Active Pharmaceutical Ingredient Market By Type of Drug(Prescription Drugs, Over-the-counter Drugs, Others), By Type(Innovative APIs, Generic APIS, Others), By Therapeutic Application(Communicable Diseases, Oncology, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

41427

-

Sep 2023

-

170

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

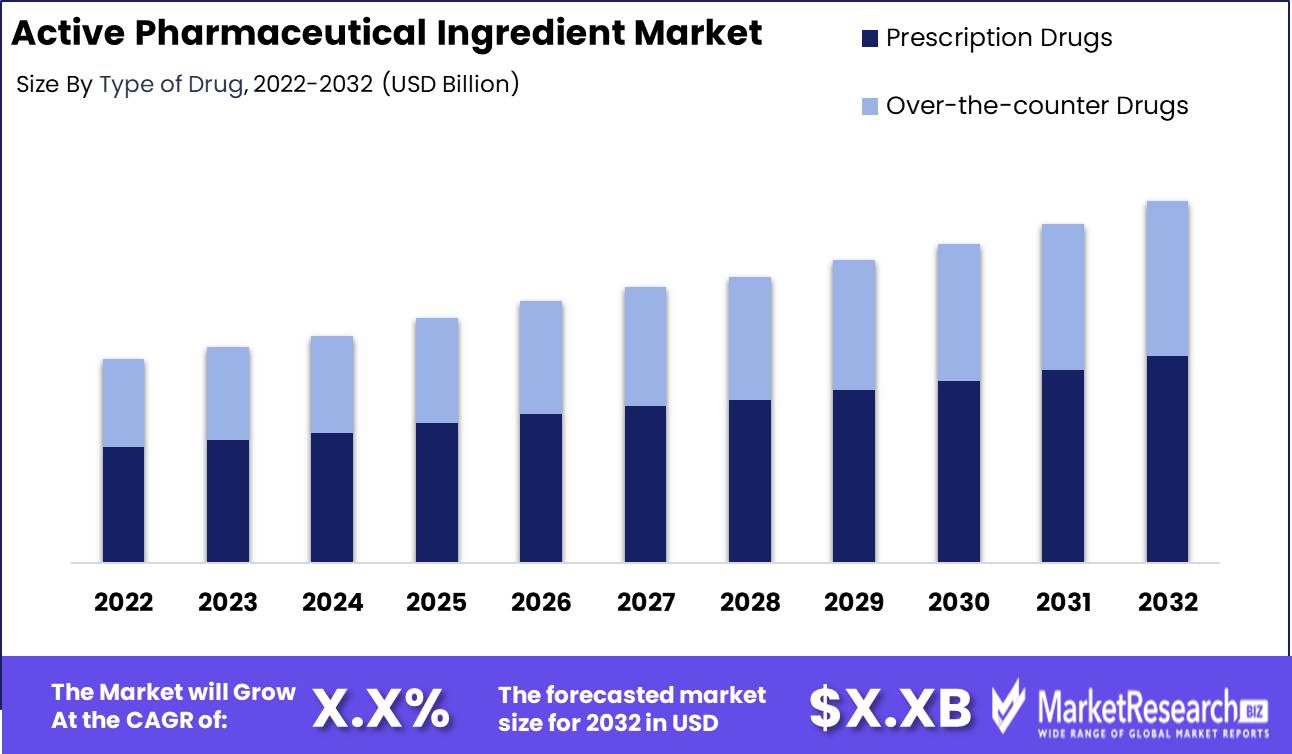

Active Pharmaceutical Ingredient Market size is expected to be worth around USD XX by 2032 from USD XX in 2022, growing at a CAGR of XX% during the forecast period from 2023 to 2032.

The active pharmaceutical ingredient market is experiencing significant growth and attracting major investments from various industries. The market, which refers to the chemical components responsible for the therapeutic effects of pharmaceutical drugs, plays a crucial role in the healthcare sector. With a surge in demand for effective medications, the active pharmaceutical ingredient market has witnessed notable innovations aimed at improving drug efficacy and patient outcomes. Companies are incorporating these ingredients into their products and services to provide high-quality healthcare solutions.

One of the key drivers of the active pharmaceutical ingredient market is the growing emphasis on transparency, explainability, and accountability in the pharmaceutical industry. As consumers become more informed about their healthcare choices, there is a need for pharmaceutical companies to disclose information about the ingredients used in their products. This increased transparency not only helps build trust with consumers but also ensures that companies adhere to ethical standards.

Furthermore, the active pharmaceutical ingredient market has witnessed significant growth due to its extensive applications in various business sectors. From pharmaceutical companies developing new drugs to cosmetic manufacturers creating innovative skincare products, the versatility of active pharmaceutical ingredients knows no bounds. This market has become a vital component in the success of many industries, enabling them to offer efficient and reliable solutions to their customers.

There are several notable examples of active pharmaceutical ingredient applications in various sectors. In the pharmaceutical industry, these ingredients are used to develop drugs that target specific diseases or conditions, improving patient outcomes and quality of life. In the cosmetics industry, active pharmaceutical ingredients are incorporated into skincare products to address various skin concerns and provide anti-aging benefits. Additionally, the food and beverage industry utilizes these ingredients to enhance the nutritional value and functional benefits of their products.

Driving factors

Generic Drug Demand

The demand for generic drugs has witnessed a tremendous upsurge over the years. Generic drugs, also known as off-patent drugs, are cost-effective alternatives to brand-name medications. They contain the same active ingredient, dosage form, and strength, ensuring therapeutic equivalence. Patients and healthcare providers have recognized the potential benefits of generic drugs, including reduced healthcare costs and increased accessibility to essential medications.

This surge in demand for generic drugs has propelled the active pharmaceutical ingredient market to new heights. Generic drug manufacturers heavily rely on APIs for the production of these cost-effective medications. Consequently, the robust demand for generic drugs directly influences the demand for APIs in the pharmaceutical industry.

Drug Patent Expirations

The expiration of drug patents serves as a catalyst for the API market. When pharmaceutical patents expire, it paves the way for other manufacturers to produce generic versions of the drug, thereby increasing competition and driving down prices. Generic drug manufacturers source APIs from API manufacturers to create affordable alternatives to patented drugs.

The expiration of drug patents creates a significant opportunity for API manufacturers to collaborate with generic drug manufacturers and supply them with high-quality active pharmaceutical ingredients. This allows the API market to thrive and expand, providing a wider range of options for patients and healthcare systems worldwide.

Biopharmaceuticals

In recent years, the biopharmaceutical sector has witnessed tremendous growth and innovation. Biopharmaceuticals are drugs derived from living organisms, such as proteins, peptides, or monoclonal antibodies. These complex molecules require advanced manufacturing processes and specialized APIs.

The production of biopharmaceuticals necessitates the use of biologically active substances, requiring a different set of skills and expertise from API manufacturers. As the biopharmaceutical industry continues to evolve, API manufacturers are adapting and expanding their capabilities to meet the unique demands of this sector.

The rising prominence of biopharmaceuticals presents a significant opportunity for API manufacturers to diversify their product portfolios and cater to the increasing demand for advanced therapies. By leveraging their expertise in API production, they can contribute to the development and manufacturing of groundbreaking biopharmaceutical products.

Restraining Factors

Price Erosion

Another restraining factor impacting the API market is price erosion. Price erosion refers to the gradual decline in the price of APIs over time. This phenomenon is primarily driven by factors such as increased competition, patent expiration of branded drugs, and cost-containment efforts by healthcare systems.

As APIs become commoditized and generic versions become available and affordable, the profit margins for API manufacturers tend to decrease. This puts pressure on their sustainability and profitability, reducing their ability to invest in research and development activities and maintain quality standards.

Price erosion also affects the overall value chain of the pharmaceutical industry. Pharmaceutical companies, in search of cost savings, often look for cheaper API sources, leading to a shift of API manufacturing to low-cost countries. While this may seem advantageous in terms of cost, it can compromise quality control measures and increase the risk of counterfeit or substandard APIs entering the market.

Supply Chain Disruptions

The active pharmaceutical ingredient market heavily relies on a global supply chain, connecting manufacturers, suppliers, and distributors across different continents. However, this interconnectedness can pose risks, especially when supply chain disruptions occur.

Supply chain disruptions include events such as natural disasters, geopolitical tensions, trade disputes, and pandemics. These disruptions can lead to delays in the transportation of APIs, shortages in supply, and increased prices. The COVID-19 pandemic, for instance, highlighted the vulnerabilities of the API supply chain, as many countries faced critical shortages of essential drugs due to disrupted supplies.

To mitigate the risks associated with supply chain disruptions, API manufacturers must invest in contingency planning, diversification of suppliers and transportation routes, and maintaining buffer stocks. However, such measures incur additional costs and can impact the pricing of APIs, further exacerbating the challenges faced by the industry.

Type of Drug Analysis

Prescription Drugs Segment dominates active pharmaceutical ingredient market

The active pharmaceutical ingredient (API) market has grown a lot recently. Prescription drugs are the dominant part of this API market. Prescription drugs are medications you can only get with a doctor's prescription. Regulators watch prescription drugs closely to ensure they are safe and work. Prescription drugs are big in the API market for several reasons. First, chronic diseases like heart disease, cancer, and diabetes are more common as the population ages. Effective prescription drugs are needed more.

Also, new research has led to innovative prescription drugs that target specific diseases. These complex prescription drugs require specialized manufacturing. So prescription drugs cover many customized medications for individual patients. In addition, countries are spending more on healthcare, including developing new prescription drugs. This brings better prescription drugs with better results.

Prescription drug use has grown especially fast in emerging economies as their healthcare has improved. More people can access and afford prescription medications. Chronic illnesses have also increased with lifestyle changes. So demand for prescription drugs has risen sharply.

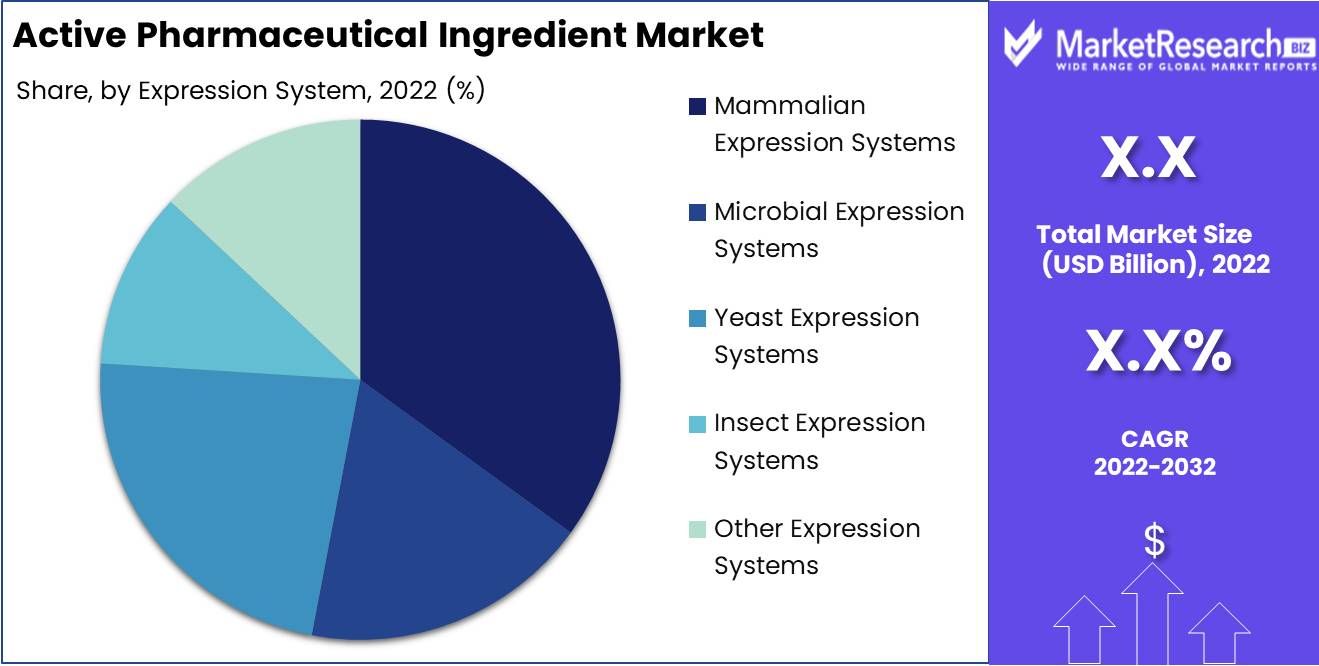

Expression System Analysis

Mammalian expression systems segment dominates the active pharmaceutical ingredient market

Mammalian expression systems have become the dominant technology for producing active pharmaceutical ingredients, particularly for biological drugs. This is due to their unique ability to generate complex human proteins that require post-translational modifications like glycosylation in order to be functional. Mammalian cells provide proper folding and assembly for multidomain proteins, maintaining their stability and bioactivity. The cell culture conditions also closely mimic the environment inside human cells, enabling optimal protein expression.

Additionally, mammalian cell lines used for API production are extremely well characterized and have a proven safety record. This minimizes the risks of host cell impurities. Improvements in vector design and expression constructs have also enabled high yields from mammalian systems, making them commercially viable on a large scale. The productivity of mammalian expression has increased to the point where they can produce APIs cost-effectively.

Finally, mammalian systems have a long track record of regulatory compliance for approved biological drugs across the globe. This experience facilitates regulatory filings for new biological drugs that utilize mammalian cell expression. The surge in demand for recombinant protein therapies and monoclonal antibodies has further driven the rapid adoption of mammalian expression.

Key Market Segments

By Type of Drug

- Prescription Drugs

- Over-the-counter Drugs

By Type

- Innovative APIs

- Generic APIS

Synthetic APIs, by Type

- Innovative Synthetic APIs

- Generic Synthetic APIs

- Biotech APIs Market

Biotech APIs, by Type

- Innovative Biotech APIs

- Generic Biotech APIs

Biotech APIs, by Product

- Monoclonal Antibodies

- Hormones

- Cytokines

- Fusion Proteins

- Therapeutic Enzymes

- Recombinant Vaccines

- Blood Factors

Biotech APIs, by Expression System

- Mammalian Expression Systems

- Microbial Expression Systems

- Yeast Expression Systems

- Insect Expression Systems

- Other Expression Systems

By Therapeutic Application

- Communicable Diseases

- Oncology

- Diabetes

- Cardiovascular Diseases

- Pain Management

- Respiratory Diseases

- Other

Growth Opportunity

Contract Development and Manufacturing (CDMO): Driving Growth and Efficiency

Contract development and manufacturing organizations (CDMOs) play a crucial role in the pharmaceutical industry, bridging the gap between API manufacturers and pharmaceutical companies. CDMOs offer end-to-end services, including process development, manufacturing, packaging, and regulatory support, enabling pharmaceutical companies to focus on their core competencies, such as research and marketing.

API manufacturers can leverage CDMOs to streamline their operations, reduce costs, and enhance efficiency. By collaborating with CDMOs, API manufacturers can benefit from their expertise, state-of-the-art facilities, and regulatory compliance, thereby accelerating the development and commercialization of their products. The growing trend of outsourcing manufacturing processes to CDMOs is expected to fuel the growth of the API market in the coming years.

Emerging Markets: Key Players in API Market Expansion

Emerging markets, such as India, China, Brazil, and South Africa, are playing a pivotal role in the expansion of the API market. These markets offer significant advantages, such as a large patient population, growing pharmaceutical industries, low manufacturing costs, and supportive government policies.

India, in particular, has emerged as a global API hub, accounting for a substantial share of the global API market. The favorable regulatory environment, availability of skilled labor, and a vast pool of API manufacturers have contributed to India's dominance in API production. Similarly, China's booming pharmaceutical industry, coupled with its strong manufacturing capabilities, has made it a key player in the API market.

Furthermore, the rising healthcare expenditure and increasing demand for affordable medications in emerging markets are driving the demand for generic drugs, which heavily rely on APIs. As a result, API manufacturers are actively tapping into these markets to cater to the growing demand, thus propelling the growth of the overall API market.

Continuous Manufacturing: Revolutionizing API Production

Continuous manufacturing has revolutionized the pharmaceutical industry, including API production. Traditionally, API manufacturing involved batch-based processes that required significant resources, time, and manual intervention. However, continuous manufacturing offers numerous advantages, such as increased productivity, cost-effectiveness, reduced waste generation, improved product quality, and shortened development timelines.

Adopting continuous manufacturing in API production enables manufacturers to optimize their operations, enhance process control, and achieve consistent quality. This, in turn, leads to improved time-to-market, reduced production costs, and increased competitiveness. The integration of advanced technologies, such as process analytical technology (PAT), automation, and artificial intelligence (AI), further enhances the efficiency and effectiveness of continuous API manufacturing.

Latest Trends

Biocatalysis and Green Chemistry: Revolutionizing API Production

Biocatalysis and Green Chemistry are transforming the API landscape by offering sustainable and eco-friendly solutions for pharmaceutical manufacturing. These innovative approaches utilize biological catalysts or enzymes to drive chemical reactions, replacing traditional methods that are often resource-intensive and generate large amounts of waste. The adoption of Biocatalysis and Green Chemistry not only reduces the environmental impact but also improves cost-effectiveness and process efficiency. Companies embracing this trend are able to position themselves as responsible and forward-thinking players in the API market, gaining a competitive edge.

Virtual API Manufacturing: Embracing Digital Transformations

Virtual API Manufacturing, also known as remote or digital manufacturing, is a transformative trend that optimizes efficiency by utilizing advanced technologies. It involves leveraging digital platforms and interconnected systems to monitor, control, and streamline API production processes. By implementing virtual manufacturing, companies can significantly reduce costs associated with physical infrastructure, labor, and transportation. The advantages of virtual manufacturing include enhanced scalability, real-time analytics, and improved supply chain management. Embracing this trend empowers API manufacturers to achieve operational excellence, thereby fostering competitiveness in the market.

API Patents: Protecting Intellectual Property

API Patents play a pivotal role in shaping the active pharmaceutical ingredient industry. Securing patents for novel APIs provides manufacturers with exclusivity and protects their intellectual property rights. Patents act as a defensive measure against competitors, preventing them from replicating or manufacturing the same API without permission. This exclusivity grants companies a significant advantage, allowing them to leverage their patent portfolio as a strategic asset and potentially establish long-term market dominance. API manufacturers investing in research and development to develop innovative APIs must prioritize protecting their inventions through patents to safeguard their competitiveness.

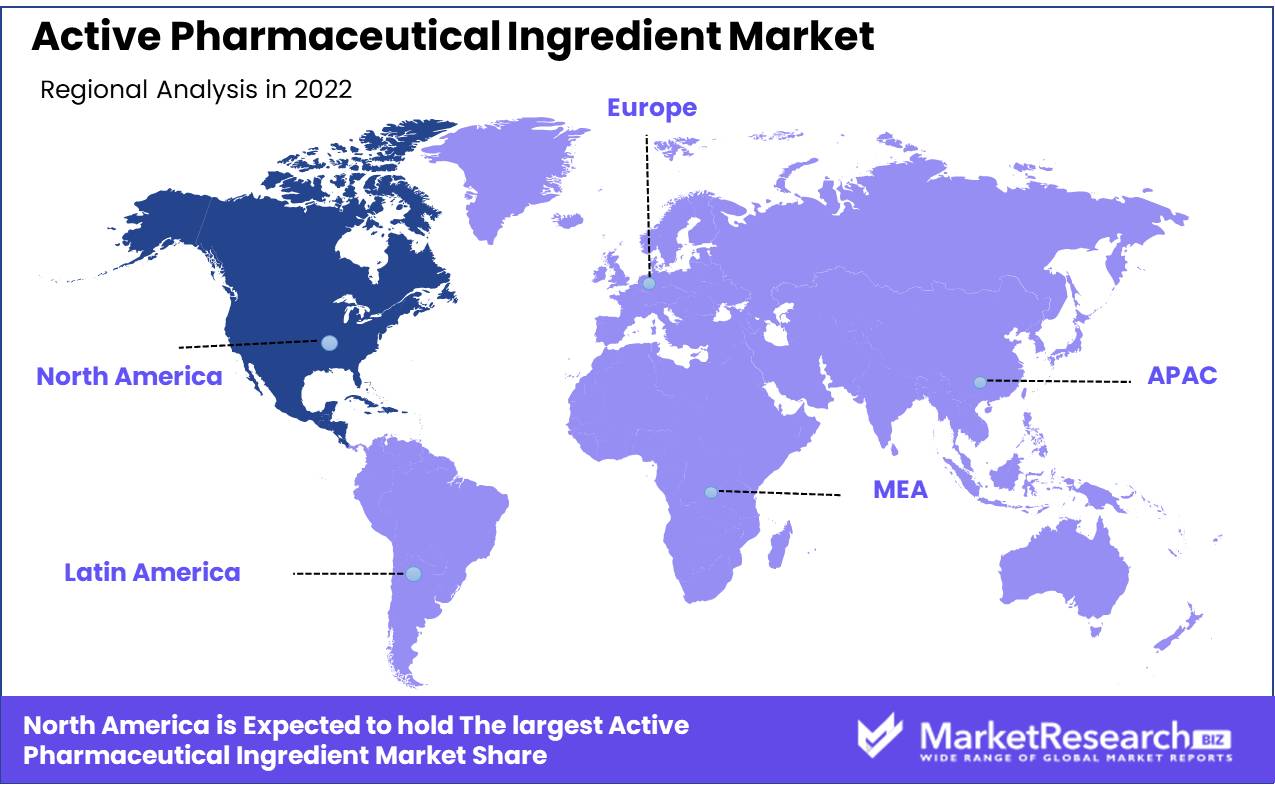

Regional Analysis

North America: The Dominant Region in the Active Pharmaceutical Ingredient Market

North America boasts a thriving pharmaceutical industry, driven by constant technological advancements and robust research and development (R&D) efforts. The region is home to cutting-edge laboratory facilities, advanced manufacturing technologies, and state-of-the-art equipment. This enables pharmaceutical companies in North America to develop, produce, and supply high-quality APIs with precision and efficiency.

North America's pharmaceutical industry operates under strict regulatory standards enforced by agencies such as the Food and Drug Administration (FDA) in the United States and Health Canada. These regulatory bodies rigorously assess the safety, efficacy, and quality of APIs to ensure patient safety. The adherence to strict compliance measures sets North American API manufacturers apart and gives them a competitive edge, especially when exporting APIs to other regions.

The region boasts a well-established and reliable supply chain infrastructure, encompassing raw material sourcing, manufacturing facilities, and distribution networks. North America's well-connected transportation system facilitates the seamless movement of APIs from manufacturing facilities to end-users, both within the region and internationally. This efficient supply chain ensures a steady and uninterrupted flow of APIs, thereby maintaining the region's dominance in the global market.

North America's pharmaceutical industry is home to a highly skilled and knowledgeable workforce. The region attracts top talent from around the world, with its renowned academic institutions, research centers, and pharmaceutical companies offering rewarding career opportunities. The collective expertise of scientists, researchers, and professionals in North America contributes to the continuous innovation and development of APIs, cementing the region's position as a key player in the global market.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Pfizer, a renowned pharmaceutical giant, has established itself as a key player in the API market. With a strong focus on research and development, Pfizer consistently introduces groundbreaking APIs to the market. Leveraging its vast experience, the company has developed a wide range of APIs used in the treatment of various diseases, including cancer, cardiovascular disorders, and neurological conditions. Pfizer's commitment to quality and safety has garnered immense trust among healthcare professionals and patients alike.

Novartis, another leading player, has positioned itself as a global provider of API solutions. Their extensive portfolio boasts APIs that cater to critical therapeutic areas, such as oncology, immunology, and neurology. Novartis's commitment to research and development allows them to develop innovative APIs that address unmet medical needs. They constantly strive to create patient-centric solutions, focusing not only on efficacy but also on affordability and accessibility.

Sanofi, a global biopharmaceutical company, has emerged as a key player in the API market by harnessing the power of biotechnology. By integrating biotechnological advancements, Sanofi has revolutionized the production of APIs, making them more efficient and cost-effective. Their extensive range of APIs covers therapeutic areas such as diabetes, cardiovascular diseases, and rare genetic disorders. Sanofi's commitment to sustainability and environmental responsibility further strengthens its position in the API market.

Boehringer Ingelheim, known for its strong emphasis on innovation, plays a vital role in shaping the API market. With an extensive network of research and development centers, Boehringer Ingelheim consistently introduces novel APIs that address evolving healthcare needs. The company's APIs are widely recognized for their superior quality and efficacy. Boehringer Ingelheim's commitment to improving patient outcomes and advancing healthcare globally has earned them a prominent position among API manufacturers.

Top Key Players in Active Pharmaceutical Ingredient Market

- Pfizer

- Novartis

- Sanofi

- Boehringer Ingelheim

- BASF

- Merck & Co.

- Teva Pharmaceutical

- Sun Pharmaceutical

- Aurobindo Pharma

- Cipla

- Others

Recent Development

- In 2022, Dr. Reddy's Laboratories opened a new state-of-the-art API manufacturing facility in Andhra Pradesh, India, representing a major investment aimed at increasing production capacity and meeting growing global API demand.

- In 2021, Pfizer invested $120 million to expand its API manufacturing facility in Michigan, U.S. This significant investment was motivated by surging demand for high-quality APIs and the necessity to enhance overall capabilities.

- In 2020, Swiss pharmaceutical company Lonza Group unveiled a large-scale, cutting-edge API manufacturing facility in Visp, Switzerland. This new facility greatly expands Lonza's capacity to produce top-quality APIs.

Report Scope

Report Features Description Market Value (2022) USD XX Forecast Revenue (2032) USD XX CAGR (2023-2032) XX% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type of Drug(Prescription Drugs, Over-the-counter Drugs, Others), By Type(Innovative APIs, Generic APIS, Others), By Therapeutic Application(Communicable Diseases, Oncology, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Pfizer, Novartis , Sanofi , Boehringer Ingelheim, BASF, Merck & Co., Teva Pharmaceutical, Sun Pharmaceutical, Aurobindo Pharma, Cipla Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Pfizer

- Novartis

- Sanofi

- Boehringer Ingelheim

- BASF

- Merck & Co.

- Teva Pharmaceutical

- Sun Pharmaceutical

- Aurobindo Pharma

- Cipla

- Others