Aerogel Market Product Type:(Silica, Polymer, Carbon), Application Industry:(Oil & Gas, Marine & Aerospace, Performance Coating, LVHS, Day-Lighting, Automotive, Construction), Form:(Monolith Aerogel, Blanket Aerogel, Article Aerogel, Panel Form Aerogel), Processing:(Virgin Processed Aerogel, Fabricated Aerogel) By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

284

-

Jan 2024

-

109

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Aerogel Market Size, Share, Trends Analysis

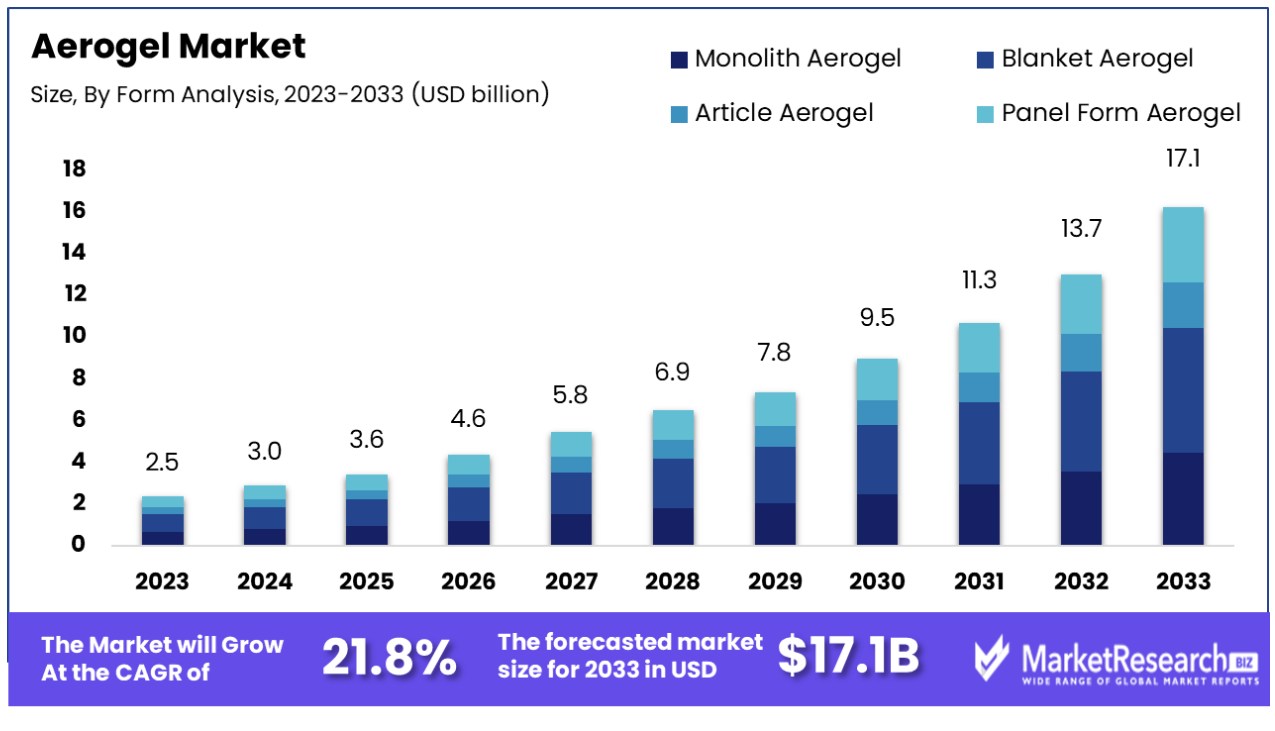

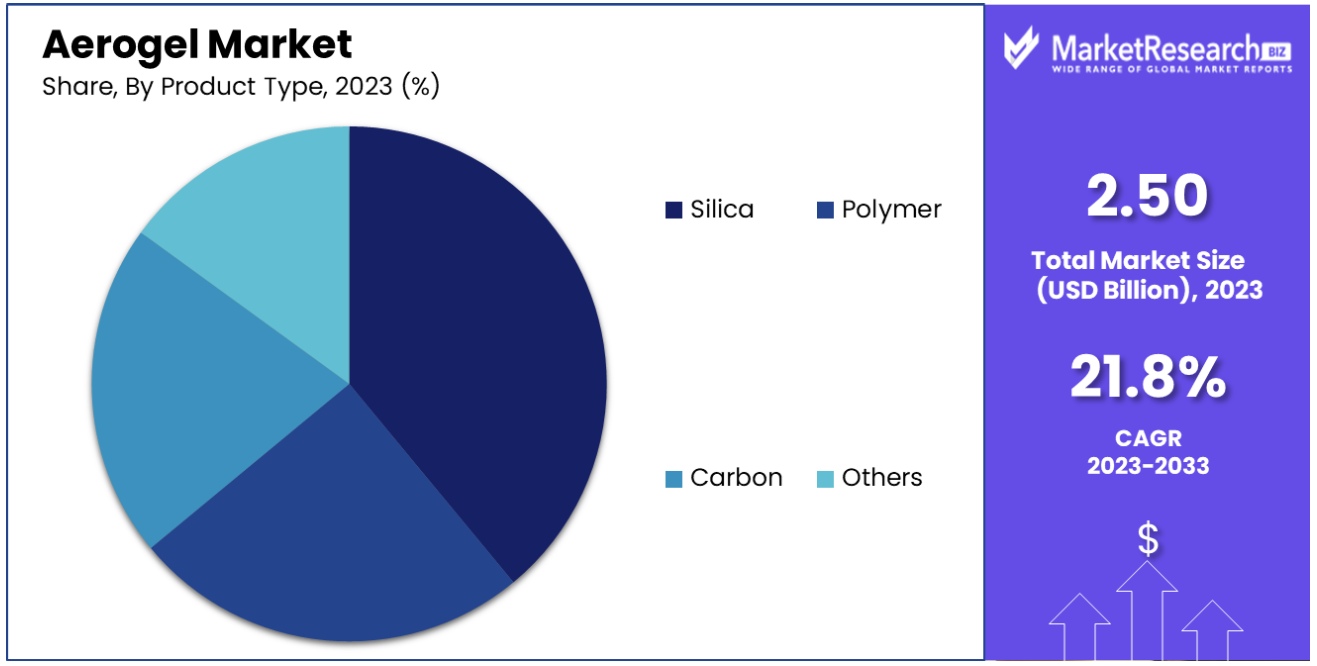

The aerogel market was valued at USD 2.50 billion in 2023. It is expected to reach USD 17.1 billion by 2033, with a CAGR of 21.8% during the forecast period from 2024 to 2033.

The surge in demand in the automobile industry and other high-end-use sectors such as construction, aerospace, and electronics are some of the main driving factors for the aerogel market. Aerogel is a smooth synthetic porous material that is extracted from a gel, in which gas swaps with the liquid substance of the gel. It signifies a geometry that a material can take on, rather than to a specific component. These are also called for the class of structures that have less density, open-cell structures, and huge surfaces. Aerogel substance is made up of 99.8% air. It consists of a porous solid design that comprises air pockets with the help of air pockets it occupies the majority of areas within the substance.

As aerogel is expanding drastically. It is changing from internal combustion engine vehicles to EVs for better efficacy and performance. Earlier, manufacturers of automobiles used to aim upon only a single category of vehicles which includes performance, comfort, safety, and efficacy. As the competition arises, these manufacturers are focusing on all these features. Since aerogel has low heat conductivity and density, it can be used as a thermal insulator for the body panels and windows along with acoustic insulation. The anti-bacterial feature of the light interior of a vehicle can be developed with the help of aerogel. It thus offers all the essential functions to attain the goal of manufacturing one of the best vehicles.

According to a report published by Reuters in January 2024, Toyota Motor will remain the leading-selling auto manufacturer in the US in 2023. The Detroit automakers shrugged off a hit from expensive auto incursion to report US new vehicle sales of more than 2.6 million units for 2023, up 14.1% from the last year 2022, whereas Toyota’s yearly sales surged 6.6% to about 2.25 million vehicles in. Moreover, US new vehicle sales as of last year completed around 15.5 million units of which EVs made up nearly 17%, as per the data published by Wards Intelligence.

Aerogels are generally used in electronics as it has thermal interface materials that provide efficacy to heat intemperance in all types of electronic devices. Moreover, the usage of aerogels in healthcare and medical industries is significant as it provides high surface area, and eco-friendly that can be used for medical purposes. Likewise, aerogels are also used in agriculture, soundproofing, and food packaging as well. The demand for aerospace will rapidly increase due to its wide range of applications which can be used in different industries that will help in market expansion in the coming years.

Driving Factors

Energy Efficiency Boosts Aerogel Market in Building Insulation

The aerogel market is significantly driven by its increasing use in energy-efficient building insulation, thanks to its exceptionally low thermal conductivity. Aerogels reduce heating and cooling costs, making them a sustainable choice for modern construction. Notably, Empa and the Slovak University of Technology have innovated with a translucent aerogel glass brick, enhancing thermal insulation while optimizing solar gains and natural light usage. Additionally, developments in transparent aerogels, offering up to 99% light transmission and superior thermal insulation, are revolutionizing building facades, skylights, and daylighting solutions. These advancements position aerogels as a key material in the green building sector, promoting energy conservation and sustainability.

Aerospace and Defense Applications Propel Aerogel Demand

Aerogels are gaining traction in the aerospace and defense industries due to their lightweight nature and ability to withstand extreme temperatures. NASA's utilization of aerogels for spacecraft insulation exemplifies their critical role in space exploration. Moreover, companies like Aerogel Core Ltd are leveraging aerogels' unique properties for soundproofing and heat shielding in aerospace and automotive applications. The versatility and durability of aerogels in these demanding environments underscore their growing importance and widespread adoption in the aerospace and defense sectors.

Manufacturing Innovations Expand Aerogel Market Reach

Advancements in aerogel manufacturing technologies, like rapid supercritical extraction, have enhanced production efficiency and cost-effectiveness. Aspen Aerogels' automated production line, established in 2020, exemplifies this trend. Furthermore, researchers at Linköping University's development of a cellulose-based conducting aerogel opens new possibilities for its use in medical imaging, communication, space exploration, and security technologies. These manufacturing innovations not only reduce production costs but also broaden aerogels' application spectrum, contributing significantly to market growth.

Restraining Factors

High Production Costs Constrain Aerogel Market Expansion

The aerogel market faces significant growth limitations due to the high production costs associated with this material. The manufacturing process of aerogels is intricate, requiring specialized chemicals and techniques, leading to elevated expenses. For example, silica aerogel blankets are reported to be over ten times costlier than traditional insulation materials per square foot. Furthermore, aerogel production typically occurs on smaller scales than conventional insulation materials, resulting in higher per-unit costs. The estimated production cost of $7.2 per square meter for a 3 cm thick silica aerogel sheet exemplifies this financial barrier, thereby limiting aerogels' widespread adoption and market growth.

Supply Chain Challenges Impede Aerogel Market Development

The aerogel market's growth is further hampered by its nascent supply chain, which presents several challenges compared to more established insulation materials. Aerogels, being a niche product, suffer from issues related to the availability of raw materials, capacity constraints in production, and complex logistics in transportation. These factors contribute to an insecure supply chain, exacerbating the already high costs of aerogel production and distribution. The less developed nature of the aerogel supply chain not only increases the costs but also adds uncertainty to the market, making it difficult for aerogel manufacturers to scale up and meet potential demand efficiently.

Aerogel Market Segmentation Analysis

Product Type Analysis :

Silica Aerogel is the dominant segment in the aerogel market. Its supremacy is attributed to its exceptional properties such as low thermal conductivity, high surface area, and low density, making it an ideal material for insulation and other applications. Silica aerogel's versatility allows for its use in a wide range of industries, from aerospace to consumer electronics. Its translucency also makes it suitable for daylighting applications.

Polymer and Carbon aerogels, while important, have more specialized applications. Polymer aerogels are used in lightweight structures and supercapacitors, whereas Carbon aerogels are notable for their electrical conductivity and are used in sensors and energy storage devices. However, the broad applicability and established market presence of Silica aerogel underline its dominant position.

Application Industry Analysis :

Oil & Gas is the leading application industry for aerogels, primarily due to their widespread use as insulation materials in pipelines and refineries. Aerogels provide superior thermal insulation, helping to maintain the integrity of pipelines and reduce energy loss. The lightweight nature of aerogels also makes them advantageous for offshore applications.

Other industries like Marine & Aerospace, Performance Coating, LVHS (Low Volume High Speed), Daylighting, Automotive, and Construction also utilize aerogels. In Marine & Aerospace, aerogels are used for thermal and acoustic insulation. In construction, aerogel-based translucent panels are used for daylighting solutions. However, the critical role of aerogels in improving energy efficiency in the Oil & Gas sector makes it the most significant application industry.

Form Analysis :

Blanket Aerogel is the dominant form in the aerogel market. Aerogel blankets combine the inherent properties of aerogels with flexibility and ease of use, making them highly suitable for a variety of insulation applications. They can be easily cut and installed in complex geometries, which is particularly beneficial in the construction and oil & gas industries.

Monolith, Article, and Panel Form Aerogels also have significant market presence. Monolith aerogels are used in specialized applications like aerospace, whereas panel-form aerogels are used in building applications. However, the adaptability and wide application range of Blanket aerogels emphasize their market dominance.

Processing :

Virgin Processed Aerogel is the predominant segment in terms of processing. Virgin-processed aerogels are those that are directly synthesized and used without any post-processing or alterations. This form of aerogel retains the pure properties of the base material, whether silica, polymer, or carbon, and is preferred for applications where these intrinsic properties are crucial.

Fabricated Aerogels, which undergo additional processing to fit specific applications, are also important but secondary to the versatility and purity of Virgin Processed Aerogels. The demand for high-performance, unaltered aerogel materials in various industries, particularly in insulation and aerospace, secures the dominance of Virgin Processed Aerogels in the market.

Aerogel Industry Segments

Product Type Analysis:

- Silica

- Polymer

- Carbon

Application Industry Analysis:

- Oil & Gas

- Marine & Aerospace

- Performance Coating

- LVHS

- Day-Lighting

- Automotive

- Construction

Form Analysis:

- Monolith Aerogel

- Blanket Aerogel

- Article Aerogel

- Panel Form Aerogel

Processing Analysis:

- Virgin Processed Aerogel

- Fabricated Aerogel

Growth Opportunities

Cold Storage Facility Insulation: Aerogel Market's New Growth Frontier

The use of aerogels in cold storage facility insulation presents a significant growth opportunity within the aerogel market. Aerogel blankets or composites can offer superior insulation for facilities such as cold storage warehouses, food processing plants, and ice rinks. The main challenge lies in the initial high costs of implementation. However, the long-term energy savings and efficiency gains make this a valuable investment. Companies like BASF are already producing aerogel composites tailored for such applications. As awareness and understanding of these long-term benefits grow, the demand for aerogel insulation in cold storage facilities is expected to increase, driving market expansion.

Next-Generation Batteries with Aerogel Technology Propel Market Growth

Aerogels in the development of next-generation batteries for electric vehicles (EVs) and electronics is another area ripe for growth. Incorporating aerogels as separators in lithium-ion batteries can significantly improve safety, lifespan, and fast-charging capabilities. The key challenge in this application is the cost reduction to make it viable for widespread use. Companies like Amprius are leveraging aerogel technology in EV batteries, indicating the potential of this application. As the demand for more efficient and safer batteries increases, especially in the burgeoning EV market, aerogels are likely to play a crucial role, thus contributing to the market's expansion.

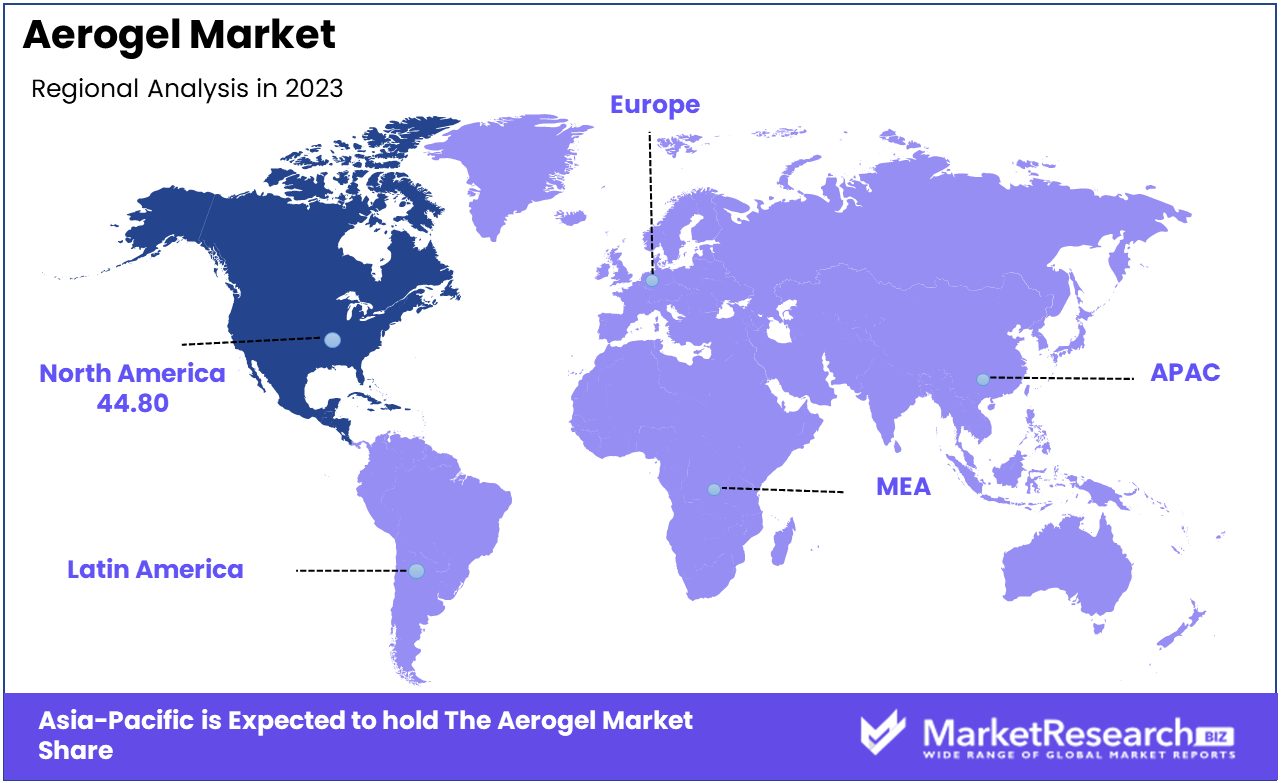

Aerogel Market Regional Analysis

North America Dominates with 44.80% Market Share in Aerogel Market

North America's leadership in the global aerogel market, holding 44.80% of the market share, is significantly influenced by the presence of key players and the region's advanced technological landscape. Companies like Aspen Aerogels in the United States are at the forefront of aerogel technology, contributing extensively to the region's production capacity. The market is further driven by the high demand for aerogel in industries such as oil and gas, construction, and aerospace for its superior insulation properties. North America's focus on energy-efficient materials and sustainable construction practices also plays a crucial role in market growth.

The aerogel market in North America is characterized by innovative applications and a strong emphasis on R&D. The U.S. leads in both the production and consumption of aerogel, with its extensive use in NASA's space missions showcasing the material's unique properties. The market benefits from the region's robust industrial base and increasing adoption of aerogel in thermal insulation, oil and gas applications, and the automotive industry. Additionally, the U.S. government's support for sustainable and energy-efficient materials further propels market growth.

Europe: Innovation and Environmental Regulations

Europe's aerogel market is driven by a focus on innovation and stringent environmental regulations. Countries like Germany and the UK are home to companies pioneering in aerogel technology. The market is supported by EU policies favoring energy-efficient materials, boosting the demand for aerogel in construction and industrial applications.

Asia-Pacific: Emerging Market with High Potential

In Asia-Pacific, the aerogel market is emerging, with countries like China and India showing significant potential due to their growing industrial sectors. The increasing adoption of energy-efficient materials and the presence of expanding industries like automotive and oil & gas offer considerable opportunities for market growth. The region's focus on sustainable development and energy conservation is likely to stimulate the demand for aerogel products.

Aerogel Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Aerogel Market Key Player Analysis

In the Aerogel Market, a sector characterized by its advanced materials technology, the companies listed are central to driving innovation and application diversity. Aspen Aerogels (US) and Cabot Corporation (US) are notable for their extensive range of aerogel products, particularly in insulation applications. Their strategic positioning emphasizes leveraging aerogel's unique properties - low thermal conductivity and high surface area - in various industries, from construction to aerospace.

BASF (Germany), a global chemical company, has integrated aerogel technology into its portfolio, showcasing its commitment to innovation in high-performance materials. Their presence in the market underscores the integration of aerogel in broader industrial applications.

Aerogel Industry Key Players

Nano Tech Co. Ltd. (China)

Cabot Corporation (US)

JIOS Aerogel (South Korea)

Aspen Aerogels (US)

Enersens (France)

Active Aerogels (Portugal)

Armacell (Germany)

Guangdong Alison Hi-Tech (China)

BASF (Germany)

Aerogel Technologies (US)Recent Development

- In February 2023. Svenska Aerogel signed a collaboration agreement with an internationally renowned manufacturer in the industry of process to improve the utilization of Quartzene in the product of the customer. Svenska Aerogel committed to supplying 30 tonnes of Quartzite each year throughout the phase of the pilot phase.

- In January 2022 Cabot Corporation reported that their aerogel with high-insulating properties was utilized in the renovation of the Mathildenhohe the artist's colony located in Darmstadt, Germany, which was recently added as a part of the UNESCO World Heritage list

- In April 2023 Aspen Aerogels created a new aerogel named Firegel(tm). It's fire-resistant compared to the older versions. Firegel(tm) is perfect for use in crucial sectors like defense and aerospace where fire resistance is essential.

Report Scope

Report Features Description Market Value (2023) USD 2.50 Billion Forecast Revenue (2033) USD 17.1 Billion CAGR (2024-2032) 21.8% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product Type:(Silica, Polymer, Carbon), Application Industry:(Oil & Gas, Marine & Aerospace, Performance Coating, LVHS, Day-Lighting, Automotive, Construction), Form:(Monolith Aerogel, Blanket Aerogel, Article Aerogel, Panel Form Aerogel), Processing:(Virgin Processed Aerogel, Fabricated Aerogel) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Nanotech Co. Ltd. (China), Cabot Corporation (US), JIOS Aerogel (South Korea), Aspen Aerogels (US), Enersens (France), Active Aerogels (Portugal), Armacell (Germany), Guangdong Alison Hi-Tech (China), BASF (Germany), Aerogel Technologies (US) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

Nano Tech Co. Ltd. (China) Cabot Corporation (US) JIOS Aerogel (South Korea) Aspen Aerogels (US) Enersens (France) Active Aerogels (Portugal) Armacell (Germany) Guangdong Alison Hi-Tech (China) BASF (Germany) Aerogel Technologies (US)