Global Armored Vehicle Market By Product(Combat Vehicles, Combat Support), By Type(Electric Armored Vehicles, Conventional Armored Vehicles), By Mobility(Wheeled, Tracked), By Mode of Operation(Manned Armored Vehicles, Unmanned Armored Vehicles), By Point of Sale(OEM, Retrofit), By System(Engines, Drive Systems, Ballistic Armor, Fire Control Systems (FCS), Navigation Systems), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

47965

-

June 2024

-

300

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Key Takeaways

- Driving factors

- Restraining Factors

- By Product Analysis

- By Type Analysis

- By Mobility Analysis

- By Mode of Operation Analysis

- By Point of Sale Analysis

- By System Analysis

- Key Market Segments

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

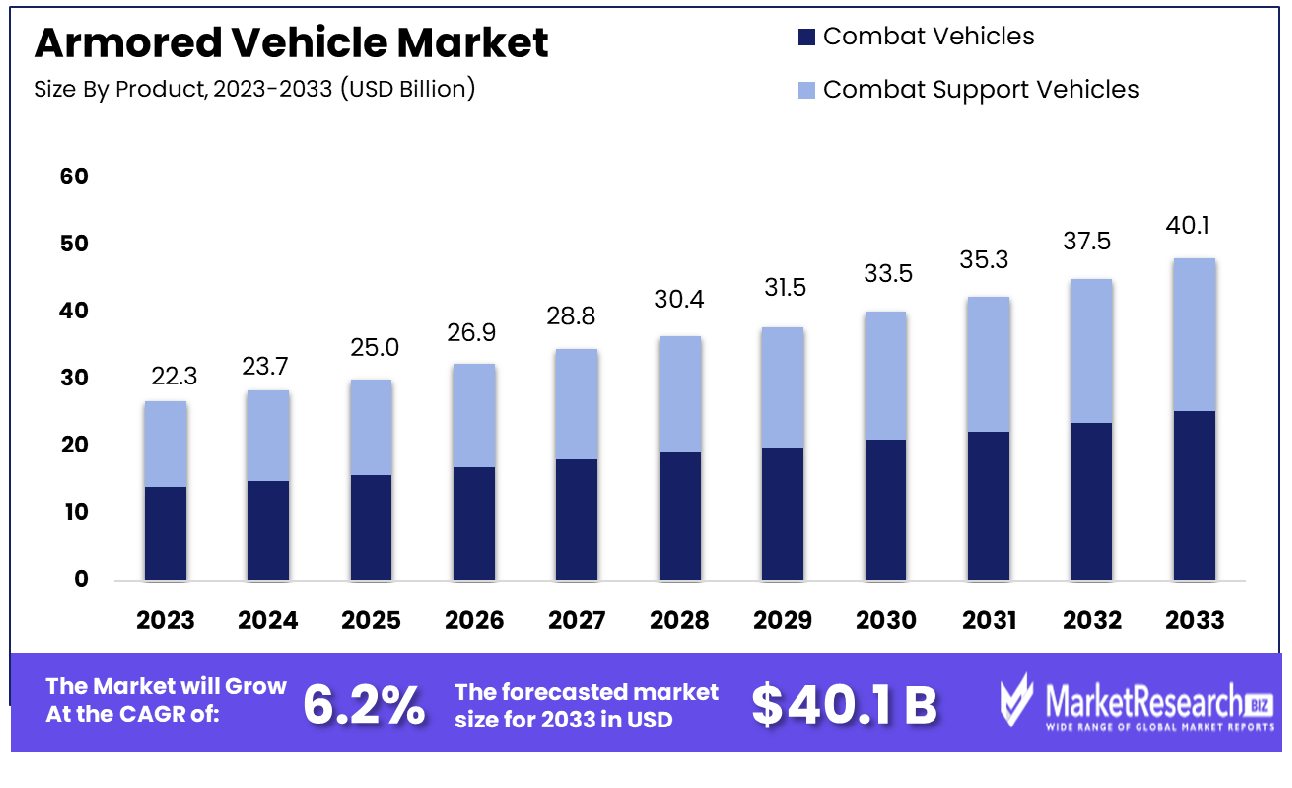

The Global Armored Vehicle Market was valued at USD 22.3 billion in 2023. It is expected to reach USD 40.1 billion by 2033, with a CAGR of 6.2% during the forecast period from 2024 to 2033.

The armored vehicle market encompasses the production and sale of vehicles specifically designed to provide enhanced defense against ballistic threats and explosive devices. These vehicles are integral to military operations, law enforcement missions, and the safeguarding of VIPs. The market includes a range of products such as tanks, armored personnel carriers, and armored cars, tailored to the needs of governmental and private entities.

The growth of this market can be attributed to increasing global security threats and the necessity for advanced protective solutions in conflict zones. Key drivers include technological advancements, rising defense budgets, and heightened demand for security in regions experiencing political instability.

The armored vehicle market is witnessing significant growth, driven by escalating global security concerns and technological advancements in defense capabilities. This market sector encompasses a broad array of vehicles designed for ballistic protection and enhanced safety in conflict zones, including battle tanks, armored personnel carriers, and customized protective vehicles for VIPs and law enforcement use.

A notable driver of this expansion is the marked increase in arms imports by Middle Eastern countries, which have surged by 103% from 2008 to 2012, and by an identical margin from 2013 to 2017. This surge is largely a response to persistent regional conflicts and heightened security necessities, necessitating substantial investments in armored vehicles.

Additionally, the Asia Pacific region is also showing robust growth in defense expenditure, with projections indicating a compound annual growth rate (CAGR) of 5% from $13 billion in 2023 to $15.8 billion by 2027. This increase in defense budgets is likely to catalyze further development and procurement in the armored vehicle sector, as nations invest heavily in modernizing their military and security fleets to address both domestic and cross-border threats.

The combined impact of these factors is fostering a conducive environment for the growth of the armored vehicle market. Manufacturers and defense contractors are therefore expected to experience a surge in demand, prompting them to innovate and expand their offerings to meet the sophisticated requirements of today's military and security forces. This market's trajectory suggests a sustained period of growth, underpinned by continuous technological enhancements and geopolitical factors driving defense spending worldwide.

Key Takeaways

- Market Growth: The Global Armored Vehicle Market was valued at USD 22.3 billion in 2023. It is expected to reach USD 40.1 billion by 2033, with a CAGR of 6.2% during the forecast period from 2024 to 2033.

- By Product: Combat vehicles dominated the product segment with a 65% market share.

- By Type: Conventional armored vehicles led the type category, capturing 97% dominance.

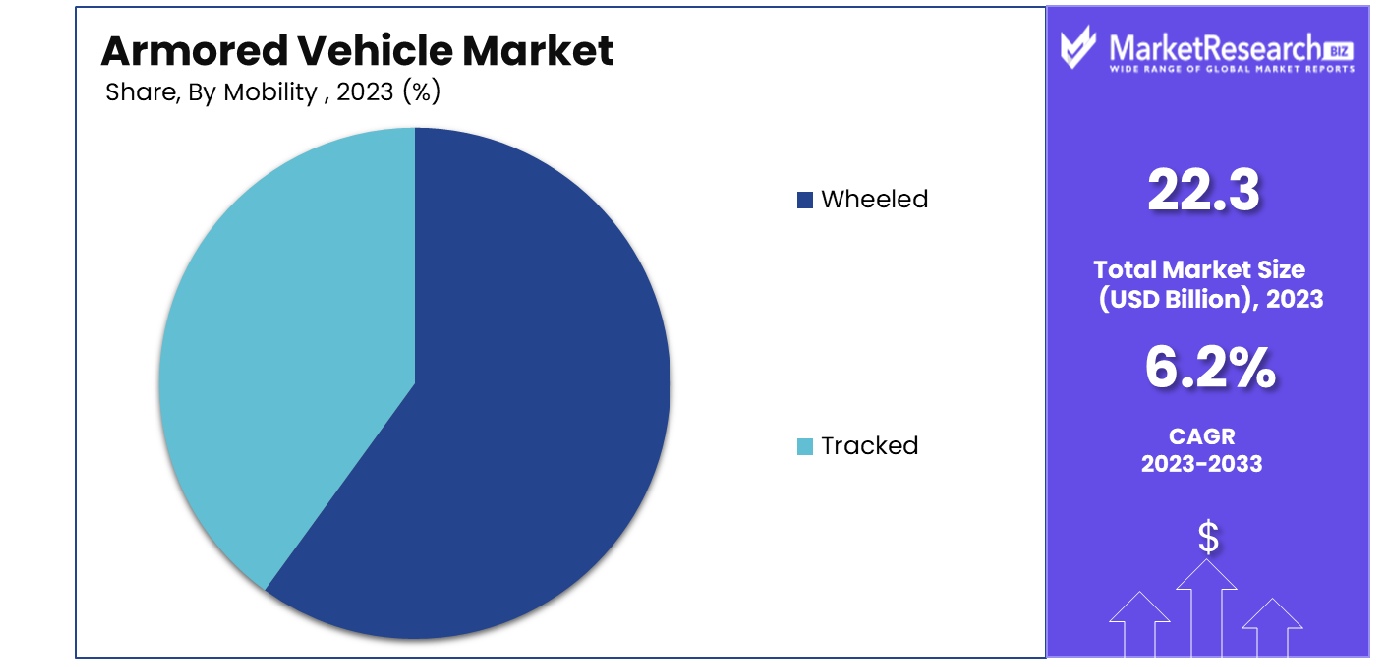

- By Mobility: Wheeled vehicles prevailed in mobility, commanding a 71% market majority.

- By Mode of Operation: Manned armored vehicles dominated operation modes with a 77% market share.

- By Point of Sale: Original Equipment Manufacturers (OEM) led sales, holding a 79% dominance.

- By System: Fire Control Systems led systems with a 32% market share.

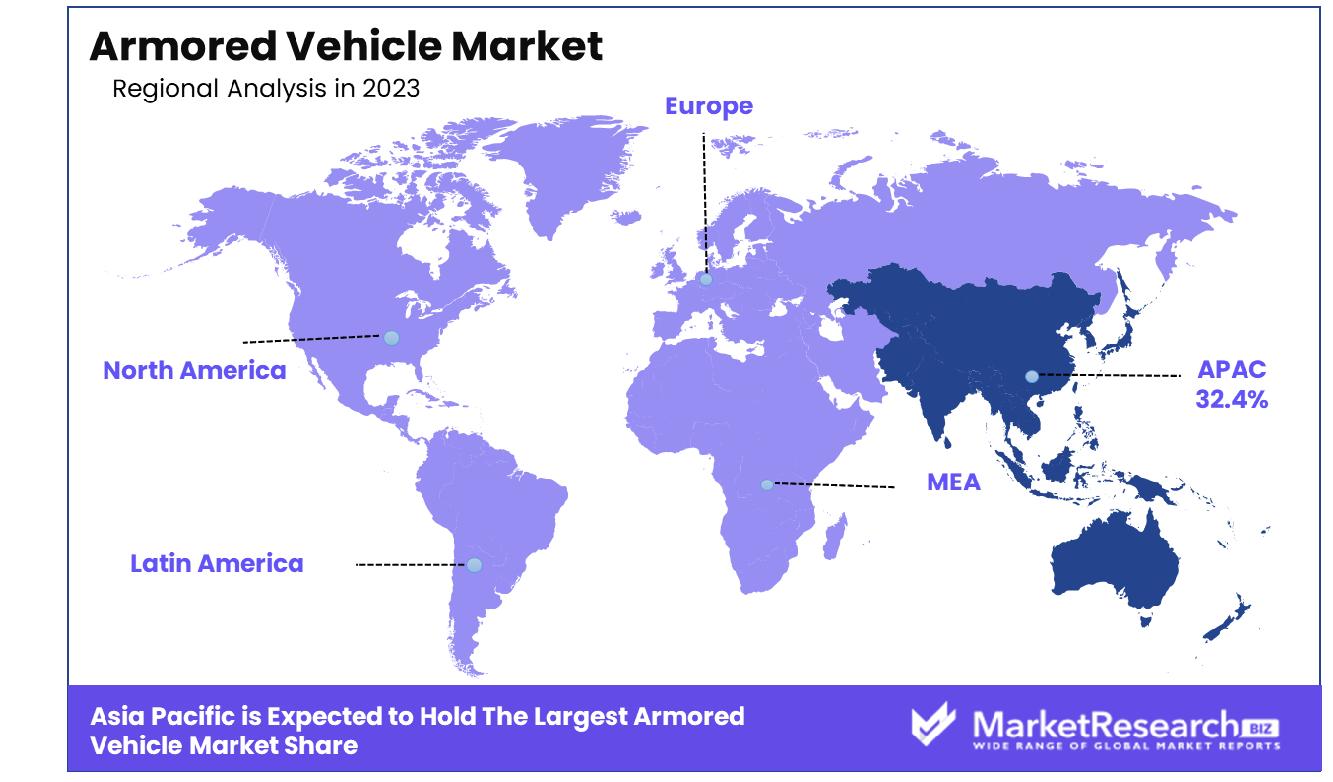

- Regional Dominance: Asia Pacific holds 32.4% of the global armored vehicle market.

- Growth Opportunity: In 2023, the global armored vehicle market is set to grow, driven by increased counter-terrorism operations and demand from commercial security services for enhanced protective transportation.

Driving factors

Rising Defense Spending in Combat Vehicles

The acceleration of global defense budgets, specifically allocated to combat vehicles, is a critical driver for the armored vehicle market. This trend is spurred by the intensifying geopolitical tensions and the need for modernized military equipment across nations. As defense spending increases, there is a direct correlation to the expansion of the armored vehicle sector.

For instance, countries like the United States and China have significantly upped their defense budgets to enhance their military capabilities, including the procurement of advanced armored vehicles. This financial influx not only supports the demand for new units but also the upgrade of existing fleets, thereby propelling market growth.

Increasing Demand for Armored Vehicles to Tackle Cross-border Conflicts

The persistent threat of cross-border conflicts has necessitated the deployment of robust defense mechanisms, notably through the acquisition of armored vehicles. These vehicles play a pivotal role in safeguarding borders and ensuring national security.

The demand is particularly pronounced in regions experiencing active conflicts or geopolitical instabilities, such as Eastern Europe and the Asia-Pacific. The armored vehicles equipped for these scenarios are often customized with reinforced protection and enhanced offensive capabilities, driving their demand and subsequent market growth.

Integration of Advanced Sensors, Communication Systems, and AI-driven Analytics

The integration of cutting-edge technologies such as advanced sensors, sophisticated communication systems, and AI-driven analytics into armored vehicles represents a transformative trend in the market. These technologies enhance the operational efficiency, survivability, and connectivity of armored vehicles, making them more effective in modern warfare scenarios.

For example, AI-driven analytics can predict maintenance needs and optimize routes to avoid threats, while advanced sensors provide critical situational awareness. This technological evolution not only extends the operational capabilities of these vehicles but also increases their market attractiveness, leading to broader adoption and growth in the sector.

Restraining Factors

Threat of Medium-density Fiberboard (MDF) as a Substitute

The emergence of Medium-density Fiberboard (MDF) as a substitute material in certain applications traditionally served by armored vehicles poses a unique challenge to the market's expansion. MDF, known for its cost-effectiveness and versatility in manufacturing, is increasingly considered for military infrastructure and less critical vehicle components, where heavy armor might not be necessary.

This shift could potentially reduce the demand for traditionally manufactured armored vehicles, as defense budgets may favor more cost-effective solutions for non-combat purposes. However, the actual impact on the armored vehicle market is limited by MDF's unsuitability for frontline combat roles, where the protection and durability of traditional armored vehicles remain paramount.

Higher Production Costs

The production of armored vehicles involves high costs due to the sophisticated materials and technologies required to meet modern warfare standards. The incorporation of advanced armor materials, enhanced weaponry systems, and state-of-the-art communication tools significantly drives up manufacturing expenses.

Additionally, the ongoing innovation in vehicle defense systems necessitates continuous investment in research and development, further escalating costs. These high production costs can limit market growth by increasing the final product prices, potentially restraining purchase volumes, especially among nations with more constrained defense budgets.

By Product Analysis

In the product category, combat vehicles command a significant 65% share of the market sector.

In 2023, Combat Vehicles held a dominant market position in the "By Product" segment of the Armored Vehicle Market, capturing more than a 65% share. This category includes diverse sub-segments such as Armored Personnel Carriers (APCs), Infantry Fighting Vehicles (IFVs), Light Protected Vehicles (LPVs), Main Battle Tanks (MBTs), Mine-resistant Ambush Protected vehicles (MRAPs), Tactical Vehicles, and others. Among these, Main Battle Tanks and Infantry Fighting Vehicles are noteworthy for their substantial contribution to market growth, driven by heightened global military expenditures and escalating geopolitical tensions.

Armored Personnel Carriers have also seen a surge in demand, particularly for models offering enhanced mobility and advanced protective features. This reflects an ongoing strategic shift by defense forces worldwide to upgrade their transport capabilities and ensure troop safety in conflict zones.

The segment of Combat Support Vehicles, which encompasses Armored Supply Trucks, Armored Command & Control Vehicles, Repair & Recovery Vehicles, and Unmanned Armored Ground Vehicles, also plays a crucial role. Although it holds a smaller market share compared to Combat Vehicles, the demand for these units is propelled by the increasing complexity of military operations which require robust logistics support and command efficiency.

Technological advancements are significantly influencing the armored vehicle market. Innovations such as unmanned systems, enhanced armor materials, and networked communication tools are becoming key differentiators. Moreover, the integration of hybrid drivetrains and the emphasis on reduced operational costs are emerging trends that are expected to shape future market dynamics.

By Type Analysis

Conventional armored vehicles hold a dominant position in type, accounting for 97% of the market presence.

In 2023, Conventional Armored Vehicles held a dominant market position in the "By Type" segment of the Armored Vehicle Market, capturing more than a 97% share. This segment primarily encompasses vehicles powered by traditional combustion engines, which continue to be preferred due to their reliability, long-range capabilities, and established supply chains. Conventional Armored Vehicles include a broad range of mobility solutions from heavily armored battle tanks to lighter, more agile reconnaissance vehicles, which are critical in various military operations.

Despite the growing interest in sustainable and innovative technologies, the penetration of Electric Armored Vehicles remains relatively low, accounting for a small portion of the market. Electric Armored Vehicles face several challenges that restrict their widespread adoption, including limitations in battery technology, concerns over operational range, and higher initial investment costs. However, they represent a forward-thinking approach with potential benefits such as reduced noise levels, lower thermal signatures, and decreased long-term operational costs, aligning with future strategic defense goals focused on sustainability and technological integration.

The dominance of Conventional Armored Vehicles is supported by ongoing global military modernization programs, where nations are investing heavily in upgrading their fleets with enhanced protective features, firepower, and mobility. This trend is driven by escalating security concerns and the need to maintain a technological edge in armored warfare.

As the market evolves, the segment for Electric Armored Vehicles is expected to grow, driven by advancements in electric drivetrain technologies and increasing environmental regulations. However, for the foreseeable future, Conventional Armored Vehicles are likely to maintain their lead, underscored by their proven performance and strategic utility in global defense scenarios.

By Mobility Analysis

Wheeled vehicles lead the mobility segment, comprising 71% of the total market distribution.

In 2023, Wheeled vehicles held a dominant market position in the "By Mobility" segment of the Armored Vehicle Market, capturing more than a 71% share. This segment encompasses vehicles that are designed for versatility and rapid deployment across varied terrains. Wheeled armored vehicles, including armored personnel carriers, reconnaissance vehicles, and infantry fighting vehicles, are favored for their high mobility, speed, and reduced maintenance costs compared to their tracked counterparts.

Tracked vehicles, while essential for certain operations requiring heavy armor and all-terrain capabilities, represent a smaller portion of the market. These vehicles are typically deployed in environments where wheeled vehicles might struggle, such as rugged terrain or areas with severe infrastructural limitations. Tracked armored vehicles are pivotal in operations that demand durability and high performance under extreme conditions.

The predominance of wheeled vehicles is attributed to their adaptability in most conflict scenarios, where roads and prepared surfaces are available. They are quicker to deploy and easier to maintain, which significantly reduces operational costs and enhances logistical efficiency. This mobility type aligns well with the modern military strategy that often requires rapid response and high-speed maneuvers.

As defense forces globally continue to emphasize strategic mobility and logistical efficiency, the demand for wheeled armored vehicles is expected to remain strong. Innovations in wheel technology and vehicle design are enhancing their operational range and protective capabilities, ensuring that they meet the evolving requirements of modern warfare while maintaining a substantial market share.

By Mode of Operation Analysis

Manned armored vehicles predominate in the mode of operation segment, representing 77% of the sector.

In 2023, Manned Armored Vehicles held a dominant market position in the "By Mode of Operation" segment of the Armored Vehicle Market, capturing more than a 77% share. This category includes vehicles that require human operators for their functioning, spanning a wide range from main battle tanks to light armored vehicles. These vehicles are integral to conventional military operations, offering direct human oversight, which is crucial for complex combat scenarios where human judgment and adaptability are paramount.

Unmanned Armored Vehicles, although they represent a smaller fraction of the market, are an emerging segment demonstrating significant growth potential. These vehicles are designed to operate autonomously or be remotely controlled, reducing the risk to human life and expanding the capabilities of armed forces in hazardous environments. They are increasingly used for surveillance, reconnaissance, and combat roles where manned vehicle deployment is either risky or impractical.

The dominance of Manned Armored Vehicles can be attributed to their proven effectiveness in a wide range of military operations and the existing infrastructure and training protocols that support their deployment. However, advancements in technology and increasing investments in artificial intelligence are likely to boost the growth of the Unmanned Armored Vehicles segment. The trend towards automation and the integration of advanced sensors and communication systems in armored vehicles are expected to enhance their operational capabilities, making them an indispensable part of future combat scenarios.

By Point of Sale Analysis

Original Equipment Manufacturers (OEMs) predominantly control the point of sale category with a 79% market share.

In 2023, Original Equipment Manufacturers (OEMs) held a dominant market position in the "By Point of Sale" segment of the Armored Vehicle Market, capturing more than a 79% share. This segment includes vehicles that are sold directly from manufacturers to military and law enforcement agencies, equipped with the latest technology and specifications tailored for modern combat and security operations. OEMs deliver vehicles that meet the specific demands of armed forces, incorporating advanced armor protection, firepower, and mobility right from the production line.

The Retrofit segment, while smaller, is significant and caters to updating older vehicles with modern systems and protections. Retrofits allow for the extension of service life and enhancement of older fleet capabilities, aligning them with current operational requirements without the need for entirely new vehicles. This segment is particularly appealing in budget-constrained environments or where legacy platforms have a strategic value that can be preserved through upgrades.

The predominance of the OEM segment is driven by continuous innovations in armored vehicle technology, including hybrid drivetrains, improved ballistic protection, and integrated command and control systems. These advancements make new OEM vehicles more attractive for defense procurers looking for ready-to-deploy solutions that conform to the latest safety and efficiency standards.

Looking ahead, the growth in the OEM sector is expected to continue robustly, fueled by increasing global security challenges and the continuous evolution of military tactics that require state-of-the-art armored vehicles. However, the retrofit market is also poised to expand as nations seek cost-effective methods to maintain and enhance their existing vehicular assets amid growing fiscal pressures.

By System Analysis

In the system category, Fire Control Systems (FCS) secure a leading share of 32%, highlighting diverse system preferences.

In 2023, Fire Control Systems (FCS) held a dominant market position in the "By System" segment of the Armored Vehicle Market, capturing more than a 32% share. Fire Control Systems are critical components that enhance the accuracy and efficiency of weapons deployed on armored vehicles. These systems integrate a range of sensors, targeting mechanisms, and onboard computing power to ensure that armament systems can effectively engage targets with high precision.

Other critical systems within the armored vehicle market include Engines, Drive Systems, Ballistic Armor, and Navigation Systems. Engines and Drive Systems form the backbone of vehicle mobility and are essential for ensuring that armored vehicles can operate in diverse and challenging terrains. Ballistic Armor is fundamental for protecting vehicle occupants from threats and enhancing survivability in hostile environments. Navigation Systems, incorporating advanced GPS and other location-tracking technologies, are crucial for the strategic maneuvering of these vehicles during missions.

The prominence of Fire Protection Systems can be attributed to the increasing sophistication of modern warfare, which demands greater precision and efficiency in combat scenarios. The integration of advanced optics, thermal imaging, and laser range-finding technology within FCS has significantly improved the combat capabilities of armored vehicles, making them more lethal and effective on the battlefield.

As military engagements become more technologically driven, the demand for sophisticated Fire Control Systems is expected to grow, reflecting ongoing advancements in military technology and the critical need for precision in armament systems. This trend underscores the importance of continuous innovation in the development of FCS to maintain operational superiority in complex combat situations.

Key Market Segments

By Product

- Combat Vehicles

- Armored Personnel Carrier (APC)

- Infantry Fighting Vehicles (IFV)

- Light Protected Vehicles (LPV)

- Main Battle Tanks (MBT)

- Mine-resistant Ambush Protected (MRAP)

- Tactical Vehicle

- Others- Combat Support Vehicles

- Armored Supply Trucks

- Armored Command & Control Vehicles

- Repair & Recovery Vehicles

- Unmanned Armored Ground VehiclesBy Type

- Electric Armored Vehicles

- Conventional Armored Vehicles

By Mobility

- Wheeled

- Tracked

By Mode of Operation

- Manned Armored Vehicles

- Unmanned Armored Vehicles

By Point of Sale

- OEM

- Retrofit

By System

- Engines

- Drive Systems

- Ballistic Armor

- Fire Control Systems (FCS)

- Navigation Systems

Growth Opportunity

Opportunities in the Global Armored Vehicle Market for Counter-Terrorism Operations

In 2023, the global armored vehicle market is poised to experience significant growth, primarily driven by escalating counter-terrorism operations. The increasing frequency and complexity of terrorist attacks globally necessitate advanced, robust armored vehicles capable of withstanding severe threats.

Governments are intensifying investments in defense and security, with a marked preference for vehicles that offer enhanced protection, agility, and advanced technological integrations such as improved surveillance systems and unmanned operational capabilities. This trend is expected to catalyze substantial market expansion, as nations strive to fortify their counter-terrorism units and safeguard national security.

Commercial Security Services and the Armored Vehicle Market

The realm of commercial security services presents a burgeoning opportunity for the armored vehicle market in 2023. With the rise in threats to personal and corporate security, there is a growing demand for armored vehicles that provide a high level of protection for executives, high-net-worth individuals, and sensitive cargo. The evolution of urban security concerns, including the need for vehicles capable of navigating complex city landscapes while ensuring safety, drives this demand.

Additionally, the adoption of armored vehicles by private security firms is expected to accelerate, supported by advancements in vehicle technology that offer both security and comfort without compromising on performance. This dual requirement fuels innovation and customization in the sector, creating a thriving market environment.

Latest Trends

Multi-Layered Defense Strategies in the Global Armored Vehicle Market

The global armored vehicle market in 2023 is increasingly characterized by the implementation of multi-layered defense strategies. This approach integrates various defensive technologies to enhance the survivability of armored vehicles in hostile environments. Key elements include advanced armor composites, active protection systems, and sophisticated electronic warfare capabilities that collectively enhance threat detection, avoidance, and neutralization.

The trend toward modular designs in armor allows for rapid adaptation to different threat levels, significantly enhancing the operational flexibility and effectiveness of these vehicles in various combat scenarios. This strategic depth in defense is crucial for modern warfare and peacekeeping missions, driving the evolution of armored vehicles to new standards of security and resilience.

Adoption of Lightweight and Ultra-High-Strength Materials

In 2023, the armored vehicle market is witnessing a transformative shift towards the use of lightweight and ultra-high-strength materials. This trend is driven by the dual demands of enhanced mobility and superior ballistic protection. Materials such as advanced high-strength steel, aluminum alloys, ceramics, and composite materials are being increasingly employed to reduce the overall weight of vehicles while maintaining, or even enhancing their protective capabilities.

The reduction in weight not only improves fuel efficiency and speed but also increases the vehicles' range and maneuverability, crucial for both combat and urban deployment. This shift not only reflects the ongoing technological advancements but also aligns with the broader defense objectives of modernizing and streamlining military assets for rapid and efficient response capabilities.

Regional Analysis

The Asia Pacific armored vehicle market commands a substantial 32.4% share, driven by escalating regional tensions.

The global armored vehicle market exhibits significant regional segmentation, reflecting varied geopolitical dynamics, defense spending, and security needs. In 2023, Asia Pacific emerged as the dominating region, holding a substantial market share of 32.4%. This dominance is attributed to heightened border tensions and internal security challenges in several countries, driving robust demand for armored vehicles. Increasing defense budgets in nations such as China and India further fuel this demand, supporting both domestic production and imports of advanced armored vehicle technologies.

North America also represents a key segment in the armored vehicle market, driven by consistent investments in military and defense infrastructures, particularly in the United States, which has a longstanding history of deploying armored vehicles in international peacekeeping and military operations. Europe's market is bolstered by rising security concerns amid geopolitical tensions, leading to renewed investments in defense sectors across NATO countries.

In contrast, the Middle East & Africa region shows a dynamic growth trajectory, propelled by ongoing regional conflicts and the need for mobile-protected firepower. Countries like Saudi Arabia and the UAE are ramping up their defense arsenals with modern armored vehicles as part of their military modernization programs.

Latin America, though smaller in comparison, is experiencing incremental growth due to increasing political instability and security concerns, which necessitate enhanced protective measures for law enforcement and security personnel.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global armored vehicle market will be significantly influenced by strategic activities and technological advancements from leading companies. Among these, BAE Systems (U.K.) and General Dynamics Corporation (U.S.) are notable for their comprehensive portfolios and persistent innovation in armored vehicle technologies.

BAE Systems, with its expertise in combat vehicles, continues to expand its global footprint through new contracts and updates to existing vehicle platforms. Similarly, General Dynamics Corporation remains a key player due to its strong focus on incorporating advanced defense technologies and securing substantial contracts from the U.S. government and other nations.

Rheinmetall AG (Germany) and Krauss-Maffei Wegmann GmbH (Germany) are pivotal in driving the European market, primarily through their cutting-edge designs and modular approaches to armored vehicles, catering effectively to both local and international demands. Their focus on integrating digital technologies and active protection systems sets them apart in the European sector.

In emerging markets, companies like Denel SOC Ltd (South Africa) and NORINCOGROUP.com Inc. (China) play crucial roles. Denel continues to innovate in mine-resistant vehicles, while NORINCO expands its influence in Asia with cost-effective solutions that appeal to a broad range of clients in developing nations.

Additionally, IVECO DEFENCE VEHICLES (Italy) and Otokar (Turkey) underscore their regional dominance by focusing on customization and flexibility, adapting to varied terrain and operational requirements. Oshkosh Defense, LLC (U.S.), known for its tactical vehicles like the JLTV, and Textron Systems (U.S.), with its focus on drones and networked battlefield operations, both enhance the market through diversified offerings and advanced warfare technologies.

Market Key Players

- BAE Systems (U.K.)

- General Dynamics Corporation (U.S.)

- Rheinmetall AG (Germany)

- Krauss-Maffei Wegmann GmbH (Germany)

- Denel SOC Ltd (South Africa)

- IVECO DEFENCE VEHICLES (Italy)

- NORINCOGROUP.com Inc. (China)

- Oshkosh Defense, LLC An Oshkosh Corporation Company (U.S.)

- Otokar, a KOC Group Company (Turkey)

- Textron Systems (U.S.)

Recent Development

- In April 2024, GM Defense, in collaboration with the Defense Innovation Unit (DIU), is advancing hybrid electric military vehicle technologies. Rick Kewley, VP of Product Development, discusses their latest R&D efforts on the Aerospace & Defense Technology podcast.

- In September 2023, The SRB Project Consortium nears completion of the design phase for an innovative rotary hydropneumatic shock absorber for armored vehicles. Piedrafita Systems, Repack-S, and IB Fischer CFD + Engineering GmbH collaborate on this revolutionary technology.

Report Scope

Report Features Description Market Value (2023) USD 22.3 Billion Forecast Revenue (2033) USD 40.1 Billion CAGR (2024-2032) 6.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Combat Vehicles(Armored Personnel Carrier (APC), Infantry Fighting Vehicles (IFV), Light Protected Vehicles (LPV), Main Battle Tanks (MBT), Mine-resistant Ambush Protected (MRAP), Tactical Vehicle, Others), Combat Support Vehicles(Armored Supply Trucks, Armored Command & Control Vehicles, Repair & Recovery Vehicles, Unmanned Armored Ground Vehicles)), By Type(Electric Armored Vehicles, Conventional Armored Vehicles), By Mobility(Wheeled, Tracked), By Mode of Operation(Manned Armored Vehicles, Unmanned Armored Vehicles), By Point of Sale(OEM, Retrofit), By System(Engines, Drive Systems, Ballistic Armor, Fire Control Systems (FCS), Navigation Systems) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape BAE Systems (U.K.), General Dynamics Corporation (U.S.), Rheinmetall AG (Germany), Krauss-Maffei Wegmann GmbH (Germany), Denel SOC ltd (South Africa), IVECO DEFENCE VEHICLES (Italy), NORINCOGROUP.com Inc. (China), Oshkosh Defense, LLC An Oshkosh Corporation Company (U.S.), Otokar, a KOC Group Company (Turkey), Textron Systems (U.S.) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- BAE Systems (U.K.)

- General Dynamics Corporation (U.S.)

- Rheinmetall AG (Germany)

- Krauss-Maffei Wegmann GmbH (Germany)

- Denel SOC Ltd (South Africa)

- IVECO DEFENCE VEHICLES (Italy)

- NORINCOGROUP.com Inc. (China)

- Oshkosh Defense, LLC An Oshkosh Corporation Company (U.S.)

- Otokar, a KOC Group Company (Turkey)

- Textron Systems (U.S.)