AI Voice Cloning Market By Component (Software and Service), By Deployment(On-premises and Cloud), By Application(Gaming, Advertising, Assistive Technologies, and Others), By Vertical(Media & Entertainment, Healthcare and Life Sciences and Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast Period 2024-2033

-

50874

-

Sept 2024

-

270

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

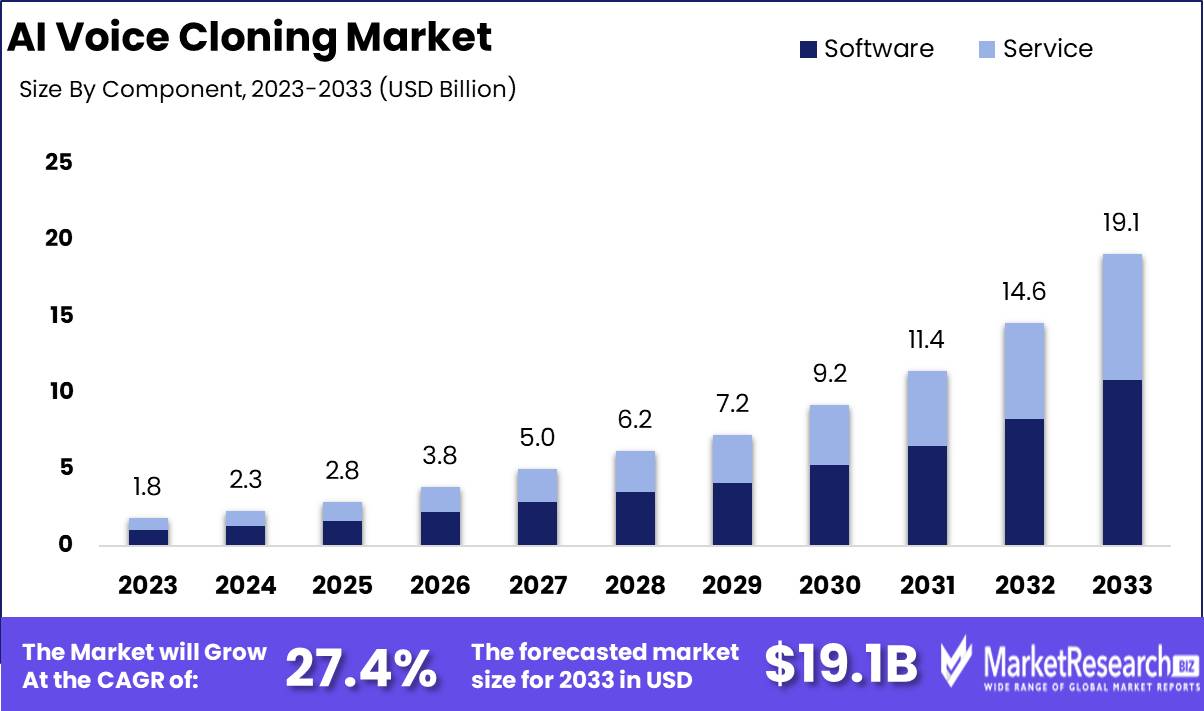

Global AI Voice Cloning Market Size was valued at USD 1.8 Billion in 2023. It is expected to reach USD 19.1 Billion by 2033, with a CAGR of 27.4% during the forecast period from 2024 to 2033.

The AI Voice Cloning Market focuses on the development and application of advanced technologies that use artificial intelligence to create lifelike replicas of human speech. By leveraging cutting-edge Natural Language Processing (NLP), deep learning, and digital content creation, these voice cloning models are increasingly being integrated into applications such as augmented and virtual reality (AR/VR) in gaming, personalized digital assistants, and interactive entertainment. As businesses strive to improve customer satisfaction and enhance user engagement, the importance of this market continues to grow. However, companies must address regulatory challenges and ethical concerns, particularly regarding privacy, consent, and the responsible use of AI-driven voice technologies, to fully realize their potential.

The AI voice cloning market is rapidly evolving, driven by significant technological advancements and strategic partnerships that are reshaping the landscape. The collaboration between Resemble AI and Speechify in 2022, for instance, exemplifies the trend towards integration of high-quality voice cloning capabilities within user-centric platforms. This partnership leverages Resemble AI’s professional-grade models and Speechify’s user-friendly interface, enabling over 1,000,000 users to create natural-sounding AI voices with just 10 seconds of data. Such developments are indicative of the growing demand for personalized digital experiences, where machine learning driven voice cloning technologies are becoming increasingly essential.

In parallel, partnerships such as that between ElevenLabs and Anthropic in 2023 are pushing the boundaries of AI voice cloning. By combining ElevenLabs' speech synthesis expertise with Anthropic's large language models, this collaboration aims to advance the state-of-the-art in the industry. The significance of AI voice cloning is further underscored by Google’s $4.5 billion acquisition of Anthropic in 2023, a move that positions Google to accelerate innovation in synthetic voice technology through enhanced resources and AI capabilities.

Additionally, Microsoft’s 2022 partnership with Resemble AI to integrate voice cloning into Azure Cognitive Services highlights the commercial potential of these technologies, enabling businesses to leverage custom voice solutions at scale. Collectively, these developments indicate a robust growth trajectory for the AI voice cloning market, underscored by the strategic importance of partnerships and acquisitions in driving innovation and market penetration.

Key Takeaways

- Market Growth: The AI Voice Cloning Market is projected to expand from USD 1.8 Billion in 2023 to USD 19.1 Billion by 2033, with a strong CAGR of 27.4%.

- By Component: In 2023, the Software segment dominated with over 65% of the market, highlighting its crucial role in voice synthesis technologies.

- By Deployment: The Software segment also led by deployment in 2023, holding a 58% market share, emphasizing its importance in scalable and customizable solutions.

- By Application: Software captured more than 40% of the market by application in 2023, driven by demand in gaming, advertising, and assistive technologies.

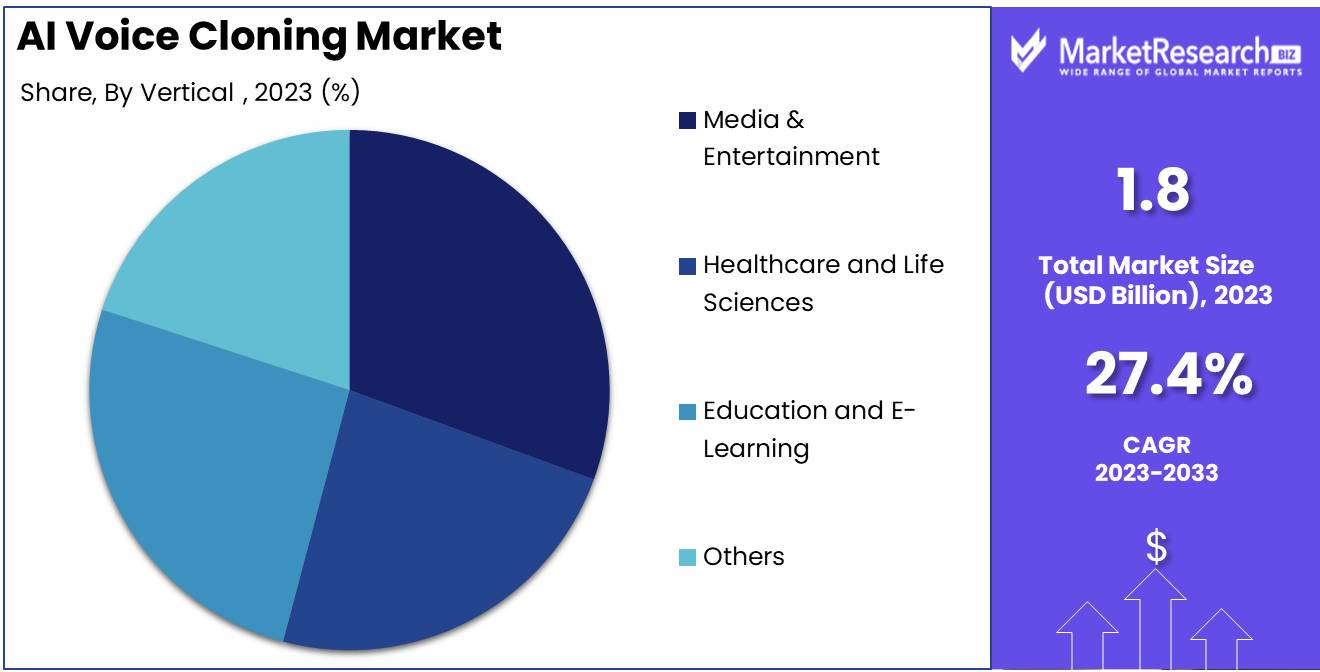

- By Vertical: The Media & Entertainment segment held a 26% share by vertical in 2023,

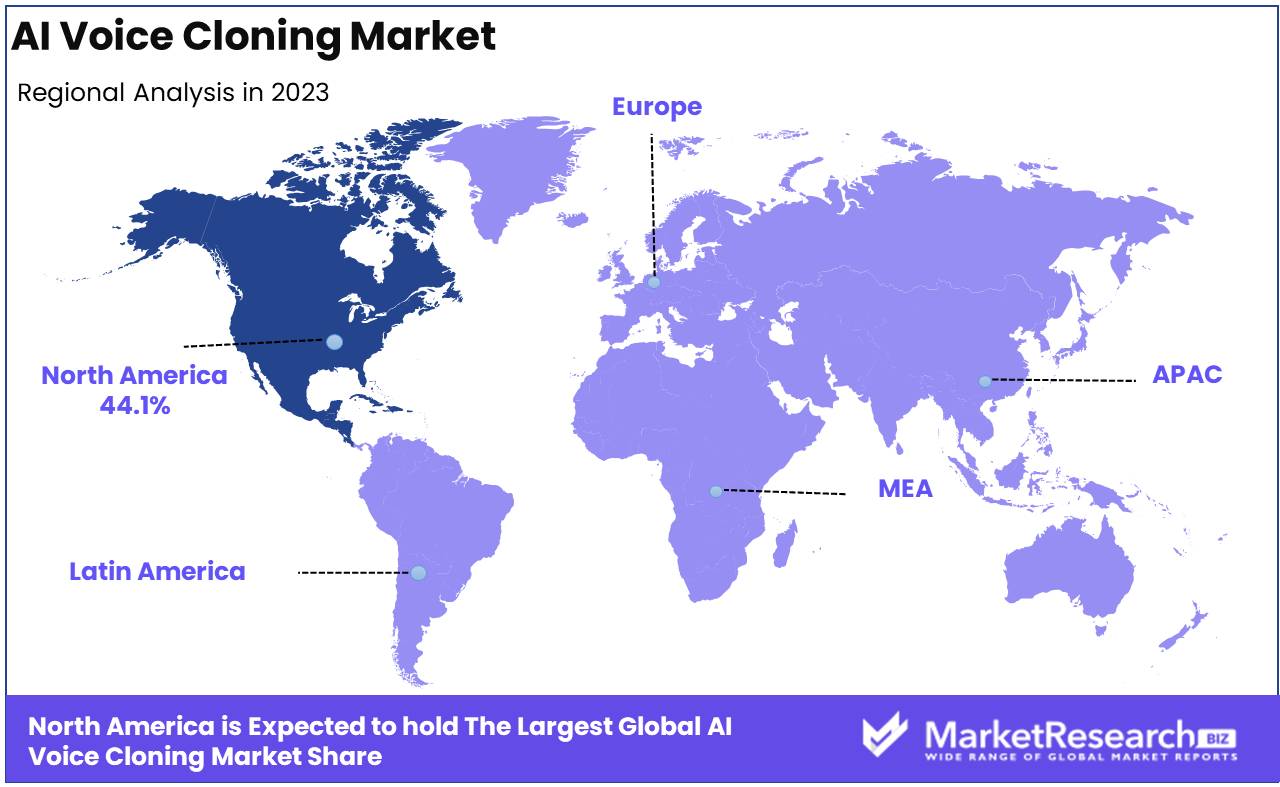

- Regional Dominance: North America led with a 44.1% market share in 2023, supported by strong AI research and digital infrastructure.

- Growth Opportunity: Expansion into healthcare and education offers significant growth potential beyond traditional media and entertainment.

- Restraining Factor: High development costs are a major barrier, limiting new entrants and slowing innovation in the market.

- Recent Developments: Microsoft (2023): Expanded Azure Cognitive Services with "zero-shot" voice cloning, allowing for new voice creation with minimal data, enhancing personalized digital assistants.

Driving factors

Deep Learning & Neural Networks: Driving Precision in AI Voice Cloning

Deep learning and neural networks are at the heart of the AI voice cloning market's rapid growth. Deep neural networks (DNNs) and recurrent neural networks (RNNs) have significantly advanced the capabilities of voice synthesis technologies, enabling the creation of highly accurate and natural-sounding voice clones. These technologies allow AI systems to analyze vast amounts of voice data, learn the intricacies of speech patterns, and replicate them with a high degree of fidelity.

The growing adoption of deep learning models has led to more robust voice cloning systems capable of emulating not just the tone and pitch but also the nuanced emotional expressions of the human voice. This technological evolution is pivotal, especially in sectors such as entertainment, customer service, and healthcare, where personalized and natural-sounding voice interactions are becoming increasingly important.

Furthermore, government investments in AI research, particularly in the United States and China, are accelerating advancements in deep learning technologies. For instance, the U.S. government allocated $1.2 billion for AI research and development in 2023, which has indirectly fueled innovation in voice cloning technologies. Similarly, China's "Next Generation Artificial Intelligence Development Plan" has earmarked billions for AI, including applications in voice technology, which is expected to significantly bolster market growth.

AR & VR Integration: Enhancing Immersive Experiences with AI Voices

The convergence of AI voice cloning with Augmented Reality (AR) and Virtual Reality (VR) is unlocking new dimensions in immersive experiences, driving significant growth in the market. Voice cloning adds a layer of authenticity to virtual environments by providing lifelike audio that complements the high-definition visuals of AR and VR. This is particularly valuable in sectors such as gaming, virtual training, and digital storytelling, where the realism of interactions enhances user engagement and satisfaction.

Government initiatives, such as the European Union's funding of AR and VR projects under the Horizon Europe program, are also supporting the integration of these technologies with AI, further accelerating market expansion. Private investments are equally robust, with companies like Facebook (now Meta) investing heavily in the metaverse, where AI voice cloning is expected to play a critical role in creating realistic virtual interactions.

Restraining Factors

High Development Costs Impeding Market Acceleration

High development costs in AI voice cloning significantly challenge the industry's growth, as these costs can deter new entrants and slow down innovation. Developing sophisticated AI models for voice cloning requires substantial investment in research, computational resources, and skilled talent. For instance, the global AI market, which is expected to reach $1.5 trillion by 2030, dedicates a large share of this value to the development phase, reflecting the financial burden faced by companies. This financial barrier not only limits the number of competitors but also prolongs the time-to-market for new solutions. Additionally, high costs can exacerbate disparities between large enterprises, which can afford such investments, and smaller firms, thus influencing market dynamics by concentrating power in the hands of a few dominant players.

Lack of Standardized Regulations Creating Market Uncertainty

The absence of standardized regulations in AI voice cloning presents a significant hurdle, contributing to market uncertainty and inhibiting growth. Without clear guidelines, companies face legal risks and ethical challenges, potentially stalling development and adoption. This regulatory ambiguity is particularly concerning in regions like the European Union, where AI-related laws are in flux. As governments begin to address these gaps—evidenced by the EU's proposed AI Act—the market could either benefit from increased clarity or struggle with compliance complexities, depending on the final regulatory framework. This uncertainty also impacts global trade, as varying regulations across borders can complicate import-export activities, further affecting market expansion.

By Component Analysis

Software Segment Dominated with Over 65% Market Share in 2023

In 2023, Software held a dominant market position within the By Component segment of the AI Voice Cloning Market, capturing more than a 65% share. This significant lead underscores the critical role that advanced software solutions play in enabling sophisticated voice cloning technologies.

The software component's dominance can be attributed to the increasing demand for high-quality voice synthesis, the integration of AI-driven tools, and the ease of deployment across various applications, from entertainment to customer service. Companies are heavily investing in developing more refined and accurate voice cloning software to meet the growing expectations of users for realistic and contextually appropriate voice interactions.

On the other hand, Services also contributed to the market, but its share was considerably smaller compared to software. voice cloning services typically encompass ongoing support, custom solution development, and integration services, which are crucial for businesses looking to tailor AI voice cloning capabilities to their specific needs. However, the relatively lower share reflects the current market emphasis on acquiring robust software tools as a priority, with service components playing a supplementary role.

By Deployment Analysis

Software Segment Dominates AI Voice Cloning Market with 58% Share in 2023

In 2023, the Software segment held a dominant market position in the AI Voice Cloning Market by Deployment, capturing more than 58% of the market share. This significant market presence can be attributed to the increasing demand for advanced voice synthesis solutions that are easily integrated into existing systems. The software solutions offer greater flexibility, scalability, and customization, making them the preferred choice for enterprises across various industries.

This segment is further categorized into On-premises and Cloud deployments, both of which cater to distinct business needs. On-premises deployment remains favored by organizations prioritizing data security and control, while the Cloud deployment is gaining traction due to its cost-effectiveness, ease of access, and ability to support large-scale AI operations. The growing adoption of cloud-based AI services is expected to bolster the Software segment's growth trajectory in the coming years.

By Application Analysis

Software Segment Dominates AI Voice Cloning Market with Over 40% Share in 2023

In 2023, the Software segment held a dominant market position within the AI Voice Cloning market, capturing more than 40% of the total market share. This leadership underscores the critical role that software solutions play in the adoption and implementation of AI voice cloning technologies across various applications.

The gaming industry continues to leverage AI voice cloning to enhance user experiences, driving dynamic in-game characters and personalized voiceovers. The increasing demand for immersive and interactive gaming experiences has positioned this segment as a key growth driver within the broader market.

In advertising, AI voice cloning is revolutionizing personalized marketing by enabling the creation of customized audio ads tailored to individual consumer profiles. This capability not only enhances engagement but also optimizes campaign effectiveness, contributing significantly to the market's expansion.

AI voice cloning has emerged as a transformative tool in assistive technologies, particularly for individuals with speech impairments. By providing highly accurate voice replication, this segment addresses critical needs in communication aids, thereby reinforcing its substantial market presence.

The Chatbots and Virtual Assistants segment is rapidly adopting AI voice cloning to create more human-like interactions. This trend is driven by the demand for enhanced customer service experiences and more intuitive user interfaces, positioning this segment as a pivotal application area within the market.

In the realm of audiobooks and podcasting, AI voice cloning enables content creators to produce high-quality audio content efficiently. The technology's ability to replicate voices with precision offers new possibilities for content personalization and scalability, thus boosting its adoption in this segment.

The "Others" category encompasses a diverse range of applications, including but not limited to, education, entertainment, and media production. The versatility of AI voice cloning technology in these areas highlights its broad applicability, further solidifying its market relevance.

By Vertical Analysis

Media & Entertainment Dominates AI Voice Cloning Market, Secures 26% Share by Vertical in 2023

In 2023, Media & Entertainment held a dominant market position in the AI Voice Cloning market's By Vertical Analysis segment, capturing more than 26% of the market share. This segment's substantial influence is driven by the industry's rapid adoption of AI voice cloning technologies to enhance content creation, streamline production processes, and personalize user experiences. The increasing demand for realistic voiceovers, dubbing, and virtual assistants in films, television, and gaming has significantly bolstered the adoption of AI-driven voice cloning solutions. As companies in this sector continue to innovate and integrate AI to maintain competitive advantage, Media & Entertainment is expected to maintain its leadership in the market.

Other verticals such as Healthcare and Life Sciences, Education and E-Learning, and Others are also experiencing notable growth in AI voice cloning adoption. The Healthcare and Life Sciences sector is leveraging this technology for personalized patient interactions and virtual health assistants, while Education and E-Learning are utilizing AI voice cloning for more engaging and accessible content delivery. Although these sectors show significant promise, they currently trail behind Media & Entertainment in terms of market share, highlighting the latter's continued dominance in the AI Voice Cloning market.

Key Market Segments

By Component

- Software

- Service

By Deployment

- On-premises

- Cloud

By Application

- Gaming

- Advertising

- Assistive Technologies

- Chatbots and Virtual Assistants

- Audiobooks and Podcasting

- Others

By Vertical

- Media & Entertainment

- Healthcare and Life Sciences

- Education and E-Learning

- Others

Growth Opportunity

Expanding Application Domains

The global AI voice cloning market is poised for significant growth in 2024, driven by the rapid expansion of its application domains. Traditionally concentrated in entertainment and media, AI voice cloning is now permeating sectors such as healthcare, education, customer service, and accessibility solutions. The healthcare sector, for instance, is increasingly leveraging voice cloning to create personalized patient interactions, enhance telemedicine services, and support speech synthesis for individuals with speech impairments. Similarly, in education, AI voice cloning is revolutionizing e-learning platforms by providing customized and engaging auditory experiences, thus catering to diverse learning needs.

Moreover, the entertainment industry continues to explore new frontiers, such as creating digital avatars for immersive experiences and preserving the voices of iconic figures, further broadening the scope of voice cloning applications. This diversification of use cases is not only expanding the market but also driving the adoption of AI voice cloning across various industries, thereby creating substantial growth opportunities.

Technological Advancements and AI Integration

The ongoing advancements in AI and machine learning are central to the growth trajectory of the AI voice cloning market. Innovations in deep learning algorithms, neural networks, and natural language processing are enhancing the accuracy, quality, and versatility of voice cloning technologies. These advancements are making voice cloning more accessible and cost-effective, enabling businesses of all sizes to integrate this technology into their operations.

Furthermore, the integration of AI voice cloning with other emerging technologies such as virtual and augmented reality, as well as its role in enhancing personalized customer experiences, is expected to drive market growth. As these technologies continue to evolve, they will unlock new possibilities for voice cloning, positioning it as a critical component in the broader AI ecosystem.

Latest Trends

Real-Time Voice Cloning: A Strategic Differentiator

As AI voice cloning technologies continue to mature, real-time voice cloning is emerging as a key driver of market growth in 2024. The ability to replicate human voices with near-instantaneous accuracy offers significant opportunities for businesses across industries, particularly in customer service, entertainment, and personalized marketing. Companies that can leverage real-time voice cloning are positioned to enhance user engagement, reduce operational costs, and deliver highly personalized experiences. The increasing demand for these capabilities is expected to catalyze innovation and adoption, further solidifying the market’s expansion trajectory.

Integration with Multimodal AI Systems: Expanding Use Cases

The integration of AI voice cloning with multimodal AI systems represents another significant opportunity in 2024. By combining voice cloning with visual, textual, and sensory data, businesses can create more immersive and intuitive user experiences. This convergence is particularly valuable in sectors like healthcare, where multimodal systems can assist in diagnosing and treating patients, and in education, where they can facilitate more effective learning environments. As businesses seek to create seamless and holistic user interactions, the demand for AI voice cloning integrated with multimodal AI systems is poised to grow, unlocking new revenue streams and market segments.

Regional Analysis

North America leads the global AI Voice Cloning market with a commanding 44.1% largest market share.

The United States, at the forefront of technological innovation and home to major AI firms, significantly contributes to this dominance. Strong investments in AI research, coupled with a robust digital infrastructure, drive the adoption of voice cloning technologies across various sectors, including entertainment, healthcare, and customer service. Canada also plays a critical role, though on a smaller scale, supporting the region's overall leadership in this space.

In Europe, the market exhibits steady growth, particularly in countries like Germany, the UK, and France, where advancements in AI and a strong industrial base provide fertile ground for AI voice cloning applications. The region benefits from a favorable regulatory framework that promotes innovation while addressing ethical concerns related to AI technologies. Germany and the UK, in particular, are key contributors, with increasing demand from industries such as automotive, media, and telecommunications.

Asia-Pacific is emerging as a significant player in the AI Voice Cloning market, driven by rapid technological advancements and growing investments in AI across countries like China, Japan, and South Korea. China's aggressive push towards AI leadership, supported by substantial government initiatives and a vast digital user base, positions it as a pivotal market within the region. Japan and South Korea also contribute notably, leveraging their strong electronics and tech industries to integrate AI voice cloning into various consumer and enterprise applications.

The Middle East & Africa region, while still in the nascent stages of AI adoption, is showing promising growth prospects. The UAE and Saudi Arabia are spearheading the region's AI initiatives, with strategic investments aimed at diversifying their economies through technology. Although the market share is currently limited, the growing interest in AI-driven solutions, particularly in sectors like banking and customer service, suggests a positive outlook.

South America presents a developing market for AI Voice Cloning, with Brazil and Mexico being key contributors. The region faces challenges such as varying levels of technological infrastructure and economic constraints, which slow down the widespread adoption of advanced AI technologies. However, the increasing digitization across industries, particularly in customer service and media, is expected to spur gradual growth in the coming years.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

The competitive landscape of the global AI Voice Cloning Market in 2024, Major players are pivotal in shaping the technological advancements and market dynamics. Among these, Google and Microsoft stand out due to their robust AI research and development capabilities, which allow for significant innovations in voice synthesis technology. Google's deep integration within its vast ecosystem of services enhances user engagement through personalized voice interactions, while Microsoft's incorporation of voice cloning in Azure AI emphasizes security and enterprise solutions, catering to a broad commercial base.

CandyVoice and LumenVox, though smaller in scale compared to tech giants, bring specialized voice cloning solutions that prioritize customization and user-friendliness, appealing particularly to niche markets. IBM Corporation and Nuance Communications continue to excel by leveraging their historical presence in speech recognition to offer voice cloning technologies that are deeply integrated into healthcare and customer service industries.

Emerging players like Descript and iSpeech are noteworthy for their innovative approaches; Descript's editing software combines text and audio editing in novel ways, making it highly appealing for content creators. Similarly, iSpeech provides accessibility-focused solutions that aid educational and corporate sectors in achieving greater inclusivity.

Amazon.com, Inc. and Baidu are enhancing their voice cloning capabilities to integrate seamlessly with their smart assistant technologies, thus enriching consumer interactions. Meanwhile, AT&T Corp. and Kata.ai are focusing on enhancing telecommunications and conversational AI in regional markets, indicating a strategy of specialized, market-oriented adaptation.

Collectively, these companies are not only advancing AI voice cloning technology but are also setting industry standards for ethical use and data security, steering the market toward sustainable growth in diverse applications across global industries.

Market Key Players

- Google LLC

- Microsoft

- CandyVoice

- LumenVox

- IBM Corporation

- Nuance Communications

- Descript

- iSpeech

- Amazon.com, Inc.

- Baidu

- AT&T Corp.

- Kata.ai

Recent Developments

- In 2023, Resemble AI advanced its position as a leader in AI voice cloning by enhancing its voice synthesis platform with features that allow users to generate voices with greater emotional depth and nuance. This innovation has been particularly impactful in sectors like gaming, entertainment, and customer service, where authentic voice experiences are crucial. The key innovation is the real-time control over the emotional tone and intonation of synthesized voices, significantly improving the versatility and authenticity of AI-generated voices.

- In 2023, ElevenLabs gained attention for its groundbreaking multilingual voice cloning technology, enabling voice replication across different languages while maintaining the unique characteristics of the original voice. This capability, which allows seamless translation and preservation of vocal traits, represents a significant leap forward for global media and localization services. Their key innovation lies in cross-language voice synthesis, offering a powerful tool for creating authentic multilingual voice experiences.

- In 2023, Microsoft expanded its voice cloning capabilities within Azure Cognitive Services, enhancing its neural TTS (Text-to-Speech) service with more languages and voices. A major breakthrough was the introduction of "zero-shot" voice cloning, allowing the synthesis of new voices with minimal training data. This innovation has paved the way for more personalized digital assistants and other AI-driven voice applications, offering developers increased flexibility and efficiency in creating customized voice experiences.

Report Scope

Report Features Description Market Value (2023) USD 1.8 Bn Forecast Revenue (2033) USD 19.1 Bn CAGR (2024-2032) 27.4% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Software, Service), By Deployment (On-premises, Cloud), By Application (Gaming, Advertising, Assistive Technologies, Chatbots and Virtual Assistants, Audiobooks and Podcasting, Others), By Vertical (Media & Entertainment, Healthcare and Life Sciences, Education and E-Learning, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Google LLC, Microsoft, CandyVoice, LumenVox, IBM Corporation, Nuance Communications, Descript, iSpeech, Amazon.com, Inc., Baidu, AT&T Corp., Kata.ai Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Google LLC

- Microsoft

- CandyVoice

- LumenVox

- IBM Corporation

- Nuance Communications

- Descript

- iSpeech

- Amazon.com, Inc.

- Baidu

- AT&T Corp.

- Kata.ai