Global Automotive Bioplastic Market By Material Type (Bio Poly-Trimethylene Terephthalate, Bio Polyethylene, Other), By Applications (Interior, Exterior, Other), By Vehicle Type (Heavy Commercial Vehicle, Light Commercial Vehicle, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

38114

-

June 2023

-

179

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

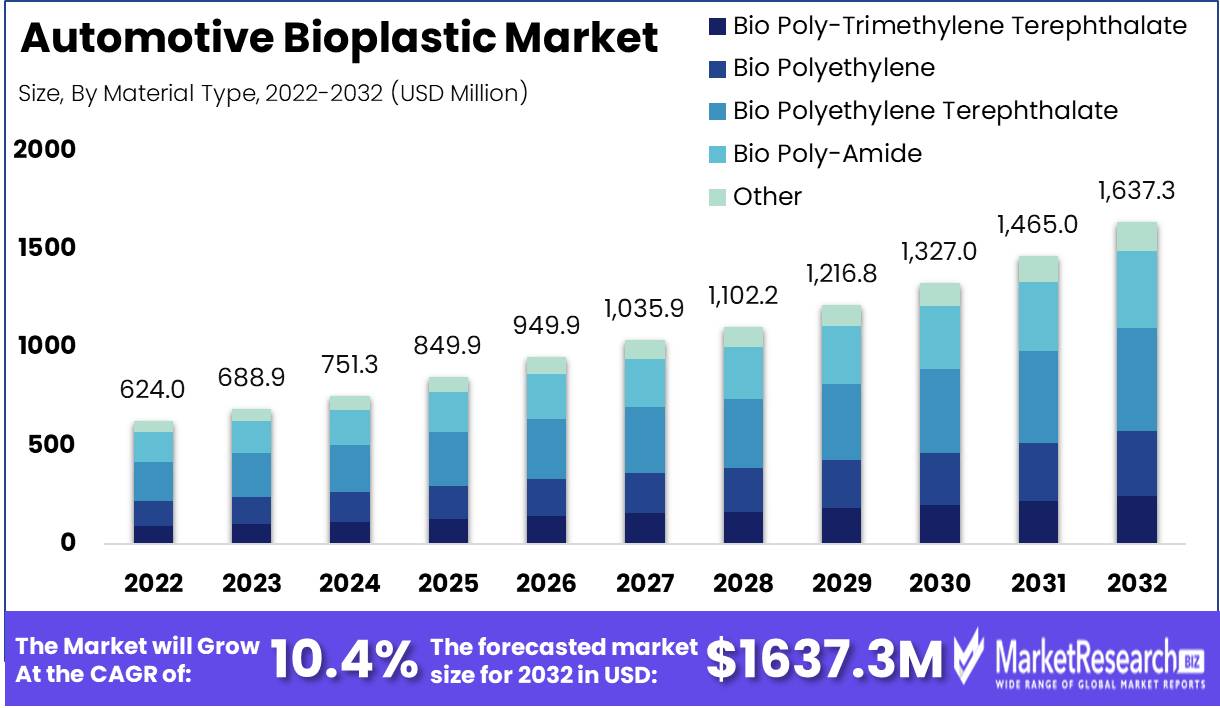

The Global Automotive Bioplastic Market size is expected to be worth around USD 1,637.3 Mn by 2032 from USD 624.0 Mn in 2022, growing at a CAGR of 10.4% during the forecast period from 2023 to 2032. The automotive bioplastic landscape is a dynamic realm, poised for exponential growth and brimming with bewildering complexities. The global stage presents a report that explores the depths of this flourishing market, unraveling its enigmatic fabric while illuminating key trends, propellers, challenges, and opportunities that lie ahead. Emerging from the crucible of renewable sources such as cornstarch, sugarcane, and potatoes, bioplastics have deftly permeated the automotive industry, captivating its plastic-dominated domain with promises of transformation. Billions of pounds of plastic free themselves from their dependence on petroleum to embrace the eco-friendly allure of bioplastics, attracted by their resplendent virtues of reduced carbon footprints and enhanced sustainability.

Inquiring into the global market for automotive bioplastics reveals a captivating saga in which supply and demand intertwine, resembling an ecological choreography. Its primary objective is to eliminate the environmental havoc caused by conventional petroleum-based plastics while heralding a new era characterized by lower carbon emissions, greater sustainability, and a fervent devotion to renewable resources.

This extraordinary realm of automotive bioplastics has witnessed an exquisite tapestry of innovation, embellished with glittering threads of progress. Among its most impressive discoveries are high-performance bioplastics, endowed with the ability to withstand scalding temperatures and the unrelenting assault of mechanical stress. However, its splendor extends to exterior applications as well, with bioplastics adorning body panels and bumpers with a radiant aura. Moreover, the realm of interior trim materials reveals a biodegradability symphony that embraces sustainability with care.

The global automotive bioplastics market has attracted substantial investment from renowned automotive manufacturers and suppliers, who have their sights set on the horizon of progress. Ford, the innovator, aims to incorporate bioplastics into its vehicles, while Toyota, the sustainability forerunner, creates interior trim components infused with bioplastic essence.

While automotive titans reign supreme in this enticing realm, other industries crave a taste of the bioplastic marvel. Observe the packaging industry as it cautiously rolls the dice on the canvas of bioplastics, attempting to create packaging materials that combat the scourge of waste, a realm of unrealized potential.

However, the ethereal appeal of automotive bioplastics is not without ethical considerations. A complex web of issues entangles the landscape, encompassing notions of competition with food crops and the urgency of responsible procurement. To assuage these stormy concerns, the industry erects unfathomable pillars of transparency, revealing the enigma of bioplastic production and sourcing with unwavering resolve.

In this global arena of automotive bioplastics, the clarion appeal for transparency, explainability, and accountability reverberates through the halls of progress. The essence of the industry rests in the disclosure of raw material origins, the sustainability of employed materials, and the environmental effects of bioplastic production.

Emerging from the crucible of renewable sources such as cornstarch, sugarcane, and potatoes, bioplastics have deftly permeated the automotive industry, captivating its plastic-dominated domain with promises of transformation. Billions of pounds of plastic free themselves from their dependence on petroleum to embrace the eco-friendly allure of bioplastics, attracted by their resplendent virtues of reduced carbon footprints and enhanced sustainability.

Inquiring into the global market for automotive bioplastics reveals a captivating saga in which supply and demand intertwine, resembling an ecological choreography. Its primary objective is to eliminate the environmental havoc caused by conventional petroleum-based plastics while heralding a new era characterized by lower carbon emissions, greater sustainability, and a fervent devotion to renewable resources.

This extraordinary realm of automotive bioplastics has witnessed an exquisite tapestry of innovation, embellished with glittering threads of progress. Among its most impressive discoveries are high-performance bioplastics, endowed with the ability to withstand scalding temperatures and the unrelenting assault of mechanical stress. However, its splendor extends to exterior applications as well, with bioplastics adorning body panels and bumpers with a radiant aura. Moreover, the realm of interior trim materials reveals a biodegradability symphony that embraces sustainability with care.

The global automotive bioplastics market has attracted substantial investment from renowned automotive manufacturers and suppliers, who have their sights set on the horizon of progress. Ford, the innovator, aims to incorporate bioplastics into its vehicles, while Toyota, the sustainability forerunner, creates interior trim components infused with bioplastic essence.

While automotive titans reign supreme in this enticing realm, other industries crave a taste of the bioplastic marvel. Observe the packaging industry as it cautiously rolls the dice on the canvas of bioplastics, attempting to create packaging materials that combat the scourge of waste, a realm of unrealized potential.

However, the ethereal appeal of automotive bioplastics is not without ethical considerations. A complex web of issues entangles the landscape, encompassing notions of competition with food crops and the urgency of responsible procurement. To assuage these stormy concerns, the industry erects unfathomable pillars of transparency, revealing the enigma of bioplastic production and sourcing with unwavering resolve.

In this global arena of automotive bioplastics, the clarion appeal for transparency, explainability, and accountability reverberates through the halls of progress. The essence of the industry rests in the disclosure of raw material origins, the sustainability of employed materials, and the environmental effects of bioplastic production.

Driving factors

Environmental Demand Drives Automotive Bioplastics Growth

Environmental concerns are among the most crucial of these elements. As global consumers become more aware of environmental concerns, they demand more sustainable and eco-friendly products. Bioplastics, derived from natural sources such as maize starch, sugarcane, and cellulose, offer an alternative to traditional plastics derived from petroleum and can help reduce the environmental impact of the automotive industry.Regulatory Impact on the Rise of Automotive Bioplastics

In addition to rising environmental concerns, regulations play a significant role in the growth of the automotive bioplastics market. Globally, governments are implementing stricter regulations to reduce carbon emissions, promote sustainability, and lessen reliance on fossil fuels. Bioplastics provide a viable option for complying with these regulations and satisfying the requirements of environmentally conscious consumers.The Auto Industry is Being Revolutionized by Bioplastics Advances

Bioplastic advancements are a crucial propelling force as well. Continuous research and development efforts aimed at enhancing the capabilities and properties of bioplastics have substantially improved their performance characteristics. The automotive industry has high standards for durability, thermal resistance, and chemical resistance, and bioplastics are now being engineered to meet those standards.Simple Resolutions Bioplastics for Automotive Applications Gain Momentum

Additionally, the trend toward lightweight vehicles is driving demand for automotive bioplastics. As automakers place a greater emphasis on enhancing fuel economy and lowering emissions, lightweight materials are gaining importance. Automotive bioplastics offer a lightweight, high-strength alternative to conventional materials, thereby enhancing fuel economy and reducing carbon emissions.Regulatory Obstacles Ahead in Bioplastics Market Navigation

Future modifications to regulations may present a challenge, despite the fact that the automotive bioplastics market's growth prospects are promising. Any regulatory shift away from environmental concerns could impede industry growth. Emerging technologies such as 3D printing may also have an effect on the market, leading to shifts in production methods and material preferences.Industry Disruptors in the Automotive Bioplastics Industry Face a Changing Landscape

New entrants and shifting consumer behavior are additional potential disruptors of the competitive landscape. As more companies enter the market and competition increases, pricing and product availability may be affected. Moreover, shifts in consumer preferences, such as the demand for electric vehicles, could result in modifications to the materials used in the automotive industry.Restraining Factors

Automotive Bioplastics Faces New Challenges

The global automotive bioplastic market is a fiercely competitive sector that is facing a number of restraining factors. Companies in this market are facing a number of challenges, including limited availability, increased costs, material property issues, and intense competition. We will examine these restraining factors in greater detail in this article and discuss how they are affecting the global automotive bioplastic market.A Bioplastic Barrier Limits Raw Materials

The limited availability of raw materials is one of the greatest challenges facing companies in the global automotive bioplastic material market. Due to the growing demand for biofuels and other bio-based products, bioplastic feedstock is in limited supply. The production of bioplastic requires a variety of crops and feedstocks, including maize, sugarcane, and cassava, which are not easily accessible in all regions. The limited availability of raw materials is a significant concern for manufacturers as it drives up the price of bioplastics.High prices hinder the bioplastics industry

The higher costs of bioplastic materials are an additional significant factor restraining the global automotive bioplastic market. Due to the need for specialized feedstocks and additional refining and manufacturing procedures, the production of bioplastics is more expensive than that of conventional plastic materials. Even though bioplastics are viewed as an eco-friendly alternative to conventional plastics, the high costs associated with their production and manufacturing pose a significant obstacle for companies in the industry.Material Difficulties with Automotive Bioplastics

Bioplastics' material property challenges are an additional significant factor restraining the global automotive bioplastics market. Bioplastics have distinct properties from traditional plastics, which may affect their suitability for automotive applications. For instance, bioplastics are more susceptible to heat and moisture, which can result in their degradation or loss of structural integrity.Intense Rivalry in the Bioplastics Market

The global automotive bioplastic market's final significant factor restraining competition is competition. Established firms and new entrants compete for market share in a highly competitive market. Companies are forced to innovate or perish due to the competition among market participants. For companies to maintain their competitiveness over the long term, new bioplastic materials must be developed with enhanced material properties and lower costs.Material Type Analysis

The Bio Polyethylene Terephthalate (Bio-PET) segment has dominated the global automotive bioplastics market. The market's most dominant material kind is for good reason.The global automotive bioplastics market uses Bio-PET, a synthetic polymer that is not biodegradable. However, its usage in automobile bioplastics is altering the story. Bio-PET has given the car sector sustainable, eco-friendly options, illustrating that technology and creativity can fight climate change.The global automotive bioplastics market adoption of Bio-PET shows humans' joint commitment to improving the earth for future generations.Emerging economies' economic growth is boosting the global automotive bioplastics market Bio-PET segment. Bioplastics manufacturers are capitalizing on these industries' huge development potential. The global automotive bioplastics market is shifting toward Bio-PET. Emerging economies are also leading the adoption of this material. This is puzzling since these countries may not have developed economies yet.Emerging economies are seeking sustainable, eco-friendly solutions to boost economic growth without harming the environment.Emerging economies are adopting Bio-PET, signaling a move toward sustainability. Humans acknowledge their role in improving the planet.Applications Analysis

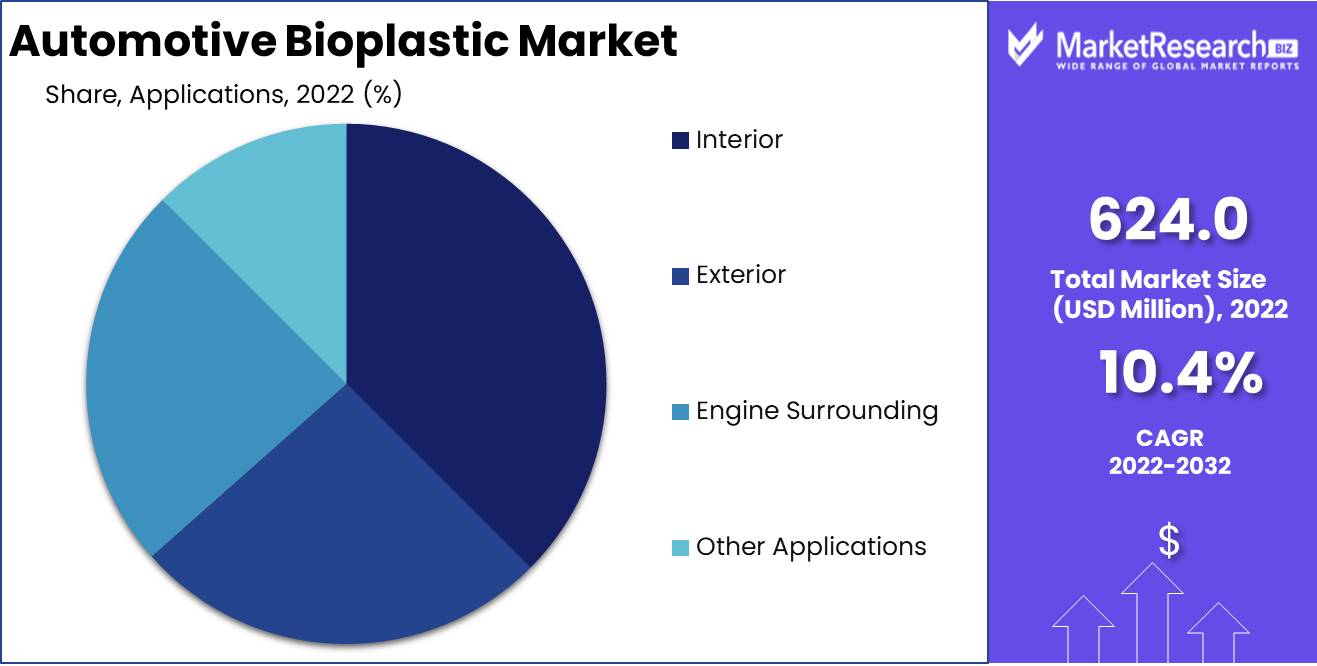

The interior segment dominates the global automotive bioplastics market. Many manufacturers have targeted this segment, with impressive results.The vehicle interior segment, formerly considered the least major bioplastics market, is now the dominant force. To use bioplastics in the interior segment of the car industry, producers must apply their imagination to make products that look and last like traditional plastics.The usage of bioplastics in the interior segment of the car industry shows that people are eager to take on the challenge of making attractive, durable, and eco-friendly products.

Vehicle Type Analysis

The passenger car segment dominates the global automotive bioplastics market. This segment has the biggest market share and is growing.The passenger vehicle segment has the biggest market share, but heavy-duty trucks and buses may have a greater environmental impact. The passenger car segment uses bioplastics, therefore manufacturers must be creative to meet automotive industry standards while being environmentally responsible.The passenger car segment dominates the global automotive bioplastics market, showing that humans are prepared to prioritize comfort and convenience while considering their environmental impact.Key Market Segments

By Material Type- Bio Poly-Trimethylene Terephthalate

- Bio Polyethylene

- Bio Polyethylene Terephthalate

- Bio Poly-Amide

- Other Material Types

- Interior

- Exterior

- Engine Surrounding

- Other Applications

- Heavy Commercial Vehicle

- Light Commercial Vehicle

- Passenger Car

- Electric Vehicles

Growth Opportunity

Eco-Friendly Automotive Bioplastic Market Growing Globally

We're thrilled to discuss worldwide automotive bioplastic market growth. The market has grown in recent years due to the adoption of bioplastics made from renewable resources. Cost-effective high-performance bioplastics, capacity growth, collaboration, and circular economy adoption promote automotive bioplastic demand.Bioplastics Transforming Automotive Industry

Automotive components have typically been made from oil-based polymers. The adoption of bioplastics has expanded due to the demand for more environmentally friendly and sustainable materials. Bioplastics made from renewable resources like cornstarch, sugarcane, and potato starch are becoming more popular because they offer greater performance and are less expensive than regular plastics.Collaboration Advances Automotive Bioplastics

Autobioplastic market growth requires collaboration. Carmakers, bioplastic manufacturers, and suppliers must collaborate to create novel automotive solutions. Collaboration can provide novel materials that offer improved performance, cost-effectiveness, and sustainability. Toyota and BASF developed Ecovio, a bioplastic used in door trims, seats, and other interior components.Circular Economy Drives Automotive Bioplastic Market

The adoption of circular economy concepts can promote bioplastic market growth in the automotive industry. By creating goods that are simple to recycle, circular economy models seek to reduce waste and encourage the reuse of materials. Bioplastics, made from renewable resources and recyclable, follow circular economy ideals.Latest Trends

The Automotive Industry's Adoption of Eco-Friendly Materials

The automotive industry is one of the leading environmental polluters. The use of non-biodegradable and non-compostable plastics has only worsened the situation. The automotive industry has been searching for more sustainable options, which has led to a change in the situation in recent years. The utilization of bioplastics, natural fiber composites, and recyclability have altered the market's dynamics.Bioplastics Transform Automotive Industry

In the automotive industry, biodegradable and compostable plastics are acquiring popularity. These bioplastics are made from renewable resources including cornstarch, sugarcane, and cellulose. Utilizing these plastics has a number of advantages, including environmental sustainability, a reduction in greenhouse gas emissions, and increased landfill space.Natural Fiber Composites Shaping Automobiles

These bioplastics have found multiple applications in the automotive industry, including interior components, door panels, and cargo liners. In the automotive industry, the use of bioplastics has increased as a result of stringent regulations imposed by governments worldwide to reduce the environmental impact of plastics.Environmental Change Caused by Bioplastics

Natural fiber composites are another trend in the bioplastics market for automobiles. These composites are made from plant-based fibers including hemp, flax, and jute. Utilizing natural fiber composites has a number of advantages, including minimal environmental impact, weight reduction, and recyclability. These composites have found numerous applications in the automotive industry, including door panels, seat backs, and dashboards.Lightweight and Environmentally Benign are Two Benefits of Natural Fiber Composites

Natural fiber composites have a significant impact on the vehicle's weight reduction. This results in improved fuel economy and reduced carbon emissions. The recyclability of natural fiber composites makes them an ideal replacement for conventional plastics, which are difficult to recycle.Recyclable Materials Revolutionize the Automotive Sector

Recycling of plastic waste is one of the automotive industry's greatest challenges. The use of bioplastics and natural fiber composites has substantially mitigated this problem. These materials are more easily recyclable than conventional plastics. They are recyclable multiple times without material degradation.Beyond Interiors, Bioplastics and Composites Find Applications

The majority of bioplastics and natural fiber composites have been used in vehicle interior components. However, technological advancements have led to their use in exterior components as well. These materials have found applications in bumper systems, exterior body panels, and grilles.Regional Analysis

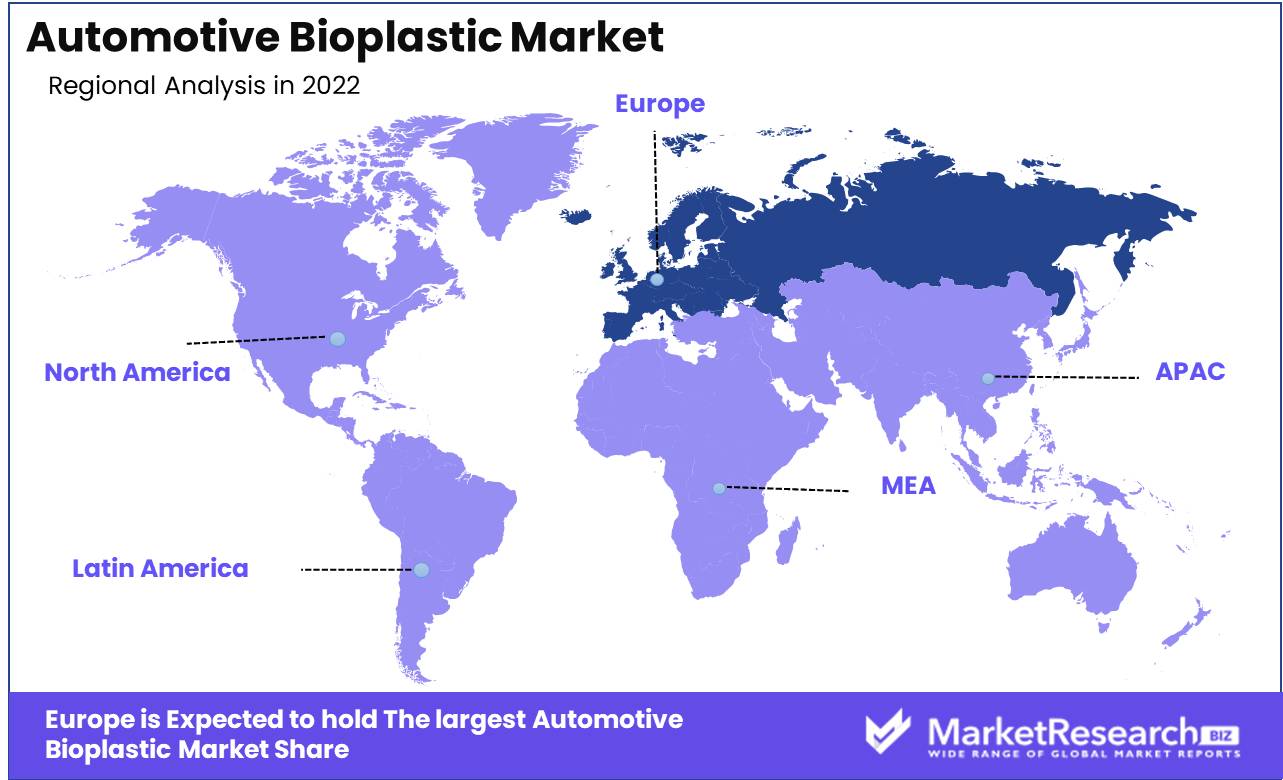

Europe dominates the automotive bioplastic market and the causes driving its growth. We will examine the drivers of bioplastic adoption in the automotive industry and how Europe is at the forefront of this movement. The automotive industry is buzzing about bioplastics. The automotive industry is increasingly using bioplastics as the globe moves toward sustainable development and green technologies. Consumers are requesting eco-friendly automotive products. Bioplastics' low carbon footprint, biodegradability, and renewable sources make them appealing. Europe has been at the forefront of sustainability, with the EU and individual countries establishing laws to promote bioplastic use in all sectors of the economy. Regulations and incentives have supported bioplastics in vehicle manufacturing in the automotive industry. Major car manufacturers in Europe, like Volkswagen and BMW, incorporate bioplastics in their vehicles. To cut carbon emissions, they use bioplastics in trims, dashboards, and seat covers. Manufacturers, suppliers, and governments are all part of the intricate ecosystem that is the automotive industry. Innovating and developing new things requires collaboration and collaboration. Europe has a robust bioplastics industry, with companies and research institutes developing new bioplastic materials for automotive uses. The Bioforever project, financed by the European Union, aims to provide affordable bioplastic materials for the automotive industry. NatureWorks and Braskem are leading bioplastics manufacturers in Europe. These companies are developing new bioplastic materials that meet the automotive industry's performance, durability, and safety standards. The circular economy emphasizes reusing, refurbishing, and recycling materials to reduce waste and environmental damage. Bioplastics' biodegradability and compostability make them essential to the circular economy. The EU promotes circular practices in numerous sectors through rules and initiatives. The automotive industry is no exception, with initiatives like the EU End-of-Life Vehicles Directive forcing automakers to keep their vehicles eco-friendly throughout their lifespan.

Key Regions and Countries

North America- US

- Canada

- Mexico

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Recently, the global automotive bioplastic market has grown rapidly. BASF SE, Braskem, Borealis AG, NatureWorks LLC, and Arkema Inc. are some of the major competitors in the market. These firms are developing bio-based materials to replace petroleum-based products in the automotive sector, lowering their environmental effect. BASF SE is a leading chemical company with several sustainable automotive products. The company is developing bioplastic materials with heat resistance and durability. Braskem, the top American polyethylene and polypropylene producer, is another prominent player in the automotive bioplastic market. The company is developing biopolymer resins for automotive applications. Austrian company Borealis AG makes bioplastic automotive interior materials. Dashboard trims, door panels, and other interior components can employ the company's sugarcane-based polypropylene resins. NatureWorks LLC's biobased polylactic acid (PLA) resins are used in many automotive applications and have contributed to the automotive bioplastic market. French specialty chemicals company Arkema Inc. has been developing bioplastic automotive materials. Biobased polyamides and thermoplastic elastomers for automotive applications are the company's products. These significant players have pushed automotive innovation and sustainable materials.Top Key Players in Automotive Bioplastic Market

- BASF SE

- Borealis AG

- Arkema Inc

- Archer Daniels Midland Company

- AGRANA Beteiligungs-AG

- Mitsubishi Chemical Corporation

- Novamont S.p.A.

- Danimer Scientific

- NatureWorks LLC

- BioSphere Plastic

- Bosk Bioproduits inc.

- Other Key Players

Recent Development

- In 2023, The use of bioplastics for electric vehicle (EV) battery enclosures is one of the most significant advancements in automotive bioplastics. The bioplastics' lightweight and insulating properties made them suitable for constructing EV battery enclosures.

- In 2022, The development and adoption of recycled bioplastics in the automotive industry received significant attention. Various techniques to recycle bioplastics, enabling their reuse in vehicle production, were investigated by manufacturers.

- In 2021, The automotive industry began to adopt a trend toward using biodegradable packaging materials. Bioplastics derived from renewable resources, such as sugarcane and maize, were utilized for the transportation packaging of automotive components.

- In 2020, Biodegradable bioplastics were first used for interior components by automotive manufacturers. Objects such as dashboard panels, seat garnishes, and storage compartments were created using biodegradable materials derived from renewable sources, such as cornstarch.

- In 2019, Bioplastic composites for automotive applications underwent significant advancements.

Report Scope:

Report Features Description Market Value (2022) USD 624.0 Mn Forecast Revenue (2032) USD 1,637.3 Mn CAGR (2023-2032) 10.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material Type (Bio Poly-Trimethylene Terephthalate, Bio Polyethylene, Bio Polyethylene Terephthalate, Bio Poly-Amide, Other Material Types), By Applications (Interior, Exterior, Engine Surrounding, Other Applications), By Vehicle Type (Heavy Commercial Vehicle, Light Commercial Vehicle, Passenger Car, Electric Vehicles) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BASF SE, Borealis AG, Arkema Inc, Archer Daniels Midland Company, AGRANA Beteiligungs-AG, Mitsubishi Chemical Corporation, Novamont S.p.A., Danimer Scientific, NatureWorks LLC, BioSphere Plastic, Bosk Bioproducts inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- BASF SE

- Borealis AG

- Arkema Inc

- Archer Daniels Midland Company

- AGRANA Beteiligungs-AG

- Mitsubishi Chemical Corporation

- Novamont S.p.A.

- Danimer Scientific

- NatureWorks LLC

- BioSphere Plastic

- Bosk Bioproduits inc.

- Other Key Players