Advanced Robotics Market By Component (Hardware, Software, Services), By Application (Industrial Robots, Service Robots, Collaborative Robots), By End-User (Manufacturing, Healthcare, Aerospace & Defense), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

50936

-

September 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

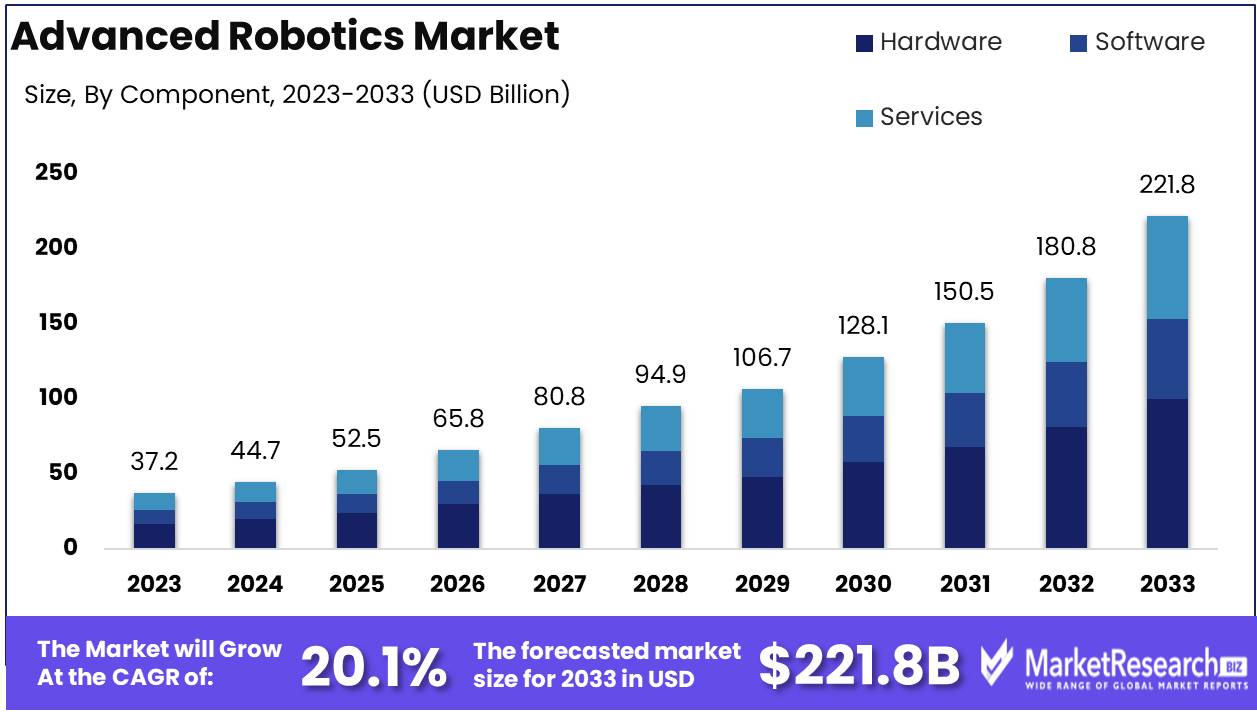

The Advanced Robotics Market was valued at USD 37.2 billion in 2023. It is expected to reach USD 221.8 billion by 2033, with a CAGR of 20.1% during the forecast period from 2024 to 2033.

The Advanced Robotics Market encompasses developing and deploying highly sophisticated robots that leverage cutting-edge technologies, including artificial intelligence (AI), machine learning (ML), and advanced sensors. These systems are designed to perform complex tasks autonomously or semi-autonomously in industries such as manufacturing, healthcare, logistics, and defense. The growth of this market is driven by increasing demand for automation, labor shortages, and the need for precision and efficiency.

The advanced robotics market is poised for substantial growth, driven primarily by increasing automation across various industries and labor market dynamics. As industries such as manufacturing, logistics, and healthcare continue to prioritize efficiency and productivity, the integration of advanced robotics is accelerating. Rising labor shortages and increasing labor costs are pushing companies to adopt automation as a solution to workforce challenges, further fueling demand for advanced robotic systems.

However, the sector still faces certain challenges, most notably the high initial costs associated with implementing these systems. Although the long-term benefits of reduced operational costs and increased productivity are well-documented, the initial investment in robotic technology remains a barrier for small and medium-sized enterprises. Despite this, the overall market outlook remains positive, with a clear growth trajectory projected in the coming years. Market forecasts indicate that advancements in artificial intelligence, sensor technologies, and machine learning are set to further bolster the capabilities of robotics, enabling more seamless integration into complex industrial environments. The advanced robotics market, therefore, represents a critical area of investment for companies seeking to remain competitive in an increasingly automated global economy.

Key Takeaways

- Market Growth: The Advanced Robotics Market was valued at USD 37.2 billion in 2023. It is expected to reach USD 221.8 billion by 2033, with a CAGR of 20.1% during the forecast period from 2024 to 2033.

- By Component: Hardware dominated the Advanced Robotics Market's component segment.

- By Application: Industrial robots dominated the advanced robotics market applications.

- By End-User: Manufacturing dominated the Advanced Robotics Market's end-user segment.

- Regional Dominance: North America leads the advanced robotics market, holding a 40% largest share.

- Growth Opportunity: The advanced robotics market offers significant growth opportunities through logistics automation and AI integration, driving innovation.

Driving factors

Increasing Automation Demand

The surge in automation demand is a pivotal factor driving the growth of the Advanced Robotics Market. As industries across various sectors seek to enhance productivity, reduce operational costs, and improve efficiency, the adoption of advanced robotic solutions has become increasingly prevalent. The global market for industrial robots, a subset of advanced robotics, is expected to grow at a compound annual growth rate (CAGR) of 10.2% from 2023 to 2030, underscoring the significant role automation plays in this expansion.

Automation demand is fueled by the need to address labor shortages and the desire for higher precision in manufacturing processes. Robotics technology provides a solution to these challenges by offering capabilities such as 24/7 operation, consistency in quality, and the ability to perform complex tasks with high accuracy. This heightened demand for automation solutions directly contributes to the acceleration of advanced robotics market growth.

Industry 4.0 Adoption

The adoption of Industry 4.0 principles is a major driver of the Advanced Robotics Market, reflecting the integration of digital technologies into manufacturing processes. Industry 4.0 emphasizes the use of cyber-physical systems, the Internet of Things (IoT), and data analytics to create smart factories that operate with minimal human intervention.

The proliferation of Industry 4.0 technologies has accelerated the demand for advanced robotics, as these systems are integral to the realization of smart manufacturing environments. For instance, the global Industry 4.0 market is projected to reach USD 300 billion by 2025, with a significant portion of this growth attributed to the deployment of advanced robotics. These robots play a crucial role in enhancing operational efficiency, facilitating real-time data collection, and enabling predictive maintenance, all of which are central to Industry 4.0's objectives.

Investment in R&D

Investment in research and development (R&D) is crucial for the advancement and expansion of the Advanced Robotics Market. Ongoing R&D efforts are driving innovations in robotics technology, leading to the development of more sophisticated, adaptable, and cost-effective robotic systems.

Increased R&D investment is translating into technological advancements such as enhanced artificial intelligence (AI) integration, improved sensory and actuation capabilities, and greater flexibility in robotic systems. For example, companies like Boston Dynamics and ABB Robotics are heavily investing in R&D to advance robotic mobility and dexterity, which, in turn, expands their application across various industries.

Statistically, global spending on robotics R&D is projected to exceed USD 12 billion by 2025, reflecting the critical role of innovation in propelling market growth. This influx of R&D investment supports the development of next-generation robotics solutions, driving further market expansion as businesses seek to leverage cutting-edge technology to gain a competitive edge.

Restraining Factors

High Initial Investment Costs: A Significant Barrier to Widespread Adoption

The advanced robotics market is characterized by the need for substantial capital investment, particularly in the early stages of implementation. High initial costs can be attributed to several factors, including the expense of acquiring advanced robotic systems, developing supporting infrastructure, and hiring skilled personnel for installation and maintenance. These financial requirements often limit the accessibility of advanced robotics technologies to large enterprises, which are more likely to have the capital reserves necessary to absorb such expenses.

Small- and medium-sized enterprises (SMEs), on the other hand, may struggle to justify these expenditures, especially in markets where cost-efficiency is paramount. This dynamic restricts the overall growth of the market by reducing the pool of potential customers. Moreover, the necessity for continued investments in research and development (R&D) to improve the technology's capabilities further contributes to the cost burden, making it more challenging for companies to realize a short-term return on investment (ROI).

This cost barrier is particularly evident in industries like manufacturing and healthcare, where the introduction of robotics could potentially revolutionize operations. However, companies within these sectors must weigh the long-term benefits against the significant upfront costs, often delaying adoption. As a result, market growth is constrained by the limited scalability of advanced robotics solutions across various sectors.

Complexity of Integration: Slowing the Pace of Deployment

The integration of advanced robotics into existing operational frameworks presents another significant challenge for the market. The complexity of successfully incorporating these systems into legacy infrastructures, workflows, and production processes often leads to prolonged deployment timelines and increased implementation costs. The requirement for extensive customization of robotics solutions to meet specific operational needs further complicates the integration process.

For companies unfamiliar with robotic systems, the steep learning curve involved in managing such sophisticated technologies can result in operational disruptions and increased downtime during the transition phase. Additionally, the need for skilled labor to manage and maintain these systems exacerbates the integration challenge, as there is a shortage of specialized talent in robotics engineering.

Moreover, the software systems and control interfaces that govern robotic operations must be compatible with a company’s existing digital ecosystem. In cases where existing systems are outdated, upgrading or replacing them to facilitate integration can add to the total cost, thus compounding the impact of the high initial investment barrier. These combined factors hinder the rapid expansion of the advanced robotics market, as companies may be reluctant to invest in technologies that are complex and potentially disruptive to their current operations.

By Component Analysis

In 2023, Hardware dominated the Advanced Robotics Market's component segment.

In 2023, Hardware held a dominant market position in the By Component segment of the Advanced Robotics Market. This leadership can be attributed to the critical role of hardware components, such as sensors, actuators, and controllers, which are essential for the physical performance and functionality of advanced robots. Increasing investments in automation across industries, including manufacturing, healthcare, and logistics, have driven the demand for robust and high-performing hardware solutions. Moreover, advancements in AI and IoT have facilitated the development of sophisticated hardware, capable of executing complex tasks with precision, contributing to the growth of this segment.

Software is another significant component, providing the intelligence that powers robotic systems. In 2023, software experienced notable growth due to the rising need for complex programming, real-time analytics, and machine-learning capabilities that optimize robotic operations. The shift toward AI-driven decision-making and adaptive learning in robots has increased the importance of software solutions in the overall market.

The services segment, encompassing maintenance, repair, and integration services, also witnessed steady growth. The increasing complexity of robotics systems necessitates ongoing support, enhancing the demand for specialized services to ensure operational efficiency and longevity.

By Application Analysis

In 2023, Industrial robots dominated the advanced robotics market applications.

In 2023, Industrial Robots held a dominant market position in the By Application segment of the advanced robotics market. Industrial robots, which are primarily used in manufacturing and assembly processes, account for a significant portion of the overall market due to their capability to enhance productivity, precision, and operational efficiency. The automotive, electronics, and metal industries were the primary adopters, driven by the demand for automation in repetitive tasks. This growth was supported by the increasing integration of artificial intelligence and machine learning, enabling more sophisticated operations.

Service Robots also experienced considerable growth, particularly in sectors such as healthcare, logistics, and agriculture. These robots are primarily used for tasks that require human interaction, such as medical assistance, warehousing, and delivery services. Their growing application in non-industrial sectors contributed to the expansion of the service robots segment.

Collaborative Robots, or cobots, witnessed significant demand in 2023 due to their ability to work safely alongside human workers. Their application in small- and medium-sized enterprises (SMEs), where flexibility and ease of use are critical, contributed to their increased adoption, particularly in light assembly and pick-and-place tasks.

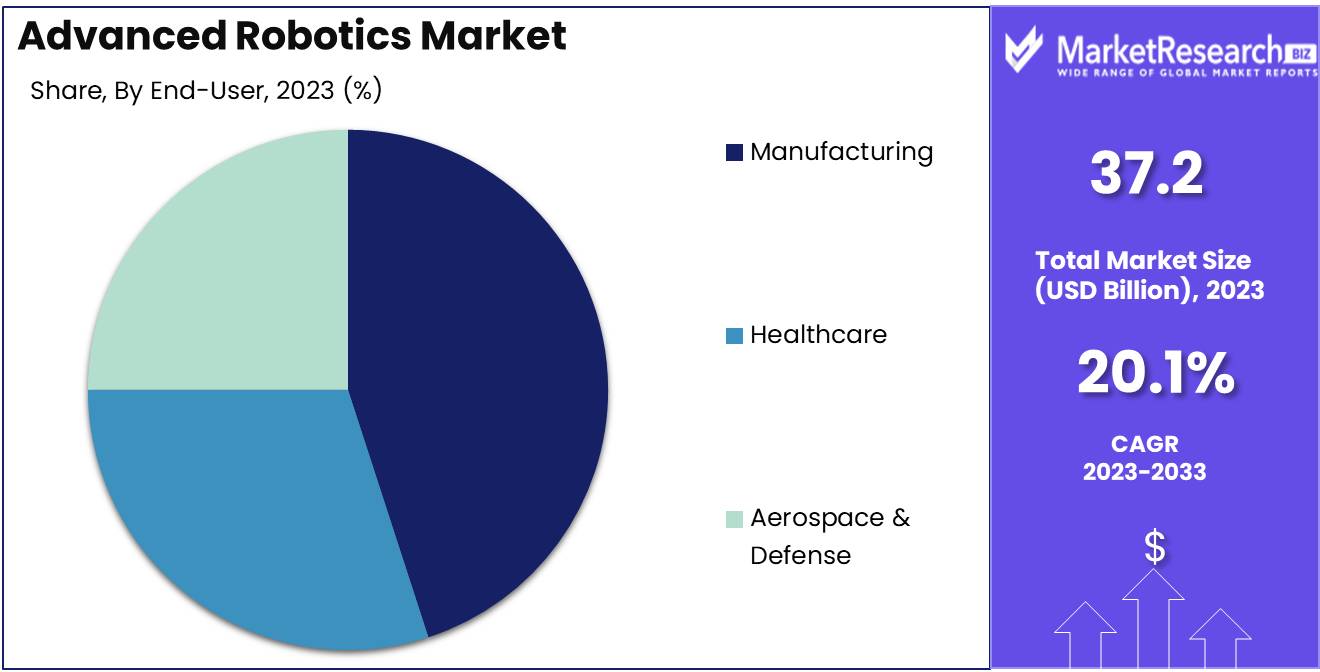

By End-User Analysis

In 2023, Manufacturing dominated the Advanced Robotics Market's end-user segment.

In 2023, The Manufacturing sector held a dominant market position in the end-user segment of the Advanced Robotics Market. This prominence is driven by the increasing adoption of robotics for automating complex tasks such as assembly, quality control, and packaging. The integration of robotics into manufacturing has improved operational efficiency, reduced labor costs, and minimized human error. The demand for robotics in the automotive, electronics, and consumer goods industries is expected to continue fueling market growth in this segment.

The healthcare sector also saw significant growth in the adoption of advanced robotics, particularly in surgical assistance, rehabilitation, and patient care. Robotics in healthcare has led to more precise surgical procedures, enhanced patient outcomes, and optimized workflow, contributing to the sector's expansion.

In the aerospace and defense sectors, robotics has been employed for tasks such as aircraft maintenance, manufacturing precision components, and handling hazardous materials. The need for high precision and safety in defense applications further reinforces the role of robotics in enhancing operational capabilities. Consequently, these three sectors remain key contributors to the overall growth of the Advanced Robotics Market.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Application

- Industrial Robots

- Service Robots

- Collaborative Robots (Cobots)

By End-User

- Manufacturing

- Healthcare

- Aerospace & Defense

Growth Opportunity

Logistics and Supply Chain Automation Driving Growth

The global advanced robotics market is poised for significant growth, driven primarily by the increasing adoption of robotics in logistics and supply chain automation. With the growing demand for faster and more efficient operations in e-commerce and retail, businesses are increasingly turning to robotics for warehouse automation, inventory management, and last-mile delivery.

Autonomous mobile robots (AMRs) and collaborative robots (cobots) are streamlining supply chain processes, reducing operational costs, and enhancing productivity. This trend is expected to accelerate as companies seek to mitigate labor shortages and manage complex global supply chains more effectively. By 2024, the market size for logistics robotics is projected to expand by over 15%, contributing significantly to the overall growth of the advanced robotics sector.

Integration of Artificial Intelligence Enhancing Capabilities

Another critical opportunity in the advanced robotics market lies in the integration of artificial intelligence (AI). AI-enabled robots offer enhanced decision-making capabilities, enabling them to perform complex tasks with minimal human intervention. AI is facilitating the development of autonomous systems capable of real-time data analysis, predictive maintenance, and adaptive learning. It is expected that AI will further improve the capabilities of industrial robots, especially in sectors like manufacturing, healthcare, and agriculture. The synergy between AI and robotics will open new avenues for innovation, boosting the market’s compound annual growth rate (CAGR) by an estimated 12% over the next five years.

Latest Trends

Autonomous Mobile Robots (AMRs)

The adoption of Autonomous Mobile Robots (AMRs) is expected to accelerate as industries prioritize flexibility and cost efficiency in their automation strategies. AMRs offer dynamic adaptability to various environments, allowing for real-time navigation and decision-making without requiring fixed infrastructure. Sectors such as manufacturing, warehousing, and healthcare are set to benefit from AMRs' capabilities in streamlining logistics, improving operational efficiency, and reducing human labor costs. This trend is further fueled by advancements in sensor technology, AI-driven algorithms, and machine learning, which enhance robots’ ability to perform complex tasks autonomously.

Robotics-as-a-Service (RaaS)

The Robotics-as-a-Service (RaaS) model is gaining traction as businesses seek cost-effective ways to adopt robotics without significant upfront capital investment. This model is expected to become a critical enabler for small and medium-sized enterprises (SMEs) to integrate robotic solutions into their operations. RaaS allows companies to pay for robotic services on a subscription or usage-based model, which lowers the barriers to entry. This trend will likely boost the deployment of robotics across various industries, enabling scalability and rapid technological adoption while providing flexibility in operational models.

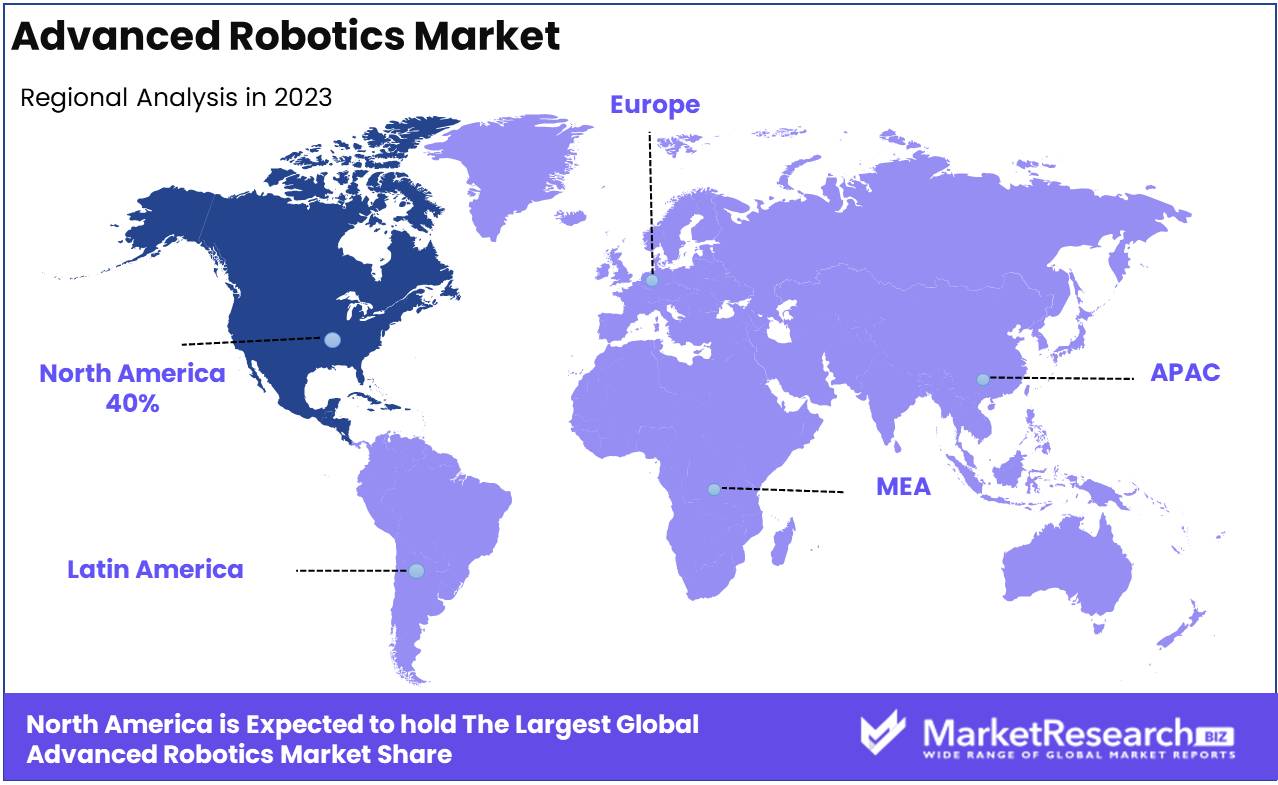

Regional Analysis

North America leads the advanced robotics market, holding a 40% largest share.

The advanced robotics market exhibits significant regional variations, with North America dominating the global landscape, accounting for approximately 40% of the market share in 2023. This can be attributed to the region's robust technological ecosystem, including key players like Boston Dynamics, iRobot, and advanced research centers fostering innovation. North America's adoption of advanced robotics spans industries such as manufacturing, healthcare, and defense, driven by substantial investments in AI and automation technologies.

Europe follows closely, holding about 30% of the market share. Germany, the UK, and France are at the forefront due to their strong industrial robotics sector, particularly in automotive manufacturing and logistics. Government initiatives supporting Industry 4.0 have further bolstered Europe's position in the market.

Asia Pacific is witnessing rapid growth, currently capturing around 25% of the market, driven by China, Japan, and South Korea. These nations are heavily investing in robotics for manufacturing, healthcare, and service industries. China's emphasis on automation and its vast manufacturing base are expected to fuel future market expansion.

Meanwhile, the Middle East & Africa and Latin America, holding smaller shares, are emerging markets for advanced robotics. Government initiatives and foreign investments in automation across these regions are anticipated to contribute to steady growth, albeit at a slower pace than other regions.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In the global advanced robotics market, key players such as NXP Semiconductors, Rethink Robotics, DENSO Corporation, CMA Robotics, ST Robotics, Techman Robots, ABB, Mitsubishi Electric Corporation, and Universal Robots are expected to drive substantial growth in 2024. Each company brings unique strengths, positioning them strategically within this competitive landscape.

NXP Semiconductors is likely to benefit from its expertise in semiconductor solutions, enabling enhanced sensor integration and AI-driven robotics. This positions NXP as a vital contributor to the rise of intelligent robotics applications across industries.

Rethink Robotics, known for collaborative robots (cobots), is anticipated to continue influencing sectors such as manufacturing and logistics. The company’s emphasis on user-friendly, cost-effective solutions aligns with the growing demand for flexible automation.

DENSO Corporation, a leader in industrial automation, is expected to capitalize on its technological innovation in robotic arms and factory automation systems. Its long-standing presence in automotive robotics will further strengthen its market foothold.

CMA Robotics and ST Robotics, specializing in precision robotic systems, are expected to benefit from increasing demand in sectors such as painting and packaging. Their cost-efficient robotic solutions provide significant value to small and mid-sized enterprises.

Techman Robots and Universal Robots will continue to lead in the collaborative robotics market, with strong adoption in SMEs due to their affordable, versatile systems.

ABB and Mitsubishi Electric Corporation will leverage their broad portfolios and industry expertise, catering to large-scale industrial automation projects, thus solidifying their leadership in the advanced robotics market.

Market Key Players

- NXP Semiconductors

- Rethink Robotics

- DENSO Corporation

- CMA Robotics

- ST Robotics

- Techman Robots

- ABB

- Mitsubishi Electric Corporation

- Universal Robots

Recent Development

- In August 2023, Locus Robotics, a leading company in autonomous mobile robots (AMRs), reached a major milestone by picking over 2 billion units, a feat achieved just 11 months after hitting its first billion in 2022. The company’s robots have become highly efficient in logistics, particularly in order fulfillment. This surge highlights the growing role of AMRs in transforming warehouse and logistics operations, significantly enhancing efficiency and scalability in e-commerce and 3PL services.

- In June 2024, Symbotic Inc. acquired most of the assets of Veo Robotics for $8.7 million. This acquisition strengthens Symbotic’s position in logistics automation by integrating Veo's technology into its offerings, particularly in the areas of robot safety and collaboration with human workers.

- In February 2023, Robotics has played a significant role in reshoring efforts in industries such as semiconductor manufacturing. Intel, for example, announced investments in new chip factories in Ohio, while Wolfspeed, in partnership with automotive supplier ZF, revealed plans to build a chip plant in Germany. These projects employ advanced robotics in precision tasks like silicon wafer fabrication and chip testing, underscoring the role of robotics in addressing global supply chain resilience.

Report Scope

Report Features Description Market Value (2023) USD 37.2 Billion Forecast Revenue (2033) USD 221.8 Billion CAGR (2024-2032) 20.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By Application (Industrial Robots, Service Robots, Collaborative Robots), By End-User (Manufacturing, Healthcare, Aerospace & Defense) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape NXP Semiconductors, Rethink Robotics, DENSO Corporation, CMA Robotics, ST Robotics, Techman Robots, ABB, Mitsubishi Electric Corporation, Universal Robots Customization Scope Customization for segments at the regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- NXP Semiconductors

- Rethink Robotics

- DENSO Corporation

- CMA Robotics

- ST Robotics

- Techman Robots

- ABB

- Mitsubishi Electric Corporation

- Universal Robots