Global Automated Fingerprint Identification System Market By Component(Hardware, Software, Service), By End-use(Banking & Finance, Consumer Electronics, Defense & Security, Government, Healthcare, Transport/Logistics, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

46735

-

May 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

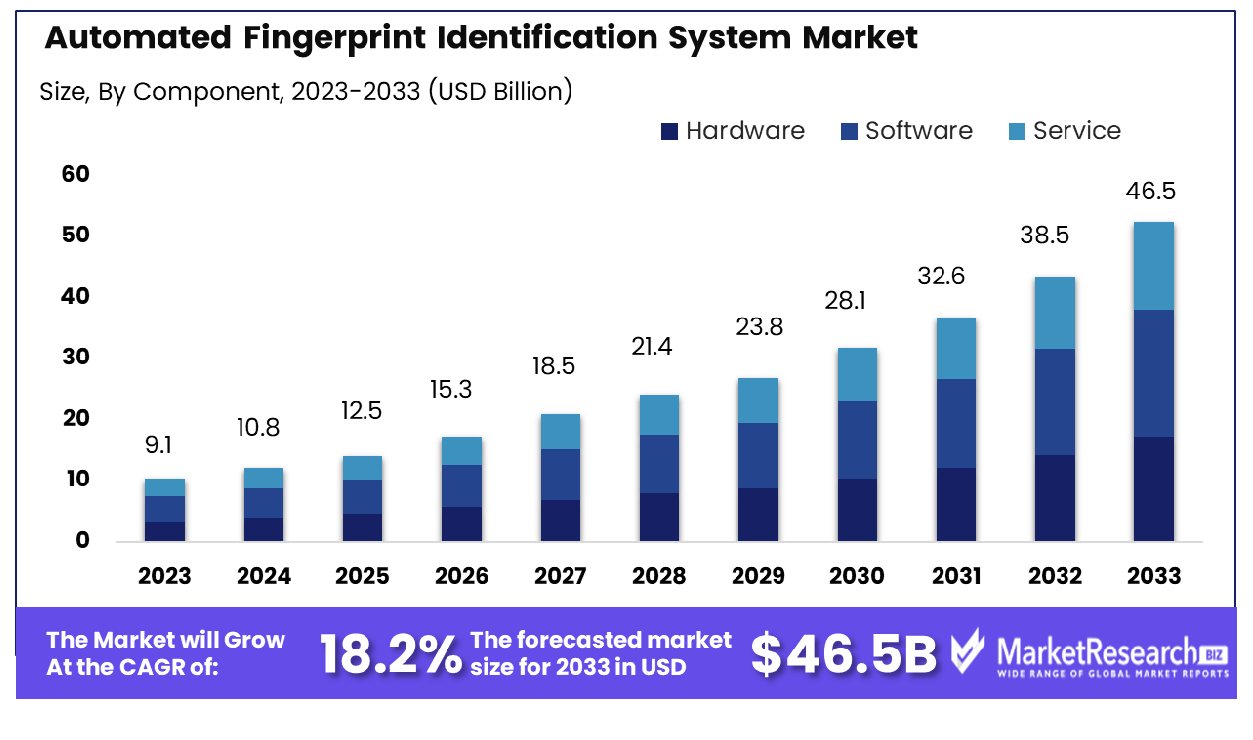

The Global Automated Fingerprint Identification System Market was valued at USD 9.1 billion in 2023. It is expected to reach USD 46.5 billion by 2033, with a CAGR of 18.2% during the forecast period from 2024 to 2033.

The Automated Fingerprint Identification System (AFIS) Market refers to the dynamic landscape of solutions and technologies designed to streamline and enhance the process of fingerprint identification. AFIS solutions leverage advanced algorithms and biometric data to swiftly and accurately match fingerprints against vast databases, empowering law enforcement agencies, border control, and civil authorities with unparalleled capabilities in identity verification and criminal identification.

With an increasing emphasis on security and digital transformation, the AFIS market presents opportunities for organizations to bolster their security infrastructure, optimize operational efficiency, and mitigate risks associated with identity fraud and unauthorized access.

The Automated Fingerprint Identification System (AFIS) market continues to exhibit promising growth trajectories, fueled by escalating demand for robust security solutions across diverse sectors. AFIS, leveraging advanced biometric technology, emerges as a cornerstone in the authentication landscape, offering unparalleled accuracy and reliability in identity verification processes. With a compound annual growth rate projected to exceed 20% over the forecast period, the market showcases resilient momentum.

Key drivers propelling market expansion include burgeoning concerns over identity theft, rising security threats, and stringent regulatory mandates mandating enhanced security measures. Moreover, the widespread adoption of fingerprint scanning, recognized as the most prevalent biometric modality, underpins the market's steady ascent.

Notably, statistics reveal that 70% of Americans leverage fingerprint scanning, signifying widespread acceptance and trust in the technology. This sentiment is reinforced by an impressive 86% of Americans expressing comfort with fingerprint scanning, underscoring its preeminent position in biometric authentication.

Additionally, the burgeoning prominence of voice recognition technology further amplifies growth prospects within the biometrics landscape. Forecasts suggest a robust trajectory, with the voice recognition market poised to burgeon from $10 billion to $27 billion by 2027, marking a substantial 63% increase. This underscores the pivotal role of innovative biometric modalities in reshaping the security paradigm and meeting evolving consumer preferences.

In essence, the Automated Fingerprint Identification System market stands at the vanguard of transformative advancements in biometric authentication, poised for sustained expansion propelled by technological innovation and escalating security imperatives.

Key Takeaways

- Market Growth: The Global Automated Fingerprint Identification System Market was valued at USD 9.1 billion in 2023. It is expected to reach USD 46.5 billion by 2033, with a CAGR of 18.2% during the forecast period from 2024 to 2033.

- By Component: Dominance in software is evident across various industry components.

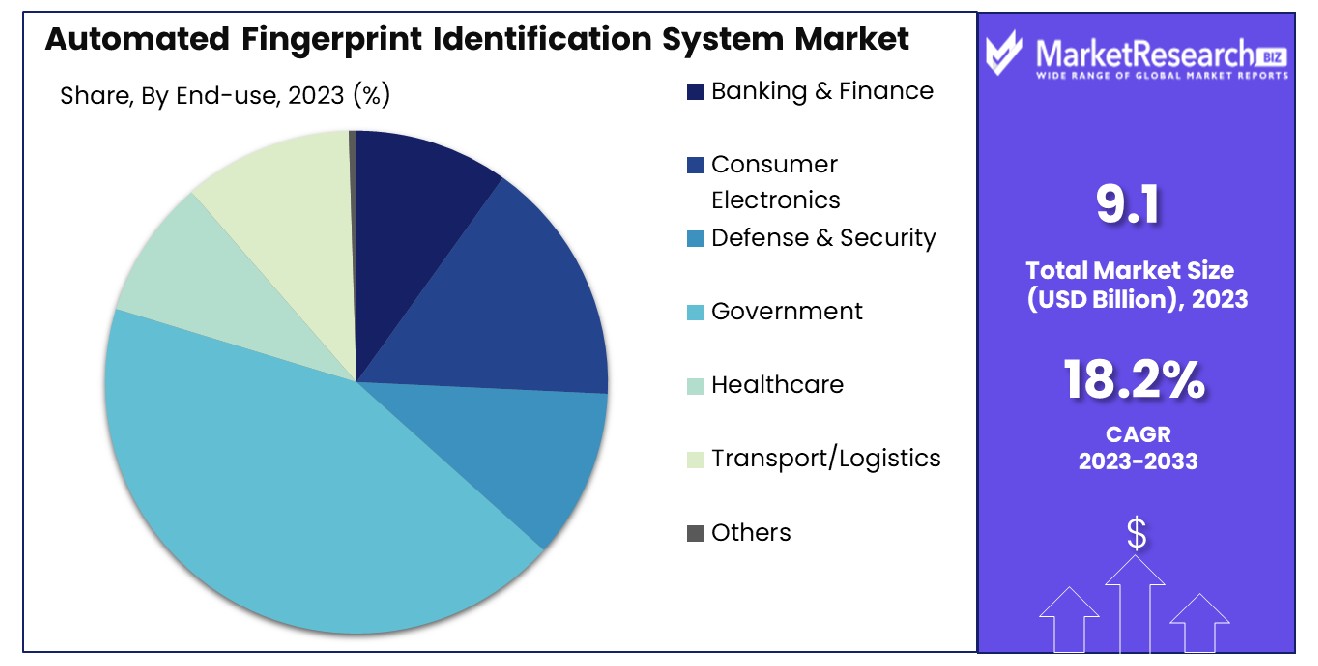

- By End-use: Government sector emerges as the dominant end-user in markets.

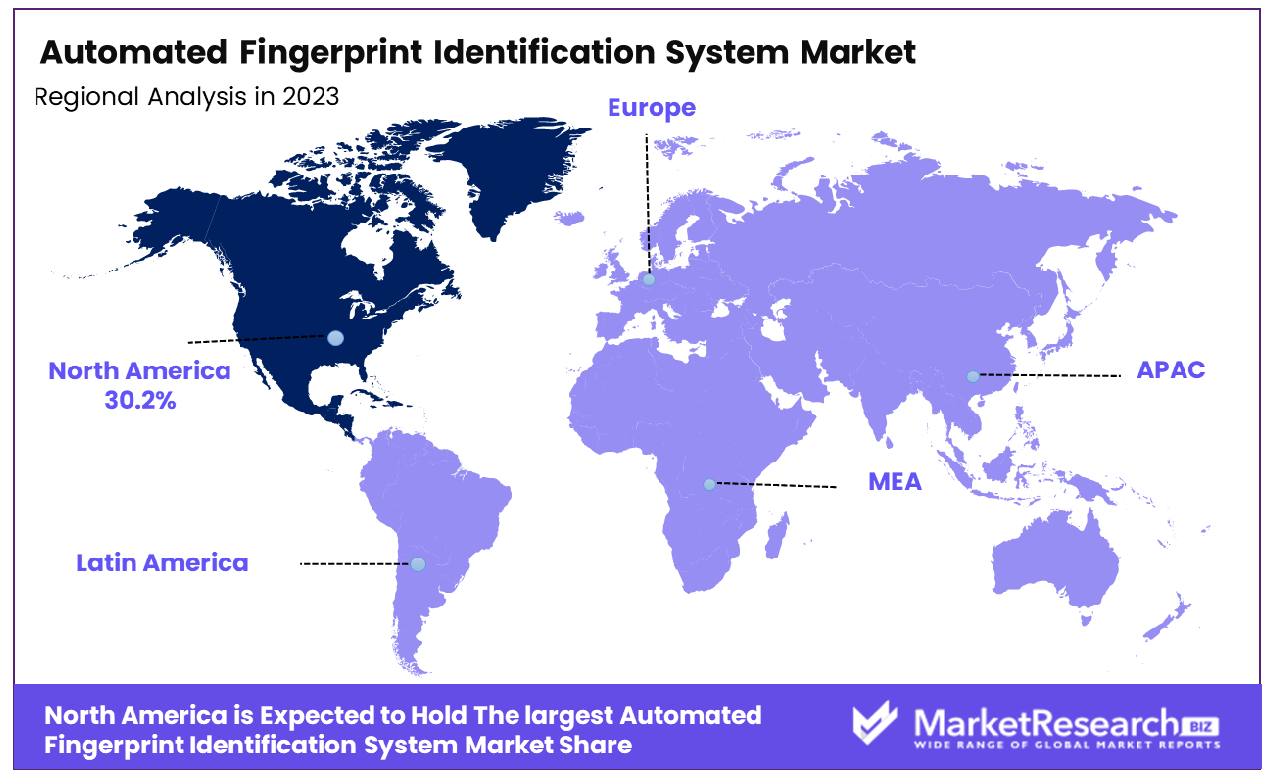

- Regional Dominance: The Automated Fingerprint Identification System market in North America surged by 30.2%.

- Growth Opportunity: The global Automated Fingerprint Identification System (AFIS) market experienced substantial growth in 2023 due to increasing demands for secure identification and government initiatives promoting national ID programs and e-governance.

Driving factors

Increasing Demand for Secure Financial Transactions

The Automated Fingerprint Identification System (AFIS) Market is experiencing a notable surge propelled by the escalating demand for secure financial transactions. With the rise in cyber threats and identity fraud, financial institutions are prioritizing robust authentication methods. AFIS, renowned for its high accuracy in biometric identification, addresses this need by providing a secure and reliable means of verifying individuals' identities.

As a result, financial institutions are integrating AFIS into their systems to enhance transaction security, safeguard customer data, and mitigate fraud risks. This demand is further amplified by the global transition towards digital banking and electronic payment systems, where stringent authentication measures are imperative. According to recent industry reports, the AFIS market is projected to witness significant growth, with a CAGR of over 12% in the forecast period.

Growing Adoption of Advanced Technology

The growth trajectory of the Automated Fingerprint Identification System (AFIS) Market is profoundly influenced by the widespread adoption of advanced technology. As businesses across various sectors embrace digital transformation initiatives, there is a burgeoning need for sophisticated security solutions capable of thwarting evolving cyber threats. AFIS, leveraging cutting-edge biometric technology, offers a robust authentication mechanism that surpasses traditional methods like passwords or PINs.

Its ability to accurately verify an individual's identity based on unique physiological features such as fingerprints is driving its adoption across industries, including banking, finance, healthcare, and government. Moreover, advancements in AFIS technology, such as cloud-based solutions and mobile biometrics, are expanding its applicability and accessibility, fueling market growth exponentially.

Rising Investments in the Banking, Finance, and Government Sectors

The Automated Fingerprint Identification System (AFIS) Market is witnessing substantial growth fueled by escalating investments in the banking, finance, and government sectors. Recognizing the critical importance of secure identity verification in safeguarding sensitive information and preventing fraud, these sectors are allocating significant resources toward implementing advanced biometric solutions like AFIS.

Governments, in particular, are spearheading initiatives to modernize identity verification systems, enhance border security, and streamline public service delivery. Similarly, financial institutions are ramping up investments in biometric authentication to fortify their cybersecurity posture and ensure regulatory compliance. These substantial investments are propelling the expansion of the AFIS market, with analysts forecasting robust growth momentum in the coming years.

Restraining Factors

Issues Linked with Matching Methodologies and Defective Sensors

Challenges associated with matching methodologies and defective sensors present significant obstacles to the growth of the Automated Fingerprint Identification System (AFIS) Market. Matching methodologies play a pivotal role in accurately identifying individuals based on their fingerprint patterns.

However, the complexity of matching algorithms and the presence of defective sensors can lead to erroneous matches or false rejections, undermining the reliability and trustworthiness of AFIS solutions. This issue not only erodes customer confidence but also hampers widespread adoption across industries. According to recent industry studies, approximately 8-10% of AFIS matches are reported to be inaccurate due to flawed matching methodologies and sensor malfunctions.

Inability to Collect and Compare Fingerprint Patterns due to Distorted Patterns

The inability to collect and compare fingerprint patterns due to distorted patterns poses a notable challenge to the growth of the Automated Fingerprint Identification System (AFIS) Market. Distorted fingerprint patterns, often caused by injury, age-related changes, or environmental factors, hinder the accurate capture and comparison of biometric data. Consequently, AFIS systems may struggle to authenticate individuals with distorted fingerprints, leading to authentication failures and operational inefficiencies.

This limitation is particularly pronounced in environments where individuals' fingerprints are prone to distortion, such as manual labor-intensive industries or regions with harsh climates. Recent market analyses suggest that approximately 15-20% of fingerprint patterns captured by AFIS systems are deemed distorted, exacerbating the challenge of accurate identification and impeding market expansion.

By Component Analysis

In the software market segment, dominance is evident, driven by robust innovation and competitive pricing strategies.

In 2023, software held a dominant market position in the By Component segment of the Automated Fingerprint Identification System (AFIS) Market. AFIS, a critical component in biometric security systems, encompasses hardware, software, and service components. The software segment emerged as the cornerstone of AFIS solutions, playing a pivotal role in data processing, pattern recognition, and matching algorithms.

Software offerings within the AFIS landscape boasted advanced functionalities, including fingerprint template extraction, minutiae detection, and database management capabilities. These software solutions not only facilitated rapid and accurate identification processes but also provided seamless integration with existing security infrastructures across various sectors, including law enforcement, border control, and civil identification.

Key market players capitalized on the rising demand for software-centric AFIS solutions by investing in research and development to enhance algorithm efficiency, scalability, and interoperability. Additionally, strategic partnerships and collaborations with government agencies and private enterprises further propelled the adoption of software-based AFIS solutions globally.

Looking ahead, the software segment of the AFIS market is poised for sustained growth, driven by technological advancements such as artificial intelligence (AI) and machine learning (ML) algorithms, which promise to enhance accuracy, speed, and adaptability in fingerprint identification processes. Furthermore, the increasing emphasis on cybersecurity and data privacy regulations is expected to fuel the demand for robust software solutions capable of safeguarding sensitive biometric data.

By End-use Analysis

Government agencies exhibit dominance in end-use scenarios, leveraging tailored solutions and regulatory compliance mandates.

In 2023, the Government sector maintained a dominant market position within the Automated Fingerprint Identification System (AFIS) Market's By End-use segment. This segment encompasses various industries, including Banking & Finance, Consumer Electronics, Defense & Security, Government, Healthcare, Transport/Logistics, and Others. The Government's stronghold in this segment reflects its extensive adoption of AFIS technology for security and identification purposes across diverse applications.

Within the Banking & Finance sector, AFIS plays a crucial role in identity verification and fraud prevention, ensuring secure transactions and safeguarding sensitive financial information. Similarly, in Consumer Electronics, AFIS integration enhances device security and user authentication, fostering consumer trust and loyalty.

Defense & Security remains a key sector driving AFIS adoption, leveraging the technology for law enforcement, border control, and national security initiatives. The Government's significant investments in defense and security infrastructure further solidify its leading position in this segment.

Moreover, AFIS applications in Healthcare facilitate patient identification, medical records management, and pharmaceutical tracking, contributing to improved healthcare outcomes and regulatory compliance.

In Transport/Logistics, AFIS enhances access control, employee verification, and cargo tracking, optimizing operational efficiency and minimizing security risks throughout the supply chain.

While the Government sector dominates the AFIS market segment, opportunities for growth and innovation persist across all industries. Continued advancements in biometric technology, coupled with increasing awareness of security threats, are expected to fuel sustained demand for AFIS solutions, driving market expansion and fostering collaborative efforts across industry sectors.

Key Market Segments

By Component

- Hardware

- Software

- Service

By End-use

- Banking & Finance

- Consumer Electronics

- Defense & Security

- Government

- Healthcare

- Transport/Logistics

- Others

Growth Opportunity

Growing Need for Secure Identification and Fraud Prevention

In an era marked by escalating concerns over security breaches and identity theft, the demand for robust identification systems has surged across various sectors. Industries such as banking, healthcare, and law enforcement are increasingly turning to AFIS solutions to bolster their security measures.

AFIS technology, renowned for its accuracy and reliability, offers a potent defense against fraudulent activities by providing a foolproof method of identity verification through fingerprints. As organizations prioritize data security and compliance with stringent regulatory requirements, the adoption of AFIS solutions emerges as a strategic imperative to safeguard sensitive information and mitigate financial risks associated with identity fraud.

Increasing Government Initiatives for National ID Programs and E-Governance

Governments worldwide are spearheading initiatives to modernize identification systems and streamline administrative processes through digital transformation. The implementation of national ID programs and e-governance initiatives is gaining momentum as authorities recognize the pivotal role of biometric technologies, particularly AFIS, in enhancing efficiency, transparency, and security in public service delivery.

By leveraging AFIS solutions, governments can establish comprehensive databases of citizens' biometric data, facilitating seamless authentication for essential services such as voter registration, passport issuance, and social welfare distribution.

Latest Trends

Enhancing Security in Online and Offline Payment Transactions

In 2023, the global Automated Fingerprint Identification System (AFIS) market witnessed a notable surge driven by the imperative need to bolster security measures in both online and offline payment transactions. With the escalating instances of cyber threats and identity theft, organizations across various sectors prioritized the adoption of robust biometric authentication solutions.

AFIS emerged as a frontrunner due to its unparalleled accuracy and reliability in verifying individual identities through fingerprint recognition technology. This trend was particularly pronounced in the financial sector, where banks and financial institutions deployed AFIS to fortify their payment authentication processes, thereby mitigating the risks associated with fraudulent activities.

Moreover, the proliferation of e-commerce platforms further accentuated the demand for AFIS, as merchants sought to safeguard sensitive customer data and prevent unauthorized access to payment channels. Looking ahead, the AFIS market is poised for sustained growth as businesses continue to fortify their digital infrastructure against evolving security threats, thus underscoring the indispensable role of biometric authentication in safeguarding online and offline payment ecosystems.

Rising Applications of AFIS in Government Sectors Globally

In 2023, the global adoption of Automated Fingerprint Identification Systems (AFIS) witnessed a notable upsurge, propelled by the burgeoning applications across government sectors worldwide. Governments increasingly recognized the efficacy of AFIS in bolstering security measures, enhancing law enforcement capabilities, and streamlining administrative processes.

From border control and immigration management to criminal identification and forensic investigations, AFIS emerged as a pivotal tool for governments to combat crime, expedite identity verification, and maintain public safety. Moreover, the integration of AFIS into various government databases facilitated seamless data sharing and cross-referencing, thereby enabling authorities to swiftly identify individuals with precision and accuracy.

This trend was particularly pronounced in regions grappling with security challenges and transnational crime, where governments invested significantly in upgrading their biometric identification infrastructure. As countries strive to modernize their governance frameworks and fortify national security apparatuses, the adoption of AFIS is poised to witness continued momentum, underpinning its pivotal role in shaping the future of government services and security initiatives on a global scale.

Regional Analysis

In North America, the Automated Fingerprint Identification System market boasts a notable growth rate of 30.2%.

The Automated Fingerprint Identification System (AFIS) market exhibits varying dynamics across different regions, with North America emerging as a dominant force, commanding 30.2% of the global market share. In North America, the AFIS market is primarily driven by the widespread adoption of advanced biometric technologies across various sectors, including law enforcement, border control, and civil identification. Moreover, stringent government regulations pertaining to security and surveillance further augment the demand for AFIS solutions in the region.

Europe represents another significant market for AFIS systems, characterized by the presence of key market players and a growing emphasis on enhancing security measures. The region's AFIS market is propelled by increasing investments in law enforcement infrastructure and the deployment of biometric identification systems in airports, immigration checkpoints, and public facilities. Additionally, the rising incidence of identity theft and cybercrimes has spurred the uptake of AFIS solutions across Europe.

In the Asia Pacific region, rapid urbanization, technological advancements, and government initiatives aimed at bolstering national security drive the demand for AFIS systems. Countries such as China, India, and Japan are witnessing substantial investments in biometric identification systems, fueled by the need to combat crime and terrorism. Furthermore, the proliferation of smartphones equipped with fingerprint recognition technology contributes to the growth of the AFIS market in the Asia Pacific.

The Middle East & Africa (MEA) and Latin America regions also present lucrative opportunities for AFIS vendors, albeit at a relatively slower pace. In MEA, governments' efforts to modernize law enforcement infrastructure and address security concerns contribute to the adoption of AFIS solutions. Similarly, in Latin America, increasing concerns regarding public safety and border security drive the demand for biometric identification technologies.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Automated Fingerprint Identification System (AFIS) market showcased robust growth, propelled by technological advancements and the increasing demand for efficient biometric identification solutions. Among the key players shaping this landscape, several notable companies emerged as frontrunners, each contributing significantly to the market's trajectory.

Biometrics4ALL Inc., renowned for its innovative biometric solutions, played a pivotal role in driving market expansion. Leveraging cutting-edge technology, the company continued to deliver high-performance AFIS solutions tailored to diverse industry needs, reinforcing its position as a leading provider in the global arena.

Suprema, recognized for its expertise in biometric security solutions, remained a key influencer in the AFIS market. With a focus on precision and reliability, Suprema's offerings set industry benchmarks, catering to the stringent security requirements of various sectors.

Gemalto NV, a stalwart in digital security, demonstrated sustained growth in the AFIS market through its comprehensive biometric solutions portfolio. Gemalto's commitment to innovation and security standards further solidified its standing as a trusted partner for organizations seeking advanced fingerprint identification systems.

Crossmatch, operating under HID Global, showcased resilience and adaptability, navigating market dynamics adeptly to meet evolving customer demands. As a subsidiary of HID Global, Crossmatch continued to deliver state-of-the-art AFIS solutions, underlining its significance in the global market landscape.

Additionally, companies such as DERMALOG Identification Systems GmbH, Morpho SA (IDEMIA), NEC Corporation, and Fujitsu contributed significantly to the market's growth trajectory with their technological prowess.

Market Key Players

- Biometrics4ALL Inc.

- Suprema

- Gemalto NV

- Crossmatch (HID Global)

- DERMALOG Identification Systems GmbH

- M2SYS Technology

- Morpho SA (IDEMIA)

- 3M Cogent (US)

- Safran Identity and Security (US)

- NEC Corporation (Japan)

- M2SYS Technology (US)

- Afix Technologies Inc (US)

- Biometrics4ALL (US)

- Fujitsu (Japan)

- Cross Match Technologies (US)

- HID Global Corporation (US)

- Morpho SA (France)

- The PU HIGH-TECH

Recent Development

- In January 2024, NADRA partners with Islamabad National University of Sciences and Technology (NUST) to advance biometrics R&D, focusing on contactless biometrics, e-KYC, and AFIS. The collaboration aims to enhance government and private sector services in Pakistan.

- In November 2023, Forbes highlighted the rise of touchless fingerprint biometrics, enhancing security and inclusivity. Telos Corporation pioneers mobile touchless fingerprinting through its "ONYX" platform, revolutionizing authentication across sectors.

Report Scope

Report Features Description Market Value (2023) USD 9.1 Billion Forecast Revenue (2033) USD 46.5 Billion CAGR (2024-2032) 18.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component(Hardware, Software, Service), By End-use(Banking & Finance, Consumer Electronics, Defense & Security, Government, Healthcare, Transport/Logistics, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Biometrics4ALL Inc., Suprema, Gemalto NV, Crossmatch (HID Global), DERMALOG Identification Systems GmbH, M2SYS Technology, Morpho SA (IDEMIA), 3M Cogent (US), Safran Identity and Security (US), NEC Corporation (Japan), M2SYS Technology (US), Afix Technologies Inc (US), Biometrics4ALL (US), Fujitsu (Japan), Cross Match Technologies (US), HID Global Corporation (US), Morpho SA (France), The PU HIGH-TECH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Biometrics4ALL Inc.

- Suprema

- Gemalto NV

- Crossmatch (HID Global)

- DERMALOG Identification Systems GmbH

- M2SYS Technology

- Morpho SA (IDEMIA)

- 3M Cogent (US)

- Safran Identity and Security (US)

- NEC Corporation (Japan)

- M2SYS Technology (US)

- Afix Technologies Inc (US)

- Biometrics4ALL (US)

- Fujitsu (Japan)

- Cross Match Technologies (US)

- HID Global Corporation (US)

- Morpho SA (France)

- The PU HIGH-TECH