Automated Microbiology Market By Product (Instruments, Automated culture systems, Microbiology analyzers, Reagents), By Diagnostic Technology (DNA sequencing, DNA & RNA probe technology, Detection techniques, Monoclonal antibodies, Immunoassays), By End-Use (Hospitals, Clinical laboratories, Biotechnology industries, Blood banks), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

49149

-

July 2024

-

136

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

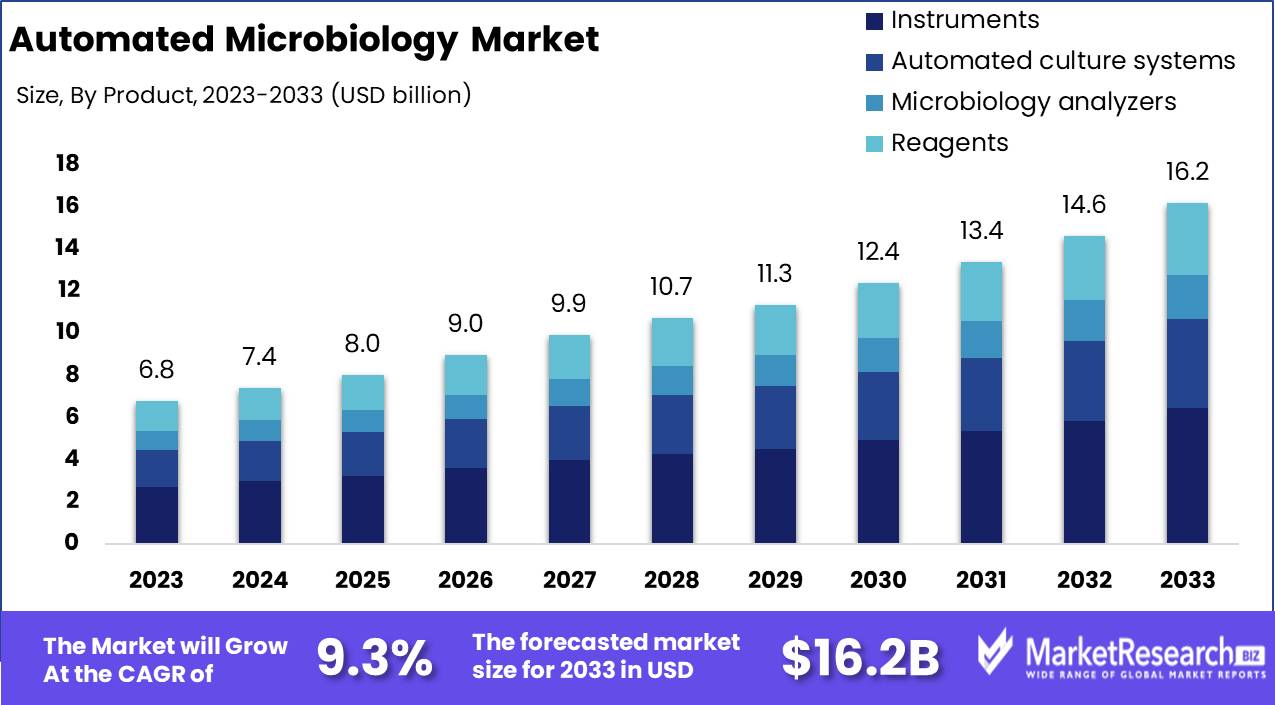

The Global Automated Microbiology Market was valued at USD 6.8 Bn in 2023. It is expected to reach USD 16.2 Bn by 2033, with a CAGR of 9.3% during the forecast period from 2024 to 2033.

The Automated Microbiology Market encompasses technologies and systems designed to automate the processes involved in microbiological testing and analysis. These include automated instruments for microbial identification, susceptibility testing, and culture processing. Automation in microbiology enhances efficiency, accuracy, and throughput while reducing manual labor and the potential for human error.

The market is driven by the increasing demand for rapid diagnostic solutions, advancements in technology, and the need for high-throughput testing in clinical, industrial, and environmental applications. Innovations such as MALDI-TOF mass spectrometry and fully automated laboratory equipment services are key components of this evolving market.

The Automated Microbiology Market is witnessing robust growth, driven by the need for rapid, accurate, and high-throughput diagnostic solutions. Traditional microbiological methods, often labor-intensive and time-consuming, are being supplanted by advanced automated systems that offer significant improvements in efficiency and reliability. One notable advancement is the use of MALDI-TOF mass spectrometry, which can identify microorganisms within 10-30 minutes, a substantial reduction from the 24-48 hours required by conventional biochemical identification methods. This rapid identification capability is critical in clinical settings where timely diagnosis can significantly impact patient outcomes.

The implementation of automated systems such as the BD Kiestra TLA (Total Laboratory Automation) has demonstrated substantial operational efficiencies. For example, the University Hospitals Cleveland Medical Center reported a 20% reduction in staffing needs after adopting the BD Kiestra TLA system. This reduction underscores the cost-saving potential and increased efficiency that automation brings to microbiology laboratories. Additionally, these systems improve the consistency and accuracy of test results, enhancing overall laboratory performance.

The market is also benefiting from the growing prevalence of infectious diseases and the need for advanced diagnostic tools to manage and control outbreaks. Automated microbiology systems are increasingly being adopted in clinical diagnostics, pharmaceutical research, food and beverage testing, and environmental monitoring. The integration of automation in these areas not only accelerates the testing process but also ensures high-quality results, supporting better decision-making in public health and safety.

Key Takeaways

- Market Growth: The Global Automated Microbiology Market was valued at USD 6.8 Bn in 2023. It is expected to reach USD 16.2 Bn by 2033, with a CAGR of 9.3% during the forecast period from 2024 to 2033.

- By Product: Instruments form a vital component, comprising 40% of the market, essential for automated and efficient microbial analysis.

- By Diagnostic Technology: DNA sequencing technology is used in 30% of applications, crucial for precise pathogen identification and resistance profiling.

- By End-Use: Hospitals are the major end-users, representing 40% of the market, due to their need for rapid and accurate microbial diagnostics.

- Regional Dominance: North America dominates with a 38% share, supported by advanced healthcare infrastructure and high investment in medical technology.

- Growth Opportunity: Integration of AI and machine learning in diagnostic processes offers opportunities for enhanced accuracy and speed in microbial identification.

Driving factors

Rising Incidence of Infectious Diseases

The increasing prevalence of infectious diseases globally is a significant driver for the automated microbiology market. With the World Health Organization reporting frequent outbreaks and the rising threat of pandemics, the need for efficient and accurate diagnostic methods is paramount. Automated microbiology systems offer rapid and reliable detection of pathogens, enabling timely intervention and treatment. This demand is crucial for managing public health and reducing the spread of infectious diseases, thereby driving the adoption of automated microbiology solutions.

Increasing Demand for Rapid Diagnostic Techniques

The demand for rapid diagnostic techniques is growing due to the need for quick and accurate detection of diseases. Automated microbiology systems significantly reduce the time required for diagnostic processes compared to traditional methods, providing results in hours rather than days. This speed is vital for critical clinical decisions, particularly in hospitals and emergency settings. As healthcare providers strive for better patient outcomes, the adoption of rapid diagnostic technologies is accelerating, propelling the automated microbiology market forward.

Technological Advancements in Automation

Technological advancements in automation are transforming the microbiology landscape. Innovations such as automated culture systems, molecular diagnostic tools, and advanced imaging technologies enhance the accuracy, efficiency, and scalability of microbiological analyses. These advancements reduce human error, improve reproducibility, and streamline workflows, making automated systems indispensable in modern laboratories. The continuous evolution of automation technology is a key driver of market growth, meeting the increasing demands of clinical diagnostics and research.

Restraining Factors

High Cost of Automated Systems

One of the major restraining factors for the automated microbiology market is the high cost associated with implementing and maintaining automated systems. These systems require substantial initial investment, which can be a barrier for smaller laboratories and healthcare facilities with limited budgets. Additionally, the cost of regular maintenance and updates further adds to the financial burden, potentially slowing down market adoption.

Limited Skilled Personnel

The shortage of skilled personnel capable of operating and managing sophisticated automated microbiology systems is another significant challenge. Specialized training and expertise are required to effectively utilize these advanced technologies, and the current workforce gap limits the widespread implementation of automated systems. Investing in education and training programs is essential to address this issue and ensure sustainable market growth.

By Product Analysis

Instruments dominated the By Product segment of the Automated Microbiology Market in 2023, capturing more than a 40% share.

In 2023, Instruments held a dominant market position in the By Product segment of the Automated Microbiology Market, capturing more than a 40% share. This significant market share is driven by the essential role of instruments such as automated culture systems and microbiology analyzers in enhancing the efficiency and accuracy of microbiological testing. These instruments are crucial for rapid and precise identification of microorganisms, which is vital in clinical diagnostics, pharmaceutical research, and food safety testing.

Automated culture systems are critical for cultivating and identifying microbial organisms quickly and accurately. They enhance laboratory throughput and reduce manual intervention, making them indispensable in modern microbiology labs.

Microbiology analyzers are integral in performing a wide range of microbiological tests, from pathogen identification to antibiotic susceptibility testing. Their ability to process multiple samples simultaneously with high accuracy contributes to their substantial use in clinical and research settings.

Reagents, while essential for performing microbiological assays and tests, hold a smaller market share compared to instruments. The ongoing need for reagents to support various diagnostic and research activities ensures steady demand, but their market share is relatively lower due to the capital investment and technological advancement driving the instruments segment.

By Diagnostic Technology Analysis

DNA sequencing dominated the By Diagnostic Technology segment of the Automated Microbiology Market in 2023, capturing more than a 30% share.

In 2023, DNA sequencing held a dominant market position in the By Diagnostic Technology segment of the Automated Microbiology Market, capturing more than a 30% share. The prominence of DNA sequencing is due to its unparalleled accuracy and ability to provide comprehensive insights into microbial genetics, facilitating the identification of pathogens and the understanding of their genetic makeup. This technology is critical in clinical diagnostics, epidemiology, and research, driving its widespread adoption and significant market share.

DNA & RNA probe technology is also a vital diagnostic tool, used for detecting specific genetic sequences of pathogens. This technology is crucial for rapid and accurate microbial identification, although its market share is smaller than DNA sequencing due to its more targeted application and lower overall adoption rate.

Detection techniques, encompassing various methods such as PCR and mass spectrometry, are essential for identifying and quantifying microorganisms. These techniques offer high sensitivity and specificity but hold a smaller market share compared to DNA sequencing due to their broader application scope and varying degrees of technological complexity.

Monoclonal antibodies are used in various diagnostic assays to detect specific antigens. They are valuable in clinical diagnostics and research but have a smaller market share due to their niche applications compared to more widely used gene sequencing technologies.

Immunoassays are employed for detecting antigens or antibodies in samples, playing a crucial role in diagnostics and monitoring of infectious diseases. Despite their importance, their market share is less than that of DNA sequencing, reflecting the broader adoption and higher precision of genetic technologies.

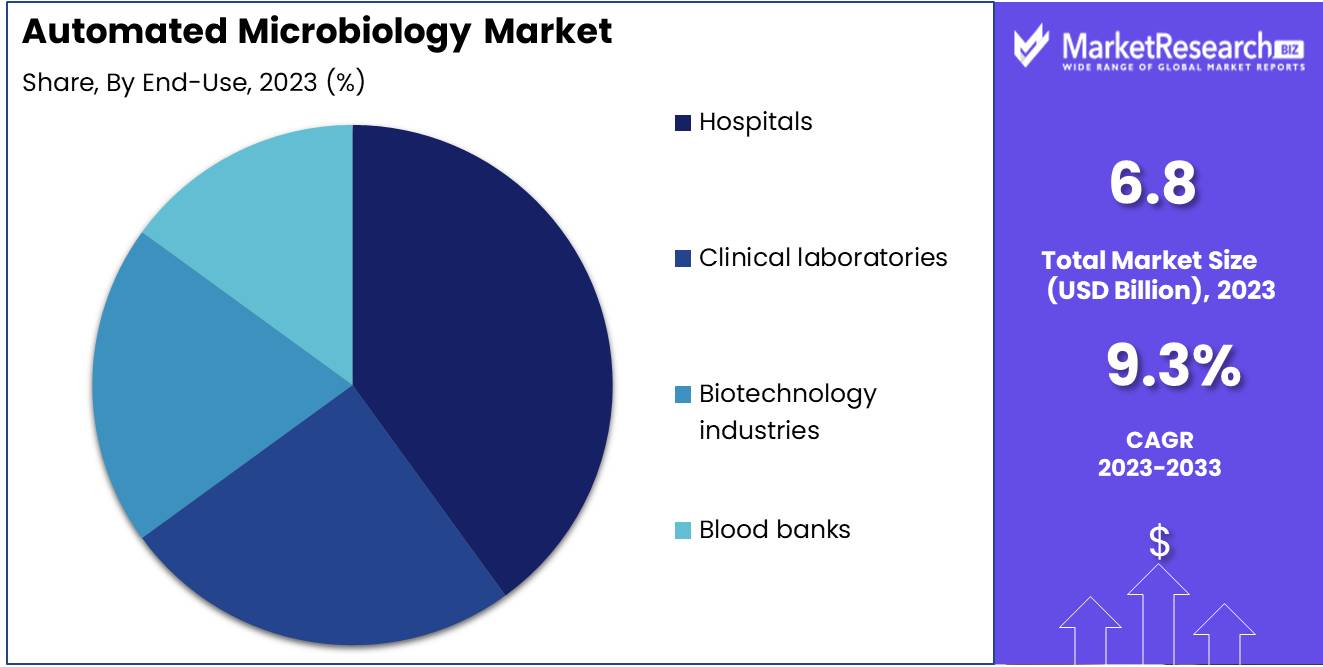

By End-Use Analysis

Hospitals dominated the By End-Use segment of the Automated Microbiology Market in 2023, capturing more than a 40% share.

In 2023, Hospitals held a dominant market position in the By End-Use segment of the Automated Microbiology Market, capturing more than a 40% share. The significant market share is attributed to the critical role hospitals play in diagnosing and treating infectious diseases. Automated microbiology systems in hospitals enhance diagnostic accuracy and speed, crucial for patient management and infection control.

Clinical laboratories are essential for conducting a wide range of diagnostic tests, including microbiological assays. They leverage automated systems to improve efficiency and accuracy in high-volume testing environments.

Biotechnology industries utilize automated microbiology systems for research and development, quality control, and production processes. These industries benefit from the precision and efficiency of automated systems, although their market share is lower compared to hospitals due to the specialized nature of their applications.

Blood banks rely on automated microbiology systems to ensure the safety and quality of products by blood screening for infectious agents. While crucial for public health, their market share is relatively modest due to the specific and limited scope of their operations compared to the extensive diagnostic activities in hospitals.

Key Market Segments

By Product

- Instruments

- Automated culture systems

- Microbiology analyzers

- Reagents

By Diagnostic Technology

- DNA sequencing

- DNA & RNA probe technology

- Detection techniques

- Monoclonal antibodies

- Immunoassays

By End-Use

- Hospitals

- Clinical laboratories

- Biotechnology industries

- Blood banks

Growth Opportunity

Development of Portable and User-Friendly Devices

The development of portable and user-friendly automated microbiology devices presents a substantial opportunity for market expansion in 2024. Portable devices enable point-of-care testing, bringing diagnostic capabilities closer to patients and reducing the need for centralized laboratory infrastructure. These user-friendly systems are particularly beneficial in resource-limited settings and remote areas, improving access to timely diagnostics and healthcare services. The growing trend towards decentralization of healthcare delivery supports the demand for such innovative solutions.

Integration with Big Data and AI for Predictive Diagnostics

The integration of big data analytics and artificial intelligence (AI) into automated microbiology systems offers promising growth opportunities. AI-driven predictive diagnostics can analyze vast datasets to identify patterns, predict disease outbreaks, and personalize treatment plans. These capabilities enhance the efficiency and accuracy of diagnostics, leading to better patient outcomes and optimized healthcare resources. Leveraging big data and AI in microbiology not only improves diagnostic precision but also drives innovation and market growth.

Latest Trends

Use of AI and Machine Learning in Microbiology

The increasing use of AI and machine learning in microbiology is a significant trend shaping the market in 2024. AI algorithms can process complex biological data, automate routine tasks, and provide insights that are beyond human capability. Machine learning models improve over time with continuous data input, enhancing the accuracy and reliability of microbiological diagnostics. This trend is expected to revolutionize the field, making automated systems more intelligent and efficient.

Growth of Lab-on-a-Chip Technology

The growth of lab-on-a-chip technology is another key trend impacting the automated microbiology market. Lab-on-a-chip devices integrate multiple laboratory functions on a single microchip, enabling high-throughput and miniaturized diagnostic testing. These compact systems offer rapid and precise results, making them ideal for point-of-care and field applications. The adoption of lab-on-a-chip technology is expected to accelerate, driven by its potential to streamline workflows, reduce costs, and enhance diagnostic capabilities.

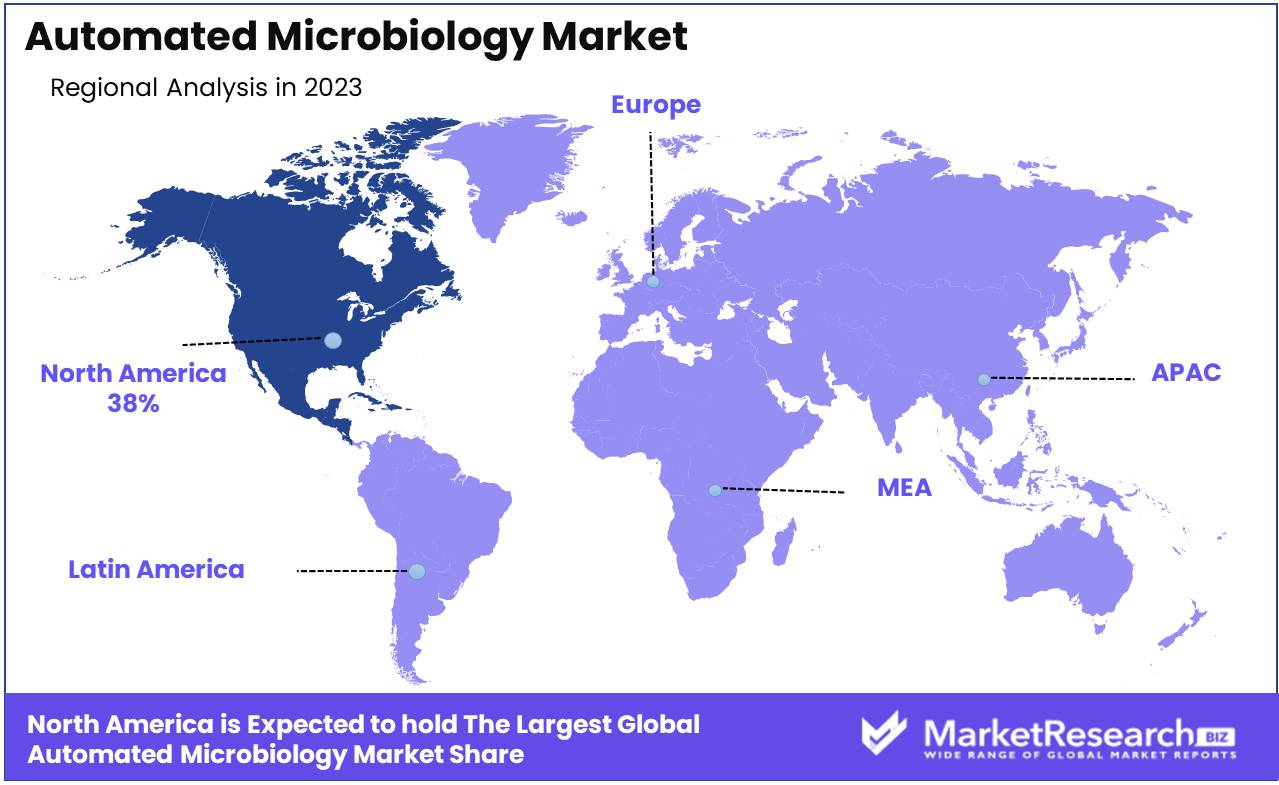

Regional Analysis

Automated Microbiology Market by Region: North America, Europe, Asia Pacific, Middle East & Africa, Latin America

In 2023, North America dominated the Automated Microbiology Market, capturing a substantial 38% share. This dominance is driven by the region's advanced healthcare infrastructure, significant investment in research and development, and the high prevalence of infectious diseases. The United States and Canada lead the market with widespread adoption of automated microbiology systems in clinical laboratories and hospitals to improve diagnostic accuracy and efficiency. The presence of major market players and continuous technological advancements further support market growth in this region.

Europe holds a significant share in the automated microbiology market, driven by the strong focus on improving healthcare outcomes and stringent regulatory requirements. The region's commitment to healthcare innovation and investment in laboratory automation support the market's substantial share.

Asia Pacific is experiencing rapid growth in the automated microbiology market, fueled by increasing healthcare investments, rising incidences of infectious diseases, and improving healthcare infrastructure. The region's large population base and growing demand for advanced diagnostic solutions drive market expansion.

Middle East & Africa show promising potential for growth in the automated microbiology market, supported by increasing investments in healthcare infrastructure and efforts to enhance disease diagnostics. The adoption of advanced microbiology systems is gradually increasing, driven by the need to improve healthcare outcomes.

Latin America is emerging as a growing market for automated microbiology systems, with Brazil and Mexico leading the demand. The region benefits from improvements in healthcare infrastructure and a growing focus on enhancing diagnostic capabilities.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global automated microbiology market is projected to witness substantial growth in 2024, driven by technological advancements and the increasing demand for efficient and accurate microbial testing. Key players such as Becton Dickinson and Company, Bio-Rad Laboratories, Inc., and bioMeriux, Inc. are at the forefront of this market, leveraging their technological prowess and comprehensive product offerings.

Becton Dickinson and Company continues to lead the market with its advanced diagnostic systems and strong focus on innovation. Their integrated solutions for microbiological testing ensure high accuracy and efficiency, catering to the needs of clinical laboratories worldwide.

Bio-Rad Laboratories, Inc. and bioMeriux, Inc. are enhancing their market presence through continuous product development and strategic collaborations. Their comprehensive range of automated systems and reagents for microbiology testing positions them well to meet the increasing demand for rapid and reliable diagnostic solutions.

QIAGEN GmbH and Beckman Coulter are leveraging their strong technological foundations to develop next-generation microbiology testing solutions. Their focus on automation and digitalization enhances laboratory workflows, improving overall productivity and accuracy.

Agilent Technologies, Inc. and Gene-Probe, Inc. are expanding their market reach through innovative product offerings and strategic partnerships. Their emphasis on high-throughput and automated solutions ensures they remain competitive in the evolving microbiology market.

Affymetrix, Inc. and Abbott Laboratories continue to focus on developing cutting-edge technologies for microbial identification and susceptibility testing. Their commitment to research and development enables them to introduce advanced solutions that cater to the needs of modern laboratories.

Market Key Players

- Becton Dickinson and Company

- Bio-Rad Laboratories, Inc.

- bioMeriux, Inc.

- QIAGEN GmbH

- Beckman Coulter

- Agilent Technologies, Inc.

- Gene-Probe, Inc.

- Affymetrix, Inc.

- Abbott Laboratories

Recent Development

- In June 2024, BD (Becton, Dickinson and Company) introduced an advanced automated blood culture system, BD BACTEC FX40, improving pathogen detection.

- In May 2024, bioMérieux launched a new automated microbiology platform, VITEK MS PRIME, enhancing lab workflow efficiency.

Report Scope

Report Features Description Market Value (2023) USD 6.8 Bn Forecast Revenue (2033) USD 16.2 Bn CAGR (2024-2033) 9.3% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Instruments, Automated culture systems, Microbiology analyzers, Reagents), By Diagnostic Technology (DNA sequencing, DNA & RNA probe technology, Detection techniques, Monoclonal antibodies, Immunoassays), By End-Use (Hospitals, Clinical laboratories, Biotechnology industries, Blood banks) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Becton Dickinson and Company, Bio-Rad Laboratories, Inc., bioMeriux, Inc., QIAGEN GmbH, Beckman Coulter, Agilent Technologies, Inc., Gene-Probe, Inc., Affymetrix, Inc., Abbott Laboratories Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Automated Microbiology Market Overview

- 2.1. Automated Microbiology Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Automated Microbiology Market Dynamics

- 3. Global Automated Microbiology Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Automated Microbiology Market Analysis, 2016-2021

- 3.2. Global Automated Microbiology Market Opportunity and Forecast, 2023-2032

- 3.3. Global Automated Microbiology Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 3.3.1. Global Automated Microbiology Market Analysis by By Product: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 3.3.3. Instruments

- 3.3.4. Automated culture systems

- 3.3.5. Microbiology analyzers

- 3.3.6. Reagents

- 3.4. Global Automated Microbiology Market Analysis, Opportunity and Forecast, By By Diagnostic Technology, 2016-2032

- 3.4.1. Global Automated Microbiology Market Analysis by By Diagnostic Technology: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Diagnostic Technology, 2016-2032

- 3.4.3. DNA sequencing

- 3.4.4. DNA & RNA probe technology

- 3.4.5. Detection techniques

- 3.4.6. Monoclonal antibodies

- 3.4.7. Immunoassays

- 3.5. Global Automated Microbiology Market Analysis, Opportunity and Forecast, By By End-Use, 2016-2032

- 3.5.1. Global Automated Microbiology Market Analysis by By End-Use: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-Use, 2016-2032

- 3.5.3. Hospitals

- 3.5.4. Clinical laboratories

- 3.5.5. Biotechnology industries

- 3.5.6. Blood banks

- 4. North America Automated Microbiology Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Automated Microbiology Market Analysis, 2016-2021

- 4.2. North America Automated Microbiology Market Opportunity and Forecast, 2023-2032

- 4.3. North America Automated Microbiology Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 4.3.1. North America Automated Microbiology Market Analysis by By Product: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 4.3.3. Instruments

- 4.3.4. Automated culture systems

- 4.3.5. Microbiology analyzers

- 4.3.6. Reagents

- 4.4. North America Automated Microbiology Market Analysis, Opportunity and Forecast, By By Diagnostic Technology, 2016-2032

- 4.4.1. North America Automated Microbiology Market Analysis by By Diagnostic Technology: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Diagnostic Technology, 2016-2032

- 4.4.3. DNA sequencing

- 4.4.4. DNA & RNA probe technology

- 4.4.5. Detection techniques

- 4.4.6. Monoclonal antibodies

- 4.4.7. Immunoassays

- 4.5. North America Automated Microbiology Market Analysis, Opportunity and Forecast, By By End-Use, 2016-2032

- 4.5.1. North America Automated Microbiology Market Analysis by By End-Use: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-Use, 2016-2032

- 4.5.3. Hospitals

- 4.5.4. Clinical laboratories

- 4.5.5. Biotechnology industries

- 4.5.6. Blood banks

- 4.6. North America Automated Microbiology Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Automated Microbiology Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Automated Microbiology Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Automated Microbiology Market Analysis, 2016-2021

- 5.2. Western Europe Automated Microbiology Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Automated Microbiology Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 5.3.1. Western Europe Automated Microbiology Market Analysis by By Product: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 5.3.3. Instruments

- 5.3.4. Automated culture systems

- 5.3.5. Microbiology analyzers

- 5.3.6. Reagents

- 5.4. Western Europe Automated Microbiology Market Analysis, Opportunity and Forecast, By By Diagnostic Technology, 2016-2032

- 5.4.1. Western Europe Automated Microbiology Market Analysis by By Diagnostic Technology: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Diagnostic Technology, 2016-2032

- 5.4.3. DNA sequencing

- 5.4.4. DNA & RNA probe technology

- 5.4.5. Detection techniques

- 5.4.6. Monoclonal antibodies

- 5.4.7. Immunoassays

- 5.5. Western Europe Automated Microbiology Market Analysis, Opportunity and Forecast, By By End-Use, 2016-2032

- 5.5.1. Western Europe Automated Microbiology Market Analysis by By End-Use: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-Use, 2016-2032

- 5.5.3. Hospitals

- 5.5.4. Clinical laboratories

- 5.5.5. Biotechnology industries

- 5.5.6. Blood banks

- 5.6. Western Europe Automated Microbiology Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Automated Microbiology Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Automated Microbiology Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Automated Microbiology Market Analysis, 2016-2021

- 6.2. Eastern Europe Automated Microbiology Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Automated Microbiology Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 6.3.1. Eastern Europe Automated Microbiology Market Analysis by By Product: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 6.3.3. Instruments

- 6.3.4. Automated culture systems

- 6.3.5. Microbiology analyzers

- 6.3.6. Reagents

- 6.4. Eastern Europe Automated Microbiology Market Analysis, Opportunity and Forecast, By By Diagnostic Technology, 2016-2032

- 6.4.1. Eastern Europe Automated Microbiology Market Analysis by By Diagnostic Technology: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Diagnostic Technology, 2016-2032

- 6.4.3. DNA sequencing

- 6.4.4. DNA & RNA probe technology

- 6.4.5. Detection techniques

- 6.4.6. Monoclonal antibodies

- 6.4.7. Immunoassays

- 6.5. Eastern Europe Automated Microbiology Market Analysis, Opportunity and Forecast, By By End-Use, 2016-2032

- 6.5.1. Eastern Europe Automated Microbiology Market Analysis by By End-Use: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-Use, 2016-2032

- 6.5.3. Hospitals

- 6.5.4. Clinical laboratories

- 6.5.5. Biotechnology industries

- 6.5.6. Blood banks

- 6.6. Eastern Europe Automated Microbiology Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Automated Microbiology Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Automated Microbiology Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Automated Microbiology Market Analysis, 2016-2021

- 7.2. APAC Automated Microbiology Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Automated Microbiology Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 7.3.1. APAC Automated Microbiology Market Analysis by By Product: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 7.3.3. Instruments

- 7.3.4. Automated culture systems

- 7.3.5. Microbiology analyzers

- 7.3.6. Reagents

- 7.4. APAC Automated Microbiology Market Analysis, Opportunity and Forecast, By By Diagnostic Technology, 2016-2032

- 7.4.1. APAC Automated Microbiology Market Analysis by By Diagnostic Technology: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Diagnostic Technology, 2016-2032

- 7.4.3. DNA sequencing

- 7.4.4. DNA & RNA probe technology

- 7.4.5. Detection techniques

- 7.4.6. Monoclonal antibodies

- 7.4.7. Immunoassays

- 7.5. APAC Automated Microbiology Market Analysis, Opportunity and Forecast, By By End-Use, 2016-2032

- 7.5.1. APAC Automated Microbiology Market Analysis by By End-Use: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-Use, 2016-2032

- 7.5.3. Hospitals

- 7.5.4. Clinical laboratories

- 7.5.5. Biotechnology industries

- 7.5.6. Blood banks

- 7.6. APAC Automated Microbiology Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Automated Microbiology Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Automated Microbiology Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Automated Microbiology Market Analysis, 2016-2021

- 8.2. Latin America Automated Microbiology Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Automated Microbiology Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 8.3.1. Latin America Automated Microbiology Market Analysis by By Product: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 8.3.3. Instruments

- 8.3.4. Automated culture systems

- 8.3.5. Microbiology analyzers

- 8.3.6. Reagents

- 8.4. Latin America Automated Microbiology Market Analysis, Opportunity and Forecast, By By Diagnostic Technology, 2016-2032

- 8.4.1. Latin America Automated Microbiology Market Analysis by By Diagnostic Technology: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Diagnostic Technology, 2016-2032

- 8.4.3. DNA sequencing

- 8.4.4. DNA & RNA probe technology

- 8.4.5. Detection techniques

- 8.4.6. Monoclonal antibodies

- 8.4.7. Immunoassays

- 8.5. Latin America Automated Microbiology Market Analysis, Opportunity and Forecast, By By End-Use, 2016-2032

- 8.5.1. Latin America Automated Microbiology Market Analysis by By End-Use: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-Use, 2016-2032

- 8.5.3. Hospitals

- 8.5.4. Clinical laboratories

- 8.5.5. Biotechnology industries

- 8.5.6. Blood banks

- 8.6. Latin America Automated Microbiology Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Automated Microbiology Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Automated Microbiology Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Automated Microbiology Market Analysis, 2016-2021

- 9.2. Middle East & Africa Automated Microbiology Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Automated Microbiology Market Analysis, Opportunity and Forecast, By By Product, 2016-2032

- 9.3.1. Middle East & Africa Automated Microbiology Market Analysis by By Product: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Product, 2016-2032

- 9.3.3. Instruments

- 9.3.4. Automated culture systems

- 9.3.5. Microbiology analyzers

- 9.3.6. Reagents

- 9.4. Middle East & Africa Automated Microbiology Market Analysis, Opportunity and Forecast, By By Diagnostic Technology, 2016-2032

- 9.4.1. Middle East & Africa Automated Microbiology Market Analysis by By Diagnostic Technology: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Diagnostic Technology, 2016-2032

- 9.4.3. DNA sequencing

- 9.4.4. DNA & RNA probe technology

- 9.4.5. Detection techniques

- 9.4.6. Monoclonal antibodies

- 9.4.7. Immunoassays

- 9.5. Middle East & Africa Automated Microbiology Market Analysis, Opportunity and Forecast, By By End-Use, 2016-2032

- 9.5.1. Middle East & Africa Automated Microbiology Market Analysis by By End-Use: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-Use, 2016-2032

- 9.5.3. Hospitals

- 9.5.4. Clinical laboratories

- 9.5.5. Biotechnology industries

- 9.5.6. Blood banks

- 9.6. Middle East & Africa Automated Microbiology Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Automated Microbiology Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Automated Microbiology Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Automated Microbiology Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Automated Microbiology Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Becton Dickinson and Company

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Bio-Rad Laboratories, Inc.

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. bioMeriux, Inc.

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. QIAGEN GmbH

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Beckman Coulter

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Agilent Technologies, Inc.

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Gene-Probe, Inc.

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Affymetrix, Inc.

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Abbott Laboratories

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- 1. Executive Summary

-

- Becton Dickinson and Company

- Bio-Rad Laboratories, Inc.

- bioMeriux, Inc.

- QIAGEN GmbH

- Beckman Coulter

- Agilent Technologies, Inc.

- Gene-Probe, Inc.

- Affymetrix, Inc.

- Abbott Laboratories