Adult Diapers Market Report By Product Type (Pad Type, Pants Type, Flat Type), By Material Type (Cotton Fabrics, Non-Woven Fabrics, Super Absorbent Polymer (SAP), Fluff Pulp), By Distribution Channel (Online Stores, Offline Stores [Supermarkets/Hypermarkets, Pharmacy Stores, Convenience Stores, Specialty Stores, Others]), By End-User (Women, Men, Unisex), By Usage (Disposable, Reusable), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

10345

-

August 2024

-

322

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

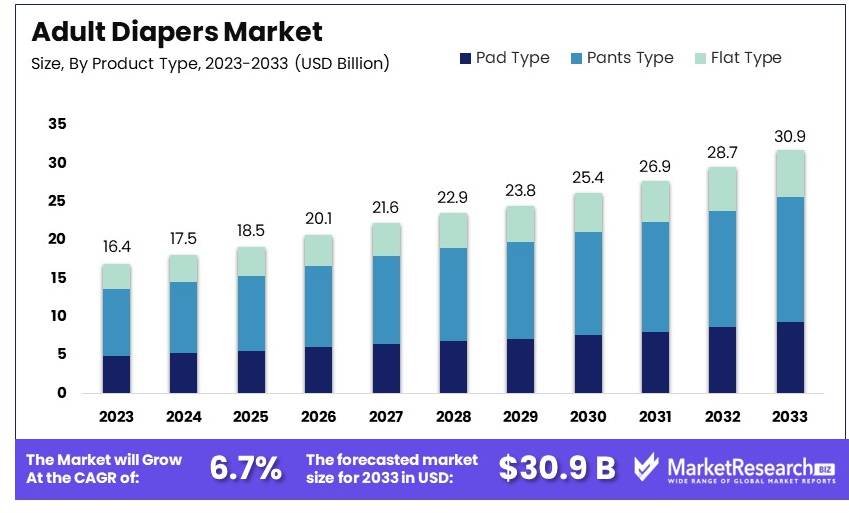

The Global Adult Diapers Market size is expected to be worth around USD 30.9 Billion by 2033, from USD 16.4 Billion in 2023, growing at a CAGR of 6.7% during the forecast period from 2024 to 2033.

The Adult Diapers Market focuses on the production and sale of diapers for adults with incontinence issues. These products are essential for the elderly, disabled individuals, and patients with medical conditions. The market is driven by the aging population and increasing awareness of incontinence solutions.

Key consumers include hospitals, nursing homes, and retail buyers. Major distribution channels are pharmacies, online platforms, and supermarkets. Innovation in materials for comfort and absorbency enhances product appeal. Challenges include social stigma and product cost. The market is competitive with established brands and emerging players. Growth is anticipated due to rising healthcare needs and advancements in diaper technology.

The adult diapers market is experiencing significant growth, driven by the increasing prevalence of incontinence and the aging global population. In the United States, approximately 33 million people suffer from overactive bladder, which substantially boosts the demand for incontinence products. On a global scale, around 425 million individuals face incontinence issues, underscoring a vast and expanding market for adult diapers.

North America is a key region for market growth, largely due to its aging population and high obesity rates. Over 42% of adults in the U.S. are classified as obese, a condition that often contributes to incontinence. This demographic trend is driving a greater need for reliable incontinence solutions.

In Singapore, companies like SeniorCare illustrate the market's potential. SeniorCare has distributed over 1 million parcels of eldercare products, including a wide range of incontinence supplies. Their significant market presence and extensive product offerings, from mobility aids to medical equipment, reflect the growing demand for eldercare solutions in the region.

The adult diapers market is poised for continued expansion as healthcare awareness and accessibility improve. Innovations in product design and materials, focusing on comfort and discretion, are enhancing user acceptance and satisfaction. Companies are investing in advanced technologies to create more effective and user-friendly products, further fueling market growth.

The adult diapers market is set for robust growth, driven by demographic trends and increasing healthcare needs. Companies that prioritize innovation, quality, and customer-centric solutions are well-positioned to capitalize on this growing market. As the global population ages and healthcare challenges persist, the demand for incontinence products will continue to rise, offering significant opportunities for market players.

Key Takeaways

- Market Value: The Adult Diapers Market was valued at USD 16.4 billion in 2023 and is projected to reach USD 30.9 billion by 2033, with a CAGR of 6.7%.

- Product Type Analysis: Pants Type diapers lead with 53.4%; preferred for comfort and ease of use.

- Material Type Analysis: Super Absorbent Polymer (SAP) is the major material at 62.3%; known for its high absorbency.

- Distribution Channel Analysis: Offline Stores dominate at 69.8%; accessibility and immediate product availability.

- End User Analysis: Unisex products have a significant share at 48.6%; catering to a broad consumer base.

- Usage Analysis: Disposable diapers dominate at 84.7%; convenience drives their demand.

Driving Factors

Aging Population Drives Market Growth

The global aging population is a significant driver for the adult diapers market. As people age, they become more susceptible to incontinence issues, leading to increased demand for adult diapers. In Japan, for example, which has one of the oldest populations globally, the adult diaper market has been growing steadily. Reports even suggest that adult diaper sales have surpassed baby diaper sales in some cases.

This trend is driven by the need to provide comfort and dignity to the elderly, making adult diapers an essential product. The growing elderly population in developed countries, combined with improved healthcare and increased life expectancy, further boosts this market. The interaction between demographic changes and healthcare needs ensures continuous market growth.

Increasing Prevalence of Incontinence Drives Market Growth

The rising prevalence of incontinence due to various medical conditions is another key factor driving the adult diapers market. Conditions like diabetes, obesity, and prostate problems are leading causes of incontinence. The International Continence Society estimates that urinary incontinence affects up to 200 million people worldwide, creating a significant demand for adult diapers.

As these conditions become more common, the need for effective incontinence management solutions increases. This trend is further supported by the growing awareness and acceptance of adult diapers, reducing the stigma associated with their use. The combined effect of these factors is driving market growth by ensuring a steady demand for adult diapers.

Improved Product Technology Drives Market Growth

Advances in product technology are significantly boosting the adult diapers market. Manufacturers are investing in research and development to create more comfortable, discreet, and effective adult diapers. Innovations like better absorption technology and thinner designs are making adult diapers more appealing and reducing the stigma associated with their use.

Companies like Kimberly-Clark have introduced products like Depend Silhouette, which looks and feels more like regular underwear. These improvements enhance user comfort and confidence, encouraging more people to use adult diapers. This trend is crucial as it addresses the need for effective incontinence management while promoting acceptance and usage.

Restraining Factors

High Cost Restrains Market Growth

The high cost of adult diapers significantly limits market growth. Adult diapers can be expensive, particularly for those who need them regularly. This expense can be a substantial barrier for many consumers, especially in developing countries or for those on fixed incomes. In the United States, a month's supply of adult diapers can cost between USD 100 to USD 300, posing a significant financial burden for many seniors.

This high cost makes it challenging for many potential users to afford these products, thereby limiting the market's expansion. Affordability remains a critical issue that needs to be addressed to make adult diapers accessible to a broader population.

Environmental Concerns Restrain Market Growth

Environmental concerns significantly restrain the adult diapers market. Most adult diapers are not biodegradable, contributing to landfill waste. This environmental impact can deter environmentally conscious consumers and increase regulatory pressure on manufacturers. For instance, some regions are considering regulations similar to those for plastic bags, which could impact the industry.

The disposal issues associated with adult diapers pose a significant challenge, leading to potential regulatory changes that could affect production and sales. Manufacturers need to find sustainable solutions to address these environmental concerns and reduce the negative impact on market growth.

Product Type Analysis

Pants Type dominates with 53.4% due to convenience and better leakage protection.

Pants Type adult diapers are the most significant sub-segment in the adult diapers market, capturing a 53.4% share. Their popularity stems from the convenience they offer, resembling regular underwear, which enhances user dignity and ease of use. They are particularly favored for their ability to provide superior leakage protection and fit, making them ideal for active adults who require reliable incontinence solutions.

Pad Type, accounting for 29.7% of the market, is preferred for users who need a less intrusive option that can be used with regular underwear. This type is particularly appealing to those with mild incontinence. Flat Type diapers, which hold a 16.9% market share, are often used in healthcare settings where patients may not be mobile; they are easier to change for caregivers than other types.

The dominance of Pants Type diapers is supported by ongoing innovations that improve comfort and absorbency, meeting the needs of a growing demographic of older adults globally. Meanwhile, Pad and Flat Types continue to be essential in providing differentiated options catering to various user needs and preferences.

Material Type Analysis

Super Absorbent Polymer (SAP) dominates with 62.3% due to its high absorbency and skin-friendly properties.

In the material segment of the adult diapers market, Super Absorbent Polymer (SAP) leads with a 62.3% share, largely because of its capacity to absorb high volumes of liquid, which significantly reduces the risk of leaks and skin irritation. SAP is crucial for creating thinner, more discreet, and highly effective diapers.

Non-Woven Fabrics, holding a 21.6% share, are valued for their breathability and softness, contributing to enhanced skin health and comfort for users. Cotton Fabrics, which comprise 11.2% of the market, are chosen for their natural feel and hypoallergenic properties, although they are less absorbent than SAP. Fluff Pulp makes up the remaining 4.9% and is typically used in combination with SAP to provide a fluffy, comfortable texture and additional absorbency.

SAP’s dominance is driven by the need for performance in incontinence products, while the roles of Non-Woven Fabrics, Cotton, and Fluff Pulp underscore the market’s focus on comfort and skin care, catering to sensitive user requirements.

Distribution Channel Analysis

Offline Stores dominate with 69.8% due to personalized customer service and immediate product availability.

Offline Stores are the predominant distribution channel for adult diapers, holding a 69.8% market share. This segment includes Pharmacy Stores, Supermarkets/Hypermarkets, Specialty Stores, and others. Pharmacy Stores, in particular, play a critical role, making up 35.2% of the offline segment, as they offer expert advice and personalized service, which is crucial for customers purchasing incontinence products for the first time.

Online Stores, although they represent a growing segment at 30.2%, are favored for their convenience and often lower prices. They are becoming increasingly popular due to the privacy they offer and the ease of recurring purchases.

The significant share of Offline Stores is driven by the need for immediate product access and the ability to receive guidance from knowledgeable staff, while Online Stores are growing due to changing consumer shopping behaviors and the increasing comfort with e-commerce platforms.

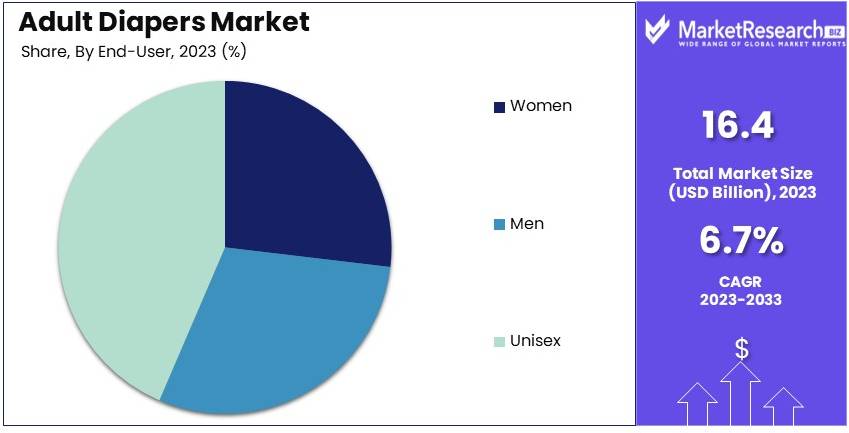

End-User Analysis

Unisex products dominate with 48.6% due to their universal design and ease of inventory management for providers.

Unisex adult diapers hold the largest share among end-users at 48.6%, due to their design that suits both men and women, simplifying manufacturing and inventory considerations for providers. This type of product is particularly prevalent in institutional settings like hospitals and nursing homes, where ease of use and stock management are priorities.

Products designed specifically for Women and Men hold 26.4% and 25% market shares, respectively. Women’s diapers are often designed with additional absorbency at specific locations to accommodate female anatomy, while men’s diapers might feature different design enhancements suited to male physiological needs.

The prevalence of Unisex products highlights the industry’s focus on efficiency and cost-effectiveness, while gender-specific products continue to evolve in response to consumer feedback and demographic trends.

Usage Analysis

Disposable diapers dominate with 84.7% due to their convenience and hygiene benefits.

Disposable adult diapers are the leading choice in the usage category, capturing an 84.7% market share. Their dominance is primarily due to the convenience and hygiene they offer, which is critical for users and caregivers alike. Disposable diapers are designed for single use, which helps prevent the complications associated with urinary and fecal incontinence, including skin irritation and infections.

Reusable diapers, making up 15.3% of the market, are favored for their cost-effectiveness and lower environmental impact. These products are suitable for individuals with mild to moderate incontinence, who can manage laundering without significant inconvenience.

The significant preference for Disposable diapers underscores the market's demand for products that provide ease, safety, and cleanliness, while Reusable diapers continue to hold a necessary position in the market, offering a sustainable alternative for suitable users.

Key Market Segments

By Product Type

- Pad Type

- Pants Type

- Flat Type

By Material Type

- Cotton Fabrics

- Non-Woven Fabrics

- Super Absorbent Polymer (SAP)

- Fluff Pulp

By Distribution Channel

- Online Stores

- Offline Stores

- Supermarkets/Hypermarkets

- Pharmacy Stores

- Convenience Stores

- Specialty Stores

- Others

By End-User

- Women

- Men

- Unisex

By Usage

- Disposable

- Reusable

Growth Opportunities

E-commerce and Direct-to-Consumer Models Offer Growth Opportunity

The rise of e-commerce presents a significant growth opportunity for the adult diapers market. Online shopping provides a discreet and convenient way for consumers to purchase adult diapers, expanding accessibility and reducing the stigma associated with in-store purchases. Companies like HDIS (Home Delivery Incontinence Supplies) have successfully built their businesses around direct-to-consumer models for adult incontinence products.

This approach allows consumers to order products from the comfort of their homes and receive them directly, enhancing privacy and convenience. As online shopping continues to grow, the market for adult diapers is likely to expand, reaching a broader audience and increasing sales.

Sustainable and Eco-friendly Options Offer Growth Opportunity

The growing demand for sustainable and eco-friendly products presents a significant growth opportunity in the adult diapers market. Consumers are increasingly seeking products that minimize environmental impact. Companies that develop biodegradable or reusable adult diapers can capture a substantial market share.

For example, Bambo Nature has introduced eco-friendly adult diapers made from sustainable materials. These products appeal to environmentally conscious consumers and align with global sustainability trends. By offering green alternatives, companies can differentiate themselves in the market, attract new customers, and contribute to environmental conservation.

Trending Factors

Smart Diapers Are Trending Factors

The integration of technology into adult diapers is an emerging trend in the market. Smart diapers equipped with sensors can monitor health indicators or alert caregivers when they need changing, offering enhanced care for users. Companies like Pixie Scientific are developing smart adult diapers that can detect conditions like urinary tract infections.

This innovation can revolutionize the adult diapers market by providing added value through health monitoring capabilities. It addresses the needs of both users and caregivers, making incontinence management more effective and efficient. The trend towards smart diapers is expected to drive market growth and technological advancements.

Customization and Personalization Are Trending Factors

The trend towards customization and personalization in the adult diapers market is gaining momentum. Consumers seek products tailored to their specific needs, including a wider range of sizes, absorbency levels, and designs. For instance, Depend offers a "Fit Finder" tool on their website to help consumers select the right product for their unique requirements.

This focus on personalization enhances user satisfaction and comfort, making incontinence products more appealing. By catering to individual preferences, companies can increase customer loyalty, improve brand reputation, and drive market growth through better-targeted product offerings.

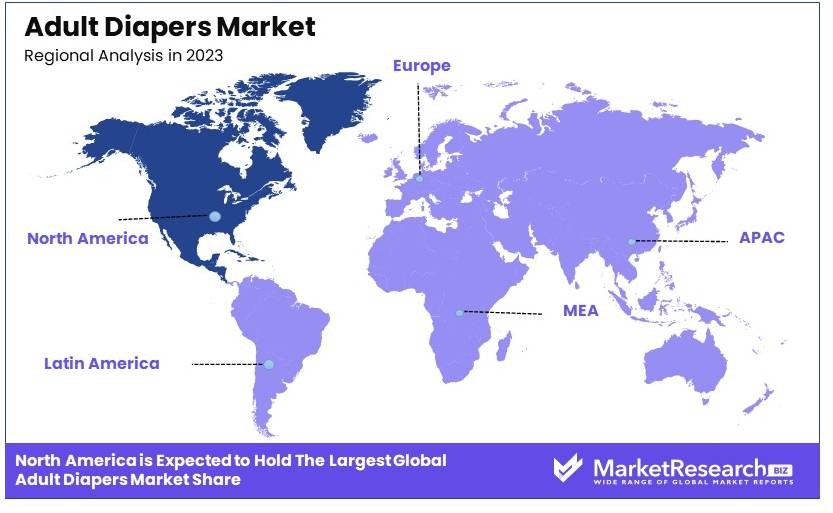

Regional Analysis

North America Dominates with 35% Market Share in the Adult Diapers Market

North America's commanding 35% share of the global adult diapers market is largely driven by an aging population and increasing awareness of incontinence-related health issues. The region has a significant demographic of seniors, and health care systems that actively promote the use of medical aids, including adult diapers, to improve quality of life. Additionally, the presence of leading manufacturers who continuously innovate product design and comfort contributes to the high market penetration.

The dynamics of the adult diapers market in North America are influenced by strong distribution networks and wide availability of products through various retail channels, including online platforms which offer privacy and convenience for consumers. Marketing campaigns and social normalization of incontinence products have also reduced stigma and boosted acceptance among consumers.

The future market presence of North America in the adult diapers sector is expected to grow further. As the population continues to age, the demand for adult diapers is anticipated to increase. Furthermore, advancements in product technology, such as thinner, more absorbent, and environmentally friendly materials, are likely to attract a broader consumer base, ensuring sustained growth in this market.

Regional Market Share Analysis

Europe: Europe holds about 30% of the global adult diapers market. The region's market is supported by similar demographic trends with an aging population. Public health programs promoting senior health and mobility also contribute to steady demand.

Asia Pacific: Asia Pacific accounts for approximately 25% of the market. Rapidly aging populations in countries like Japan and a growing acceptance of incontinence products fuel the market growth in this region.

Middle East & Africa: This region captures around 5% of the market share. Increasing awareness and improving healthcare infrastructure are gradually boosting the demand for adult diapers.

Latin America: Holding about 5% of the global market, growth in Latin America is driven by improving healthcare standards and rising awareness about adult incontinence solutions, especially in populous countries like Brazil and Mexico.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The adult diapers market is influenced by several key players who drive growth through innovation and strategic positioning. Kimberly-Clark Corporation and Procter & Gamble Co. lead with strong brand portfolios and extensive distribution networks. Unicharm Corporation and Essity AB focus on product quality and technological advancements, catering to diverse consumer needs.

Ontex Group NV and Hengan International Group Company Limited expand market reach through affordable and accessible products. Paul Hartmann AG and Daio Paper Corporation emphasize medical-grade products, appealing to healthcare providers and consumers alike.

Domtar Corporation and Chiaus (Fujian) Industrial Development Co., Ltd. leverage strong regional presence and innovative designs. DSG International Ltd. and Medline Industries, Inc. offer comprehensive incontinence solutions, enhancing consumer comfort and convenience.

Nippon Paper Industries Co., Ltd. and Kao Corporation focus on high-quality materials and advanced absorbency technologies. First Quality Enterprises, Inc. emphasizes customer-centric approaches and product innovation. These companies collectively shape the adult diapers market through strategic initiatives, product diversity, and market influence.

Market Key Players

- Kimberly-Clark Corporation

- The Procter & Gamble Company

- Unicharm Corporation

- Essity AB

- Ontex Group NV

- Hengan International Group Company Limited

- Paul Hartmann AG

- Daio Paper Corporation

- Domtar Corporation

- Chiaus (Fujian) Industrial Development Co., Ltd.

- DSG International Ltd.

- Medline Industries, Inc.

- Nippon Paper Industries Co., Ltd.

- Kao Corporation

- First Quality Enterprises, Inc.

Recent Developments

2024: Kimberly-Clark, a key player in the personal care industry, reported a 12% increase in sales of its adult incontinence products for the second quarter of 2024. This growth is attributed to rising demand in both North America and Europe, driven by an aging population and increased awareness of incontinence issues. The company continues to innovate, focusing on product comfort and absorption capabilities.

2024: A study published by the University of Queensland and Southern Cross University reveals that waste from adult incontinence products is outpacing that of infant diapers. The research indicates that by 2030, adult diapers will produce four to ten times more waste than baby diapers, emphasizing the need for more sustainable solutions in this growing market.

Report Scope

Report Features Description Market Value (2023) USD 16.4 Billion Forecast Revenue (2033) USD 30.9 Billion CAGR (2024-2033) 6.7% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Pad Type, Pants Type, Flat Type), By Material Type (Cotton Fabrics, Non-Woven Fabrics, Super Absorbent Polymer (SAP), Fluff Pulp), By Distribution Channel (Online Stores, Offline Stores [Supermarkets/Hypermarkets, Pharmacy Stores, Convenience Stores, Specialty Stores, Others]), By End-User (Women, Men, Unisex), By Usage (Disposable, Reusable) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Kimberly-Clark Corporation, Procter & Gamble Co., Unicharm Corporation, Essity AB, Ontex Group NV, Hengan International Group Company Limited, Paul Hartmann AG, Daio Paper Corporation, Domtar Corporation, Chiaus (Fujian) Industrial Development Co., Ltd., DSG International Ltd., Medline Industries, Inc., Nippon Paper Industries Co., Ltd., Kao Corporation, First Quality Enterprises, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Kimberly-Clark Corporation

- The Procter & Gamble Company

- Unicharm Corporation

- Essity AB

- Ontex Group NV

- Hengan International Group Company Limited

- Paul Hartmann AG

- Daio Paper Corporation

- Domtar Corporation

- Chiaus (Fujian) Industrial Development Co., Ltd.

- DSG International Ltd.

- Medline Industries, Inc.

- Nippon Paper Industries Co., Ltd.

- Kao Corporation

- First Quality Enterprises, Inc.