Advanced Lead Acid Battery Market Report By Type of Battery (Absorbent Glass Mat (AGM) Batteries, Gel Batteries, Enhanced Flooded Batteries (EFB), Others), By Application (Automotive Batteries, Stationary Batteries, Industrial Batteries, Motive Batteries, Others), By End Users, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

46436

-

May 2024

-

325

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

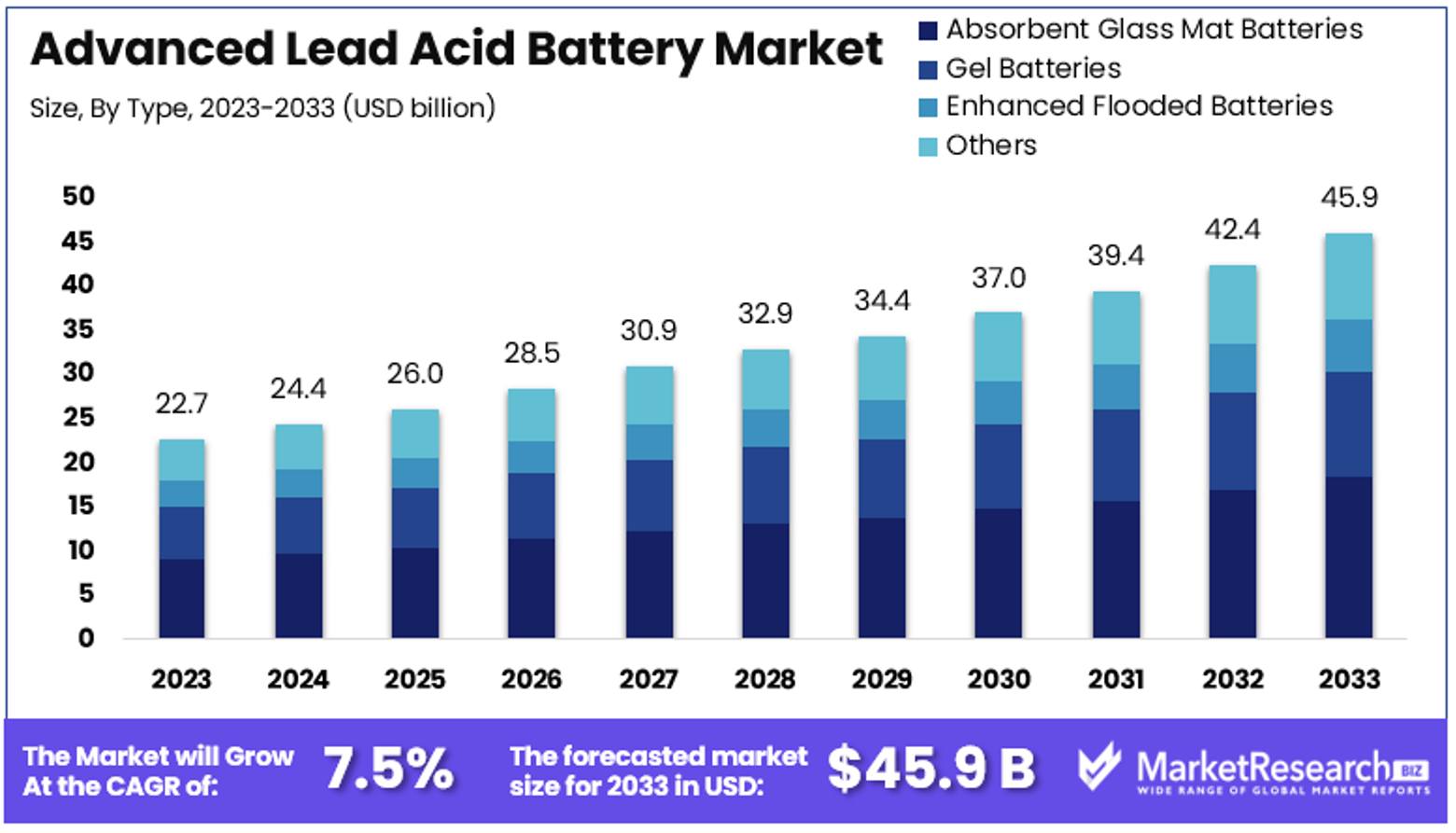

The Global Advanced Lead Acid Battery Market size is expected to be worth around USD 45.9 Billion by 2033, from USD 22.7 Billion in 2023, growing at a CAGR of 7.5% during the forecast period from 2024 to 2033.

The Advanced Lead Acid Battery Market focuses on improved versions of traditional lead-acid batteries. These batteries offer better performance, longer life, and increased energy efficiency. They are widely used in applications such as renewable energy storage, automotive, and industrial sectors. The market is driven by the growing demand for reliable and cost-effective energy storage solutions.

Companies are investing in research and development to enhance battery capabilities and meet the rising energy needs. This market is essential for supporting the transition to cleaner energy sources and improving energy storage systems.

The Advanced Lead Acid Battery Market is witnessing significant growth, driven by the rising demand for reliable and cost-effective energy storage solutions. Advanced lead-acid batteries, known for their improved performance, longer lifespan, and increased energy efficiency, are becoming essential in various sectors, including renewable energy storage, automotive, and industrial applications. The increasing adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs) significantly boosts this market.

According to the U.S. Energy Information Administration, in the second quarter of 2023, hybrid, plug-in hybrid, and battery-electric vehicles accounted for 16% of light-duty vehicle sales, up from 12.9% in 2022. This trend underscores the growing reliance on advanced battery technologies to support the complex electronics required for battery management and power control in these vehicles.

In 2022, global sales of electric cars reached 10.5 million units, representing 14.2% of total vehicle sales. This surge highlights the increasing shift towards cleaner energy solutions. The U.S. electric vehicle market alone saw a remarkable 60% year-over-year increase, with sales rising from 1 million in 2022 to 1.6 million in 2023. States such as California, Florida, Texas, and Washington lead in EV registrations, indicating strong regional adoption.

These market dynamics suggest a robust growth trajectory for advanced lead-acid batteries, as they play a critical role in supporting the transition to sustainable energy systems. Companies are investing heavily in research and development to enhance battery capabilities, meeting the rising energy demands. The Advanced Lead Acid Battery Market is poised for sustained growth, driven by technological advancements and the expanding adoption of electric and hybrid vehicles.

Key Takeaways

- Market Value: The market value stood at USD 22.7 billion in 2023, with a projected CAGR of 7.5%, expected to reach USD 45.9 billion by 2033.

- Type of Battery Analysis: AGM batteries dominate with over 40%; superior performance and versatility.

- Application Analysis: Automotive batteries dominate with 50%; widespread adoption in start-stop systems and EVs.

- End User Analysis: Automotive industry dominates with over 45%; high demand in start-stop systems and hybrid/EVs.

- Dominant Region: APAC dominates with 37.6%; strong manufacturing and automotive sectors.

- High Growth Region: North America with 24.3%; driven by robust automotive and industrial sectors.

- Analyst Viewpoint: The advanced lead-acid battery market is growing steadily, with significant demand from the automotive and stationary power sectors. The market is moderately competitive, with established players focusing on technological advancements and expanding applications. Future growth will be driven by increased hybrid/EV production and renewable energy storage needs.

- Growth Opportunities: Key players can leverage advancements in AGM and EFB technologies, explore niche applications in industrial sectors, and expand their presence in high-growth regions like APAC and North America to stand out in the market.

Driving Factors

Increasing Demand for Renewable Energy Storage Solutions Drives Market Growth

The global shift towards renewable energy sources, such as solar and wind power, is significantly driving the growth of the advanced lead-acid battery market. As countries and companies invest in renewable energy, the need for efficient and reliable energy storage solutions has increased. Advanced lead-acid batteries are cost-effective and can store excess energy produced during peak production periods, releasing it when needed. This capability enhances the efficiency and reliability of renewable energy systems.

For instance, utility-scale solar and wind farms are integrating advanced lead-acid battery banks to mitigate the intermittent nature of power generation, ensuring a steady energy supply. According to the International Renewable Energy Agency (IRENA), global renewable energy capacity reached 2,799 GW in 2021, further boosting the demand for advanced lead-acid batteries. This trend is expected to continue, with the Battery Energy Storage System Market size is expected to be worth around USD 199.5 Bn by 2032 from USD 24.5 Bn in 2022, growing at a CAGR of 24% during the forecast period from 2023 to 2032. The combination of renewable energy investments and the proven reliability of advanced lead-acid batteries positions these storage solutions as a critical component of the global energy transition.

Growing Popularity of Hybrid and Electric Vehicles Drives Market Growth

The increasing adoption of hybrid and electric vehicles (EVs) is a major driver of the advanced lead-acid battery market. The automotive industry's shift towards more environmentally friendly vehicles has created a significant demand for reliable and affordable energy storage solutions. Advanced lead-acid batteries are commonly used in start-stop systems and as auxiliary power sources in hybrid and EVs, providing the necessary power for various electrical components while reducing fuel consumption and emissions.

Major automakers, including Toyota, Ford, and Volkswagen, have integrated advanced lead-acid batteries into their hybrid and EV models. According to the International Energy Agency (IEA), global EV sales reached 6.6 million units in 2021, representing nearly 9% of the global car market. This growing market is expected to drive further demand for advanced lead-acid batteries, which are valued for their cost-effectiveness and reliability. The interaction between the automotive industry's push for sustainability and the capabilities of advanced lead-acid batteries is set to continue fueling market growth in this sector.

Expansion of Telecom and Data Center Infrastructure Drives Market Growth

The rapid expansion of telecommunications and data center infrastructure is another key factor driving the growth of the advanced lead-acid battery market. As the demand for uninterrupted power supply (UPS) systems increases, advanced lead-acid batteries are becoming essential for ensuring continuous operation during power outages. These batteries help prevent data loss and service disruptions, which are critical for telecom networks and data centers.

Companies like Vertiv and Eaton have integrated advanced lead-acid batteries into their UPS solutions to enhance reliability and efficiency. The global data center market is expected to grow at a CAGR of 10.5% from 2021 to 2026, driven by increasing internet usage, cloud computing, and the proliferation of IoT devices. Similarly, the telecom industry's expansion, with 5G networks expected to cover one-third of the world's population by 2025, is increasing the demand for robust backup power solutions. The synergy between the need for reliable power in telecom and data centers and the performance of advanced lead-acid batteries is significantly contributing to market growth.

Restraining Factors

Competition from Alternative Battery Technologies Restrains Market Growth

The advanced lead-acid battery market is limited by competition from alternative battery technologies like lithium-ion and other advanced chemistries. Lithium-ion batteries offer higher energy densities and longer cycle lives, making them more attractive for applications in the automotive and consumer electronics sectors.

For instance, the growing adoption of lithium-ion batteries in electric vehicles (EVs) and portable devices reduces the market share for advanced lead-acid batteries. According to BloombergNEF, lithium-ion battery prices have dropped by 89% in the past decade, making them more cost-competitive. This price decline and superior performance characteristics have led to a surge in demand for lithium-ion batteries, particularly in EVs. The advanced lead-acid battery market faces significant pressure from these advancements, limiting its growth potential in sectors that prioritize energy efficiency and compact design.

Environmental Concerns and Regulatory Restrictions Restrain Market Growth

Environmental concerns and regulatory restrictions significantly hinder the growth of the advanced lead-acid battery market. Lead-acid batteries, although recyclable, involve the use of lead in mining and production processes, posing environmental risks. Stringent regulations and guidelines regarding lead handling, disposal, and recycling add compliance costs and operational complexities for manufacturers and users.

The European Union’s Batteries Directive, for instance, imposes strict rules on the use of lead and mandates proper recycling and disposal practices. These regulations can impact market dynamics by increasing production costs and limiting the ease of market entry for new players. The global battery recycling market is projected to grow due to these stringent regulations, indicating a shift towards more environmentally friendly alternatives. This regulatory landscape creates challenges for the advanced lead-acid battery market, restricting its growth and adoption.

Type of Battery Analysis

AGM batteries dominate with over 40% market share due to their superior performance and versatility.

The advanced lead-acid battery market is segmented by battery type into Absorbent Glass Mat (AGM) batteries, Gel batteries, Enhanced Flooded Batteries (EFB), and others. AGM batteries dominate this segment with a significant market share due to their superior performance and versatility.

AGM batteries are widely used in automotive applications, particularly for start-stop systems, which are essential for reducing fuel consumption and emissions. AGM batteries accounted for more than 40% of the advanced lead-acid battery market in 2022. Their popularity is attributed to their ability to deliver high current, long life, and maintenance-free operation. This makes them ideal for use in both conventional and hybrid vehicles. Additionally, AGM batteries are preferred in renewable energy systems and backup power applications due to their deep cycling capabilities and resilience to harsh environments.

Gel batteries, another important sub-segment, are known for their robust performance in extreme conditions. They are widely used in applications where durability and reliability are critical, such as in telecommunications and renewable energy systems. However, their market share is smaller compared to AGM batteries due to higher costs and lower energy densities.

Enhanced Flooded Batteries (EFB) are primarily used in automotive applications, offering a cost-effective solution with improved charge acceptance and cycle life compared to traditional flooded batteries. They are gaining traction in the market as a reliable and economical option for start-stop systems in vehicles. The remaining sub-segment, which includes various specialized and niche battery types, plays a role in specific applications requiring unique performance characteristics.

Application Analysis

Automotive batteries dominate with 50% market share due to the widespread adoption of start-stop systems and hybrid/EV production.

The advanced lead-acid battery market can also be segmented by application into automotive batteries, stationary batteries, industrial batteries, motive batteries, and others. Automotive batteries represent the largest sub-segment, driven by the widespread adoption of start-stop systems and the increasing production of hybrid and electric vehicles (EVs).

Automotive batteries accounted for approximately 50% of the market share in 2022. The demand for advanced lead-acid batteries in this segment is propelled by their cost-effectiveness, reliability, and ability to provide the necessary power for modern vehicle electronics. Start-stop systems, which automatically shut off and restart the engine to reduce idling time, heavily rely on advanced lead-acid batteries to function efficiently. Furthermore, the growing popularity of hybrid and EVs, which require auxiliary power sources, is boosting the demand for these batteries.

Stationary batteries, another significant sub-segment, are used in applications requiring uninterrupted power supply (UPS), such as data centers, telecommunications, and renewable energy storage systems. These batteries ensure continuous operation during power outages and are essential for maintaining critical infrastructure. The market share of stationary batteries is growing steadily, driven by the expansion of data centers and telecom networks.

Industrial batteries are used in various applications, including forklifts, mining equipment, and backup power for industrial facilities. They are valued for their robustness and ability to deliver reliable power in demanding environments. Motive batteries, used in electric vehicles and other transportation applications, also contribute to the market, although their share is smaller compared to automotive and stationary batteries.

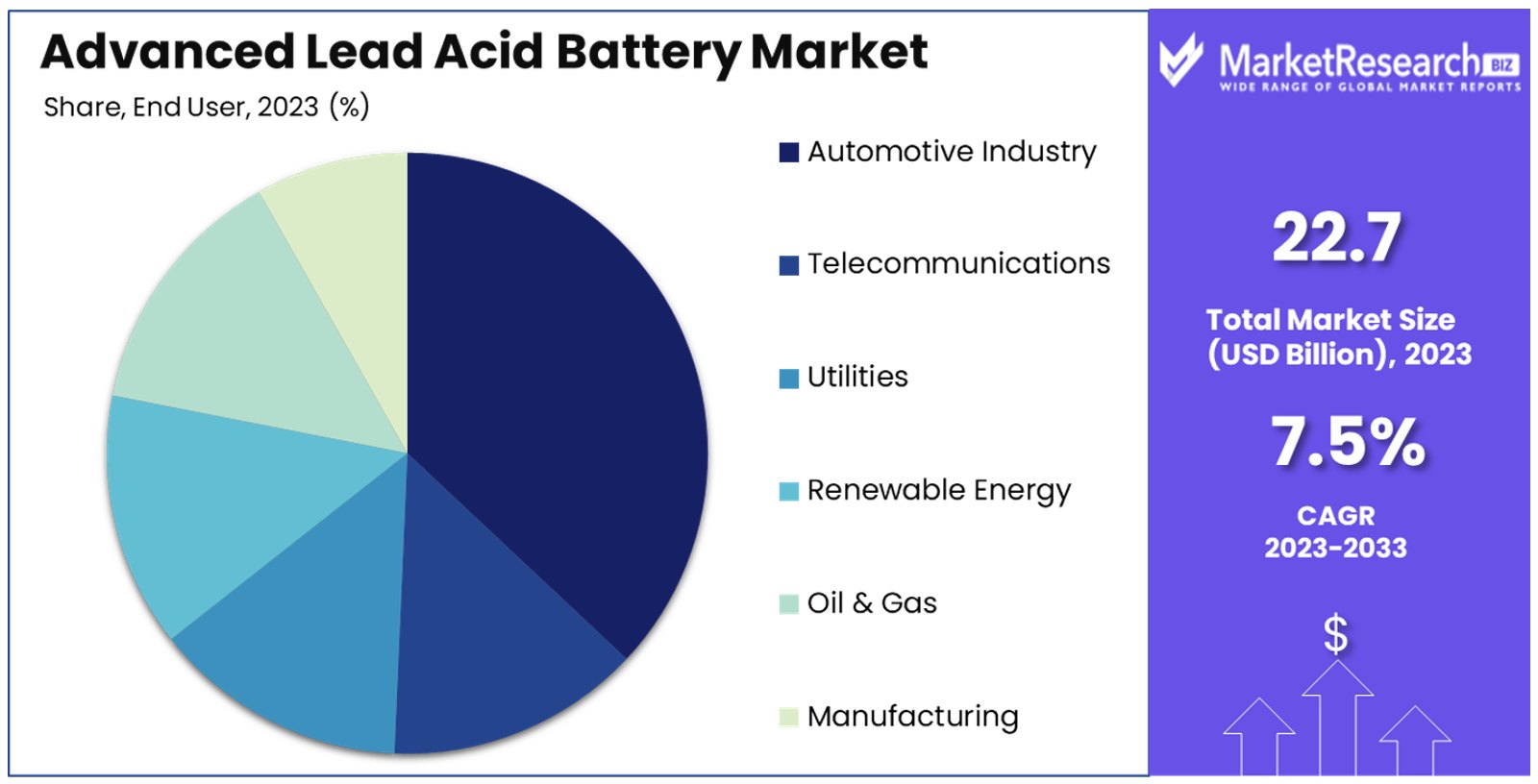

End User Analysis

The automotive industry dominates with over 45% market share due to the high demand for batteries in start-stop systems and hybrid/EVs.

The advanced lead-acid battery market is further segmented by end user into automotive industry, telecommunications, utilities, renewable energy, oil & gas, manufacturing, and others. The automotive industry is the dominant end user, driving significant demand for advanced lead-acid batteries.

The automotive industry accounted for over 45% of the market share in 2022. The need for reliable, cost-effective, and high-performance batteries in start-stop systems and hybrid/EVs fuels this demand. Advanced lead-acid batteries are essential for providing the necessary power to support various electrical components in vehicles, enhancing fuel efficiency and reducing emissions. Advanced fuel management systems provide real-time monitoring and data analytics for efficient fuel consumption.

The telecommunications sector is another key end user, relying on advanced lead-acid batteries for backup power in telecom towers and data centers. The rapid expansion of 5G networks and the increasing importance of uninterrupted connectivity drive the demand for these batteries in the telecommunications industry. Utilities and renewable energy sectors also significantly contribute to market growth, using advanced lead-acid batteries for energy storage and grid stabilization.

In the oil & gas and manufacturing sectors, advanced lead-acid batteries provide critical backup power and support for industrial operations. Their reliability and ability to perform in harsh environments make them suitable for these demanding applications. The remaining end user sub-segment, which includes various specialized industries, plays a role in niche applications requiring specific battery characteristics.

Key Market Segments

By Type of Battery

- Absorbent Glass Mat (AGM) Batteries

- Gel Batteries

- Enhanced Flooded Batteries (EFB)

- Others

By Application

- Automotive Batteries

- Stationary Batteries

- Industrial Batteries

- Motive Batteries

- Others

By End User

- Automotive Industry

- Telecommunications

- Utilities

- Renewable Energy

- Oil & Gas

- Manufacturing

- Others

Growth Opportunities

Increasing Demand for Backup Power Solutions Offers Growth Opportunity

The growing need for reliable and cost-effective backup power solutions in sectors like healthcare, telecommunications, and data centers presents a significant growth opportunity for advanced lead-acid batteries. These batteries are crucial in uninterrupted power supply (UPS) systems, providing backup power during outages to ensure continuous operations and prevent data loss.

The expansion of data centers and the increasing reliance on digital services drive the demand for advanced lead-acid batteries in UPS systems. The global data center market is expected to grow at a high CAGR indicating a strong demand for backup power solutions. This trend highlights the potential for advanced lead-acid batteries to capture a substantial market share in the growing backup power segment.

Adoption in Microgrids and Off-Grid Energy Systems Offers Growth Opportunity

The rising interest in microgrids and off-grid energy systems, especially in remote and rural areas, creates a growth opportunity for advanced lead-acid batteries. These batteries can be integrated into renewable energy systems, such as solar and wind power installations, to store excess energy and provide a reliable power supply when needed.

For example, many remote communities and off-grid facilities in developing countries are deploying advanced lead-acid battery banks alongside solar panels to ensure a consistent and sustainable energy supply. According to the International Renewable Energy Agency (IRENA), the global microgrid market is expected to reach USD 30.9 billion by 2026, growing at a CAGR of 10.9%. This growth reflects the increasing deployment of advanced lead-acid batteries in microgrid and off-grid applications, highlighting their potential to support sustainable energy solutions.

Trending Factors

Emphasis on Sustainability and Recycling Are Trending Factors

The increasing emphasis on sustainability and recycling in the battery industry has led to a trend toward more environmentally friendly and recyclable battery technologies. Effective battery recycling processes are essential for mitigating environmental impact and reclaiming valuable materials. Advanced lead-acid batteries have a well-established recycling infrastructure and are highly recyclable, making them popular for applications where sustainability is a priority.

Many automotive manufacturers promote using advanced lead-acid batteries in their vehicles due to their recyclability and lower environmental impact compared to other battery types. According to the Battery Council International (BCI), lead-acid batteries have a recycling rate of over 99%, the highest of any battery technology. This strong focus on sustainability and recyclability drives the preference for advanced lead-acid batteries in various sectors, contributing to their trending status in the market.

Integration of Advanced Battery Management Systems Are Trending Factors

The integration of advanced battery management systems (BMS) is a trending factor in the advanced lead-acid battery market. These systems monitor and manage battery performance, ensuring optimal charging and discharging cycles, and extending the overall battery life. BMS technology also enhances safety and reliability, making advanced lead-acid batteries more attractive for critical applications.

For instance, many UPS and renewable energy storage systems now incorporate advanced BMS to optimize the performance and lifespan of their lead-acid battery banks. This trend underscores the increasing adoption of BMS in advanced lead-acid batteries, highlighting their importance in enhancing battery performance and reliability.

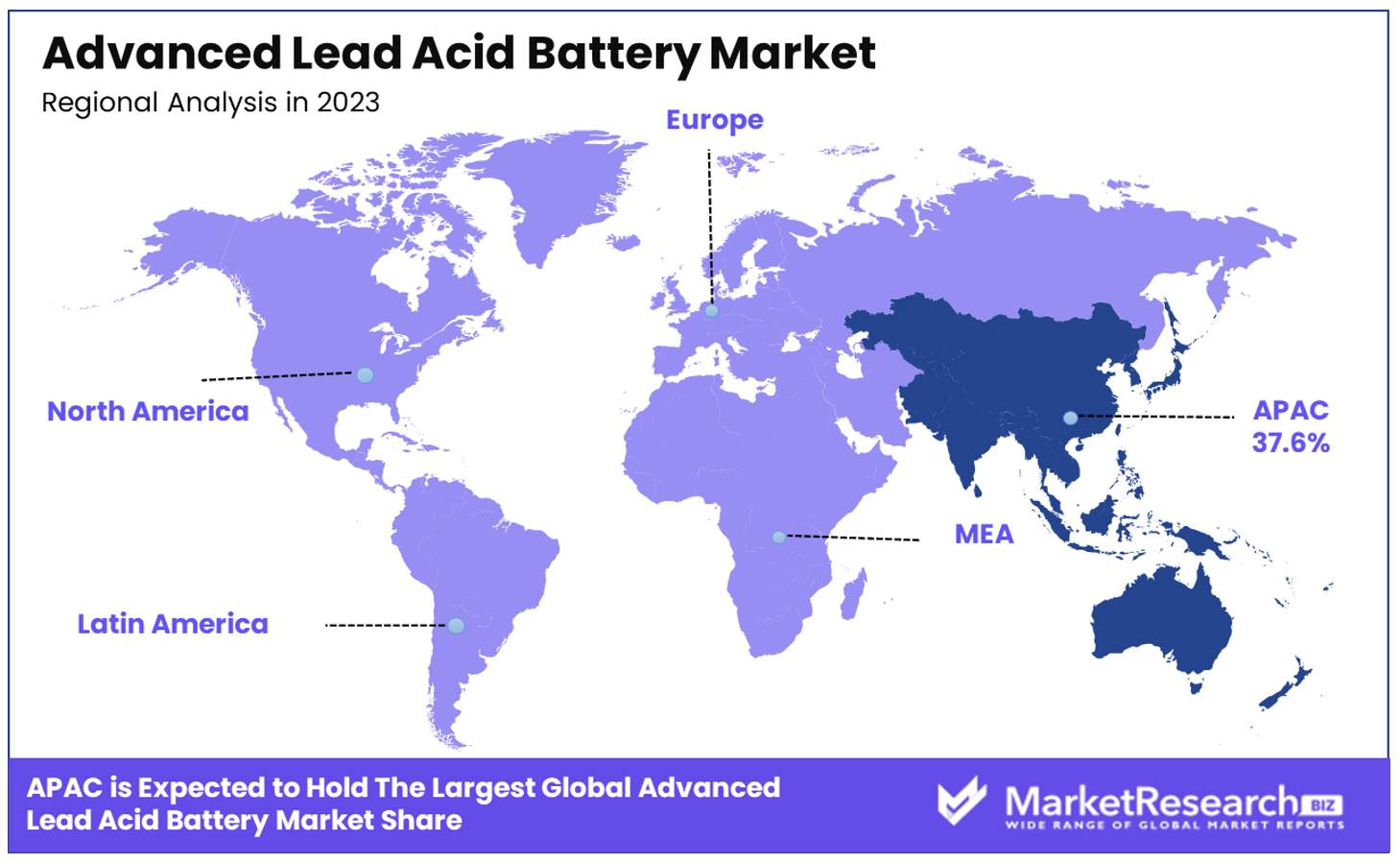

Regional Analysis

APAC Dominates with 37.6% Market Share

The Asia-Pacific (APAC) region leads the advanced lead-acid battery market with a 37.6% share. Several factors drive this dominance.

APAC's high market share is driven by rapid industrialization and urbanization, particularly in China and India. The automotive industry in this region is booming, with significant demand for start-stop systems in vehicles. Additionally, the expansion of telecommunications and data centers increases the need for reliable backup power solutions, further boosting demand for advanced lead-acid batteries.

The region's characteristics, such as a large population and growing middle class, contribute to high demand for automotive and industrial applications. Government initiatives supporting renewable energy and infrastructure development also play a critical role. China's focus on renewable energy and India's growing telecom industry are key drivers.

North America Market Share

North America holds a 24.3% market share in the advanced lead-acid battery market. This is driven by strong automotive and industrial sectors and the growing demand for backup power solutions in data centers and telecommunications.

Europe Market Share

Europe accounts for 21.7% of the market. The region's focus on sustainability and renewable energy, coupled with stringent environmental regulations, drives demand for advanced lead-acid batteries, especially in automotive applications.

Middle East & Africa Market Share

The Middle East & Africa region has a 9.4% market share. The demand here is driven by the expansion of the oil and gas industry and the need for reliable backup power in extreme conditions.

Latin America Market Share

Latin America holds a 7% market share. The region's market growth is influenced by increasing industrial activities and the adoption of renewable energy solutions, particularly in remote and off-grid areas.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Advanced Lead Acid Battery Market features several prominent companies, each influencing the market through strategic positioning and impact. Exide Technologies and EnerSys are major players, leveraging their extensive distribution networks and advanced technology to dominate market share. GS Yuasa Corporation and Clarios (formerly Johnson Controls Battery Group) hold significant influence due to their strong R&D capabilities and global reach.

C&D Technologies, Inc. and East Penn Manufacturing Co. are recognized for their innovative battery solutions, catering to various industrial and commercial applications. NorthStar Battery and Trojan Battery Company are noted for their high-performance products, especially in renewable energy and motive power sectors. Discover Battery and Leoch International Technology Limited focus on expanding their market presence through product diversification and strategic partnerships.

Coslight Technology International Group and Hoppecke Batterien GmbH & Co. KG contribute to market growth with their robust product portfolios and emphasis on sustainability. HBL Power Systems Ltd. and Enersys Hawker enhance their market influence by providing reliable and efficient battery solutions across different regions. CSB Battery Co., Ltd. is known for its extensive product range and strong customer relationships.

These companies' strategic initiatives, such as mergers, acquisitions, and collaborations, drive market competition and innovation. Their continuous investment in technology and capacity expansion positions them as key influencers in the Advanced Lead Acid Battery Market, shaping industry trends and future growth trajectories.

Market Key Players

- Exide Technologies

- EnerSys

- GS Yuasa Corporation

- Clarios (formerly Johnson Controls Battery Group)

- C&D Technologies, Inc.

- East Penn Manufacturing Co.

- NorthStar Battery

- Trojan Battery Company

- Discover Battery

- Leoch International Technology Limited

- Coslight Technology International Group

- Hoppecke Batterien GmbH & Co. KG

- HBL Power Systems Ltd.

- Enersys Hawker

- CSB Battery Co., Ltd.

Recent Developments

- On February 2024, Loughborough University's world-first lead-acid battery-electrolyser was nominated in all three Academic Excellence categories of the 2024 Hydrogen Awards. This innovative low-cost system allows the use of excess renewable energy to produce hydrogen gas, with applications in renewable energy-powered microgrids to support communities without access to electricity or clean cooking.

- On December 2023, TAILG, a global leader in electric two-wheelers, launched its latest sodium-ion battery technology in China. This technology offers exceptional long-range capabilities, extended warranties, superior low-temperature resistance, and enhanced safety.

Report Scope

Report Features Description Market Value (2023) USD 22.7 Billion Forecast Revenue (2033) USD 45.9 Billion CAGR (2024-2033) 7.5% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type of Battery (Absorbent Glass Mat (AGM) Batteries, Gel Batteries, Enhanced Flooded Batteries (EFB), Others), By Application (Automotive Batteries, Stationary Batteries, Industrial Batteries, Motive Batteries, Others), By End User (Automotive Industry, Telecommunications, Utilities, Renewable Energy, Oil & Gas, Manufacturing, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Exide Technologies, EnerSys, GS Yuasa Corporation, Clarios (formerly Johnson Controls Battery Group), C&D Technologies, Inc., East Penn Manufacturing Co., NorthStar Battery, Trojan Battery Company, Discover Battery, Leoch International Technology Limited, Coslight Technology International Group, Hoppecke Batterien GmbH & Co. KG, HBL Power Systems Ltd., Enersys Hawker, CSB Battery Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Exide Technologies

- EnerSys

- GS Yuasa Corporation

- Clarios (formerly Johnson Controls Battery Group)

- C&D Technologies, Inc.

- East Penn Manufacturing Co.

- NorthStar Battery

- Trojan Battery Company

- Discover Battery

- Leoch International Technology Limited

- Coslight Technology International Group

- Hoppecke Batterien GmbH & Co. KG

- HBL Power Systems Ltd.

- Enersys Hawker

- CSB Battery Co., Ltd.