Global Baby Stroller and Pram Market Analysis, Drivers, Restraints, Opportunities, Threats, Trends, Applications, and Growth Forecast to 2028

-

11709

-

May 2023

-

175

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Global Baby Stroller and Pram Market: Overview

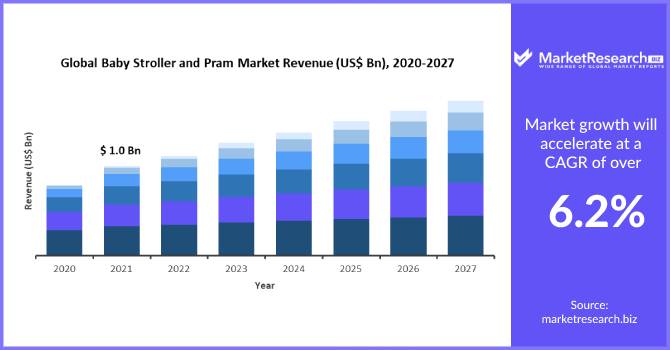

“The global Baby Stroller and Pram Market size is expected to be worth around US$ xx Billion by 2021 from US$ X.xx million in 2031, growing at a CAGR of X.x% during the forecast period 2021 to 2031.”

Baby stroller and pram also known as baby carriers are a type of transport designed to move a baby or a toddler around. A pram is used for carrying infants and strollers are used for carrying children until the age of three years. Baby stroller and pram are an efficient way to travel with children as it eliminates the need of carrying them all the time. Availability of various types of baby stroller, in different sizes, shapes, designs, and features are making consumers more inclined towards its usage.

Global Baby Stroller and Pram Market: Dynamics

Growing awareness regarding advantages of multifunctional baby strollers and prams, coupled with government safety regulation for carrying child safety is a major factor driving growth of the global baby stroller and pram market. In addition, baby strollers allow parents to perform daily chore while taking care of the baby is another factor fueling growth of the global market. Furthermore, strollers and pram protect the child from extreme weather conditions and UV light is a factor expected to support growth of the global baby stroller and pram market in the near future.

However, the high cost of raw materials of baby stroller and pram is a factor that may hamper growth of the global baby stroller and pram market. In addition, the lack of skilled workers is another factor that could affect growth of the global market. Nevertheless, the availability of cost-effective baby strollers with advance features can create high revenue opportunities for players in the target market.

Global Baby Stroller and Pram Market: Segment Analysis

Among the product type segments, the lightweight or umbrella stroller segment is expected to register lucrative growth in terms of revenue over the forecast period. Increasing adoption of lightweight or umbrella stroller as it is foldable and easy to fit into the trunk of the car. It also provides support for the child. These are some of the supporting growth of this segment in the global market.

Among the distribution channel segments, the online stores' segment is expected to register high growth in terms of revenue in the near future. Availability of various types of baby strollers and prams categorized according to the requirements of customer and price range, coupled with growing penetration of internet are factors supporting growth of this segment in the global market.

Global Baby Stroller and Pram Market: Regional Analysis

The market in Asia Pacific is expected to accounts for significant growth in terms of revenue over the forecast period. High birth rate, coupled with increasing disposable income among end users are factors driving growth of the target market in this region. I addition, growing e-commerce sector in developing countries is another factor anticipated to support growth of the baby stroller and pram market in Asia Pacific region. The market in North America and Europe is expected to register average growth in terms of revenue in the near future. Low birth rates in developed countries are anticipated to affect growth of the target market in these regions.

Global Baby Stroller and Pram Market Segmentation:

Segmentation by product type:

- Pram

- Sports Stroller

- Standard or Traditional Stroller

- Multi-child Stroller

- Infant or Toddler Stroller

- Lightweight or Umbrella Stroller

Segmentation by distribution channel:

- Supermarkets and Hypermarkets

- Specialized Stores

- Online Stores

Segmentation by region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Attribute Report Details Market Size Ask For Market Size Growth Rate Ask For Growth Rate Key Companies Ask For Companies Report Coverage Revenue analysis, Competitive landscape, Key company analysis, Market Trends, Key segments, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis and more… Historical Data Period 2015-2020 Base Year 2022 Forecast Period 2022-2031 Region Scope North America, Europe, Asia-Pacific, South America, Middle East & Africa Country Scope United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa Revenue in US$ Mn -

-

- Baby Jogger, LLC

- Dorel Industries Inc.

- Chicco

- Evenflo Company, Inc.

- Concord

- Combi USA, Inc.

- Graco Children's Products Inc.

- Baby Trend Inc.

- Mamas & Papas Ltd.

- Stokke AS