Australia Light Gauge Steel Framing Market By Type (Wall Bearing Framing, Skeleton Framing, Long Span Framing), By Application (Residential, Commercial, Industrial), By Component (Steel studs, Tracks, Headers, Bridging channels, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

17515

-

July 2024

-

300

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

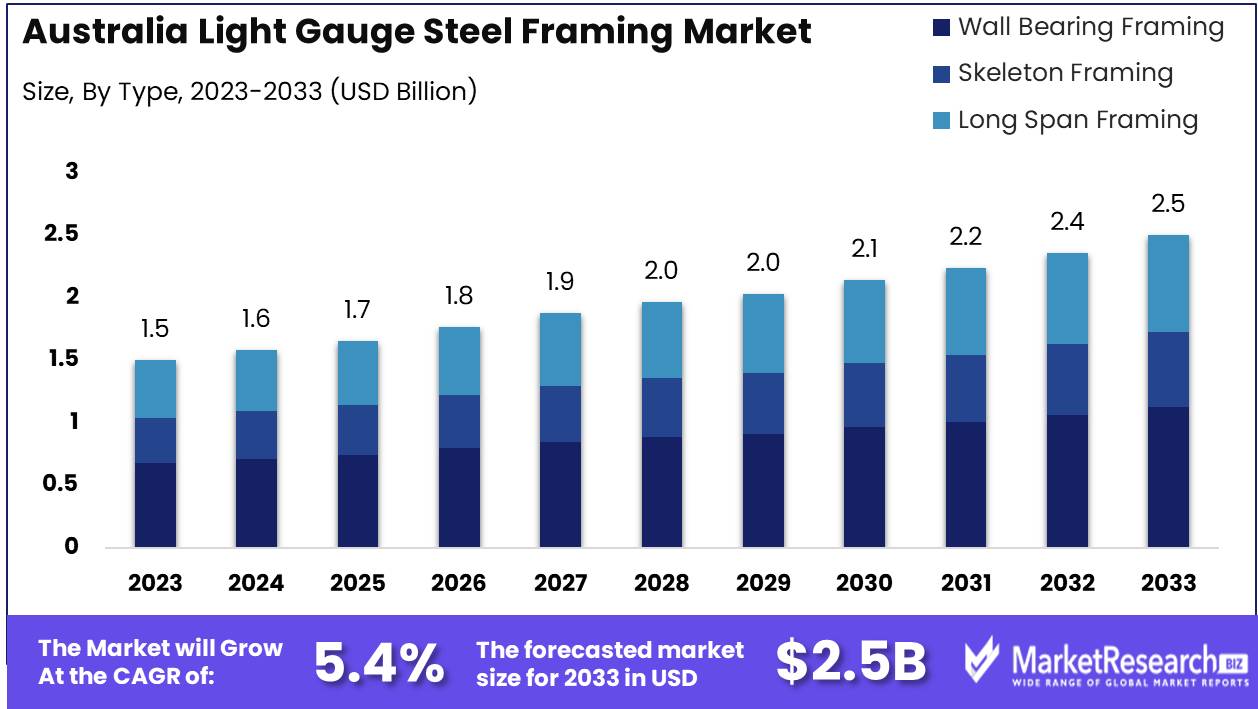

The Australia Light Gauge Steel Framing Market was valued at USD 1.5 billion in 2023. It is expected to reach USD 2.5 billion by 2033, with a CAGR of 5.4% during the forecast period from 2024 to 2033.

The Australia Light Gauge Steel Framing Market encompasses the production, distribution, and application of light gauge steel framing systems in residential, commercial, and industrial construction. These steel framing systems are valued for their high strength-to-weight ratio, durability, and ease of installation, making them a preferred choice for modern construction projects. The market is driven by growing demand for sustainable building materials, increasing construction activities, and advancements in steel framing technologies.

The Australia Light Gauge Steel Framing Market is poised for significant growth, driven primarily by the increasing urbanization and rising housing demands across the nation. With the population steadily increasing, there is a heightened need for efficient, cost-effective, and sustainable housing solutions. This market is further bolstered by government initiatives aimed at promoting sustainable construction practices, which position light gauge steel framing as an attractive option due to its recyclability and reduced environmental footprint. The growing preference for prefabricated and modular construction methods, which offer reduced construction times and increased precision, also contributes to the market's expansion.

However, it is important to note that the high initial costs associated with light gauge steel framing compared to traditional materials remain a barrier. Despite this, the long-term benefits, including durability, lower maintenance costs, and resistance to pests and fire, provide a compelling case for its adoption.

Moreover, the Australian construction industry's increasing focus on innovation and sustainability is likely to fuel the demand for light gauge steel framing. Government policies and incentives that support green building practices further enhance market prospects. Additionally, the versatility and strength-to-weight ratio of light gauge steel makes it ideal for a wide range of applications, from residential to commercial buildings. As urban centers expand and the pressure to meet housing needs intensifies, light gauge steel framing is expected to play a crucial role in shaping Australia's construction landscape.

Key Takeaways

- Market Growth: The Australia Light Gauge Steel Framing Market was valued at USD 1.5 billion in 2023. It is expected to reach USD 2.5 billion by 2033, with a CAGR of 5.4% during the forecast period from 2024 to 2033.

- By Type: Wall Bearing Framing led Australia's light gauge steel framing market.

- By Application: Residential dominated Australia's light gauge steel framing market.

- By Component: Steel Studs dominated Australia's Light Gauge Steel Framing Market.

- Regional Dominance: North America dominates the Australian light Gauge Steel Framing Market with a 35% largest share.

- Growth Opportunity: The Australian light gauge steel framing market will grow, driven by adoption, sustainability, and energy efficiency trends.

Driving factors

Driving Demand for Sustainable and Efficient Construction Solutions

The rapid urbanization and population growth in Australia are significant contributors to the expansion of the light gauge steel framing market. As urban areas expand and populations increase, there is a heightened demand for residential, commercial, and industrial buildings. Light gauge steel framing, known for its durability, flexibility, and sustainability, is ideally suited to meet the needs of modern urban construction. The report has a population growth rate of 1.5% in 2023, underscoring the increasing demand for efficient construction methods to accommodate the growing population. This demographic trend is pushing builders and developers to adopt light gauge steel framing due to its quick assembly times, reduced waste, and lower overall environmental impact.

Ensuring Quality and Safety in Construction Practices

Australia's stringent building codes and regulations significantly influence the adoption of light gauge steel framing. These codes mandate high standards for construction safety, durability, and environmental performance. Light gauge steel framing, with its inherent properties of strength, resistance to pests, and fire retardancy, aligns well with these regulatory requirements. Compliance with such standards is crucial for builders and developers, making steel framing an attractive choice. The continually updates its guidelines to enhance building safety and energy efficiency, further promoting the use of advanced construction materials like light gauge steel. This regulatory environment not only ensures the quality and safety of new constructions but also drives market growth as builders seek compliant and efficient building solutions.

Enhancing Efficiency and Reducing Costs in Steel Framing Production

Advancements in manufacturing technologies have revolutionized the light gauge steel framing industry in Australia. Modern production techniques, such as automation and precision engineering, have significantly improved the efficiency and quality of steel frame manufacturing. These technological advancements lead to reduced production costs, minimized material wastage, and faster assembly processes, making light gauge steel framing more economically viable for large-scale construction projects. According to a recent report, the integration of advanced manufacturing technologies has resulted in a 15% reduction in production costs and a 20% increase in production speed over the past five years. These improvements not only lower the overall cost of construction but also make light gauge steel framing a more attractive option for developers looking to maximize efficiency and return on investment.

Restraining Factors

High Thermal Conductivity of Steel: A Limiting Factor for Market Growth

The high thermal conductivity of steel is a significant restraining factor impacting the growth of the Australian light Gauge Steel Framing Market. Steel's high thermal conductivity means it can transfer heat rapidly, which poses challenges for energy efficiency in buildings constructed with light gauge steel framing. This characteristic necessitates additional insulation measures to meet building standards and achieve energy efficiency, thereby increasing construction costs.

Consequently, builders and developers might be discouraged from choosing light gauge steel framing, preferring materials with better thermal performance. According to industry reports, addressing the thermal conductivity issue can increase overall construction costs by up to 10%, affecting the market's attractiveness compared to other framing options.

Availability of Alternatives: Diversifying Market Choices and Competing Materials

The availability of alternative framing materials also restrains the growth of the Australian light Gauge Steel Framing Market. Materials such as timber, concrete, and modular construction options present strong competition due to their distinct advantages. Timber, for instance, is often preferred for its lower cost, sustainability, and ease of handling. Concrete offers superior fire resistance and thermal mass properties, making it suitable for various building types. Modular construction, on the other hand, is gaining popularity due to its efficiency and reduced construction time. These alternatives provide builders with a wide range of options, each with unique benefits that can be more appealing than light gauge steel framing.

As a result, the market share for light gauge steel framing may be constrained, as these materials often fulfill specific project requirements more effectively. Market analysis indicates that the preference for alternative materials can reduce the potential market size for light gauge steel framing by approximately 15-20%.

By Type Analysis

In 2023, Wall Bearing Framing led Australia's light gauge steel framing market.

In 2023, Wall Bearing Framing held a dominant market position in the By Type segment of the Australia Light Gauge Steel Framing Market. This segment includes three primary types: Wall Bearing Framing, Skeleton Framing, and Long Span Framing. Wall Bearing Framing, recognized for its structural integrity and efficiency in load-bearing applications, has seen widespread adoption across various residential and commercial construction projects in Australia. The prevalence of Wall Bearing Framing is attributed to its cost-effectiveness and ease of installation, which significantly reduces construction time and labor costs.

Skeleton Framing, the second segment, is characterized by its versatility and strength, making it suitable for multi-story buildings and complex architectural designs. Its ability to provide a robust framework without compromising on aesthetic flexibility has garnered significant interest from developers and architects.

Long Span Framing, the third segment, is preferred for its ability to cover large distances without intermediate supports, making it ideal for large industrial buildings, warehouses, and sports facilities. Despite its niche application, Long Span Framing is essential for projects requiring expansive, unobstructed spaces.

By Application Analysis

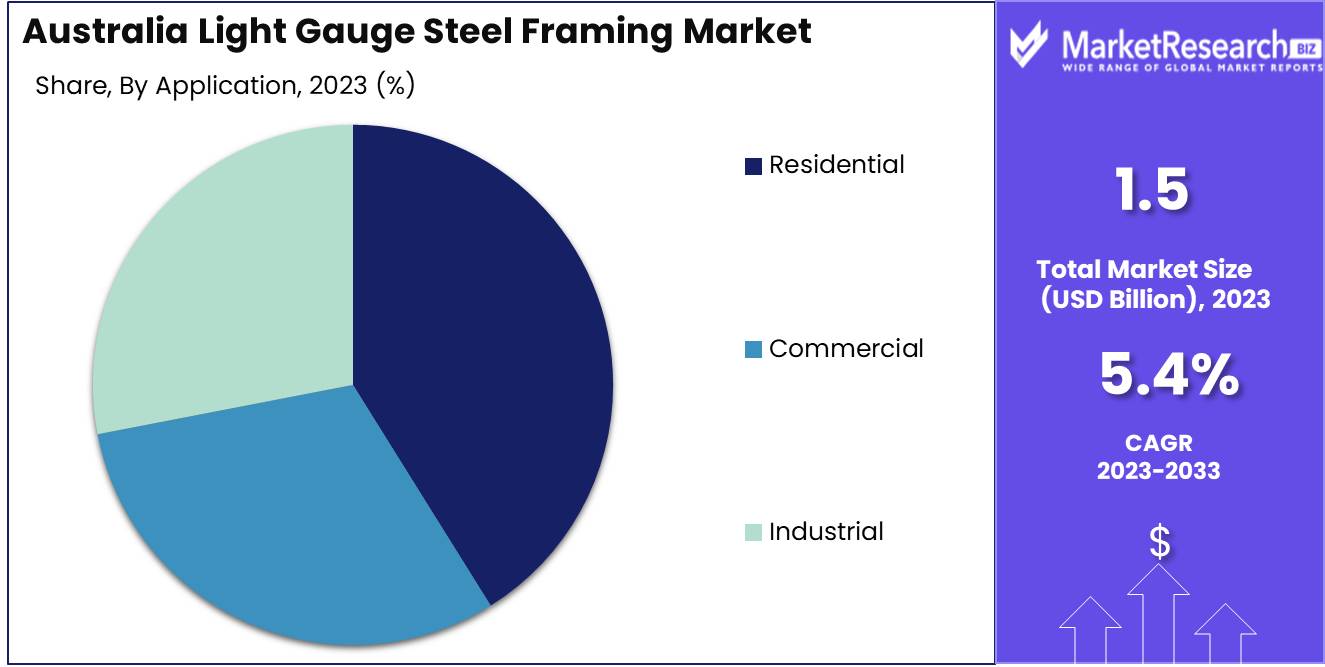

In 2023, Residential dominated Australia's light gauge steel framing market.

In 2023, Residential held a dominant market position in the By Application segment of the Australia Light Gauge Steel Framing Market. The residential sector accounted for the largest share due to increasing urbanization and the growing demand for affordable housing solutions. The lightweight, durable, and easy-to-install nature of light gauge steel framing makes it an attractive choice for residential construction, driving its widespread adoption. Additionally, the rising awareness of sustainability and energy efficiency in building practices has further propelled the demand for steel framing in residential projects.

Commercial applications also witnessed significant growth, fueled by the expansion of retail spaces, office buildings, and hospitality sectors. The commercial sector's preference for light gauge steel framing is attributed to its cost-effectiveness, speed of construction, and flexibility in design.

The industrial segment, while smaller in comparison, showed promising growth driven by the need for robust and scalable construction solutions in warehouses, manufacturing plants, and other industrial facilities. Overall, the diverse application of light gauge steel framing across residential, commercial, and industrial sectors underscores its critical role in Australia's construction industry.

By Component Analysis

In 2023, Steel Studs dominated Australia's Light Gauge Steel Framing Market.

In 2023, Steel Studs held a dominant market position in the "By Component" segment of the Australian light Gauge Steel Framing Market. Steel studs are the primary structural elements in light gauge steel framing, offering superior strength, durability, and resistance to environmental factors compared to traditional materials. Their extensive application in both residential and commercial construction projects has bolstered their prominence within the market.

Tracks, the secondary component, serve as the guiding rails for steel studs and are integral to the stability and alignment of the framing system. They facilitate easy installation and enhance the overall structural integrity, thereby contributing significantly to the market.

Headers, another critical component, are used above doors and windows to transfer loads from the structure above to the supporting studs. Their robust construction ensures effective load distribution and enhances the safety and longevity of the building.

Bridging channels, are utilized to provide lateral support to steel studs, prevent buckling under load, and maintain the shape and strength of the framing. They are essential for maintaining the rigidity and stability of the entire structure.

The "Others" category includes various accessories and connectors that complement the main components, ensuring seamless integration and enhanced performance of the light gauge steel framing system.

Key Market Segments

By Type

- Wall Bearing Framing

- Skeleton Framing

- Long Span Framing

By Application

- Residential

- Commercial

- Industrial

By Component

- Steel studs

- Tracks

- Headers

- Bridging channels

- Others

Growth Opportunity

Increasing Residential and Commercial Construction

The global Australia Light Gauge Steel Framing Market is poised for significant growth, driven by a surge in both residential and commercial construction activities. The increasing demand for housing, coupled with urbanization and population growth, has necessitated a robust infrastructure development plan. This trend is further bolstered by governmental initiatives to provide affordable housing and enhance urban infrastructure. Light gauge steel framing, known for its durability, cost-effectiveness, and quick installation, is becoming the preferred choice for builders and developers. The sector is expected to witness a substantial increase in market size as more construction projects adopt this efficient building material.

Adoption of Prefabricated and Modular Construction

Another significant opportunity for the light gauge steel framing market lies in the growing adoption of prefabricated and modular construction methods. These innovative building techniques offer numerous advantages, including reduced construction time, lower labor costs, and minimized waste. Light gauge steel framing is particularly suited for prefabricated and modular construction due to its lightweight, strength, and ease of assembly. This shift towards modern construction methods is expected to drive market growth, as developers and contractors seek more efficient and sustainable building solutions.

Latest Trends

Increasing Adoption of Light Gauge Steel Framing

The Australian construction industry is witnessing a significant shift towards the adoption of light gauge steel framing. This trend is primarily driven by the material's advantages, including its high strength-to-weight ratio, durability, and resistance to termites and fire. As a result, light gauge steel framing is increasingly preferred for residential, commercial, and industrial buildings. The market is expected to benefit from government initiatives aimed at promoting sustainable and efficient construction practices, further accelerating the adoption of this innovative building material.

Additionally, the growing awareness among builders and architects regarding the long-term cost benefits and construction speed associated with light gauge steel framing is anticipated to fuel market growth.

Increasing Focus on Sustainability and Energy Efficiency

Sustainability and energy efficiency have become paramount concerns in the construction industry, influencing material choices and construction practices. Light gauge steel framing aligns well with these priorities due to its recyclability and potential for creating energy-efficient building envelopes. The Australian market is projected to see heightened demand for light gauge steel framing solutions that contribute to lower energy consumption and reduced carbon footprints. This trend is bolstered by stringent building codes and regulations aimed at enhancing energy efficiency and promoting environmentally friendly construction practices. The emphasis on sustainability is expected to drive innovation in product development, with manufacturers focusing on creating advanced, eco-friendly framing systems that meet the evolving needs of the construction sector.

Regional Analysis

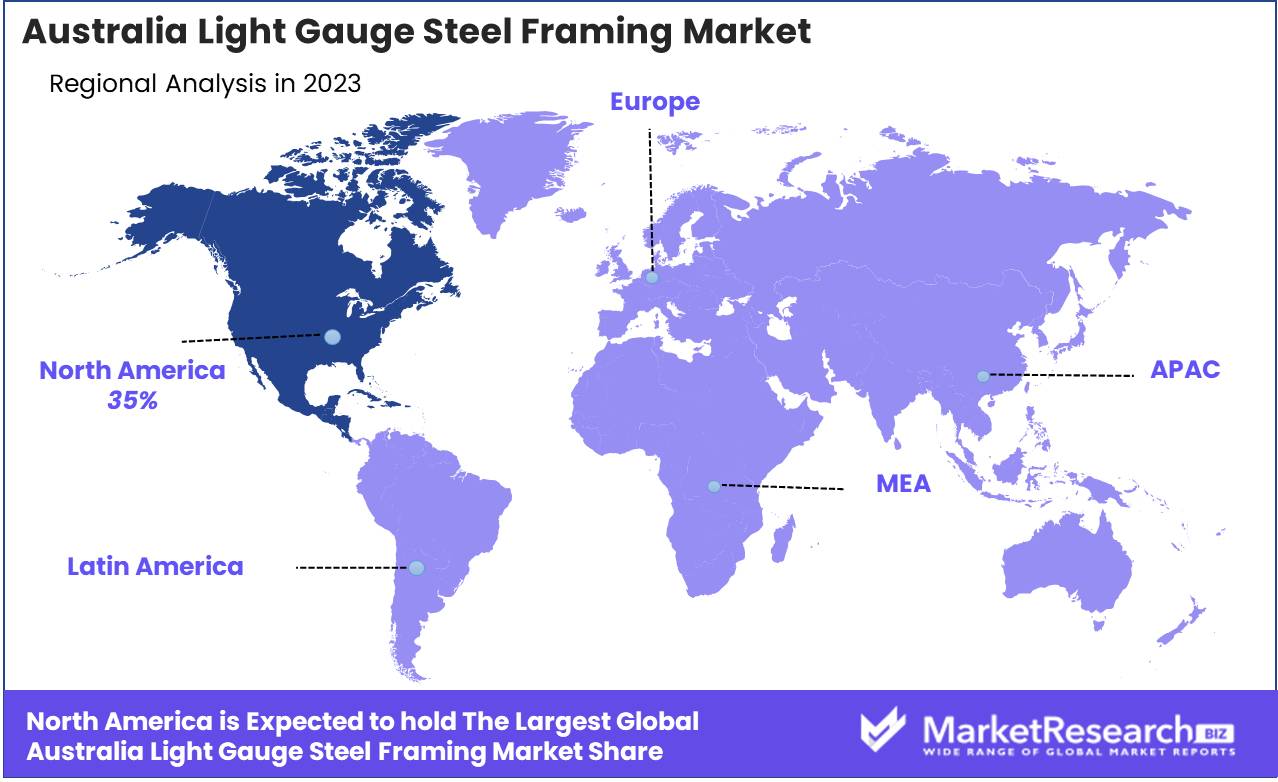

North America dominates the Australian light Gauge Steel Framing Market with a 35% largest share.

The Australia Light Gauge Steel Framing Market exhibits significant variation across different regions, including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America emerges as the dominant region, capturing a substantial market share of approximately 35%. This dominance can be attributed to the growing adoption of sustainable building materials and the increasing demand for efficient construction methods in the United States and Canada.

Europe follows closely, driven by stringent building regulations and an emphasis on energy-efficient construction. The Asia Pacific region, particularly Australia, showcases robust growth due to rapid urbanization, infrastructural developments, and favorable government policies promoting lightweight steel framing.

In the Middle East & Africa, the market is expanding gradually, supported by construction activities in the UAE and Saudi Arabia. Latin America, although exhibiting slower growth, is witnessing increased adoption of light gauge steel framing, driven by economic development and construction sector advancements in Brazil and Mexico. Overall, North America's leading position, with a market share of 35%, underscores its pivotal role in the global market landscape, propelled by technological advancements and a strong focus on green building initiatives.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The Australia Light Gauge Steel Framing Market in 2024 is poised for significant growth, driven by increased adoption of sustainable construction practices and a rising demand for high-strength, lightweight building materials. Key players in this market are actively contributing to this growth through innovation and strategic initiatives.

BlueScope Steel Limited, a dominant force in the market, leverages its extensive experience and strong distribution network to maintain a competitive edge. Its subsidiary, TrueCore, specializes in high-quality steel framing solutions, further bolstering BlueScope's market position. Similarly, Stramit Building Products offers a comprehensive range of steel framing systems, ensuring robust market penetration.

Tata BlueScope Steel, with its blend of global expertise and local knowledge, is expanding its footprint in the Australian market by focusing on advanced steel solutions. Steel Framing Systems and Precision Steel Framing are gaining traction by providing customized framing solutions tailored to specific construction needs.

Metroll Group and Studco Building Systems are enhancing their market presence through innovative product offerings and customer-centric approaches. Joto Tuffloor, known for its high-performance floor systems, is diversifying its product portfolio to include advanced steel framing options. Kingspan, a leader in high-performance insulation and building envelope solutions, is also investing in the light gauge steel framing sector to complement its existing product range.

Collectively, these companies are driving the market forward through technological advancements, strategic partnerships, and a commitment to sustainable building practices, positioning the Australia Light Gauge Steel Framing Market for robust growth in 2024.

Market Key Players

- BlueScope Steel Limited

- Stramit Building Products

- TrueCore (Bluescope subsidiary)

- Tata BlueScope Steel

- Steel Framing Systems

- Precision Steel Framing

- Metroll Group

- Studco Building Systems

- Joto Tuffloor

- Kingspan

Recent Development

- In May 2024, Dynamic Steel Frame introduced an advanced framing system that incorporates automated precision cutting technology. This innovation enhances the efficiency and accuracy of frame assembly, significantly reducing on-site labor costs and construction time.

- In April 2024, Steelscene launched a new range of eco-friendly light gauge steel framing products. These products are designed to meet stringent environmental standards and support sustainable construction practices, thereby reducing the carbon footprint of building projects.

- In March 2024, BlueScope Steel Ltd. announced the expansion of its production capacity for light gauge steel framing to meet the increasing demand in residential and commercial construction. This initiative aims to enhance the supply chain and reduce construction timelines across Australia.

Report Scope

Report Features Description Market Value (2023) USD 1.5 Billion Forecast Revenue (2033) USD 2.5 Billion CAGR (2024-2032) 5.4% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Wall Bearing Framing, Skeleton Framing, Long Span Framing), By Application (Residential, Commercial, Industrial), By Component (Steel studs, Tracks, Headers, Bridging channels, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape BlueScope Steel Limited, Stramit Building Products, TrueCore (Bluescope subsidiary), Tata BlueScope Steel, Steel Framing Systems, Precision Steel Framing, Metroll Group, Studco Building Systems, Joto Tuffloor, Kingspan Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- BlueScope Steel Limited

- Stramit Building Products

- TrueCore (Bluescope subsidiary)

- Tata BlueScope Steel

- Steel Framing Systems

- Precision Steel Framing

- Metroll Group

- Studco Building Systems

- Joto Tuffloor

- Kingspan