Acetone Market By Application (Methyl Methacrylate (MMA), Bisphenol-A, Solvents), By End-User (Automotive, Pharmaceuticals, Chemical, and Electronics), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

1910

-

May 2023

-

186

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

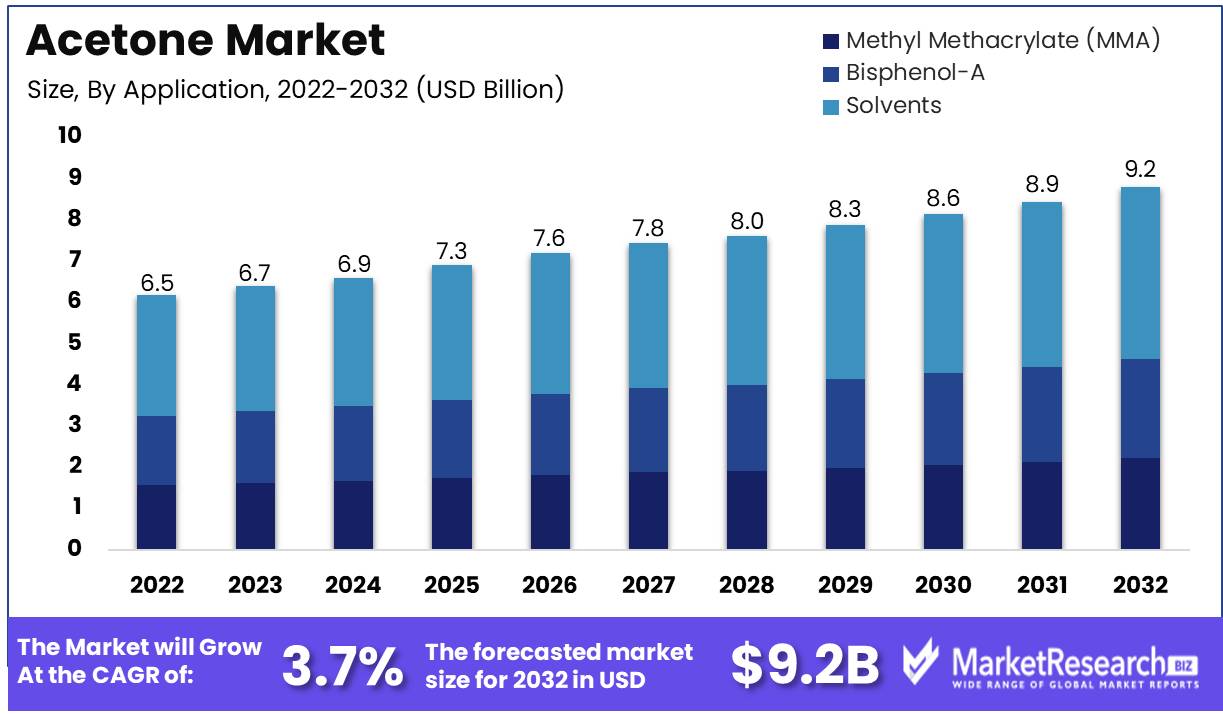

Acetone Market size is expected to be worth around USD 9.2 Bn by 2032 from USD 6.5 Bn in 2022, growing at a CAGR of 3.7% during the forecast period from 2023 to 2032.

Global Acetone Market is expanding at a rapid rate, propelled by rising demand from industries including paints and coatings, pharmaceuticals, cosmetics, and chemicals. There are numerous industrial and consumer applications for acetone, a colorless, combustible organic solvent. In the petrochemical industry, it is predominantly produced as a byproduct of phenol or from propylene. In addition to being used as a solvent for paints, coatings, polymers, and adhesives, acetone is extensively employed in the production of chemicals, pharmaceuticals, and cosmetics.

This versatile solvent is indispensable to the production of a vast array of goods, making it an integral part of the global economy. Acetone is a cost-effective option for paints, varnishes, and adhesives due to its superior solubility and quick curing time. In addition, it is an essential basic material for the production of industrial compounds such as bisphenol-A, methyl methacrylate, and methyl isobutyl ketone. In addition, acetone is used as a solvent for natural and synthetic polymers in a number of industries, including the plastics and textiles sectors.

Innovations in the acetone market have made it possible for manufacturers to enhance their production processes and increase their sustainability. The development of bio-based acetone, which is derived from renewable resources such as maize or sugar cane, is a significant advancement. This environmentally beneficial method reduces greenhouse gas emissions and fossil fuel reliance. In addition, acetone is currently used in 3D printing applications to remove superfluous material from printed parts, resulting in a finer finish and shorter post-processing time.

Investments in the acetone market originate from a wide spectrum of industries, reflecting its diverse applications and benefits. Due to acetone's superior solubility and quick-drying properties, the paints and coatings industry relies heavily on it. Other industries, including pharmaceuticals, cosmetics, textiles, plastics, and chemicals, recognize acetone's value and invest actively in its potential.

It is necessary to resolve ethical issues associated with the acetone market. The production and use of acetone can contribute to air pollution, causing respiratory problems and other health issues. In addition, the highly combustible nature of this material poses significant fire risks in the workplace. Manufacturers must comply with safety regulations and implement appropriate risk management practices to ensure the production and use of acetone is conducted in a manner that prioritizes the health of humans and the environment.

Driving factors

Chemical, Pharmaceutical, and Coatings Sector

Acetone, a colorless, volatile, and combustible liquid, plays a crucial function in numerous industries, including the chemical, pharmaceutical, electronic, and automotive sectors. The global acetone market is anticipated to expand significantly in the future years due to a number of factors. First, the chemical and pharmaceutical industries have a rising demand for acetone as an essential solvent in the manufacture of compounds and medications. In addition, the versatility of acetone as a solvent in coatings, adhesives, and plastics contributes to the growth of the acetone market.

Cosmetics and derivatives of acetone stimulate market growth.

Increasing demand for acetone-based derivatives, such as methyl methacrylate and bisphenol-A, is another factor propelling the global acetone market's expansion. These derivatives are widely used in the production of plastics, adhesives, and electronic components. In addition, the growing use of acetone in the cosmetics industry, particularly as a nail varnish remover and solvent for a variety of cosmetic products, contributes to the expansion of the market as a whole.

Automotive and Healthcare Industries Drive Acetone Market

The automotive industry contributes significantly to the increasing demand for acetone. Its application in the production of composites and as a solvent for automotive coatings is crucial to the expansion of the acetone market. In addition, the manufacturing of medical devices and apparatus necessitates the use of acetone, which contributes to the market growth. In addition, the prevalence of bio-based acetone as a sustainable alternative contributes to the expansion of the market. However, potential changes to regulations, emerging technologies, and market disruptors may affect the competitive landscape and future growth of the acetone market.

Restraining Factors

Cost of acetone production is impacted by fluctuations in crude oil prices

Since acetone is a derivative of crude oil, its production costs are highly sensitive to fluctuations in crude oil prices. As the price of crude oil increases or decreases, so will the cost of producing acetone, influencing the price of the final product. This fluctuation in production costs makes it difficult for manufacturers to foresee the price of acetone, creating a challenge for them.

Supply Variability of Raw Materials Used to Produce Acetone

In addition to crude oil, several other basic materials are utilized in the production of acetone. Included among these are propylene, phenol, and cumene. However, the supply of these basic materials is highly volatile, and any disruption in the supply chain can lead to an acetone shortage. This unstable supply chain results in unpredictably fluctuating production costs, which increases consumer prices.

Dangers to Health Associated with Acetone Exposure

Acetone is a highly volatile and combustible chemical that poses a significant threat to human health if it is not handled with care. Long-term exposure to acetone can lead to skin irritation, ocular irritation, and in some cases, respiratory issues. Due to its risk to human health, regulatory authorities around the globe have imposed stringent guidelines on the use and management of acetone in a variety of applications.

The Availability of Acetone Substitutes in Various Applications

On the market, substitutes for acetone are readily available, and they are used in applications where acetone is typically employed. As a substitute for acetone, ethanol can be used as a solvent. In the manufacture of paints and coatings, butanol is also a viable alternative to acetone. These substitutes pose a substantial threat to the expansion of the acetone market.

Environmental Issues Related to Acetone Use and Disposal

Acetone is an environmentally hazardous chemical that is highly volatile and combustible. Any accidental release or negligent disposal of acetone can pollute the environment. In addition, the disposal of acetone presents a significant difficulty because it necessitates cautious disposal procedures. Across the globe, a number of regulatory agencies have imposed stringent guidelines for the use and disposal of acetone.

By Application Analysis

With the Solvents Segment dominating its market share, the Acetone industry is expanding rapidly. Acetone is a versatile Solvents that has a wide range of industrial applications, including paints, adhesives, coatings, and Solventss. Due to its extensive application in diverse end-use industries, such as pharmaceuticals, agrochemicals, and cosmetics, the Solvents Segment holds the largest share of the acetone market.

The Solvents Segment of the Acetone market has seen a significant shift in consumer behavior. Consumers are increasingly demanding safe, environmentally favorable, and compliant with stringent regulatory standards products of superior quality. This trend has led to the pervasive use of Acetone-based Solvents, which are renowned for their superior effectiveness, adaptability, and sustainability. In addition, consumers are willing to pay a premium for products containing acetone-based solvents, which bodes well for the expansion of the Solvents Segment of the acetone market.

Due to a number of factors, the Solvents Segment of the acetone market is anticipated to exhibit the highest CAGR over the coming years. First, the Solvents Segment is experiencing robust demand from end-use industries including pharmaceuticals, agrochemicals, and cosmetics. Second, emerging economies, particularly in the Asia-Pacific region, are propelling the adoption of Acetone-based Solvents. The growth of the Solvents Segment in the Acetone Market is also being fueled by favorable government policies and initiatives to promote industrial growth.

By End-User Analysis

The Chemical Segment controls a substantial share of the acetone market. In the production of numerous compounds, including methyl methacrylate (MMA), bisphenol A (BPA), and methyl isobutyl ketone (MIBK), acetone is a common building block. In the coming years, the Chemical Segment is anticipated to experience robust growth due to the rising demand for MMA and BPA in end-use industries such as automotive, electronics, and construction.

Consumers are increasingly demanding safe, environmentally favorable, and compliant with stringent regulatory standards products of superior quality. This trend is propelling the adoption of Acetone-based compounds, which are renowned for their superior effectiveness, versatility, and sustainability. Moreover, consumers are willing to pay a premium for products made from chemicals derived from acetone, which bodes well for the expansion of the Chemical Segment of the acetone market.

Due to a number of factors, the Chemical Segment of the acetone market is anticipated to record the highest growth rate over the coming years. First, the Chemical Segment is experiencing robust demand from end-use industries such as the automotive, electronics, and construction industries, which are experiencing robust expansion. Second, the economic growth of emerging economies, particularly in the Asia-Pacific region, is propelling the adoption of compounds based on acetone. The growth of the Chemical Segment of the acetone market is further fueled by favorable government policies and initiatives aimed at fostering industrial expansion.

Key Market Segments

By Application

- Methyl Methacrylate (MMA)

- Bisphenol-A

- Solvents

By End-User

- Automotive

- Pharmaceuticals

- Chemical

- Cosmetics & personal care

- Electronics

- Cleaning agent

Growth Opportunity

Multiple industries are influenced by a versatile chemical

Acetone is a versatile chemical that is used extensively in numerous industries, including the healthcare, cosmetics, construction, and automotive sectors. Its multifaceted properties have contributed to the expansion of the global acetone market, which is anticipated to continue its ascent in the years to come. This article will explore the factors driving market growth and cast light on its increasing significance.

The market-leading sustainable alternative

Increasing demand for bio-based acetone as a sustainable alternative to conventional acetone is one of the primary forces propelling the acetone market. Bio-based acetone is an environmentally preferable option because it is derived from renewable resources such as sugarcane, maize, and other biomass sources. As industries acknowledge the benefits of sustainable practices, the market has been propelled forward by this transition towards environmentally conscious alternatives.

Influencing Demand and Market Expansion

Increasing demand for acetone-based derivatives, notably methyl methacrylate and bisphenol-A, also contributes to the expansion of the acetone market. Bisphenol-A is commonly used in polycarbonate plastics and epoxy resins, whereas methyl methacrylate is widely employed in the production of acrylic plastics. Acetone is in high demand due to the growing demand for these derivatives, which has been fueled by numerous industries.

Facilitating the Expansion of Acetone

The development of novel applications across a variety of industries is another factor driving the growth of the acetone market. Acetone is an important solvent in the production of adhesives, coatings, sealants, and printing inks. Moreover, the expanding market presence in emerging economies like China, India, and Brazil has played a crucial role. These nations are experiencing accelerated industrialization and urbanization, which is causing a surge in demand for acetone. In addition, the automotive industry's increased reliance on acetone for the production of polycarbonate plastics and coatings has accelerated market expansion.

Latest Trends

Increased emphasis on the creation of bio-based acetone

Growing emphasis on the development of bio-based acetone is one of the most significant market trends influencing the acetone industry. This is primarily a result of the growing demand for eco-friendly and sustainable products. Compared to conventional acetone produced from fossil fuels, bio-based acetone produces fewer greenhouse gas emissions. In the coming years, bio-based acetone is anticipated to acquire significant market share due to the increasing emphasis on sustainability across numerous industries. Companies in the acetone industry are investing in research and development in order to commercialize bio-based acetone. Therefore, businesses able to provide sustainable alternatives will likely enjoy a competitive advantage.

Escalating demand for pharmaceutical-grade acetone of high purity

Another significant market trend in the acetone industry is the increasing demand for pharmaceutical-grade acetone of high purity. This trend is being driven by the increasing use of acetone in the manufacturing of various pharmaceutical products. In the production of various pharmaceutical products, including medications and medical devices, ultrapure acetone is utilized. Future projections indicate that the demand for pharmaceutical-grade acetone will increase, driven by an increase in the demand for new pharmaceuticals and medical device innovations. To meet the growing demand for pharmaceutical-grade acetone of high purity, businesses in this industry should prioritize the quality of their products and ensure compliance with all applicable regulatory requirements.

Increasing use of eco-friendly solvents in numerous industries

Various industries, including the acetone industry, have adopted green solvents in response to the increasing demand for environmentally benign and sustainable products. Green solvents are derived from renewable resources and have less of an impact on the environment than petroleum-based solvents. Additionally, they are less hazardous to human health, making them a preferable alternative to conventional solvents. The growing use of environmentally friendly solvents has created new opportunities for businesses in the acetone industry. Offering eco-friendly and sustainable products will provide a competitive advantage for businesses that adopt green solvents.

Increasing use of acetone in the automotive industry's composites manufacturing

Increased use of acetone in the production of composites, particularly in the automotive industry. Composite materials provide a lightweight solution for a variety of automotive manufacturing processes, resulting in their increased use. Due to its ability to dissolve polymers and reduce viscosity, acetone is used as a solvent in the manufacturing of composite materials. The automotive industry is anticipated to continue incorporating composite materials into vehicle production, thereby increasing the demand for acetone. Companies operating in the acetone market should capitalize on this development by providing acetone products and services of superior quality that accommodate to the specific requirements of the automotive industry.

The development of novel acetone production technologies

Innovative acetone manufacturing techniques have the potential to revolutionize the market. Adopting new production processes can result in a rise in productivity, a decrease in production costs, and an improvement in product quality. This trend is fueled by the increasing emphasis on enhancing the sustainability of production processes while maintaining high quality standards. Consider investing in R&D to enhance production processes for companies in the acetone industry. In order to remain competitive in the industry, they should also keep abreast of the most recent technological advancements.

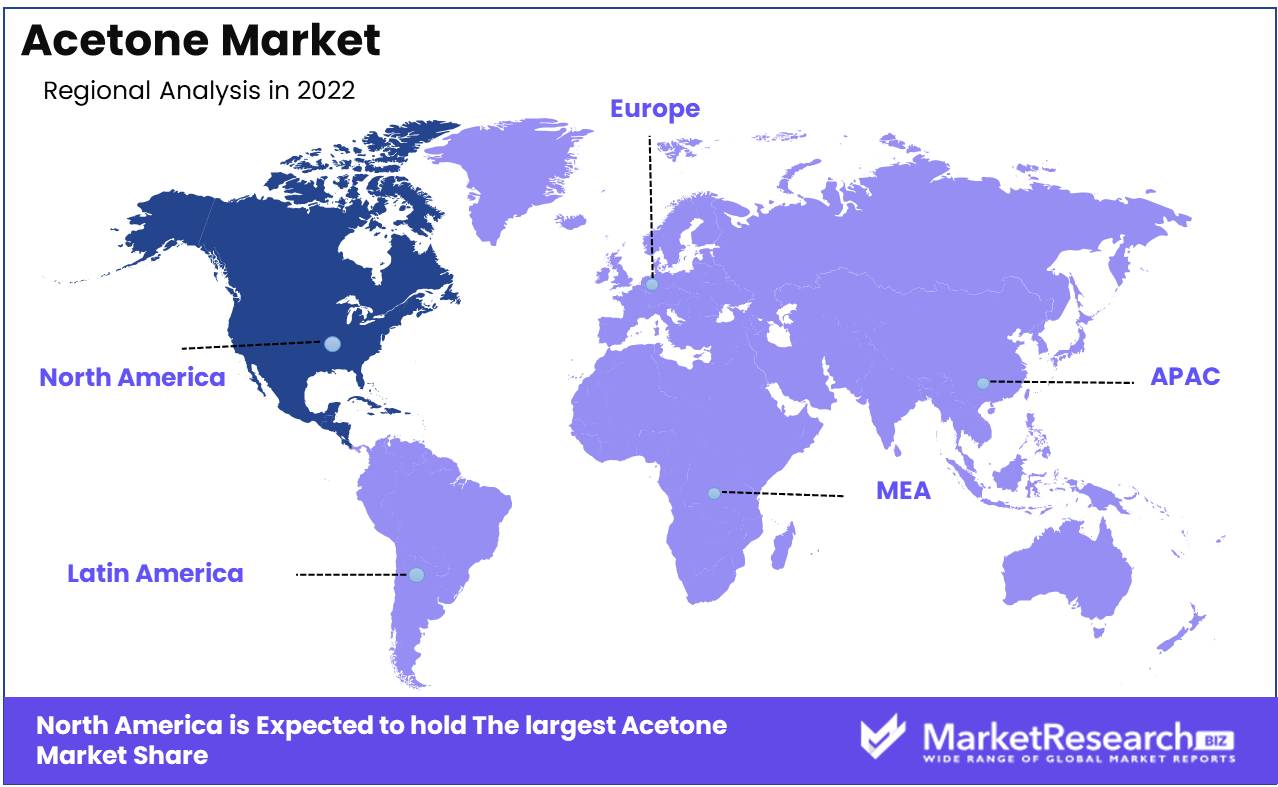

Regional Analysis

Due to the presence of numerous end-use industries, including chemical, pharmaceutical, and automotive, the North American region has arisen as one of the major participants in the acetone industry. In response to the expanding global demand for acetone, the North American region is actively contributing to market supply.

The chemical industry is one of the leading contributors to acetone demand in the North American region. Acetone is an indispensable basic material in the production of numerous compounds, such as bisphenol-A (BPA) and methyl methacrylate (MMA). It is a common component of solvents, coatings, adhesives, and resins. Consumption and production of acetone in the region are influenced by the rising domestic and international demand for these products.

The pharmaceutical industry also plays a significant role in the demand for acetone in the North American region. There is a significant increase in demand for analgesics and anesthetics in the region, and acetone is an essential constituent in their production. The increasing prevalence of chronic diseases and cardiovascular disorders has resulted in a rise in the consumption of these pharmaceutical products, which has contributed to the expansion of the acetone market.

Due to the presence of numerous manufacturers, both domestic and international, the North American region has emerged as one of the most important producers of acetone. Shell Chemical, Dow Chemicals, and INEOS Phenol are three of the most notable acetone manufacturers in the region. To satisfy the growing demand for acetone, these manufacturers are perpetually expanding their production facilities and investing in research and development.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global market for acetone is extremely competitive and diverse. INEOS Phenol, Royal Dutch Shell, Mitsui Chemicals, Inc., CEPSA Qumica, Honeywell International, BASF SE, Dow Chemical Company, and Sasol are among the main participants. These companies hold the majority of the market share and are expanding their market presence through technological advancements and strategic partnerships.

INEOS Phenol is a major participant in the acetone market. They are well-known for their high-quality acetone production process and have a vast selection of products to meet the varied requirements of consumers. Royal Dutch Shell is another market leader with a strong emphasis on product innovation and market expansion via mergers and partnerships.

Mitsui Chemicals, Inc. has established its position in the acetone market through its efficient administration of the supply chain and technological advancements. CEPSA Qumica is known for its extensive product line and customer-centric approach. Honeywell International has been a market leader due to its innovative technologies and R&D developments.

BASF SE is also a significant player in the acetone market, concentrating on expanding its product portfolio through strategic collaborations and partnerships. Dow Chemical Company is well-known for its global presence and diverse product line.

Top Key Players in Acetone Market

- INEOS Phenol

- Royal Dutch Shell PLC

- Mitsui Chemicals, Inc.

- Hindustan Organic Chemicals Limited

- DOW Chemical Co.

- BASF SE

- Sunoco

- Prasol

- Formosa Chemicals and Fiber Corporation

- Shanghai Sinopec Mitsui

Recent Development

In October 2021, As acetone demand rises worldwide, chemical companies are investing heavily to gain their market share. Celanese Corporation stated it will build a new acetone manufacturing plant in China to address Asia-Pacific demand.

In March 2021, Green Biologics bought the Ohio acetone manufacturing facility advancing its North American market development goals. The business plans to use the facility's infrastructure and capabilities to develop sustainable acetone production methods.

In January 2021, Dow announced a large acetone manufacturing expansion in Texas to fulfill rising customer demand. The expansion might boost production by 20%.

In December 2020, worldwide phenol and acetone maker INEOS Phenol reported that it has expanded its German acetone manufacturing capacity. European and global acetone demand is rising, prompting the change.

In November 2020, Prasol Chemicals launched a new acetone factory in India. The new plant will meet the increasing acetone market in India with a 50,000-tonne annual production capacity.

Report Scope

Report Features Description Market Value (2022) USD 6.5 Bn Forecast Revenue (2032) USD 9.2 Bn CAGR (2023-2032) 3.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application: Methyl Methacrylate (MMA), Bisphenol-A, Solvents

By End-User: Automotive, Pharmaceuticals, Cosmetics & personal care, Electronics, Cleaning agentRegional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape INEOS Phenol, Royal Dutch Shell PLC, Mitsui Chemicals, Inc., Hindustan Organic Chemicals Limited, DOW Chemical Co., BASF SE, Sunoco, Prasol, Formosa Chemicals and Fiber Corporation, Shanghai Sinopec Mitsui Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- INEOS Phenol

- Royal Dutch Shell PLC

- Mitsui Chemicals, Inc.

- Hindustan Organic Chemicals Limited

- DOW Chemical Co.

- BASF SE

- Sunoco

- Prasol

- Formosa Chemicals and Fiber Corporation

- Shanghai Sinopec Mitsui