Bioburden Testing Market Report By Test Type (Aerobic Count Testing, Anaerobic Count Testing, Fungi/Mold Testing, Spore Testing), By Product (Consumables , Instruments), By Application (Raw Material Testing, Medical Devices Testing, Pharmaceutical & Biotechnology Testing, Sterility Testing), By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

312

-

March 2024

-

163

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

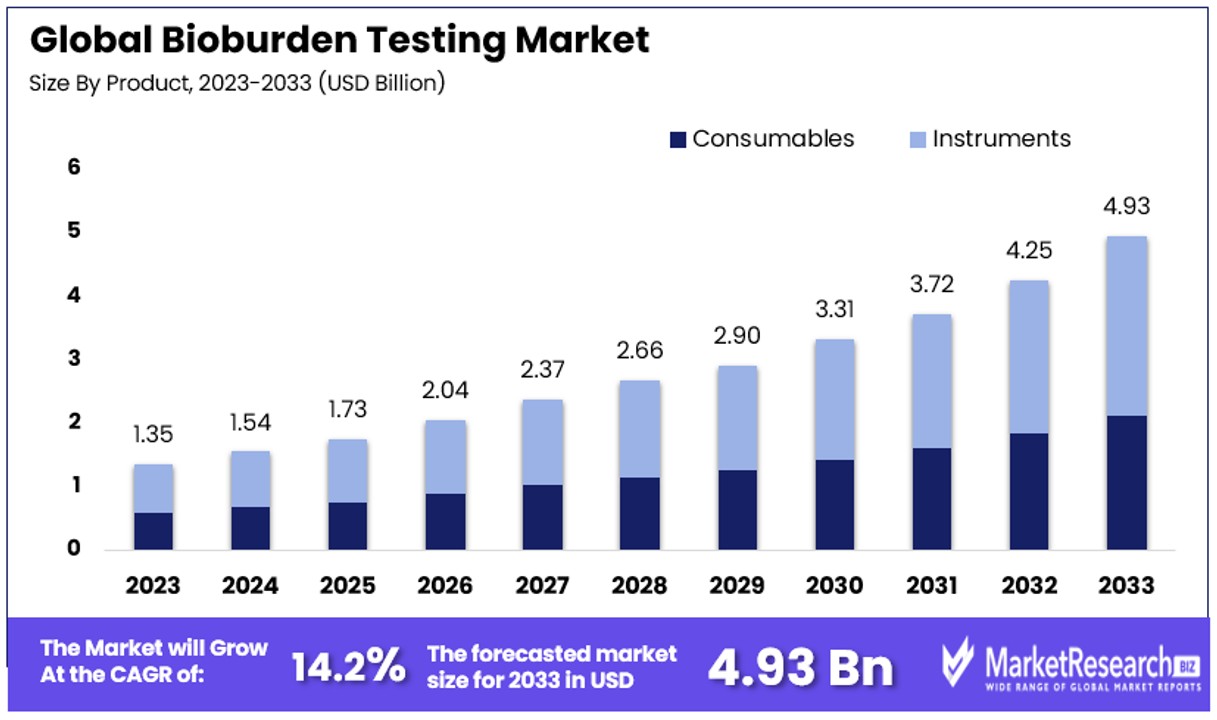

The Global Bioburden Testing Market size is expected to be worth around USD 4.93 Billion by 2033, from USD 1.35 Billion in 2023, growing at a CAGR of 14.20% during the forecast period from 2024 to 2033.

The surge for demand in biotechnology, rise in food and beverages sector and research and development investments in life sciences are some of the main key driving factors for the bioburden testing market.

Bioburden testing is defined as a vital method in the pharmaceutical and medical equipment industries to access the microbial contamination level on products, raw materials and manufacturing surroundings. This testing makes the compliance with regulatory guidelines and helps in upholding product safety and quality. The procedure includes gathering of the samples and subjecting them to microbial records and identification techniques.

Generally, bioburden testing uses methods such as membrane filtrations and direct inoculation in culture media to quantify viable microorganism. The outcome s offers valuable details into the cleanliness of manufacturing methods by helping to identify capable sources of contamination and makes the employment of corrective measures.

Bioburden testing is important for avoiding microbial contamination by ensuring product sterility and preserving patients’ safety in healthcare environment. It is a basic step in quality control regulations by supporting the production of pharmaceutical and medical equipments with strict hygiene guidelines.

According to an article published by Clinical research news in April 2023, highlights that STEMart, a US based provider of detailed services for all the stages of medical equipment developments has launched the Bioburden and sterility testing services for medical devices under the guidance of the ISO 11731 method.

Additionally, according to an article published by Pharmprom in March 2022, highlights that Plastikon Healthcare, LLC is willingly recalling 3 lots of milk of magnesia 2400 mg/30 ml oral suspension, 1 lot of acetaminophen 650mg/ 20.3mL, and 6 lot of magnesium hydroxide 1200mg/aluminium hydroxide 1200mg/simethicone 120mg per 30 ml to the hospital, clinic and patient level. This product is being evoked as the outcome of microbial contamination and a catastrophe to effectively examine failed microbial testing.

Bioburden testing plays an important role in maintaining strict hygiene guidelines in pharmaceutical and medical equipments. As many hospitals are focusing upon patient’s health and safety, this testing makes sure of the product sterility, reduces contamination challenges and preserves regulatory standards, protecting both the patient’s wellbeing and industry reputation. The demand for the bioburden testing will increase due to its requirement in the healthcare sector that will help in market expansion in the coming years.

Key Takeaways

- Market Value Projection: The Global Bioburden Testing Market is anticipated to reach USD 4.93 Billion by 2033, exhibiting growth from USD 1.35 Billion in 2023, with a notable CAGR of 14.20% during the forecast period from 2024 to 2033.

- Test Type: Aerobic Count Testing Emerges as the dominant sub-segment, capturing a significant portion of the market share. It focuses on quantifying aerobic microorganisms, crucial in industries like pharmaceuticals and biotechnology.

- Product: Consumables (Culture Media and Reagents) Dominate market dynamics due to perpetual demand across diverse industries engaged in microbial enumeration activities. Automated bioburden testing systems further amplify the demand for consumables.

- Instruments: Encompass a broad spectrum of equipment but hold a subordinate market share due to higher upfront costs and lower consumable dependency.

- Regional Dynamics: North America dominates the market with a 42% market share in the Bioburden Testing Market. This dominance is attributed to factors such as advanced healthcare infrastructure, stringent regulations, and technological advancements.

- Analyst Viewpoint: Analysts foresee significant growth opportunities in the Bioburden Testing Market, driven by increasing emphasis on hygiene standards, stringent regulatory requirements, and advancements in testing technologies. Investments in R&D and strategic collaborations are expected to propel market expansion further.

- Growth Opportunities: Opportunities lie in expanding applications of bioburden testing beyond pharmaceuticals to industries such as food and beverage, cosmetics, and medical devices. Additionally, focusing on developing rapid and accurate testing methods, along with enhancing automation and integration capabilities, presents avenues for sustained growth in the global Bioburden Testing Market.

Driving Factors

Stringent Regulatory Compliance Drives Bioburden Testing Market Growth

The necessity to adhere to strict regulatory standards set by authorities like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) is a significant driver for the Bioburden Testing Market. These regulations ensure that pharmaceutical and biotechnology products are safe and effective for consumer use by mandating thorough bioburden testing.

The impact of non-compliance, as evidenced by FDA warning letters and consequent product recalls, underscores the critical nature of bioburden testing in manufacturing processes. This regulatory landscape not only safeguards public health but also propels the demand for bioburden testing services and solutions, fostering market growth as companies invest in compliance to maintain market access and consumer trust.

Increasing Demand for Biologics and Biosimilars Fuels Market Expansion

The bioburden testing market is witnessing substantial growth, fueled by the rising demand for biologic drugs and biosimilars. These products, derived from living organisms, are inherently more susceptible to microbial contamination than synthetic pharmaceuticals. Such contamination can significantly affect the safety and efficacy of these complex molecules.

In response, pharmaceutical companies are escalating their investment in bioburden testing to ensure product integrity. This trend not only highlights the growing role of biologics and biosimilars in modern medicine but also emphasizes the increasing importance of rigorous bioburden testing practices to support the development and production of these high-value therapeutics.

Adoption of Advanced Testing Technologies Enhances Market Dynamics

The bioburden testing market is evolving rapidly with the adoption of advanced testing technologies. Innovations such as ATP bioluminescence assays and flow cytometry offer rapid, accurate, and less labor-intensive alternatives to traditional microbial detection methods. This technological advancement enables quicker decision-making and more efficient production cycles for pharmaceutical and biotechnology companies.

The shift towards these advanced methods reflects the industry's response to the demand for faster, more reliable testing solutions. As companies continue to adopt and invest in these technologies, the bioburden testing market is set to experience significant growth, driven by the need for efficiency and accuracy in microbial contamination detection.

Restraining Factors

High Capital Investment and Operating Costs Restrain Market Growth

The substantial financial investment required for setting up and running bioburden testing facilities presents a significant barrier to the market's growth. The acquisition of advanced testing equipment, establishment of clean rooms, and employment of specialized personnel entail high capital and operational expenditures.

This financial challenge is especially pronounced for smaller companies and those in developing regions, where access to substantial capital is limited. The high cost associated with maintaining state-of-the-art bioburden testing capabilities can deter market entry and limit the expansion of testing services, particularly in markets where cost-efficiency is paramount.

Complexity of Testing Procedures Limits Market Expansion

The intricate nature of bioburden testing procedures further inhibits the market's growth. Bioburden testing involves a series of complex steps that require meticulous execution and strict adherence to protocols. Any deviation or error in processes such as sample collection, incubation, or data analysis can compromise the accuracy of test results, leading to potential quality control issues.

This complexity necessitates extensive training for personnel and the implementation of rigorous, standardized procedures. The demand for high-level expertise and the risk of inaccuracies place additional pressures on testing facilities, challenging their capacity to ensure consistent and reliable bioburden testing outcomes.

Test Type Analysis

In analyzing the Bioburden Testing Market, it's essential to scrutinize the various test types employed in microbial enumeration. Among these, Aerobic Count Testing emerges as the dominant sub-segment, capturing a significant portion of the market share.

Aerobic Count Testing focuses on quantifying aerobic microorganisms present in a given sample, providing crucial insights into contamination levels and microbial proliferation. This dominance can be attributed to the widespread application of aerobic testing across industries such as pharmaceuticals, biotechnology, and medical devices, where strict hygiene standards are paramount.

Meanwhile, Anaerobic Count Testing and Fungi/Mold Testing constitute secondary sub-segments, each catering to specific niches within the bioburden testing landscape. Anaerobic Count Testing targets anaerobic microorganisms thriving in oxygen-deprived environments, while Fungi/Mold Testing specializes in detecting fungal and mold contaminants.

Although these sub-segments hold significance in niche applications, their market shares remain comparatively smaller. Spore Testing, while essential in certain industries like food and beverage, pharmaceuticals, and cosmetics, occupies a modest share within the bioburden testing market, reflecting its niche applicability and specialized nature.

Product Analysis

Moving on to the product segment of the Bioburden Testing Market, it becomes evident that consumables exert a dominant influence on market dynamics. Consumables, comprising Culture Media and Reagents along with other ancillary consumables, emerge as the cornerstone of bioburden testing workflows. This dominance is underpinned by the perpetual demand for culture media and reagents across diverse industries engaged in microbial enumeration activities.

The consistent need for reliable, standardized consumables to support microbial growth and detection fuels the growth of this sub-segment. Additionally, the proliferation of automated bioburden testing systems further amplifies the demand for consumables, as these systems rely heavily on specialized culture media and reagents for accurate microbial enumeration.

Conversely, Instruments encompass a broad spectrum of equipment utilized in bioburden testing, ranging from automated systems to traditional microbial enumeration instruments, PCR instruments, incubators, microscopes, and other ancillary devices. While instruments play a crucial role in facilitating bioburden testing procedures, their market share remains subordinate to consumables due to higher upfront costs, longer replacement cycles, and lower consumable dependency.

Test Type Analysis

In analyzing the Bioburden Testing Market, it's essential to scrutinize the various test types employed in microbial enumeration. Among these, Aerobic Count Testing emerges as the dominant sub-segment, capturing a significant portion of the market share.

Aerobic Count Testing focuses on quantifying aerobic microorganisms present in a given sample, providing crucial insights into contamination levels and microbial proliferation. This dominance can be attributed to the widespread application of aerobic testing across industries such as pharmaceuticals, biotechnology, and medical devices, where strict hygiene standards are paramount.

Meanwhile, Anaerobic Count Testing and Fungi/Mold Testing constitute secondary sub-segments, each catering to specific niches within the bioburden testing landscape. Anaerobic Count Testing targets anaerobic microorganisms thriving in oxygen-deprived environments, while Fungi/Mold Testing specializes in detecting fungal and mold contaminants.

Although these sub-segments hold significance in niche applications, their market shares remain comparatively smaller. Spore Testing, while essential in certain industries like food and beverage, pharmaceuticals, and cosmetics, occupies a modest share within the bioburden testing market, reflecting its niche applicability and specialized nature.

Product Analysis

Transitioning to the product segment of the Bioburden Testing Market, it becomes evident that consumables exert a dominant influence on market dynamics. Consumables, comprising Culture Media and Reagents along with other ancillary consumables, emerge as the cornerstone of bioburden testing workflows.

This dominance is underpinned by the perpetual demand for culture media and reagents across diverse industries engaged in microbial enumeration activities. The consistent need for reliable, standardized consumables to support microbial growth and detection fuels the growth of this sub-segment. Additionally, the proliferation of automated bioburden testing systems further amplifies the demand for consumables, as these systems rely heavily on specialized culture media and reagents for accurate microbial enumeration.

Conversely, Instruments encompass a broad spectrum of equipment utilized in bioburden testing, ranging from automated systems to traditional microbial enumeration instruments, PCR instruments, incubators, microscopes, and other ancillary devices. While instruments play a crucial role in facilitating bioburden testing procedures, their market share remains subordinate to consumables due to higher upfront costs, longer replacement cycles, and lower consumable dependency.

Key Market Segments

By Test Type

- Aerobic Count Testing

- Anaerobic Count Testing

- Fungi/Mold Testing

- Spore Testing

By Product

- Consumables

- Culture Media and Reagents

- Other Consumables

- Instruments

- Automated Bioburden Testing Systems

- Microbial Enumeration Instruments

- PCR Instruments

- Incubators

- Microscopes

- Others

By Application

- Raw Material Testing

- Medical Devices Testing

- Pharmaceutical & Biotechnology Testing

- Sterility Testing

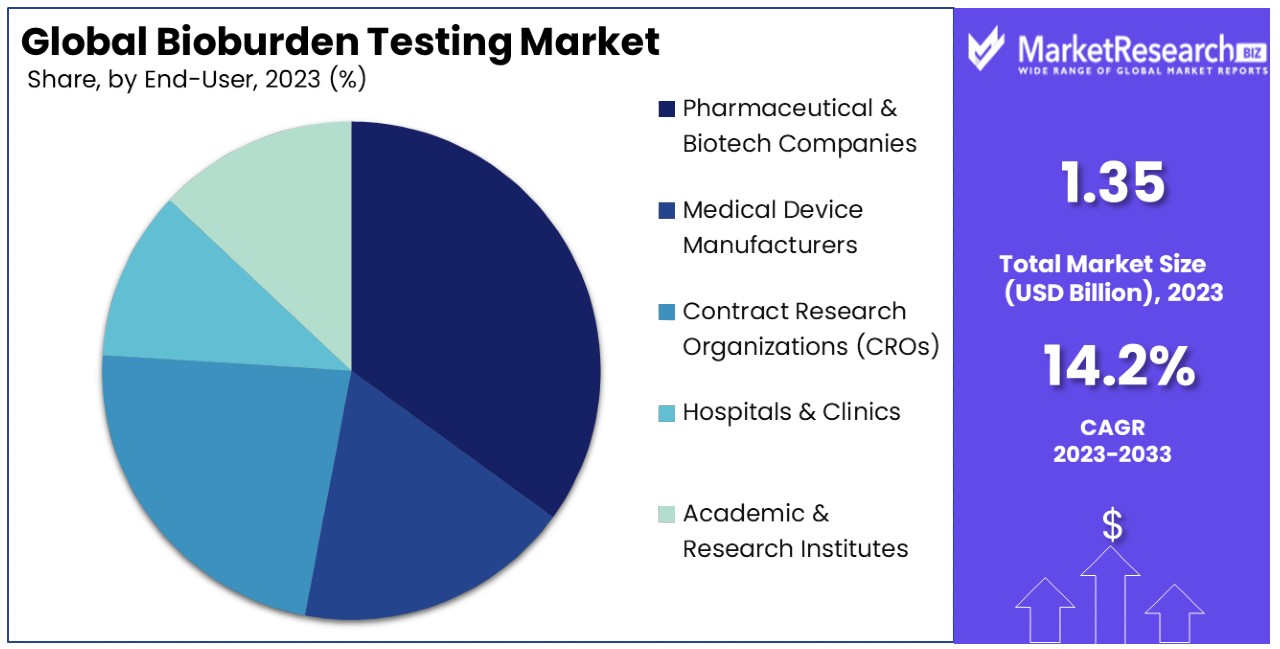

By End-User

- Pharmaceutical & Biotechnology Companies

- Medical Device Manufacturers

- Contract Research Organizations (CROs)

- Hospitals & Clinics

- Academic & Research Institutes

Growth Opportunities

Integration of Advanced Technologies Offers Growth Opportunity

The integration of cutting-edge technologies like next-generation sequencing (NGS), rapid microbial detection systems, and automated sample processing presents significant growth opportunities for the Bioburden Testing Market. These technologies revolutionize traditional bioburden testing by offering faster, more accurate, and efficient analysis.

By adopting these advanced tools, companies can enhance their service offerings, meet the stringent requirements of pharmaceutical and biotech clients, and stay ahead in a competitive market. This technological evolution not only addresses the current limitations of bioburden testing but also sets a new standard, driving the market towards more innovative solutions that can handle the complexities of modern biopharmaceutical production.

Expansion into Adjacent Markets Offers Growth Opportunity

The potential for the Bioburden Testing Market to expand into adjacent sectors like medical devices, cosmetics, and food and beverage industries represents a significant growth avenue. These sectors demand rigorous microbiological testing to ensure product safety and comply with regulatory standards, similar to the pharmaceutical and biotechnology industries.

By leveraging their expertise in bioburden testing and adapting methodologies to meet the unique requirements of these new markets, service providers can diversify their customer base. This expansion not only broadens the market's scope but also introduces bioburden testing companies to new revenue streams, underscoring the versatility and adaptability of their services in ensuring product quality across various industries.

Trending Factors

Increased Focus on Environmental Monitoring Are Trending Factors

The heightened emphasis on environmental monitoring in the bioburden testing market is becoming a trending factor. Regulatory bodies are increasingly prioritizing the need to test manufacturing environments like clean rooms, air handling systems, and water systems for microbial contamination. This shift aims to prevent product contamination and ensure consumer safety.

As a result, there's a growing demand for environmental monitoring solutions and services tailored to these requirements. The trend underscores the industry's proactive approach to quality control and regulatory compliance, driving innovations and developments in environmental bioburden testing solutions.

Adoption of Rapid Microbiological Methods (RMMs) Are Trending Factors

Rapid Microbiological Methods (RMMs), including adenosine triphosphate (ATP) bioluminescence assays and flow cytometry, are rapidly gaining ground in the bioburden testing market. Their popularity stems from their ability to deliver quicker results than traditional testing methods, offering significant time and cost efficiencies.

This trend is particularly beneficial for pharmaceutical and biotechnology companies, enabling them to swiftly address potential contamination issues and enhance manufacturing efficiency. The move towards RMMs reflects a broader industry trend towards increasing productivity and reliability in microbial detection, signaling a shift in how companies approach bioburden testing in their operations.

Regional Analysis

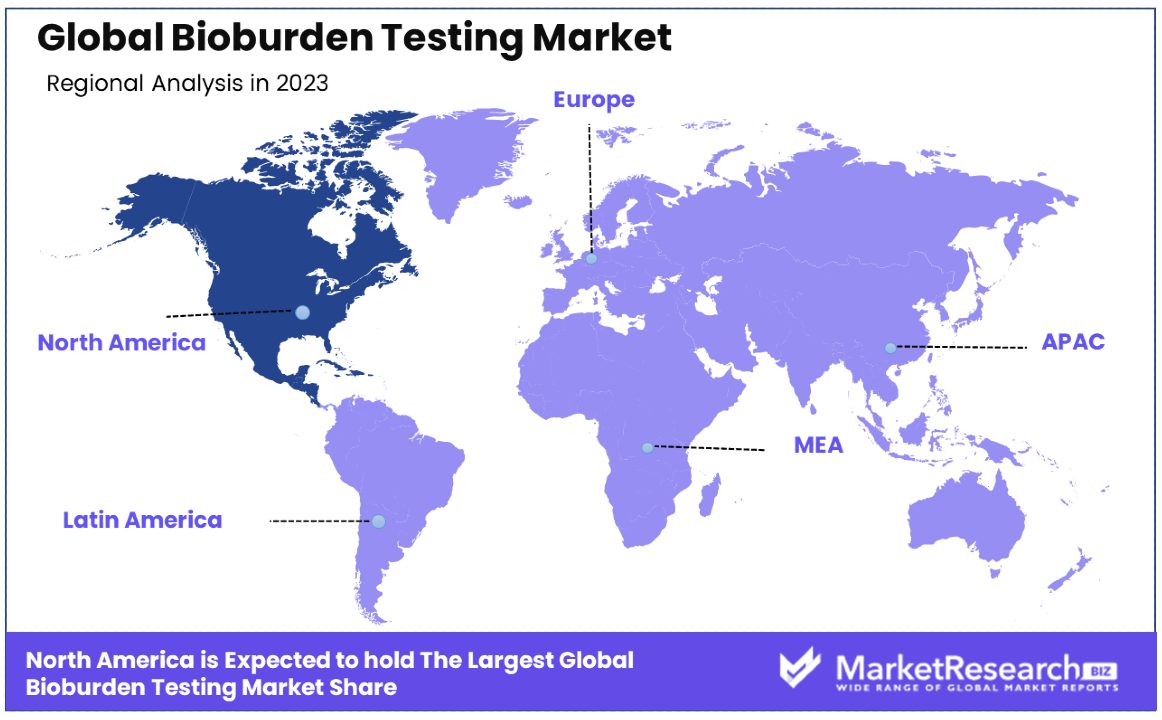

North America Dominates with 42% Market Share

North America's dominance in the Bioburden Testing Market can be attributed to several key factors. Firstly, the region boasts a robust healthcare infrastructure and stringent regulatory framework, mandating microbial testing across various industries. Additionally, the presence of leading pharmaceutical and biotechnology companies drives demand for bioburden testing services. Moreover, technological advancements and a focus on research and development further bolster market growth in North America.

In North America, the Bioburden Testing Market benefits from a highly developed healthcare system, fostering innovation and adoption of advanced testing methodologies. The region's emphasis on quality control and regulatory compliance ensures sustained demand for bioburden testing services. Furthermore, the presence of academic and research institutions facilitates collaboration and knowledge exchange, driving market growth. Additionally, increasing awareness about healthcare-associated infections and the importance of microbial control further propels market expansion in North America.

Market Share/Growth Rate in Other Regions:

- In Europe, where the market share stands at 28%, the bioburden testing industry is characterized by steady growth fueled by substantial investments in healthcare infrastructure and stringent regulatory measures.

- Meanwhile, in the Asia Pacific region, holding an 18% market share, the bioburden testing market is poised for rapid growth. With increasing healthcare expenditure and a growing focus on infection control measures, demand for microbial testing services is on the rise.

- In the Middle East & Africa, where the market share stands at 8%, the bioburden testing market exhibits moderate growth. Despite facing challenges such as limited access to healthcare and regulatory complexities, the region is witnessing increasing investments in healthcare infrastructure and initiatives aimed at improving healthcare quality and safety standards.

- Lastly, Latin America holds a 4% market share in the bioburden testing industry. While the region experiences modest growth, emerging economies like Brazil, Mexico, and Argentina are driving market expansion through investments in healthcare infrastructure and initiatives aimed at enhancing food safety and pharmaceutical quality standards.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Bioburden Testing Market, several major players wield significant influence, impacting industry dynamics through strategic positioning and market presence. These companies, through their extensive product portfolios and industry expertise, cater to the diverse needs of pharmaceutical industries, contract manufacturing organizations, and other stakeholders.

Market Size & Strategic Positioning:

Leading companies such as Biomérieux SA, Merck KGaA, and Thermo Fisher Scientific Inc. command the largest market share, leveraging their extensive experience and technological prowess to offer comprehensive bioburden testing solutions. Their strategic positioning enables them to cater to the growing demand for microbial testing services across various sectors, including pharmaceuticals and contract manufacturing organizations.Impact & Market Influence:

The influence of major players like Becton Dickinson and Company, Charles River Laboratories International Inc., and WuXi AppTec extends beyond their product offerings. These companies play pivotal roles in driving industry standards, fostering innovation, and shaping regulatory frameworks governing bioburden testing. Their contributions to product launches, advancements in testing methodologies, and equipment cleaning validation initiatives underscore their significance in the market.Consumables Segment & Major Factors:

Within the bioburden testing market, companies like Nelson Laboratories Inc., ATS Laboratories, and Pacific BioLabs Inc. specialize in providing consumables essential for microbial enumeration. Their product offerings, ranging from culture media to reagents, form the basis of product validation and ensure the accuracy of bioburden testing results. Major factors influencing their market presence include product quality, reliability, and compatibility with industry standards.In conclusion, major players in the bioburden testing market play indispensable roles in meeting the evolving needs of pharmaceutical industries, contract manufacturing organizations, and other stakeholders. Their strategic positioning, diverse product portfolios, and contributions to industry standards underscore their significance in driving market growth and ensuring the safety and efficacy of pharmaceutical products and finished products alike.

Market Key Players

- Biomérieux SA

- Nelson Laboratories

- Merck KGaA

- SGS S.A.

- Pacific BioLabs Inc.

- IBR Inc.

- ATS Laboratories

- Thermo Fisher Scientific Inc.

- Wuxi Pharmatech

- Becton Dickinson and Company

- Nelson Laboratories Inc.

- Charles River Laboratories International Inc.

- WuXi AppTec

- NAMSA

- Nelson Laboratories, LLC

- Thermo Fisher Scientific, Inc.

- Biomérieux SA

- Sotera Health (Nelson)

- North American Science Associates Inc.

Recent Developments

- On September 2023, Redberry SAS introduced Red One™, an automated platform for rapid and quantitative microbiological detection. This innovative technology offers a 2-step sterility testing method in accordance with USP <71> and Ph. Eur. 2.6.1.I, with enrichment phase in compendial liquid media.

- On May 2023, Ashland Global Holdings Inc. announced the opening of a research and development center for microbial protection in Hamburg, Germany. This state-of-the-art facility houses chemists, microbiologists, and technicians within five personal care labs to provide services such as antimicrobial efficacy testing for cosmetics.

- On April 2023, STEMart launched bioburden and sterility testing services for medical devices, enhancing its comprehensive offerings for medical device development. This strategic move by the U.S.-based provider aligns with the industry's focus on ensuring the safety and efficacy of medical devices through rigorous testing protocols.

- On July 2022, Merck announced the launch of its Microbiology Application and Training (MAT) Lab in Jigani, Bengaluru. This state-of-the-art facility offers facilities and technical expertise to support India's life science community in developing microbial quality control capabilities.

Report Scope

Report Features Description Market Value (2023) USD 1.35 Billion Forecast Revenue (2033) USD 4.93 Billion CAGR (2024-2033) 14.20% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Test Type (Aerobic Count Testing, Anaerobic Count Testing, Fungi/Mold Testing, Spore Testing), By Product (Consumables , Instruments), By Application (Raw Material Testing, Medical Devices Testing, Pharmaceutical & Biotechnology Testing, Sterility Testing), By End-User (Pharmaceutical & Biotechnology Companies, Medical Device Manufacturers, Contract Research Organizations (CROs), Hospitals & Clinics, Academic & Research Institutes) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Biomérieux SA, Nelson Laboratories, Merck KGaA, Pacific BioLabs Inc., IBR Inc., ATS Laboratories, Thermo Fisher Scientific Inc., Wuxi Pharmatech, Becton Dickinson and Company, Nelson Laboratories Inc., Charles River Laboratories International Inc., WuXi AppTec, NAMSA, Nelson Laboratories, LLC, Thermo Fisher Scientific, Inc., Biomérieux SA, Sotera Health (Nelson), North American Science Associates Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) - Market Value Projection: The Global Bioburden Testing Market is anticipated to reach USD 4.93 Billion by 2033, exhibiting growth from USD 1.35 Billion in 2023, with a notable CAGR of 14.20% during the forecast period from 2024 to 2033.

-

-

- Charles River Laboratories International, Inc.

- Sigma-Aldrich Corporation

- SGS S.A.

- WuXi PharmaTech (Cayman) Inc.

- Merck & Co., Inc.

- Becton, Dickinson and Company

- North American Science Associates

- ATS Labs, Inc.

- Nelson Laboratories

- Pacific Biolabs