Aesthetic Implants Market Forecast, Trend Analysis & Competition Tracking - Global Industry Insights 2015 to 2031

-

27515

-

May 2023

-

164

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Demand for aesthetic implants from 2015 to 2020 Vs Future Market Projections for 2021-2031

From 2015 to 2020, sales of aesthetic implants were significantly high, expanding at under 7% CAGR. Dentistry has made many improvements in oral health, such as modification of the implant surface, development of an alternative technique for complications, and reduced complexity for breast, dental, facial procedures, have been driving the majority of market growth.

The COVID-19 pandemic has promised new growth for the expanding healthcare sector. The total healthcare spending has increased to reach USD 8.3 trillion in 2020 and is further expected to grow more and reach USD 8.8 trillion in 2021. From 2021 to 2031, demand is likely to expand at a CAGR exceeding 8% as people focus more on their appearance and increasing interest in retaining youth and beauty.

Global Aesthetic Implants Market Revenue Outlook:

The global aesthetic implants market was valued at US$ 2.2 Bn in 2018 and is projected to register а САGR of 8% by 2031.

Nonetheless, various industry players in the global aesthetic implants market are now increasing their focus towards the establishment of successful collaborations, acquisitions, and joint venture activities as a means to enhance their respective customer bases. In doing so, these players are also increasing their supply capabilities to meet customer requirements on a local and global scale. This factor, paired with promising industrialization prospects in developing economies of the Asia-Pacific region, such as China, India, Taiwan, Indonesia, etc., are expected to create massive business opportunities for key players over the forecast period.

How is Demand for aesthetic surgery increasing aesthetic Implants sales?

Aesthetic surgery or cosmetic surgery is performed to improve an individual's appearance of their face and body. According to the American Society of Plastic Surgeons' recent report published in 2020, the number of cosmetic surgical procedures increased by approximately 7.4% in 2020 vas compared to 2019.

During the first wave of the pandemic, the demand for facial procedures has upsurged due to the given downtime for recovery at home. The national survey findings show that tummy tucks (22%) and liposuction (17%) are among the top procedures are the most likely procedures considered by women during the Q2 and Q3 of 2020. This is attributed to weight fluctuation during quarantine and reconsideration for such procedures that were long-delayed due to time or cost.

Top 5 Cosmetic Surgical Procedures Performed In 2020:

- Nose reshaping – 352,555 procedures

- Eyelid surgery – 352,112 procedures

- Facelift– 234,374 procedures

- Liposuction – 211,067 procedures

- Breast augmentation – 193,073 procedures

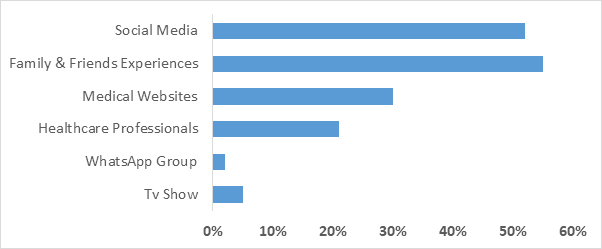

High Influence Of Social Media And Glamorous World To Fuel The Growth Of The Global Aesthetic Implants Market

Social media is an electronic platform that promotes information to targeted users/audiences. These platforms play a critical role in fostering aesthetic procedures, especially during COVID, when Facebook, Instagram, and others were among the most popular apps. Various social media platforms enable high-profile celebrities to share their everyday personal lives via images, videos, and daily blogs, thus increasing the demand for numerous aesthetic procedures as people wanted to be the perfect version of themselves.

The American Society Of Plastic Surgeons Recent Survey Findings – The Best Source Of Information For Aesthetic Procedures:

To learn more about this report, request for sample report

What Are The Key Challenges To Market Expansion For Players In The Aesthetic Implants Market?

A significant challenge expected to hamper sales of aesthetic implants is that the rules and regulations differ from country to country. The regulatory environment is ever-changing due to increasing development costs and times and market pressures impacting medical devices and the pharmaceuticals sector. The differences in the regulations of different countries are driven by numerous economic, legal, or political factors, thus limiting market growth.

However, certain players are attempting to expand their business in overseas markets to expand their geographical footprint, widening expansion prospects.

Country-wise Analysis

How Is The Growing Popularity Of Aesthetic Implants Sales In The US?

The market for aesthetic implants in the US is likely to expand at under 8.5% CAGR until 2031. Increasing preference among youth to look 'good' is attributed as the region's key growth driver.

The International Society Of Aesthetic Plastic Surgery (ISAPS) Survey Of 2020 Findings - Top Five Countries That Perform The Most Cosmetic Surgeries And Procedures:

Position Country Total procedures (Approximately) 1 USA 4361867 2 Brazil 2267405 3 Mexico 1043247 4 Germany 922056 5 India 895896 To learn more about this report, request for sample report

Why Is Demand For Aesthetic Implants High In Brazil?

Brazil ranks only second after the US for the most cosmetic procedures performed in the year. Brazilian aesthetic surgeons are world-renowned as the best in cosmetic surgery, owing to new techniques in cosmetic surgery and the low cost of procedures. Brazil has developed into one of the world's top destinations for medical tourism.

- According to the International Society of Aesthetic Plastic Surgery (ISAPS) recent survey, ~392,530 breast augmentations are performed every year.

Why Are Breast Implants More Preferred?

By type, demand for breast implants is likely to witness an impressive incline, at a staggering 13.4% CAGR until 2031, owing to an increased mortality rate of breast cancer in low- and mid-income countries. According to the World health organization (WHO), In 2020, there were 2.3 million women diagnosed with breast cancer and 685,000 deaths globally.

Competitive Landscape

The aesthetic implants landscape appears highly consolidated, with a major chunk of it being dominated by US players.

- Surgiform Technologies LLC.

- Allergan

- Polytech Health & Aesthetics GmbH

- Mentor Worldwide LLC

- Sientra, Inc.

- GC Aesthetics

- Dentsply Sirona

- Institut Straumann AG

- Johnson & Johnson

- Other Players

Some notable developments in the market include:

- In Oct 2020, Ireland-based GC Aesthetics Ltd. launched PERLE – a new novel round breast implant. The implants are developed with reverse surface technology, allowing for reduced inflammation, easier placement, incision, and lower risk of capsular contracture.

- In Sept 2020, Germany-based POLYTECH Health & Aesthetics GmbH launched B-Lite® portfolio, the world's first and only lightweight breast implants. B-Lite® breast implants have many unique advantages for women, with quicker recovery and reduced post-operative pain, enabling patients to resume their daily routine quickly.

Report Scope

- Forecast Period: 2022-2031

- Actual Year: 2021

- Historical Data Available for: 2015-2020

Key Regions Covered

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Key Segments Covered

Aesthetic Implant Market, By Type

- Breast Implants

- Dental Implants

- Facial Implants

- Other Types

Aesthetic Implant Market, By Raw Material

- Metals

- Ceramics

- Polymers

- Biomaterials

Aesthetic Implant Market, By End Users

- Hospitals

- Specialty Clinics

Attribute Report Details Market Size Ask For Market Size Growth Rate Ask For Growth Rate Key Companies Ask For Companies Report Coverage Revenue analysis, Competitive landscape, Key company analysis, Market Trends, Key segments, Distribution Channel, Market Dynamics, COVID-19 Impact Analysis and more… Historical Data Period 2015-2020 Base Year 2022 Forecast Period 2022-2031 Region Scope North America, Europe, Asia-Pacific, South America, Middle East & Africa Country Scope United States, Canada and Mexico, Germany, France, UK, Russia and Italy, China, Japan, Korea, India and Southeast Asia, Brazil, Argentina, Colombia etc.Saudi Arabia, UAE, Egypt, Nigeria and South Africa Revenue in US$ Mn To learn more about this report, request for sample report

-

-

- Surgiform Technologies LLC.

- Allergan

- Polytech Health & Aesthetics GmbH

- Mentor Worldwide LLC

- Sientra, Inc.

- GC Aesthetics

- Dentsply Sirona

- Institut Straumann AG

- Johnson & Johnson

- Other Players