Aquaculture Market By Environment (Fresh Water, Marine Water, Brackish Water) By Product (Carp, Crustaceans, Mackerel, Milkfish, Mollusks, Salmon, Sea Bass, Sea Bream, Trout) and Region - Global Forecast to 2026

-

3746

-

March 2023

-

156

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

The global aquaculture market was valued at over US$ 170 billion in 2017 and is expected to register a CAGR of 5.2%. The report offers in-depth insights, revenue details, and other vital information regarding the global aquaculture market and the various trends, drivers, restraints, opportunities, and threats in the target market till 2026. The report also offers insightful and detailed information regarding the various key players operating in the global aquaculture market, and their financials, apart from strategies, acquisitions & mergers, and market footprint. The global aquaculture market is segmented on the basis of type, application, and region.

Aquaculture is the process of breeding, rearing, and harvesting of fish, shellfish, plants, algae, and other organisms in all types of water environments. As per product requirements there are some available water environment options such as fresh, marine, and brackish for aquaculture. At the time of farming, some environmental concerns need to be taken care of such as water flow considerations, parasites, pollution from effluents, handle escapees, and unhealthy culture conditions. Aquatic products especially farmed salmon and shrimps are considered as a high nutritious source of food which consists of proteins, vitamins A, B, D, and niacin, and minerals like iodine, Iron, Phosphorus and Zinc.

Global Aquaculture Market Dynamics:

Consumption of seafood has been witnessing a steady increase in the recent past, owing to rising awareness regarding health benefits and nutritional value associated with seafood is expected to drive market growth. Salmon and shrimps are rich nutritional sources comprising proteins, vitamins, minerals, and omega-3 fatty acids.

[report-coverage short_image="https://marketresearch.biz/wp-content/uploads/2018/07/global-aquaculture-market-segments.jpg"]

Natural fisheries have limitations on how many fish can be caught and are only available during certain months/time of the year. As an alternative, aquaculture market can provide large and consistent quantities of seafood in a monitored and maintained environment.

Moreover, technical advancements in fish farming industry is anticipated to fuel market growth over the forecast period. Recirculation aquaculture systems (RAS) continue to improve and move towards commercial reality. Also, emerging and innovative systems such as Integrated Multi-Trophic Aquaculture Systems (IMTA), aquaponics, macro algae and submersible cages represent high revenue opportunities in future.

Greater availability of hatchery-raised post-larvae, better feed formulations, and a shift in preferred shrimp species from Penaeus monodon to specific pathogen free (SPF) Litopenaeus vannamei appear to have been critical advancements and factors that are expected to trigger rapid growth in shrimp farming over the forecast period.

However, diseases that develop during fish farming are not always of the same strain that is usually seen in the wild. If a specific disease does evolve, wild population of fish and other aquatic creatures could potentially be completely eliminated. Furthermore, environmental concerns related to aquaculture include water flow considerations, pollution from effluents, handling escapees, and unhealthy culture conditions is expected to hamper market growth.

Integrated culture of fish with crops helps to remediate the nutrients pollution of aquaculture. In addition, rice-fish co-culture in ponds can be an efficient method to mitigate the eutrophication in an intensive culture pond. Cultivating fish reduces the area available for planting rice, but the integrated system leads to higher returns than that of only rice cultivation. Dual farming results in higher rice yield, and also enables farmers to generate additional income. In addition, costs can be saved on fertilizers and pesticides, and this type of farming enables a more efficient use of water. This in turn is expected to create lucrative opportunities for players in the market.

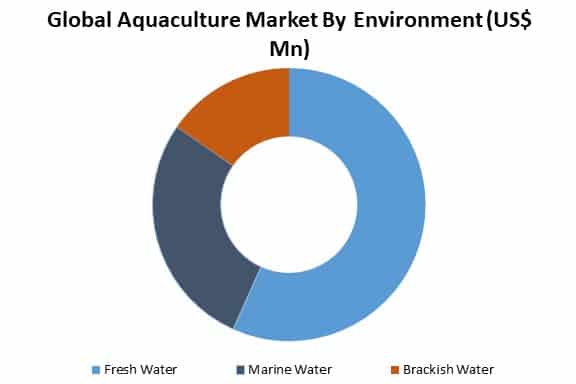

Market analysis by environment:

On the basis of environment segmentation, the freshwater segment is expected to contribute major revenue share, and is expected to maintain its dominance over the forecast period. Major factors driving growth of the segment are increasing exports of freshwater fish such as Tilapia and Pangasius, easy availability of resources such as lakes, irrigation canals, reservoirs, and paddy fields and rising government expenditure on aquaculture initiatives and favorable policies. In addition, rising preference for intensive pond aquaculture market due to various benefits such as environment-friendly method, maximum use of available water resources, better and safer aquatic fish products, and increasing number of hatcheries in countries such as India and China is expected to support growth of the fresh water segment.

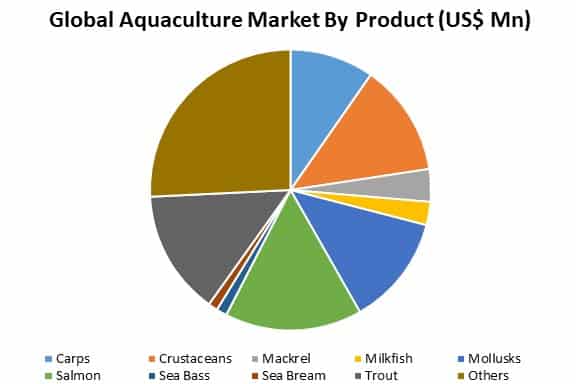

Market analysis by product:

Among all the product segments, salmon segment is expected to be fastest growing product segment in the global aquaculture market. Farmed salmon is most commonly recognized for its high levels of Omega-3 content and is also a good source of high-quality protein, vitamins, and minerals. Hence, it is widely considered a healthy meal choice among consumers. Salmon is available from both wild and farmed sources, and Atlantic salmon is the most commercially available species.

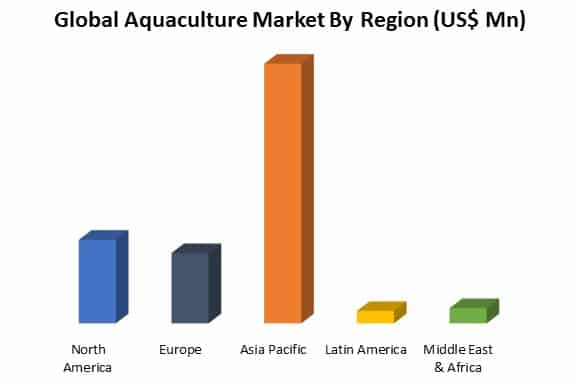

Analysis by Region:

Asia Pacific market is expected to dominate the global aquaculture market, and it accounts for largest market revenue as compared to that of markets in other regions. Dominance by Asia Pacific market is expected to continue over the forecast period and expected to grow with a CAGR over 5%.

China is expected to be world’s largest aquaculture producer, accounting for over 60% of cultured seafood production globally. Seafood import volume of China is estimated to reach 2.8 MMT in 2017, up by 6.5% over the previous year. The China market is followed by India, Vietnam, Indonesia, and Thailand in terms of major producers of aquaculture.

Favorable schemes and incentives offered by governments are expected to result in increasing aquaculture product production over the forecast period. For instance, Low production cost and tariff rate in China are expected to create opportunities for new entrants in the market, which is further expected to fuel market growth.

North America is expected to be second largest region in terms of revenue in the global aquaculture market. Continuous efforts by manufacturers to supply consistent, safe, and high quality products that provide various health-related benefits are some additional factors expected to drive growth of the North America market over the forecast period. Moreover, increasing government initiatives for development of the aquaculture sector in the US is expected to drive growth of North America market to a significant extent in the near future.

Global Aquaculture Market Segmentation:

Global aquaculture segmentation, by environment:

- Fresh Water

- Marine Water

- Brackish Water

Global aquaculture segmentation, by product:

- Carp

- Crustaceans

- Mackerel

- Milkfish

- Mollusks

- Salmon

- Sea Bass

- Sea Bream

- Trout

- Others

Global aquaculture segmentation, by region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

-

-

- Cermaq Group AS

- Cooke Aquaculture Inc.

- Grupo Farallon Aquaculture

- Lerøy Midt AS

- Marine Harvest ASA

- P/F Bakkafrost

- Tassal Group Limited

- Thai Union Group Public Company Limited

- Blue Ridge Aquaculture, Inc.

- Huon Aquaculture Group Limited