Autonomous Agriculture Equipment Market By Product (Tractors, Harvesters, Seeders, Sprayers, Others), By Automation (Fully Autonomous, Semi-autonomous), By Application (Cultivating, Plowing, Fertilizing, Harvesting, Planting, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

51342

-

September 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

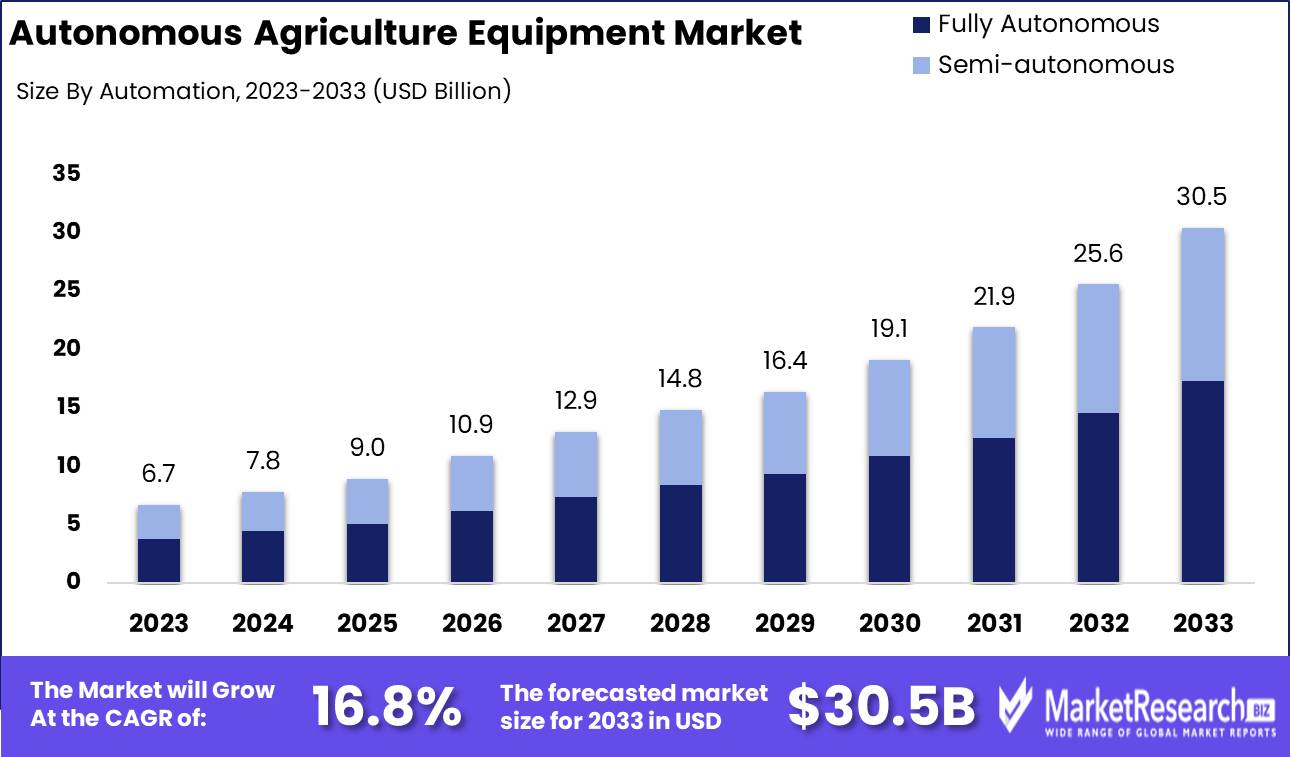

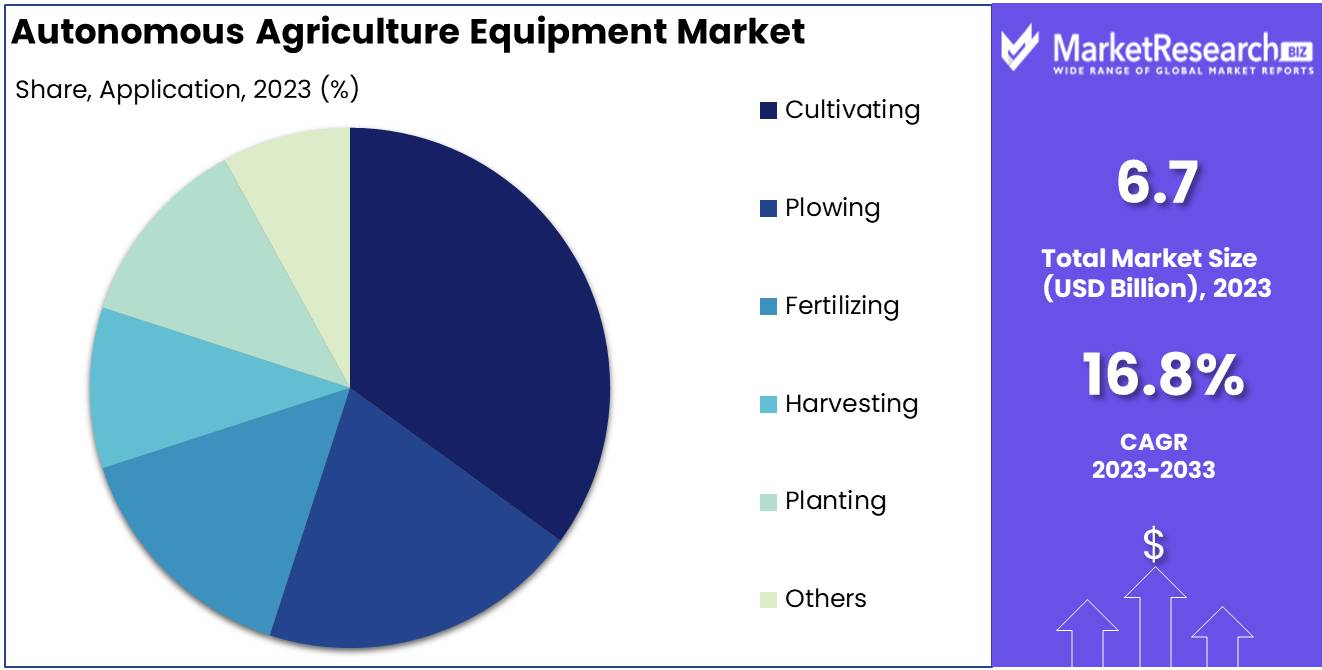

The Autonomous Agriculture Equipment Market was valued at USD 6.7 billion in 2023. It is expected to reach USD 30.5 billion by 2033, with a CAGR of 16.8% during the forecast period from 2024 to 2033.

The Autonomous Agriculture Equipment Market encompasses advanced farming machinery that operates with minimal human intervention through technologies like AI, machine learning, GPS, and IoT. These systems optimize tasks such as planting, harvesting, and monitoring, enhancing productivity and reducing labor costs. The market is driven by the need for sustainable agricultural practices, increased food demand, and advancements in precision farming.

The Autonomous Agriculture Equipment Market is poised for significant transformation, driven predominantly by technological advancements and the growing demand for precision agriculture. Innovations in automation, artificial intelligence, and machine learning are facilitating the development of sophisticated equipment that enhances productivity and reduces labor costs. The increasing emphasis on precision agriculture reflects a strategic shift among farmers seeking to optimize resource usage and yield, further amplifying the market's growth trajectory. Notably, the integration of real-time data analytics into farming practices allows for improved decision-making processes, thereby increasing operational efficiency.

However, several challenges must be addressed to fully realize the market's potential. The high initial investment required for autonomous equipment can deter widespread adoption, particularly among small to medium-sized enterprises. Additionally, data security concerns pose a significant hurdle, as farmers and stakeholders become increasingly aware of the vulnerabilities associated with data collection and management. Despite these challenges, the overall growth potential remains robust, driven by the urgent need for sustainable farming solutions and enhanced agricultural productivity. As the industry evolves, the adoption of autonomous technologies is expected to reshape traditional farming paradigms, positioning stakeholders for competitive advantage in an increasingly data-driven agricultural landscape.

Key Takeaways

- Market Growth: The Autonomous Agriculture Equipment Market was valued at USD 6.7 billion in 2023. It is expected to reach USD 30.5 billion by 2033, with a CAGR of 16.8% during the forecast period from 2024 to 2033.

- By Product: Tractors dominated the autonomous agriculture equipment market.

- By Automation: Fully Autonomous equipment dominated the Autonomous Agriculture Equipment Market.

- By Application: Cultivating dominated the Autonomous Agriculture Equipment market applications.

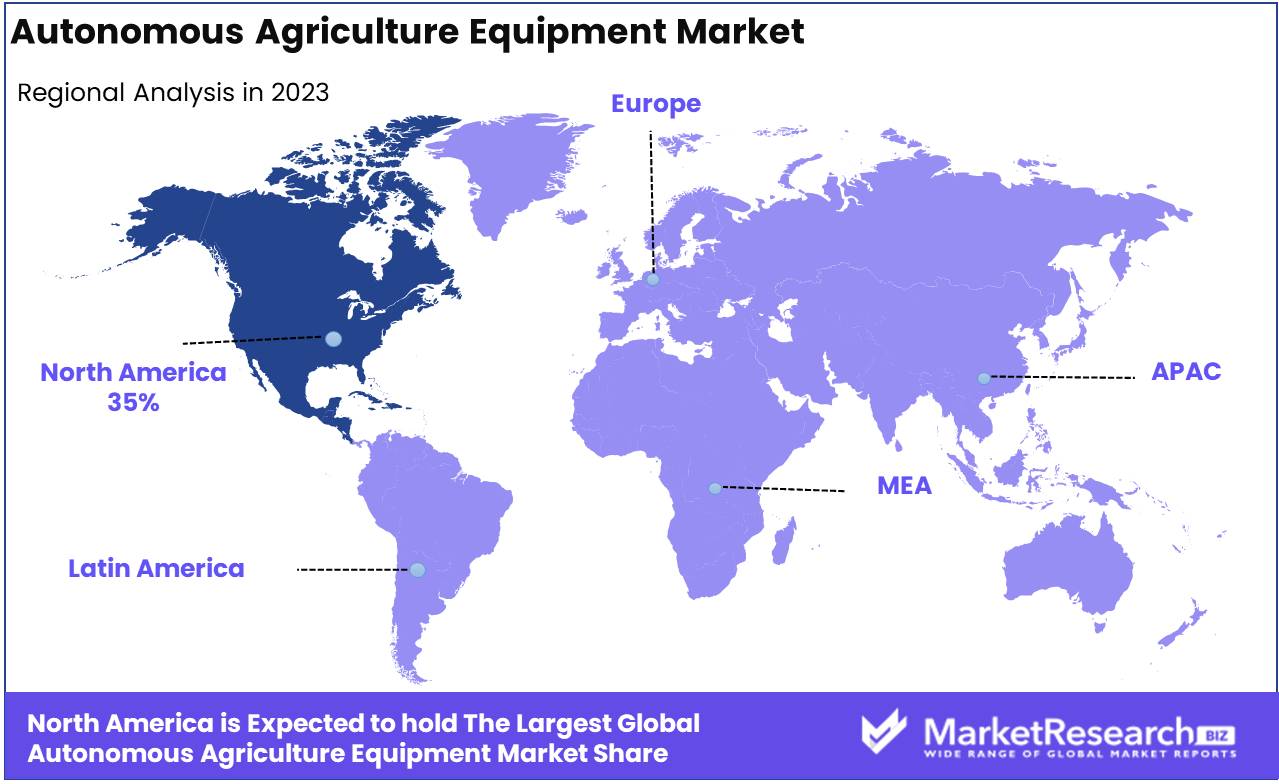

- Regional Dominance: North America dominates the autonomous agriculture market with a 35% largest share.

- Growth Opportunity: The global autonomous agriculture equipment market is set for substantial growth, driven by technological advancements and rising food production demands, creating significant investment and innovation opportunities.

Driving factors

Shift Toward Sustainable Farming Practices Driving Autonomous Agriculture Equipment Adoption

The increasing global emphasis on sustainability has significantly impacted the autonomous agriculture equipment market. As countries and agricultural organizations adopt policies aimed at reducing environmental impact, there is a growing demand for farming methods that minimize resource use, such as water, fertilizers, and pesticides. Autonomous equipment, equipped with precision farming technologies, supports sustainable practices by optimizing resource utilization. For instance, automated tractors and drones can monitor soil health, detect pests, and assess crop needs with minimal input from human operators, thereby reducing excessive application of chemicals and conserving water.

Moreover, the rise in organic farming and the push for carbon-neutral operations have led farmers to seek out autonomous equipment capable of adhering to these new standards. By automating processes that ensure resource-efficient practices, autonomous machinery helps meet sustainability targets. These capabilities align with global efforts to reduce greenhouse gas emissions from agriculture, thereby boosting the demand for such equipment in the market.

Increased Crop Yields as a Major Driver of Autonomous Equipment Utilization

The pressing need for higher agricultural productivity to feed a growing global population is a primary factor accelerating the adoption of autonomous agriculture equipment. Autonomous machinery contributes to increased crop yields by allowing for precise, consistent, and efficient farming practices. For example, automated planting machines can ensure optimal seed placement and spacing, leading to better crop establishment and overall yields. Similarly, autonomous spraying systems can apply fertilizers and pesticides more accurately, reducing waste and improving crop health.

According to reports, farms that adopt autonomous equipment often report yield improvements between 10% and 20% due to these efficiencies. The ability to optimize input usage while simultaneously increasing output makes autonomous machinery a valuable investment for large-scale and small-scale farmers alike. This technological shift is essential in meeting global food demand, which is projected to increase by 60% by 2050, further fueling the market’s growth.

Technological Integration as the Backbone of Market Expansion

The integration of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), and GPS systems into agricultural equipment is at the core of the market’s expansion. Autonomous farming equipment relies heavily on these technologies to operate with minimal human intervention while improving operational accuracy and efficiency. For example, AI-powered systems enable autonomous tractors and harvesters to make real-time decisions based on environmental data and crop conditions, while GPS technology ensures precise navigation across vast fields.

The incorporation of IoT allows for continuous monitoring of equipment and crops, ensuring that farmers can make data-driven decisions regarding maintenance schedules, crop health, and input application. This technological integration reduces downtime, increases machinery lifespan, and enables predictive maintenance, further enhancing productivity. Additionally, automation technologies, such as robotic systems, facilitate tasks like planting, weeding, and harvesting, ensuring consistent operational flow and reduced labor dependency.

Restraining Factors

Technological Complexity as a Barrier to Adoption

The technological sophistication of autonomous agriculture equipment is a significant restraining factor in the market. This complexity arises from the integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), GPS-guided systems, and IoT devices, all of which are crucial for the automation of agricultural tasks. However, many farmers, particularly those in developing or rural regions, may lack the necessary expertise or infrastructure to adopt and maintain such advanced systems.

The high costs associated with the deployment, maintenance, and operation of these complex systems can further limit market penetration. According to industry studies, the total cost of ownership for autonomous equipment, including training and support infrastructure, often becomes prohibitive for small- to medium-scale farmers. This financial burden, coupled with the technical skills gap, restricts the widespread adoption of autonomous technologies.

Additionally, the interoperability between different systems is often challenging. Farmers need to ensure that new autonomous equipment can seamlessly integrate with their existing machinery and farm management software. The lack of standardization across the industry heightens these challenges, creating further hesitation among potential buyers and reducing the speed of market growth.

Data Management Issues and Operational Challenges

The effective functioning of autonomous agricultural equipment depends heavily on data, which must be collected, processed, and analyzed to guide decision-making processes. However, data management poses a critical challenge, particularly in handling large volumes of data generated by sensors and real-time monitoring systems. Many farmers face difficulties in managing this data due to a lack of infrastructure, limited technical know-how, or insufficient data storage capabilities.

Data security is also a growing concern, with farmers hesitant to adopt autonomous systems due to fears of data breaches or misuse of their sensitive information, particularly if the data is stored in cloud-based systems. This issue is especially pertinent as more stakeholders, including equipment manufacturers and software developers, gain access to farm data for purposes such as predictive maintenance, crop management, and operational optimization.

By Product Analysis

In 2023, Tractors dominated the autonomous agriculture equipment market.

In 2023, Tractors held a dominant market position in the by-product segment of the Autonomous Agriculture Equipment Market, accounting for a significant share due to their wide range of applications in both large-scale farming operations and smaller agricultural activities. Autonomous tractors are becoming increasingly integral to precision agriculture, offering improved efficiency, reduced labor costs, and optimized field management. This leadership is attributed to the rising adoption of advanced driver-assistance systems (ADAS) and autonomous driving technologies by farmers seeking to enhance productivity and sustainability.

Harvesters followed closely, driven by their critical role in automating crop gathering processes, which helps reduce post-harvest losses and improve operational efficiency. The seeders segment also experienced substantial growth as autonomous technology enhances planting accuracy and reduces input waste.

Sprayers emerged as another key category, benefiting from integrating AI-driven precision in chemical and nutrient application, which minimizes environmental impact while increasing crop yields. Lastly, other equipment such as balers and tillers played a complementary role, contributing to the overall market expansion for autonomous agricultural solutions.

By Automation Analysis

In 2023, Fully Autonomous equipment dominated the Autonomous Agriculture Equipment Market.

In 2023, Fully Autonomous equipment held a dominant market position within the "By Automation" segment of the Autonomous Agriculture Equipment Market. This segment is categorized into Fully Autonomous and Semi-Autonomous solutions, with the former experiencing significant adoption due to advancements in artificial intelligence, robotics, and machine learning. Fully Autonomous equipment is characterized by its ability to perform farming tasks independently, reducing labor costs and enhancing operational efficiency. This dominance can be attributed to the increasing need for precision farming and the labor shortages faced by the agriculture industry, pushing farmers to adopt automated solutions.

In contrast, Semi-Autonomous equipment, while still widely utilized, requires human intervention to a certain degree, limiting its appeal in large-scale farming operations. However, it remains a viable solution for smaller farms and those hesitant to fully transition to autonomous systems. The Semi-Autonomous segment also benefits from lower upfront costs, making it more accessible for certain markets. Nonetheless, Fully Autonomous systems are expected to continue growing due to technological advancements and the increasing trend toward smart farming.

By Application Analysis

In 2023, Cultivating dominated the Autonomous Agriculture Equipment market applications.

In 2023, Cultivating held a dominant market position in the By Application segment of the Autonomous Agriculture Equipment Market, reflecting a significant portion of global demand. Cultivating, which involves soil preparation for sowing, has benefited from increased automation to improve operational efficiency and crop yields. The rising adoption of autonomous cultivating equipment is driven by labor shortages and the need to enhance precision in farming practices.

Plowing follows closely, with autonomous plowing systems providing key benefits such as reduced labor costs and improved soil health through optimized tillage practices. Fertilizing has gained traction as well, with the precision application of fertilizers made possible by autonomous machinery, enhancing crop nutrition and reducing waste.

The Harvesting segment has experienced notable advancements, particularly in fruit and grain harvesting, where autonomous equipment ensures timely and efficient collection, reducing post-harvest losses. Planting has witnessed growth as autonomous systems allow for precise seed placement, ensuring optimal plant density and uniform growth.

Lastly, the Others category, which includes weeding and irrigation, represents a growing segment as various autonomous technologies continue to be integrated into these essential farming tasks, further boosting overall efficiency in agriculture.

Key Market Segments

By Product

- Tractors

- Harvesters

- Seeders

- Sprayers

- Others

By Automation

- Fully Autonomous

- Semi-autonomous

By Application

- Cultivating

- Plowing

- Fertilizing

- Harvesting

- Planting

- Others

Growth Opportunity

Technological Advancements Driving Market Growth

The autonomous agriculture equipment market presents significant growth opportunities, driven primarily by technological advancements. The integration of artificial intelligence (AI), machine learning, and the Internet of Things (IoT) into agricultural machinery is revolutionizing the farming landscape. Autonomous tractors, drones, and robotic harvesters are becoming increasingly efficient, reducing labor costs and improving yield precision. The rapid adoption of precision farming technologies is expected to drive demand for autonomous equipment, as farmers seek to optimize resource usage and increase productivity. Furthermore, the expansion of 5G networks enhances real-time data sharing and remote monitoring capabilities, accelerating the adoption of autonomous systems across farms globally.

Rising Demand for Food Production Boosts Adoption

The global demand for food production is set to rise by 70% by 2050, fueled by population growth and increased urbanization. In response, autonomous agriculture equipment is being positioned as a key solution to meet this growing demand. These machines can operate continuously and efficiently, helping to address labor shortages in the agricultural sector while boosting overall productivity. Farmers are increasingly adopting autonomous technologies to scale operations and enhance crop yields, especially in regions facing agricultural workforce constraints.

Latest Trends

Rising Demand for Autonomous Tractors

The autonomous agriculture equipment market is expected to witness significant growth driven primarily by the rising demand for autonomous tractors. These tractors, equipped with advanced sensors, GPS, and AI-based software, are becoming essential to modern farming operations, reducing the need for manual labor and increasing efficiency. The rising shortage of skilled labor in the agriculture sector, coupled with the need for precise farming techniques, is fueling the adoption of autonomous tractors. Furthermore, advancements in AI, machine learning, and robotics are expected to enhance the operational capabilities of these tractors, leading to improved yield and lower operational costs.

Emergence of Smart Farming Solutions

In parallel, the emergence of smart farming solutions is another key trend reshaping the autonomous agriculture equipment market. Technologies such as the Internet of Things (IoT), precision agriculture, and big data analytics are enabling farmers to make data-driven decisions, optimizing crop management and resource usage. These solutions, often integrated with autonomous machinery, allow for real-time monitoring of soil conditions, weather patterns, and crop health. As a result, smart farming solutions are being adopted at a faster pace, especially in regions with large-scale, high-output farming. This trend is expected to significantly increase the productivity and sustainability of the agricultural sector, further driving the demand for autonomous agricultural equipment.

Regional Analysis

North America dominates the autonomous agriculture market with a 35% largest share.

The autonomous agriculture equipment market demonstrates regional disparities in growth due to varying levels of technological adoption, agricultural practices, and investment capabilities. North America dominates the market, accounting for over 35% of the global share in 2023, driven by the early adoption of precision farming technologies, favorable government subsidies, and a highly mechanized agricultural sector, especially in the U.S. The region's emphasis on reducing labor costs and increasing efficiency further boosts the demand for autonomous tractors and drones.

In Europe, advanced farming techniques and stringent environmental regulations contribute to market expansion. Countries such as Germany and France are leading in automation, backed by government initiatives promoting sustainable agriculture, with Europe holding a significant market share of approximately 25%.

Asia-Pacific, led by China and India, exhibits rapid growth due to rising population pressures and increased investments in smart farming technologies. The region is expected to witness a compound annual growth rate (CAGR) of over 20% through 2030 as automation becomes essential for improving productivity on smaller farms.

The Middle East and Africa are gradually adopting autonomous technologies, with a focus on improving water efficiency and adapting to harsh climate conditions. Latin America, particularly Brazil and Argentina, is emerging due to the increasing need for efficient large-scale farming operations. However, these regions still face challenges related to high equipment costs and limited technical expertise.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global autonomous agriculture equipment market is expected to witness robust growth, driven by technological advancements and the increasing demand for efficiency in agricultural operations. Several key players are contributing significantly to this market landscape, each leveraging unique strengths to capitalize on emerging opportunities.

Deere & Company remains a leader in the market, with its well-established portfolio of autonomous tractors and advanced precision agriculture technologies. Their strong global presence and continuous R&D efforts are expected to further enhance their market share. CNH Industrial and its Case IH brand, alongside AGCO Corporation, also play prominent roles, particularly in North America and Europe, with their focus on high-performance machinery and autonomous solutions.

Smaller yet innovative companies such as Bear Flag Robotics (acquired by Deere) and Monarch Tractor are making notable contributions, bringing AI-powered, electric, and driverless tractors to the market. This shift is part of a larger trend toward electrification and sustainability in farming.

Kubota, Mahindra & Mahindra, and CLAAS KGaA are strengthening their foothold in the Asia-Pacific region, tapping into the growing mechanization trend. Their investments in autonomous and smart machinery are expected to drive regional adoption.

Companies like DJI Agriculture and Naïo Technologies focus on autonomous drones and robotics, adding precision in areas like crop monitoring and weeding. These players are gaining traction due to the rising demand for precision agriculture tools.

Market Key Players

- AGCO Corporation

- CLAAS KGaA mbH

- CNH Industrial

- Deere & Company

- HORSCH Maschinen GmbH

- Kubota

- Mahindra and Mahindra Ltd.

- Monarch Tractor

- SDF Group

- YANMAR HOLDINGS

- Autonomous Solutions

- Bear Flag Robotics

- Case IH

- Hexagon

- Mahindra & Mahindra Ltd.

- YTO Group Corporation

- DJI Agriculture

- Naïo Technologies

- Carbon Robotics

Recent Development

- In June 2024, Raven Industries announced a strategic partnership with Farmers Edge to develop advanced autonomous farming solutions that leverage data analytics and real-time monitoring. The collaboration aims to integrate Raven's autonomous driving technology with Farmers Edge's data-driven insights, enabling farmers to make informed decisions regarding resource allocation and crop management. This initiative is expected to enhance operational efficiency and promote sustainable agricultural practices across various crop types.

- In April 2024, AG Leader Technology unveiled its latest autonomous planter, equipped with cutting-edge sensors and GPS technology that allow for precise planting without human intervention. This equipment can be monitored remotely via a mobile application, providing real-time data on planting depth and seed spacing. The company emphasizes that this innovation will significantly minimize labor costs and reduce the environmental impact of traditional farming methods.

- In March 2024, Trimble introduced a suite of autonomous solutions designed for large-scale farming operations. This development includes the launch of the Trimble Ag Software, which incorporates machine learning algorithms to enable the autonomous operation of various equipment, including seeders and harvesters. Trimble’s solutions aim to improve yield prediction and resource management, thereby enhancing productivity and profitability for agribusinesses.

- In January 2024, John Deere announced the expansion of its precision agriculture technologies, which now integrate fully autonomous tractors and advanced drone systems. The new models utilize artificial intelligence (AI) to optimize planting and harvesting schedules based on real-time weather data and soil conditions. The initiative aims to enhance operational efficiency and reduce costs for farmers, supporting sustainable agricultural practices.

Report Scope

Report Features Description Market Value (2023) USD 6.7 Billion Forecast Revenue (2033) USD 30.5 Billion CAGR (2024-2032) 16.8% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Tractors, Harvesters, Seeders, Sprayers, Others), By Automation (Fully Autonomous, Semi-autonomous), By Application (Cultivating, Plowing, Fertilizing, Harvesting, Planting, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape AGCO Corporation, CLAAS KGaA mbH, CNH Industrial, Deere & Company, HORSCH Maschinen GmbH, Kubota, Mahindra and Mahindra Ltd., Monarch Tractor, SDF Group, YANMAR HOLDINGS, Autonomous Solutions, Bear Flag Robotics, Case IH, Hexagon, Mahindra & Mahindra Ltd., YTO Group Corporation, DJI Agriculture, Naïo Technologies, Carbon Robotics Customization Scope Customization for segments at the regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- AGCO Corporation

- CLAAS KGaA mbH

- CNH Industrial

- Deere & Company

- HORSCH Maschinen GmbH

- Kubota

- Mahindra and Mahindra Ltd.

- Monarch Tractor

- SDF Group

- YANMAR HOLDINGS

- Autonomous Solutions

- Bear Flag Robotics

- Case IH

- Hexagon

- Mahindra & Mahindra Ltd.

- YTO Group Corporation

- DJI Agriculture

- Naïo Technologies

- Carbon Robotics