biology Offers Growth Opportunity

Integrating omics data and systems biology into biosimulation models presents significant growth opportunities. By combining diverse biological data sources like genomics, proteomics, and metabolomics, researchers can create comprehensive and predictive models.

These models enhance the understanding of complex biological systems and their interactions. This integration allows for more accurate simulations and better decision-making in drug development and disease research. As the demand for personalized medicine grows, the need for advanced biosimulation tools that incorporate omics data will drive market growth.

Collaborative Initiatives and Model Sharing Offers Growth Opportunity

Collaborative initiatives and model sharing in biosimulation can significantly drive market growth. Developing platforms for sharing models and best practices fosters collaboration among researchers, academia, and industry.

This collaboration accelerates the development and validation of new models, leading to more robust and widely adopted solutions. By promoting knowledge exchange, these initiatives enhance innovation and efficiency in biosimulation. As the biosimulation community grows, such collaborative efforts will be crucial in advancing the field and expanding market opportunities.

Trending Factors

Cloud-based Biosimulation Solutions Are Trending Factors

The shift towards cloud-based biosimulation solutions is gaining traction in the market. These platforms provide researchers and organizations with access to powerful computational resources and enhanced collaboration capabilities.

Cloud-based solutions offer scalability, cost-effectiveness, and the integration of advanced technologies like AI and ML. They are attractive to both small and large organizations due to their flexibility and efficiency. As more companies adopt cloud-based biosimulation, this trend will drive innovation and market growth by making advanced biosimulation tools more accessible.

Multiscale Modeling and Simulation Are Trending Factors

Multiscale modeling and simulation are emerging trends in biosimulation, offering a comprehensive understanding of complex biological systems. This approach integrates biological processes at different spatial and temporal scales, from molecular to organ levels.

By capturing the interactions at various scales, multiscale models provide more accurate and predictive simulations. This trend enhances drug development, disease research, and personalized medicine. As the need for detailed biological insights grows, the adoption of multiscale modeling will drive advancements in biosimulation and expand market potential.

Regional Analysis

North America Dominates with 45% Market Share in the Biosimulation Market

North America's commanding 45% market share in the biosimulation industry is primarily due to its advanced biotechnological and pharmaceutical sectors, which extensively use biosimulation for drug development and other applications. The region's strong focus on research and development, supported by significant investments from both the public and private sectors, drives this high market share. Additionally, the presence of leading biosimulation software and technology companies in the U.S. and Canada enhances regional capabilities and innovation.

The biosimulation market in North America benefits from a robust regulatory framework that encourages simulation in drug development to ensure safety and efficacy, reducing the need for extensive clinical trials. Collaborations between academic institutions, research facilities, and pharmaceutical companies further enrich the market landscape. The high adoption of technology and a well-established healthcare infrastructure also contribute to the dynamic growth of this sector.

The future outlook for North America in the biosimulation market remains positive, with growth expected to continue due to technological advancements and increasing acceptance of biosimulation methods. Ongoing innovations in artificial intelligence and machine learning are likely to enhance the accuracy and efficiency of biosimulations, further solidifying North America's dominant position in the global market.

Regional Market Shares and Dynamics:

Europe: Europe holds approximately 30% of the global biosimulation market. The region's strength lies in its rigorous healthcare regulations and substantial healthcare R&D expenditure, which promote the use of biosimulation in pharmaceutical research and personalized medicine.

Asia Pacific: Accounting for about 20% of the market, Asia Pacific is witnessing rapid growth driven by increasing investments in healthcare technology and a growing focus on efficient drug development processes. Countries like China, Japan, and South Korea are leading this expansion.

Middle East & Africa: This region represents around 3% of the global market. Although smaller, there is potential for growth as healthcare sectors in countries like Saudi Arabia and the UAE continue to develop and embrace modern technological solutions.

Latin America: Latin America also captures about 2% of the market. The region's growth is gradual, with increasing awareness and investments in healthcare technologies slowly driving the adoption of biosimulation.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Biosimulation Market is influenced by several major companies with significant market presence. Certara, Inc. and Simulations Plus, Inc. are leaders with extensive software solutions and strong R&D capabilities. They focus on innovation and precision.

Dassault Systèmes SE and Schrodinger, Inc. are notable for their advanced simulation technologies and global reach. Their strategic focus on drug development and discovery enhances their market positions.

Advanced Chemistry Development, Inc. and Chemical Computing Group ULC excel in producing high-quality software for molecular modeling. They leverage their strong distribution networks and regional strengths.

Rosa & Co. LLC and Insilico Biotechnology AG are recognized for their innovative biosimulation tools and emphasis on reducing development timelines. Their strategies include expanding their product portfolios and enhancing customer support.

In Silico Biosciences, Inc. and Genedata AG are influential due to their focus on computational biology and strategic partnerships. They prioritize research and development to meet evolving market needs.

Evidera, Inc. and Physiomics plc stand out for their comprehensive biosimulation services and commitment to improving drug efficacy. Their market influence is strengthened by their continuous product development.

Rhenovia Pharma Ltd. and Insilico Medicine, Inc. are known for their advanced AI-driven solutions and reliable performance. They focus on meeting industry standards and expanding their market reach.

Quantitative Solutions, Inc. is significant for its specialized biosimulation software, contributing to the market with its high-quality products.

Overall, the market features a mix of global leaders and specialized firms, each enhancing the market through innovation, quality, and strategic initiatives.

Market Key Players

- Certara, Inc.

- Simulations Plus, Inc.

- Dassault Systèmes SE

- Schrodinger, Inc.

- Advanced Chemistry Development, Inc.

- Chemical Computing Group ULC

- Rosa & Co. LLC

- Insilico Biotechnology AG

- In Silico Biosciences, Inc.

- Genedata AG

- Evidera, Inc.

- Physiomics plc

- Rhenovia Pharma Ltd.

- Insilico Medicine, Inc.

- Quantitative Solutions, Inc.

Recent Developments

- June 2024 / Certara: Certara, a leading provider of biosimulation technology and services, acquired Applied BioMath. This acquisition aims to expand Certara’s capabilities in quantitative systems pharmacology (QSP) and optimize novel therapies' dosing. The integration of Applied BioMath's expertise and Certara's existing biosimulation and AI portfolios will enhance drug development processes across the industry.

- June 2022 / Certara: Certara unveiled an updated version of its biosimulation software tailored for novel biologics. The new version includes simulators for Immunogenicity (IG), Immuno-Oncology (IO), and Vaccines, enabling users to better understand and forecast drug mechanisms. This advancement is aimed at improving the development process of innovative biologic therapies.

Report Scope

Report Features Description Market Value (2023) USD 2.7 Billion Forecast Revenue (2033) USD 11.2 Billion CAGR (2024-2033) 15.7% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Software Type (Pharmacokinetic [PK], Pharmacodynamic [PD], PBPK [Physiologically Based Pharmacokinetic], Toxicity Prediction, Trial Design, Others), By Service Type (In-house, Contract Services), By Modeling & Simulation Type (Physiological, Patient-centric, Mechanistic, Non-mechanistic, Others), By Application (Drug Development [Lead Optimization, Clinical Trial Simulation, Disease Modeling, Others], Biomedical Research, Clinical Decision Support, Regulatory Approval, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Certara, Inc., Simulations Plus, Inc., Dassault Systèmes SE, Schrodinger, Inc., Advanced Chemistry Development, Inc., Chemical Computing Group ULC, Rosa & Co. LLC, Insilico Biotechnology AG, In Silico Biosciences, Inc., Genedata AG, Evidera, Inc., Physiomics plc, Rhenovia Pharma Ltd., Insilico Medicine, Inc., Quantitative Solutions, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Certara, Inc.

- Simulations Plus, Inc.

- Dassault Systèmes SE

- Schrodinger, Inc.

- Advanced Chemistry Development, Inc.

- Chemical Computing Group ULC

- Rosa & Co. LLC

- Insilico Biotechnology AG

- In Silico Biosciences, Inc.

- Genedata AG

- Evidera, Inc.

- Physiomics plc

- Rhenovia Pharma Ltd.

- Insilico Medicine, Inc.

- Quantitative Solutions, Inc.