Adulticides Market By Type (Synthetic Adulticides, Natural Adulticides, Biological Adulticides), By Application (Government, Commercial, Residential), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

47542

-

June 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

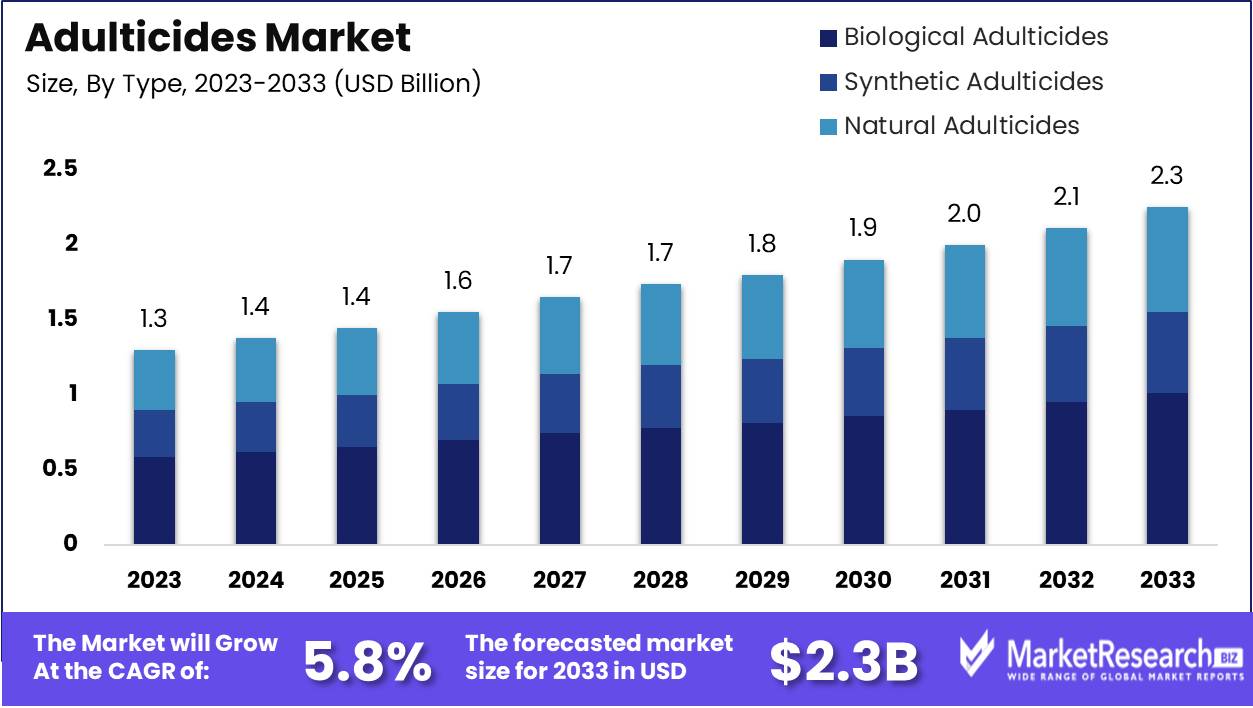

The Adulticides Market was valued at USD 1.3 Billion in 2023. It is expected to reach USD 2.3 Billion by 2033, with a CAGR of 5.8% during the forecast period from 2024 to 2033.

The adulticides market encompasses the sector focused on products designed to control or eliminate adult insect pests, primarily targeting mosquitoes and other vectors of disease. This market includes chemical, biological, and natural formulations, catering to public health agencies, agricultural sectors, and residential consumers. Innovations in sustainable and eco-friendly solutions are driving growth, alongside regulatory developments and increasing awareness of vector-borne diseases.

The adulticides market is experiencing significant growth driven by the rising incidence of vector-borne diseases. With the increasing outbreaks of malaria, dengue, and Zika, there is an escalating demand for effective adulticides to control adult mosquito populations, which are primary vectors for these diseases. This surge is further amplified by heightened agricultural activities where adulticides are pivotal in protecting crops and enhancing yield and quality. The agricultural sector's demand is particularly pronounced in regions with intensive farming practices, where pest control is critical to safeguarding food security and economic stability.

Simultaneously, sustainability trends are reshaping the market landscape. There is a marked shift towards biological and natural adulticides as stakeholders respond to growing environmental concerns and stringent regulatory pressures. This transition is reflective of a broader industry trend prioritizing sustainable and eco-friendly solutions. However, the reliance on chemical adulticides poses significant environmental concerns, particularly regarding their adverse effects on non-target species and ecosystems.

Consequently, the market is witnessing increased innovation and investment in developing environmentally benign alternatives that can provide effective pest control while minimizing ecological impact. In summary, the adulticides market is poised for robust growth, driven by the dual imperatives of public health and agricultural productivity, yet it must navigate the complex interplay of efficacy, sustainability, and regulatory compliance.

Key Takeaways

- Market Growth: The Adulticides Market was valued at USD 1.3 Billion in 2023. It is expected to reach USD 2.3 Billion by 2033, with a CAGR of 5.8% during the forecast period from 2024 to 2033.

- By Type: Biological Adulticides dominated the market due to sustainability and efficacy.

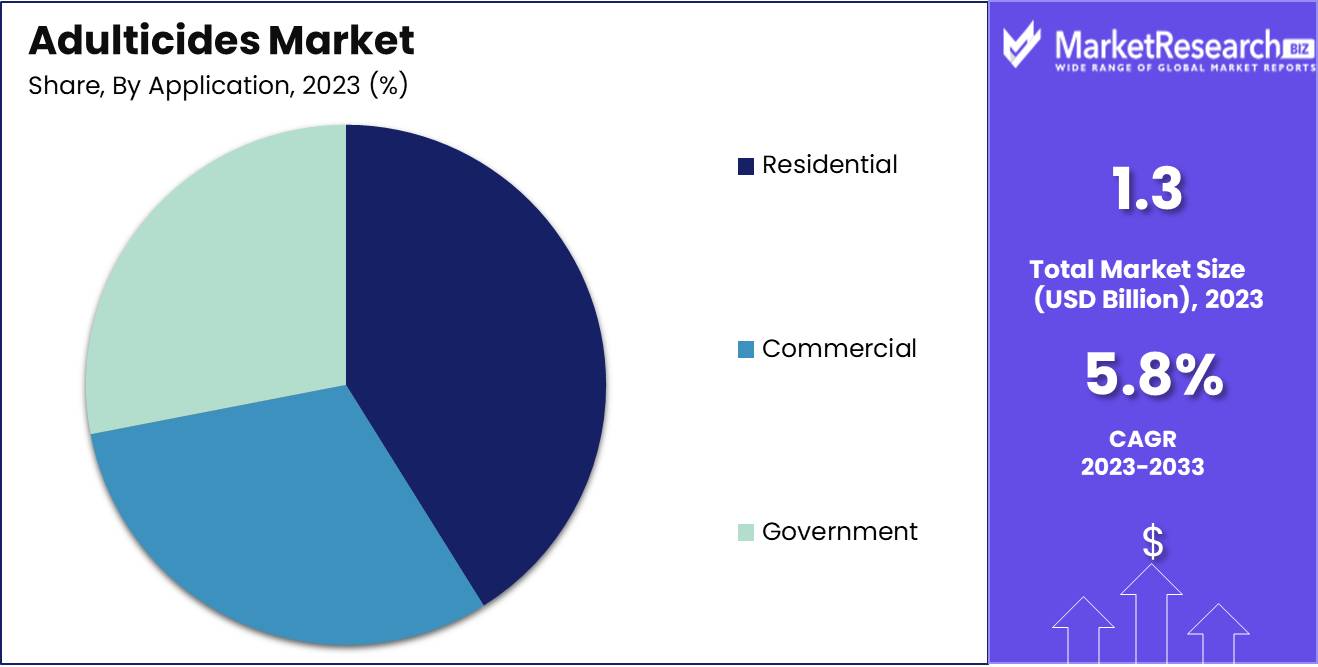

- By Application: The Residential Segment dominated the Adulticides Market by application.

- Regional Dominance: North America leads the adulticides market with a 35% global share.

- Growth Opportunity: The adulticides market offers growth opportunities through biological solutions and innovative strategies against pesticide resistance.

Driving factors

Increased Demand for Agricultural Products: A Catalyst for Adulticides Market Expansion

The surge in global population and the consequent increase in food demand have significantly heightened the need for agricultural productivity. According to the United Nations, the world population is projected to reach 9.7 billion by 2050, necessitating a 70% increase in food production to meet the growing needs. This demand for higher crop yields drives farmers to adopt more effective pest control methods, including adulticides, to protect crops from insect infestations and ensure stable food supplies. The emphasis on maximizing output from limited arable land has propelled the adoption of adulticides as a critical component of integrated pest management strategies, thereby significantly contributing to the market's growth.

Costs Associated with Pesticide Usage: Balancing Expenditure with Efficacy

While the agricultural sector heavily relies on pesticides, including adulticides, to protect crops, the associated costs remain a pivotal consideration for market growth. The financial burden of pesticide application includes the purchase cost, application equipment, labor, and potential environmental and health-related liabilities. According to the Food and Agriculture Organization (FAO), global pesticide expenditure exceeds $50 billion annually. Despite these costs, the economic justification for using adulticides lies in their efficacy in preventing crop losses due to pests, which can otherwise result in substantial financial setbacks for farmers. Advanced formulations and targeted application techniques are being developed to enhance cost-efficiency, ensuring that the benefits of adulticide usage outweigh the expenses, thus supporting market expansion.

Growing Awareness of Insecticide Resistance: Driving Innovation and Sustainable Solutions

The increasing recognition of insecticide resistance presents both a challenge and an opportunity for the adulticides market. Over-reliance on certain pesticides has led to the evolution of resistant insect populations, undermining the effectiveness of traditional chemical controls. The Insecticide Resistance Action Committee (IRAC) reports that over 500 insect species have developed resistance to one or more types of insecticides. This growing awareness is driving research and development efforts toward novel adulticide formulations and integrated pest management approaches that reduce the likelihood of resistance development. Innovations such as rotating active ingredients, combining chemical and biological controls, and adopting precision agriculture techniques are gaining traction. These advancements not only address resistance issues but also promote sustainable pest management practices, thereby fostering long-term market growth.

Restraining Factors

Environmental Concerns: A Major Barrier to Market Expansion

Environmental concerns represent a significant restraining factor for the growth of the adulticides market. The use of adulticides, which are insecticides targeting adult pests, often leads to unintended consequences on non-target species and ecosystems. Regulatory bodies are increasingly imposing stringent guidelines and restrictions to mitigate these environmental impacts. For instance, the European Union's regulations on the use of certain chemicals in pest control have tightened, limiting the market penetration of some adulticides. Additionally, public awareness and advocacy for environmental conservation have heightened scrutiny and opposition to chemical pest control methods. This has led to a shift towards integrated pest management (IPM) practices that prioritize environmentally friendly and sustainable approaches, further dampening the demand for traditional adulticides.

Health Risks: Impeding Market Adoption and Usage

Health risks associated with adulticides are another critical factor that hinders market growth. Many adulticides contain chemicals that pose potential health hazards to humans, particularly when exposure is not adequately controlled. For example, organophosphates and pyrethroids, commonly used in adulticides, have been linked to neurological and respiratory issues in humans. These concerns are exacerbated in residential and agricultural settings where human exposure is more likely. The World Health Organization (WHO) and other health agencies have highlighted the need for safer pest control alternatives, leading to a decline in the use of conventional adulticides. As a result, there is increased investment in research and development for safer, bio-based, and less toxic pest control solutions, which, while beneficial for public health, restrain the growth of the traditional adulticides market.

By Type Analysis

In 2023, Biological Adulticides dominated the market due to sustainability and efficacy.

In 2023, Biological Adulticides held a dominant market position in the By Type segment of the Adulticides Market. This ascendancy is attributed to growing environmental awareness and regulatory pressures favoring sustainable pest control solutions. Biological adulticides, derived from natural organisms such as bacteria, fungi, and nematodes, offer targeted action against adult insects while minimizing ecological impact and resistance development. This segment outpaced Synthetic Adulticides, which, despite their effectiveness, face scrutiny over chemical residues and potential health risks. Meanwhile,

Natural Adulticides, encompassing botanical extracts and essential oils, gained traction for their eco-friendly appeal but struggled with consistency and potency compared to their biological counterparts. The comprehensive efficacy, safety profile, and regulatory compliance of Biological Adulticides positioned them as the preferred choice among pest management professionals. Their adoption was further bolstered by advancements in biotechnological research, leading to innovative formulations and broader spectrum applications. As the market continues to shift towards environmentally responsible practices, Biological Adulticides are expected to maintain their leadership, driven by ongoing developments and increasing acceptance in integrated pest management programs.

By Application Analysis

In 2023, The Residential Segment dominated the Adulticides Market by application.

In 2023, The Residential Segment held a dominant market position in the By Application segment of the Adulticides Market. This dominance can be attributed to several factors. Firstly, the increasing urbanization and population density in residential areas have heightened the demand for effective pest control solutions to ensure health and safety standards. Secondly, growing consumer awareness regarding vector-borne diseases has led to a higher adoption rate of adulticides in households. Additionally, the proliferation of innovative and user-friendly products in the market has made it easier for homeowners to manage pest control independently.

Conversely, the Government and Commercial segments also contribute significantly but are overshadowed by the vast residential demand. Government applications often focus on large-scale pest control initiatives in public spaces, requiring substantial investments and coordination, which can limit rapid market expansion. The Commercial segment, encompassing businesses such as hotels, restaurants, and offices, demands high-quality adulticides to maintain hygiene standards and customer satisfaction, though its market share remains secondary to residential needs. Collectively, these factors underscore the Residential segment's leading role, driven by direct consumer engagement and the pressing need for personal and family health protection.

Key Market Segments

By Type

- Synthetic Adulticides

- Natural Adulticides

- Biological Adulticides

By Application

- Government

- Commercial

- Residential

Growth Opportunity

Rise of Biological and Natural Adulticides Fuels Market Growth

The global adulticides market is poised for significant expansion, driven by the increasing shift towards biological and natural solutions. With growing environmental concerns and regulatory pressures against synthetic chemicals, there is a rising demand for eco-friendly and sustainable alternatives. Biological adulticides, derived from natural sources such as bacteria, fungi, and plant extracts, are gaining traction due to their lower toxicity and minimal environmental impact. This trend is further bolstered by advancements in biotechnology, which have enhanced the efficacy and affordability of natural adulticides. As a result, companies investing in research and development of these products are well-positioned to capitalize on this burgeoning market segment.

Addressing Resistance to Pesticides Through Innovation and Diversification

Resistance to traditional chemical pesticides is a critical challenge that continues to drive innovation in the adulticides market. Overreliance on specific chemical classes has led to the development of resistant pest populations, diminishing the effectiveness of conventional treatments. This resistance necessitates the continuous development of new and diverse adulticides to maintain control over pest populations. Industry players are increasingly focusing on integrated pest management (IPM) strategies that combine chemical, biological, and cultural practices. Such approaches not only mitigate resistance but also enhance the sustainability and long-term efficacy of pest control programs. Companies that can effectively integrate these innovative solutions into their portfolios will likely see substantial growth opportunities and beyond.

Latest Trends

Increased Use of Fogging and Spraying Applications

The adulticides market is poised to witness a notable surge in the adoption of fogging and spraying applications. These methods, known for their effectiveness in rapidly reducing adult mosquito populations, are becoming increasingly favored due to their efficiency and broad coverage. The enhancement of delivery technologies and formulations ensures more precise and potent dispersal, minimizing environmental impact while maximizing efficacy. Additionally, urbanization and the expansion of residential areas into mosquito-prone regions are driving demand for these applications. Regulatory bodies are also encouraging their use by streamlining approval processes for new and improved fogging and spraying solutions.

Growing Importance of Mosquito Control

The rising global threat of mosquito-borne diseases, such as dengue, malaria, Zika, and West Nile virus, underscores the growing importance of mosquito control. Governments and health organizations worldwide are prioritizing mosquito management as a public health imperative. This has led to increased funding and initiatives aimed at controlling mosquito populations, particularly in tropical and subtropical regions. The development of innovative adulticides, including those targeting insecticide-resistant mosquito strains, is critical to these efforts. Moreover, public awareness campaigns are amplifying the significance of preventive measures and the role of adulticides in safeguarding public health.

Regional Analysis

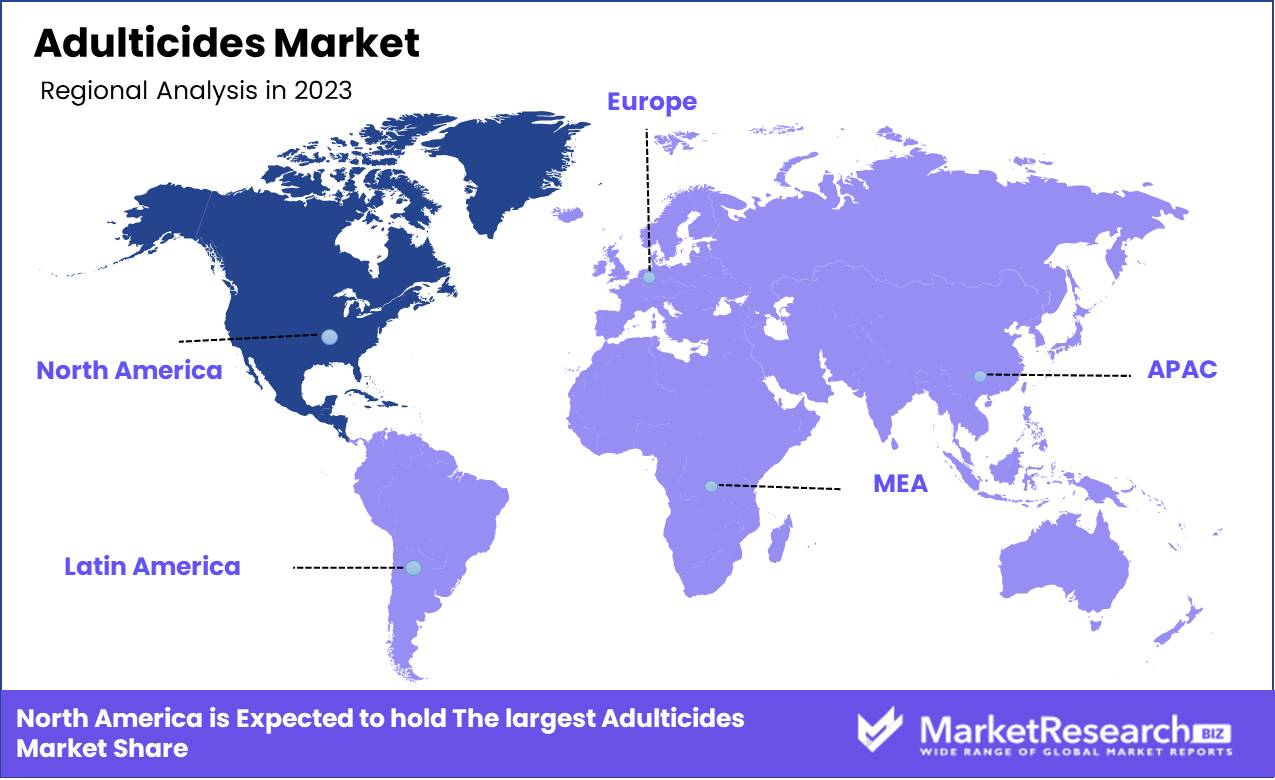

North America leads the adulticides market with a 35% global share.

The global adulticides market, segmented by region, reveals distinct trends and growth drivers across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. North America dominates the market, accounting for approximately 35% of the global share. This dominance is driven by heightened public awareness of vector-borne diseases and robust governmental initiatives in countries like the United States and Canada. The region’s advanced healthcare infrastructure further bolsters market growth.

In Europe, the market is propelled by stringent regulations on pest control and increased incidences of mosquito-borne diseases, particularly in Southern Europe, which faces rising temperatures due to climate change. The Asia Pacific region exhibits significant potential due to its large population base and tropical climates conducive to mosquito proliferation. Countries such as India and China are experiencing rapid urbanization, enhancing the demand for effective adulticides.

The Middle East & Africa market is growing steadily, driven by increased international efforts to combat malaria and dengue fever. Lastly, Latin America shows moderate growth, with Brazil leading the region due to recurring dengue outbreaks and proactive governmental interventions. Collectively, these regional dynamics underscore the critical role of adulticides in public health and disease prevention worldwide.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In the global adulticides market, the competitive landscape is shaped by a mix of established leaders and innovative newcomers, each leveraging unique strategies to capture market share. Bayer Environmental Science and BASF, both industry giants, continue to dominate through robust R&D investments and extensive product portfolios. Bayer's focus on integrated pest management solutions and BASF's advancements in chemical innovations are critical in maintaining their market leadership.

Valent BioSciences and Clarke are pivotal players emphasizing sustainability. Valent's biopesticide offerings and Clarke's environmental stewardship programs resonate strongly with the increasing regulatory and consumer demand for eco-friendly solutions. Central Life Sciences also holds a significant position, driven by its diversified product range catering to various sectors, including public health and agriculture.

Summit Chemical (AMVAC) and Univa are gaining traction through strategic acquisitions and partnerships, enhancing their market footprint and technological capabilities. UPL's aggressive expansion strategies in emerging markets, coupled with its broad-spectrum adulticide products, position it as a formidable competitor.

Kadant GranTek and Babolna-Bio focus on niche segments, leveraging specialized technologies to address specific pest control needs. Meanwhile, Westham and AllPro Vector are emerging players making strides with innovative, cost-effective solutions that cater to a broad customer base.

Overall, the adulticides market is characterized by a blend of innovation, sustainability, and strategic expansion, with key players continuously adapting to evolving regulatory landscapes and market dynamics.

Market Key Players

- Bayer Environmental Science

- Valent BioSciences

- Clarke

- Central Life Sciences

- BASF

- Summit Chemical (AMVAC)

- Univa

- UPL

- Kadant GranTek

- Babolna-Bio

- MGK

- Westham

- AllPro Vector

Recent Development

- In May 2024, Sumitomo Chemical completed the acquisition of a manufacturing facility in Southeast Asia to increase its production capacity of adulticides. This strategic move aims to meet the growing demand in the region and enhance supply chain resilience.

- In April 2024, Bayer announced the expansion of its adulticide portfolio by releasing a new formulation that enhances efficacy and environmental safety. This product is tailored for use in urban and rural areas to combat mosquito-borne diseases.

- In March 2024, BASF introduced a new adulticide product designed to effectively target mosquito populations. Incorporating a novel active ingredient, the product aims to provide longer-lasting control and reduce resistance development.

Report Scope

Report Features Description Market Value (2023) USD 1.3 Billion Forecast Revenue (2033) USD 2.3 Billion CAGR (2024-2032) 5.8% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Synthetic Adulticides, Natural Adulticides, Biological Adulticides), By Application (Government, Commercial, Residential) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Bayer Environmental Science, Valent BioSciences, Clarke, Central Life Sciences, BASF, Summit Chemical (AMVAC), Univa, UPL, Kadant GranTek, Babolna-Bio, Bayer Environmental Science, Westham, AllPro Vector Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Bayer Environmental Science

- Valent BioSciences

- Clarke

- Central Life Sciences

- BASF

- Summit Chemical (AMVAC)

- Univa

- UPL

- Kadant GranTek

- Babolna-Bio

- MGK

- Westham

- AllPro Vector