Global Antacid Market By Drug Class(Proton pump inhibitors, H2 antagonist, Acid neutralizers), By Formulation(Tablets, Capsules, Suspension, Drops), By Distribution Channel(Hospital pharmacy, Retail pharmacy, Others) By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

-

3744

-

May 2023

-

163

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

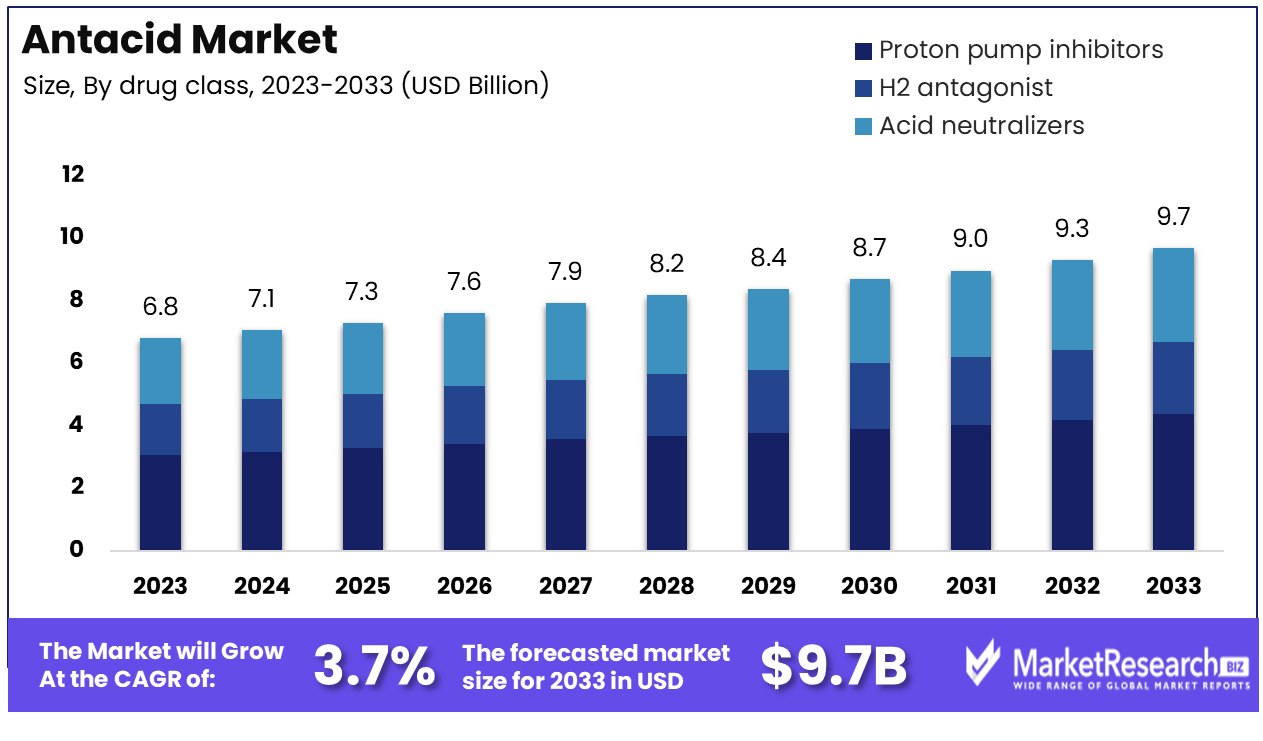

The Global Antacid Market size is expected to be worth around USD 9.7 Billion by 2033, from USD 6.8 Billion in 2023, growing at a CAGR of 3.7% during the forecast period from 2024 to 2033.

The Antacid Market is a pivotal sector within the pharmaceutical landscape, dedicated to the formulation, manufacturing, and dissemination of drugs aimed at mitigating excess stomach acidity. These medications are indispensable in soothing symptoms linked to digestive ailments including heartburn, indigestion, and gastroesophageal reflux disease (GERD). Spanning a diverse array of product forms such as tablets, liquid suspensions, and chewable options, the market adeptly meets varied consumer demands and preferences.

A key propulsion for this market's expansion is attributed to the rising incidence of acidity-related health conditions, influenced by modern dietary practices, elevated stress levels, and lifestyle changes globally. The competitive dynamics of this market are characterized by the presence of both established pharmaceutical conglomerates and specialized niche entities, indicating a robust arena for growth fueled by continuous product innovation and heightened consumer awareness toward digestive health.

Reflecting on statistics from the National Institutes of Health (NIH) in 2022, there was a notable diagnosis of GERD affecting 783.95 million individuals worldwide in 2021. From 1990 to 2021, there was a striking increase in the total number of years lived with disability (YLD) by 77.19%, prevalent cases by 77.53%, and incident cases by 74.79%, underscoring the escalating burden of this condition.

Antacids, by design, neutralize stomach acid through a chemical reaction that elevates the pH levels (diminishes acidity) within the stomach, incorporating compounds that transform acidic contents into neutral substances and water. This mechanism offers relief from discomfort by lessening stomach acidity.

The offerings within the antacid market include an assortment of both over-the-counter (OTC) and prescription-based solutions aimed at mitigating the symptoms of excessive stomach acid production. Market growth is propelled by several factors including advancements in antacid formulations, evolving consumer health awareness, significant medical research breakthroughs, regulatory updates, and the widespread prevalence of conditions necessitating antacid intervention. Consequently, the antacid market is an integral component of the larger pharmaceutical and healthcare industry, playing a crucial role in addressing digestive health challenges and enhancing life quality for individuals with acid-related symptoms.

Key Takeaways

- Market Growth: Antacid Market was valued at USD 6.7 Billion in 2023 and is expected to reach USD 9.7 Billion in 2033, at a CAGR of 3.7%

- Drug Class Analysis: Proton Pump Inhibitors (PPIs) represented a significant share of the antacid market

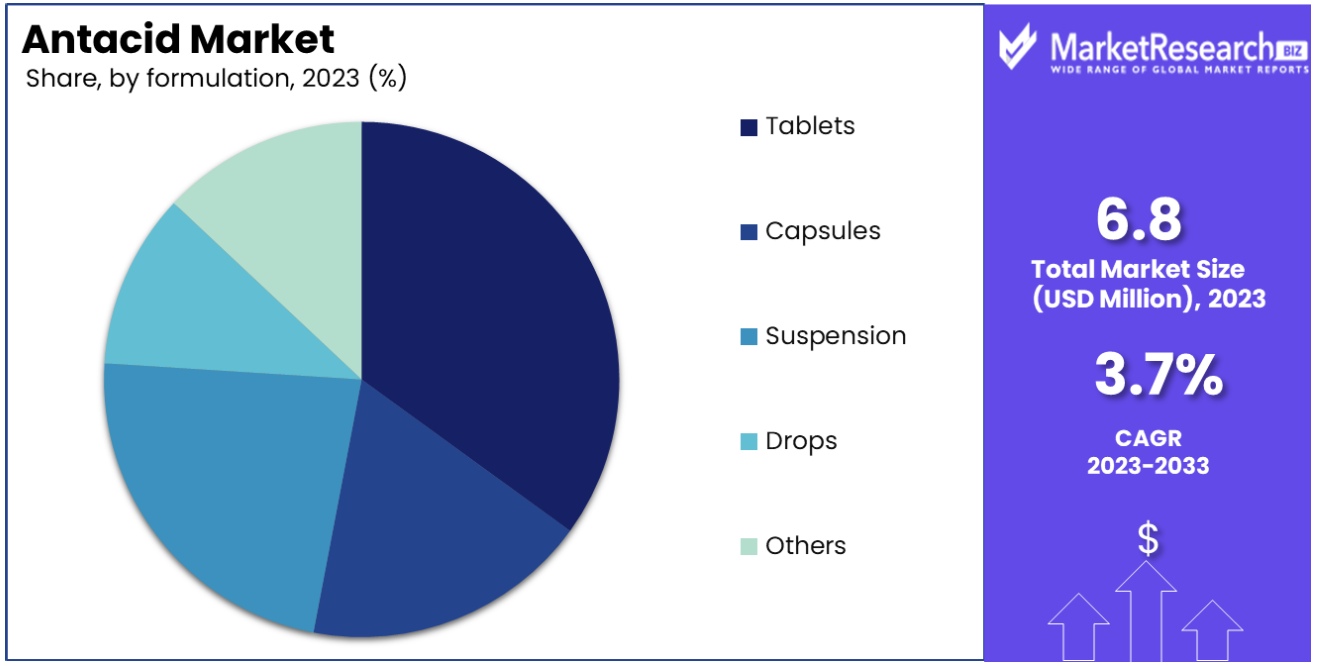

- Formulation Analysis: Tablets held a prominent position in the antacid market

- Distribution Channel Analysis: Hospital pharmacies constituted a significant distribution channel for the antacid market

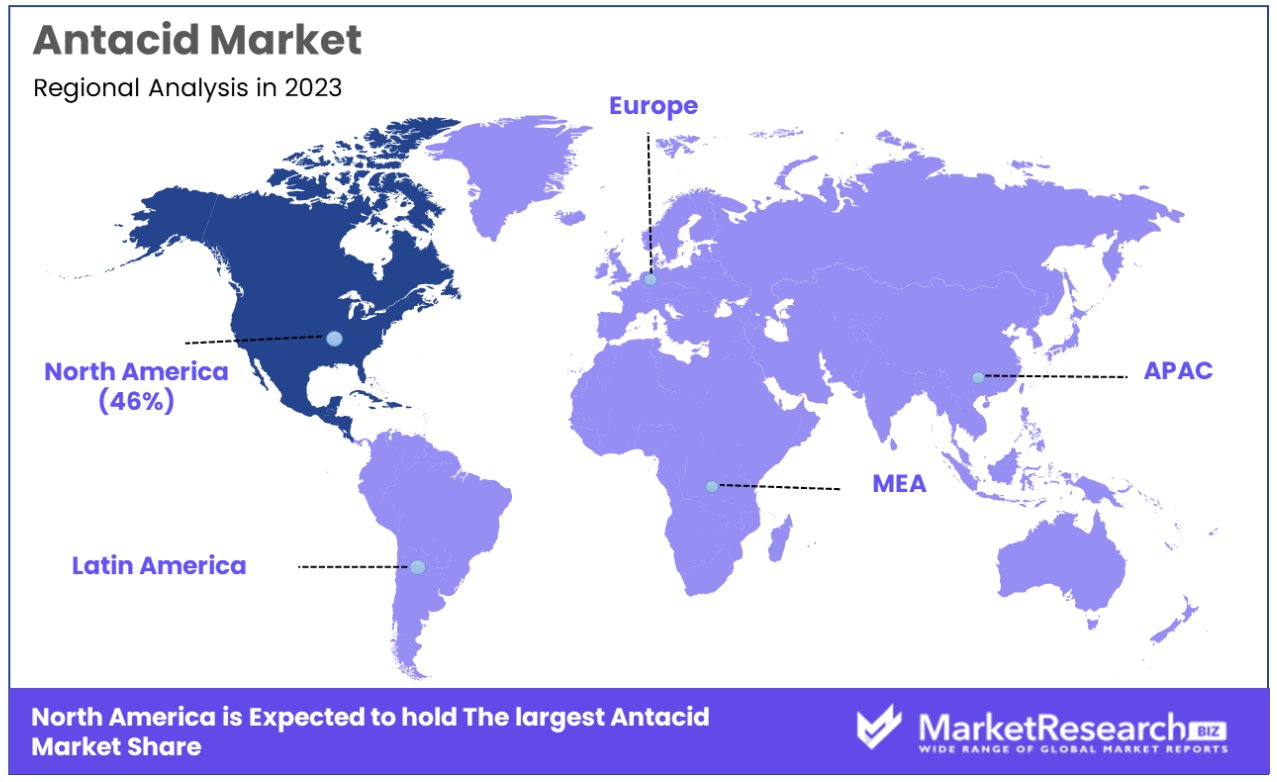

- Regional Analysis: America, with a dominating share of 46%, leads the global antacid market.

Driving Factors

Growing Prevalence of Heartburn and Indigestion: A Key Catalyst for Demand

The escalating incidence of heartburn and indigestion stands as a principal driver for the antacid market's expansion. This trend is largely attributable to dietary habits, lifestyle changes, and the global increase in stress levels, which collectively contribute to a higher demand for antacid products. Studies indicate that a significant portion of the adult population experiences heartburn at least once a month, underscoring the widespread need for effective relief solutions. The direct correlation between the prevalence of these gastrointestinal symptoms and the consumption of antacids underpins the market's growth trajectory.

Accessibility and Convenience of OTC Antacids: Fueling Market Penetration

The widespread availability of over-the-counter (OTC) antacids significantly enhances market growth, offering consumers convenient and immediate access to relief from gastrointestinal discomfort. This accessibility is further bolstered by the deregulation of pharmaceutical sales in numerous countries, allowing antacids to be sold outside traditional pharmacy settings. The ease of purchase, coupled with the minimal need for professional consultation, positions OTC antacids as a go-to solution for a broad demographic, thus driving sales volume and market expansion.

Rising Healthcare Infrastructure and Disposable Income: Elevating Market Potential

The expansion of healthcare infrastructure, particularly in emerging economies, alongside increasing disposable incomes, plays a pivotal role in the antacid market's growth. Enhanced healthcare systems contribute to greater awareness and diagnosis of gastrointestinal disorders, thereby elevating the demand for therapeutic products like antacids. Concurrently, rising disposable incomes enable a larger segment of the population to access and afford over-the-counter medication, including antacids. This dual phenomenon not only broadens the consumer base but also encourages the adoption of premium antacid formulations, further fueling market growth.

Increasing Prevalence of Gastrointestinal Disorders: Amplifying Need for Antacids

The surge in gastrointestinal disorders, such as gastroesophageal reflux disease (GERD), peptic ulcers, and gastritis, directly impacts the demand for antacid products. The growing awareness and diagnosis of these conditions amplify the need for effective and accessible treatment options. The increasing global prevalence of such disorders, driven by factors including aging populations and the adoption of lifestyle-related risk factors, necessitates a steady supply of antacids. This heightened need solidifies antacids' role in both therapeutic and preventative gastrointestinal healthcare, thereby contributing significantly to market growth.

Restraining Factors

Intensified Competition from Alternative Treatments: A Barrier to Market Dominance

The antacid market faces substantial challenges from alternative treatments, such as prescription medications, natural remedies, and lifestyle modification strategies, which offer comprehensive solutions for gastrointestinal disorders. The growing consumer preference for holistic and long-term treatments over symptomatic relief provided by antacids significantly impacts market growth. For instance, proton pump inhibitors (PPIs) and H2 receptor antagonists, which offer more prolonged relief for conditions like GERD, are increasingly preferred over traditional antacids. This shift not only diverts potential sales but also positions antacids as a less favorable option for consumers seeking long-term management of gastrointestinal issues.

Limited Effectiveness for Certain Conditions: Narrowing the Market Scope

Antacids, while effective for immediate relief of mild symptoms like heartburn and indigestion, exhibit limited efficacy in treating more severe or chronic gastrointestinal disorders. Their action is generally restricted to neutralizing stomach acid rather than addressing the underlying causes of conditions such as GERD, peptic ulcers, or gastritis. This limitation narrows their applicability and market potential, as consumers and healthcare providers increasingly opt for treatments that offer both symptomatic relief and therapeutic benefits. The perceived inadequacy of antacids in managing complex conditions thereby restrains market growth, pushing consumers towards more effective alternatives.

Potential for Drug Interactions: Heightening Consumer Caution

The possibility of drug interactions presents another significant constraint to the antacid market's expansion. Antacids can interfere with the absorption and efficacy of various medications, including antibiotics, blood thinners, and certain cardiovascular drugs, posing risks to patients with multiple health concerns. This potential for adverse interactions necessitates cautious use and often consultation with healthcare providers before commencing antacid treatment, especially among patients with chronic conditions or those on multiple medications. The heightened concern over drug interactions discourages the indiscriminate use of antacids, thereby impacting market growth.

Drug Class Analysis

Proton Pump Inhibitors (PPIs) represented a significant share of the antacid market, driven by their efficacy in reducing gastric acid production. PPIs have been the treatment of choice for chronic conditions such as gastroesophageal reflux disease (GERD) and peptic ulcers, owing to their long-lasting relief compared to other antacid classes. The growing prevalence of these conditions globally has underpinned the demand for PPIs. Despite concerns over long-term use and potential side effects, the segment continues to grow, supported by ongoing research and the development of next-generation PPIs with improved safety profiles.

H2 antagonists, which also reduce stomach acid by blocking histamine receptors on gastric cells, have maintained a steady position in the antacid market as of 2023. This segment benefits from the medication's quick action and suitability for treating mild to moderate symptoms of heartburn and indigestion. Although overshadowed by the efficacy of PPIs for severe conditions, H2 antagonists remain popular for their fewer side effects and suitability for occasional use. The availability of these medications in both prescription and over-the-counter forms contributes to their sustained market presence.

Acid neutralizers, comprising basic compounds like magnesium hydroxide, calcium carbonate, and aluminum hydroxide, have been pivotal for immediate relief from acute symptoms of heartburn and indigestion. In 2023, this segment continued to appeal to a wide consumer base due to the instant relief it provides. Acid neutralizers are especially popular in over-the-counter formulations, offering a convenient option for consumers seeking quick symptom management without the need for prescription drugs. Despite their limited duration of action and effectiveness for chronic conditions, the demand for acid neutralizers underscores the segment's importance in the broader antacid market.

Formulation Analysis

Tablets held a prominent position in the antacid market, attributed to their convenience, portability, and ease of use. This form benefits from a broad consumer base, including individuals seeking on-the-go relief from gastrointestinal discomfort. Tablets offer precise dosing, extended shelf life, and the advantage of slow-release formulations, making them a preferred choice for both consumers and healthcare providers. Their widespread acceptance is further supported by the extensive variety available, catering to diverse preferences and specific health needs.

Capsules emerged as a significant segment within the antacid market in 2023, prized for their fast action and high efficacy. This form appeals to consumers looking for quick relief with the added benefit of easy ingestion, particularly for those who find tablets difficult to swallow. Capsules often contain liquid or powder ingredients that are absorbed more quickly than solid tablets, providing a faster onset of action. Despite their typically higher cost, the preference for capsules continues to grow, driven by consumer demand for rapid and effective treatment options.

Suspensions accounted for a key share of the antacid market in 2023, offering immediate relief for acute symptoms of heartburn and indigestion. This liquid form is especially favored for its fast absorption and flexibility in dosing, suitable for all age groups, including children and the elderly who may have difficulty with solid forms. Suspensions provide a soothing effect on the esophagus and stomach lining, making them highly effective for immediate symptom relief. The segment benefits from a variety of flavors and formulations, enhancing consumer acceptance and compliance.

Drops, though a smaller segment of the antacid market in 2023, hold a unique position for offering precise dosage, especially in pediatric and geriatric populations. This form is particularly useful for infants and young children, providing a convenient and accurate method to administer antacid medication without the challenges of swallowing pills or the potential for overdosing associated with suspensions. The market for drops is driven by a niche demand, focusing on safety, ease of use, and targeted relief for mild to moderate symptoms.

Distribution Channel Analysis

Hospital pharmacies constituted a significant distribution channel for the antacid market, primarily catering to patients requiring prescription-based antacid treatments. This segment benefits from the direct link between healthcare providers and patients, ensuring access to specialized formulations tailored to specific medical conditions. Hospital pharmacies play a pivotal role in the distribution of more potent antacid medications, often reserved for acute or severe cases of gastrointestinal disorders. The trust and reliability associated with hospital-based prescriptions underpin the sustained demand within this segment, emphasizing its importance in providing patient-centric care.

Retail pharmacies emerged as the dominant distribution channel for the antacid market in 2023, leveraging their widespread accessibility and convenience. This channel is at the forefront of supplying over-the-counter (OTC) antacid products to a broad consumer base, encompassing various formulations such as tablets, capsules, and suspensions. Retail pharmacies offer the advantage of immediate availability, coupled with the opportunity for consumers to select from a wide range of products based on personal preference and specific health requirements. The segment's growth is further fueled by the expanding network of retail pharmacies and the increasing consumer preference for self-medication in managing mild to moderate gastrointestinal symptoms.

Driven by the growing trend of online pharmacies and e-commerce platforms, alongside non-traditional outlets such as supermarkets and convenience stores. This segment addresses the evolving consumer behavior toward digital shopping and the demand for more accessible purchasing options. Online channels, in particular, offer the benefits of convenience, discreetness, and often competitive pricing, appealing to a tech-savvy demographic seeking efficient ways to manage health and wellness. Furthermore, the inclusion of antacids in non-pharmacy retail settings underscores the product's transition into mainstream consumer goods, broadening its reach and accessibility.

Key Market Segments

Based on drug class:

- Proton pump inhibitors

- H2 antagonist

- Acid neutralizers

Based on formulation:

- Tablets

- Capsules

- Suspension

- Drops

- Others

Based on the distribution channel:

- Hospital pharmacy

- Retail pharmacy

- Others

Growth Opportunities

Innovative Product Development:

The drive toward innovation remains a cornerstone for growth within the antacid market. With an increasing demand for faster relief and longer-lasting effects, companies are investing in research and development to formulate advanced antacid solutions. The introduction of novel ingredients and combination therapies offers a dual advantage—enhancing efficacy and minimizing side effects. This innovation is not only attracting a broader consumer base but also enabling premium pricing strategies. The market is witnessing a trend towards natural and organic formulations, catering to the growing consumer preference for wellness-oriented products.

Online Pharmacy Growth:

The ascent of online pharmacies is revolutionizing the way consumers access over-the-counter (OTC) medications, including antacids. The convenience, privacy, and often lower prices offered by these platforms are significantly increasing their market share. In 2023, online sales channels are expected to grow by double digits, facilitating greater market penetration, especially in underserved regions. This shift is supported by improving logistics, digital payment infrastructures, and consumer trust in e-commerce.

Regulatory Changes:

Regulatory landscapes across the globe are evolving to accommodate the dynamic healthcare needs of populations. Relaxation of regulations concerning OTC medications, including antacids, is opening up new avenues for market entry and expansion. These changes, aimed at reducing healthcare burdens by enabling self-care practices, are expected to lower barriers to new products and encourage innovation within the sector.

Trending Factors

Development of New Antacid Formulations:

- Innovation and Efficacy: The continuous advancement in pharmaceutical research has led to the development of new antacid formulations. These formulations offer improved efficacy, reduced side effects, and longer duration of action, catering to the nuanced needs of diverse patient populations.

- Market Expansion: As a result of these innovations, the antacid market is expected to witness substantial growth. New formulations enhance treatment outcomes for gastrointestinal conditions, thereby widening the market's consumer base and appeal.

- Customization and Specialization: Tailored solutions addressing specific symptoms or patient groups (such as formulations with minimal side effects for pregnant women) are gaining traction, offering growth avenues for manufacturers to differentiate their products in a competitive market.

Consumer Awareness:

- Educational Initiatives and Marketing: Increased efforts in consumer education on gastrointestinal health, driven by healthcare providers and strategic marketing by pharmaceutical companies, have heightened awareness of the benefits of timely antacid use.

- Self-Care Trends: With a growing trend towards self-care and proactive health management, individuals are more informed about the importance of digestive health and the role of antacids in managing discomfort. This awareness is translating into a more health-conscious consumer base, ready to invest in quality antacid products.

Regional Analysis

America, with a dominating share of 46%, leads the global antacid market.

This prominence is attributed to high healthcare expenditure, a strong presence of leading pharmaceutical companies, and a well-established healthcare infrastructure. Additionally, the high prevalence of gastrointestinal disorders due to dietary habits and lifestyle factors contributes to the region's substantial market share.

Europe follows closely, driven by increasing consumer awareness regarding health and wellness, alongside supportive healthcare policies. The region benefits from a robust healthcare system and a high degree of consumer trust in OTC medications, facilitating the widespread use of antacids.

Asia Pacific is identified as a rapidly growing market, propelled by rising disposable incomes, expanding healthcare infrastructure, and the growing prevalence of gastrointestinal conditions. Countries like China and India are pivotal to this growth, with their large populations and increasing access to healthcare services.

Middle East & Africa and Latin America are emerging markets, showing potential due to gradual improvements in healthcare infrastructure and growing awareness about digestive health. Although these regions currently hold smaller shares of the global market, they present significant opportunities for expansion as access to healthcare improves and consumer awareness increases.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the rapidly evolving pharmaceutical and healthcare sectors, several key players stand out for their contributions to innovation, global health improvement, and market dynamics. AstraZeneca plc, Bayer AG, Boehringer Ingelheim GmbH, Dr. Reddy’s Laboratories Ltd., GlaxoSmithKline plc (GSK), Pfizer Inc., and Procter & Gamble Company (P&G) are among these leading entities, each bringing forth unique strengths and extensive portfolios that cater to a wide array of therapeutic areas, including the antacid market.

AstraZeneca plc and Pfizer Inc. are renowned for their pioneering efforts in biopharmaceuticals and a broad spectrum of medications, respectively. AstraZeneca’s focus on addressing unmet medical needs in oncology, cardiovascular, and respiratory diseases, alongside Pfizer’s significant contributions through blockbuster drugs and vaccines, underscores the profound impact these companies have on global healthcare outcomes. Similarly, Bayer AG’s operations extend beyond pharmaceuticals to consumer health, showcasing a diverse product range that includes notable digestive health solutions.

On the other hand, companies like GSK and P&G highlight the importance of consumer health alongside traditional pharmaceutical offerings. GSK’s diversified portfolio includes consumer healthcare products that address digestive health, reinforcing its position in the antacid market. Meanwhile, P&G’s foray into healthcare through over-the-counter medications and wellness products demonstrates the growing intersection between consumer goods and health solutions, aiming to improve everyday health.

These corporations not only contribute significantly to medical advancements through their extensive research and development efforts but also play a crucial role in shaping the competitive landscape of the healthcare industry. Their global presence, coupled with a commitment to innovation and addressing healthcare challenges, positions them as key drivers of progress in the pharmaceutical and healthcare sectors, ensuring access to advanced treatments and improving health outcomes worldwide.

Market Key Players

- AstraZeneca plc.

- Bayer AG

- Boehringer Ingelheim GmbH

- Reddy’s Laboratories Ltd.

- GlaxoSmithKline plc.

- Pfizer Inc.

- Procter & Gamble Company

- Sun Pharmaceuticals Ltd.

- Takeda Pharmaceutical Company Ltd.

- Sanofi-Aventis LLC

Recent Developments

- In November 2023 Reckitt with its brand name Gaviscon introduced Gaviscon Double Action offering consumers an alternative to acid reflux that is prevalent in Tamil Nadu.

- In March 2023. Wonderbelly an antacid and digestive health firm, introduced three antacid flavor options including one, Fruity Cereal, at some Target stores. The flavors are only available to Target customers.

Report Scope

Report Features Description Market Value (2023) USD 6.8 Billion Forecast Revenue (2033) USD 9.7 Billion CAGR (2024-2033) 3.70% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Drug Class(Proton pump inhibitors, H2 antagonist, Acid neutralizers), By Formulation(Tablets, Capsules, Suspension, Drops), By Distribution Channel(Hospital pharmacy, Retail pharmacy, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape AstraZeneca plc., Bayer AG, Boehringer Ingelheim GmbH, Reddy’s Laboratories Ltd., GlaxoSmithKline plc., Pfizer Inc., Procter & Gamble Company, Sun Pharmaceuticals Ltd., Takeda Pharmaceutical Company Ltd., Sanofi-Aventis LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- AstraZeneca plc.

- Bayer AG

- Boehringer Ingelheim GmbH

- Reddy’s Laboratories Ltd.

- GlaxoSmithKline plc.

- Pfizer Inc.

- Procter & Gamble Company

- Sun Pharmaceuticals Ltd.

- Takeda Pharmaceutical Company Ltd.

- Sanofi-Aventis LLC