Aluminum Curtain Wall Market By Type (Stick Built, Semi-unitized, Unitized), By Application (Commercial and Residential), By Installation (New Construction and Refurbishment), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

48386

-

July 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

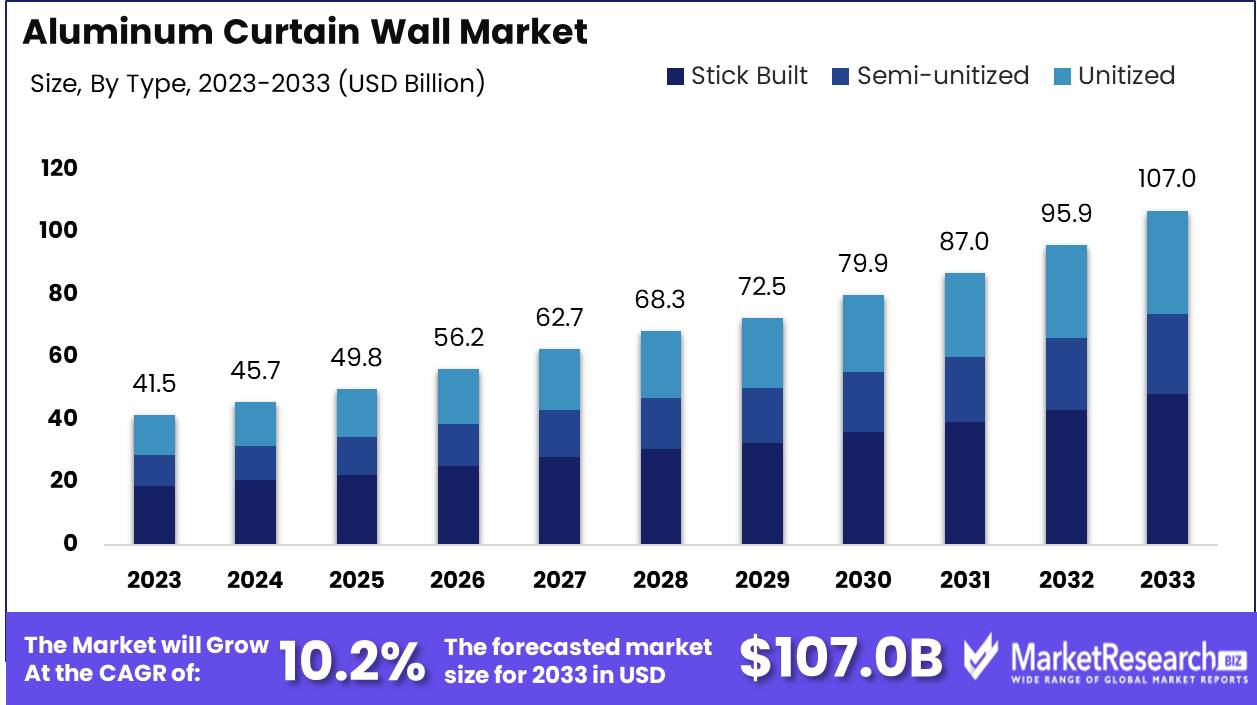

The Aluminum Curtain Wall Market was valued at USD 41.5 billion in 2023. It is expected to reach USD 107.0 billion by 2033, with a CAGR of 10.2% during the forecast period from 2024 to 2033.

The Aluminum Curtain Wall Market encompasses the global industry involved in the design, manufacture, and installation of aluminum-framed exterior walls, which are non-structural and used primarily to enclose buildings. These systems are favored for their lightweight, durability, and ability to enhance aesthetic appeal while providing thermal insulation and energy efficiency.

The aluminum curtain wall market is poised for significant growth, driven by a confluence of factors reflecting broader trends in sustainability, urban development, and technological advancement. A primary catalyst is the escalating demand for energy-efficient building solutions aimed at minimizing carbon footprints. This demand is further amplified by stringent environmental regulations and growing awareness among consumers and businesses about the importance of sustainable practices.

Additionally, the rapid pace of urbanization and industrialization in emerging economies is propelling the construction sector forward, subsequently boosting the market for aluminum curtain walls. These structures not only enhance the aesthetic appeal of buildings but also contribute to their energy efficiency, aligning with the increasing adoption of green building materials and practices.

However, the market faces challenges that could temper its growth trajectory. The high initial costs associated with the installation of aluminum curtain walls are a significant barrier for many potential adopters, particularly in cost-sensitive markets. Despite these challenges, the long-term benefits of energy savings and reduced environmental impact are likely to outweigh the initial expenditure, making aluminum curtain walls a compelling choice for forward-thinking developers and architects. As the industry continues to innovate and economies of scale are achieved, it is anticipated that the cost barriers will diminish, further stimulating market growth. In summary, the aluminum curtain wall market is set to expand robustly, underpinned by global sustainability trends and urbanization, though stakeholders must navigate the cost-related challenges to fully capitalize on this opportunity.

Key Takeaways

- Market Growth: The Aluminum Curtain Wall Market was valued at USD 41.5 billion in 2023. It is expected to reach USD 107.0 billion by 2033, with a CAGR of 10.2% during the forecast period from 2024 to 2033.

- By Type: Stick Built dominated Aluminum Curtain Wall Market By Type.

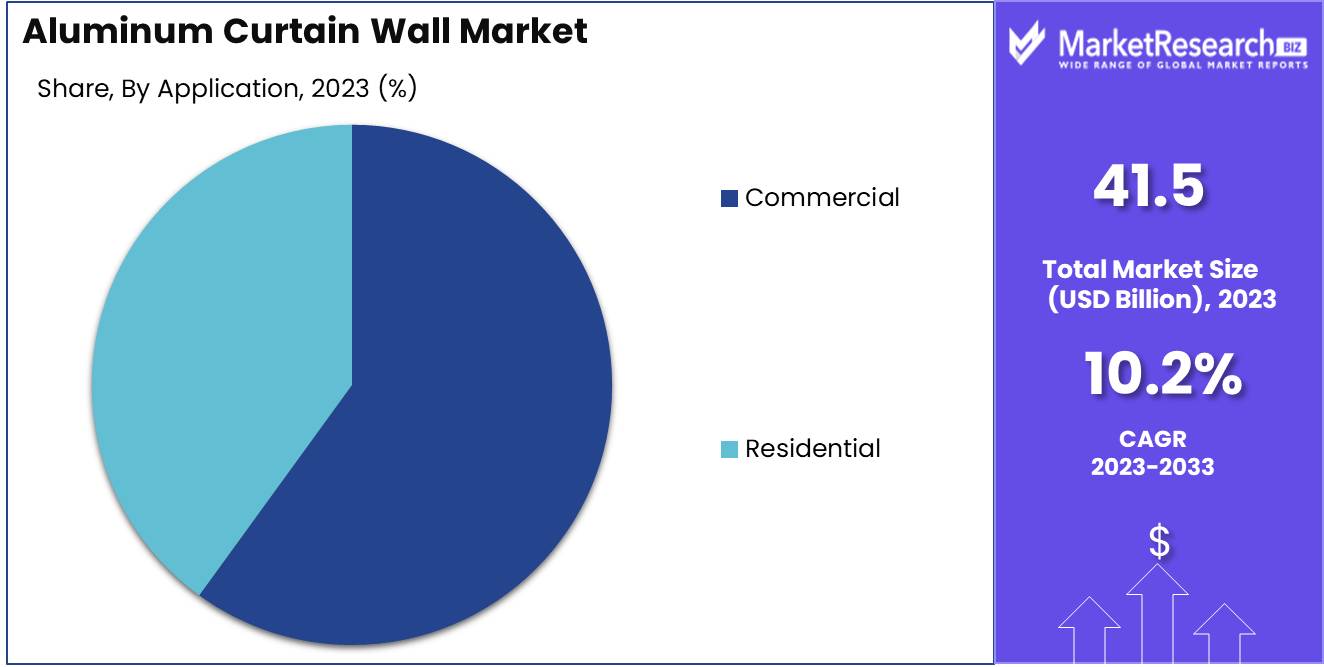

- By Application: The Commercial segment dominated the Aluminum Curtain Wall Market.

- By Installation: New Construction dominated, driven by urban, sustainable building demand.

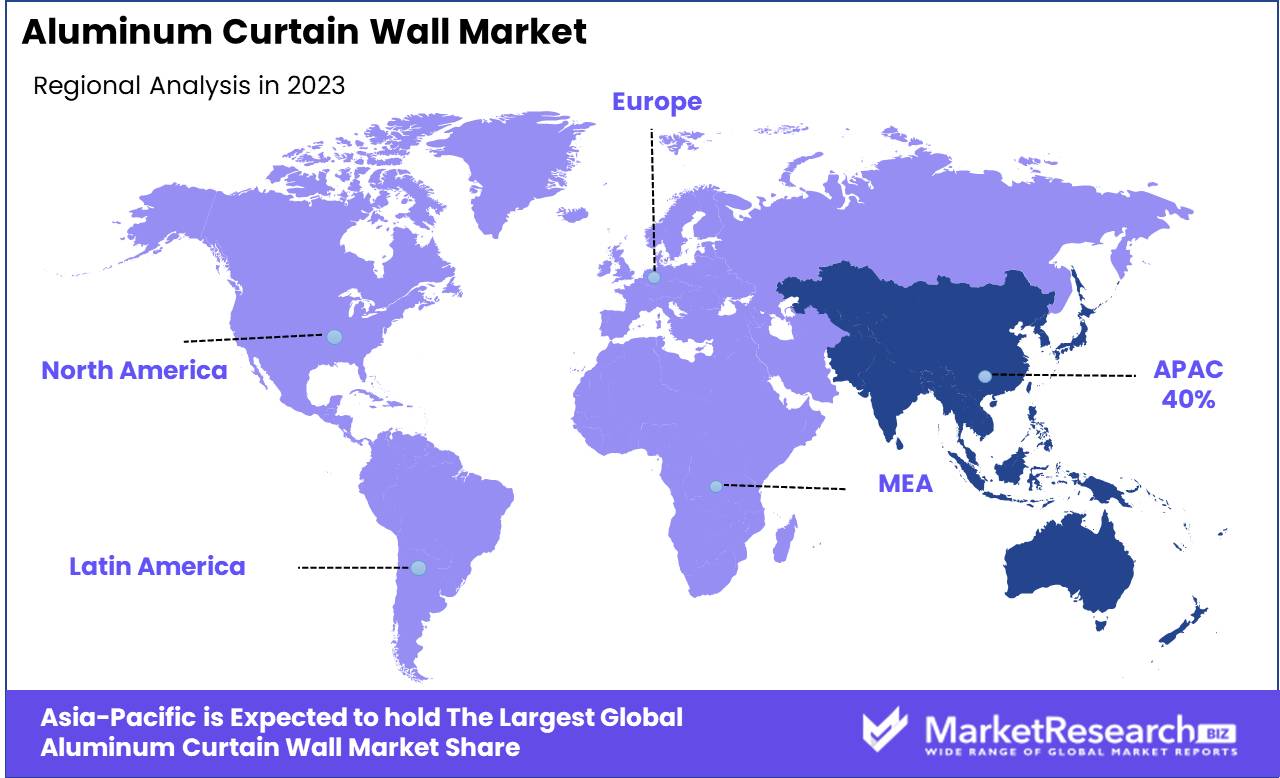

- Regional Dominance: Asia Pacific dominates the Aluminum Curtain Wall Market with a 40% share.

- Growth Opportunity: The aluminum curtain wall market will thrive due to rising construction activities and tourism sector expansion, emphasizing sustainability and energy efficiency.

Driving factors

Increasing Demand for Energy-Efficient and Sustainable Buildings

The global emphasis on sustainability and energy efficiency significantly propels the aluminum curtain wall market. As governments and industries intensify efforts to reduce carbon footprints, the construction sector faces mounting pressure to adopt green building practices. Aluminum curtain walls, known for their superior insulation properties, play a crucial role in enhancing building energy efficiency. These walls reduce energy consumption by minimizing heat transfer, thereby supporting regulations and standards such as LEED (Leadership in Energy and Environmental Design).

The demand for sustainable buildings has catalyzed advancements in aluminum curtain wall technology. Innovations such as thermal breaks and improved glazing techniques have made aluminum curtain walls more effective in managing energy use. This focus aligns with the growing trend of constructing net-zero energy buildings, where energy consumption is balanced by renewable energy production, further bolstering the market.

Growing Construction of High-Rise Buildings and Commercial Structures

Urbanization trends and the surge in high-rise and commercial building projects are pivotal to the aluminum curtain wall market's growth. As urban populations swell, cities worldwide experience a construction boom characterized by skyscrapers and extensive commercial facilities. Aluminum curtain walls are preferred in these projects due to their ability to provide structural strength while allowing for extensive use of glass, creating aesthetically appealing and modern facades.

Statistics indicate a notable increase in high-rise building constructions globally, particularly in Asia-Pacific and Middle Eastern regions, where cities like Dubai, Shanghai, and Singapore are iconic for their skylines. This trend is supported by the rapid economic growth in these areas, driving the demand for commercial spaces, office buildings, and luxury residential towers. The scalability and adaptability of aluminum curtain walls make them ideal for these applications, ensuring they remain a staple in modern architectural design.

Aluminum's High Durability and Resistance to Corrosion

Aluminum's intrinsic properties of high durability and corrosion resistance are critical factors enhancing the market appeal of aluminum curtain walls. Unlike other materials that may degrade over time, aluminum maintains its structural integrity and appearance with minimal maintenance. This characteristic is particularly advantageous in harsh environmental conditions, such as coastal areas or regions with extreme weather fluctuations.

The longevity of aluminum curtain walls translates into lower lifecycle costs for building owners and developers, providing a compelling economic incentive. Moreover, aluminum's recyclability aligns with the broader sustainability goals of the construction industry, as it can be reused without loss of properties, further enhancing its desirability in green building projects.

Restraining Factors

Regulatory Hurdles: A Brake on Market Expansion

Stringent regulations in the construction and architectural industries significantly impact the growth trajectory of the aluminum curtain wall market. These regulations, often established to ensure safety, energy efficiency, and environmental protection, necessitate compliance with complex standards and certifications. For instance, imposes rigorous requirements on building materials, including aluminum curtain walls, to meet specified performance criteria.

Such regulatory frameworks can slow down market expansion by increasing the time and cost associated with product development and approval. Companies must invest heavily in research and development (R&D) to create products that comply with these stringent standards. Moreover, the process of obtaining the necessary certifications can be prolonged and costly, discouraging smaller players from entering the market. According to industry reports, the cost of compliance can add an estimated 10-15% to the overall production costs, which can be a significant deterrent, particularly in price-sensitive markets.

Maintenance and Repair Costs: An Ongoing Challenge

The high maintenance and repair costs associated with aluminum curtain walls present another substantial restraining factor for the market. These costs stem from the need for regular upkeep to prevent and address issues such as corrosion, sealant failures, and structural degradation, which are crucial to maintaining the aesthetic and functional integrity of the curtain walls.

Aluminum, while durable, is susceptible to corrosion, particularly in coastal or industrial environments where saltwater and pollutants are prevalent. Routine inspections, cleaning, and repairs are necessary to mitigate these effects, which can be both labor-intensive and costly. Industry estimates suggest that maintenance and repair can account for up to 20-30% of the total lifecycle cost of an aluminum curtain wall system. This financial burden can deter potential adopters, especially building owners and developers looking to minimize long-term operational costs.

Furthermore, the complexity of repairing and replacing components of aluminum curtain walls can require specialized skills and equipment, further escalating the costs. The need for such specialized services can limit the market’s growth, particularly in regions where access to skilled labor and advanced technology is limited.

By Type Analysis

In 2023, Stick Built dominated the Aluminum Curtain Wall Market By Type.

In 2023, Stick Built held a dominant market position in the By Type segment of the Aluminum Curtain Wall Market. The Stick Built system, known for its flexibility and cost-effectiveness, was particularly favored in both commercial and residential applications. Its ability to be assembled piece-by-piece on-site provided significant customization advantages, accommodating complex architectural designs and adjustments during construction. This system's market dominance was supported by its relatively lower upfront costs and the widespread availability of skilled labor.

Conversely, the Semi-unitized system, which combines on-site assembly with pre-fabricated components, saw moderate growth. It balanced the customization benefits of Stick Built with some efficiency gains from pre-fabrication, appealing to projects requiring faster installation times without fully compromising design flexibility.

The Unitized system, characterized by its pre-assembled panels delivered to the site for quick installation, experienced growing adoption in high-rise buildings and large-scale projects. Its higher initial costs were offset by significant reductions in on-site labor and construction time, alongside superior quality control and performance. Despite these benefits, its market share was limited by higher capital requirements and less flexibility compared to the Stick Built system.

By Application Analysis

In 2023, The Commercial segment dominated the Aluminum Curtain Wall Market.

In 2023, The Commercial segment held a dominant market position in the By Application segment of the Aluminum Curtain Wall Market. This leadership is attributed to the high demand for aluminum curtain walls in office buildings, retail complexes, and institutional buildings. The commercial sector's preference for aluminum curtain walls is driven by their superior aesthetic appeal, energy efficiency, and sustainability. Modern commercial buildings prioritize reducing energy consumption, and aluminum curtain walls offer excellent thermal insulation, thereby aligning with green building practices.

Conversely, the Residential segment, although growing, trails behind. The adoption of aluminum curtain walls in residential buildings is slower due to cost constraints and a traditional preference for alternative materials. However, rising urbanization and the increasing number of high-rise residential buildings are driving gradual adoption. As residential developers recognize the long-term benefits of aluminum curtain walls, such as durability and low maintenance, this segment is expected to witness steady growth. Nonetheless, the commercial sector's robust investment capacity and larger project scales ensure its continued dominance in the market.

By Installation Analysis

In 2023, New Construction dominated, driven by urban, sustainable building demand.

In 2023, New Construction held a dominant market position in the Installation segment of the Aluminum Curtain Wall Market. This dominance is primarily driven by the booming construction activities globally, particularly in urban areas where the demand for modern, energy-efficient building facades is high. The implementation of sustainable building practices has further propelled the adoption of aluminum curtain walls in new construction projects, as they offer superior thermal performance and aesthetic versatility.

Conversely, the refurbishment sub-segment, while smaller, also demonstrated significant growth. This can be attributed to the rising trend of upgrading existing structures to meet current energy efficiency standards and enhance architectural appeal. Refurbishment projects often involve replacing outdated facades with advanced aluminum curtain walls, thereby extending the life of buildings and reducing operational costs. The refurbishment segment's growth is also fueled by government incentives and regulations aimed at promoting sustainability in the built environment. Both new construction and refurbishment segments benefit from advancements in aluminum curtain wall technologies, ensuring the market remains robust and dynamic.

Key Market Segments

By Type

- Stick Built

- Semi-unitized

- Unitized

By Application

- Commercial

- Residential

By Installation

- New Construction

- Refurbishment

Growth Opportunity

Rise in Commercial and Residential Construction

The aluminum curtain wall market is poised for significant growth, driven primarily by the rise in both commercial and residential construction activities. As urbanization continues to expand globally, there is an increasing demand for modern, aesthetically pleasing, and energy-efficient building facades. Aluminum curtain walls, known for their durability, lightweight, and versatile design options, are becoming the material of choice for new constructions. In particular, emerging markets in Asia-Pacific and the Middle East are experiencing rapid urban growth, with substantial investments in infrastructure and high-rise buildings, which significantly boost the demand for aluminum curtain walls. Additionally, the trend towards sustainable building practices is accelerating the adoption of energy-efficient curtain wall systems that contribute to LEED certification and other green building standards.

Expansion of the Tourism Sector

Another key driver for the aluminum curtain wall market is the robust expansion of the global tourism sector. The construction of new hotels, resorts, and other tourism-related infrastructure is on the rise to cater to the growing number of international travelers. Aluminum curtain walls are favored in these projects due to their ability to provide sleek, modern aesthetics while also offering excellent thermal and acoustic insulation properties, which enhance the guest experience. Notably, regions such as Southeast Asia, the Middle East, and parts of Europe are witnessing a boom in tourism-related construction activities, further propelling market growth.

Latest Trends

Adoption of Complex Shapes and Curved Designs

The aluminum curtain wall market is witnessing a transformative shift towards more complex shapes and curved designs. This trend is driven by the architectural industry's growing demand for aesthetically unique and innovative structures. Advanced manufacturing technologies, such as 3D printing and CNC machining, are enabling the creation of intricate aluminum curtain wall systems that were previously unattainable. This evolution allows architects to push the boundaries of design, enhancing the visual appeal and uniqueness of modern buildings. As a result, the adoption of complex shapes and curved designs is set to become a significant competitive differentiator for manufacturers, attracting clients seeking distinctive architectural solutions.

Improved Thermal Performance

Improved thermal performance is another critical trend in the aluminum curtain wall market. With increasing emphasis on energy efficiency and sustainability, building codes and regulations are becoming more stringent. Aluminum curtain walls, traditionally challenged by thermal conductivity, are now being engineered with advanced thermal breaks, high-performance glazing, and insulation materials to meet these rigorous standards. The integration of these technologies not only reduces energy consumption but also enhances indoor comfort, making aluminum curtain walls a preferred choice for eco-conscious developers. This trend is expected to drive substantial investment in research and development, leading to continuous innovations in thermal performance solutions.

Regional Analysis

Asia Pacific dominates the Aluminum Curtain Wall Market with a 40% share.

The Aluminum Curtain Wall Market exhibits significant regional variation, driven by differing levels of construction activity, urbanization, and technological adoption. In North America, the market is bolstered by robust demand from commercial and residential construction sectors, with the U.S. leading in technological advancements and green building initiatives. Europe, characterized by stringent energy efficiency regulations, sees substantial adoption of aluminum curtain walls, particularly in countries like Germany and the U.K., where sustainability is a critical focus.

Asia Pacific dominates the market, accounting for approximately 40% of the global share. This dominance is attributed to rapid urbanization, infrastructural development, and the increasing prevalence of high-rise buildings, particularly in China and India. The region's construction boom and government initiatives supporting smart cities further propel market growth.

The Middle East & Africa, with growing investments in commercial infrastructure and notable projects in the UAE and Saudi Arabia, shows promising growth potential. Latin America, although smaller in market size, is experiencing gradual growth driven by urban development and modernization efforts, especially in Brazil and Mexico. Overall, the Asia Pacific region remains the leading market due to its expansive construction activities and economic growth.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2024, the global Aluminum Curtain Wall Market is characterized by robust competition among key players, each contributing significantly to market growth and innovation. Alumil S.A., known for its extensive product portfolio and advanced technologies, continues to lead with its high-performance curtain wall systems, emphasizing energy efficiency and sustainability. Kalwall Corporation, with its translucent panel systems, remains pivotal in projects requiring enhanced daylighting and thermal performance.

Enclos Corporation is notable for its expertise in custom-engineered façade solutions, addressing complex architectural requirements. HUECK GmbH and Co., along with Gutmann AG, maintain strong market positions through their innovative aluminum systems and commitment to quality. Heroal, with its integrated solutions, focuses on durability and energy efficiency, catering to diverse building requirements.

Hansen Group Ltd and EFCO Corporation have fortified their market presence through strategic partnerships and technological advancements, enhancing their product offerings. Aluplex, recognized for its bespoke solutions, continues to cater to high-end architectural demands. Reynaers Aluminum, a leader in sustainable solutions, leverages its global presence to meet evolving market needs.

Capitol Aluminum and Glass Corporation and Petra Aluminum, with their comprehensive range of aluminum systems, contribute to the market's competitive landscape, emphasizing quality and customization. Collectively, these companies drive innovation, quality, and sustainability in the Aluminum Curtain Wall Market.

Market Key Players

- Alumil S.A

- Kalwall Corporation

- Enclos Corporation

- HUECK GmbH and Co.

- Gutmann AG

- Heroal

- Hansen Group Ltd

- EFCO Corporation

- Aluplex

- Reynaers Aluminum

- Capitol Aluminum and Glass Corporation

- Petra Aluminum

Recent Development

- In April 2024, C.R. Laurence Co., Inc. entered into a strategic partnership with Technal UK to co-develop and market innovative curtain wall solutions tailored for high-rise buildings. This collaboration aims to leverage both companies' strengths in design and engineering to create more sustainable and efficient building facades.

- In March 2024, Apogee Enterprises, Inc. launched a new line of ultra-thin aluminum curtain walls. These new systems offer improved thermal performance and aesthetic flexibility, catering to modern architectural trends that favor minimalist designs.

- In February 2024, Kawneer announced the expansion of its manufacturing facility in North America to meet the increasing demand for unitized curtain wall systems. This expansion aims to enhance production capacity and reduce lead times for their high-performance aluminum curtain walls.

Report Scope

Report Features Description Market Value (2023) USD 41.5 Billion Forecast Revenue (2033) USD 107.0 Billion CAGR (2024-2032) 10.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Stick Built, Semi-unitized, Unitized), By Application (Commercial and Residential), By Installation (New Construction and Refurbishment) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Alumil S.A, Kalwall Corporation, Enclos Corporation, HUECK GmbH and Co., Gutmann AG, Heroal, Hansen Group Ltd, EFCO Corporation, Aluplex, Reynaers Aluminum, Capitol Aluminum and Glass Corporation, Petra Aluminum Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Alumil S.A

- Kalwall Corporation

- Enclos Corporation

- HUECK GmbH and Co.

- Gutmann AG

- Heroal

- Hansen Group Ltd

- EFCO Corporation

- Aluplex

- Reynaers Aluminum

- Capitol Aluminum and Glass Corporation

- Petra Aluminum