Asthma Drugs Market By Medication (Quick Relief Medications, Long-term Control Medications, Others), By Mode of Administration (Tablets and Capsules, Liquids, Inhalers, Injections), By Organization Type (Public, Private), By Application (Pediatric, Adults, Adolescent), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

47345

-

June 2024

-

300

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

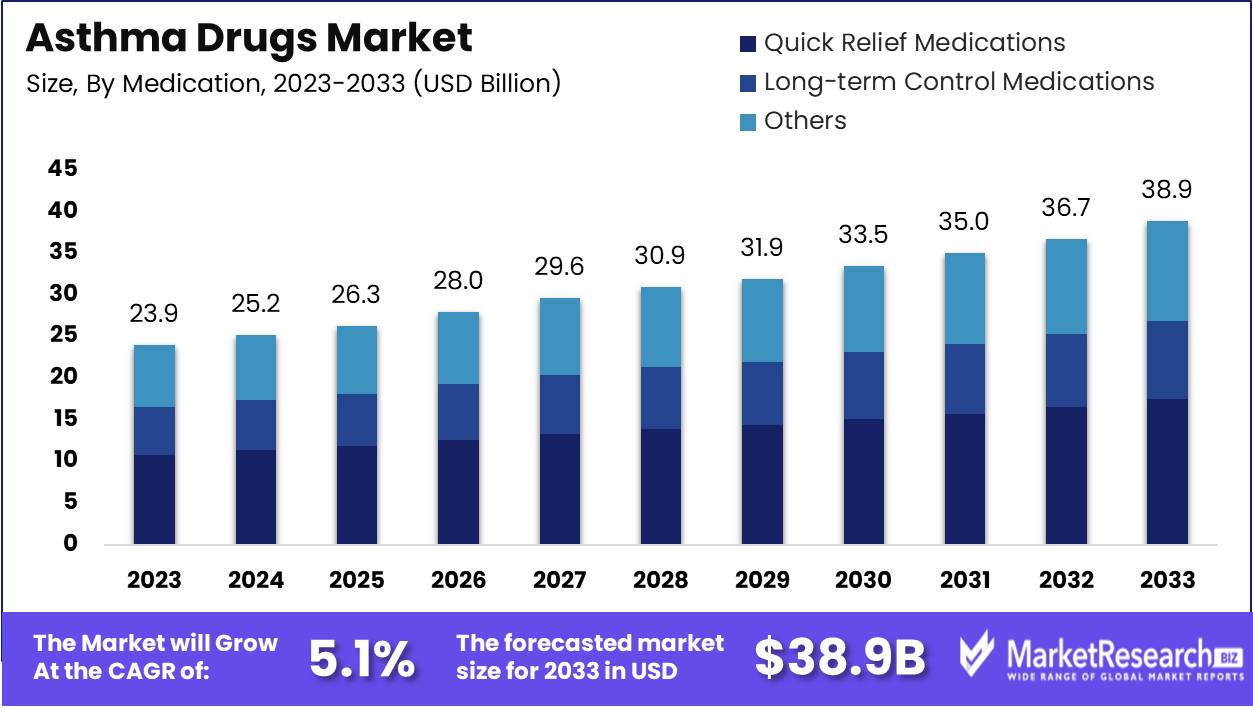

The Asthma Drugs Market was valued at USD 23.9 billion in 2023. It is expected to reach USD 38.9 billion by 2033, with a CAGR of 5.1% during the forecast period from 2024 to 2033.

The Asthma Drugs Market encompasses the global pharmaceutical industry segment focused on the development, production, and distribution of medications designed to manage and treat asthma. This market includes a variety of drug classes such as bronchodilators, anti-inflammatory agents, and combination therapies, available in various forms including inhalers, pills, and injectables.

The asthma drugs market is poised for substantial growth, driven by the increasing prevalence of asthma globally. This surge in asthma cases is predominantly influenced by a combination of environmental factors such as pollution and allergens, as well as genetic predispositions. Consequently, there is a rising demand for effective therapeutic solutions to manage and mitigate asthma symptoms. However, the market faces challenges related to the long-term use of asthma medications, particularly corticosteroids, which can lead to significant adverse effects. These side effects often impact patient adherence and complicate long-term treatment strategies, underscoring the need for innovative and safer therapeutic options.

Furthermore, there is a growing emphasis on addressing environmental triggers through initiatives aimed at improving air quality and controlling allergens. This dual approach of advancing pharmacological treatments while mitigating environmental risks is expected to drive market dynamics significantly.

The future of the asthma drug market is likely to be shaped by ongoing research and development efforts focused on creating medications with fewer side effects and enhanced efficacy. The increasing awareness and implementation of environmental control measures also play a critical role in managing asthma, potentially reducing the overall burden of the disease. As healthcare providers and policymakers prioritize integrated care approaches that combine medication with environmental management, the market is expected to witness a paradigm shift. This integrated strategy not only promises to improve patient outcomes but also offers a comprehensive solution to the growing asthma prevalence, making the asthma drug market a critical area of focus for stakeholders aiming to address this public health challenge comprehensively.

Key Takeaways

- Market Growth: The Asthma Drugs Market was valued at USD 23.9 billion in 2023. It is expected to reach USD 38.9 billion by 2033, with a CAGR of 5.1% during the forecast period from 2024 to 2033.

- By Medication: Quick Relief Medications Segment dominated the asthma drug market due to its immediate efficacy.

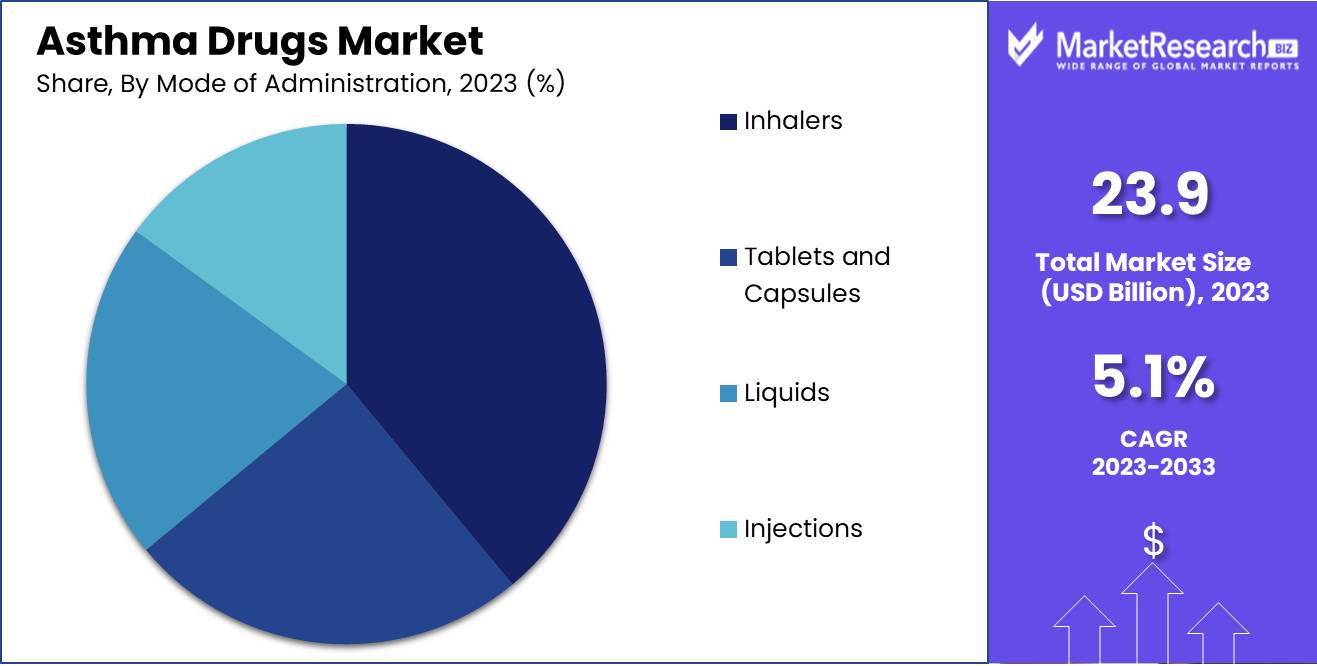

- By Mode of Administration: Inhalers Segment dominates due to efficacy, convenience, and user preference in 2023.

- By Organization Type: Public organizations dominate the asthma drug market through affordability and accessibility.

- By Application: Pediatric asthma drugs dominate due to their high prevalence and tailored formulations.

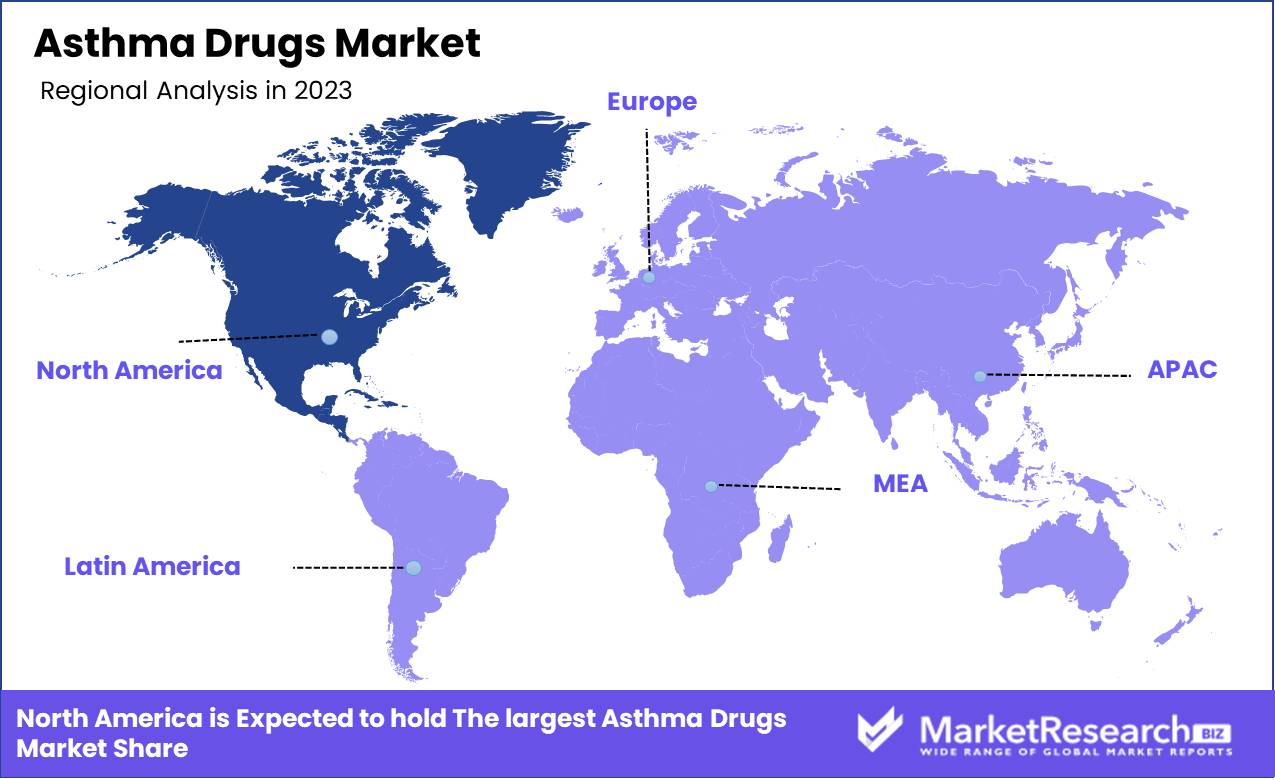

- Regional Dominance: North America dominates the asthma drugs market with a 40% share.

- Growth Opportunity: The global asthma drug market is set for growth driven by pharmaceutical advancements and increased awareness.

Driving factors

Increasing Prevalence of Asthma Cases: Driving Demand for Effective Treatments

The rising incidence of asthma worldwide is a primary driver of the asthma drug market. According to the Global Asthma Network, there are approximately 339 million people affected by asthma globally. This growing patient population necessitates effective management strategies, thereby spurring demand for advanced asthma medications. The increase in urbanization and environmental pollutants has exacerbated asthma cases, particularly in developing countries, leading to heightened market demand for both preventive and symptomatic treatments. As the prevalence of asthma continues to rise, pharmaceutical companies are motivated to innovate and expand their product lines, ensuring sustained market growth.

Growing Focus on Respiratory Health: Elevating Public Awareness and Market Penetration

The global focus on respiratory health has significantly increased, partly due to the COVID-19 pandemic, which highlighted the critical importance of maintaining respiratory well-being. This heightened awareness has led to more robust public health initiatives and education campaigns aimed at early detection and management of asthma, contributing to a broader acceptance and utilization of asthma drugs. Additionally, advancements in digital health technologies, such as mobile apps for asthma monitoring and telemedicine services, have improved patient adherence to medication regimens and facilitated timely medical interventions. Consequently, these developments enhance the market penetration of asthma drugs, driving growth as more patients engage in proactive disease management.

Increasing Healthcare Expenditure: Facilitating Access to Advanced Therapies

Rising healthcare expenditure globally is another significant factor contributing to the growth of the asthma drug market. According to the World Bank, global health expenditure as a percentage of GDP has been steadily increasing, reflecting enhanced government and private sector investment in healthcare infrastructure. This increased spending enables better access to advanced asthma treatments, including biologics and personalized medicine approaches, which were previously less accessible due to high costs.

Furthermore, improved healthcare infrastructure in emerging economies has facilitated broader access to asthma diagnostics and treatments, fostering market expansion. As healthcare budgets continue to grow, the capacity to support comprehensive asthma management programs will further propel market growth.

Restraining Factors

Lack of Adherence to Asthma Treatment: Impeding Optimal Market Growth

A significant restraining factor in the asthma drug market is the lack of adherence to prescribed asthma treatment regimens. Patient non-compliance with medication protocols stems from multiple issues, including forgetfulness, misunderstanding of the treatment's importance, side effects, and the misconception of being symptom-free as being disease-free. This non-adherence can lead to poor asthma control, increased frequency of exacerbations, hospitalizations, and ultimately higher overall healthcare costs.

Statistics indicate that non-adherence rates in asthma patients can be as high as 50%, which significantly impacts the effectiveness of prescribed therapies. This high rate of non-compliance undermines the market potential of asthma drugs because it diminishes the perceived efficacy of treatments, leading to lower repeat purchases and reduced patient trust in available medications. Consequently, pharmaceutical companies face challenges in demonstrating the full benefits of their products, which can hinder market expansion.

High Costs of Asthma Care Products and Medications: Barrier to Widespread Accessibility

The high costs associated with asthma care products and medications represent another critical restraining factor in the growth of the asthma drug market. Asthma medications, particularly inhalers and biologics, can be expensive, making them less accessible to a significant portion of the population, especially in low-income and middle-income regions.

For instance, the average annual cost of asthma care in the United States is estimated to be over $3,000 per patient, with medication costs accounting for a substantial portion of this expenditure. These high costs can lead to underutilization of necessary treatments, as patients may skip doses or avoid purchasing medications altogether due to financial constraints. This cost barrier is particularly pronounced in countries without robust healthcare systems or insurance coverage, further limiting market penetration.

By Medication Analysis

Quick Relief Medications Segment dominated the asthma drug market due to its immediate efficacy.

In 2023, The Quick Relief Medications Segment held a dominant market position in the By Medication segment of the Asthma Drugs Market. Quick Relief Medications, also known as rescue inhalers or bronchodilators, are essential for providing immediate relief from acute asthma symptoms. This sub-segment's prominence can be attributed to the rising prevalence of asthma globally, increasing awareness of asthma management, and the immediate efficacy of these drugs in preventing severe asthma attacks.

Conversely, the Long-term Control Medications segment, which includes inhaled corticosteroids, leukotriene modifiers, and long-acting beta-agonists, is critical for managing chronic symptoms and preventing exacerbations over time. Despite their importance in maintaining long-term respiratory health, their market share lags behind due to factors such as patient non-compliance and the necessity for consistent, prolonged use. The Others category encompasses emerging therapies and adjunct treatments, including biologics and novel drug delivery systems, which are gaining traction due to advances in medical research and personalized medicine approaches.

By Mode of Administration Analysis

The Inhalers Segment dominates due to efficacy, convenience, and user preference in 2023.

In 2023, The Inhalers Segment held a dominant market position in the "By Mode of Administration" segment of the Asthma Drugs Market. This dominance can be attributed to several factors. Firstly, inhalers offer direct delivery of medication to the lungs, resulting in faster relief of symptoms and greater efficacy compared to other forms. Their ease of use and portability make them a preferred choice for many asthma patients, ensuring consistent market demand.

In contrast, tablets and capsules, while effective, have a slower onset of action and are less preferred for acute symptom relief. Liquids, often used for pediatric or geriatric patients, represent a smaller market share due to their limited use and storage challenges. Injections, although highly effective for severe cases, are typically reserved for hospital settings or severe asthma management, limiting their widespread use. Consequently, inhalers' advantages in terms of efficacy, convenience, and user preference have solidified their leading position in the market, driving their substantial market share and continued growth in the asthma drugs sector.

By Organization Type Analysis

Public organizations dominate the asthma drug market through affordability and accessibility.

In 2023, Public Organizations held a dominant market position in the "By Organization Type" segment of the Asthma Drugs Market. Public healthcare institutions, including government-funded hospitals and clinics, leveraged their extensive reach and resources to secure a significant share of the market. These entities benefit from large-scale procurement capabilities, enabling bulk purchases at negotiated prices, which enhances the accessibility and affordability of asthma medications for a broader population base. Additionally, public organizations often spearhead national health initiatives and public awareness campaigns, fostering early diagnosis and continuous management of asthma conditions. Their role in subsidizing medication costs through various health programs further solidifies their market leadership.

Conversely, private organizations, while significant, typically cater to a different segment of the population, focusing on personalized care and advanced treatment options often at a higher cost. Public entities' emphasis on widespread, cost-effective healthcare solutions positions them as key players in the asthma drugs market, driving both demand and supply through robust infrastructure and comprehensive healthcare policies. This dynamic underscores the crucial role of public organizations in shaping market trends and ensuring equitable healthcare access.

By Application Analysis

Pediatric asthma drugs dominate due to their high prevalence and tailored formulations.

In 2023, The Pediatric segment held a dominant market position in the "By Application" segment of the Asthma Drugs Market. This prominence can be attributed to several key factors. Firstly, the prevalence of asthma in children is notably higher, driving substantial demand for pediatric asthma medications. With the increasing awareness of asthma management and early diagnosis in children, healthcare providers, and parents are prioritizing effective treatment options tailored specifically for younger patients. Additionally, the development of pediatric-friendly drug formulations, such as inhalers with lower dosages and easier administration mechanisms, has further fueled the segment's growth.

Adults also represent a significant segment of the asthma drug market. This demographic benefits from a broad range of treatment options, including long-term control medications and quick-relief drugs. The growing incidence of asthma among adults, partly due to environmental factors and lifestyle changes, underscores the importance of targeted therapies in this age group.

The Adolescent segment, while smaller, remains crucial due to the transitional needs of this age group. Adolescents often require adjustments in their treatment plans as they outgrow pediatric dosages and adapt to adult formulations. This segment's growth is driven by innovative drug delivery systems and personalized treatment plans that cater to their unique physiological changes and lifestyle requirements.

Key Market Segments

By Medication

- Quick Relief Medications

- Long-term Control Medications

- Others

By Mode of Administration

- Tablets and Capsules

- Liquids

- Inhalers

- Injections

By Organization Type

- Public

- Private

By Application

- Pediatric

- Adults

- Adolescent

Growth Opportunity

Advancements in Pharmaceutical Research and Treatment Options

The global asthma drug market is poised for significant growth, driven by notable advancements in pharmaceutical research and the development of innovative treatment options. Recent breakthroughs in biologics and targeted therapies have enhanced the efficacy of asthma management, offering patients more personalized and effective treatments. Biologics, such as monoclonal antibodies targeting specific pathways involved in asthma, have shown considerable promise in reducing exacerbations and improving overall patient outcomes. The approval and increased adoption of these advanced therapies are expected to substantially boost market growth. Additionally, the integration of digital health technologies, such as smart inhalers and remote monitoring systems, is transforming asthma management by enabling real-time tracking and personalized treatment adjustments, further enhancing patient adherence and outcomes.

Growing Awareness of Asthma Management

Increasing awareness of asthma management and the importance of early diagnosis are pivotal factors contributing to the market's expansion. Public health initiatives and educational campaigns are raising awareness about asthma symptoms, triggers, and the necessity of proper medication adherence. This heightened awareness is driving higher diagnosis rates and encouraging patients to seek timely and appropriate medical interventions. Furthermore, the collaboration between healthcare providers, pharmaceutical companies, and patient advocacy groups is fostering a more informed patient population, ultimately leading to better disease management and an increased demand for asthma drugs.

Latest Trends

Growing Environmental Implications of Air Pollution

The escalating levels of air pollution worldwide are significantly influencing the asthma drugs market. The correlation between air quality deterioration and the prevalence of asthma is becoming increasingly evident. As air pollution intensifies, particularly in urban centers, the incidence of asthma is rising, driving demand for effective asthma management solutions. Pharmaceutical companies are investing heavily in research and development to innovate drugs that address the exacerbated symptoms caused by pollutants. This trend underscores the need for stringent regulatory measures and enhanced public awareness campaigns to mitigate environmental risks, further propelling the market for asthma medications.

Increased Focus on Long-Term Control Medications

The asthma drugs market is witnessing a pronounced shift towards long-term control medications. Unlike rescue inhalers, which provide immediate relief, long-term control medications are designed to manage chronic symptoms and reduce the frequency of asthma attacks. This trend is driven by advancements in biologics and inhaled corticosteroids, which offer more effective and sustained management of asthma. Healthcare providers are increasingly recommending these medications due to their ability to improve patient's quality of life and reduce healthcare costs associated with emergency asthma treatments. As patient education improves and adherence to prescribed regimens increases, the market for long-term control medications is expected to expand significantly.

Regional Analysis

North America dominates the asthma drugs market with a 40% share.

The global asthma drugs market exhibits notable regional variations, driven by differing healthcare infrastructures, prevalence rates, and economic capabilities. North America stands as the dominant region, accounting for approximately 40% of the largest market share. This dominance is attributable to advanced healthcare systems, high asthma prevalence, and substantial investment in R&D. The region's market is further bolstered by robust pharmaceutical pipelines and the presence of key industry players. Europe follows closely, holding a significant market share, underpinned by high healthcare expenditure and a well-established pharmaceutical sector. Countries such as Germany, the UK, and France are pivotal contributors, driven by increasing asthma incidences and a strong focus on innovative drug development.

In the Asia Pacific, the market is experiencing rapid growth due to rising urbanization, increased pollution levels, and growing awareness about asthma management. China and India are emerging as crucial markets with significant potential, supported by improving healthcare access and economic growth. The Middle East & Africa and Latin America regions, though currently holding smaller market shares, are projected to witness steady growth. This is due to improving healthcare infrastructure, increasing government initiatives, and rising disease awareness. However, challenges such as lower economic capabilities and healthcare access disparities need addressing to realize full market potential in these regions.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Asthma Drugs Market in 2024 is shaped by the strategic maneuvers of key industry players such as GlaxoSmithKline Plc, Pfizer, Vectura Group, Boehringer Ingelheim, Roche, Novartis, Merck, AstraZeneca, and Teva Pharmaceutical. Each of these companies leverages distinct competencies to maintain and expand their market presence.

GlaxoSmithKline and AstraZeneca continue to dominate with their robust portfolios of inhaled corticosteroids and combination therapies, benefiting from their extensive R&D capabilities and global distribution networks. Pfizer, known for its innovative approach, is expected to enhance its market share through strategic acquisitions and collaborations, potentially diversifying its asthma drug pipeline.

Vectura Group, specializing in inhalation technology, plays a crucial role as a partner for larger pharmaceutical firms, offering advanced delivery solutions that can enhance drug efficacy and patient compliance. Boehringer Ingelheim and Roche are likely to capitalize on their biologic therapies, targeting severe asthma and unmet needs in the market.

Novartis and Merck, with their strong emphasis on cutting-edge biologics and personalized medicine, are positioned to drive growth through novel therapeutic options. Teva Pharmaceutical, focusing on generics and cost-effective solutions, caters to the broader market segments, ensuring accessibility and affordability of asthma treatments.

Market Key Players

- GlaxoSmithKline Plc

- Pfizer

- Vectura Group

- Boehringer Ingelheim

- Roche

- Novartis

- Merck

- AstraZeneca

- Teva Pharmaceutical

Recent Development

- In May 2024, The Global Initiative for Asthma (GINA) published a report in this comprehensive update that incorporates the latest scientific insights and emphasizes new strategies for asthma management and prevention. It highlights the importance of personalized medicine and the integration of new biological therapies for severe asthma.

- In February 2024, Amgen and AstraZeneca announced that the U.S. FDA approved TEZSPIRE (tezepelumab-ekko) for self-administration in a pre-filled, single-use pen for patients aged 12 years and older with severe asthma. This approval is significant as it allows patients greater autonomy and convenience in managing their condition.

- In July 2023, Viatris launched Breyna, the first FDA-approved generic version of Symbicort, an inhalation aerosol used for asthma treatment. This generic option is expected to increase the accessibility and affordability of asthma medications.

Report Scope

Report Features Description Market Value (2023) USD 23.9 Billion Forecast Revenue (2033) USD 38.9 Billion CAGR (2024-2032) 5.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Medication (Quick Relief Medications, Long-term Control Medications, Others), By Mode of Administration (Tablets and Capsules, Liquids, Inhalers, Injections), By Organization Type (Public, Private), By Application (Pediatric, Adults, Adolescent) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape GlaxoSmithKline Plc, Pfizer, Vectura Group, Boehringer Ingelheim, Roche, Novartis, Merck, AstraZeneca, Teva Pharmaceutical Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- GlaxoSmithKline Plc

- Pfizer

- Vectura Group

- Boehringer Ingelheim

- Roche

- Novartis

- Merck

- AstraZeneca

- Teva Pharmaceutical