Anisole Market By Grade (Up To 99.5% and Above 99.5%), By Application (Pharmaceuticals, Cosmetics, Food & Beverages, Perfumes, Pesticides and Insecticides, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

49012

-

July 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

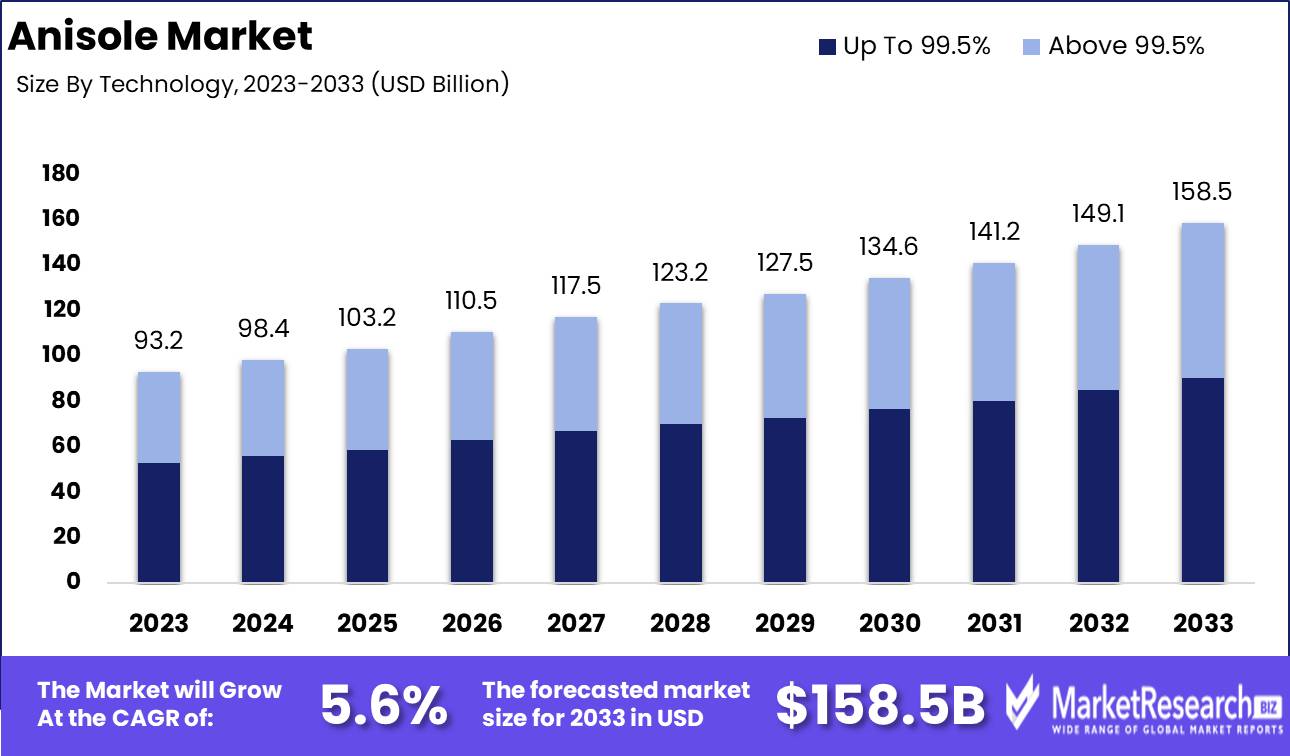

The Anisole Market was valued at USD 93.2 billion in 2023. It is expected to reach USD 158.5 billion by 2033, with a CAGR of 5.6% during the forecast period from 2024 to 2033.

The Anisole Market encompasses the production, distribution, and application of anisole, a chemical compound with the formula C7H8O, primarily used as an intermediate in synthesizing perfumes, pharmaceuticals, and agrochemicals. This market is driven by the rising demand for anisole in fragrance manufacturing due to its pleasant aroma and in pharmaceutical applications for its solvent properties. Additionally, the agrochemical sector leverages anisole for synthesizing herbicides and pesticides.

The anisole market is witnessing a steady growth trajectory, fueled by its expanding applications across various industries. A significant driver of this growth is the increased demand for anisole in the pharmaceutical sector. Anisole serves as a crucial intermediate in synthesizing numerous pharmaceutical compounds, thereby bolstering its market presence. Additionally, the cosmetics industry has seen a rising incorporation of anisole in the formulation of perfumes and fragrances. This trend contributes substantially to market expansion, as consumers increasingly favor high-quality, aromatic personal care products.

However, the market is not without its challenges. Stringent environmental regulations governing chemical production and usage present considerable hurdles for manufacturers. These regulations necessitate compliance with rigorous standards, thereby increasing operational costs and impacting overall market dynamics. Despite these challenges, the anisole market is expected to maintain a positive growth trajectory. The resilience of the market can be attributed to the continuous innovation and adaptation by industry players, ensuring compliance while exploring new applications. The steady demand from pharmaceuticals and cosmetics, combined with strategic advancements by manufacturers, underscores a promising outlook for the anisole market in the coming years.

Key Takeaways

- Market Growth: The Anisole Market was valued at USD 93.2 billion in 2023. It is expected to reach USD 158.5 billion by 2033, with a CAGR of 5.6% during the forecast period from 2024 to 2033.

- By Grade: The "Up To 99.5%" grade dominated the anisole market.

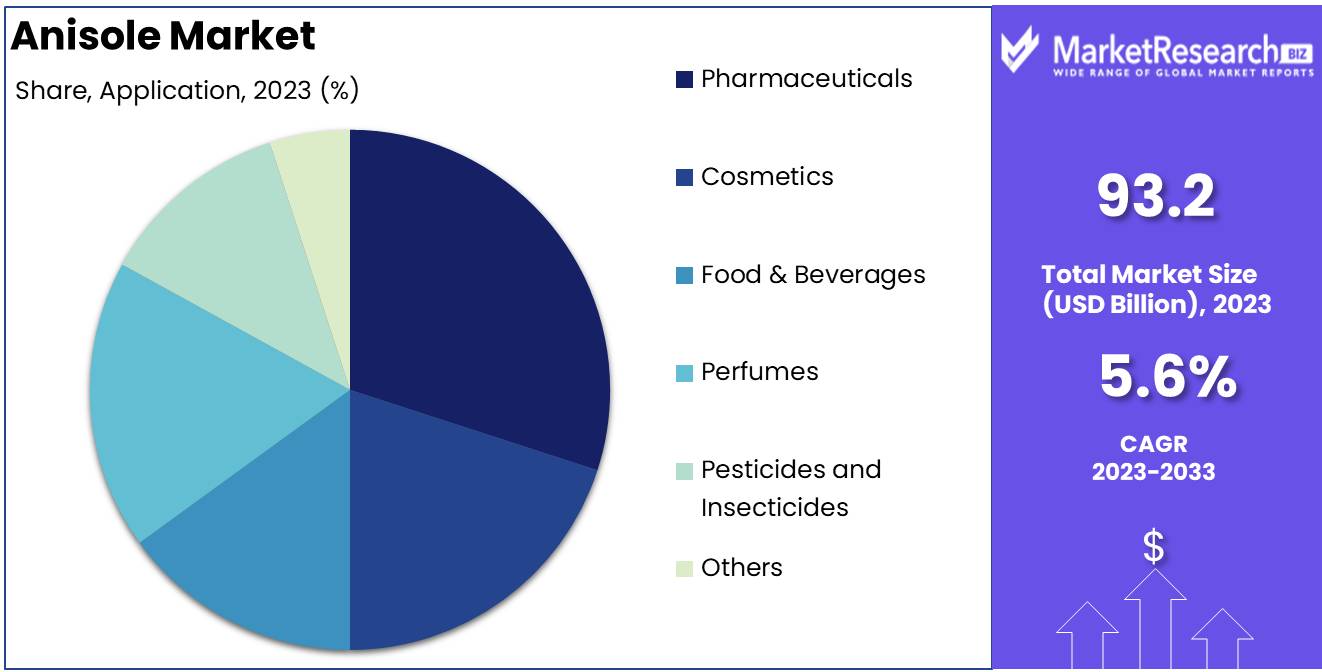

- By Application: Pharmaceuticals dominated the anisole market across diverse applications.

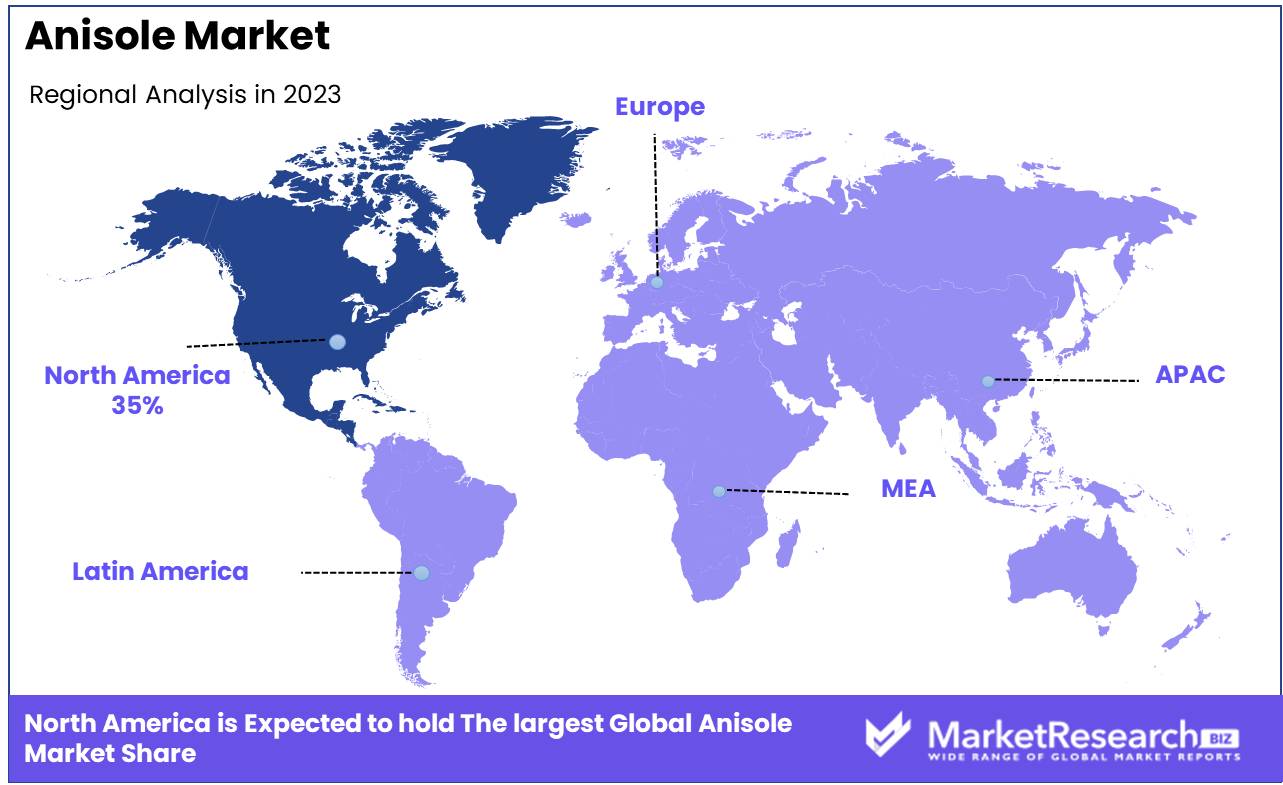

- Regional Dominance: North America dominates the Anisole Market with a 35% largest share.

- Growth Opportunity: The global anisole market is set to experience significant opportunities, driven by the expanding pharmaceutical industry and the increasing popularity of personal care and cosmetic products.

Driving factors

Increasing Demand for Fragrances and Perfumes

The anisole market has experienced significant growth due to the increasing demand for fragrances and perfumes. Anisole, known for its pleasant aroma reminiscent of anise and fennel, is a key ingredient in the manufacture of various perfumes and fragrances. The global fragrance industry has been expanding steadily, driven by consumer preferences for personal grooming and hygiene products. According to industry reports, the global fragrance market was valued at approximately USD 72.7 billion in 2023 and is projected to reach USD 94.6 billion by 2027, growing at a CAGR of 6.7% during the forecast period. This growth is attributed to the rising demand for luxury and premium fragrances, particularly in emerging markets, which in turn boosts the demand for anisole.

Rising Disposable Income and Rapid Population Growth

The rise in disposable income and rapid population growth, especially in developing countries, have substantially contributed to the growth of the anisole market. As disposable incomes increase, consumers are more willing to spend on luxury goods, including high-quality perfumes and cosmetics, which often contain anisole as a key ingredient. For instance, the Asia-Pacific region has witnessed a remarkable increase in middle-class consumers, leading to higher spending on personal care products. The reports that the global middle-class population is expected to grow by 1.4 billion people by 2030, with a significant portion of this growth occurring in Asia and Africa. This demographic shift translates into higher demand for consumer goods that utilize anisole, driving market expansion.

Growing Usage of Anisole in the Pharmaceutical Sector

The pharmaceutical sector's growing usage of anisole has also played a crucial role in driving market growth. Anisole is utilized as an intermediate in the synthesis of various pharmaceuticals, including anesthetics and analgesics. The pharmaceutical industry's expansion, driven by increased healthcare spending and advancements in medical research, has led to a surge in the demand for anisole. According to the report, global pharmaceutical sales reached approximately USD 1.2 trillion in 2022 and are projected to grow at a compound annual growth rate (CAGR) of 5-8% over the next few years. This growth is fueled by the rising prevalence of chronic diseases, an aging population, and increased access to healthcare in emerging markets, all of which necessitate the production of pharmaceuticals that require anisole in their manufacturing process.

Restraining Factors

Impact of Market Volatility on Anisole Market Growth

Market volatility plays a significant role in influencing the growth trajectory of the anisole market. Volatility can lead to fluctuations in raw material prices, which in turn impacts production costs. This unpredictability can deter investment and expansion plans within the market as companies may hesitate to commit to long-term projects without price stability. Additionally, market volatility can affect supply chain dynamics, leading to inconsistent availability of anisole and related products. For instance, sudden spikes in the cost of raw materials such as methoxybenzene, used in the production of anisole, can lead to increased manufacturing expenses, which might not always be transferable to consumers, thus squeezing profit margins. This environment of uncertainty can impede market growth as companies struggle to maintain consistent pricing and profitability.

Environmental Concerns and Their Impact on the Anisole Market

Environmental concerns are a major restraining factor in the anisole market. The production and usage of anisole, which is commonly used in the fragrance and pharmaceutical industries, often involve processes that can have significant environmental impacts. Strict regulations on emissions and waste management can increase operational costs for manufacturers. Compliance with environmental standards may require investments in cleaner technologies and processes, which can be costly. For example, the implementation of eco-friendly production methods to reduce volatile organic compound (VOC) emissions can drive up manufacturing costs, potentially reducing the competitive edge of anisole-based products.

By Grade Analysis

In 2023, The "Up To 99.5%" grade dominated the anisole market.

In 2023, The "Up To 99.5%" grade held a dominant market position in the Anisole Market, capturing a substantial share of the market. This segment is primarily driven by its extensive use in the synthesis of pharmaceuticals and agrochemicals, where purity levels up to 99.5% are deemed sufficient for most applications. The lower cost associated with this grade compared to the "Above 99.5%" grade further boosts its preference among manufacturers looking to optimize production costs without compromising on quality. The versatility of anisole, coupled with the high demand for its derivatives in various industries, underpins the significant market share of the "Up To 99.5%" segment.

Conversely, the "Above 99.5%" grade, while essential for applications requiring ultra-high purity, such as specific medical and research purposes, occupies a smaller portion of the market. This segment's growth is anticipated to be steady, driven by advancements in specialty chemical applications and increased investment in high-purity product development. Overall, the "Up To 99.5%" segment's dominance is a testament to its broad applicability and cost-efficiency in the anisole market.

By Application Analysis

In 2023, Pharmaceuticals dominated the anisole market across diverse applications.

In 2023, The Pharmaceutical segment held a dominant market position in the By Application segment of the Anisole Market, reflecting significant demand for this compound in drug formulation and development. The pharmaceutical industry's reliance on anisole as an intermediate in the synthesis of various medicinal compounds has driven this dominance.

Cosmetics also represented a substantial portion of the market, utilizing anisole's pleasant aromatic properties in the formulation of fragrances and skincare products. This sector's growth is supported by increasing consumer preference for high-quality personal care items.

In the Food & Beverages segment, anisole's role as a flavoring agent contributed to its market presence, although to a lesser extent compared to pharmaceuticals and cosmetics. Its application in the perfumes segment, due to its sweet and pleasant odor, further bolstered market growth, appealing to a wide range of consumers seeking unique and appealing scents.

The use of anisole in Pesticides and Insecticides, while less dominant, played a critical role in pest control products, aiding in the development of effective solutions for agricultural and residential purposes. Lastly, the Others segment, encompassing various niche applications, provided additional market opportunities, demonstrating Anisole's versatility across different industries. This comprehensive application spectrum underscores the diverse utility of anisole and its significant market potential.

Key Market Segments

By Grade

- Up To 99.5%

- Above 99.5%

By Application

- Pharmaceuticals

- Cosmetics

- Food & Beverages

- Perfumes

- Pesticides and Insecticides

- Others

Growth Opportunity

Increasing Demand from the Pharmaceutical Industry

The global anisole market is poised for significant growth, driven by the increasing demand from the pharmaceutical industry. Anisole, a vital intermediate in the synthesis of various pharmaceutical compounds, has seen a surge in demand due to its role in producing active pharmaceutical ingredients (APIs) and other essential drugs. The pharmaceutical industry's expansion, especially in emerging economies, further amplifies the market's growth prospects. With the global pharmaceutical market projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2022 to 2027, the anisole market is expected to witness robust demand, offering lucrative opportunities for manufacturers and suppliers.

Rising Popularity of Personal Care and Cosmetic Products

The rising popularity of personal care and cosmetic products is another critical factor contributing to the growth of the anisole market. Anisole is widely used in the formulation of fragrances and perfumes, thanks to its pleasant aromatic properties. As consumer preferences shift towards premium and luxury personal care products, the demand for high-quality fragrances is on the rise. The global cosmetics market, estimated to be worth $380.2 billion in 2020, is expected to reach $463.5 billion by 2027, growing at a CAGR of 5.3%. This growth trajectory presents a substantial opportunity for anisole manufacturers, as the compound plays a crucial role in enhancing the olfactory appeal of cosmetic products.

Latest Trends

Increasing Use of Insect Pheromones

The anisole market is projected to witness substantial growth due to its increasing application in insect pheromones. The heightened focus on sustainable agriculture practices is driving the demand for eco-friendly pest control solutions. Anisole, a key intermediate in the synthesis of insect pheromones, is gaining traction as a critical component in integrated pest management (IPM) programs. The shift towards biological pest control methods, supported by stringent regulations on synthetic pesticides, is anticipated to propel anisole consumption in this sector. Market participants are likely to benefit from this trend by aligning their production capabilities with the rising demand for pheromone-based products.

Shift Towards Higher Purity Grades

The anisole market is also experiencing a significant shift towards higher purity grades. This trend is primarily driven by the growing demand from the pharmaceutical and cosmetic industries, where high-purity anisole is essential for ensuring product efficacy and safety. Advances in purification technologies and increasing investments in R&D are facilitating the production of higher-purity anisole, meeting the stringent quality requirements of end-users. Additionally, the enhanced performance characteristics of high-purity anisole, such as improved stability and reduced impurity levels, are contributing to its elevated demand. Companies that can deliver high-purity anisoles are expected to gain a competitive edge in the market, capturing a larger share of the pharmaceutical and cosmetic applications.

Regional Analysis

North America dominates the Anisole Market with a 35% largest share.

The Anisole Market is segmented into several key regions, including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. In North America, the market is projected to experience significant growth, driven by increasing applications in pharmaceuticals and agrochemicals. The region accounts for approximately 35% of the global largest market share, making it the dominant player. The United States, in particular, is a major contributor due to its advanced pharmaceutical industry and high demand for chemical intermediates.

In Europe, the market is also expected to grow steadily, supported by the robust presence of the cosmetics and personal care industry. Germany, France, and the United Kingdom are key markets within Europe, with Germany leading due to its strong chemical manufacturing base.

The Asia Pacific region is witnessing rapid market expansion, fueled by the booming pharmaceutical and cosmetic sectors in countries such as China, India, and Japan. This region is anticipated to register the highest CAGR during the forecast period, reflecting the increasing industrialization and urbanization trends.

The Middle East & Africa region shows moderate growth potential, primarily driven by the expanding industrial sectors in countries like Saudi Arabia and South Africa. Latin America, particularly Brazil, is seeing a rise in anisole demand due to growth in the pharmaceutical and agricultural sectors. Overall, North America remains the leading region with the largest market share, while Asia Pacific is emerging as a rapidly growing market.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global anisole market in 2024 is poised for significant growth, driven by the increasing demand in the pharmaceutical, cosmetic, and food industries. Key players such as Evonik Industries AG, Solvay, and Merck & Co., Inc. are expected to dominate the market due to their extensive product portfolios and robust distribution networks.

Evonik Industries AG stands out with its strong focus on research and development, enabling the company to introduce innovative solutions tailored to meet the evolving needs of end-users. Similarly, Solvay, with its comprehensive range of fine chemicals, continues to maintain a competitive edge through strategic partnerships and expansions aimed at enhancing production capabilities.

Merck & Co., Inc., along with Merck KGaA, leverage their well-established brand presence and extensive expertise in the chemical industry to offer high-quality anisole products, catering to diverse application requirements. Atul Ltd and Benzo Chem Industries Pvt. Ltd is notable for its strong foothold in the Indian market, contributing significantly to the regional supply chain.

Companies like Parchem Fine & Specialty Chemicals, Shanghai Worldyang Chemical Co., Limited, and Kessler Chemical, Inc. emphasize quality and regulatory compliance, ensuring their products meet stringent industry standards. Oakwood Products, Inc. and Eastman Chemical Company are recognized for their strategic market positioning and focus on customer-centric solutions.

Clean Science and Technology Limited, Westman Chemicals Pvt. Ltd and Emmennar Pharma Pvt. Ltd. are anticipated to drive growth through their innovative approaches and commitment to sustainability. Tokyo Chemical Industry Co., Ltd. and SURYA LIFE SCIENCES LTD. continue to expand their market reach through strategic alliances and investments in advanced manufacturing technologies, ensuring a consistent supply of high-purity anisoles for various applications.

Market Key Players

- Evonik Industries AG

- Solvay

- Merck & Co., Inc.

- Atul Ltd

- Benzo Chem Industries Pvt. Ltd

- Parchem fine & specialty chemicals

- Merck KGaA

- Parchem fine & specialty chemicals

- Shanghai Worldyang Chemical Co., Limited

- Kessler Chemical, Inc.

- Oakwood Products, Inc.

- Eastman Chemical Company

- Clean Science and Technology Limited

- Westman Chemicals Pvt. Ltd

- Emmennar Pharma Pvt. Ltd.

- Tokyo Chemical Industry Co., Ltd.

- SURYA LIFE SCIENCES LTD.

Recent Development

- In June 2024, Evonik announced the acquisition of Infinitec Activos S.L., a Spanish company specializing in active ingredients for the personal care industry. This acquisition expands Evonik's portfolio of active ingredients for cosmetic applications, strengthening its position in the anisole market.

- In June 2024, BASF SE announced a collaboration with Siemens Energy and Mitsubishi Hitachi Power Systems (MHPS) to enhance the efficiency and reduce carbon emissions of its steam crackers, which are essential for chemical production. This joint project aims to optimize steam cracker operations by integrating advanced analytics, machine learning, and artificial intelligence, which indirectly benefits the anisole production process.

- In May 2024, significant technological advancements in the manufacturing processes of high-purity anisoles were reported in the United States. These improvements are crucial for the food, beverage, pharmaceutical, and fragrance industries, ensuring continuous high-purity levels and increasing demand for anisole in these sectors.

Report Scope

Report Features Description Market Value (2023) USD 93.2 Billion Forecast Revenue (2033) USD 158.5 Billion CAGR (2024-2032) 5.6% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Grade (Up To 99.5% and Above 99.5%), By Application (Pharmaceuticals, Cosmetics, Food & Beverages, Perfumes, Pesticides and Insecticides, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Evonik Industries AG, Solvay, Merck & Co., Inc., Atul Ltd, Benzo Chem Industries Pvt. Ltd, Parchem fine & specialty chemicals, Merck KGaA, Parchem fine & specialty chemicals, Shanghai Worldyang Chemical Co., Limited, Kessler Chemical, Inc., Oakwood Products, Inc., Eastman Chemical Company, Clean Science and Technology Limited, Westman Chemicals Pvt. Ltd, Emmennar Pharma Pvt. Ltd., Tokyo Chemical Industry Co., Ltd., SURYA LIFE SCIENCES LTD. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Evonik Industries AG

- Solvay

- Merck & Co., Inc.

- Atul Ltd

- Benzo Chem Industries Pvt. Ltd

- Parchem fine & specialty chemicals

- Merck KGaA

- Parchem fine & specialty chemicals

- Shanghai Worldyang Chemical Co., Limited

- Kessler Chemical, Inc.

- Oakwood Products, Inc.

- Eastman Chemical Company

- Clean Science and Technology Limited

- Westman Chemicals Pvt. Ltd

- Emmennar Pharma Pvt. Ltd.

- Tokyo Chemical Industry Co., Ltd.

- SURYA LIFE SCIENCES LTD.