Benelux Collagen Market By Application (Food & Beverages, Healthcare, Cosmetics, Others), By Source (Bovine Collagen, Porcine Collagen, Marine Collagen, Others), By Product Type (Gelatin, Hydrolyzed Collagen, Native Collagen), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

48490

-

July 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

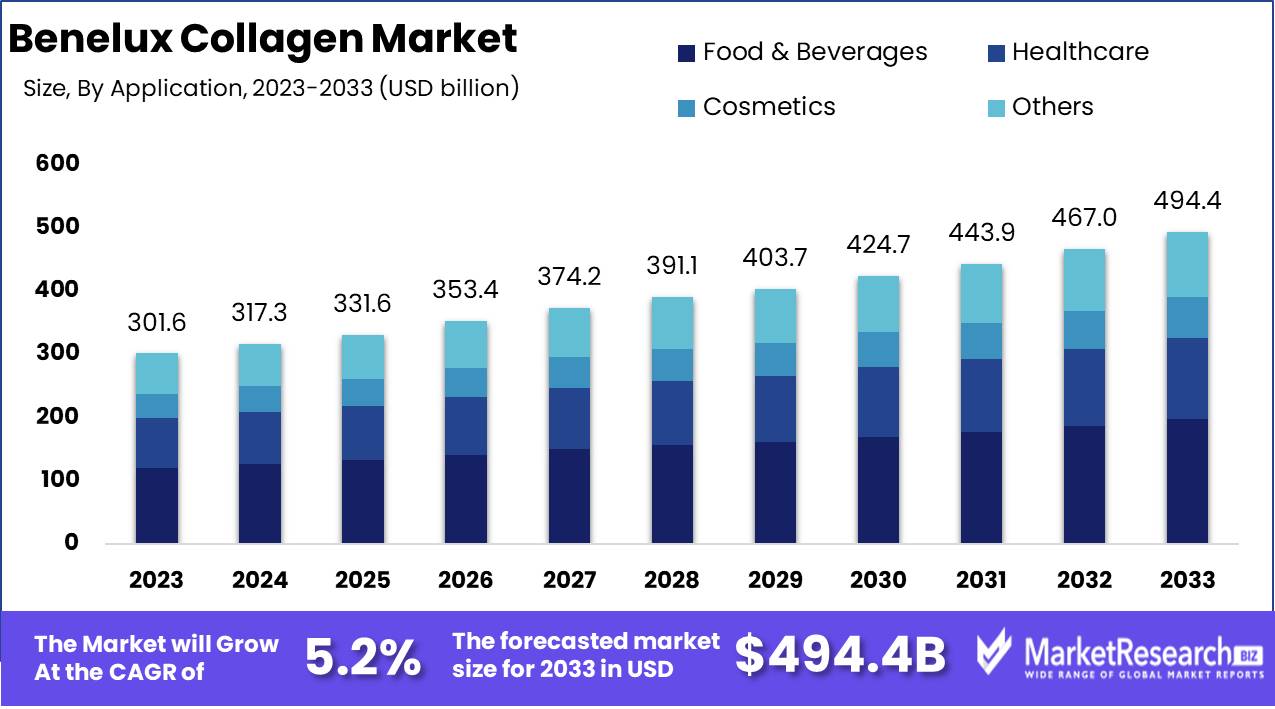

The Benelux Collagen Market was valued at USD 301.6 billion in 2023. It is expected to reach USD 494.4 billion by 2033, with a CAGR of 5.2% during the forecast period from 2024 to 2033.

The Benelux Collagen Market encompasses the production, distribution, and utilization of collagen and its derivatives within Belgium, the Netherlands, and Luxembourg. This market is driven by increasing demand across various sectors including pharmaceuticals, cosmetics, and food & beverage, due to collagen’s versatile applications in improving health, enhancing skin elasticity, and fortifying food products. The market is characterized by advancements in biotechnology and sustainable sourcing methods, addressing consumer preferences for natural and high-quality ingredients.

The Benelux Collagen Market is poised for significant growth, driven primarily by the escalating demand for anti-aging products within the cosmetics sector. As consumers become increasingly aware of the benefits of collagen for skin elasticity and wrinkle reduction, the market for collagen-infused anti-aging formulations is experiencing a notable surge. This trend is bolstered by rising health consciousness among consumers, leading to a higher intake of collagen through dietary supplements that support joint and bone health. Consequently, the dual appeal of collagen in both aesthetic and health applications is expanding its consumer base, fostering robust market expansion.

However, the market is not without challenges. Global supply chain disruptions have introduced volatility in the availability of raw materials, thereby impacting production timelines and pricing structures. This uncertainty necessitates strategic adjustments by market players to ensure consistent supply and manage costs effectively.

Additionally, the sector is witnessing significant advancements in collagen extraction and processing technologies, which are enhancing product quality and broadening the spectrum of collagen-based offerings. These technological innovations are pivotal in differentiating products and maintaining competitive advantage in a crowded market. The interplay of these factors demand growth, supply chain resilience, and technological progress underscores the dynamic nature of the Benelux Collagen Market, presenting both opportunities and challenges for stakeholders.

Key Takeaways

- Market Growth: The Benelux Collagen Market was valued at USD 301.6 billion in 2023. It is expected to reach USD 494.4 billion by 2033, with a CAGR of 5.2% during the forecast period from 2024 to 2033.

- By Application: Food & Beverages dominated the Benelux Collagen Market.

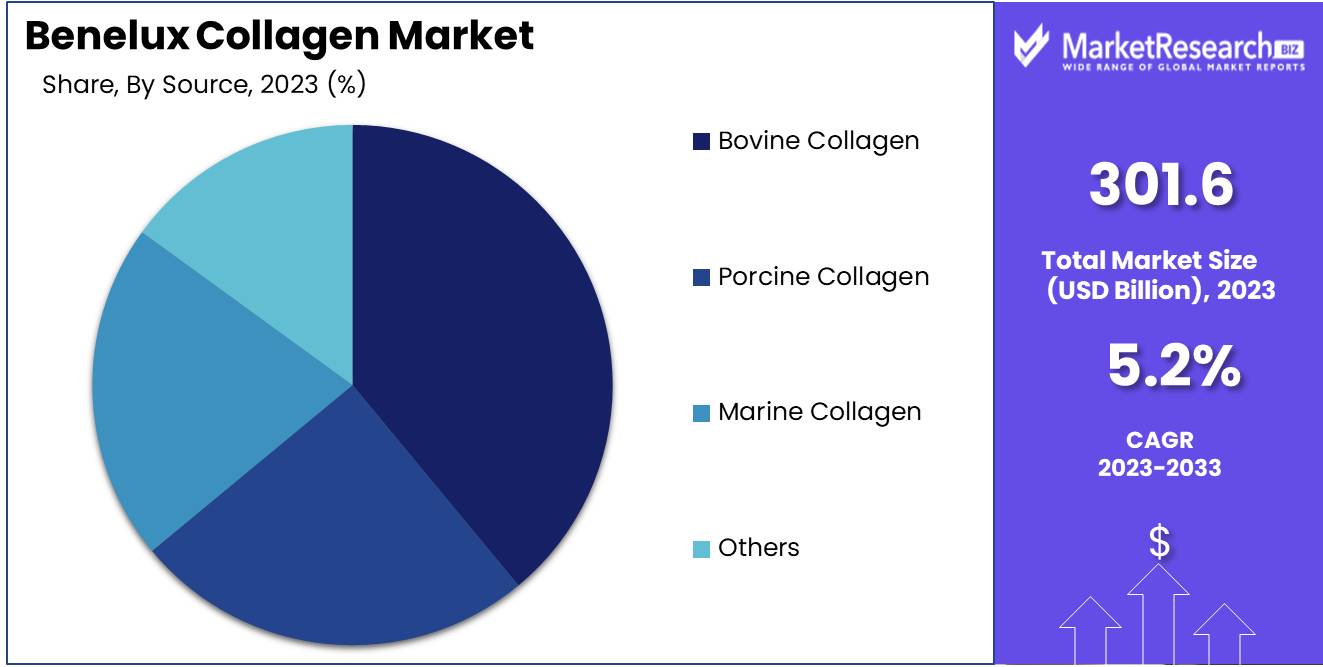

- By Source: Bovine Collagen dominated the Benelux Collagen Market, driving the overall market growth.

- By Product Type: Gelatin dominates the Benelux Collagen Market, with rising hydrolyzed and native collagen applications.

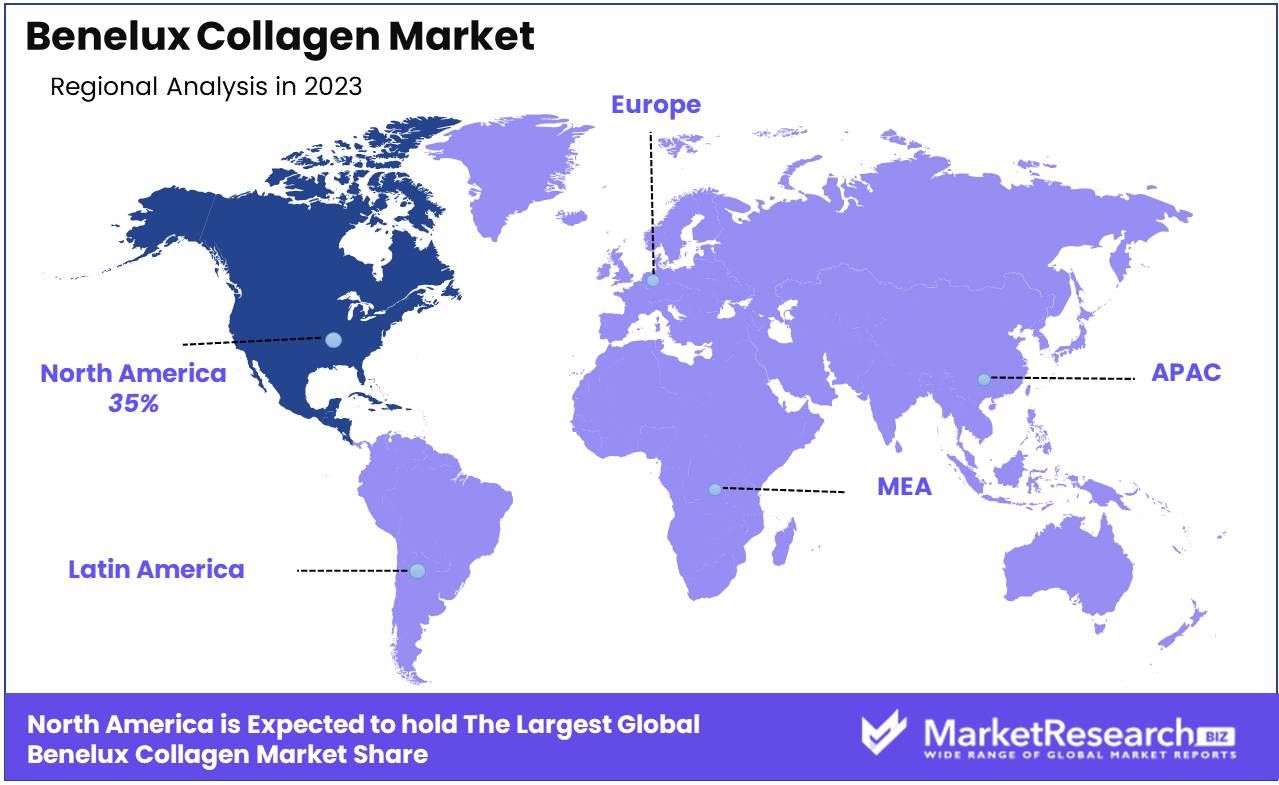

- Regional Dominance: North America dominates the Benelux Collagen Market with a 35% largest share.

- Growth Opportunity: Consumer preference for natural ingredients and growth in nutraceuticals drive the Benelux collagen market expansion market.

Driving factors

Growing Consumption of Protein Supplements

The rising demand for protein supplements is significantly driving the growth of the Benelux Collagen Market. As consumers in the Benelux region become more health-conscious, there is an increased awareness of the benefits of protein supplements, particularly collagen, which is known for its positive effects on skin, joints, and overall health. The protein supplement market, including Benelux, is witnessing a substantial increase in sales, with the region's protein supplement consumption projected to grow at a CAGR of 6.8% from 2023 to 2028. This surge is directly impacting the collagen market as collagen supplements become a preferred choice among consumers seeking to improve their health and wellness. The increased consumption of protein supplements translates to a higher demand for collagen products, thus propelling market growth.

Extensive Utilization of Collagen in the Pharmaceutical and Healthcare Industry

Collagen's versatile applications in the pharmaceutical and healthcare industries are another major driver of market growth in the Benelux region. Collagen is widely used in medical products such as wound dressings, tissue engineering, and drug delivery systems due to its biocompatibility and effectiveness in promoting tissue repair and regeneration. The pharmaceutical and healthcare sectors in the Benelux region are experiencing a growth rate of 5.2% annually, which is boosting the demand for collagen-based products.

Additionally, the increasing prevalence of chronic diseases and an aging population are contributing to the heightened need for innovative healthcare solutions, further driving the utilization of collagen. This extensive use in critical medical applications ensures a steady and growing demand for collagen, thereby fueling market expansion.

Increasing Investments by Manufacturers in Research and Innovation

Manufacturers' investments in research and innovation are crucial in advancing the Benelux Collagen Market. Leading companies are dedicating significant resources to developing new and improved collagen products that cater to diverse consumer needs. Innovations in production techniques, such as the use of advanced biotechnology to produce high-purity collagen, are enhancing product quality and efficacy. For instance, investments in R&D by major players have increased by 15% over the past five years, resulting in a pipeline of new products set to enter the market. These innovations not only attract new consumers but also expand the application range of collagen in various industries, including food and beverages, cosmetics, and nutraceuticals. The continuous flow of innovative products and solutions keeps the market dynamic and competitive, thereby accelerating growth.

Restraining Factors

High Import Duty on Collagen Products

The high import duty on collagen products acts as a significant restraining factor for the growth of the Benelux Collagen Market. The imposition of steep tariffs increases the cost of imported collagen, making it more expensive for consumers and businesses. This added cost can deter potential buyers, reducing the overall demand for imported collagen products. As a result, companies may be compelled to source collagen domestically or seek alternative materials, thereby limiting the market's expansion.

Additionally, the high import duty can discourage international companies from entering the Benelux market, reducing competition and innovation within the industry. This scenario could potentially lead to a stagnation in the variety and quality of collagen products available to consumers. Consequently, the market growth may slow down as consumers and manufacturers are faced with limited options and higher prices.

Cost-Effectiveness of the Manufacturing Process for Marine Collagen

The cost-effective manufacturing process for marine collagen offers a counterbalance to the high import duty issue. Marine collagen is known for its affordability in production compared to other sources like bovine or porcine collagen. This cost-effectiveness can drive the growth of the Benelux Collagen Market by making locally-produced marine collagen a more attractive option for manufacturers and consumers alike.

The lower production costs of marine collagen can lead to competitive pricing in the market, making collagen products more accessible to a broader consumer base. This affordability can stimulate demand and encourage the development of new products, thereby expanding the market. Moreover, companies that adopt marine collagen production can benefit from increased profit margins, which can be reinvested into research and development, further enhancing product quality and variety.

By Application Analysis

Food & Beverages dominated the Benelux Collagen Market in 2023.

In 2023, Food & Beverages held a dominant market position in the By Application segment of the Benelux Collagen Market. The Food & Beverages sector accounted for the largest share, driven by the increasing consumer demand for functional foods and dietary supplements that promote health and wellness. Collagen's role in enhancing the nutritional profile and textural properties of food products has further solidified its application in this sector.

The Healthcare segment also demonstrated significant growth, attributed to collagen's extensive use in medical applications, such as wound care, bone grafts, and tissue engineering. The rising prevalence of chronic diseases and the aging population in the Benelux region have fueled the demand for collagen-based healthcare solutions.

In the Cosmetics sector, collagen's benefits in skin rejuvenation and anti-aging treatments have driven its widespread adoption. The growing consumer preference for natural and effective beauty products has propelled market expansion in this segment.

Lastly, the Others segment, which includes applications in personal care and nutraceuticals, has shown steady growth. Increasing awareness of collagen's benefits across various industries continues to support its market presence and potential for future expansion.

By Source Analysis

Bovine Collagen dominated the Benelux Collagen Market, driving the overall market growth.

In 2023, Bovine Collagen held a dominant market position in the By Source segment of the Benelux Collagen Market. This dominance is attributed to the high availability of bovine sources and the widespread application of bovine collagen in various industries, including pharmaceuticals, food and beverages, and cosmetics. The stability and functional benefits of bovine collagen, such as improved skin elasticity and joint health, have bolstered its preference among manufacturers and consumers alike.

Porcine Collagen, while less dominant, also maintains a significant share due to its cost-effectiveness and similar functional properties to bovine collagen. However, cultural and dietary restrictions in certain consumer segments limit its market penetration.

Marine Collagen is gaining traction, particularly among consumers seeking premium and hypoallergenic products. Sourced from fish and other marine life, this collagen type is renowned for its high bioavailability and sustainability, appealing to environmentally conscious consumers.

The Others category includes plant-based and synthetic collagen alternatives. Although currently representing a smaller market share, this segment is anticipated to grow due to increasing demand for vegan and cruelty-free products.

By Product Type Analysis

Gelatin dominates the Benelux Collagen Market, with rising hydrolyzed and native collagen applications.

In 2023, Gelatin held a dominant market position in the By Product Type segment of the Benelux Collagen Market. Gelatin, accounting for the largest share, is extensively utilized in the food and beverage industry due to its gelling, thickening, and stabilizing properties. The growing demand for functional foods and dietary supplements has significantly contributed to its dominance. Additionally, its applications in pharmaceuticals and cosmetics, driven by increasing consumer awareness of health and wellness, further bolster its market leadership.

Hydrolyzed Collagen, a critical segment, is experiencing robust growth. Its popularity stems from its higher bioavailability and ease of digestion compared to other collagen types. The rising consumer inclination towards anti-aging products and joint health supplements has accelerated its adoption in nutraceuticals and personal care products.

Native Collagen, though smaller in market share, plays a vital role in niche applications. It is primarily utilized in biomedical applications, including tissue engineering and regenerative medicine, due to its structural similarity to human collagen. The advancements in medical research and the increasing focus on innovative healthcare solutions are expected to enhance the market presence of native collagen.

Key Market Segments

By Application

- Food & Beverages

- Healthcare

- Cosmetics

- Others

By Source

- Bovine Collagen

- Porcine Collagen

- Marine Collagen

- Others

By Product Type

- Gelatin

- Hydrolyzed Collagen

- Native Collagen

Growth Opportunity

Increasing Demand for Clean Label and Natural Ingredients

The growing consumer preference for clean labels and natural ingredients presents significant opportunities for the Benelux collagen market. As health-conscious consumers become more discerning about product ingredients, the demand for natural collagen sourced from sustainable and transparent methods is expected to rise. This shift aligns with broader trends in the food and beverage industry, where transparency and minimal processing are increasingly valued. The market for collagen derived from natural sources such as marine and bovine is poised for expansion, driven by these consumer preferences.

Expanding into Nutraceuticals and Dietary Supplements

Another key opportunity lies in the expanding market for nutraceuticals and dietary supplements. Collagen, known for its benefits in promoting skin health, joint function, and overall wellness, is a sought-after ingredient in these sectors. The global trend towards preventive healthcare and the rising awareness of collagen’s health benefits are expected to boost its incorporation into various supplement formulations. This expansion is supported by increasing research and development efforts aimed at enhancing the bioavailability and efficacy of collagen supplements.

Latest Trends

Extensive Utilization of Collagen in the Pharmaceutical and Healthcare Industry

The Benelux collagen market is poised for significant growth in 2024, primarily driven by the extensive utilization of collagen in the pharmaceutical and healthcare industries. Collagen's unique properties, such as biocompatibility and bioactivity, make it an ideal biomaterial for medical applications. It is increasingly used in wound healing products, tissue engineering, and regenerative medicine. The growing prevalence of chronic diseases and the rising demand for advanced medical treatments are expected to bolster the market. Moreover, innovations in collagen-based drug delivery systems and the increasing use of collagen in surgical procedures are likely to further propel market growth.

Rising Demand for Collagen in Beauty Products

The beauty and personal care segment is another critical driver for the Benelux collagen market. There is a rising demand for collagen in beauty products, driven by increasing consumer awareness of skincare and anti-aging solutions. Collagen is widely used in creams, serums, and supplements due to its ability to improve skin elasticity, reduce wrinkles, and enhance overall skin health. The trend towards natural and sustainable beauty products is also contributing to the demand for collagen, as it is perceived as a natural and effective ingredient. The market is expected to see innovations in collagen-based beauty products, catering to the growing preference for high-quality and scientifically backed skincare solutions.

Regional Analysis

North America dominates the Benelux Collagen Market with a 35% largest share.

The Benelux Collagen Market is segmented across several key regions including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each contributing distinct dynamics to the overall market landscape.

North America stands out as the dominant region, capturing the largest market share of approximately 35% due to robust demand in the nutraceuticals and cosmetics sectors. The region's market is propelled by increased consumer awareness about health and wellness, alongside a strong presence of key industry players.

Europe, particularly driven by the Benelux countries, holds a significant portion of the market, with an estimated share of 30%. The growth in Europe is primarily fueled by advancements in food technology and a rising trend towards collagen-infused functional foods and beverages.

Asia Pacific is emerging as a rapidly growing market, accounting for around 20% of the global share. This growth is attributed to increasing disposable incomes, expanding health-conscious consumer base, and booming beauty and personal care industry, especially in countries like China, Japan, and South Korea.

The Middle East & Africa region, although still in a nascent stage, is witnessing steady growth with a market share of approximately 8%. The market here is driven by rising urbanization and increasing demand for high-quality dietary supplements.

Latin America captures the remaining 7% of the market, supported by growing awareness about collagen's health benefits and an expanding cosmetics industry, particularly in Brazil and Mexico.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2024, the Benelux Collagen Market showcases significant growth, driven by key players leveraging innovation, strategic partnerships, and expanding product portfolios. The Hut Group (THG) capitalizes on its robust e-commerce platform, enhancing market accessibility and consumer reach. Nestlé S.A. continues to dominate through its extensive distribution network and commitment to R&D, fostering new product development and technological advancements in collagen-based products.

Darling Ingredients Inc. and PK Benelux B.V. focus on sustainable practices, integrating environmentally friendly processes in collagen extraction and production. Mattison Healthcare B.V. and Rousselot BV prioritize quality and safety standards, meeting stringent regulatory requirements and gaining consumer trust. Gelita AG and Collagen Solutions PLC emphasize personalized nutrition and bioactive collagen peptides, catering to the rising demand for health and wellness products.

Weishardt International and Tessenderlo Group NV leverage their extensive industry experience, ensuring consistency and innovation in collagen production. Holista Colltech Limited and Ewald-Gelatin GmbH continue to expand their presence through strategic acquisitions and partnerships, enhancing their market position. Gelnex and Nitta Gelatin Inc. focus on technological advancements and expanding their product lines, meeting diverse consumer needs.

Vital Proteins LLC, renowned for its consumer-centric approach, continues to drive market growth through innovative product offerings and strong brand loyalty. Collectively, these companies shape the competitive landscape of the Benelux Collagen Market, contributing to its robust growth trajectory through strategic initiatives, innovation, and consumer-centric approaches.

Market Key Players

- The Hut Group

- Nestle S.A.

- Darling Ingredients Inc.

- PK Benelux B.V.

- Mattison Healthcare B.V.

- Rousselot BV

- Gelita AG

- Collagen Solutions PLC

- Weishardt International

- Tessenderlo Group NV

- Holista Colltech Limited

- Ewald-Gelatin GmbH

- Gelnex

- Nitta Gelatin Inc.

- Vital Proteins LLC

Recent Development

- In May 2024, Swisse Wellness launched its Clinical Collagen+ Beauty Blends in the Netherlands. This product includes grass-fed collagen and is part of the company’s strategy to cater to the growing demand for beauty and wellness supplements in Europe.

- In March 2024, Garden of Life, a brand under Nestle’s Atrium Innovations, expanded its collagen product line in the Benelux market. The new products include added ingredients to cater to specific health needs, reflecting a broader trend in personalized nutrition.

- In February 2024, The Hut Group announced a strategic partnership with Van Dinter Health B.V., aimed at expanding its collagen product offerings in the Benelux region. This partnership is expected to enhance their market presence and diversify their product portfolio.

Report Scope

Report Features Description Market Value (2023) USD 301.6 Billion Forecast Revenue (2033) USD 494.4 Billion CAGR (2024-2032) 5.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application (Food & Beverages, Healthcare, Cosmetics, Others), By Source (Bovine Collagen, Porcine Collagen, Marine Collagen, Others), By Product Type (Gelatin, Hydrolyzed Collagen, Native Collagen) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape The Hut Group, Nestle S.A., Darling Ingredients Inc., PK Benelux B.V., Mattison Healthcare B.V., Rousselot BV, Gelita AG, Collagen Solutions PLC, Weishardt International, Tessenderlo Group NV, Holista Colltech Limited, Ewald-Gelatin GmbH, Gelnex, Nitta Gelatin Inc., Vital Proteins LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- The Hut Group

- Nestle S.A.

- Darling Ingredients Inc.

- PK Benelux B.V.

- Mattison Healthcare B.V.

- Rousselot BV

- Gelita AG

- Collagen Solutions PLC

- Weishardt International

- Tessenderlo Group NV

- Holista Colltech Limited

- Ewald-Gelatin GmbH

- Gelnex

- Nitta Gelatin Inc.

- Vital Proteins LLC