Air Springs Market By Product Type (Single Convolute, Multi Convolute, Sleeve, Rolling Lobe), By Sales Channel (OEMs, Aftermarket), By Application (Passenger Cars, Buses, Trailers & Trucks, Light Commercial Vehicles, Railways, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

47236

-

June 2024

-

136

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

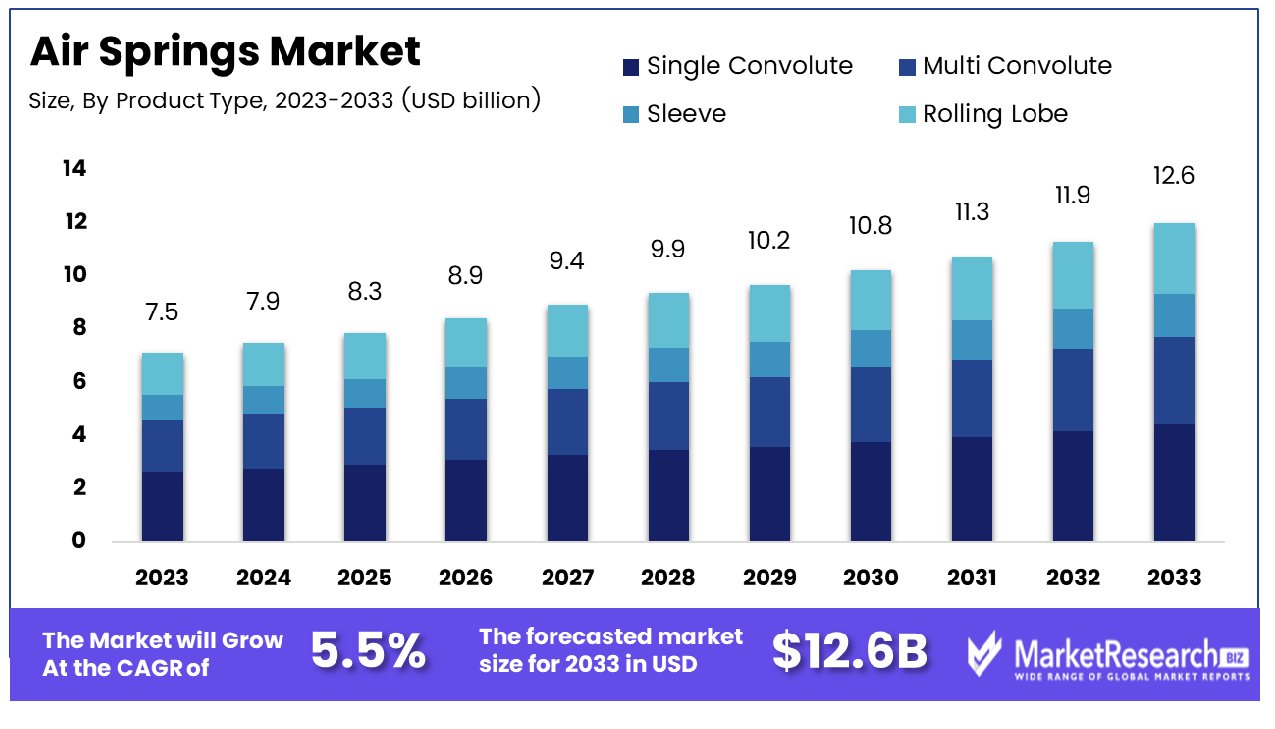

The Global Air Springs Market was valued at USD 7.5 Bn in 2023. It is expected to reach USD 12.6 Bn by 2033, with a CAGR of 5.5% during the forecast period from 2024 to 2033.

The Air Springs Market encompasses a segment within the automotive and industrial sectors, focusing on the production, distribution, and application of air-filled rubber or fabric bags designed to provide cushioning, vibration isolation, and support. These essential components offer superior load-bearing capabilities, enhancing vehicle and machinery performance, stability, and comfort. With an increasing emphasis on sustainability and technological advancements, the Air Springs Market is witnessing significant growth, driven by demands for improved ride quality, operational efficiency, and safety across various industries. Strategic insights into market trends, consumer preferences, and emerging innovations are pivotal for stakeholders navigating this dynamic landscape.

The Air Springs Market exhibits promising growth prospects driven by key players such as Vibracoustic SE, a renowned manufacturer with over two decades of expertise in developing and producing air springs for the automotive industry. Their robust experience underscores the market's potential for innovation and advanced solutions. Furthermore, standards like JASO C613 and NAVISTAR TMS 1070 contribute to market stability by defining quality benchmarks for air springs used in trucks, buses, and suspension systems. These regulatory frameworks ensure product reliability and safety, instilling confidence among consumers and industry stakeholders.

The Air Springs Market exhibits promising growth prospects driven by key players such as Vibracoustic SE, a renowned manufacturer with over two decades of expertise in developing and producing air springs for the automotive industry. Their robust experience underscores the market's potential for innovation and advanced solutions. Furthermore, standards like JASO C613 and NAVISTAR TMS 1070 contribute to market stability by defining quality benchmarks for air springs used in trucks, buses, and suspension systems. These regulatory frameworks ensure product reliability and safety, instilling confidence among consumers and industry stakeholders.Air springs in enhancing vehicle performance, comfort, and safety across diverse applications. With the automotive sector experiencing rapid technological advancements and a growing emphasis on sustainability, the demand for efficient and durable air spring solutions is poised to escalate. This trend is further accentuated by evolving consumer preferences for smoother rides and enhanced driving experiences.

In this dynamic landscape, market participants must remain vigilant, leveraging insights into emerging trends, regulatory requirements, and competitive strategies. The Air Springs Market presents lucrative opportunities for strategic partnerships, product diversification, and market expansion. By harnessing these insights and adopting a forward-thinking approach, stakeholders can position themselves competitively and capitalize on the evolving dynamics of this thriving market segment.

Key Takeaways

- Market Value: The Global Air Springs Market was valued at USD 7.5 Bn in 2023. It is expected to reach USD 12.6 Bn by 2033, with a CAGR of 5.5% during the forecast period from 2024 to 2033.

- By Product Type: Rolling Lobe air springs hold a 45% market share, attributed to their superior load-carrying capacity and durability in various applications.

- By Sales Channel: OEMs lead the market with a 60% share, as they provide air springs directly to vehicle manufacturers, ensuring compatibility and reliability.

- By Application: Trailers & Trucks application holds a 50% market share, driven by the high demand for robust and reliable suspension systems in heavy-duty vehicles.

- Regional Dominance: North America leads the Air Springs Market with a 35% market share, owing to the significant presence of automotive manufacturers and the high demand for commercial vehicles.

- Growth Opportunity: The Air Springs Market is poised for growth with increasing adoption in electric and autonomous vehicles, enhancing ride comfort and performance.

Driving factors

Growing Automotive Industry

The expansion of the automotive sector serves as a significant catalyst for the growth of the air springs market. As the automotive industry experiences upward trends in production and sales, the demand for air springs, a crucial component in vehicle suspension systems, follows suit. With the global automotive industry continually evolving, particularly in emerging economies, there's a heightened need for innovative suspension solutions to meet the demands of modern vehicle designs and consumer preferences.

According to industry reports, the automotive industry has been witnessing steady growth, with forecasts predicting continued expansion in the coming years. The automotive industry showed resilience, with several regions reporting increased vehicle sales compared to previous years. This growth trajectory is expected to persist as economies recover and consumer confidence rebounds, further driving the demand for air springs.

Lightweight Suspension Systems

The emphasis on lightweight suspension systems in the automotive industry plays a pivotal role in propelling the air springs market forward. Manufacturers are increasingly prioritizing the development of lightweight components to enhance fuel efficiency, reduce emissions, and improve overall vehicle performance. As a result, air springs, known for their lightweight properties compared to traditional coil springs, are gaining prominence in the market.

The shift towards lightweight suspension systems aligns with broader industry trends such as electric vehicles (EVs) and hybrid vehicles, where every pound saved contributes to extended range and improved efficiency. Moreover, lightweight suspension systems offer benefits in terms of ride comfort, handling, and durability, further driving their adoption among automakers and end consumers.

Restraining Factors

Mechanical Leaks

Mechanical leaks represent a challenge within the air springs market, as they can lead to performance degradation and increased maintenance costs for vehicle owners. When air springs develop leaks due to wear and tear or manufacturing defects, they compromise the integrity of the suspension system, affecting ride quality and stability. Moreover, leaks can result in uneven weight distribution among the vehicle's wheels, leading to accelerated tire wear and potential safety hazards.

Addressing mechanical leaks requires proactive maintenance and timely repairs, which can be both time-consuming and costly for vehicle owners. However, advancements in air spring technology, such as improved sealing mechanisms and materials, aim to mitigate the risk of leaks and enhance the durability of these components. Manufacturers also offer aftermarket solutions for diagnosing and repairing leaks efficiently, reducing downtime and minimizing the impact on vehicle performance.

Cost of Replacement

The cost of replacement serves as a critical consideration for both vehicle manufacturers and consumers when assessing the viability of air springs in suspension systems. While air springs offer numerous benefits in terms of performance and comfort, their initial purchase cost and potential replacement expenses influence adoption rates in the market. High replacement costs may deter some consumers from investing in air springs, particularly in budget-conscious segments of the automotive market.

However, manufacturers are increasingly focused on optimizing production processes and sourcing cost-effective materials to mitigate the financial burden associated with air spring replacement. Additionally, advancements in manufacturing technologies, such as additive manufacturing and automation, contribute to cost reduction efforts while maintaining product quality and performance.

By Product Type Analysis

The 45% dominance of Rolling Lobe air springs, coupled with the steady performance.

In 2023, Rolling Lobe held a dominant market position in the By Product Type segment of the Air Springs Market, capturing more than a 45% share. The Rolling Lobe air springs are highly preferred in various automotive and industrial applications due to their superior durability and performance in high-load conditions. This segment's significant market share is attributed to the rising demand for heavy-duty vehicles and advanced suspension systems.

The Single Convolute segment is known for their simple design and reliability, Single Convolute air springs are extensively used in light-duty commercial vehicles and passenger cars. The growing focus on vehicle comfort and safety is driving the demand for this product type, contributing to its robust market presence.

Multi Convolute air springs, designed for applications requiring higher load capacities and greater flexibility, held a significant portion of the market. The increasing adoption of these springs in off-road vehicles and heavy-duty trucks is a key factor supporting their market growth. The segment benefits from advancements in material technology and the push for more efficient and resilient suspension systems.

The Sleeve air springs segment maintained a steady market share. These air springs are favored for their compact size and versatility, making them ideal for a variety of automotive and industrial applications. The segment's performance is bolstered by the continuous development of lightweight and cost-effective solutions, meeting the evolving needs of end-users.

By Sales Channel Analysis

The clear dominance of OEMs in the sales channel, combined with the vital role of 60% market share.

In 2023, OEMs held a dominant market position in the By Sales Channel segment of the Air Springs Market, capturing more than a 60% share. The dominance of OEMs (Original Equipment Manufacturers) can be attributed to the strong demand from automotive and industrial sectors for high-quality, reliable air springs. The partnership of OEMs with leading vehicle manufacturers ensures the integration of advanced air spring systems in new vehicles, driving the growth and capturing a significant market share.

The Aftermarket segment caters to the replacement and maintenance needs of vehicles already in use. The growth of the aftermarket is fueled by the increasing number of aging vehicles and the rising awareness among vehicle owners regarding the benefits of regular maintenance and timely replacement of air springs.

By Application Analysis

The dominance of Trailers & Trucks underscores the diverse and dynamic landscape of the Air Springs Market by Application with 50% share.

In 2023, Trailers & Trucks held a dominant market position in the By Application segment of the Air Springs Market, capturing more than a 50% share. The robust growth in the transportation and logistics sectors, coupled with the increasing demand for heavy-duty vehicles, significantly contributed to this segment's leadership.

The Passenger Cars segment accounted for a substantial share of the Air Springs Market. The rising consumer preference for comfort, safety, and better handling in passenger vehicles has led to a growing demand for air springs in this segment.

Buses also represented a significant portion of the market in 2023. The increasing focus on public transportation infrastructure and the need for comfortable and reliable ride experiences in buses are driving the adoption of air springs. Enhanced passenger comfort, safety features, and improved vehicle stability are some of the benefits fueling demand in this segment.

The Light Commercial Vehicles (LCVs) segment maintained a notable share of the Air Springs Market. The expanding e-commerce and logistics sectors, requiring efficient and reliable delivery vehicles, are key contributors to the demand for air springs in LCVs.

In the Railways segment, air springs are crucial for providing stability, comfort, and safety in train operations. This segment showed steady growth due to ongoing investments in rail infrastructure and the modernization of existing railway systems.

The Industrial segment also demonstrated a significant presence in the Air Springs Market. Air springs are extensively used in industrial machinery and equipment to reduce vibrations, ensure stability, and enhance the performance of various industrial applications.

Key Market Segments

By Product Type

- Single Convolute

- Multi Convolute

- Sleeve

- Rolling Lobe

By Sales Channel

- OEMs

- Aftermarket

By Application

- Passenger Cars

- Buses

- Trailers & Trucks

- Light Commercial Vehicles

- Railways

- Industrial

Growth Opportunity

Increasing Demand for Luxury and Electric Vehicles

One of the primary catalysts fueling the growth of the air springs market is the escalating demand for luxury and electric vehicles (EVs). As discerning consumers gravitate towards premium automotive offerings, manufacturers are compelled to integrate advanced suspension systems that deliver unparalleled comfort and performance. Additionally, the rise of EVs presents unique challenges and opportunities for the automotive sector, with air springs emerging as a preferred solution to optimize ride quality and address the weight distribution requirements of electric powertrains.

Industry reports indicate a surge in sales of luxury vehicles worldwide, with forecasts projecting sustained growth in this segment. Moreover, the rapid adoption of EVs across major markets underscores the need for innovative suspension solutions capable of meeting the distinct requirements of electric mobility.

Technological Advancements

Innovation remains at the forefront of the air springs market, driving manufacturers to explore new frontiers in design, materials, and functionality. Technological advancements, including the integration of smart sensors, adaptive damping systems, and predictive maintenance capabilities, empower air springs to deliver enhanced performance, efficiency, and reliability. Furthermore, advancements in additive manufacturing techniques and lightweight materials contribute to the development of next-generation air spring solutions that cater to evolving industry demands.

Research indicates a steady influx of investments in research and development within the automotive sector, particularly aimed at advancing suspension technologies. Additionally, partnerships between automotive OEMs and technology firms underscore a concerted effort to accelerate innovation and bring cutting-edge solutions to market.

Latest Trends

Electronically Operated Air Springs

A prominent trend shaping the air springs market is the proliferation of electronically operated air springs, representing a paradigm shift in suspension system technology. By integrating electronic controls and actuators, manufacturers empower air springs with dynamic adjustability, enabling real-time response to changing road conditions and driver preferences. This trend not only enhances ride comfort and stability but also paves the way for autonomous driving capabilities, as vehicles leverage intelligent suspension systems to optimize performance and safety.

Start-up Innovations

In 2024, the air springs market witnesses a surge in start-up innovations, as entrepreneurial ventures disrupt traditional paradigms with novel approaches and solutions. Start-ups leverage advanced materials, novel manufacturing techniques, and data-driven insights to introduce innovative air spring designs that offer superior performance, durability, and sustainability. Furthermore, these agile enterprises catalyze industry collaboration and foster a culture of experimentation, driving continuous improvement and pushing the boundaries of what's possible in air spring technology.

Regional Analysis

North America leads the air springs market with a share of 35%.

North America holds a substantial share of the global air springs market, accounting for approximately 35% of the total market. The region's dominance can be attributed to the presence of key market players, advanced manufacturing infrastructure, and a robust automotive industry. The United States, in particular, contributes significantly to the growth of the market due to the high demand for commercial vehicles and luxury automobiles equipped with air suspension systems.

Europe is another prominent region in the air springs market, characterized by a well-established automotive sector and stringent regulations pertaining to vehicle safety and emissions. With a diverse range of automotive manufacturers and a growing demand for passenger vehicles equipped with air suspension systems, Europe holds a substantial market share. Germany, France, and the United Kingdom emerge as key contributors to the regional market growth.

Asia Pacific is poised to witness robust growth in the air springs market, driven by rapid industrialization, urbanization, and increasing investments in the automotive sector. The region's expanding transportation and logistics industry further augments the demand for air springs in heavy-duty trucks and trailers.

While currently holding a smaller share of the global air springs market, the Middle East & Africa region is witnessing gradual growth due to infrastructural developments, rising consumer preferences for premium vehicles, and increasing investments in the automotive aftermarket.

Latin America represents a burgeoning market for air springs, driven by the growing automotive industry, improving road infrastructure, and rising consumer disposable income. Countries such as Brazil, Mexico, and Argentina are witnessing a surge in demand for passenger vehicles and commercial trucks equipped with air suspension technology.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global Air Springs Market is poised for substantial growth, with key players such as Continental AG, Bridgestone Industrial, and Wabco Holdings Inc. leading the charge. These companies are strategically positioned to capitalize on increasing demand driven by the burgeoning automotive and transportation industries worldwide.

Continental AG, a renowned name in the automotive sector, stands out for its innovative approach and commitment to quality. With a diverse product portfolio and a strong global presence, Continental AG is expected to maintain its competitive edge in the air springs market.

Bridgestone Industrial, leveraging its expertise in rubber and polymer technology, is well-positioned to cater to the growing demand for durable and high-performance air springs. The company's focus on research and development ensures that its products meet the evolving needs of customers across various industries.

Wabco Holdings Inc., a leader in commercial vehicle technologies, brings unparalleled expertise in pneumatic systems to the air springs market. Its innovative solutions for improving vehicle safety and efficiency make it a key player in driving market growth.

Other notable players such as Vibracoustic SE, Sumitomo Electric Industries, Ltd., and ThyssenKrupp AG are also expected to make significant contributions to the market. With a focus on product innovation, strategic partnerships, and expansion into emerging markets, these companies are well-positioned to capitalize on the growing demand for air springs globally.

Market Key Players

- Continental AG

- Bridgestone Industrial

- Wabco Holdings Inc.

- Vibracoustic SE

- Sumitomo Electric Industries, Ltd.

- ThyssenKrupp AG

- Trelleborg AB

- VDL Groep

- VB AirSuspension

- Hendrickson L.L.C.

- Tata AutoComp Systems

- BWI Group

- Stemco

Recent Development

- In April 2024, Firestone Airide opens a new distribution center in Williamsburg, investing $26 million to enhance customer service and operational efficiency. The center supports demand for air springs, especially in the electric vehicle sector.

- In August 2023, KH (Zhengjiang) Advanced Suspension Co., Ltd. settles in Chongqing's High-tech Zone, establishing a southwest production base for new energy vehicle air suspension systems, aiming for 500,000 units annually by 2028.

Report Scope

Report Features Description Market Value (2023) USD 7.5 Bn Forecast Revenue (2033) USD 12.6 Bn CAGR (2024-2033) 5.5% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Single Convolute, Multi Convolute, Sleeve, Rolling Lobe), By Sales Channel (OEMs, Aftermarket), By Application (Passenger Cars, Buses, Trailers & Trucks, Light Commercial Vehicles, Railways, Industrial) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Continental AG, Bridgestone Industrial, Wabco Holdings Inc., Vibracoustic SE, Sumitomo Electric Industries, Ltd., ThyssenKrupp AG, Trelleborg AB, VDL Groep, VB AirSuspension, Hendrickson L.L.C., Tata AutoComp Systems, BWI Group, Stemco Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Continental AG

- Bridgestone Industrial

- Wabco Holdings Inc.

- Vibracoustic SE

- Sumitomo Electric Industries, Ltd.

- ThyssenKrupp AG

- Trelleborg AB

- VDL Groep

- VB AirSuspension

- Hendrickson L.L.C.

- Tata AutoComp Systems

- BWI Group

- Stemco