Bamboos Market By End User (Construction, Furniture, Paper and Pulp, Textile, Medical, and Agriculture), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

1917

-

May 2023

-

182

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

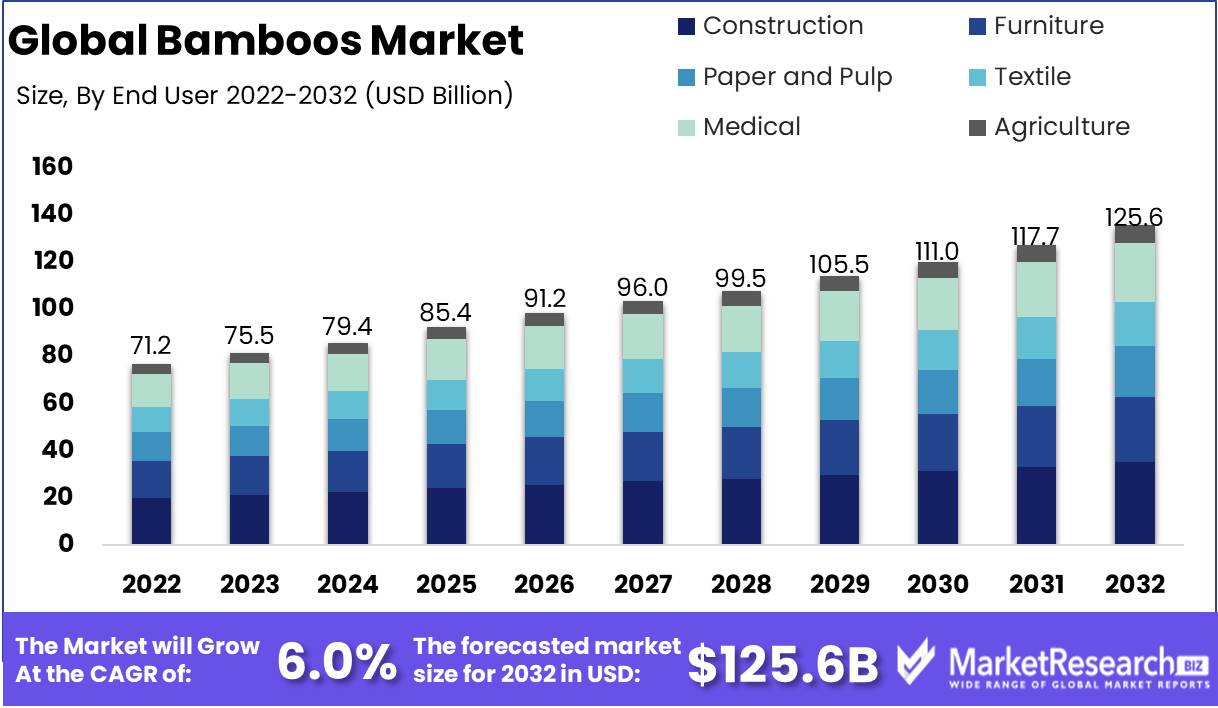

Bamboos Market size is expected to be worth around USD 125.6 Bn by 2032 from USD 71.2 Bn in 2022, growing at a CAGR of 6% during the forecast period from 2023 to 2032.

Due to the growing awareness and importance of natural and sustainable products, the global Bamboos Market has become an industry standard. There are countless applications for bamboo, including construction, textiles, cosmetics, and furniture. The market overview of Bamboos reveals that the growth of the market is driven by a number of factors, such as the growing emphasis on sustainability, the demand for non-toxic and eco-friendly products, and the development of innovative technologies that make Bamboo products more durable and long-lasting.

Bamboo is a versatile and environmentally benign material that has found widespread application in a variety of industries. It is not only a robust and resilient material, but also a rapidly growing and renewable resource. In response to the growing demand for sustainable and eco-friendly products, Bamboo has emerged as an industry of choice in numerous sectors. Therefore, the Bamboos market refers to Bamboos Market-related goods and services.

The primary objective of the Bamboos market is to offer an eco-friendly and sustainable alternative to conventional products. The market intends to promote Bamboo products as a viable and environmentally responsible option for consumers and businesses. The market seeks to stimulate demand for Bamboo goods and services, thereby promoting the expansion and growth of the industry.

The Bamboos market is significant because it offers an eco-friendly and sustainable alternative to conventional products. Bamboo is renewable, biodegradable, and requires fewer resources than other natural resources to grow and harvest. Bamboo products are also resilient and long-lasting, making them an economical choice for consumers and businesses.

In recent years, the Bamboos market has witnessed several noteworthy innovations. These include the development of new technologies that render Bamboo stronger, more durable, and more pest- and disease-resistant. There have also been advancements in the use of bamboo in industries such as cosmetics, textiles, and construction.

Multiple industries are investing in Bamboos Markets, recognizing the potential for eco-friendly and sustainable products. Among these industries are construction, textiles, furniture, and personal care products, among others. Bamboos Market products is ripe with opportunities for industries seeking to invest in sustainability and environmental tolerance.

Driving factors

Environmental Awareness Fuels the Growth

The Bamboo market has emerged as a shining beacon of hope in a world increasingly concerned with environmental sustainability. The intricate web of factors driving this market to unprecedented heights is deciphered by market.us in a thorough research report. From shifting consumer preferences to global environmental concerns, let's examine the enthralling complexities propelling the rise in demand for bamboo, which range from shifting consumer preferences to global environmental concerns.

The Appeal of Bamboo in a Changing World

Increasing interest in sustainable materials and bamboo products is one of the factors propelling the expansion of the Bamboo market. With a greater awareness of our impact on the planet, consumers are pursuing eco-friendly alternatives in all aspects of their lives. The extraordinary properties of bamboo have captivated their attention. This renewable resource offers a plethora of eco-friendly advantages, such as rapid growth, durability, and natural biodegradability.

The importance of bamboo in construction

Increasing demand for eco-friendly building materials has paved the way for bamboo's astounding ascent. As the manufacturing and construction industry embraces sustainability, bamboo has become architects' and constructors' material of choice. Its extraordinary tensile strength, pliability, and capacity for carbon sequestration make it an ideal alternative to conventional materials. Each time a bamboo structure is erected, Bamboos Market grows, fueled by the evolution of sustainable building practices.

Textiles and Clothing Made of Bamboo

The pursuit of sustainability is transforming consumer preferences in the fashion industry. Bamboo textiles and apparel have captured the attention of eco-conscious and comfortable fashionistas. Bamboo fibers are naturally breathable, moisture-wicking, and antibacterial. As the fashion industry embraces this natural marvel, the Bamboo market experiences a substantial increase, fueled by the allure of fashionable, eco-friendly apparel.

Bamboo's Wellness Benefits

Growing awareness of the health advantages of bamboo is another factor propelling the thriving Bamboo market. Consumers are drawn to toiletries and cosmetics derived from bamboo in an increasingly health-conscious society. Bamboo is a desirable ingredient for natural and organic products due to its antibacterial and anti-inflammatory properties and its organic nature. As health-conscious individuals seek holistic alternatives, the demand for bamboo-based health and wellness products continues to skyrocket, driving the Bamboo market to further expansion.

Restraining Factors

High-Quality Bamboo Inventories

Obviously, the primary source material for the bamboo industry is bamboo. The grade of the bamboo used in the manufacturing process has a significant impact on the ultimate product's quality. However, the availability of high-quality bamboo is limited, especially in countries where bamboo grows in abundance. This necessitates the importation of high-quality bamboo from other countries, which considerably increases production costs. The absence of standards and regulations in the bamboo industry also means there is no assurance of quality, resulting in a gradual decline in product quality.

Transport and Distribution Expenses

Because bamboo is a relatively weighty and bulky material, transporting and disseminating bamboo products can pose significant obstacles. In some instances, the transportation and distribution costs for these goods can be comparable to their production costs. This necessitates substantial investments in transportation and distribution logistics, which reduces manufacturers' profit margins. In addition, the limited availability of bamboo products in some regions can make it more difficult for consumers to obtain these items, which can reduce demand and ultimately hinder the development of the industry.

Alternatives to Conventional Products

The bamboo industry has positioned itself as an environmentally preferable alternative to conventional materials such as wood, plastic, and metal. Demand for bamboo-based products is still relatively low, despite the increasing popularity of eco-friendly products. In addition to environmental concerns, consumers are concerned with the quality and longevity of the products they purchase. Due to concerns regarding product quality, durability, and lack of design variety, many consumers still prefer conventional products over those made from bamboo.

Absence of a Regulatory Structure

The absence of a regulatory framework is a significant obstacle for the global bamboo industry. The bamboo industry is still in its infancy, and there is no regulatory framework in place to govern the sector. This makes it difficult for producers to adhere to sustainable harvesting practices, which can have long-term effects on the environment. The regulatory bodies of governments play a crucial role in promoting sustainable bamboo harvesting practices and ensuring that the industry adheres to international standards and practices.

Competition from Synthetic Materials

Popularity of synthetic materials that mimic bamboo's properties has increased, posing formidable competition for the bamboo industry. These materials are frequently less expensive to manufacture, making them more accessible to consumers. In addition, their production is not subject to the same environmental scrutiny as bamboo, making them an attractive option for consumers seeking a more environmentally friendly alternative to conventional products. The growing prevalence of these materials poses a threat to the development and sustainability of the bamboo industry, which confronts an uphill battle to maintain market competitiveness.

End User Analysis

Due to its many advantages, the construction segment is dominating the bamboo market. Because of their strength, durability, and adaptability, bamboos are frequently used in the construction sector. The segment is utilized in flooring, walls, ceilings, roofing, and more. Bamboos have distinct qualities that make them stand out in construction. Pest- and disease-resistant, they have a high strength-to-weight ratio. Bamboos are also long-lived and resilient, making them suitable for sustainable construction. They're eco-friendly since they're renewable and biodegradable.

The construction segment of the bamboos market has been driven by its unique qualities and advantages. Consumers are choosing sustainable and eco-friendly products as they become more environmentally conscious. In this way, bamboos provide various advantages. They're a great alternative to non-renewable materials because they're renewable and biodegradable. Bamboos also provide construction materials a distinctive look and feel.

Key Market Segments

By End User

- Construction

- Furniture

- Paper and Pulp

- Textile

- Medical

- Agriculture

Growth Opportunity

Expanding Client Base

As consumers become more eco-conscious and interested in sustainable alternatives to traditional materials, bamboo's customer base continues to grow. Numerous advantages, such as its rapid development rate and durability, make bamboo an attractive material for a variety of applications. Bamboo is a versatile material that appeals to consumers across numerous industries, including furniture, flooring, and apparel.

Online Visibility

The rise of e-commerce has contributed to the expansion of the bamboo industry. With more consumers than ever before purchasing online, bamboo businesses have the chance to reach a larger audience and increase sales. This requires a robust online presence, including an easily navigable and search engine-optimized website. By investing in digital marketing and social media advertising, bamboo companies can further expand their reach.

Differentiation of Brands

Diversification of brands is an additional crucial factor in the expansion of the bamboo market. As the use of bamboo expands into new industries, businesses must differentiate themselves from the competition. This can be accomplished through product innovation, distinctive marketing campaigns, and strategic alliances with other companies.

Global Collaborations

By forming strategic alliances with businesses from around the globe, bamboo companies can increase their consumer base and expand their market reach. This may involve collaborating with suppliers to ensure a constant supply of high-quality bamboo, or with other companies to offer novel products or services. As the bamboo market continues to expand, businesses that wish to remain competitive and expand their reach will find global partnerships to be of increasing importance.

Sustainability Emphasis

Lastly, the emphasis on sustainability is propelling the expansion of the bamboo market. As consumers become more environmentally conscious, they seek products that are sourced and produced sustainably. Bamboo is an extremely sustainable material due to its rapid development cycle and low environmental impact. Bamboo businesses can attract customers who value eco-friendly products by emphasizing their commitment to sustainability.

Latest Trends

An increasing renewable source

In recent years, bamboo, a renewable and rapidly-growing resource, has attracted worldwide attention. Its adaptability has led to the development of numerous bamboo-based products, including flooring, furniture, textiles, and even automobiles. With its many uses, bamboo has established itself as a sustainable and environmentally favorable alternative to conventional materials.

Utilizing Bamboo within Product Lines

Beyond its environmental benefits, bamboo's allure as a renewable resource extends further. In recent years, there has been a significant increase in interest in utilizing bamboo as a result of its affordability. Bamboo is being incorporated into the product categories of businesses from a variety of industries. This not only promotes sustainability but also provides cost reductions to consumers, making it a win-win situation for both enterprises and eco-conscious individuals.

From Cook to Serve

The increasing demand for kitchenware and dinnerware made from bamboo is driving the expansion of this market segment. Consumers are actively pursuing sustainable alternatives to plastic as environmental concerns increase. As a result of its durability and endurance, bamboo has become the material of choice for utensils, dishes, and bowls. Its eco-friendly properties and aesthetic allure make it an excellent option for those who value both style and sustainability.

Prosperity Cultivation

Bamboo is not only beneficial for the environment, but farmers and rural communities can also benefit greatly from it. The increasing interest in bamboo as a renewable resource has resulted in increased cultivation efforts, especially in China, India, and Indonesia. Small-scale producers seeking to diversify their income streams while promoting sustainable agricultural practices may consider bamboo cultivation.

Ethical Consumption Motivates the Bamboo Revolution

As consumers become more cognizant of their purchasing decisions, there is a rising demand for products that align with their values and beliefs. Individuals searching for ethical alternatives to conventional materials such as plastic and wood have favored bamboo due to its eco-friendly properties. The transition towards conscious consumerism is boosting interest in bamboo products, driving market expansion and promoting sustainable practices.

Advances in Technology

The development of bamboo processing and manufacturing techniques is facilitating the production of a wide variety of products. As technology advances, new and innovative bamboo-based products are being created, and existing products are becoming more sustainable and cost-effective. This convergence of technology and sustainability is not only beneficial to the environment, but it also stimulates economic development, creating a bright future for the bamboo market.

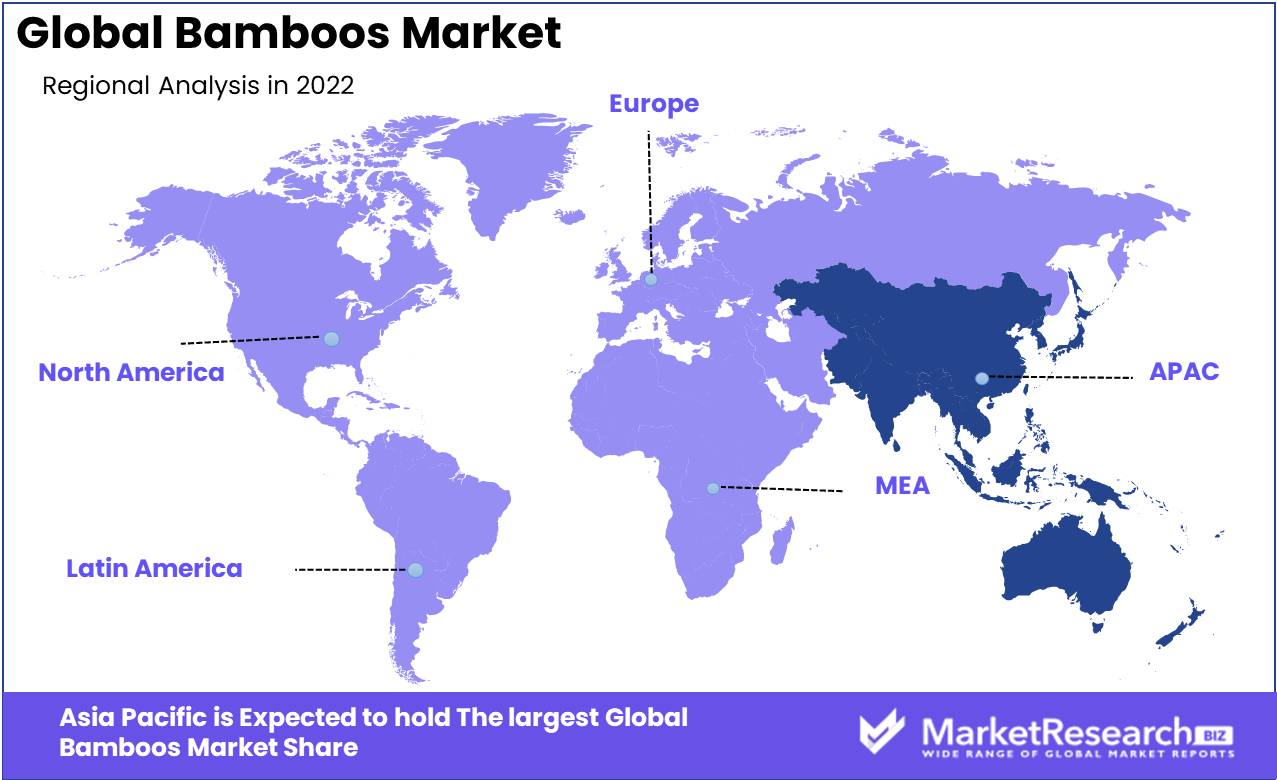

Regional Analysis

We would like to share with you the recent trends and projected growth of the global bamboos market, with a focus on the Asia-Pacific region's market share and revenue dominance. The bamboos industry has grown consistently over the years as a result of its numerous implementations in numerous industries. The versatility of bamboo makes it a valuable resource on the market, as it can be used for home decor, construction, agriculture, handicrafts, and furniture.

Bamboos are a rapidly expanding, renewable resource with exceptional strength and durability, making them a desirable material for a variety of applications. The considerable growth of the bamboos market can be attributed to the increasing awareness of eco-friendly materials and the growing demand for sustainable products.

The Asia-Pacific region holds the highest market share and is anticipated to maintain its market dominance throughout the forecast period. The region's dominance is attributable to the abundant availability of bamboos and the high demand for bamboo-based products in numerous industries, such as construction, agriculture, and manufacturing. China is the dominant producer and exporter of bamboos, representing more than fifty percent of the global market. India, Vietnam, and Indonesia are three additional significant actors in the Asia-Pacific.

In the agricultural sector, bamboo is extensively used to produce bamboo stalks, a delicacy in many Asian countries. Bamboo fiber is also used to produce eco-friendly and biodegradable products, such as plates, glasses, and silverware.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Construction, furniture, and packaging are just a few of the many industries that have utilized bamboos. In the future years, the global bamboo market is anticipated to expand due to the rising demand for eco-friendly and sustainable products. Moso International BV, Shanghai Tenbro Bamboo Textile Co. Ltd., Jiangxi Feiyu Industry Co. Ltd., Bamboo Village Company Limited, Fujian Hong Bamboo Trading Co. Ltd., EcoPlanet Bamboo, Smith & Fong Co., Bamboo Revolution SA, Teragren LLC, and Jiangxi Kangda Bamboo Ware Group Co. Ltd. are key players in the bamboo market.

Moso International BV is the market leader in bamboo flooring. The company is renowned for its eco-friendly and long-lasting bamboo flooring products of superior quality. Shanghai Tenbro Bamboo Textile Co., Ltd. is an industry leader in bamboo textiles. The company produces bamboo fiber for use in the production of wash towels, bed linens, and other textiles.

Bamboo Village Company Limited dominates Bamboos Market furnishings. It manufactures a variety of furniture, including chairs, tables, and cabinetry, from bamboo as its primary basic material. Fujian Hong Bamboo Trading Co., Ltd. is an additional well-known participant in the bamboo market, specializing in the production of bamboo utensils and other disposable products.

EcoPlanet Bamboo is a sustainable forestry business specializing in bamboo cultivation. They collaborate with local communities to cultivate bamboo plantations, which yield sustainable, eco-friendly materials ideal for the construction, furniture, and textile industries. Smith & Fong Co. is a prominent provider of bamboo plywood, manufacturing high-quality products suitable for use in furniture, cabinetry, and interior design.

Top Key Players in Bamboos Market

- Kerala State Bamboo Corporation Ltd.

- Jiangxi Feiyu Industry Co. Ltd.

- Dasso Industrial Group Co., Ltd.

- Xingli Bamboo Products Company

- China Bambro Textile Company Limited

- Fujian Jianou Huayu Bamboo Industry Co., Ltd.

- Tengda Bamboo-Wood Co.

- Jiangxi Kangda Bamboo Ware Group Co.

- Moso International B.V.

- Bamboo Australia Pty Ltd.

Recent Development

- 2022: Moso International BV and Bestseller collaborate to create an eco-friendly textile called Bamboo Movement.

- 2022: EcoPlanet Bamboo and Unilever partner to create a sustainable supply chain for their products.

- 2022: Smith & Fong merges with USFloors to offer more sustainable flooring options.

- 2023: Bamboo Technologies and HEBI Robotics create a bamboo-based robot arm.

Report Scope:

Report Features Description Market Value (2022) USD 71.2 Bn Forecast Revenue (2032) USD 125.6 Bn CAGR (2023-2032) 6% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By End User (Construction, Furniture, Paper and Pulp, Textile, Medical, and Agriculture) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Kerala State Bamboo Corporation Ltd., Jiangxi Feiyu Industry Co. Ltd., Dasso Industrial Group Co., Ltd., Xingli Bamboo Products Company, China Bambro Textile Company Limited, Fujian Jianou Huayu Bamboo Industry Co., Ltd., Tengda Bamboo-Wood Co., Jiangxi Kangda Bamboo Ware Group Co., Moso International B.V., Bamboo Australia Pty Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Bamboos Market Overview

- 2.1. Bamboos Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Bamboos Market Dynamics

- 3. Global Bamboos Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Bamboos Market Analysis, 2016-2021

- 3.2. Global Bamboos Market Opportunity and Forecast, 2023-2032

- 3.3. Global Bamboos Market Analysis, Opportunity and Forecast, By By End User, 2016-2032

- 3.3.1. Global Bamboos Market Analysis by By End User: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End User, 2016-2032

- 3.3.3. Construction

- 3.3.4. Furniture

- 3.3.5. Paper and Pulp

- 3.3.6. Textile

- 3.3.7. Medical

- 3.3.8. Agriculture

- 4. North America Bamboos Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Bamboos Market Analysis, 2016-2021

- 4.2. North America Bamboos Market Opportunity and Forecast, 2023-2032

- 4.3. North America Bamboos Market Analysis, Opportunity and Forecast, By By End User, 2016-2032

- 4.3.1. North America Bamboos Market Analysis by By End User: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End User, 2016-2032

- 4.3.3. Construction

- 4.3.4. Furniture

- 4.3.5. Paper and Pulp

- 4.3.6. Textile

- 4.3.7. Medical

- 4.3.8. Agriculture

- 4.4. North America Bamboos Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.4.1. North America Bamboos Market Analysis by Country : Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.4.2.1. The US

- 4.4.2.2. Canada

- 4.4.2.3. Mexico

- 5. Western Europe Bamboos Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Bamboos Market Analysis, 2016-2021

- 5.2. Western Europe Bamboos Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Bamboos Market Analysis, Opportunity and Forecast, By By End User, 2016-2032

- 5.3.1. Western Europe Bamboos Market Analysis by By End User: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End User, 2016-2032

- 5.3.3. Construction

- 5.3.4. Furniture

- 5.3.5. Paper and Pulp

- 5.3.6. Textile

- 5.3.7. Medical

- 5.3.8. Agriculture

- 5.4. Western Europe Bamboos Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.4.1. Western Europe Bamboos Market Analysis by Country : Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.4.2.1. Germany

- 5.4.2.2. France

- 5.4.2.3. The UK

- 5.4.2.4. Spain

- 5.4.2.5. Italy

- 5.4.2.6. Portugal

- 5.4.2.7. Ireland

- 5.4.2.8. Austria

- 5.4.2.9. Switzerland

- 5.4.2.10. Benelux

- 5.4.2.11. Nordic

- 5.4.2.12. Rest of Western Europe

- 6. Eastern Europe Bamboos Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Bamboos Market Analysis, 2016-2021

- 6.2. Eastern Europe Bamboos Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Bamboos Market Analysis, Opportunity and Forecast, By By End User, 2016-2032

- 6.3.1. Eastern Europe Bamboos Market Analysis by By End User: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End User, 2016-2032

- 6.3.3. Construction

- 6.3.4. Furniture

- 6.3.5. Paper and Pulp

- 6.3.6. Textile

- 6.3.7. Medical

- 6.3.8. Agriculture

- 6.4. Eastern Europe Bamboos Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.4.1. Eastern Europe Bamboos Market Analysis by Country : Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.4.2.1. Russia

- 6.4.2.2. Poland

- 6.4.2.3. The Czech Republic

- 6.4.2.4. Greece

- 6.4.2.5. Rest of Eastern Europe

- 7. APAC Bamboos Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Bamboos Market Analysis, 2016-2021

- 7.2. APAC Bamboos Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Bamboos Market Analysis, Opportunity and Forecast, By By End User, 2016-2032

- 7.3.1. APAC Bamboos Market Analysis by By End User: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End User, 2016-2032

- 7.3.3. Construction

- 7.3.4. Furniture

- 7.3.5. Paper and Pulp

- 7.3.6. Textile

- 7.3.7. Medical

- 7.3.8. Agriculture

- 7.4. APAC Bamboos Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.4.1. APAC Bamboos Market Analysis by Country : Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.4.2.1. China

- 7.4.2.2. Japan

- 7.4.2.3. South Korea

- 7.4.2.4. India

- 7.4.2.5. Australia & New Zeland

- 7.4.2.6. Indonesia

- 7.4.2.7. Malaysia

- 7.4.2.8. Philippines

- 7.4.2.9. Singapore

- 7.4.2.10. Thailand

- 7.4.2.11. Vietnam

- 7.4.2.12. Rest of APAC

- 8. Latin America Bamboos Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Bamboos Market Analysis, 2016-2021

- 8.2. Latin America Bamboos Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Bamboos Market Analysis, Opportunity and Forecast, By By End User, 2016-2032

- 8.3.1. Latin America Bamboos Market Analysis by By End User: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End User, 2016-2032

- 8.3.3. Construction

- 8.3.4. Furniture

- 8.3.5. Paper and Pulp

- 8.3.6. Textile

- 8.3.7. Medical

- 8.3.8. Agriculture

- 8.4. Latin America Bamboos Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.4.1. Latin America Bamboos Market Analysis by Country : Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.4.2.1. Brazil

- 8.4.2.2. Colombia

- 8.4.2.3. Chile

- 8.4.2.4. Argentina

- 8.4.2.5. Costa Rica

- 8.4.2.6. Rest of Latin America

- 9. Middle East & Africa Bamboos Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Bamboos Market Analysis, 2016-2021

- 9.2. Middle East & Africa Bamboos Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Bamboos Market Analysis, Opportunity and Forecast, By By End User, 2016-2032

- 9.3.1. Middle East & Africa Bamboos Market Analysis by By End User: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End User, 2016-2032

- 9.3.3. Construction

- 9.3.4. Furniture

- 9.3.5. Paper and Pulp

- 9.3.6. Textile

- 9.3.7. Medical

- 9.3.8. Agriculture

- 9.4. Middle East & Africa Bamboos Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.4.1. Middle East & Africa Bamboos Market Analysis by Country : Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.4.2.1. Algeria

- 9.4.2.2. Egypt

- 9.4.2.3. Israel

- 9.4.2.4. Kuwait

- 9.4.2.5. Nigeria

- 9.4.2.6. Saudi Arabia

- 9.4.2.7. South Africa

- 9.4.2.8. Turkey

- 9.4.2.9. The UAE

- 9.4.2.10. Rest of MEA

- 10. Global Bamboos Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Bamboos Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Bamboos Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Kerala State Bamboo Corporation Ltd.

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Jiangxi Feiyu Industry Co. Ltd.

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Dasso Industrial Group Co., Ltd.

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Xingli Bamboo Products Company

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. China Bambro Textile Company Limited

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Fujian Jianou Huayu Bamboo Industry Co., Ltd.

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Tengda Bamboo-Wood Co.

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Jiangxi Kangda Bamboo Ware Group Co.

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Moso International B.V.

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Bamboo Australia Pty Ltd.

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- List of Figures

- Figure 1: Global Bamboos Market Revenue (US$ Mn) Market Share by By End User in 2022

- Figure 2: Global Bamboos Market Attractiveness Analysis by By End User, 2016-2032

- Figure 3: Global Bamboos Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 4: Global Bamboos Market Attractiveness Analysis by Region, 2016-2032

- Figure 5: Global Bamboos Market Revenue (US$ Mn) (2016-2032)

- Figure 6: Global Bamboos Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 7: Global Bamboos Market Revenue (US$ Mn) Comparison by By End User (2016-2032)

- Figure 8: Global Bamboos Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 9: Global Bamboos Market Y-o-Y Growth Rate Comparison by By End User (2016-2032)

- Figure 10: Global Bamboos Market Share Comparison by Region (2016-2032)

- Figure 11: Global Bamboos Market Share Comparison by By End User (2016-2032)

- Figure 12: North America Bamboos Market Revenue (US$ Mn) Market Share by By End Userin 2022

- Figure 13: North America Bamboos Market Attractiveness Analysis by By End User, 2016-2032

- Figure 14: North America Bamboos Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 15: North America Bamboos Market Attractiveness Analysis by Country, 2016-2032

- Figure 16: North America Bamboos Market Revenue (US$ Mn) (2016-2032)

- Figure 17: North America Bamboos Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 18: North America Bamboos Market Revenue (US$ Mn) Comparison by By End User (2016-2032)

- Figure 19: North America Bamboos Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 20: North America Bamboos Market Y-o-Y Growth Rate Comparison by By End User (2016-2032)

- Figure 21: North America Bamboos Market Share Comparison by Country (2016-2032)

- Figure 22: North America Bamboos Market Share Comparison by By End User (2016-2032)

- Figure 23: Western Europe Bamboos Market Revenue (US$ Mn) Market Share by By End Userin 2022

- Figure 24: Western Europe Bamboos Market Attractiveness Analysis by By End User, 2016-2032

- Figure 25: Western Europe Bamboos Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 26: Western Europe Bamboos Market Attractiveness Analysis by Country, 2016-2032

- Figure 27: Western Europe Bamboos Market Revenue (US$ Mn) (2016-2032)

- Figure 28: Western Europe Bamboos Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 29: Western Europe Bamboos Market Revenue (US$ Mn) Comparison by By End User (2016-2032)

- Figure 30: Western Europe Bamboos Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 31: Western Europe Bamboos Market Y-o-Y Growth Rate Comparison by By End User (2016-2032)

- Figure 32: Western Europe Bamboos Market Share Comparison by Country (2016-2032)

- Figure 33: Western Europe Bamboos Market Share Comparison by By End User (2016-2032)

- Figure 34: Eastern Europe Bamboos Market Revenue (US$ Mn) Market Share by By End Userin 2022

- Figure 35: Eastern Europe Bamboos Market Attractiveness Analysis by By End User, 2016-2032

- Figure 36: Eastern Europe Bamboos Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 37: Eastern Europe Bamboos Market Attractiveness Analysis by Country, 2016-2032

- Figure 38: Eastern Europe Bamboos Market Revenue (US$ Mn) (2016-2032)

- Figure 39: Eastern Europe Bamboos Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 40: Eastern Europe Bamboos Market Revenue (US$ Mn) Comparison by By End User (2016-2032)

- Figure 41: Eastern Europe Bamboos Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 42: Eastern Europe Bamboos Market Y-o-Y Growth Rate Comparison by By End User (2016-2032)

- Figure 43: Eastern Europe Bamboos Market Share Comparison by Country (2016-2032)

- Figure 44: Eastern Europe Bamboos Market Share Comparison by By End User (2016-2032)

- Figure 45: APAC Bamboos Market Revenue (US$ Mn) Market Share by By End Userin 2022

- Figure 46: APAC Bamboos Market Attractiveness Analysis by By End User, 2016-2032

- Figure 47: APAC Bamboos Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 48: APAC Bamboos Market Attractiveness Analysis by Country, 2016-2032

- Figure 49: APAC Bamboos Market Revenue (US$ Mn) (2016-2032)

- Figure 50: APAC Bamboos Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 51: APAC Bamboos Market Revenue (US$ Mn) Comparison by By End User (2016-2032)

- Figure 52: APAC Bamboos Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 53: APAC Bamboos Market Y-o-Y Growth Rate Comparison by By End User (2016-2032)

- Figure 54: APAC Bamboos Market Share Comparison by Country (2016-2032)

- Figure 55: APAC Bamboos Market Share Comparison by By End User (2016-2032)

- Figure 56: Latin America Bamboos Market Revenue (US$ Mn) Market Share by By End Userin 2022

- Figure 57: Latin America Bamboos Market Attractiveness Analysis by By End User, 2016-2032

- Figure 58: Latin America Bamboos Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 59: Latin America Bamboos Market Attractiveness Analysis by Country, 2016-2032

- Figure 60: Latin America Bamboos Market Revenue (US$ Mn) (2016-2032)

- Figure 61: Latin America Bamboos Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 62: Latin America Bamboos Market Revenue (US$ Mn) Comparison by By End User (2016-2032)

- Figure 63: Latin America Bamboos Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 64: Latin America Bamboos Market Y-o-Y Growth Rate Comparison by By End User (2016-2032)

- Figure 65: Latin America Bamboos Market Share Comparison by Country (2016-2032)

- Figure 66: Latin America Bamboos Market Share Comparison by By End User (2016-2032)

- Figure 67: Middle East & Africa Bamboos Market Revenue (US$ Mn) Market Share by By End Userin 2022

- Figure 68: Middle East & Africa Bamboos Market Attractiveness Analysis by By End User, 2016-2032

- Figure 69: Middle East & Africa Bamboos Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 70: Middle East & Africa Bamboos Market Attractiveness Analysis by Country, 2016-2032

- Figure 71: Middle East & Africa Bamboos Market Revenue (US$ Mn) (2016-2032)

- Figure 72: Middle East & Africa Bamboos Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 73: Middle East & Africa Bamboos Market Revenue (US$ Mn) Comparison by By End User (2016-2032)

- Figure 74: Middle East & Africa Bamboos Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 75: Middle East & Africa Bamboos Market Y-o-Y Growth Rate Comparison by By End User (2016-2032)

- Figure 76: Middle East & Africa Bamboos Market Share Comparison by Country (2016-2032)

- Figure 77: Middle East & Africa Bamboos Market Share Comparison by By End User (2016-2032)

- List of Tables

- Table 1: Global Bamboos Market Comparison by By End User (2016-2032)

- Table 2: Global Bamboos Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 3: Global Bamboos Market Revenue (US$ Mn) (2016-2032)

- Table 4: Global Bamboos Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 5: Global Bamboos Market Revenue (US$ Mn) Comparison by By End User (2016-2032)

- Table 6: Global Bamboos Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 7: Global Bamboos Market Y-o-Y Growth Rate Comparison by By End User (2016-2032)

- Table 8: Global Bamboos Market Share Comparison by Region (2016-2032)

- Table 9: Global Bamboos Market Share Comparison by By End User (2016-2032)

- Table 10: North America Bamboos Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 11: North America Bamboos Market Revenue (US$ Mn) (2016-2032)

- Table 12: North America Bamboos Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 13: North America Bamboos Market Revenue (US$ Mn) Comparison by By End User (2016-2032)

- Table 14: North America Bamboos Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 15: North America Bamboos Market Y-o-Y Growth Rate Comparison by By End User (2016-2032)

- Table 16: North America Bamboos Market Share Comparison by Country (2016-2032)

- Table 17: North America Bamboos Market Share Comparison by By End User (2016-2032)

- Table 18: Western Europe Bamboos Market Comparison by By End User (2016-2032)

- Table 19: Western Europe Bamboos Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 20: Western Europe Bamboos Market Revenue (US$ Mn) (2016-2032)

- Table 21: Western Europe Bamboos Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 22: Western Europe Bamboos Market Revenue (US$ Mn) Comparison by By End User (2016-2032)

- Table 23: Western Europe Bamboos Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 24: Western Europe Bamboos Market Y-o-Y Growth Rate Comparison by By End User (2016-2032)

- Table 25: Western Europe Bamboos Market Share Comparison by Country (2016-2032)

- Table 26: Western Europe Bamboos Market Share Comparison by By End User (2016-2032)

- Table 27: Eastern Europe Bamboos Market Comparison by By End User (2016-2032)

- Table 28: Eastern Europe Bamboos Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 29: Eastern Europe Bamboos Market Revenue (US$ Mn) (2016-2032)

- Table 30: Eastern Europe Bamboos Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 31: Eastern Europe Bamboos Market Revenue (US$ Mn) Comparison by By End User (2016-2032)

- Table 32: Eastern Europe Bamboos Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 33: Eastern Europe Bamboos Market Y-o-Y Growth Rate Comparison by By End User (2016-2032)

- Table 34: Eastern Europe Bamboos Market Share Comparison by Country (2016-2032)

- Table 35: Eastern Europe Bamboos Market Share Comparison by By End User (2016-2032)

- Table 36: APAC Bamboos Market Comparison by By End User (2016-2032)

- Table 37: APAC Bamboos Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 38: APAC Bamboos Market Revenue (US$ Mn) (2016-2032)

- Table 39: APAC Bamboos Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 40: APAC Bamboos Market Revenue (US$ Mn) Comparison by By End User (2016-2032)

- Table 41: APAC Bamboos Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 42: APAC Bamboos Market Y-o-Y Growth Rate Comparison by By End User (2016-2032)

- Table 43: APAC Bamboos Market Share Comparison by Country (2016-2032)

- Table 44: APAC Bamboos Market Share Comparison by By End User (2016-2032)

- Table 45: Latin America Bamboos Market Comparison by By End User (2016-2032)

- Table 46: Latin America Bamboos Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 47: Latin America Bamboos Market Revenue (US$ Mn) (2016-2032)

- Table 48: Latin America Bamboos Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 49: Latin America Bamboos Market Revenue (US$ Mn) Comparison by By End User (2016-2032)

- Table 50: Latin America Bamboos Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 51: Latin America Bamboos Market Y-o-Y Growth Rate Comparison by By End User (2016-2032)

- Table 52: Latin America Bamboos Market Share Comparison by Country (2016-2032)

- Table 53: Latin America Bamboos Market Share Comparison by By End User (2016-2032)

- Table 54: Middle East & Africa Bamboos Market Comparison by By End User (2016-2032)

- Table 55: Middle East & Africa Bamboos Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 56: Middle East & Africa Bamboos Market Revenue (US$ Mn) (2016-2032)

- Table 57: Middle East & Africa Bamboos Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 58: Middle East & Africa Bamboos Market Revenue (US$ Mn) Comparison by By End User (2016-2032)

- Table 59: Middle East & Africa Bamboos Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 60: Middle East & Africa Bamboos Market Y-o-Y Growth Rate Comparison by By End User (2016-2032)

- Table 61: Middle East & Africa Bamboos Market Share Comparison by Country (2016-2032)

- Table 62: Middle East & Africa Bamboos Market Share Comparison by By End User (2016-2032)

- 1. Executive Summary

-

- Kerala State Bamboo Corporation Ltd.

- Jiangxi Feiyu Industry Co. Ltd.

- Dasso Industrial Group Co., Ltd.

- Xingli Bamboo Products Company

- China Bambro Textile Company Limited

- Fujian Jianou Huayu Bamboo Industry Co., Ltd.

- Tengda Bamboo-Wood Co.

- Jiangxi Kangda Bamboo Ware Group Co.

- Moso International B.V.

- Bamboo Australia Pty Ltd.