Aerospace Adhesives And Sealants Market By Sealants Resin (Silicone, Polysulfide, Others), By Adhesive Resin (Polyurethane, Epoxy, Others), By Aircraft (Military, Commercial, Others), By User Type (OEM, MRO), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

50039

-

August 2024

-

300

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

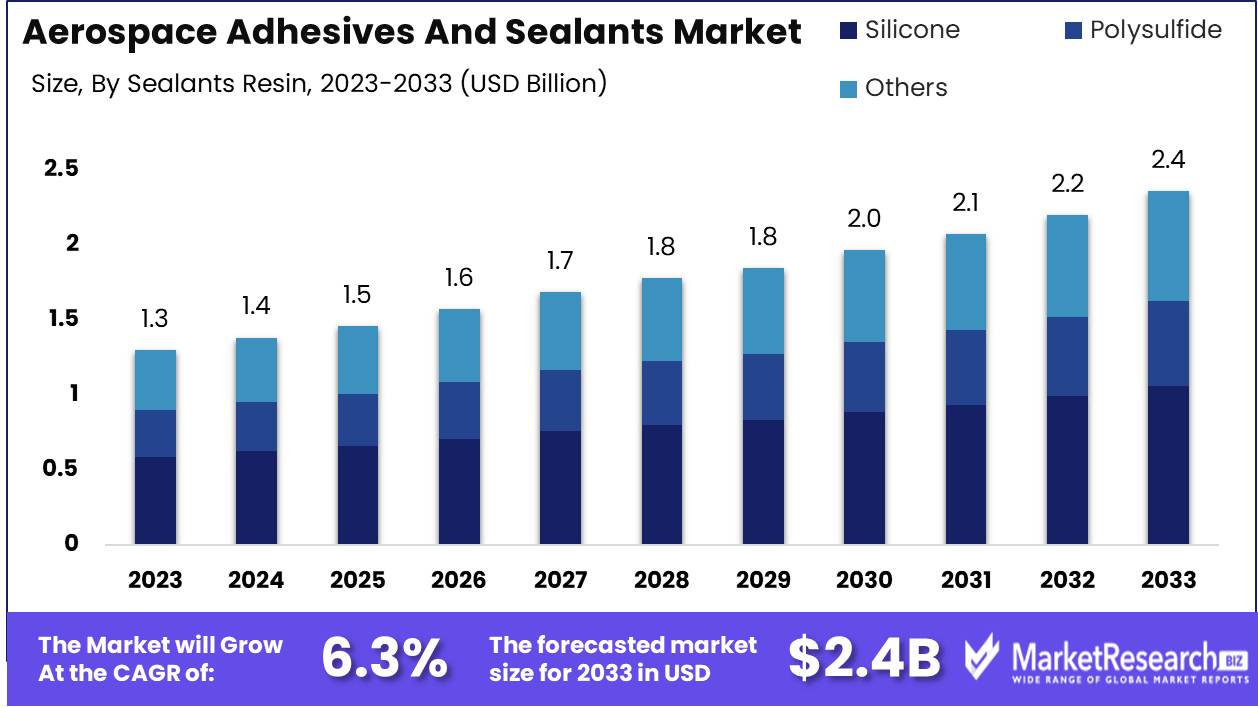

The Aerospace Adhesives And Sealants Market was valued at USD 1.3 billion in 2023. It is expected to reach USD 2.4 billion by 2033, with a CAGR of 6.3% during the forecast period from 2024 to 2033.

The Aerospace Adhesives and Sealants Market encompasses specialized materials designed for bonding and sealing applications in the aerospace industry. These products are critical for ensuring structural integrity, weight reduction, and enhanced performance of aircraft components. Innovations in adhesives and sealants contribute to advancements in fuel efficiency, durability, and safety standards of modern aircraft. The market is driven by increasing aircraft production, rising demand for lightweight materials, and stringent regulatory requirements.

The aerospace adhesives and sealants market is poised for robust growth, driven by several key factors. One of the primary drivers is the increased production of aircraft, both commercial and military, to meet rising global demand for air travel and defense capabilities. This surge in aircraft manufacturing necessitates advanced adhesives and sealants to ensure structural integrity and performance. Technological advancements further propel the market, as innovations in material science enhance the properties of adhesives and sealants, offering better durability, flexibility, and resistance to extreme environmental conditions.

However, the market faces challenges, notably stringent regulatory requirements that mandate rigorous testing and certification processes. Compliance with these regulations is essential but can also increase costs and extend product development timelines.

Additionally, the volatility in raw material prices poses a significant risk to market stability, potentially affecting manufacturer profit margins. Despite these challenges, the push towards sustainable solutions presents new opportunities. The aerospace industry increasingly prioritizes eco-friendly materials to reduce environmental impact, driving demand for adhesives and sealants that meet sustainability criteria. Manufacturers investing in green technologies will likely gain a competitive edge as they align with the broader industry trend toward environmental responsibility. Overall, while the aerospace adhesives and sealants market faces several hurdles, it is well-positioned for growth, supported by technological innovations, regulatory compliance, and a shift towards sustainable practices.

Key Takeaways

- Market Growth: The Aerospace Adhesives And Sealants Market was valued at USD 1.3 billion in 2023. It is expected to reach USD 2.3 billion by 2033, with a CAGR of 6.3% during the forecast period from 2024 to 2033.

- By Sealants Resin: Silicone dominated aerospace sealants for its superior stability and flexibility.

- By Adhesive Resin: Polyurethane-dominated aerospace adhesives with superior flexibility and durability.

- By Aircraft: The Military segment dominated the Aerospace Adhesives and Sealants market.

- By User Type: OEMs dominated the Aerospace Adhesives and Sealants market.

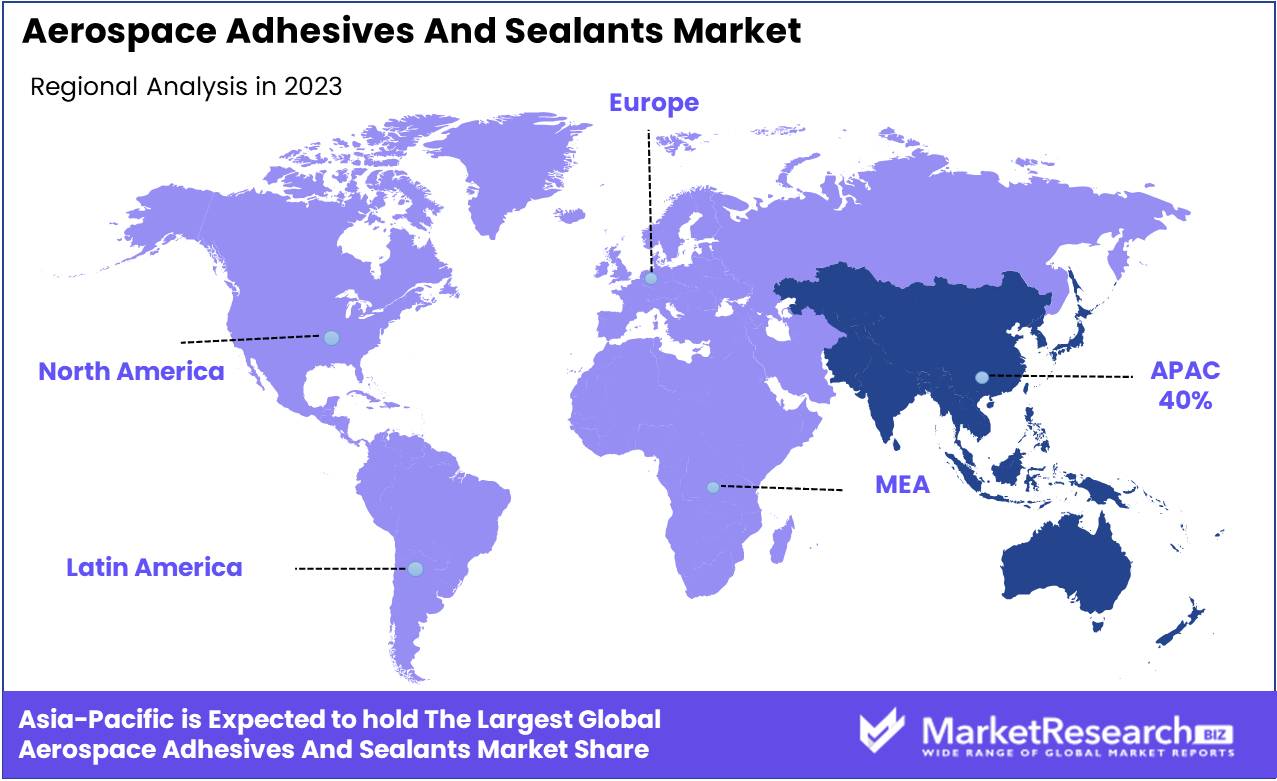

- Regional Dominance: Asia Pacific dominates aerospace adhesives and sealants market, projected at 40% by 2025.

- Growth Opportunity: The global aerospace adhesives and sealants market is set for robust growth, driven by the expansion of the commercial aviation sector and groundbreaking technological innovations.

Driving factors

Growing Demand for Air Travel Fueling Expansion in the Aerospace Adhesives and Sealants Market

The demand for air travel has been steadily increasing, driven by factors such as globalization, economic growth, and rising disposable incomes. According to the International Air Transport Association (IATA), global passenger traffic is expected to double over the next 20 years, creating a significant boost in the aviation sector. This surge in air travel necessitates the production of more aircraft, thereby increasing the demand for aerospace adhesives and sealants. These materials are crucial for ensuring the structural integrity and longevity of aircraft, which must withstand extreme conditions during flight. Consequently, the escalating need for air travel directly correlates with heightened demand for aerospace adhesives and sealants, supporting market growth.

Rising Aircraft Deliveries Accelerating Market Growth for Aerospace Adhesives and Sealants

The aviation industry's robust order book, reflecting a steady increase in aircraft deliveries, significantly drives the aerospace adhesives and sealants market. Major aircraft manufacturers, such as Boeing and Airbus, have reported record backlogs, with projections indicating the delivery of thousands of new aircraft over the next two decades. This trend is fueled by the need to replace aging fleets and expand existing ones to accommodate growing passenger numbers and cargo volumes. The continuous influx of new aircraft deliveries necessitates a substantial supply of adhesives and sealants for assembly and maintenance.

Consequently, the steady rise in aircraft deliveries directly boosts the market for aerospace adhesives and sealants, as these products are essential for manufacturing and sustaining aircraft performance and safety.

Increasing Penetration of Lightweight Composite Materials Driving Demand for Aerospace Adhesives and Sealants

The aerospace industry is increasingly adopting lightweight composite materials to enhance fuel efficiency and reduce carbon emissions. Composite materials, such as carbon fiber reinforced polymers (CFRP), offer superior strength-to-weight ratios compared to traditional materials like aluminum and steel. The growing use of these advanced materials necessitates specialized adhesives and sealants designed to bond and seal composites effectively. This shift towards lightweight materials is not only driven by regulatory pressures to meet environmental standards but also by the economic benefits of reduced operational costs. The increasing penetration of lightweight composite materials in aircraft manufacturing significantly boosts the demand for aerospace adhesives and sealants, as these products are integral to the assembly and maintenance of composite structures.

Restraining Factors

High Costs Associated with Research and Development of Aerospace Adhesives and Sealants

The aerospace adhesives and sealants market is significantly impacted by the high costs associated with research and development (R&D). Developing advanced adhesives and sealants that meet stringent aerospace industry standards requires substantial investment in R&D. This includes costs for material research, testing, certification, and compliance with regulatory standards. According to industry estimates, companies often allocate a considerable portion of their revenue to R&D activities to ensure the performance, durability, and safety of their products in aerospace applications.

These high R&D costs can act as a restraining factor by limiting the entry of new players into the market and reducing the frequency of innovation. Established companies with robust financial capabilities can manage these costs, but smaller firms may struggle, leading to less competition and potentially higher prices for end-users. Furthermore, the time-consuming nature of the R&D process can delay the introduction of new products to the market, slowing overall market growth.

Increasing Preference for Mechanical Fasteners Over Adhesives in Certain Applications

Another significant restraining factor for the aerospace adhesives and sealants market is the increasing preference for mechanical fasteners over adhesives in certain applications. Mechanical fasteners, such as bolts and rivets, are often favored for their reliability and ease of inspection, especially in critical structural components. This preference is driven by the long-standing familiarity with mechanical fasteners in the aerospace industry and their proven track record of performance under extreme conditions.

The preference for mechanical fasteners is particularly evident in applications where disassembly for maintenance, repair, or inspection is required. Adhesives, while offering benefits such as weight reduction and improved aerodynamics, may not always provide the same level of assurance in these scenarios. This has led to a slower adoption rate of adhesives and sealants in certain segments of the aerospace industry.

By Sealants Resin Analysis

In 2023, Silicone dominated aerospace sealants for its superior stability and flexibility.

In 2023, Silicone held a dominant market position in the sealants resin segment of the aerospace adhesives and sealants market. This can be attributed to silicone's superior thermal stability, flexibility, and resistance to harsh environmental conditions, which are critical in aerospace applications. Silicone sealants are particularly valued for their ability to maintain performance characteristics across a wide temperature range, which is essential for aircraft that experience significant temperature fluctuations during operation.

Polysulfide, another key resin in this segment, is renowned for its excellent fuel and chemical resistance. Its application is pivotal in fuel tanks and systems where exposure to aviation fuels and hydraulic fluids is frequent. Despite its lower market share compared to silicone, polysulfide remains a crucial material for specific aerospace sealant applications due to its durability and resistance properties.

The 'Others' category encompasses a range of alternative resins, including polyurethane and epoxy. These materials are often selected for their specific properties, such as high mechanical strength and bonding capabilities. While not as dominant as silicone or polysulfide, these resins provide tailored solutions for unique aerospace sealant requirements, contributing to the overall market diversity and functionality.

By Adhesive Resin Analysis

In 2023, Polyurethane dominated aerospace adhesives with superior flexibility and durability.

In 2023, Polyurethane held a dominant market position in the adhesive resin segment of the Aerospace Adhesives and Sealants Market. Known for its exceptional flexibility, durability, and resistance to environmental factors, polyurethane adhesives are extensively utilized in various aerospace applications. Their ability to withstand high stress and provide strong bonding on a range of substrates makes them a preferred choice for aircraft manufacturing and maintenance.

Epoxy adhesives, another crucial segment, are valued for their superior mechanical properties and excellent chemical resistance. These characteristics make them ideal for structural applications where high strength and long-term durability are critical. Epoxies are widely used in bonding components such as wings, fuselages, and other critical parts of an aircraft.

The "Others" category encompasses various adhesive types, including silicone, acrylic, and cyanoacrylate, each catering to specific niche applications within the aerospace industry. Silicone adhesives, for example, are known for their high-temperature resistance and flexibility, making them suitable for sealing and gasketing applications. As aerospace technologies advance, the demand for specialized adhesive solutions continues to grow, driving innovation and diversification within this market segment.

By Aircraft Analysis

In 2023, The Military segment dominated the Aerospace Adhesives and Sealants market.

In 2023, The Military segment held a dominant market position in the By Aircraft segment of the Aerospace Adhesives and Sealants Market. This dominance is driven by the high demand for advanced adhesive and sealant solutions in military aircraft manufacturing and maintenance. Military aircraft, including fighters, transporters, and unmanned aerial vehicles (UAVs), require robust and durable materials to withstand extreme operational conditions. The sector's significant budget allocations and ongoing modernization programs further propel the market growth.

In the Commercial segment, the market is buoyed by the rapid expansion of the global aviation industry. The growing fleet of commercial aircraft and the surge in air travel demand drive the need for reliable and lightweight adhesive solutions. Airlines and manufacturers prioritize fuel efficiency and operational cost reduction, which spurs the adoption of advanced adhesives and sealants.

The Others segment, encompassing general aviation and spacecraft, sees moderate growth. Innovations in adhesive technologies and the increasing use of drones in various sectors contribute to this segment's development. However, its market share remains smaller compared to the military and commercial segments due to the relatively lower production volumes.

By User Type Analysis

In 2023, OEMs dominated the Aerospace Adhesives and Sealants market.

In 2023, The OEM (Original Equipment Manufacturer) segment held a dominant market position in the Aerospace Adhesives and Sealants market by user type. This dominance can be attributed to the rising production of new aircraft to meet the surging global demand for air travel and cargo transportation. OEMs, being primary manufacturers of aircraft, significantly drive the demand for advanced adhesives and sealants that meet stringent performance and safety standards. The adoption of lightweight materials and innovative manufacturing processes has further amplified the need for specialized adhesives and sealants, essential for enhancing fuel efficiency and structural integrity.

Conversely, the MRO (Maintenance, Repair, and Overhaul) segment also plays a crucial role in the aerospace adhesives and sealants market. With the aging fleet of existing aircraft and the emphasis on extending their operational lifespan, the MRO sector is experiencing steady growth. Adhesives and sealants are pivotal in maintenance activities, ensuring the reliability and safety of aircraft. The ongoing need for regular maintenance, repairs, and overhauls to comply with stringent regulatory standards ensures consistent demand within the MRO segment.

Key Market Segments

By Sealants Resin

- Silicone

- Polysulfide

- Others

By Adhesive Resin

- Polyurethane

- Epoxy

- Others

By Aircraft

- Military

- Commercial

- Others

By User Type

- OEM

- MRO

Growth Opportunity

Expansion of the Commercial Aviation Sector as a Key Driver

The global aerospace adhesives and sealants market is poised for substantial growth, driven primarily by the expansion of the commercial aviation sector. With the global economy recovering and travel restrictions easing, the demand for commercial aircraft is increasing. This surge is not just a return to pre-pandemic levels but an expansion fueled by rising middle-class populations in emerging markets and increased air travel frequency in developed regions. Major airlines are placing significant orders for new, more efficient aircraft, which in turn boosts the demand for advanced adhesives and sealants used in aircraft assembly and maintenance. This expansion is a critical growth driver, as modern aircraft require lightweight, durable, and high-performance materials to meet stringent safety and efficiency standards.

Technological Innovations Transforming the Market Landscape

Technological innovations are set to transform the aerospace adhesives and sealants market, offering new growth opportunities. Advances in material science have led to the development of next-generation adhesives and sealants that provide superior bonding strength, flexibility, and resistance to extreme temperatures and chemicals. For instance, the introduction of nanotechnology-enhanced adhesives offers improved performance characteristics, crucial for the high-stress environments of aerospace applications.

Additionally, innovations in manufacturing processes, such as automated application techniques and 3D printing, are streamlining production and reducing waste, thereby lowering costs and improving efficiency. These technological advancements are not only enhancing the performance of aerospace adhesives and sealants but also expanding their application scope, including in new aircraft designs and maintenance, repair, and overhaul (MRO) services.

Latest Trends

Increasing Demand for Environmentally Sustainable and Eco-Friendly Products

The aerospace adhesives and sealants market is poised to see a significant shift towards environmentally sustainable and eco-friendly products. As regulatory pressures mount globally, aerospace manufacturers are increasingly seeking adhesives and sealants that comply with stringent environmental standards. This trend is driven by both regulatory mandates and a growing awareness of environmental impacts among consumers and industry stakeholders. Products that are free from volatile organic compounds (VOCs) and hazardous air pollutants (HAPs) are gaining traction. Furthermore, the development and adoption of bio-based adhesives and sealants, which offer a lower carbon footprint without compromising performance, are expected to accelerate.

Rising Incorporation of Technology to Improve Product Quality and Efficiency

Technological advancements are playing a pivotal role in enhancing the quality and efficiency of aerospace adhesives and sealants. The incorporation of cutting-edge technologies such as nanotechnology, artificial intelligence (AI), and advanced analytics is expected to drive significant improvements in product performance. Nanotechnology, for instance, enables the development of adhesives with superior bonding properties, increased resistance to extreme temperatures, and enhanced durability. AI and machine learning algorithms are being leveraged to optimize formulations, predict performance outcomes, and streamline manufacturing processes, leading to reduced waste and improved consistency. These technological innovations not only enhance the functional properties of adhesives and sealants but also contribute to cost efficiencies and sustainable production practices.

Regional Analysis

Asia Pacific dominates aerospace adhesives and sealants market, projected at 40% by 2025.

The aerospace adhesives and sealants market exhibits regional variances driven by differing industrial capacities, technological advancements, and economic conditions. North America, dominated by the United States, holds a significant market share due to its robust aerospace sector, advanced manufacturing technologies, and high defense expenditure. In 2023, North America accounted for approximately 35% of the global market. Europe follows closely, with key contributors like Germany, France, and the UK benefiting from a strong presence of leading aerospace manufacturers and continuous innovations in aircraft technologies. The region commands roughly 25% of the market share.

Asia Pacific emerges as the dominant region, projected to capture over 40% of the market by 2025. This growth is propelled by rapid industrialization, increasing investments in aerospace infrastructure, and expanding commercial aviation sectors in countries such as China, India, and Japan. Notably, China’s aerospace industry is witnessing unprecedented growth, bolstered by government initiatives and the rising demand for air travel.

The Middle East & Africa region, though smaller in market size, is growing steadily due to increasing investments in aerospace infrastructure, especially in the Gulf Cooperation Council (GCC) countries. Latin America shows moderate growth, driven by expanding commercial aviation and maintenance, repair, and overhaul (MRO) activities, particularly in Brazil and Mexico.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Aerospace Adhesives and Sealants market is witnessing robust growth in 2024, driven by increasing demand for lightweight, durable, and high-performance materials in the aerospace industry. Key players such as H.B. Fuller Company, Henkel Corporation, 3M, and PPG Industries Inc. are at the forefront, leveraging their extensive R&D capabilities to innovate and develop advanced adhesive and sealant solutions.

H.B. Fuller Company continues to emphasize sustainability and innovation, focusing on eco-friendly products that comply with stringent aerospace regulations. Henkel Corporation, known for its broad portfolio and strong market presence, is investing heavily in smart adhesive technology, enhancing product performance and reliability.

3M remains a significant player, benefiting from its diversified product range and strong global distribution network. PPG Industries Inc. is capitalizing on its expertise in coatings and materials, offering integrated solutions that improve fuel efficiency and reduce maintenance costs.

Huntsman International LLC and Cytec Solvay Group are notable for their advanced composites and adhesive technologies, catering to the evolving needs of next-generation aircraft. Dowdupont and Bostik are focusing on strategic partnerships and acquisitions to strengthen their market positions and expand their product offerings.

Lord Corporation, now part of Parker Hannifin Corp, continues to innovate with its vibration and motion control technologies, while Hexcel Corporation and Arkema Group are pushing the boundaries in thermoplastic composites and specialty chemicals, respectively.

Avery Dennison Corporation, Beacon Adhesives Inc., and Chemique Adhesives & Sealants Ltd are enhancing their market presence through strategic expansions and product diversification. DELO Industrie Klebstoffe GmbH & Co. KGaA and Illinois Tool Works Inc. are emphasizing precision and performance, catering to high-demand applications in the aerospace sector.

In conclusion, the competitive landscape of the aerospace adhesives and sealants market in 2024 is characterized by a strong focus on innovation, sustainability, and strategic growth, with key players leveraging their strengths to capture market share and drive industry advancements.

Market Key Players

- H.B. Fuller Company

- Henkel Corporation

- 3M

- PPG Industries Inc.

- Huntsman International LLC

- Cytec Solvay Group

- Dowdupont

- Bostik

- Lord Corporation (Parker Hannifin Corp)

- Hexcel Corporation

- Arkema Group

- Avery Dennison Corporation

- Beacon Adhesives Inc.

- Chemique Adhesives & Sealants Ltd

- DELO Industrie Klebstoffe GmbH & Co. KGaA

- Illinois Tool Works Inc.

Recent Development

- In June 2024, PPG Industries introduced a revolutionary aerospace sealant that significantly reduces curing time while maintaining high-performance standards. This innovation is expected to streamline the aircraft assembly process, reducing production lead times and costs. PPG's new sealant technology also emphasizes sustainability, with lower volatile organic compound (VOC) emissions compared to traditional products.

- In May 2024, 3M announced the expansion of its aerospace adhesives and sealants production facility in Minnesota, USA. This expansion is part of 3M's strategic plan to meet the growing global demand for advanced aerospace materials. The new facility will focus on producing next-generation sealants that provide superior performance in extreme conditions, contributing to the safety and longevity of modern aircraft.

- In April 2024, Henkel launched a new range of high-performance adhesives specifically designed for aerospace applications. These adhesives offer enhanced thermal resistance and improved bonding strength, catering to the increasing demand for lightweight materials in aircraft manufacturing. The new product line aims to support the aerospace industry's shift towards more fuel-efficient and environmentally friendly aircraft.

Report Scope

Report Features Description Market Value (2023) USD 1.3 Billion Forecast Revenue (2033) USD 2.4 Billion CAGR (2024-2032) 6.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Sealants Resin (Silicone, Polysulfide, Others), By Adhesive Resin (Polyurethane, Epoxy, Others), By Aircraft (Military, Commercial, Others), By User Type (OEM, MRO) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape H.B. Fuller Company, Henkel Corporation, 3M, PPG Industries Inc., Huntsman International LLC, Cytec Solvay Group, Dowdupont, Bostik, Lord Corporation (Parker Hannifin Corp), Hexcel Corporation, Arkema Group, Avery Dennison Corporation, Beacon Adhesives Inc., Chemique Adhesives & Sealants Ltd, DELO Industrie Klebstoffe GmbH & Co. KGaA, Illinois Tool Works Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Aerospace Adhesives And Sealants Market Overview

- 2.1. Aerospace Adhesives And Sealants Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Aerospace Adhesives And Sealants Market Dynamics

- 3. Global Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Aerospace Adhesives And Sealants Market Analysis, 2016-2021

- 3.2. Global Aerospace Adhesives And Sealants Market Opportunity and Forecast, 2023-2032

- 3.3. Global Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Sealants Resin, 2016-2032

- 3.3.1. Global Aerospace Adhesives And Sealants Market Analysis by Sealants Resin: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Sealants Resin, 2016-2032

- 3.3.3. Silicone

- 3.3.4. Polysulfide

- 3.3.5. Others

- 3.4. Global Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Adhesive Resin, 2016-2032

- 3.4.1. Global Aerospace Adhesives And Sealants Market Analysis by Adhesive Resin: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Adhesive Resin, 2016-2032

- 3.4.3. Polyurethane

- 3.4.4. Epoxy

- 3.4.5. Others

- 3.5. Global Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Aircraft, 2016-2032

- 3.5.1. Global Aerospace Adhesives And Sealants Market Analysis by Aircraft: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Aircraft, 2016-2032

- 3.5.3. Military

- 3.5.4. Commercial

- 3.5.5. Others

- 3.6. Global Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By User Type, 2016-2032

- 3.6.1. Global Aerospace Adhesives And Sealants Market Analysis by User Type: Introduction

- 3.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By User Type, 2016-2032

- 3.6.3. OEM

- 3.6.4. MRO

- 4. North America Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Aerospace Adhesives And Sealants Market Analysis, 2016-2021

- 4.2. North America Aerospace Adhesives And Sealants Market Opportunity and Forecast, 2023-2032

- 4.3. North America Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Sealants Resin, 2016-2032

- 4.3.1. North America Aerospace Adhesives And Sealants Market Analysis by Sealants Resin: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Sealants Resin, 2016-2032

- 4.3.3. Silicone

- 4.3.4. Polysulfide

- 4.3.5. Others

- 4.4. North America Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Adhesive Resin, 2016-2032

- 4.4.1. North America Aerospace Adhesives And Sealants Market Analysis by Adhesive Resin: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Adhesive Resin, 2016-2032

- 4.4.3. Polyurethane

- 4.4.4. Epoxy

- 4.4.5. Others

- 4.5. North America Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Aircraft, 2016-2032

- 4.5.1. North America Aerospace Adhesives And Sealants Market Analysis by Aircraft: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Aircraft, 2016-2032

- 4.5.3. Military

- 4.5.4. Commercial

- 4.5.5. Others

- 4.6. North America Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By User Type, 2016-2032

- 4.6.1. North America Aerospace Adhesives And Sealants Market Analysis by User Type: Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By User Type, 2016-2032

- 4.6.3. OEM

- 4.6.4. MRO

- 4.7. North America Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.7.1. North America Aerospace Adhesives And Sealants Market Analysis by Country : Introduction

- 4.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.7.2.1. The US

- 4.7.2.2. Canada

- 4.7.2.3. Mexico

- 5. Western Europe Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Aerospace Adhesives And Sealants Market Analysis, 2016-2021

- 5.2. Western Europe Aerospace Adhesives And Sealants Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Sealants Resin, 2016-2032

- 5.3.1. Western Europe Aerospace Adhesives And Sealants Market Analysis by Sealants Resin: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Sealants Resin, 2016-2032

- 5.3.3. Silicone

- 5.3.4. Polysulfide

- 5.3.5. Others

- 5.4. Western Europe Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Adhesive Resin, 2016-2032

- 5.4.1. Western Europe Aerospace Adhesives And Sealants Market Analysis by Adhesive Resin: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Adhesive Resin, 2016-2032

- 5.4.3. Polyurethane

- 5.4.4. Epoxy

- 5.4.5. Others

- 5.5. Western Europe Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Aircraft, 2016-2032

- 5.5.1. Western Europe Aerospace Adhesives And Sealants Market Analysis by Aircraft: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Aircraft, 2016-2032

- 5.5.3. Military

- 5.5.4. Commercial

- 5.5.5. Others

- 5.6. Western Europe Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By User Type, 2016-2032

- 5.6.1. Western Europe Aerospace Adhesives And Sealants Market Analysis by User Type: Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By User Type, 2016-2032

- 5.6.3. OEM

- 5.6.4. MRO

- 5.7. Western Europe Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.7.1. Western Europe Aerospace Adhesives And Sealants Market Analysis by Country : Introduction

- 5.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.7.2.1. Germany

- 5.7.2.2. France

- 5.7.2.3. The UK

- 5.7.2.4. Spain

- 5.7.2.5. Italy

- 5.7.2.6. Portugal

- 5.7.2.7. Ireland

- 5.7.2.8. Austria

- 5.7.2.9. Switzerland

- 5.7.2.10. Benelux

- 5.7.2.11. Nordic

- 5.7.2.12. Rest of Western Europe

- 6. Eastern Europe Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Aerospace Adhesives And Sealants Market Analysis, 2016-2021

- 6.2. Eastern Europe Aerospace Adhesives And Sealants Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Sealants Resin, 2016-2032

- 6.3.1. Eastern Europe Aerospace Adhesives And Sealants Market Analysis by Sealants Resin: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Sealants Resin, 2016-2032

- 6.3.3. Silicone

- 6.3.4. Polysulfide

- 6.3.5. Others

- 6.4. Eastern Europe Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Adhesive Resin, 2016-2032

- 6.4.1. Eastern Europe Aerospace Adhesives And Sealants Market Analysis by Adhesive Resin: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Adhesive Resin, 2016-2032

- 6.4.3. Polyurethane

- 6.4.4. Epoxy

- 6.4.5. Others

- 6.5. Eastern Europe Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Aircraft, 2016-2032

- 6.5.1. Eastern Europe Aerospace Adhesives And Sealants Market Analysis by Aircraft: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Aircraft, 2016-2032

- 6.5.3. Military

- 6.5.4. Commercial

- 6.5.5. Others

- 6.6. Eastern Europe Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By User Type, 2016-2032

- 6.6.1. Eastern Europe Aerospace Adhesives And Sealants Market Analysis by User Type: Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By User Type, 2016-2032

- 6.6.3. OEM

- 6.6.4. MRO

- 6.7. Eastern Europe Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.7.1. Eastern Europe Aerospace Adhesives And Sealants Market Analysis by Country : Introduction

- 6.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.7.2.1. Russia

- 6.7.2.2. Poland

- 6.7.2.3. The Czech Republic

- 6.7.2.4. Greece

- 6.7.2.5. Rest of Eastern Europe

- 7. APAC Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Aerospace Adhesives And Sealants Market Analysis, 2016-2021

- 7.2. APAC Aerospace Adhesives And Sealants Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Sealants Resin, 2016-2032

- 7.3.1. APAC Aerospace Adhesives And Sealants Market Analysis by Sealants Resin: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Sealants Resin, 2016-2032

- 7.3.3. Silicone

- 7.3.4. Polysulfide

- 7.3.5. Others

- 7.4. APAC Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Adhesive Resin, 2016-2032

- 7.4.1. APAC Aerospace Adhesives And Sealants Market Analysis by Adhesive Resin: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Adhesive Resin, 2016-2032

- 7.4.3. Polyurethane

- 7.4.4. Epoxy

- 7.4.5. Others

- 7.5. APAC Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Aircraft, 2016-2032

- 7.5.1. APAC Aerospace Adhesives And Sealants Market Analysis by Aircraft: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Aircraft, 2016-2032

- 7.5.3. Military

- 7.5.4. Commercial

- 7.5.5. Others

- 7.6. APAC Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By User Type, 2016-2032

- 7.6.1. APAC Aerospace Adhesives And Sealants Market Analysis by User Type: Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By User Type, 2016-2032

- 7.6.3. OEM

- 7.6.4. MRO

- 7.7. APAC Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.7.1. APAC Aerospace Adhesives And Sealants Market Analysis by Country : Introduction

- 7.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.7.2.1. China

- 7.7.2.2. Japan

- 7.7.2.3. South Korea

- 7.7.2.4. India

- 7.7.2.5. Australia & New Zeland

- 7.7.2.6. Indonesia

- 7.7.2.7. Malaysia

- 7.7.2.8. Philippines

- 7.7.2.9. Singapore

- 7.7.2.10. Thailand

- 7.7.2.11. Vietnam

- 7.7.2.12. Rest of APAC

- 8. Latin America Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Aerospace Adhesives And Sealants Market Analysis, 2016-2021

- 8.2. Latin America Aerospace Adhesives And Sealants Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Sealants Resin, 2016-2032

- 8.3.1. Latin America Aerospace Adhesives And Sealants Market Analysis by Sealants Resin: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Sealants Resin, 2016-2032

- 8.3.3. Silicone

- 8.3.4. Polysulfide

- 8.3.5. Others

- 8.4. Latin America Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Adhesive Resin, 2016-2032

- 8.4.1. Latin America Aerospace Adhesives And Sealants Market Analysis by Adhesive Resin: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Adhesive Resin, 2016-2032

- 8.4.3. Polyurethane

- 8.4.4. Epoxy

- 8.4.5. Others

- 8.5. Latin America Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Aircraft, 2016-2032

- 8.5.1. Latin America Aerospace Adhesives And Sealants Market Analysis by Aircraft: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Aircraft, 2016-2032

- 8.5.3. Military

- 8.5.4. Commercial

- 8.5.5. Others

- 8.6. Latin America Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By User Type, 2016-2032

- 8.6.1. Latin America Aerospace Adhesives And Sealants Market Analysis by User Type: Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By User Type, 2016-2032

- 8.6.3. OEM

- 8.6.4. MRO

- 8.7. Latin America Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.7.1. Latin America Aerospace Adhesives And Sealants Market Analysis by Country : Introduction

- 8.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.7.2.1. Brazil

- 8.7.2.2. Colombia

- 8.7.2.3. Chile

- 8.7.2.4. Argentina

- 8.7.2.5. Costa Rica

- 8.7.2.6. Rest of Latin America

- 9. Middle East & Africa Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Aerospace Adhesives And Sealants Market Analysis, 2016-2021

- 9.2. Middle East & Africa Aerospace Adhesives And Sealants Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Sealants Resin, 2016-2032

- 9.3.1. Middle East & Africa Aerospace Adhesives And Sealants Market Analysis by Sealants Resin: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Sealants Resin, 2016-2032

- 9.3.3. Silicone

- 9.3.4. Polysulfide

- 9.3.5. Others

- 9.4. Middle East & Africa Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Adhesive Resin, 2016-2032

- 9.4.1. Middle East & Africa Aerospace Adhesives And Sealants Market Analysis by Adhesive Resin: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Adhesive Resin, 2016-2032

- 9.4.3. Polyurethane

- 9.4.4. Epoxy

- 9.4.5. Others

- 9.5. Middle East & Africa Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Aircraft, 2016-2032

- 9.5.1. Middle East & Africa Aerospace Adhesives And Sealants Market Analysis by Aircraft: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Aircraft, 2016-2032

- 9.5.3. Military

- 9.5.4. Commercial

- 9.5.5. Others

- 9.6. Middle East & Africa Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By User Type, 2016-2032

- 9.6.1. Middle East & Africa Aerospace Adhesives And Sealants Market Analysis by User Type: Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By User Type, 2016-2032

- 9.6.3. OEM

- 9.6.4. MRO

- 9.7. Middle East & Africa Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.7.1. Middle East & Africa Aerospace Adhesives And Sealants Market Analysis by Country : Introduction

- 9.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.7.2.1. Algeria

- 9.7.2.2. Egypt

- 9.7.2.3. Israel

- 9.7.2.4. Kuwait

- 9.7.2.5. Nigeria

- 9.7.2.6. Saudi Arabia

- 9.7.2.7. South Africa

- 9.7.2.8. Turkey

- 9.7.2.9. The UAE

- 9.7.2.10. Rest of MEA

- 10. Global Aerospace Adhesives And Sealants Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Aerospace Adhesives And Sealants Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Aerospace Adhesives And Sealants Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. H.B. Fuller Company

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Henkel Corporation

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. 3M

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. PPG Industries Inc.

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Huntsman International LLC

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Cytec Solvay Group

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Dowdupont

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Bostik

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Lord Corporation (Parker Hannifin Corp)

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Hexcel Corporation

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Arkema Group

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Beacon Adhesives Inc.

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. Chemique Adhesives & Sealants Ltd

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. DELO Industrie Klebstoffe GmbH & Co. KGaA

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 11.18. Illinois Tool Works Inc.

- 11.18.1. Company Overview

- 11.18.2. Financial Highlights

- 11.18.3. Product Portfolio

- 11.18.4. SWOT Analysis

- 11.18.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

"

- List of Figures

- "

- Figure 1: Global Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Sealants Resin in 2022

- Figure 2: Global Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Sealants Resin, 2016-2032

- Figure 3: Global Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Adhesive Resinin 2022

- Figure 4: Global Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Adhesive Resin, 2016-2032

- Figure 5: Global Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Aircraftin 2022

- Figure 6: Global Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Aircraft, 2016-2032

- Figure 7: Global Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by User Typein 2022

- Figure 8: Global Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by User Type, 2016-2032

- Figure 9: Global Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 10: Global Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Region, 2016-2032

- Figure 11: Global Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) (2016-2032)

- Figure 12: Global Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 13: Global Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Sealants Resin (2016-2032)

- Figure 14: Global Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Adhesive Resin (2016-2032)

- Figure 15: Global Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Aircraft (2016-2032)

- Figure 16: Global Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by User Type (2016-2032)

- Figure 17: Global Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 18: Global Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Sealants Resin (2016-2032)

- Figure 19: Global Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Adhesive Resin (2016-2032)

- Figure 20: Global Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Aircraft (2016-2032)

- Figure 21: Global Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by User Type (2016-2032)

- Figure 22: Global Aerospace Adhesives And Sealants Market Market Share Comparison by Region (2016-2032)

- Figure 23: Global Aerospace Adhesives And Sealants Market Market Share Comparison by Sealants Resin (2016-2032)

- Figure 24: Global Aerospace Adhesives And Sealants Market Market Share Comparison by Adhesive Resin (2016-2032)

- Figure 25: Global Aerospace Adhesives And Sealants Market Market Share Comparison by Aircraft (2016-2032)

- Figure 26: Global Aerospace Adhesives And Sealants Market Market Share Comparison by User Type (2016-2032)

- Figure 27: North America Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Sealants Resinin 2022

- Figure 28: North America Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Sealants Resin, 2016-2032

- Figure 29: North America Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Adhesive Resinin 2022

- Figure 30: North America Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Adhesive Resin, 2016-2032

- Figure 31: North America Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Aircraftin 2022

- Figure 32: North America Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Aircraft, 2016-2032

- Figure 33: North America Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by User Typein 2022

- Figure 34: North America Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by User Type, 2016-2032

- Figure 35: North America Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 36: North America Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 37: North America Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) (2016-2032)

- Figure 38: North America Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 39: North America Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Sealants Resin (2016-2032)

- Figure 40: North America Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Adhesive Resin (2016-2032)

- Figure 41: North America Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Aircraft (2016-2032)

- Figure 42: North America Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by User Type (2016-2032)

- Figure 43: North America Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: North America Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Sealants Resin (2016-2032)

- Figure 45: North America Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Adhesive Resin (2016-2032)

- Figure 46: North America Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Aircraft (2016-2032)

- Figure 47: North America Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by User Type (2016-2032)

- Figure 48: North America Aerospace Adhesives And Sealants Market Market Share Comparison by Country (2016-2032)

- Figure 49: North America Aerospace Adhesives And Sealants Market Market Share Comparison by Sealants Resin (2016-2032)

- Figure 50: North America Aerospace Adhesives And Sealants Market Market Share Comparison by Adhesive Resin (2016-2032)

- Figure 51: North America Aerospace Adhesives And Sealants Market Market Share Comparison by Aircraft (2016-2032)

- Figure 52: North America Aerospace Adhesives And Sealants Market Market Share Comparison by User Type (2016-2032)

- Figure 53: Western Europe Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Sealants Resinin 2022

- Figure 54: Western Europe Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Sealants Resin, 2016-2032

- Figure 55: Western Europe Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Adhesive Resinin 2022

- Figure 56: Western Europe Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Adhesive Resin, 2016-2032

- Figure 57: Western Europe Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Aircraftin 2022

- Figure 58: Western Europe Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Aircraft, 2016-2032

- Figure 59: Western Europe Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by User Typein 2022

- Figure 60: Western Europe Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by User Type, 2016-2032

- Figure 61: Western Europe Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 62: Western Europe Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 63: Western Europe Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) (2016-2032)

- Figure 64: Western Europe Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 65: Western Europe Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Sealants Resin (2016-2032)

- Figure 66: Western Europe Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Adhesive Resin (2016-2032)

- Figure 67: Western Europe Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Aircraft (2016-2032)

- Figure 68: Western Europe Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by User Type (2016-2032)

- Figure 69: Western Europe Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 70: Western Europe Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Sealants Resin (2016-2032)

- Figure 71: Western Europe Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Adhesive Resin (2016-2032)

- Figure 72: Western Europe Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Aircraft (2016-2032)

- Figure 73: Western Europe Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by User Type (2016-2032)

- Figure 74: Western Europe Aerospace Adhesives And Sealants Market Market Share Comparison by Country (2016-2032)

- Figure 75: Western Europe Aerospace Adhesives And Sealants Market Market Share Comparison by Sealants Resin (2016-2032)

- Figure 76: Western Europe Aerospace Adhesives And Sealants Market Market Share Comparison by Adhesive Resin (2016-2032)

- Figure 77: Western Europe Aerospace Adhesives And Sealants Market Market Share Comparison by Aircraft (2016-2032)

- Figure 78: Western Europe Aerospace Adhesives And Sealants Market Market Share Comparison by User Type (2016-2032)

- Figure 79: Eastern Europe Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Sealants Resinin 2022

- Figure 80: Eastern Europe Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Sealants Resin, 2016-2032

- Figure 81: Eastern Europe Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Adhesive Resinin 2022

- Figure 82: Eastern Europe Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Adhesive Resin, 2016-2032

- Figure 83: Eastern Europe Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Aircraftin 2022

- Figure 84: Eastern Europe Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Aircraft, 2016-2032

- Figure 85: Eastern Europe Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by User Typein 2022

- Figure 86: Eastern Europe Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by User Type, 2016-2032

- Figure 87: Eastern Europe Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 88: Eastern Europe Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 89: Eastern Europe Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) (2016-2032)

- Figure 90: Eastern Europe Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 91: Eastern Europe Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Sealants Resin (2016-2032)

- Figure 92: Eastern Europe Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Adhesive Resin (2016-2032)

- Figure 93: Eastern Europe Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Aircraft (2016-2032)

- Figure 94: Eastern Europe Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by User Type (2016-2032)

- Figure 95: Eastern Europe Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 96: Eastern Europe Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Sealants Resin (2016-2032)

- Figure 97: Eastern Europe Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Adhesive Resin (2016-2032)

- Figure 98: Eastern Europe Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Aircraft (2016-2032)

- Figure 99: Eastern Europe Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by User Type (2016-2032)

- Figure 100: Eastern Europe Aerospace Adhesives And Sealants Market Market Share Comparison by Country (2016-2032)

- Figure 101: Eastern Europe Aerospace Adhesives And Sealants Market Market Share Comparison by Sealants Resin (2016-2032)

- Figure 102: Eastern Europe Aerospace Adhesives And Sealants Market Market Share Comparison by Adhesive Resin (2016-2032)

- Figure 103: Eastern Europe Aerospace Adhesives And Sealants Market Market Share Comparison by Aircraft (2016-2032)

- Figure 104: Eastern Europe Aerospace Adhesives And Sealants Market Market Share Comparison by User Type (2016-2032)

- Figure 105: APAC Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Sealants Resinin 2022

- Figure 106: APAC Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Sealants Resin, 2016-2032

- Figure 107: APAC Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Adhesive Resinin 2022

- Figure 108: APAC Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Adhesive Resin, 2016-2032

- Figure 109: APAC Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Aircraftin 2022

- Figure 110: APAC Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Aircraft, 2016-2032

- Figure 111: APAC Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by User Typein 2022

- Figure 112: APAC Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by User Type, 2016-2032

- Figure 113: APAC Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 114: APAC Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 115: APAC Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) (2016-2032)

- Figure 116: APAC Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 117: APAC Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Sealants Resin (2016-2032)

- Figure 118: APAC Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Adhesive Resin (2016-2032)

- Figure 119: APAC Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Aircraft (2016-2032)

- Figure 120: APAC Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by User Type (2016-2032)

- Figure 121: APAC Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 122: APAC Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Sealants Resin (2016-2032)

- Figure 123: APAC Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Adhesive Resin (2016-2032)

- Figure 124: APAC Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Aircraft (2016-2032)

- Figure 125: APAC Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by User Type (2016-2032)

- Figure 126: APAC Aerospace Adhesives And Sealants Market Market Share Comparison by Country (2016-2032)

- Figure 127: APAC Aerospace Adhesives And Sealants Market Market Share Comparison by Sealants Resin (2016-2032)

- Figure 128: APAC Aerospace Adhesives And Sealants Market Market Share Comparison by Adhesive Resin (2016-2032)

- Figure 129: APAC Aerospace Adhesives And Sealants Market Market Share Comparison by Aircraft (2016-2032)

- Figure 130: APAC Aerospace Adhesives And Sealants Market Market Share Comparison by User Type (2016-2032)

- Figure 131: Latin America Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Sealants Resinin 2022

- Figure 132: Latin America Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Sealants Resin, 2016-2032

- Figure 133: Latin America Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Adhesive Resinin 2022

- Figure 134: Latin America Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Adhesive Resin, 2016-2032

- Figure 135: Latin America Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Aircraftin 2022

- Figure 136: Latin America Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Aircraft, 2016-2032

- Figure 137: Latin America Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by User Typein 2022

- Figure 138: Latin America Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by User Type, 2016-2032

- Figure 139: Latin America Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 140: Latin America Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 141: Latin America Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) (2016-2032)

- Figure 142: Latin America Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 143: Latin America Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Sealants Resin (2016-2032)

- Figure 144: Latin America Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Adhesive Resin (2016-2032)

- Figure 145: Latin America Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Aircraft (2016-2032)

- Figure 146: Latin America Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by User Type (2016-2032)

- Figure 147: Latin America Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 148: Latin America Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Sealants Resin (2016-2032)

- Figure 149: Latin America Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Adhesive Resin (2016-2032)

- Figure 150: Latin America Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Aircraft (2016-2032)

- Figure 151: Latin America Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by User Type (2016-2032)

- Figure 152: Latin America Aerospace Adhesives And Sealants Market Market Share Comparison by Country (2016-2032)

- Figure 153: Latin America Aerospace Adhesives And Sealants Market Market Share Comparison by Sealants Resin (2016-2032)

- Figure 154: Latin America Aerospace Adhesives And Sealants Market Market Share Comparison by Adhesive Resin (2016-2032)

- Figure 155: Latin America Aerospace Adhesives And Sealants Market Market Share Comparison by Aircraft (2016-2032)

- Figure 156: Latin America Aerospace Adhesives And Sealants Market Market Share Comparison by User Type (2016-2032)

- Figure 157: Middle East & Africa Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Sealants Resinin 2022

- Figure 158: Middle East & Africa Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Sealants Resin, 2016-2032

- Figure 159: Middle East & Africa Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Adhesive Resinin 2022

- Figure 160: Middle East & Africa Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Adhesive Resin, 2016-2032

- Figure 161: Middle East & Africa Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Aircraftin 2022

- Figure 162: Middle East & Africa Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Aircraft, 2016-2032

- Figure 163: Middle East & Africa Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by User Typein 2022

- Figure 164: Middle East & Africa Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by User Type, 2016-2032

- Figure 165: Middle East & Africa Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 166: Middle East & Africa Aerospace Adhesives And Sealants Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 167: Middle East & Africa Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) (2016-2032)

- Figure 168: Middle East & Africa Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 169: Middle East & Africa Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Sealants Resin (2016-2032)

- Figure 170: Middle East & Africa Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Adhesive Resin (2016-2032)

- Figure 171: Middle East & Africa Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Aircraft (2016-2032)

- Figure 172: Middle East & Africa Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by User Type (2016-2032)

- Figure 173: Middle East & Africa Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 174: Middle East & Africa Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Sealants Resin (2016-2032)

- Figure 175: Middle East & Africa Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Adhesive Resin (2016-2032)

- Figure 176: Middle East & Africa Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Aircraft (2016-2032)

- Figure 177: Middle East & Africa Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by User Type (2016-2032)

- Figure 178: Middle East & Africa Aerospace Adhesives And Sealants Market Market Share Comparison by Country (2016-2032)

- Figure 179: Middle East & Africa Aerospace Adhesives And Sealants Market Market Share Comparison by Sealants Resin (2016-2032)

- Figure 180: Middle East & Africa Aerospace Adhesives And Sealants Market Market Share Comparison by Adhesive Resin (2016-2032)

- Figure 181: Middle East & Africa Aerospace Adhesives And Sealants Market Market Share Comparison by Aircraft (2016-2032)

- Figure 182: Middle East & Africa Aerospace Adhesives And Sealants Market Market Share Comparison by User Type (2016-2032)

"

- List of Tables

- "

- Table 1: Global Aerospace Adhesives And Sealants Market Market Comparison by Sealants Resin (2016-2032)

- Table 2: Global Aerospace Adhesives And Sealants Market Market Comparison by Adhesive Resin (2016-2032)

- Table 3: Global Aerospace Adhesives And Sealants Market Market Comparison by Aircraft (2016-2032)

- Table 4: Global Aerospace Adhesives And Sealants Market Market Comparison by User Type (2016-2032)

- Table 5: Global Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) (2016-2032)

- Table 7: Global Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 8: Global Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Sealants Resin (2016-2032)

- Table 9: Global Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Adhesive Resin (2016-2032)

- Table 10: Global Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Aircraft (2016-2032)

- Table 11: Global Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by User Type (2016-2032)

- Table 12: Global Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 13: Global Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Sealants Resin (2016-2032)

- Table 14: Global Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Adhesive Resin (2016-2032)

- Table 15: Global Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Aircraft (2016-2032)

- Table 16: Global Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by User Type (2016-2032)

- Table 17: Global Aerospace Adhesives And Sealants Market Market Share Comparison by Region (2016-2032)

- Table 18: Global Aerospace Adhesives And Sealants Market Market Share Comparison by Sealants Resin (2016-2032)

- Table 19: Global Aerospace Adhesives And Sealants Market Market Share Comparison by Adhesive Resin (2016-2032)

- Table 20: Global Aerospace Adhesives And Sealants Market Market Share Comparison by Aircraft (2016-2032)

- Table 21: Global Aerospace Adhesives And Sealants Market Market Share Comparison by User Type (2016-2032)

- Table 22: North America Aerospace Adhesives And Sealants Market Market Comparison by Adhesive Resin (2016-2032)

- Table 23: North America Aerospace Adhesives And Sealants Market Market Comparison by Aircraft (2016-2032)

- Table 24: North America Aerospace Adhesives And Sealants Market Market Comparison by User Type (2016-2032)

- Table 25: North America Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 26: North America Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) (2016-2032)

- Table 27: North America Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 28: North America Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Sealants Resin (2016-2032)

- Table 29: North America Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Adhesive Resin (2016-2032)

- Table 30: North America Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Aircraft (2016-2032)

- Table 31: North America Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by User Type (2016-2032)

- Table 32: North America Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 33: North America Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Sealants Resin (2016-2032)

- Table 34: North America Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Adhesive Resin (2016-2032)

- Table 35: North America Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Aircraft (2016-2032)

- Table 36: North America Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by User Type (2016-2032)

- Table 37: North America Aerospace Adhesives And Sealants Market Market Share Comparison by Country (2016-2032)

- Table 38: North America Aerospace Adhesives And Sealants Market Market Share Comparison by Sealants Resin (2016-2032)

- Table 39: North America Aerospace Adhesives And Sealants Market Market Share Comparison by Adhesive Resin (2016-2032)

- Table 40: North America Aerospace Adhesives And Sealants Market Market Share Comparison by Aircraft (2016-2032)

- Table 41: North America Aerospace Adhesives And Sealants Market Market Share Comparison by User Type (2016-2032)

- Table 42: Western Europe Aerospace Adhesives And Sealants Market Market Comparison by Sealants Resin (2016-2032)

- Table 43: Western Europe Aerospace Adhesives And Sealants Market Market Comparison by Adhesive Resin (2016-2032)

- Table 44: Western Europe Aerospace Adhesives And Sealants Market Market Comparison by Aircraft (2016-2032)

- Table 45: Western Europe Aerospace Adhesives And Sealants Market Market Comparison by User Type (2016-2032)

- Table 46: Western Europe Aerospace Adhesives And Sealants Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 47: Western Europe Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) (2016-2032)

- Table 48: Western Europe Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 49: Western Europe Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Sealants Resin (2016-2032)

- Table 50: Western Europe Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Adhesive Resin (2016-2032)

- Table 51: Western Europe Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by Aircraft (2016-2032)

- Table 52: Western Europe Aerospace Adhesives And Sealants Market Market Revenue (US$ Mn) Comparison by User Type (2016-2032)

- Table 53: Western Europe Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 54: Western Europe Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Sealants Resin (2016-2032)

- Table 55: Western Europe Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Adhesive Resin (2016-2032)

- Table 56: Western Europe Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by Aircraft (2016-2032)

- Table 57: Western Europe Aerospace Adhesives And Sealants Market Market Y-o-Y Growth Rate Comparison by User Type (2016-2032)

- Table 58: Western Europe Aerospace Adhesives And Sealants Market Market Share Comparison by Country (2016-2032)