Autonomous Last Mile Delivery Market By Application(Retail, Logistics, Food and Beverage, Others), By Solution(Hardware, Software, Services), By Range(Short Range, Long Range), By Vehicle Type(Ground Delivery Bots, Aerial Delivery Drones), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

42586

-

May 2024

-

300

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Key Takeaways

- Driving factors

- Restraining Factors

- By Application Analysis

- By Solution Analysis

- By Range Analysis

- By Vehicle Type Analysis

- Autonomous Last Mile Delivery Industry Segments

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Autonomous Last Mile Delivery Industry Key Players

- Recent Development

- Report Scope

Report Overview

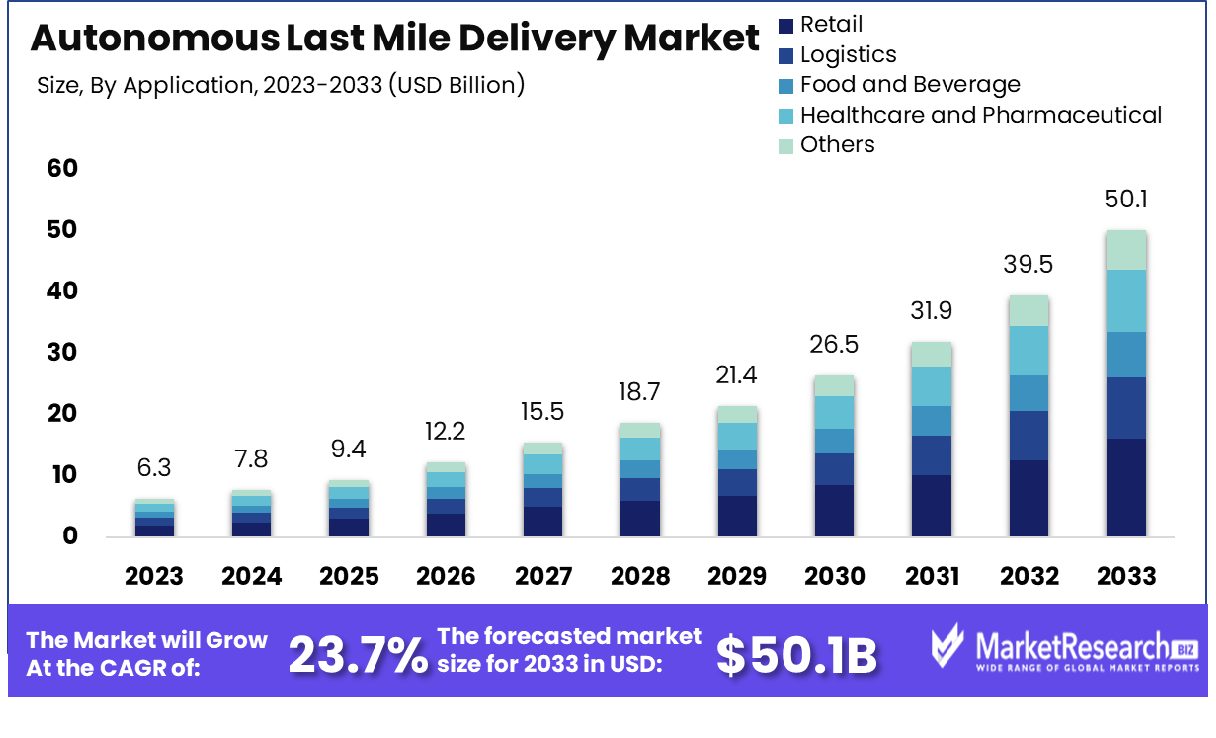

The autonomous last-mile delivery market was valued at USD 6.3 billion in 2023. It is expected to reach USD 50.1 billion by 2033, with a CAGR of 23.7% during the forecast period from 2024 to 2033.

The surge in demand for fast delivery of products and technological advancements are some of the main driving factors for the autonomous last mile delivery market expansion. The emergence of e-commerce has taken over the majority of the commercial and residential areas as they are highly populated, through which the delivery options should be quick, efficient, and cost-effective. Autonomous last mile delivery provides distribution of the products from one supplier to the consumer’s location without any human interference.

The surge in demand for fast delivery of products and technological advancements are some of the main driving factors for the autonomous last mile delivery market expansion. The emergence of e-commerce has taken over the majority of the commercial and residential areas as they are highly populated, through which the delivery options should be quick, efficient, and cost-effective. Autonomous last mile delivery provides distribution of the products from one supplier to the consumer’s location without any human interference.Drones are autonomous delivery that fulfill the requirement of quicker delivery than other carrier ground options and work through AI. Most logistics and shipping firms are improving their distribution chain with autonomous last mile delivery. Autonomous last mile delivery consumes 50% of overall parcel spend which makes it important to find expenses wherever possible.

According to Carnegie Mellon University College of Engineering, drone delivery is getting more attention from consumers. More than 60% of online consumers prefer to pay an extra amount of money to receive their parcels by using autonomous delivery robots. Last mile deliveries are implementing quadcopter drones for delivering small items that could result in significant energy savings while decreasing greenhouse gas emissions. These drones save 94% of the energy consumption per package as compared to other vehicles.

Autonomous last mile delivery uses autonomous delivery robots that can help to find the consumer’s location with GPS navigation, sensors, 360-degree camera vision, and many more features that can easily finish the delivery process. Suppliers offer an application that the consumers can access to supervise the location of the delivery robot and secure compartments held during their purchase.

AI intelligence helps these robots to transport the quick-delivering route with the shortest distance while using satellite-grade GPS navigation. These robots are fully autonomous but whenever required humans can easily operate them. Autonomous last mile delivery is sustainable and impacts less to the environment. These robots make deliveries faster and are environmentally friendly. It does not require any petrol or gas vehicle for supplying the products. As consumers are more inclined to online shopping and prefer quick delivery, the market of autonomous last mile delivery will increase, which will help in market expansion in the forecast period.

Key Takeaways

- Market Value: The autonomous last mile delivery market was valued at USD 6.3 billion in 2023. It is expected to reach USD 50.1 billion by 2033, with a CAGR of 23.7% during the forecast period from 2024 to 2033.

- Based on Application: Retail-driven autonomous delivery boosts efficiency, reduces costs, and enhances convenience.

- Based on Solution: Hardware innovations drive efficiency in the autonomous last mile delivery market.

- Based on Range: Short-range autonomous delivery boosts efficiency in dense urban environments.

- Based on Vehicle Type: Ground delivery bots streamline last-mile services in urban environments.

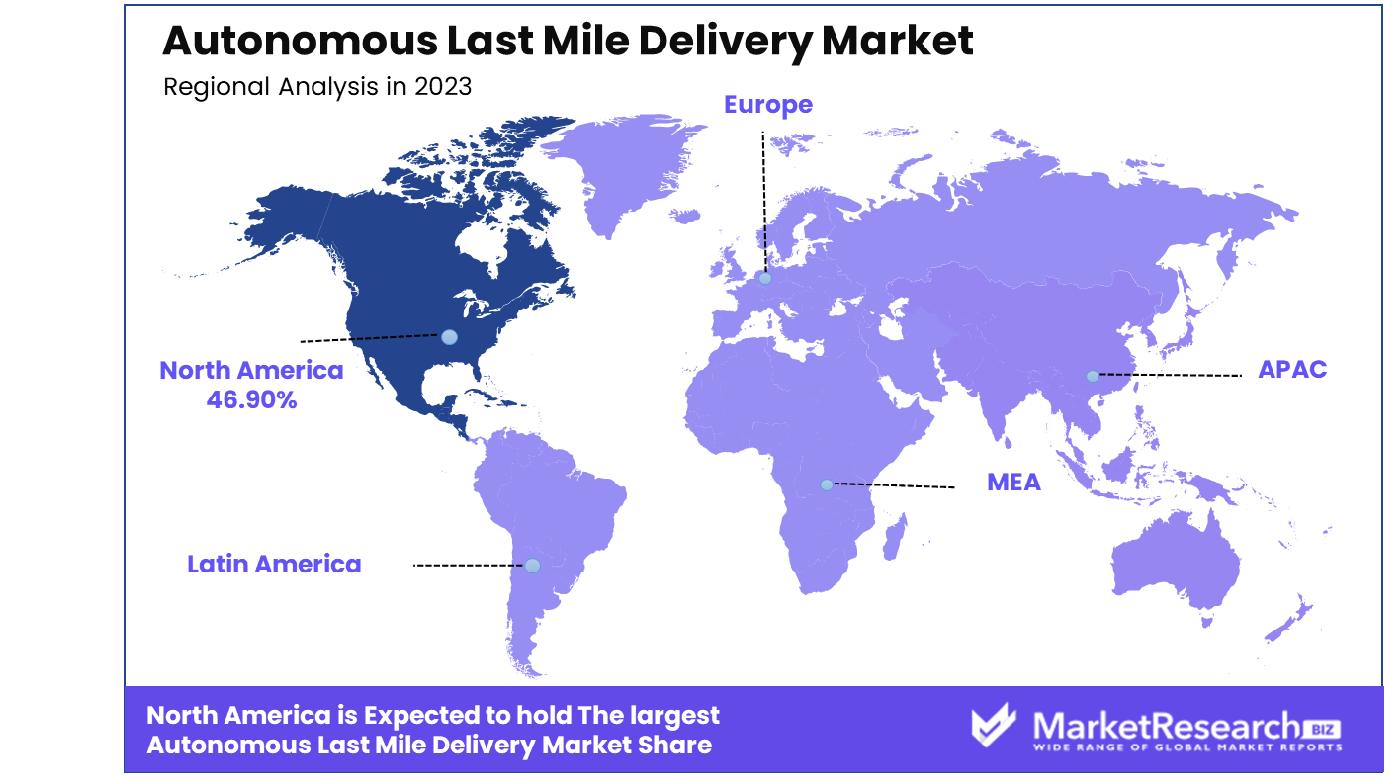

- Regional Analysis: North America holds 46.90% of the autonomous last mile delivery market.

- Growth Opportunity: In 2023, technological advancements in drones and self-driving vehicles are catalyzing the expansion of the autonomous last mile delivery market by enhancing operational efficiencies and broadening delivery capabilities across diverse environments.

Driving factors

Accelerated Package Delivery Needs Fuel Market Expansion

The autonomous last-mile delivery market is significantly propelled by the increasing demand for fast delivery of packages. In today's fast-paced e-commerce environment, consumers expect quick and efficient delivery services, often within the same day. This urgency is a critical driver, pushing companies to innovate and streamline their delivery processes. Autonomous delivery systems, such as drones and self-driving vehicles, offer a promising solution by potentially reducing delivery times and operational costs.

This demand is particularly pronounced in urban areas, where traditional delivery methods face challenges like traffic congestion. By integrating autonomous delivery solutions, companies can enhance customer satisfaction and competitive edge, thereby accelerating market growth.

E-Commerce Boom Spurs Autonomous Delivery Innovations

The burgeoning e-commerce industry serves as a catalyst for the growth of the autonomous last-mile delivery market. With the continuous rise in online shopping, there is a corresponding increase in the volume of goods that require delivery to consumers' doorsteps. This surge has necessitated the development of efficient, scalable delivery methods.

Autonomous delivery technologies are ideally suited to meet these needs, offering scalable solutions that can adapt to increasing delivery volumes without the proportional increase in labor costs. Furthermore, these technologies improve reliability and reduce human error, making them increasingly attractive to e-commerce businesses aiming to optimize their logistics and enhance consumer trust.

Technological Advancements Propel Market Capabilities

Technological advancements in autonomous vehicles, drones, and robotic systems are foundational to the growth of the autonomous last-mile delivery market. These innovations enhance the feasibility and efficiency of autonomous deliveries. For instance, improvements in sensor technology and AI enable drones and autonomous vehicles to navigate complex urban environments safely.

Additionally, advances in battery technology and machine learning development algorithms improve the operational duration and decision-making capabilities of these autonomous systems, respectively. This technological progression not only increases the practicality of autonomous deliveries but also broadens the scope of their application, facilitating expansion into new markets and sectors. These advancements ensure a robust, scalable infrastructure capable of handling the complexities of modern delivery needs.

Restraining Factors

Infrastructure Deficiencies Limit Aerial Drone Deployment

The autonomous last-mile delivery market faces significant growth constraints due to the lack of infrastructure necessary to support aerial drones. Aerial drones require specific launch and landing zones, as well as charging stations and maintenance facilities, which are not yet widely established, especially in urban and densely populated areas. This absence of infrastructure impedes the operational efficiency of drone-based delivery systems and limits their scalability. Without adequate investment and planning in drone-friendly infrastructure, the potential for drones to revolutionize last-mile delivery remains unrealized.

The development of such infrastructure would require substantial capital expenditure and coordination with urban planners to integrate seamlessly into existing cityscapes and transportation networks. This challenge not only slows the adoption of drone technology in last-mile delivery but also impacts the ability of firms to deploy these solutions on a large scale.

Regulatory Uncertainties Slow Market Adoption

Regulatory challenges present another critical barrier to the growth of the autonomous last-mile delivery market. The regulatory landscape for autonomous delivery systems, particularly drones and autonomous vehicles, is still in a state of flux. Many regions lack specific guidelines that govern the operation of these technologies, creating a challenging environment for companies that wish to implement them. This uncertainty can deter investment and innovation, as companies may be reluctant to deploy resources toward technologies that may not comply with future legal frameworks.

Additionally, potential safety, privacy, and liability issues continue to be major concerns for regulators and can lead to restrictive policies that further inhibit market growth. Effective growth in the autonomous last-mile delivery sector depends significantly on the development of clear, supportive regulations that encourage innovation while ensuring public safety and privacy.

By Application Analysis

The autonomous last mile delivery market is revolutionizing retail by enhancing efficiency and reducing costs.

The retail sector stands as the dominant segment in the autonomous last mile delivery market. This success can be attributed to the rapid expansion of online retailing and its demand for speedier and more cost-efficient delivery techniques. Retailers are turning more frequently to autonomous delivery systems to increase customer satisfaction, reduce delivery costs, and enhance operational efficiencies.

Key drivers include using advanced technologies, like AI machine learning, AI, and IoT, to enhance delivery routes and ensure safe, timely deliveries. Unfortunately, regulatory restrictions and issues surrounding autonomous deliveries remain roadblocks to widespread adoption of this trend - thus the importance of investing in this sector for retail logistics' future development cannot be overemphasized.

Logistics deploys autonomous delivery for efficient warehouse-to-door deliveries, improving supply chain operations while drastically cutting time and expense spent on traditional delivery methods. Food and beverage industries have seen tremendous growth due to online delivery services offering fast solutions to consumers' immediate requirements - this market uses auto-delivery as one way of meeting these demands in as short a timeframe as possible.

By Solution Analysis

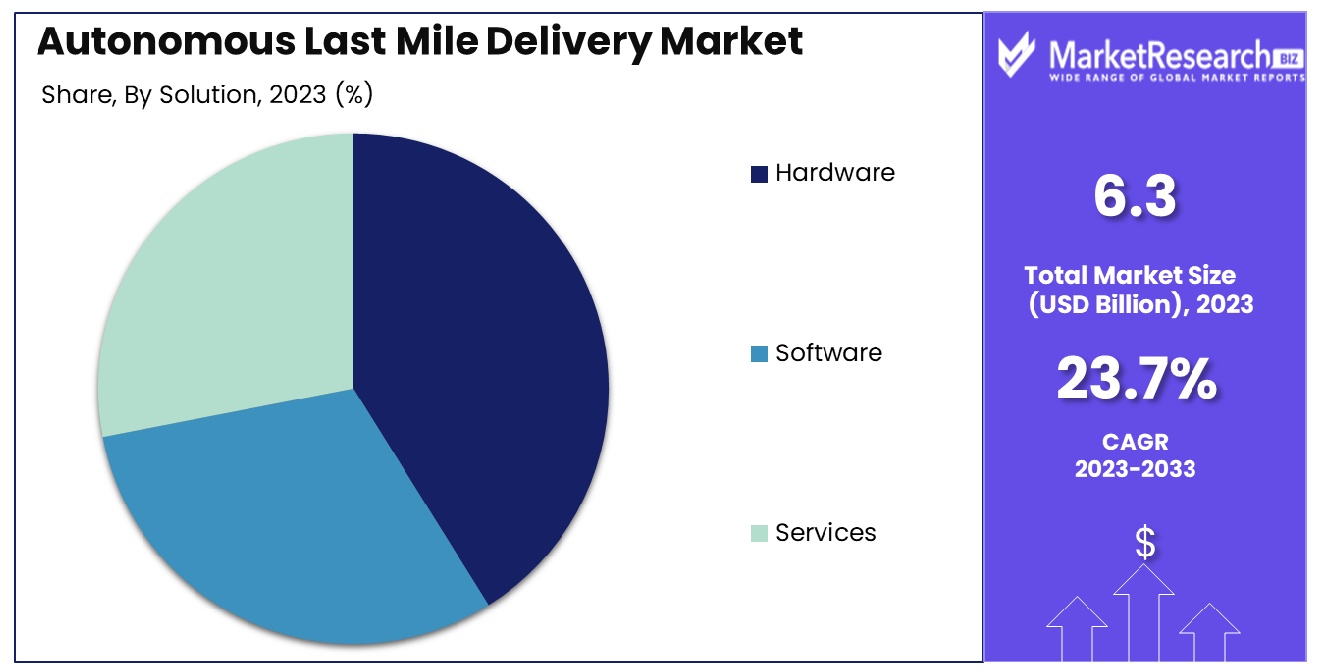

In the autonomous last mile delivery market, advanced hardware solutions are pivotal for operational success.

The hardware segment, comprising autonomous vehicles, drones, and related technologies, is the backbone of the autonomous last mile delivery market. This segment's growth is driven by continuous advancements in sensor technology, robotics, and vehicle automation. Hardware solutions are being increasingly refined for better navigation, safety, and adaptability to various environments. This segment growth faces challenges in terms of high initial investment and maintenance costs, as well as the need for continuous technological upgrades. Nevertheless, the ongoing innovation in hardware is pivotal in enhancing the efficiency and feasibility of autonomous last mile delivery solutions.

The software includes route optimization, fleet management, and operational analytics solutions, crucial for the efficient functioning of autonomous delivery systems. This software is integral in managing complex logistics and ensuring seamless integration of autonomous vehicles into existing delivery networks. Services encompass support, maintenance, and training services, vital for the adoption and effective use of autonomous delivery technologies. These services are crucial in bridging the gap between technology and its practical application, ensuring that organizations can fully leverage the benefits of autonomous delivery.

By Range Analysis

In the autonomous last mile delivery market, short-range solutions prioritize quick, efficient urban deliveries.

Short-range deliveries, typically within a radius of 15-20 kilometers, dominate the autonomous last mile delivery market. This market's growth can be directly tied to its wide availability in suburban and urban environments, making short-range deliveries both financially feasible and practical. These short-range options have been tailored specifically for complex urban environments and quick turnaround times, which make them essential in industries like food delivery and eCommerce. Their growth is also directly tied to urbanization trends as well as consumers' increasing desire for speedy services.

Long-range segment autonomous delivery services are increasingly popular, yet face some hurdles that may impede the fastest growth and expansion, such as needing advanced navigation capabilities and regulatory authorities' approval for operations over longer distances. Such deliveries play a vital role in connecting remote regions and expanding services offered, potentially altering logistics environments in rural or underserved regions.

By Vehicle Type Analysis

Ground delivery bots are transforming the autonomous last mile delivery market with enhanced route efficiency.

Ground delivery bots, including delivery robots, self-driving cars, and trucks, currently lead the autonomous last mile delivery market. Ground bots' rapid expansion is driven by their versatility in handling different items and terrain types while being simple integrations into existing road infrastructure. Other driving forces for the fastest growth in this sector are advancements in AI robotics as well as efforts to reduce road traffic emissions and carbon emissions. Their potential to revolutionize delivery systems in cities is enormous but there remain regulations and acceptance issues as potential issues to consider when considering ground bots as solutions.

Aerial delivery drones - fixed-wing, rotary, and hybrid versions - have become an important yet not necessarily popular segment of the industry. Their advantages lie in speed as well as being able to avoid ground traffic, making them perfect for urgent deliveries to difficult-to-access locations with traffic congestion issues. Unfortunately, they also present several security, regulatory, and privacy risks that must be addressed for wider acceptance.

Autonomous Last Mile Delivery Industry Segments

By Application

- Retail

- Logistics

- Food and Beverage

- Healthcare and Pharmaceutical

- Others

By Solution

- Hardware

- Software

- Services

By Range

- Short Range

- Long Range

By Vehicle Type

- Ground Delivery Bots

- Delivery Bots

- Self-driving Vans & Trucks- Aerial Delivery Drones

- Fixed-Wing

- Rotary-Wing

- HybridGrowth Opportunity

Technological Innovations Drive Market Expansion

The year 2023 presents substantial opportunities for the global autonomous last mile delivery market, primarily fueled by advancements in drone and self-driving vehicle technologies. These advancements are enhancing the efficiency, safety, and reliability of autonomous delivery systems. As sensors, artificial intelligence, and machine learning algorithms become more sophisticated, the operational capabilities of these technologies improve, allowing for more complex navigation and decision-making processes in varied environments. These technological strides not only boost the functional aspects of autonomous delivery but also help in reducing the costs associated with last mile delivery challenges, such as labor and time inefficiencies.

Broadening Horizons with Diverse Delivery Modalities

Furthermore, the expansion of both ground and aerial delivery solutions significantly broadens the potential reach and impact of the autonomous last mile market. Ground-based autonomous vehicles, such as self-driving vans and robotic delivery carts, are becoming increasingly capable of handling urban and suburban delivery tasks. Simultaneously, drones are carving out a niche for quick, aerial delivery of small packages, particularly useful in congested city environments or remote areas. This dual expansion facilitates a more integrated approach to last mile delivery, enabling services to cater to a wider range of markets and consumer needs, from rural areas lacking in traditional infrastructure to urban centers where speed and efficiency are paramount.

Latest Trends

Ascendancy of Ground Delivery Bots

A prominent trend in the 2023 autonomous last mile delivery market is the burgeoning impact of ground delivery bots. These bots, which navigate sidewalks and pedestrian areas to deliver goods directly to consumers' doorsteps, are forecasted to generate substantial revenue, with projections suggesting a market size of $34.90 billion by 2030.

The growth in this segment is driven by their ability to efficiently complete short-range deliveries, their lower operational costs compared to traditional delivery methods, and their minimal environmental impact. As retailers and logistics companies strive to meet consumer demand for rapid, cost-effective delivery solutions, ground delivery bots are becoming increasingly integral to urban and suburban logistics landscapes, facilitating quicker turnaround times and enhancing customer satisfaction.

Enhancement Through 5G Technology

Another significant trend shaping the autonomous last mile delivery market in 2023 is the integration of 5G technology. This advanced communication technology promises to revolutionize the operational dynamics of autonomous delivery systems by enabling higher data transfer speeds and reduced latency. The application of 5G will allow real-time monitoring and enhanced control over package transportation processes, facilitating more dynamic routing and scheduling based on live traffic and weather data.

Furthermore, 5G's ability to handle vast networks of connected devices will prove crucial in densely populated urban environments where numerous autonomous delivery units operate simultaneously. This integration is expected to not only increase the efficiency of delivery operations but also improve reliability and customer trust in autonomous delivery services.

Regional Analysis

North America Dominates with 46.90% Market Share in Autonomous Last Mile Delivery Market

North America is the most dominant region in this market, accounting for 46.90% of the global share. This significant lead is primarily driven by robust technological infrastructure, high e-commerce penetration, and supportive regulatory frameworks in the U.S. and Canada. North America's pioneering role in technological innovations, with key players like Amazon and Nuro, underscores its market leadership.

Europe follows closely, with a strong emphasis on sustainability and smart city initiatives driving the adoption of autonomous delivery solutions. The European market benefits from rigorous research and development, backed by governmental and EU policies favoring automation and digital transformation. Countries like Germany and the UK are front runners, integrating autonomous drones and vehicles into their urban logistics frameworks.

Asia Pacific is positioned as a rapidly growing segment in the autonomous last-mile delivery market, expected to witness the highest CAGR in the coming years. This growth is fueled by the rise of e-commerce giants like Alibaba and JD.com, which are investing heavily in drone and robotic delivery systems. China, Japan, and South Korea are leading this charge, leveraging dense urban populations and technological agility to optimize delivery logistics.

Middle East & Africa and Latin America, though nascent, are emerging as potential growth areas with specific regional challenges such as vast rural areas and underdeveloped logistics networks. These regions are increasingly experimenting with drone deliveries to enhance access and efficiency in remote and urban settings alike, although their market share remains comparatively small.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In the evolving landscape of the global autonomous last-mile delivery market, key players are differentiating themselves through innovative solutions and strategic partnerships, positioning for dominance as the industry grows toward 2023. Leading this transformation are companies like Amazon.com and UPS, whose vast logistical networks and investments in technology set a robust foundation for deploying autonomous delivery vehicles and drones at scale.

DHL International GmbH and JD.com Inc. are also pivotal, leveraging their global reach and strong e-commerce ties to experiment and implement autonomous delivery solutions, which could redefine efficiency and consumer satisfaction in last-mile delivery. JD.com, in particular, has made significant advancements in autonomous drone delivery in China, hinting at future global expansion possibilities.

Emerging innovators such as Nuro, Inc. and Starship Technologies are critical to watch. Nuro's focus on road-based autonomous vehicles and Starship Technologies' deployment of sidewalk robots demonstrate niche specializations that cater to specific market needs, such as urban environments and university campuses.

Furthermore, companies like Flytrex and Drone Delivery Canada are enhancing aerial delivery capabilities, indicating a trend towards the skies as regulatory environments gradually become more accommodating. The strategic positioning of Alphabet Inc., through its subsidiary Wing, showcases the potential for integrating drone delivery within broader technological ecosystems, enhancing the synergies across various data and service platforms.

Autonomous Last Mile Delivery Industry Key Players

- DPD

- United Parcel Service of America, Inc.

- DHL International GmbH

- Savioke

- Starship Technologies

- Marble Robot

- JD.com Inc.

- Amazon.com

- Flytrex

- Drone Delivery Canada

- Flirtey

- Matternet, Inc.

- Airbus S.A.S.

- Alphabet Inc.

- Alibaba Group

- Nuro, Inc.

Recent Development

- In April 2024, Kakao Mobility Corp., in partnership with LG Electronics, is set to launch an indoor robot delivery service in South Korea, leveraging LG's CLOi ServeBot robots and signaling a significant advancement in the autonomous last-mile delivery market.

- In April 2024, The "Last-Mile Leaders" event, hosted by FarEye in collaboration with Microsoft, convened global supply chain experts to discuss leveraging technology, including AI and autonomous drones, for transformative cost reductions in logistics, as highlighted in the Last-Mile Trends Report 2024.

- In April 2024, Walmart and other investors have boosted their investment in GM's autonomous vehicle subsidiary, Cruise, to $2.75 billion to support the development of a scalable, low-cost last mile delivery ecosystem, as reported by the Associated Press.

- In April 2024, As reported by TechCrunch, Kiwibot, a U.S.-based robotic delivery firm, has strategically acquired Taipei-based chipmaker Auto Mobility Solutions to bolster cybersecurity for its AI-driven robots and expand its presence in the Asian market amidst U.S.-China tensions.

Report Scope

Report Features Description Market Value (2023) USD 6.3 Billion Forecast Revenue (2033) USD 50.1 Billion CAGR (2024-2032) 23.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application(Retail, Logistics, Food and Beverage, Healthcare and Pharmaceutical, Others), By Solution(Hardware, Software, Services), By Range(Short Range, Long Range), By Vehicle Type(Ground Delivery Bots(Delivery Bots, Self-driving Vans & Trucks), Aerial Delivery Drones(Fixed-Wing, Rotary-Wing, Hybrid)) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape DPD, United Parcel Service of America, Inc., DHL International GmbH, Savioke, Starship Technologies, Marble Robot, JD.com Inc., Amazon.com, Flytrex, Drone Delivery Canada, Flirtey, Matternet, Inc., Airbus S.A.S., Alphabet Inc., Alibaba Group, Nuro, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- DPD

- United Parcel Service of America, Inc.

- DHL International GmbH

- Savioke

- Starship Technologies

- Marble Robot

- JD.com Inc.

- Amazon.com

- Flytrex

- Drone Delivery Canada

- Flirtey

- Matternet, Inc.

- Airbus S.A.S.

- Alphabet Inc.

- Alibaba Group

- Nuro, Inc.