Agricultural Drone Market By Product (Hardware, Fixed-wing, Rotary blade, and Others), By Application (Field Mapping, Corp Management, Spraying, and Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

37014

-

May 2023

-

153

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

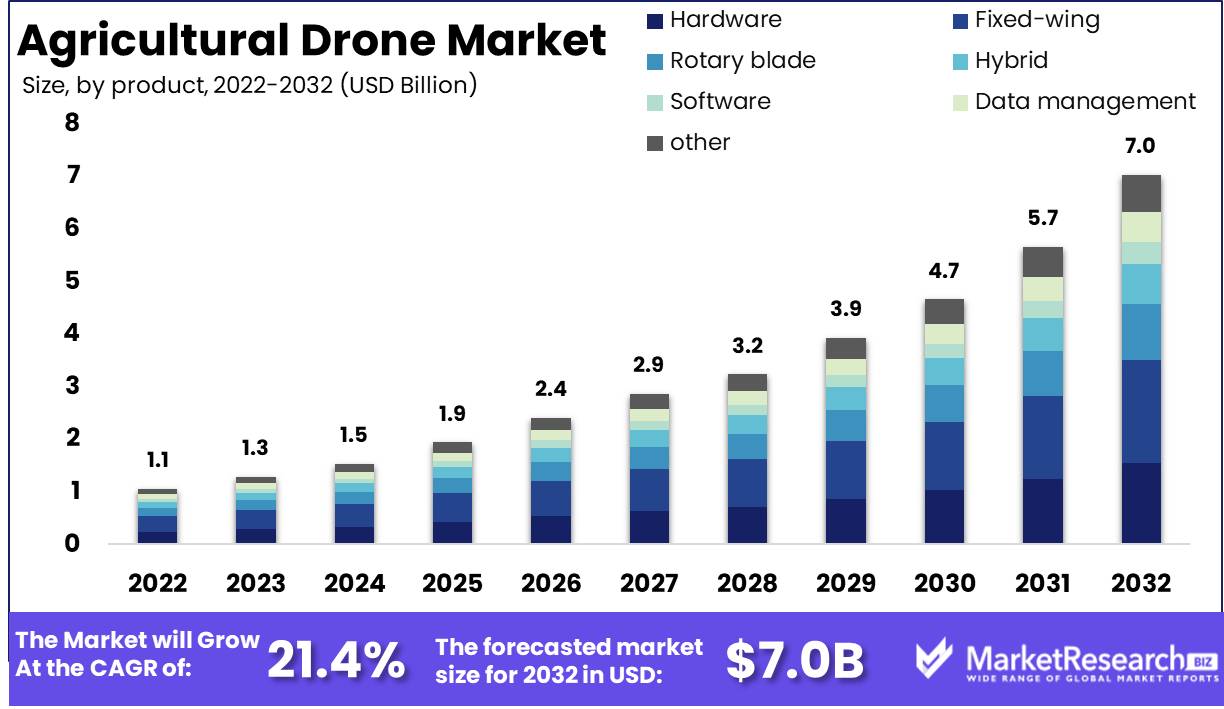

Agricultural Drone Market size is expected to be worth around USD 7.0 Bn by 2032 from USD 1.1 Bn in 2022, growing at a CAGR of 21.4% during the forecast period from 2023 to 2032.

The Agricultural Drone Market is growing, giving farmers new options to care for their crops and cattle. This blog article will cover this industry's definition, importance, advantages, important inventions, growth, applications, industries investing, main drivers, ethical issues, responsible practices, and business applications. Let's explore agricultural drones. Agricultural drones (UAVs) do agricultural mapping, soil analysis, crop spraying, and animal monitoring. These drones use advanced sensors, cameras, and other technology to gather data and do jobs faster than traditional methods.

Providing farmers with reliable data and insights, agricultural drones aim to boost crop yields, save costs, and boost efficiency. These drones survey fields, monitor agricultural development, identify pests and illnesses, and more. Due to their many benefits, agricultural drones are gaining popularity. They save farmers time, money, pesticides, and yields. These drones can also reach hard-to-reach locations, giving farmers more precise and complete crop and land data.

Over time, agricultural drones have seen several developments. Multispectral sensors on certain drones can detect multiple wavelengths of light, helping farmers to spot crop illnesses and nutritional deficits. automotive LIDAR sensors on other drones detect crop height and density. Many agricultural goods and services use drones. Some seed and fertilizer firms use drones to transport their supplies to farmers' fields. Many firms provide farmers drone-based crop mapping and analysis.

Due to rising agricultural demand, the agricultural drones industry will increase significantly. Crop mapping, irrigation management, crop spraying, and animal monitoring employ these drones. Seed, fertilizer, drone, and agricultural technology businesses are investing in agricultural drones. These firms use drones to improve their goods and services and consumer value.

Driving factors

The Revolution of Precision Agriculture and Technological Progress

Agricultural Drone Market is embarking on an awe-inspiring voyage, propelled by a plethora of captivating factors that are fueling its phenomenal development. As one delves deeper into the world of precision cultivation techniques, an enthralling landscape emerges. Farmers, enlightened by precision farming's plethora of benefits, are enjoying the bountiful harvest of increased crop yields and enhanced productivity. A symphony of drone technology and software advancements has contributed harmoniously to the thriving melody of the market. These advanced drones, outfitted with high-resolution cameras, sensors, and GPS systems, conduct a symphony of agricultural surveillance and disease detection.

Leverage the Strength of Efficiency and Cost Reduction

In Agricultural Drone Market, a captivating force emanates from the domain of reduced manual labor costs and increased productivity. These ethereal drones soar above vast stretches of land, traversing them at unrivaled speeds while collecting data with unmatched precision. Their celestial endeavors result in significant time and financial savings for producers. In addition, the convergence of government initiatives and support for drone technology in agriculture accentuates the market's ascent. Governments, motivated by a desire for progress, extend a helping hand to farmers in the form of financing and incentives, igniting their desire to embrace the marvels of drone technology.

The Conjunction of AI and IoT An Enchanting Harmony

In this hypnotic symphony, the graceful integration of AI and IoT technologies shines a bright light on the Agricultural Drone Market. These enlightened drones, empowered by the enchantment of artificial intelligence, glide effortlessly through fields, revealing their hidden secrets. Crop diseases and stresses tremble in the presence of these omnipotent celestial creatures. In addition, these drones embark on a noble mission by transforming into water guardians and championing irrigation management and water conservation. Their divine intervention has become an absolute necessity for producers in a world beset by water scarcity.

The Winds of Change: Emerging Technologies and Regulations

There are murmurs of change amidst the Agricultural Drone Market's harmonious melody. The evolution of rules, adorned with both advantages and disadvantages, casts a mysterious shadow. Future agricultural drone adoption is shrouded in mystery by the intricate dance between regulations governing drone utilization and privacy concerns. As the gusts of change continue their unpredictable course, the market anticipates the unfolding of destiny with bated breath.

Interwoven Disruptors and Emerging Trends

Agricultural Drone Market, a tapestry woven by human ingenuity, encompasses a world replete with potential disruptors and compelling emergent trends. New entrants with audacious aspirations emerge as wildcards capable of reshaping the competitive landscape. Existing competitors, meanwhile, are aggressively expanding their drone services. As the canvas of innovation unfurls, the market transforms into a sanctuary of expanding awareness, where precision agriculture paints its expressive strokes on the minds of consumers. Organic and sustainable agricultural practices, pulsing with undeniable allure, emerge as a driving force, molding the market's destiny with their insatiable demands.

Restraining Factors

High upfront investment costs

Initial investment costs are one of the primary factors that prevent producers from using agricultural drones. Depending on their specifications, high-quality agricultural drones can cost anywhere from $5,000 to $50,000 or more. In addition, maintenance and repair costs can be quite high, particularly if the drone is involved in an accident or encounters extreme weather conditions. Farmers with a limited budget may find it difficult to justify the expense of investing in agricultural drones.

Limited Access to Qualified Drone Pilots

A further factor restraining the Agricultural Drone Market is the scarcity of qualified drone pilots. flight a drone requires specific flight and mapping abilities, as well as knowledge of specialized software. Training pilots to operate drones is time-consuming, costly, and can take several months to master. Due to the scarcity of qualified drone pilots, producers may have difficulty locating seasoned pilots to operate their agricultural drones.

Regulatory Obstacles and Security Concerns

The expansion of the Agricultural Drone Market may be hampered by regulatory obstacles and safety concerns regarding agricultural drones. In a number of nations, the operation of commercial drones is strictly regulated, and specific licenses and permits are required. Additionally, drone excursions are subject to numerous restrictions, including operating below a certain altitude or within a certain radius. Additionally, there is the possibility of drones falling or harming people or animals, which can raise grave safety concerns.

Drones' limited flight time and payload capacity

Additionally, the Agricultural Drone Market is constrained by the limited flight duration and payload capacity of drones. The flight duration of most agricultural drones is between 20 and 30 minutes, limiting their ability to cover vast agricultural areas. Additionally, drones have a limited payload capacity, limiting the weight and categories of equipment that can be affixed. Therefore, drones with longer flight durations and greater payload capacities are required to reduce the time and manpower required for numerous drone flights.

Lack of Awareness and Education Regarding Drone Technology Among Farmers

A lack of awareness and education about drone technology among farmers is one of the major drawbacks of the Agricultural Drone Market. Despite the numerous advantages of using drones in agriculture, many farmers lack the knowledge and comprehension necessary to integrate drone technology with conventional agricultural practices. Consequently, many producers continue to rely on time-consuming and labor-intensive traditional methods.

By Product Analysis

Agricultural drones have emerged as an innovative technological tool in the agricultural sector. These drones have the potential to revolutionize the way farming is done and increase productivity while reducing costs. The Agricultural Drone Market is divided into three segments, which are fixed-wing, multi-rotor, and hybrid drones. Among these segments, the fixed-wing segment dominates the market in terms of revenue generation with a market share of 61.6% in the year 2020.

Consumers are aware of the advantages of using fixed-wing agricultural drones as compared to other segments. The fixed-wing drones have a longer range and endurance as compared to multi-rotor and hybrid drones. Moreover, fixed-wing drones can cover a larger area of land, offering greater efficiency and cost-effectiveness. These factors have led to a growing trend among farmers to adopt fixed-wing drones for their agricultural operations. The fixed-wing Agricultural Drone Market is expected to register the fastest growth rate over the forthcoming years. This is due to the increasing demand for drones that can map large areas of farmland and provide accurate data for soil, crop, and plant health assessment. The fixed-wing drones offer greater stability and longer flight times, making them ideal for such applications.

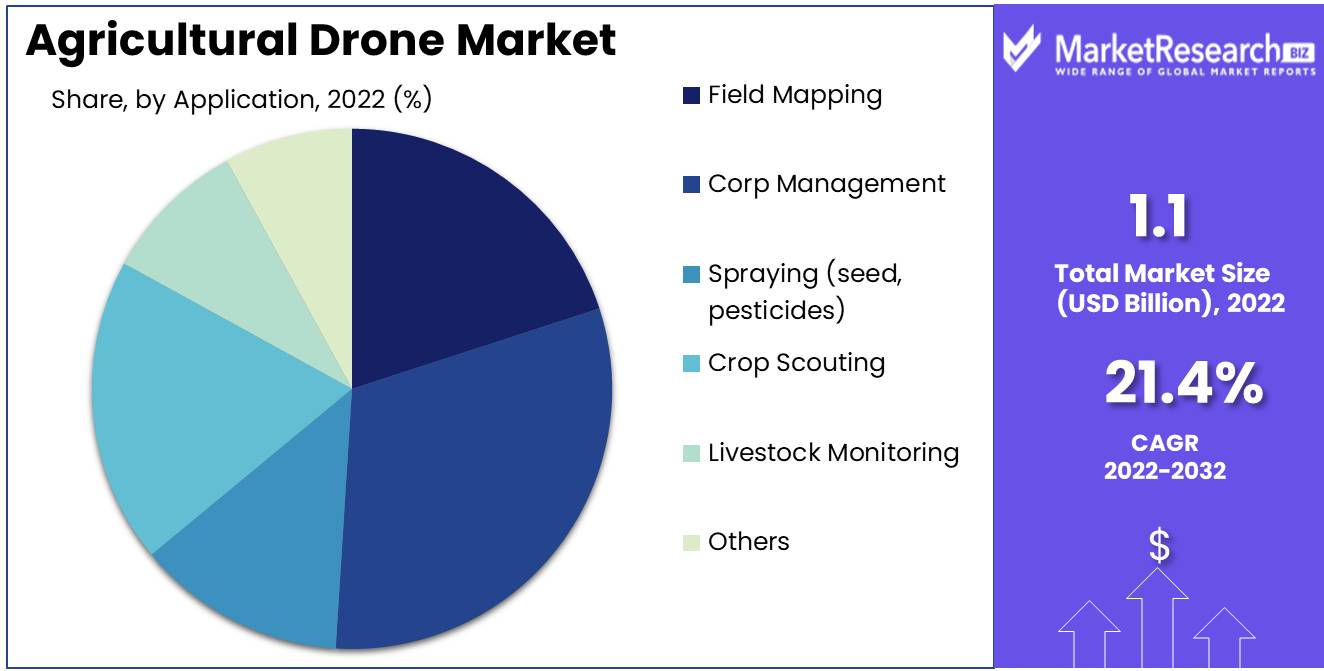

By Application Analysis

The Agricultural Drone Market is further divided into segments according to their use in farming operations. These segments are crop Management, irrigation, spraying, planting, and soil analysis. Among these segments, crop Management dominates the Agricultural Drone Market in terms of revenue generation with a market share of 40% in the year 2020.

There is a growing trend among farmers to adopt the use of crop Management drones. This is due to the better accuracy, efficiency, and cost-effectiveness offered by these drones. crop Management drones provide farmers with real-time data about their crops, including plant health, growth development, and yield estimation. This data helps farmers make informed decisions about nutrient and water management, pest control, and crop harvesting. The crop Management segment in the Agricultural Drone Market is expected to register the fastest growth rate over the forthcoming years. This is due to the increasing demand for monitoring and crop mapping services among farmers. crop Management drones offer greater efficiency and accuracy, providing farmers with real-time data that can help improve crop yields, quality, and returns on investment.

Key Market Segments

By Product

- Hardware

- Fixed-wing

- Rotary blade

- Hybrid

- Software

- Data management

- Imaging software

- Data analysis

- Others (flight management, flight monitoring, etc.)

By Application

- Field Mapping

- Corp Management

- Spraying (seed, pesticides)

- Crop Scouting

- Livestock Monitoring

- Others (leaf area indexing, phenology, tree classification, etc.)

Growth Opportunity

Expanding precision agriculture techniques and technologies

Precision agriculture is a method of cultivation that employs technology and data to optimize crop management, reduce waste, and boost productivity. With the aid of precision agricultural techniques, producers can make informed decisions regarding planting, irrigation, and harvesting. Drones can be used to capture high-resolution images and data of crops, which can then be analyzed to provide insightful information. Drones, for instance, can assist farmers in identifying areas that require additional care, such as those with low crop density, vegetation, or water stress. Utilizing drones for precision agriculture can help producers save time, reduce expenses, and increase yields.

Increasing dietary demand caused by population expansion

According to the United Nations, the world's population will reach 9.7 billion by 2050. This means that the demand for food will continue to rise, making it difficult for cultivators to produce more with fewer resources. Farmers can increase their productivity and efficacy with the assistance of drones, which provide them with real-time data and insights that enable them to make informed decisions. For instance, drones can be used to monitor crops and identify problem areas, allowing farmers to save time and increase yields.

Agricultural AI and IoT technology integration

In agriculture, the integration of artificial intelligence (AI) and the internet of things (IoT) is transforming agricultural practices. AI and IoT technologies allow producers to collect and analyze vast quantities of data, which can be used to make informed decisions and optimize crop management. The data collected by drones, such as temperature, humidity, and soil moisture, can be analyzed to provide valuable insights. The data collected by drones can be used to predict crop yields, identify optimal irrigation patterns, and optimize fertilizer applications, among other things.

Use of drones in irrigation management and water conservation

Water scarcity is a significant issue in agriculture, particularly in regions with limited precipitation. Drones can be used to monitor water levels in fields, identify areas that require more or less water, and detect irrigation system breaches. This can assist producers in conserving water and optimizing irrigation, thereby increasing crop yields and decreasing expenses. Drones can also be used to spray crops with water and pesticides, thereby reducing chemical use and conserving water.

Latest Trends

Use of multispectral imaging and hyperspectral sensors for crop analysis is increasing

In agriculture, multispectral imaging and hyperspectral sensors are increasingly used for crop analysis. Multispectral imaging entails the collection of data from various electromagnetic spectrum wavelengths, whereas hyperspectral sensors collect data from hundreds of different wavelengths. This information enables producers to identify agricultural health issues early on, thereby preventing crop failure and increasing yield.

Precision agriculture adoption of swarm technology

Swarm technology is the utilization of multiple drones operating in tandem to cover larger areas in less time. This technology is gaining popularity in precision agriculture as it enables producers to survey larger agricultural areas with greater speed and accuracy. Farmers can identify areas that require irrigation or fertilization with the aid of swarm technology, making the process more efficient and cost-effective.

Implementation of blockchain technology for supply chain management in agriculture

Supply chain management is becoming increasingly dependent on blockchain technology in agriculture. This technology enables producers to monitor their produce from the farm to the market. It aids in enhancing transparency and lowering the risk of fraud, which is especially important in international trade. With the aid of blockchain technology, producers can also identify supply chain processes that can be optimized, thereby increasing the industry's efficiency.

Use of machine learning algorithms to forecast agricultural yield

For crop yield prediction, machine learning algorithms are gaining popularity in the agriculture industry. These algorithms analyze data from multiple sources, including satellite imagery and meteorological data, to accurately predict crop yield. A precise yield forecast enables producers to make informed judgments regarding irrigation, fertilization, and pest management.

Software advancements for real-time data analysis and decision-making using drones.

As agriculture becomes increasingly dependent on technology, advancements in drone software are essential. In precision agriculture, real-time data analysis and decision making are becoming increasingly essential. With the aid of drone software, farmers are able to create precise maps of their fields, enabling them to rapidly identify problems and make well-informed decisions. Real-time data analysis also enables producers to monitor crops more effectively, thereby increasing crop yield and decreasing crop failure risk.

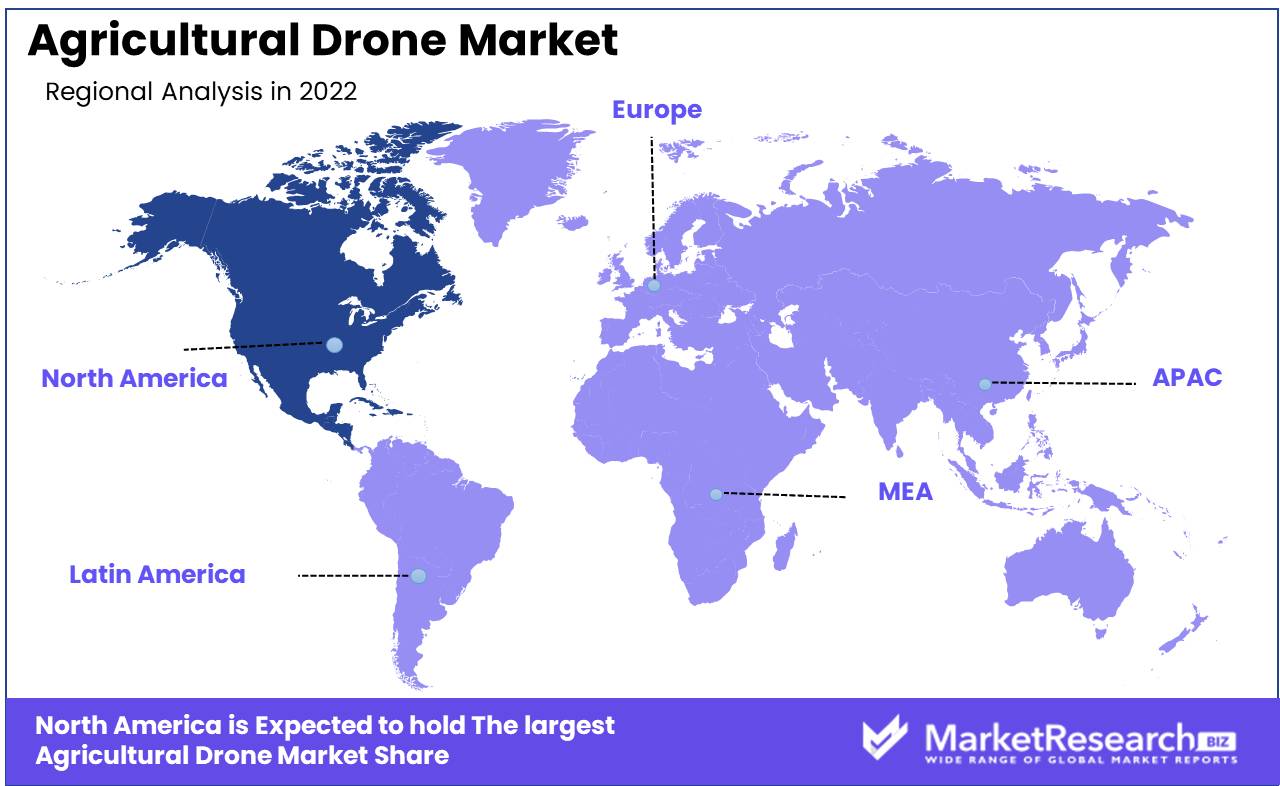

Regional Analysis

Our research has led us to conclude that North America has a significant market share owing to the high adoption rate of advanced farming technologies such as precision agriculture and supportive government policies. Precision agriculture is the use of technology to optimize crop yields and reduce waste by analyzing data collected from sensors and mapping tools. This technology has gained popularity in North America due to its ability to increase crop yields and reduce the use of pesticides and fertilizers, resulting in cost savings for farmers.

Additionally, North America's supportive government policies have helped to drive the adoption of these farming technologies. The U.S. Department of Agriculture (USDA) has invested heavily in precision agriculture research, resulting in the development of new technologies that improve farming practices. This has led to increased adoption rates among farmers who view these technologies as an investment in the future of their farms.

The adoption of precision agriculture technologies has also led to advancements in other areas of farming, such as robotics and automation. These technologies have helped to reduce labor costs and increase efficiency, leading to further cost savings for farmers.

North America's market share in farming technologies is further supported by the region's favorable climate conditions and extensive research facilities. The region's vast research and development infrastructure has led to the creation of new technologies that have helped to increase crop yields and reduce waste.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The agricultural drone market is expanding rapidly as drones continue to be employed for a variety of farming applications, including crop monitoring, mapping, sprinkling, and soil analysis. Numerous key actors have arisen in this industry, offering inventive, cutting-edge drone solutions to satisfy the requirements of both farmers and agricultural businesses.

DJI, a Chinese drone manufacturer that has made a reputation for itself in a variety of industries, is one of the top participants in this market. Agriculture-specific DJI drones include the AGRAS T20 and T30, which are capable of transporting large cargoes and spraying crops precisely. Another important participant is PrecisionHawk, which offers a variety of agriculture-specific drone technologies, such as the ubiquitous Lancaster and the fixed-wing Puma.

Yamaha, a Japanese company that has produced agricultural drones since the 1980s; Parrot, a French drone manufacturer that offers a variety of agricultural drones, such as the popular Disco-Pro AG and the Bebop-Pro Thermal; and Agribotix, an American drone company that offers the Enduro and the Agribotix Processing Solutions platform, are also notable players in the agricultural drone market.

Top Key Players in Agricultural Drone Market

- 3D Robotics Inc.

- AeroVironment

- AGCO Corp.

- AgEagle LLC

- Agribotix LLC

- AutoCopter Corp.

- Delair-Tech SAS

- DJI

- DroneDeploy

- Eagle UAV Services

Recent Development

- In October 2021, DJI Agriculture, a prominent manufacturer of agricultural drones, introduced the DJI Agras T20. The T20 is designed to apply pesticides and fertilizers more efficiently than other models, with greater coverage and accuracy. The T20 drone is anticipated to increase agricultural output and decrease the environmental impact of chemical sprinkling.

- In July 2021, AgEagle Aerial Systems announced a multi-year agreement with AeroVironment Inc. to develop new precision agriculture drone technology. The partnership intends to offer inventive drone-based services to farmers, including aerial imaging, mapping, and crop analysis.

- In January 2021, Sentera introduced its new High-Precision NDVI Single Sensor for drones. It precisely analyzes the chlorophyll content of plants, allowing farmers to make informed decisions regarding crop health and yield.

- In August 2020, DroneDeploy, a leader in drone software, partnered with John Deere to integrate their software with John Deere's operations center. This partnership enables farmers to rapidly access drone data such as crop estimates, plant health, and field maps, thereby enhancing their efficiency and output.

- In May 2020, Aerobotics, a South African drone startup, raised $17 million in order to expand its agricultural drone technology. Aerobotics will be able to enhance its technology, expand its offerings, and further develop its analytics software with these funds.

Report Scope

Report Features Description Market Value (2022) USD 1.1 Bn Forecast Revenue (2032) USD 7.0 Bn CAGR (2023-2032) 21.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product: Hardware, Fixed-wing, Rotary blade, Hybrid, Software, Data management, Imaging software, Data analysis, Others (flight management, flight monitoring, etc.)

By Application: Field Mapping, Corp Management, Spraying (seed, pesticides), Crop Scouting, Livestock Monitoring, Others (leaf area indexing, phenology, tree classification, etc.)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape 3D Robotics Inc., AeroVironment, AGCO Corp., AgEagle LLC, Agribotix LLC, AutoCopter Corp., Delair-Tech SAS, DJI, DroneDeploy, Eagle UAV Services Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- 3D Robotics Inc.

- AeroVironment

- AGCO Corp.

- AgEagle LLC

- Agribotix LLC

- AutoCopter Corp.

- Delair-Tech SAS

- DJI

- DroneDeploy

- Eagle UAV Services