Aircraft Exhaust System Market Report By Component Type (Exhaust Pipes, Exhaust Mufflers, Turbochargers, Nozzles, Heat Shields, Others), By Aircraft Type (Commercial Aircraft [Narrow-Body Aircraft, Wide-Body Aircraft], Regional Aircraft, General Aviation Aircraft, Military Aircraft [Fighter Jets, Transport Aircraft], Business Jets), By Engine Type, By Material, By End-Use, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

8485

-

July 2024

-

298

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

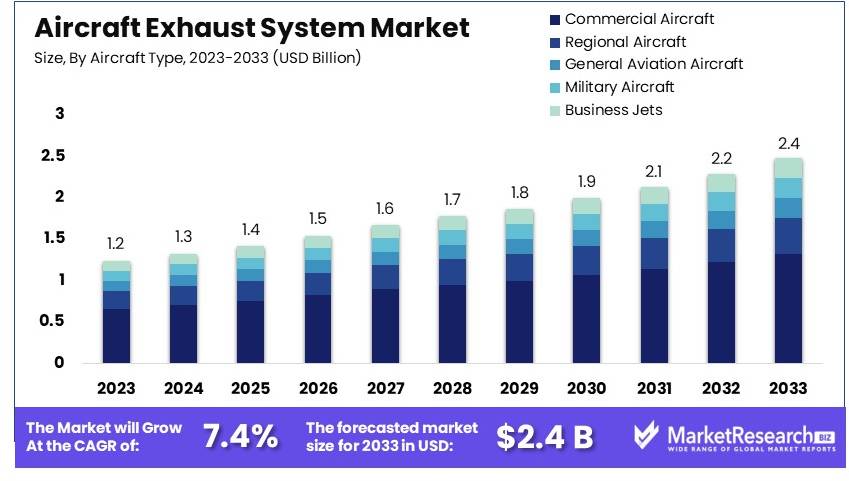

The Global Aircraft Exhaust System Market size is expected to be worth around USD 2.4 Billion by 2033, from USD 1.2 Billion in 2023, growing at a CAGR of 7.4% during the forecast period from 2024 to 2033.

The Aircraft Exhaust System Market includes the development, manufacturing, and sale of exhaust systems for aircraft. These systems are vital for managing engine emissions, reducing noise, and improving fuel efficiency. The market is driven by the increasing demand for new aircraft, the need for fuel-efficient technologies, and stringent environmental regulations.

Key components include exhaust ducts, manifolds, and silencers. Major players in this market focus on lightweight materials, advanced manufacturing processes, and innovative designs to meet industry standards and enhance aircraft performance. The growth of the aviation industry and the replacement of aging aircraft fleets further support this market's expansion.

The aircraft exhaust system market is poised for growth, driven by advancements in safety protocols and technology. In 2023, the International Air Transport Association (IATA) reported notable improvements in aviation safety. The overall accident rate decreased in most regions, highlighting advancements in aircraft systems, including exhaust systems. These systems play a crucial role in maintaining aircraft performance and safety.

Enhanced safety measures and technological progress have significantly contributed to reducing non-fatal accidents, such as landing gear incidents and runway excursions. This trend underscores the importance of reliable and efficient aircraft exhaust systems in the aviation industry. Despite these improvements, North America experienced an increase in its accident rate, from 0.53 per million sectors in 2022 to 1.14 in 2023. This indicates a need for continued focus on safety enhancements in the region.

Technological advancements in aircraft exhaust systems have been pivotal in driving market growth. Innovations aimed at improving efficiency and reducing emissions are becoming increasingly important. The integration of advanced materials and designs ensures better performance and longevity of these systems.

Market dynamics suggest a positive outlook for the aircraft exhaust system market. The global push for enhanced safety protocols and the continuous development of new technologies are key drivers. The demand for efficient and reliable exhaust systems is expected to rise, supported by the growing emphasis on aviation safety and performance.

Overall, the aircraft exhaust system market is set to expand, with significant contributions from technological advancements and heightened safety measures. The focus on reducing emissions and improving system efficiency will continue to drive market growth in the coming years.

Key Takeaways

- Market Value: The Aircraft Exhaust System market was valued at USD 1.2 billion in 2023, and is expected to reach USD 2.4 billion by 2033, with a CAGR of 7.4%.

- By Component Type Analysis: Exhaust Pipes 40%; Key for managing engine emissions and improving performance.

- By Aircraft Type Analysis: Commercial Aircraft 55%; High demand due to increasing air travel and fleet expansion.

- By Engine Type Analysis: Turbofan Engines 50%; Widely used in commercial aviation for their efficiency.

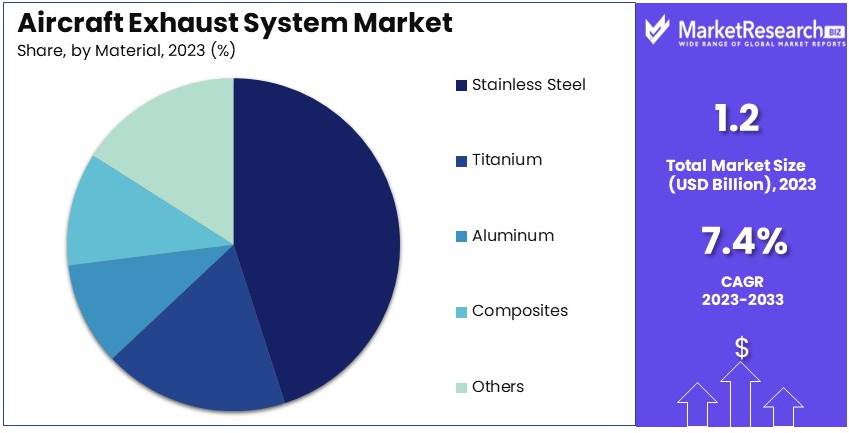

- By Material Analysis: Stainless Steel 45%; Preferred for its durability and resistance to high temperatures.

- By End-Use Analysis: OEM 60%; Essential for initial aircraft manufacturing and upgrades.

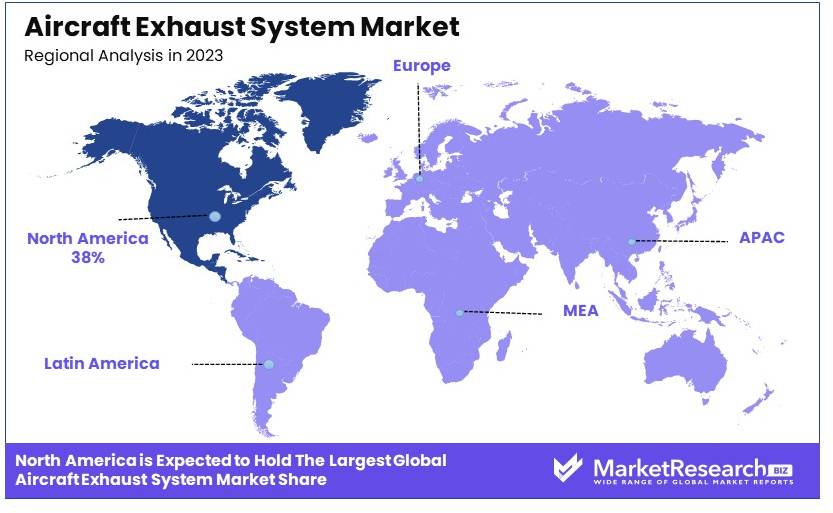

- Dominant Region: North America 38%; Leading due to strong aerospace manufacturing base.

- High Growth Region: Asia-Pacific; Growing aviation sector and increasing aircraft deliveries.

- Analyst Viewpoint: The market is expected to grow steadily with increasing demand for commercial aircraft and technological advancements in exhaust systems.

- Growth Opportunities: Innovations in lightweight materials and noise reduction technologies can provide competitive advantages.

Driving Factors

Increasing Air Traffic and Fleet Expansion Drive Market Growth

The global rise in air passenger traffic and cargo transportation significantly boosts the aircraft exhaust system market. As air travel becomes more popular and accessible, airlines are expanding their fleets to meet the growing demand. According to forecasts by the International Air Transport Association (IATA), global air passenger traffic is expected to double by 2037. This surge in air traffic necessitates the acquisition of new aircraft, each requiring advanced exhaust systems.

Major airlines such as Delta and Emirates are placing large orders for new aircraft to accommodate the increased passenger and cargo volumes. These new aircraft incorporate the latest exhaust system technologies, driving demand in the market. The expansion of airline fleets not only supports the aircraft manufacturing industry but also stimulates growth in the aircraft exhaust system market as more planes take to the skies, each equipped with state-of-the-art exhaust solutions.

Technological Advancements in Exhaust System Design Drive Market Growth

Innovations in materials and engineering are revolutionizing the aircraft exhaust system market. Advances in exhaust system design lead to more efficient, lightweight, and durable systems. Airlines and aircraft manufacturers are increasingly seeking these advanced systems to improve fuel efficiency and reduce emissions.

Companies like Safran and Ducommun are at the forefront of this technological evolution, developing titanium exhaust systems that offer significant weight reductions compared to traditional stainless steel systems. These titanium systems can potentially improve fuel efficiency by 1-2%, providing substantial savings for airlines. The pursuit of better performance and cost savings drives the adoption of these cutting-edge exhaust systems, contributing to market growth.

Stringent Environmental Regulations Drive Market Growth

Stringent environmental regulations are a significant factor driving the aircraft exhaust system market. Regulatory bodies such as the International Civil Aviation Organization (ICAO) and the Environmental Protection Agency (EPA) are implementing increasingly strict emissions standards. These regulations push the aviation industry to adopt more advanced and efficient exhaust systems to meet the rigorous standards.

The ICAO's Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) initiative, for instance, compels airlines to invest in more efficient aircraft and components, including advanced exhaust systems, to reduce their carbon footprint. This regulatory pressure drives innovation in exhaust system design, leading to the development of systems that can comply with these strict standards. As a result, manufacturers are continuously innovating, and airlines are updating their fleet management solutions with environmentally friendly technologies, driving growth in the aircraft exhaust system market.

Restraining Factors

Supply Chain Disruptions Restrain Market Growth

The global supply chain for aerospace components, including aircraft exhaust systems, is complex and susceptible to disruptions. Recent events like the COVID-19 pandemic and geopolitical tensions have exposed these vulnerabilities, resulting in production delays and increased costs. For example, the pandemic-induced shutdown of aerospace manufacturing in 2020 created a significant backlog in aircraft deliveries, which negatively impacted the demand for exhaust systems and other components.

These disruptions lead to delays in the manufacturing and delivery of aircraft, affecting the entire supply chain. The increased costs and unpredictability in the supply chain can make it challenging for manufacturers to maintain steady production rates, thus restraining market growth. Companies may face difficulties in sourcing essential materials and components, leading to delays in fulfilling orders and higher operational costs.

Long Development Cycles in the Aviation Industry Restrain Market Growth

The long development cycles required for aircraft development, testing, and certification can slow the adoption of new exhaust system technologies. This extended process can hinder market growth, as innovative solutions may take years to reach commercial implementation.

A notable example is the Boeing 777X program, which has faced multiple delays, postponing the introduction of its advanced exhaust system technologies and impacting suppliers in the exhaust system market. These delays mean that suppliers must wait longer to see returns on their investments in new technologies.

Component Type Analysis

Exhaust Pipes dominate with 40% due to high demand in engine efficiency improvements

The aircraft exhaust system market is segmented by component type into Exhaust Pipes, Exhaust Mufflers, Turbochargers, Nozzles, Heat Shields, and others. Exhaust pipes dominate this segment with a 40% market share. This dominance is due to the critical role exhaust pipes play in improving engine efficiency and reducing emissions. Exhaust pipes are essential components that direct and manage the expulsion of gases from the aircraft engine, ensuring optimal engine performance and compliance with environmental regulations.

Exhaust pipes are widely used in all types of aircraft, including commercial, military, and general aviation, making them indispensable. Their design and material composition are crucial for withstanding high temperatures and pressures, ensuring durability and reliability. The continuous advancements in materials and manufacturing techniques have further enhanced the performance and longevity of exhaust pipes, driving their demand.

Other components such as exhaust mufflers, turbochargers, nozzles, and heat shields also contribute significantly to the market. Exhaust mufflers are used to reduce the noise generated by the exhaust gases, improving passenger comfort and complying with noise regulations. Turbochargers enhance engine performance by increasing the amount of air intake, leading to better fuel efficiency and power output.

Nozzles control the flow of exhaust gases, playing a critical role in thrust generation and engine efficiency. Heat shields protect various parts of the aircraft from high temperatures generated by the exhaust system, ensuring safety and structural integrity. Although these components hold a smaller market share compared to exhaust pipes, they are essential for the overall functionality and efficiency of aircraft exhaust systems, contributing to market growth.

Aircraft Type Analysis

Commercial Aircraft dominate with 55% due to high air travel demand

The aircraft exhaust system market is segmented by aircraft type into Commercial Aircraft, Regional Aircraft, General Aviation Aircraft, Military Aircraft, and Business Jets. Commercial aircraft dominate this segment with a significant 55% market share. This dominance is driven by the high demand for air travel and the continuous expansion of airline fleets globally. Within commercial aircraft, narrow-body and wide-body aircraft are the primary sub-segments.

Narrow-body aircraft, commonly used for short to medium-haul flights, have a higher production rate due to their widespread use by airlines for domestic and regional routes. Wide-body aircraft, used for long-haul flights, also contribute significantly to the market due to their large size and the extensive exhaust systems required to manage the high power engines. The ongoing replacement of older aircraft with newer, more fuel-efficient models further drives the demand for advanced exhaust systems in the commercial segment.

Regional aircraft and general aviation aircraft also play essential roles in the market. Regional aircraft, used for short regional flights, require efficient exhaust systems to meet stringent emissions standards and ensure operational efficiency. General aviation aircraft, including private planes and small commuter aircraft, also utilize advanced exhaust systems to enhance performance and reduce environmental impact.

Military aircraft, including fighter jets and transport aircraft, represent a vital segment due to their specialized exhaust system requirements. Fighter jets require advanced exhaust systems capable of handling high-speed, high-temperature operations, while transport aircraft need robust systems for reliability in various mission profiles. Business jets, catering to corporate and private clients, demand high-performance exhaust systems for optimal efficiency and reduced noise levels. These segments, while not as dominant as commercial aircraft, are crucial for the overall market dynamics, driving innovation and technological advancements.

Engine Type Analysis

Turbofan Engines dominate with 55.6% due to high efficiency and widespread use

The aircraft exhaust system market is segmented by engine type into Turbofan Engines, Turboprop Engines, Turbojet Engines, and Reciprocating Engines. Turbofan engines dominate this segment with a commanding 50% market share. This dominance is attributed to the high efficiency, low noise levels, and widespread use of turbofan engines in commercial aviation. Turbofan engines are preferred for their ability to provide a high thrust-to-weight ratio and better fuel efficiency, making them ideal for long-haul flights and large commercial aircraft.

Turbofan engines are extensively used in both narrow-body and wide-body commercial aircraft, driving the demand for advanced exhaust systems that can manage the high power output and stringent emission regulations. The continuous advancements in turbofan engine technology, aimed at reducing fuel consumption and emissions, further boost the market for high-performance exhaust systems.

Turboprop engines, commonly used in regional and general aviation aircraft, also hold a significant share in the market. These engines are valued for their efficiency at lower speeds and shorter distances, making them suitable for regional flights and small commuter aircraft. The need for efficient exhaust systems to optimize performance and meet emission standards drives the demand in this segment.

Turbojet engines, primarily used in military and high-speed aircraft, require specialized exhaust systems capable of handling extreme operational conditions. These engines, while not as widely used as turbofan or turboprop engines, play a critical role in defense and high-speed aviation, driving demand for advanced exhaust systems.

Reciprocating engines, used in smaller general aviation and older aircraft models, represent a smaller market segment. However, the demand for replacement and upgraded exhaust systems in these engines ensures their continued relevance. Overall, each engine type's specific requirements and advancements contribute to the growth and diversification of the aircraft exhaust system market.

Material Analysis

Stainless Steel dominates with 45% due to high durability and resistance to corrosion

The aircraft exhaust system market is segmented by material into Stainless Steel, Titanium, Aluminum, Composites, and others. Stainless steel dominates this segment with a significant 45% market share. This dominance is due to the high durability, resistance to corrosion, and ability to withstand high temperatures, making stainless steel an ideal material for aircraft exhaust systems.

Stainless steel is widely used in exhaust pipes, mufflers, and other components due to its excellent performance in harsh environments and its relatively low cost compared to other high-performance materials. The material's ability to maintain structural integrity under high stress and temperature conditions ensures the reliability and longevity of exhaust systems, driving its demand in the market.

Titanium and aluminum also hold significant shares in the market. Titanium, known for its high strength-to-weight ratio and excellent corrosion resistance, is used in applications where weight reduction is critical, such as in high-performance military and commercial aircraft. Although more expensive than stainless steel, titanium's benefits in weight savings and performance justify its use in specific applications.

Aluminum is valued for its lightweight and good thermal conductivity, making it suitable for components that do not require as much strength as stainless steel or titanium. Its use in certain exhaust system parts helps in reducing the overall weight of the aircraft, contributing to fuel efficiency and performance.

Composites, although a smaller segment, are gaining traction due to their potential for significant weight reduction and design flexibility. Advances in composite materials technology are opening new possibilities for their use in aircraft exhaust systems, offering benefits such as improved fuel efficiency and reduced emissions. The 'others' category includes emerging materials that offer unique properties, addressing specific needs within the aircraft exhaust system market.

End-Use Analysis

OEM dominates with 60% due to integration of advanced systems in new aircraft

The aircraft exhaust system market is segmented by end-use into OEM (Original Equipment Manufacturer) and Aftermarket. OEM dominates this segment with a commanding 60% market share. This dominance is driven by the integration of advanced exhaust systems in new aircraft models. Aircraft manufacturers are increasingly focusing on improving fuel efficiency, reducing emissions, and complying with stringent regulatory standards, driving the demand for high-performance exhaust systems at the OEM level.

The continuous production of new commercial, military, and business aircraft requires state-of-the-art exhaust systems to meet the latest technological and environmental standards. OEMs work closely with exhaust system manufacturers to incorporate the latest advancements, ensuring optimal performance and compliance. The growing demand for new aircraft, driven by increasing air travel and fleet expansions, further boosts the OEM segment's dominance.

The aftermarket segment, including replacement parts and upgrades and modifications, also plays a crucial role in the market. Replacement parts are essential for maintaining the operational efficiency and safety of existing aircraft. As aircraft age, the need for replacing worn-out or outdated exhaust system components ensures a steady demand in the aftermarket.

Upgrades and modifications in the aftermarket segment are driven by the need to improve performance, comply with new regulations, and extend the service life of older aircraft. Airlines and operators invest in upgrading exhaust systems to enhance fuel efficiency, reduce emissions, and improve overall reliability. The aftermarket segment, while not as dominant as OEM, is vital for the continued growth and sustainability of the aircraft exhaust system market, ensuring that both new and existing aircraft meet the highest standards of performance and safety.

Key Market Segments

By Component Type

- Exhaust Pipes

- Exhaust Mufflers

- Turbochargers

- Nozzles

- Heat Shields

- Others

By Aircraft Type

- Commercial Aircraft

- Narrow-Body Aircraft

- Wide-Body Aircraft

- Regional Aircraft

- General Aviation Aircraft

- Military Aircraft

- Fighter Jets

- Transport Aircraft

- Business Jets

By Engine Type

- Turbofan Engines

- Turboprop Engines

- Turbojet Engines

- Reciprocating Engines

By Material

- Stainless Steel

- Titanium

- Aluminum

- Composites

- Others

By End-Use

- OEM (Original Equipment Manufacturer)

- Aftermarket

- Replacement Parts

- Upgrades and Modifications

Growth Opportunities

Emerging Electric and Hybrid Aircraft Market Offers Growth Opportunity

The growing interest in electric and hybrid-electric aircraft presents a unique opportunity for exhaust system manufacturers to diversify their product lines. While these aircraft may not require traditional exhaust systems, they will need thermal management solutions, which existing exhaust system manufacturers are well-positioned to develop.

For example, companies like Safran are already working on electric propulsion systems that will require innovative cooling and exhaust solutions for battery and motor systems. This shift towards electric and hybrid technology opens up new markets and demands for specialized thermal management, providing significant growth potential for traditional exhaust system manufacturers. By leveraging their expertise in exhaust and thermal management, these manufacturers can create new products that meet the needs of modern aircraft, thus driving market expansion.

Aftermarket Services and Retrofitting Offer Growth Opportunity

As airlines seek to extend the life of their existing fleets, there's a growing opportunity in the aftermarket for exhaust system upgrades and retrofits. This sector allows manufacturers to offer improved efficiency and reduced emissions for older aircraft models.

For instance, Honeywell Aerospace offers retrofit kits for its 131-9A auxiliary power unit exhaust, which can improve fuel efficiency and reduce noise levels for existing aircraft. These upgrades not only enhance the performance of older aircraft but also help airlines meet stricter environmental regulations. By focusing on aftermarket services and retrofitting, exhaust system manufacturers can tap into a steady demand for enhancements and maintenance, ensuring sustained growth and relevance in the market.

Trending Factors

Additive Manufacturing in Exhaust System Production Are Trending Factors

The adoption of 3D printing technologies is revolutionizing the manufacturing process for aircraft components, including exhaust systems. This trend allows for more complex designs, reduced weight, and potentially lower production costs.

GE Aviation, for instance, has successfully used additive manufacturing to produce lighter and more efficient exhaust nozzles for its GE9X engine, demonstrating the potential of this technology in the exhaust system market. The ability to quickly produce and test new designs accelerates innovation and enhances the performance of exhaust systems. As additive manufacturing becomes more widespread, it is expected to play a crucial role in the development of next-generation aircraft exhaust components, making it a significant trend in the industry.

Integration of Smart Technologies Are Trending Factors

The trend towards more intelligent aircraft systems is extending to exhaust components. Manufacturers are incorporating sensors and smart materials to enable real-time monitoring and adaptive performance of exhaust systems.

Rolls-Royce, for example, is developing "intelligent engine" concepts that include smart exhaust systems capable of adjusting their performance based on flight conditions and engine health data. These smart technologies enhance the efficiency, safety, and longevity of exhaust systems by providing precise control and diagnostics. The integration of smart technologies represents a significant advancement in aircraft exhaust systems, positioning them to meet the demands of modern aviation through enhanced functionality and reliability.

Regional Analysis

North America Dominates with 38% Market Share in the Aircraft Exhaust System Market

North America's leadership in the aircraft exhaust system market, marked by a 38% share, is driven by the presence of major aerospace manufacturers and stringent environmental regulations. The region's focus on reducing emissions and enhancing aircraft efficiency stimulates the demand for advanced exhaust systems. Additionally, robust research and development capabilities contribute to continual improvements in exhaust technologies.

The regional characteristics that bolster North America's dominance include its well-established aerospace industry and high defense spending, which demand cutting-edge aircraft technologies. The emphasis on sustainability and emission reductions further accelerates advancements in and adoption of new exhaust system technologies.

The future influence of North America in the aircraft exhaust system market is likely to remain strong. Expected increases in aircraft production and ongoing innovations in emission reduction technologies are set to drive further growth. The region's stringent regulatory environment will continue to push for advancements in exhaust system efficiency and environmental friendliness.

Regional Market Shares and Dynamics:

- Europe: Europe accounts for approximately 33% of the market. The region's strong aerospace sector, coupled with high environmental consciousness, drives the demand for efficient aircraft exhaust systems. Ongoing efforts to meet stringent EU emission standards are likely to sustain growth in the European market.

- Asia Pacific: Holding about 20% of the market, Asia Pacific's share is fueled by rising aircraft manufacturing and maintenance activities in countries like China and India. Increasing air traffic and regional investments in aerospace capabilities will continue to stimulate the market's expansion in this area.

- Middle East & Africa: This region captures around 5% of the market. Investments in expanding airline fleets and upgrading airport infrastructure in the Middle East contribute to the demand for modern aircraft exhaust systems, with growth expected to accelerate in the coming years.

- Latin America: Representing around 4% of the market, Latin America's growth is driven by gradual improvements in its aerospace infrastructure and increasing air travel, which necessitate the adoption of better and more efficient aircraft systems, including exhaust systems.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Aircraft Exhaust System Market plays a crucial role in aviation safety and performance. Leading companies such as Magellan Aerospace Corporation and Triumph Group, Inc. dominate the market with their comprehensive product offerings and strong industry relationships. These firms are known for their advanced technologies and commitment to quality, setting high standards in the industry.

GKN Aerospace and Nordam are at the forefront of market growth, focusing on the development of advanced materials and innovative designs. Their efforts in research and development drive technological advancements in aircraft exhaust systems. Safran S.A. and Ducommun Incorporated leverage their extensive R&D capabilities to maintain competitive advantages, continuously improving their products and services.

Esterline Technologies Corporation and Senior Aerospace offer high-quality solutions that enhance their market positions. Their focus on durability and performance ensures their products meet the rigorous demands of the aviation industry. Wall Colmonoy Corporation and Sky Dynamics Corporation cater to niche markets by emphasizing customization and customer service, attracting a diverse range of clients.

Companies like Aerospace Welding Minneapolis, Inc. and Power Flow Systems, Inc. focus on providing customized solutions to meet specific client needs, enhancing their market influence. Knisley Exhaust Service, Inc. and Acorn Welding Ltd. leverage strong regional presence to increase their market share, while Aircraft Exhaust, Inc. combines technology and expertise to maintain a competitive edge.

These companies employ strategies such as mergers, partnerships, and technological innovations to strengthen their market positions. Their focus on performance and reliability aligns with industry needs, ensuring their continued success. Leaders like Magellan Aerospace and Triumph Group set industry standards through their innovative approaches and strategic collaborations, influencing market trends and driving growth within the aircraft exhaust system market.

Market Key Players

- Magellan Aerospace Corporation

- Triumph Group, Inc.

- GKN Aerospace

- Nordam

- Safran S.A.

- Ducommun Incorporated

- Esterline Technologies Corporation

- Senior Aerospace

- Wall Colmonoy Corporation

- Sky Dynamics Corporation

- Aerospace Welding Minneapolis, Inc.

- Power Flow Systems, Inc.

- Knisley Exhaust Service, Inc.

- Acorn Welding Ltd.

- Aircraft Exhaust, Inc.

Recent Developments

- June 2023: Safran Nacelles delivered the first LEAP 1-A propulsion systems, including nacelles and engines, to Airbus from its new facility in China. This development is part of the company's effort to establish a stronger presence in the Asia Pacific market, driven by increasing green technology initiatives and partnerships for manufacturing and assembling various aircraft exhaust system components.

- October 2023: Beta Technologies opened a new electric aircraft manufacturing plant at Patrick Leahy Burlington International Airport in Vermont. The facility is designed to produce up to 300 aircraft per year. Beta's electric aircraft prototypes, including the CX300 electric conventional-takeoff-and-landing (eCTOL) version, are set for production, with FAA certification targeted for 2025. This expansion is part of Beta's strategy to meet growing demand for electric aircraft and advance its production capabilities.

- May 2023: Textron Aviation announced the launch of the Cessna Citation Ascend, the newest business jet in its 560XL series. The aircraft is powered by Pratt & Whitney Canada's PW545D engines, which incorporate advanced materials and technologies to enhance exhaust performance, fuel efficiency, and reduce maintenance costs. This launch signifies Textron's commitment to advancing business aviation technology.

Report Scope

Report Features Description Market Value (2023) USD 1.2 Billion Forecast Revenue (2033) USD 2.4 Billion CAGR (2024-2033) 7.4% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component Type (Exhaust Pipes, Exhaust Mufflers, Turbochargers, Nozzles, Heat Shields, Others), By Aircraft Type (Commercial Aircraft [Narrow-Body Aircraft, Wide-Body Aircraft], Regional Aircraft, General Aviation Aircraft, Military Aircraft [Fighter Jets, Transport Aircraft], Business Jets), By Engine Type (Turbofan Engines, Turboprop Engines, Turbojet Engines, Reciprocating Engines), By Material (Stainless Steel, Titanium, Aluminum, Composites, Others), By End-Use (OEM (Original Equipment Manufacturer), Aftermarket [Replacement Parts, Upgrades and Modifications]) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Magellan Aerospace Corporation, Triumph Group, Inc., GKN Aerospace, Nordam, Safran S.A., Ducommun Incorporated, Esterline Technologies Corporation, Senior Aerospace, Wall Colmonoy Corporation, Sky Dynamics Corporation, Aerospace Welding Minneapolis, Inc., Power Flow Systems, Inc., Knisley Exhaust Service, Inc., Acorn Welding Ltd., Aircraft Exhaust, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Magellan Aerospace Corporation

- Triumph Group, Inc.

- GKN Aerospace

- Nordam

- Safran S.A.

- Ducommun Incorporated

- Esterline Technologies Corporation

- Senior Aerospace

- Wall Colmonoy Corporation

- Sky Dynamics Corporation

- Aerospace Welding Minneapolis, Inc.

- Power Flow Systems, Inc.

- Knisley Exhaust Service, Inc.

- Acorn Welding Ltd.

- Aircraft Exhaust, Inc