Bioink Market By Type (Synthetic bioink, Natural bioink), By Material (Agarose, Alginate, Chitosan, Collagen, Gelatin, Hyaluronic Acid, Hydroxyapatite, Others), By Printing Modality (Extrusion based bioprinting, Ink-jet based bioprinting, Laser-based bioprinting), By Application (Tissue engineering, Regenerative medicine, Medical applications, Drug discovery & delivery, Others), By End-use (Pharmaceutical and biotechnology companies, Hospitals & clinics, Academic & research institutes, Others), By Region and Companies - Industry Segment Outlook, Mar

-

46225

-

Feb 2025

-

136

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

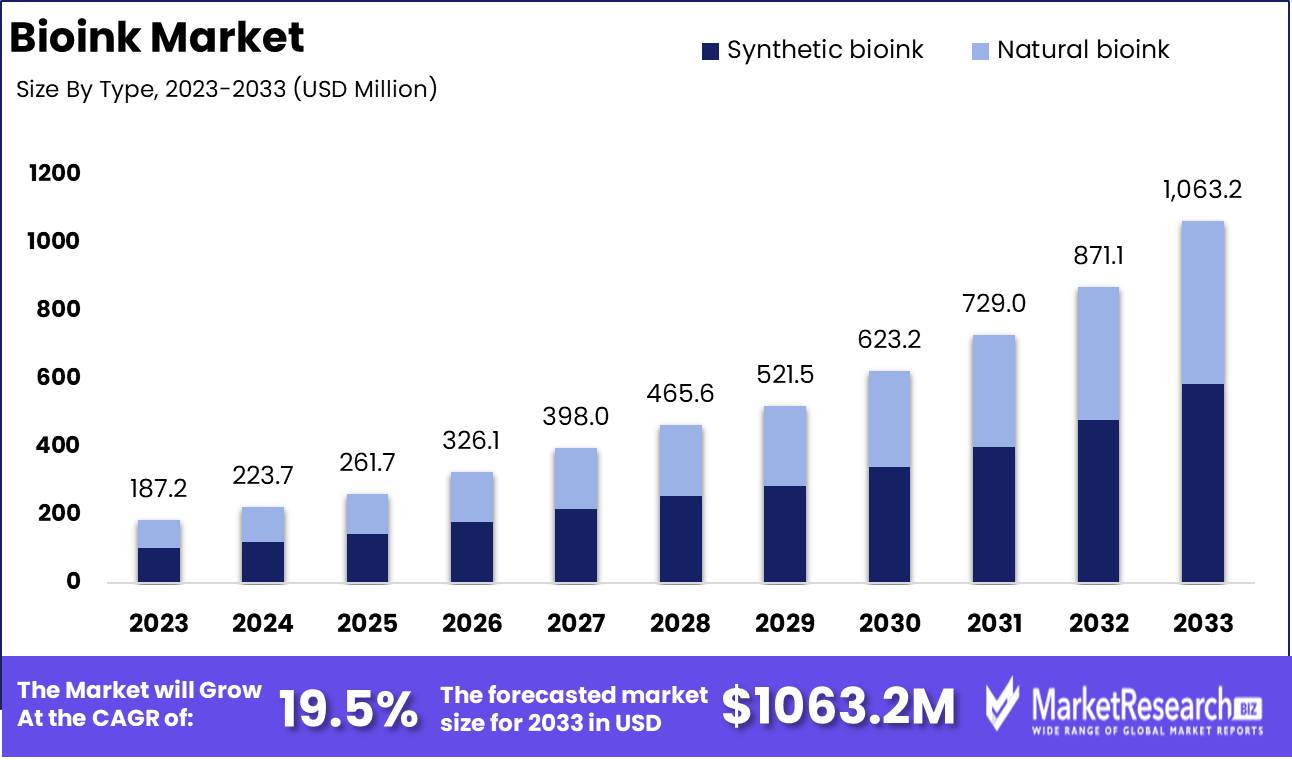

The Global Bioink Market was valued at USD 187.2 Mn in 2023. It is expected to reach USD 1,063.2 Mn by 2033, with a CAGR of 19.5% during the forecast period from 2024 to 2033.

The Bioink Market encompasses the burgeoning realm of biomaterials engineered for three-dimensional bioprinting applications, revolutionizing tissue engineering, regenerative medicine, and pharmaceutical research. Bioinks serve as the crucial biofabrication components, enabling precise deposition of living cells layer by layer to construct intricate tissue structures mimicking native biology.

This market's growth is propelled by escalating demand for personalized medicine, organ transplantation solutions, and advancements in bioprinting technologies. As pioneers in this transformative landscape, companies are innovating bioinks with enhanced biocompatibility, printability, and biofunctionality, fostering collaborations across academia, healthcare, and industry to unlock unprecedented opportunities for therapeutic innovation and patient care.

The Bioink Market stands at the forefront of biomedical innovation, poised for exponential growth and transformational impact. With the advent of 3D bioprinting technologies, bioinks have emerged as indispensable tools, facilitating the precise fabrication of complex tissue structures with unparalleled fidelity. Alginate, reigning as the most prevalent bioink, commands a significant portion of the market landscape, capturing 30% of scholarly attention. Notably, recent advancements have underscored the viability and versatility of alginate-methylcellulose bioinks, showcasing their remarkable storability for up to four weeks at refrigerated temperatures, a pivotal feat in streamlining bioprinting workflows and enhancing logistical efficiency.

Moreover, the integration of innovative formulations, such as gold nanoparticles (AuNPs) embedded within thiolated hyaluronic acid (HA) and gelatin matrices, heralds a new era of bioink engineering. This synergistic approach not only enhances printability but also imparts superior mechanical properties to the bioink, paving the way for unprecedented precision and functionality in bioprinted constructs. Such advancements signify a paradigm shift in the biofabrication landscape, offering profound implications for regenerative medicine, drug discovery, and personalized healthcare.

Analysis further emphasizes the imperative for companies to prioritize sustainability and scalability in bioink production processes. By implementing eco-friendly manufacturing practices and scalable production methodologies, businesses can mitigate environmental impact, optimize resource utilization, and ensure long-term viability in an increasingly competitive landscape. As sustainability emerges as a key differentiator and value driver in the biofabrication ecosystem, proactive adaptation to evolving market dynamics will be paramount for sustained growth and market leadership.

Key Takeaways

- Market Growth: The Global Bioink Market was valued at USD 187.2 Mn in 2023. It is expected to reach USD 1,063.2 Mn by 2033, with a CAGR of 19.5% during the forecast period from 2024 to 2033.

- By Type: Synthetic bioink dominates the Bioink Market with a 55% share, owing to its customizable properties and consistent performance.

- By Material: Alginate leads the bioink material segment with a 32% share, due to its excellent biocompatibility and ease of use in bioprinting applications.

- By Printing Modality: Extrusion-based bioprinting holds the majority with a 40% share, attributed to its versatility and ability to print with a wide range of materials.

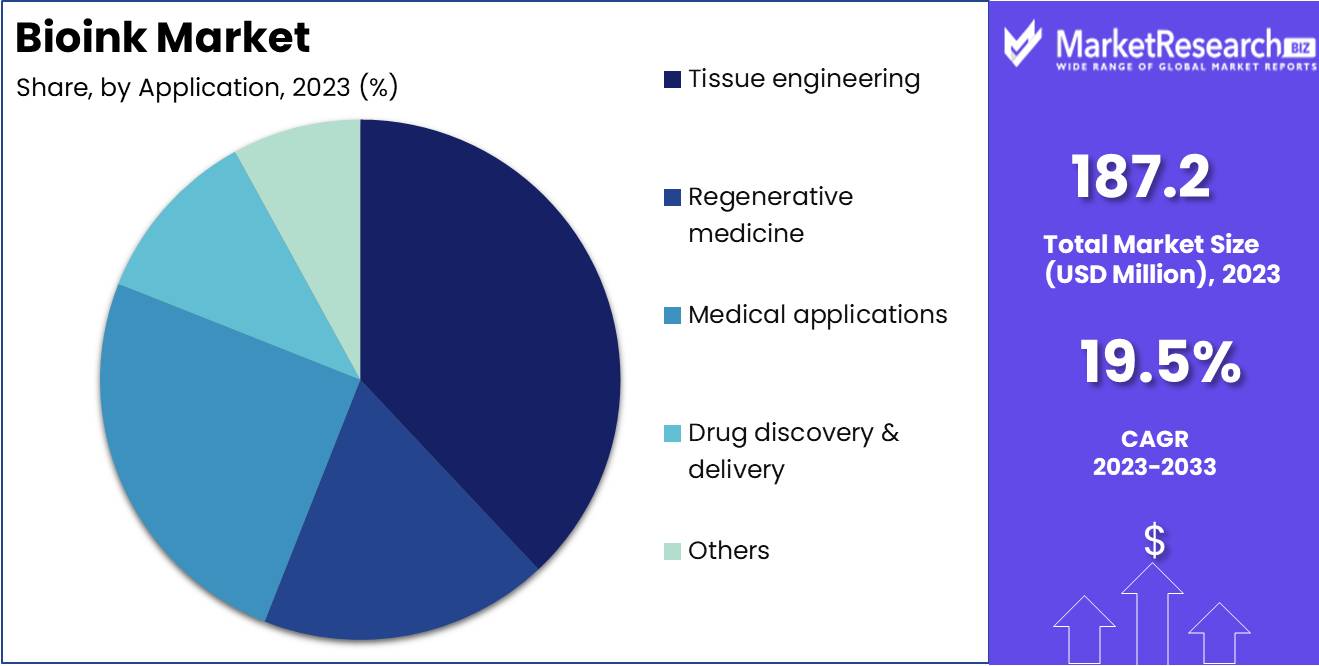

- By Application: Tissue engineering is the top application, capturing 38% of the Bioink Market, driven by the increasing demand for tissue and organ regeneration.

- By End-use: Pharmaceutical and biotechnology companies dominate the end-use segment with a 45% share, reflecting the high investment in bioprinting for drug discovery and development.

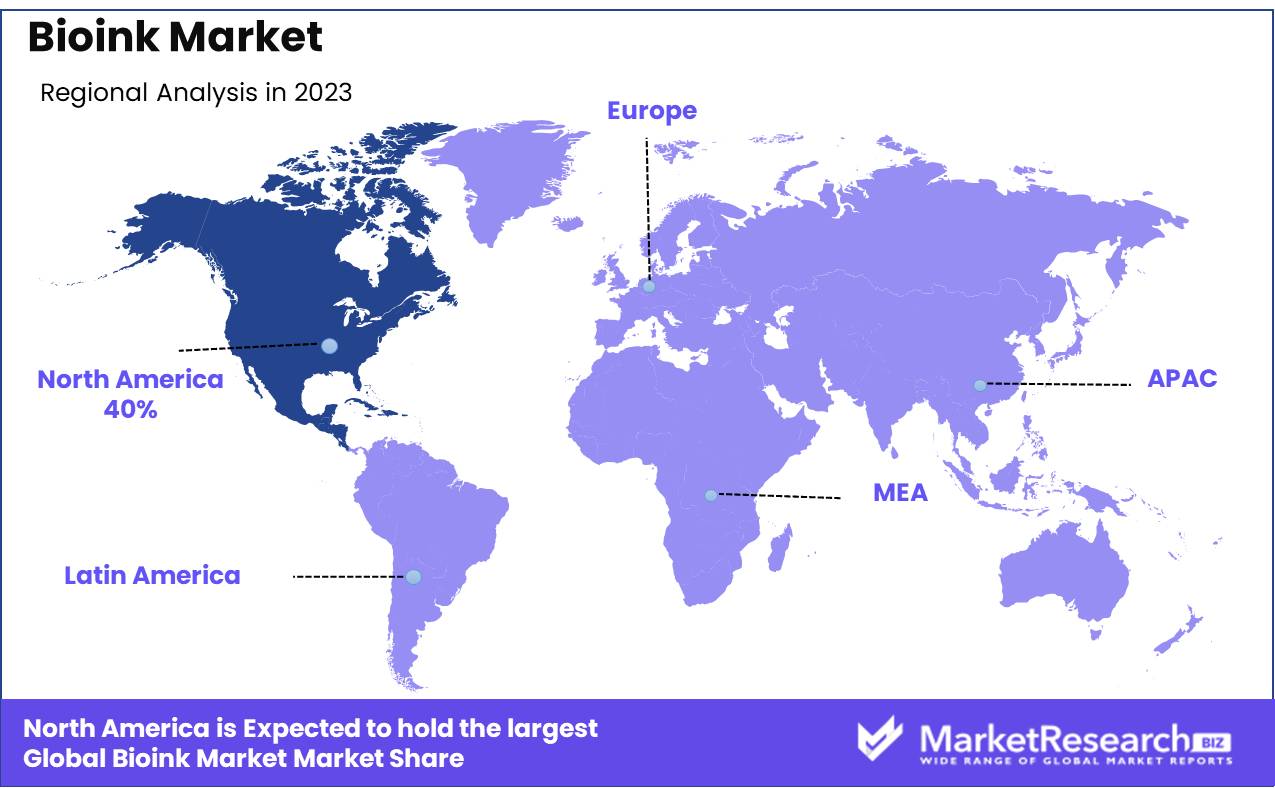

- Regional Dominance: North America holds a dominant position in the bioink market, accounting for approximately 40% of the market share, reflecting its robust infrastructure

- Growth Opportunity: A substantial growth opportunity exists in advancing bioink technologies to revolutionize regenerative medicine and tissue engineering applications.

Driving factors

Advancements in 3D Printing Technology

The evolution of 3D printing technology stands as a pivotal driving force propelling the expansion of the bioink market. As printing techniques become more sophisticated and precise, they enable the creation of complex biological structures with unprecedented accuracy. This advancement has revolutionized the field of regenerative medicine by allowing the fabrication of tissue-like structures and organoids, essential for research, drug testing, and ultimately transplantation. The synergy between 3D printing and bioink has opened avenues for personalized medicine, as it enables the creation of patient-specific tissues and organs. Such precision and customization not only enhance treatment efficacy but also mitigate the risk of rejection in transplantation procedures.

The bioprinting segment is expected to witness substantial growth, driven by the increasing demand for tissue engineering and regenerative medicine applications. The seamless integration of bioink with advanced printing technologies like inkjet, extrusion-based, and laser-assisted printing has significantly expanded the capabilities of bioprinting, fostering innovation and driving market growth.

Shortage of Organs for Transplantation

The scarcity of organs available for transplantation has emerged as a pressing global health challenge, underscoring the critical need for alternative solutions. Bioink technology offers a promising avenue to address this shortage by facilitating the fabrication of functional tissues and organs ex vivo. Through bioprinting, researchers can precisely deposit bioink composed of living cells and biomaterials layer by layer, mimicking the native architecture of human organs. This capability holds immense potential for generating transplantable organs on-demand, mitigating the dependency on traditional organ donation and reducing patient wait times.

Despite efforts to increase organ donation rates, the demand for transplantable organs continues to outstrip supply, resulting in significant morbidity and mortality among patients on waiting lists. In the United States alone, approximately 110,000 individuals are currently awaiting organ transplants, with an average of 17 people dying each day due to the lack of available organs. Bioink technology offers a transformative solution to this crisis by enabling the production of patient-specific tissues and organs that are biocompatible and functionally viable.

Advancing Regenerative Medicine

At the heart of regenerative medicine lies the potential to restore, repair, or replace damaged tissues and organs, offering new hope to patients suffering from debilitating conditions. Bioink plays an integral role in advancing this field by serving as the building blocks for tissue engineering and regeneration. Composed of biocompatible materials and living cells, bioink formulations can be tailored to mimic the biochemical and mechanical properties of native tissues, fostering cellular proliferation, differentiation, and tissue maturation.

The application of bioink extends beyond transplantation, encompassing a wide spectrum of regenerative medicine therapies, including wound healing, cartilage repair, and nerve regeneration. By harnessing the innate regenerative capacity of the body and providing a supportive scaffold for tissue growth, bioink-based approaches offer a minimally invasive and potentially curative alternative to conventional treatments.

Restraining Factors

Lack of Standardization and Regulatory Guidelines

The bioink market faces a significant hurdle in the form of a lack of standardization and regulatory guidelines governing bioprinting technologies and products. Unlike conventional medical devices, bioink-based constructs involve living cells and complex biomaterials, necessitating comprehensive regulatory frameworks to ensure safety, efficacy, and quality control. The absence of harmonized standards and clear regulatory pathways poses challenges for industry players seeking to commercialize bioink products and therapies, leading to uncertainty and potential barriers to market entry.

Addressing this challenge requires collaboration among regulators, industry stakeholders, and academic researchers to establish robust standards and guidelines that accommodate the unique characteristics of bioink-based technologies. By harmonizing regulatory requirements and streamlining approval processes, policymakers can foster innovation while safeguarding patient safety and promoting market growth.

High Costs of Bioprinting Technologies

While bioprinting holds immense promise for revolutionizing healthcare, the high costs associated with bioprinting technologies present a formidable barrier to widespread adoption and market growth. The development and deployment of bioprinters, biomaterials, and bioink formulations entail substantial investment in research, development, and manufacturing infrastructure.

Despite significant advancements in 3D printing technology, cost remains a key consideration for stakeholders across academia, industry, and healthcare. The challenge lies in balancing the investment required for innovation with the affordability and sustainability of bioprinted products and therapies. Efforts to reduce costs and improve cost-effectiveness include optimizing printing processes, enhancing material efficiency, and leveraging economies of scale through collaboration and shared resources.

By Type Analysis

Synthetic bioink leads the market with a 55% share, valued for its customizable properties.

In 2023, Synthetic bioink held a dominant market position in the By Type segment of the Bioink Market, capturing more than a 55% share. Synthetic bioinks have emerged as a preferred choice due to their customizable properties, offering researchers and manufacturers greater control over biofabrication processes. These bioinks are engineered with precision to mimic the structural and biochemical characteristics of native tissues, facilitating the development of advanced tissue constructs for various biomedical applications.

The robust dominance of Synthetic bioink can be attributed to its versatility and consistency in performance across a wide range of bioprinting technologies. With advancements in material science and biotechnology, Synthetic bioinks have witnessed significant enhancements in printability, biocompatibility, and mechanical properties, enabling the fabrication of complex tissue structures with enhanced functionality and durability.

The growing adoption of Synthetic bioinks in regenerative medicine, drug discovery, and personalized healthcare further fuels its market dominance. Researchers and pharmaceutical companies are increasingly leveraging Synthetic bioinks to develop innovative solutions for tissue engineering, organ transplantation, and disease modeling, driving the demand for advanced biofabrication technologies.

By Material Analysis

Alginate tops the material segment at 32%, owing to its excellent biocompatibility.

In 2023, Alginate held a dominant market position in the By Material segment of the Bioink Market, capturing more than a 32% share. Alginate, a naturally occurring polysaccharide derived from seaweed, has garnered significant attention for its excellent biocompatibility, gel-forming properties, and ease of crosslinking, making it a preferred choice for bioink formulations.

The dominance of Alginate can be attributed to its versatility and suitability for a wide range of bioprinting applications, including tissue engineering, wound healing, and drug delivery. Alginate-based bioinks offer favorable rheological properties, enabling precise deposition and structural integrity during the printing process, thereby facilitating the fabrication of intricate tissue constructs with high fidelity.

Moreover, Alginate bioinks exhibit tunable mechanical properties and degradation kinetics, allowing researchers and manufacturers to tailor the microenvironment for specific cell types and tissue regeneration processes. This flexibility in design and customization enhances the applicability of Alginate bioinks across diverse biomedical applications, driving their widespread adoption in both academic research and commercial ventures.

While Alginate maintains its stronghold in the Bioink Market, other materials such as Agarose, Chitosan, Collagen, Gelatin, Hyaluronic Acid, Hydroxyapatite, and others continue to contribute to the segment's growth. Each material offers unique properties and advantages, catering to specific requirements and preferences in biofabrication.

Agarose, for instance, is valued for its thermoresponsive gelation behavior, making it suitable for encapsulating cells and bioprinting delicate structures. Chitosan, derived from chitin, possesses antimicrobial properties and promotes cell adhesion and proliferation, making it ideal for wound healing applications.

Gelatin, derived from collagen, offers similar bioactive properties with enhanced printability and stability, while Hyaluronic Acid contributes to cell migration and tissue hydration, critical factors in wound healing and tissue repair. Hydroxyapatite, a calcium phosphate compound, serves as a bioactive material for bone tissue engineering, promoting osteogenic differentiation and mineralization.

By Printing Modality Analysis

Extrusion-based bioprinting holds the majority with 40%, thanks to its versatility.

In 2023, Extrusion-based bioprinting held a dominant market position in the By Printing Modality segment of the Bioink Market, capturing more than a 40% share. Extrusion-based bioprinting, also known as material extrusion bioprinting, is characterized by its versatility, scalability, and compatibility with a wide range of bioink formulations, including hydrogels, cell-laden materials, and composite scaffolds.

The dominance of Extrusion-based bioprinting can be attributed to its simplicity of operation, cost-effectiveness, and capability to fabricate complex three-dimensional (3D) structures with high resolution and precision. This printing modality relies on pneumatic or mechanical forces to deposit bioink layer by layer, enabling researchers and manufacturers to control the spatial distribution of cells and biomaterials in the printed construct.

Extrusion-based bioprinting offers advantages such as high throughput production, minimal cell damage, and the ability to print with viscous or shear-sensitive bioinks, making it suitable for various tissue engineering and regenerative medicine applications.

While Extrusion-based bioprinting leads the market, other printing modalities such as Inkjet-based bioprinting and Laser-based bioprinting contribute to the segment's growth. Inkjet-based bioprinting utilizes thermal or piezoelectric mechanisms to eject droplets of bioink onto a substrate, offering precise control over droplet size and placement.

Laser-based bioprinting relies on focused laser energy to induce the transfer of bioink from a donor substrate to a receiving substrate, enabling the deposition of biomaterials with micron-level precision. This modality excels in printing delicate structures and cell-laden materials while minimizing thermal damage to cells, offering potential applications in tissue engineering, organ-on-a-chip platforms, and drug screening assays.

By Application Analysis

Tissue engineering captures 38% of the market, driven by the demand for tissue and organ regeneration.

In 2023, Tissue engineering held a dominant market position in the By Application segment of the Bioink Market, capturing more than a 38% share. Tissue engineering, a multidisciplinary field focused on creating functional biological substitutes to restore, maintain, or improve tissue function, has emerged as a key application area driving the demand for bioinks.

The dominance of Tissue engineering in the Bioink Market can be attributed to its wide-ranging applications in regenerative medicine, organ transplantation, and the development of in vitro tissue models for drug testing and disease modeling. Bioinks play a crucial role in tissue engineering by providing a supportive matrix for cell growth, proliferation, and differentiation, enabling the fabrication of complex tissue constructs with biomimetic properties.

Tissue engineering applications encompass a diverse range of tissues and organs, including skin, cartilage, bone, blood vessels, and organs such as liver, kidney, and heart. Researchers and clinicians leverage bioinks to create tissue scaffolds with precise spatial organization, mechanical properties, and bioactive cues, facilitating the regeneration of damaged or diseased tissues and organs.

To Tissue engineering, other applications such as Regenerative medicine, Medical applications, Drug discovery & delivery, and Others contribute to the growth of the Bioink Market. Regenerative medicine focuses on harnessing the body's innate healing mechanisms to restore tissue structure and function, utilizing bioinks to create biomimetic scaffolds and cell-based therapies for tissue regeneration.

Medical applications of bioinks extend beyond tissue engineering to include wound healing, surgical implants, and the delivery of therapeutic agents such as growth factors, cytokines, and drugs. Bioinks play a vital role in facilitating controlled release kinetics and targeted delivery, enhancing the efficacy and safety of medical interventions.

Bioinks find applications in Drug discovery & delivery, where they serve as platforms for 3D cell culture models, enabling researchers to mimic physiological environments and study drug responses in vitro. These bioengineered tissues provide more accurate predictions of drug efficacy, toxicity, and pharmacokinetics compared to traditional 2D cell culture models, thereby accelerating the drug development process and reducing reliance on animal testing.

By End-use Analysis

Pharmaceutical and biotechnology companies dominate the end-use segment, commanding a 45% share.

In 2023, Pharmaceutical and biotechnology companies held a dominant market position in the By End-use segment of the Bioink Market, capturing more than a 45% share. The significant presence of Pharmaceutical and biotechnology companies in the market underscores their pivotal role in driving innovation and commercialization of bioink-based technologies for various biomedical applications.

Pharmaceutical and biotechnology companies are at the forefront of leveraging bioink technology to develop advanced therapies, drug delivery systems, and tissue engineering solutions.

The dominance of Pharmaceutical and biotechnology companies in the Bioink Market is attributed to their substantial investments in infrastructure, technology platforms, and expertise to advance bioprinting capabilities and accelerate product development.

Pharmaceutical and biotechnology companies play a critical role in driving collaborations and partnerships across the bioink ecosystem, including academic institutions, research organizations, and contract manufacturing firms. By leveraging multidisciplinary expertise and resources, these companies accelerate the translation of bioink-based technologies from bench to bedside, bringing innovative solutions to market and addressing unmet medical needs.

While Pharmaceutical and biotechnology companies lead the market, other end-use segments such as Hospitals & clinics, Academic & research institutes, and Others contribute to the adoption and utilization of bioink technology. Hospitals & clinics employ bioink-based products and services for patient care, surgical procedures, and tissue regeneration therapies.

Academic & research institutes serve as hubs of innovation and knowledge creation in the Bioink Market, driving fundamental research, technology development, and education in bioprinting and tissue engineering.

Key Market Segments

By Type

- Synthetic bioink

- Natural bioink

By Material

- Agarose

- Alginate

- Chitosan

- Collagen

- Gelatin

- Hyaluronic Acid

- Hydroxyapatite

- Others

By Printing Modality

- Extrusion based bioprinting

- Ink-jet based bioprinting

- Laser-based bioprinting

By Application

- Tissue engineering

- Regenerative medicine

- Medical applications

- Drug discovery & delivery

- Others

By End-use

- Pharmaceutical and biotechnology companies

- Hospitals & clinics

- Academic & research institutes

- Others

Growth Opportunity

Increasing Demand for Collagen-based Bioinks

In 2024, the global bioink market is poised for significant expansion, fueled by a growing demand for collagen-based bioinks. Collagen, a key structural protein in the human body, is widely recognized for its biocompatibility, bioactivity, and ability to support cellular growth and tissue regeneration. As awareness of the therapeutic potential of collagen-based bioinks continues to rise, fueled by a robust pipeline of preclinical and clinical research, stakeholders across academia, industry, and healthcare are increasingly turning to collagen as a preferred biomaterial for bioprinting applications.

Collagen-based bioinks offer several advantages, including enhanced cell viability, tissue-specific cues, and tunable mechanical properties, making them well-suited for a wide range of regenerative medicine and tissue engineering applications. Moreover, the versatility of collagen allows for the incorporation of bioactive molecules, growth factors, and other therapeutic agents, further expanding the scope of bioink-based therapies. With advancements in bioprinting technology enabling precise deposition and spatial control of collagen-based bioinks, researchers and clinicians are poised to unlock new frontiers in personalized medicine, organ transplantation, and drug discovery.

Rise in Sales of Natural Bioinks

Another compelling opportunity driving the growth of the bioink market in 2024 is the surge in sales of natural bioinks. Natural bioinks, derived from renewable sources such as alginate, gelatin, and hyaluronic acid, offer inherent biocompatibility, minimal immunogenicity, and environmentally sustainable properties, aligning with growing consumer preferences for natural and eco-friendly products.

The rise in sales of natural bioinks reflects a broader shift towards sustainable and biodegradable biomaterials, driven by concerns over environmental impact and regulatory compliance. As bioprinting technology continues to mature and diversify, natural bioinks are poised to play a pivotal role in enabling innovative applications across diverse industries, including pharmaceuticals, cosmetics, and food.

Latest Trends

Storage of Bioinks for Space Missions

In 2024, a pioneering trend shaping the global bioink market is the exploration of bioink storage solutions tailored for space missions. As humanity ventures further into space, the need for sustainable medical technologies capable of supporting long-duration missions becomes increasingly urgent. Bioinks, composed of living cells and biomaterials, hold immense potential for on-demand fabrication of tissues and organs in space, addressing medical emergencies and supporting prolonged space exploration.

The challenges of preserving bioink integrity and viability in the harsh environment of space present formidable obstacles. Researchers and industry innovators are therefore exploring novel storage methods, including cryopreservation and lyophilization, to extend the shelf life of bioinks and maintain cellular viability during space missions. By optimizing storage conditions and developing space-compatible packaging solutions, stakeholders aim to ensure the availability of bioink resources for in-situ bioprinting applications aboard spacecraft and extraterrestrial habitats.

Nanoparticles as Cross-linkers in Bioinks

Another notable trend driving the evolution of the global bioink market in 2024 is the integration of nanoparticles as cross-linkers in bioink formulations. Nanoparticles, with their unique physicochemical properties and tunable surface characteristics, offer versatile platforms for enhancing the mechanical, rheological, and bioactive properties of bioinks. By leveraging nanoparticles as cross-linkers, researchers can tailor the structural integrity, degradation kinetics, and biocompatibility of bioink scaffolds for specific tissue engineering applications.

The use of nanoparticles in bioink formulations represents a paradigm shift in bioprinting technology, enabling precise control over scaffold architecture and cellular microenvironments. Moreover, nanoparticles hold promise for facilitating targeted drug delivery, bioimaging, and theranostic applications within bioprinted constructs, further expanding the utility and impact of bioink-based therapies. As research in nanoparticle-enabled bioinks continues to advance, the global bioink market stands to benefit from transformative innovations that unlock new possibilities in regenerative medicine, personalized healthcare, and biomanufacturing.

Regional Analysis

North America dominates the bioink market, capturing approximately 40% of the global market share. This is primarily attributed to the region's robust healthcare infrastructure, extensive research and development activities, and increasing adoption of 3D bioprinting technologies. The United States, in particular, stands out as a major contributor to market growth, with a high concentration of biotechnology and pharmaceutical companies driving innovation in bioink development.

Europe holds a significant share in the bioink market, driven by the region's progressive regulatory environment, growing investments in biomedical research, and increasing demand for personalized medicine. Countries such as Germany, the UK, and Switzerland are at the forefront of bioink adoption, with a robust presence of leading biotechnology and healthcare companies.

Asia Pacific emerges as a promising region in the bioink market, fueled by the region's rapidly expanding healthcare infrastructure, rising prevalence of chronic diseases, and growing investment in biotechnology research and development. Countries such as China, Japan, and South Korea are witnessing increased adoption of bioink technologies, driven by government initiatives promoting healthcare innovation and regenerative medicine.

The Middle East & Africa region is gradually adopting bioink technologies, supported by improving healthcare infrastructure and a growing focus on personalized medicine. Countries such as the UAE, Saudi Arabia, and South Africa are witnessing increasing investment in biotechnology research and development, driving demand for bioink products.

Latin America represents an emerging market for bioink technologies, buoyed by the region's expanding healthcare sector, increasing investment in biotechnology, and growing awareness of regenerative medicine.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global bioink market continues to thrive, propelled by technological advancements, growing investment in regenerative medicine, and increasing applications across various industries. Among the key players shaping this dynamic landscape, several companies stand out with their innovative products, strategic partnerships, and commitment to research and development.

Merck KGaA, a leading pharmaceutical and life science company, maintains a strong position in the bioink market with its diverse portfolio and global presence. Leveraging its expertise in materials science and biotechnology, Merck KGaA offers high-quality bioinks tailored for specific applications, driving adoption across academic, clinical, and industrial sectors.

CELLINK, a pioneer in bioprinting technologies, continues to lead innovation with its cutting-edge bioink solutions and scalable bioprinting platforms. Through strategic acquisitions and collaborations, CELLINK expands its product offerings and strengthens its market presence, catering to the evolving needs of researchers and biotech companies worldwide.

BICO, Advance BioMatrix, and CollPlant Biotechnologies Ltd. are also prominent players, known for their commitment to quality, reliability, and customer satisfaction. These companies focus on developing bioinks with enhanced functionality, biocompatibility, and printability, driving advancements in tissue engineering, drug discovery, and personalized medicine.

Market Key Players

- Merck KGaA

- CELLINK

- BICO

- Advance BioMatrix

- CollPlant Biotechnologies Ltd.

- Humabiologics

- Allevi Inc.

- Black Drop Biodrucker Gmb

- Foldink

- Essent Biologics

- UPM Biomedicals

- Axolotl Biosciences

- Manchester BIOGEL

- TheWell Bioscience Inc.

- 3DPL.

Recent Development

- In November 2023, BIO INX develops innovative bio-inks for 3D bioprinting, aiming to revolutionize tissue engineering. Projects include placenta-based bioinks and 3D-printed cardiac tissue for space research.

- In September 2023, Bioprinting merges 3D printing with biology to fabricate living tissue-like structures. It offers potential for organ replacements and drug testing. Challenges include regulatory hurdles and ethical considerations regarding stem cells.

Report Scope

Report Features Description Market Value (2023) USD 187.2 Mn Forecast Revenue (2033) USD 1,063.2 Mn CAGR (2024-2033) 19.5% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Synthetic bioink, Natural bioink), By Material (Agarose, Alginate, Chitosan, Collagen, Gelatin, Hyaluronic Acid, Hydroxyapatite, Others), By Printing Modality (Extrusion based bioprinting, Ink-jet based bioprinting, Laser-based bioprinting), By Application (Tissue engineering, Regenerative medicine, Medical applications, Drug discovery & delivery, Others), By End-use (Pharmaceutical and biotechnology companies, Hospitals & clinics, Academic & research institutes, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Merck KGaA, CELLINK, BICO, Advance BioMatrix, CollPlant Biotechnologies Ltd., Humabiologics, Allevi Inc., Black Drop Biodrucker Gmb, Foldink, Essent Biologics, UPM Biomedicals, Axolotl Biosciences, Manchester BIOGEL, TheWell Bioscience Inc., 3DPL.) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Merck KGaA

- CELLINK

- BICO

- Advance BioMatrix

- CollPlant Biotechnologies Ltd.

- Humabiologics

- Allevi Inc.

- Black Drop Biodrucker Gmb

- Foldink

- Essent Biologics

- UPM Biomedicals

- Axolotl Biosciences

- Manchester BIOGEL

- TheWell Bioscience Inc.

- 3DPL.