6G Market Report By Component (Hardware, Software, Services), By Communication Infrastructure (Wireless, Mobile Cellular, Mobile Broadband, Fixed), By Application (Multisensory XR Applications, Connected Robotics and Autonomous Systems (CRAS), Wireless Brain-Computer Interactions, By End User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2029-2039

-

44704

-

April 2024

-

290

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

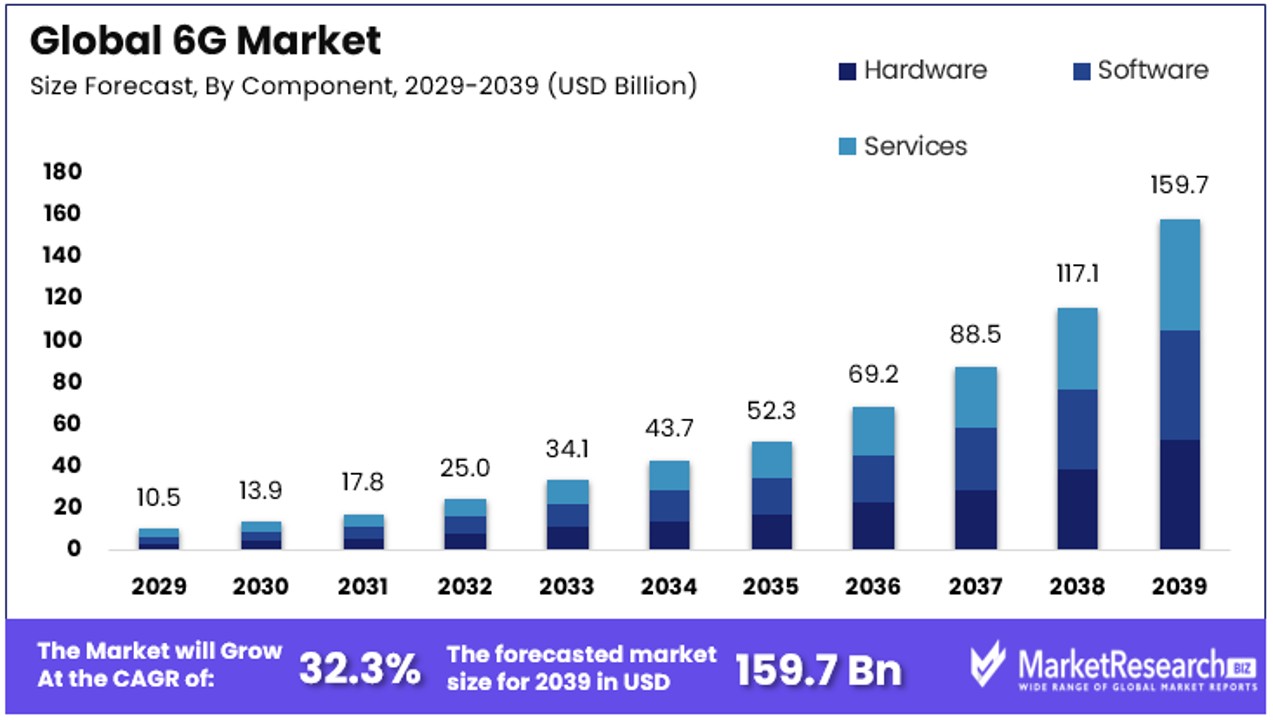

The Global 6G Market size is expected to be worth around USD 159.7 Billion by 2039, from USD 10.5 Billion in 2029, growing at a CAGR of 32.30% during the forecast period from 2029 to 2039.

The 6G market refers to the emerging sector focused on the development and implementation of sixth-generation wireless technology. This market encompasses advanced telecommunications, enhanced data speeds, and innovative applications like immersive virtual reality and autonomous vehicles. The technology aims to provide significant improvements over 5G, including higher data rates, lower latency, and greater network reliability.

Key stakeholders, including telecom companies, technology providers, and government bodies, are involved in shaping this nascent market. As 6G technology advances, it promises to unlock new business opportunities and drive economic growth, making it crucial for leaders in technology and innovation to stay informed.

The 6G market, designated as the next technological revolution in wireless communications, is anticipated to commence deployment toward the late 2020s. As the planned successor to 5G, 6G is currently in the nascent stages of the standardization process, governed by the International Telecommunication Union's IMT-2030 framework. This groundbreaking technology promises to enhance data transmission speeds to unprecedented levels—offering one terabyte of data per microsecond, which is a thousandfold increase compared to 5G's capability of 20 gigabytes per millisecond.

6G will dramatically transform various industries by enabling ultra-high-speed internet, superior reliability, and virtually instantaneous communication. This advancement is crucial for developing applications such as sophisticated remote operations, enhanced virtual and augmented reality, and more comprehensive, instant connectivity for autonomous vehicles.

Research and development are vigorously underway, with significant strides being made in laboratories and academic forums globally. Notably, teams from the City University of Hong Kong and the University of Sydney have already initiated formal lab testing. The trajectory of 6G development points to the availability of commercial products by 2028, followed by a broader commercial rollout slated for 2030.

Understanding the progression of the 6G market is vital. It not only represents a leap forward in technology but also opens up a spectrum of new business opportunities and challenges that will shape the competitive landscape of the future. As such, staying ahead in understanding 6G dynamics is crucial for strategic planning and investment in the next decade.

Key Takeaways

- Market Value: The Global 6G Market is projected to reach approximately USD 159.7 Billion by 2039, growing from USD 10.5 Billion in 2029, with a CAGR of 32.30% during 2029-2039.

- Dominant Segments:

- Hardware: Expected to emerge as the dominant segment, facilitating ultra-fast and highly reliable communication with significantly higher speeds, lower latency, and greater capacity compared to previous generations.

- Wireless Communication Infrastructure: Predicted to lead the market, driven by advancements in mmWave technology, beamforming, and Massive MIMO, enabling high data rates and low latency.

- Multisensory XR Applications: Emerging as the dominant application segment, leveraging 6G's capabilities for ultra-high-speed data transfer and low latency, crucial for immersive experiences.

- Enterprise: Positioned as the dominant end-user segment, seeking high-speed, reliable, and secure communication networks to enhance operational efficiency and innovation.

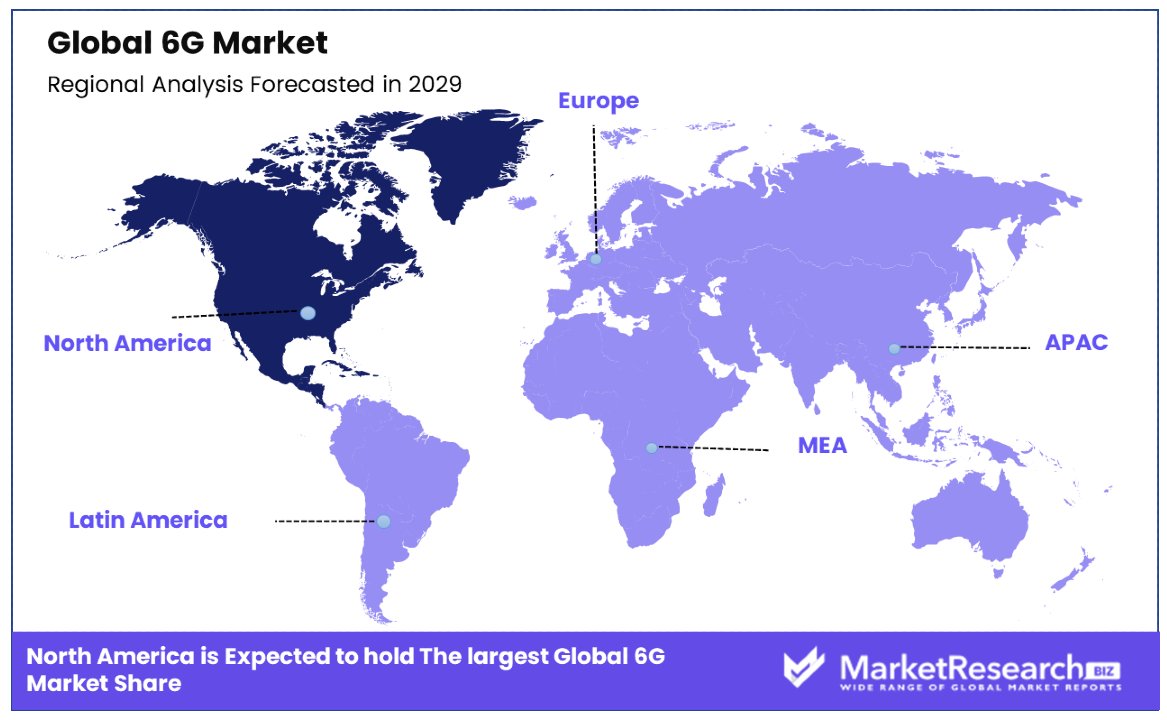

- Regional Analysis:

- North America: Dominates the market with a 35.20% share, fueled by significant governmental investment, robust academic contributions, and private sector innovation.

- Asia: Pioneering 6G research and development, with countries like China and South Korea making significant strides and investments in advancing 6G technology.

- Europe: Strategically investing in 6G, focusing on open network architectures and pushing the boundaries of speed and connectivity.

- Players: Key players like Nokia, Ericsson, Huawei, Qualcomm, Intel, Samsung, and LG are at the forefront of research and development for 6G technology, emphasizing innovation and transformative communication solutions.

- Analyst Viewpoint: Analysts foresee 6G revolutionizing industries by enabling ultra-high-speed internet, superior reliability, and virtually instantaneous communication, fostering new business opportunities and economic growth.

- Growth Opportunities: Robust investment and research in developing countries present substantial growth opportunities, with initiatives like the Next G Alliance in North America and significant investments in Europe driving market leadership.

Driving Factors

Vision of the Cyber-Physical Continuum Propels 6G Market Growth

Ericsson predicts that 6G will revolutionize the interaction between the physical and digital worlds, creating a seamless cyber-physical continuum. This advancement will extend beyond the current metaverse concept, offering a more profound connection to reality through virtual and augmented realities. The integration of these technologies in 6G will enable new dimensions of digital interaction and experiences, significantly impacting various sectors from entertainment to healthcare.

Ongoing Research Catalyzes 6G Development

Collaborative international research efforts, such as those by Osaka University and the University of Adelaide, are going to be pivotal in advancing 6G technology, particularly in terahertz-range communications. This research, coupled with significant funding like the £3.1m awarded to the University of York, underscores the global commitment to 6G development. These efforts will likely lead to breakthroughs in speed, efficiency, and bandwidth, forming the backbone of 6G infrastructure. The global research focus promises substantial advancements in 6G capabilities, positioning it as a revolutionary force in future communication technologies.

Efficiency Enhancements in Spectrum Utilization Boost 6G Prospects

6G is poised to significantly enhance the efficiency of spectrum utilization, a crucial aspect of wireless communication. By employing advanced mathematical techniques to enable simultaneous transmission and reception on the same frequency, 6G will optimize current Frequency Division Duplex (FDD) and Time Division Duplex (TDD) methods. This innovation will not only increase bandwidth efficiency but also pave the way for more robust and faster communication systems. Such advancements in spectrum efficiency are anticipated to be key drivers in the widespread adoption and success of 6G technology.

Integration of Edge and Core Computing in 6G Infrastructure

The convergence of edge and core computing in 6G networks will create a unified communication and computation infrastructure, offering numerous advantages. This integration will enhance access to AI capabilities and support complex mobile devices and systems, catering to the increasing demand for high-speed, low-latency, and data-intensive applications. The synergy between edge computing's localized data processing and 6G's ultra-reliable communication will likely revolutionize various industries, from autonomous vehicles to smart cities, marking a significant leap in technological advancement.

Restraining Factors

Increased Security Vulnerabilities in 6G Networks May Hinder Market Growth

As the 6G technology market develops, it is anticipated to face significant challenges related to security breaches. The expansion of 6G's network, particularly with the integration of IoT, virtualized networks, and open-source technology, will enlarge the attack surface, offering more potential entry points for unauthorized users.

Drawing parallels from 5G, where approximately 75% of communication service providers globally experienced up to six security breaches within a year, as reported in a Nokia survey from November 2022, the security concerns for 6G are expected to be more pronounced. This heightened vulnerability could deter investment and slow down the market's growth, as the need for robust security measures becomes paramount.

Component Analysis

Hardware Poised to Lead 6G Market, Fueling Next-Generation Telecommunications

In the evolving landscape of the 6G Market, Hardware is expected to emerge as the dominant segment. 6G is anticipated to revolutionize telecommunications with significantly higher speeds, lower latency, and greater capacity compared to its predecessors. The hardware segment includes a range of essential components like advanced antennas, transceivers, routers, and servers, all designed to support the ultra-fast and highly reliable communication that 6G promises.

While Hardware leads, Software and Services are also integral to the 6G ecosystem. The Software segment is pivotal for the operation and management of 6G networks, focusing on the development of advanced algorithms, network management solutions, and security protocols. As 6G networks are expected to support a wide array of futuristic applications, including augmented reality, autonomous vehicles, and IoT (Internet of Things) on a massive scale, the role of software in ensuring seamless integration, interoperability, and security cannot be overstated.

Communication Infrastructure Analysis

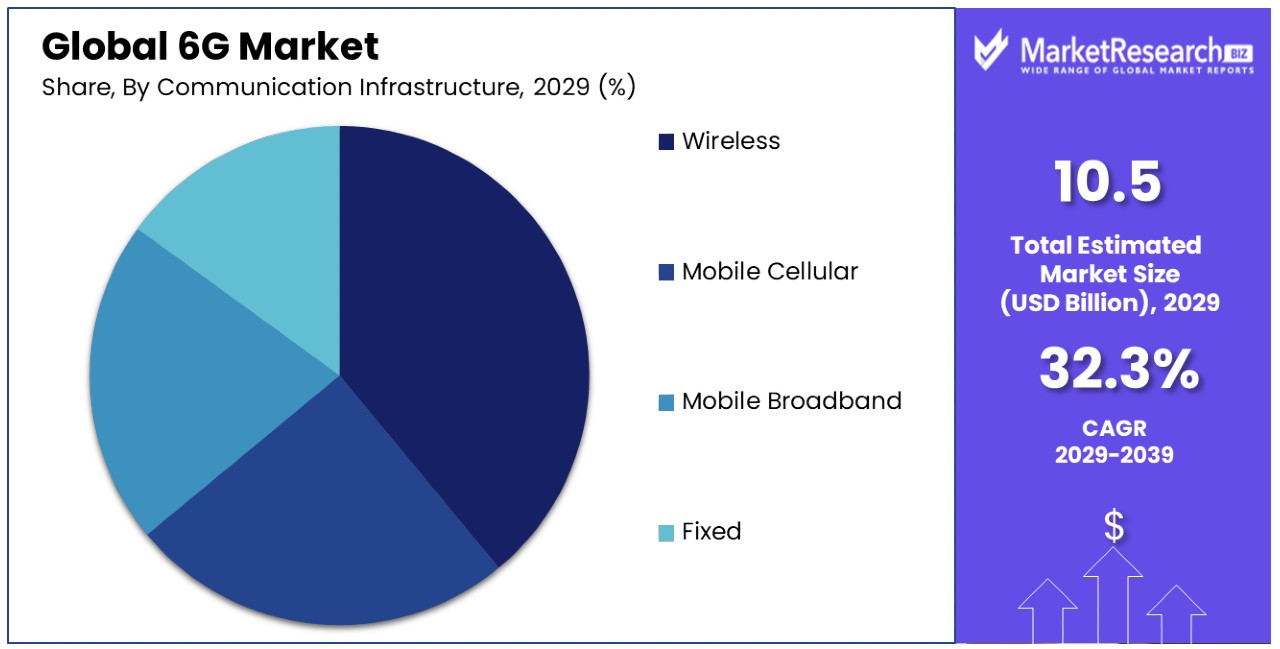

Wireless Communication Infrastructure Takes Center Stage in 6G Market, Enabling Futuristic Applications

In the 6G Market, Wireless communication infrastructure is predicted to be the dominant segment. 6G, as the next frontier in wireless technology, is expected to offer groundbreaking performance that will enable a host of new applications and services. The wireless segment includes various components such as small cells, macro cells, and advanced antenna systems, all of which are essential for building the dense and widespread network coverage that 6G envisions. The development of these components is closely tied to advancements in mmWave technology, beamforming, and Massive MIMO (Multiple Input Multiple Output), technologies that are crucial for achieving the high data rates and low latency promised by 6G.

While Wireless infrastructure is set to lead, other sub-segments like Mobile Cellular, Mobile Broadband, and Fixed infrastructure also play crucial roles in the overall 6G landscape. Mobile Cellular infrastructure will continue to be important for providing broad coverage and supporting mobile connectivity, which remains a cornerstone of modern communication. Mobile Broadband will likely see significant enhancements with 6G, offering even faster and more reliable internet access on the go.

Application Analysis

Multisensory XR Applications Take Center Stage in 6G Market, Poised for Immersive Experiences

Multisensory XR (Extended Reality) Applications are emerging as the dominant segment in the 6G market. This dominance is attributed to 6G's anticipated ability to support ultra-high-speed data transfer and low latency, which are crucial for immersive XR experiences combining virtual, augmented, and mixed reality. These applications, ranging from enhanced virtual reality (VR) gaming to complex augmented reality (AR) for industrial maintenance, will benefit significantly from 6G's advanced capabilities.

While Multisensory XR leads, other segments like Connected Robotics and Autonomous Systems (CRAS), Wireless Brain-Computer Interactions (BCI), Digital Twins, Smart Cities, Internet of Everything (IoE), Blockchain, and Distributed Ledger Technology (DLT) are also critical. Each of these applications will leverage 6G's high bandwidth and low latency to enable more connected, interactive, and smart solutions. CRAS will benefit from more seamless and efficient machine-to-machine communications, BCI will advance human-computer interaction, and Digital Twins and Smart Cities will utilize 6G for real-time monitoring and management.

End User Analysis

Enterprise Sector Emerges as Dominant End-User in 6G Market, Fueling Digital Transformation

In the 6G market, the Enterprise sector is expected to be positioned as the dominant end-user segment. This is largely due to enterprises' need for high-speed, reliable, and secure communication networks to support their growing array of digital operations and services. 6G will be instrumental in enabling enterprises to harness the full potential of emerging technologies like AI, IoT, and cloud computing, significantly enhancing operational efficiency and innovation.

As the Enterprise sector is predicted to lead, Government, Consumer, and Industrial sectors also play crucial roles. Governments will likely use 6G for infrastructure management and public services enhancement, while the Consumer sector will benefit from improved mobile broadband experiences and innovative services like enhanced AR/VR. The Industrial sector will leverage 6G for Industry 4.0 initiatives, including smart manufacturing and automation. The Enterprise sector’s focus on digital transformation, coupled with its substantial investment capabilities, positions it at the forefront of adopting and benefiting from 6G technology.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Communication Infrastructure

- Wireless

- Mobile Cellular

- Mobile Broadband

- Fixed

By Application

- Multisensory XR Applications

- Connected Robotics and Autonomous Systems (CRAS)

- Wireless Brain-Computer Interactions (BCI)

- Digital Twins

- Smart Cities

- Internet of Everything (IoE)

- Blockchain and DLT

- Others

By End User

- Government

- Consumer

- Industrial

- Enterprise

Growth Opportunities

Robust Investment and Research in Developing Countries Propel 6G Market Growth

The proactive approach of developing countries and regions in investing and researching 6G technology presents substantial growth opportunities for the 6G market. Initiatives like the Next G Alliance in North America and Europe's significant investment in 6G research, including 35 new projects worth €250 million, highlight a global commitment to pioneering the next generation of wireless technology.

This focus on cutting-edge research and development for revolutionary 6G advancements, including new system architectures and large-scale trials, is setting the foundation for market leadership in 6G.

Trending Factors

Global Collaboration and Ecosystem Development Are Trending Factors

The 6G market thrives on global collaboration and ecosystem development. By uniting industry leaders, governments, and academic institutions, the field is set to innovate and streamline 6G development. These alliances are crucial for tackling the immense technical challenges of 6G and achieving interoperability among diverse systems worldwide.

Initiatives like innovation hubs and industry consortia facilitate experimental projects and market trials, which are vital for validating 6G technologies and showcasing their practical benefits. This cooperative environment not only accelerates the technological advancements necessary for 6G but also enhances the global rollout and adoption of these networks, promising a robust expansion in the telecom sector.

Integration of Emerging Technologies and Architectures Are Trending Factors

Integrating cutting-edge technologies into 6G networks is key to their evolution. Technologies such as terahertz communication and AI-driven network orchestration are set to redefine connectivity with higher speeds and smarter network management. This integration promises to support revolutionary applications like real-time holographic communications, which demand ultra-low latency and massive data handling capabilities.

Furthermore, new architectures like decentralized and edge computing improve network resilience and security, facilitating more efficient data processing closer to users. This technological leap forward not only enhances network performance but also positions the 6G market as a leader in high-tech infrastructure development, driving growth and attracting significant investment in next-generation telecom solutions.

Regional Analysis

North America Dominates with 35.20% Market Share in 6G Market

North America’s 35.20% share in the emerging 6G market is propelled by significant governmental investment and a robust academic contribution to research and development. The US government’s allocation of $4.5 billion towards 6G development, focusing on research and international collaboration, notably with Japan, demonstrates its commitment to leading the next generation of wireless technology.

The active involvement of renowned universities like Virginia Tech, which aims to propel the 6G vision beyond mere incremental improvements over 5G, highlights the pivotal role academia plays in shaping and advancing 6G technology in the region.

The market dynamics in North America are characterized by a strong synergy between government initiatives, academic research, and private sector innovation. This collaboration is crucial for overcoming the technological challenges of 6G, such as achieving higher data rates and lower latency. The region's advanced technological infrastructure and the presence of leading tech companies provide a fertile ground for testing and implementing 6G technologies.

Asia: Pioneering 6G Research and DevelopmentIn Asia, countries like China and South Korea are making significant strides in 6G technology. Chinese researchers’ achievement of transmitting 1 terabyte of data over 3,000 feet in one second, and South Korea’s ambitious K-Network 2030 plan, demonstrate their commitment to pioneering 6G development. These countries are investing heavily in 6G research, aiming to secure world-class technologies and strengthen their network supply chains.

Europe: Strategic Investments and Innovative PredictionsEurope, led by the UK, is strategically investing in the future of 6G. The UK government’s goal to route 35% of mobile network traffic over open and interoperable RAN architectures by 2030, coupled with predictions from the University of Sydney about the potential of 6G networks, indicates a strong focus on developing and adopting cutting-edge wireless technologies. Europe’s approach involves leveraging open network architectures and pushing the boundaries of speed and connectivity in 6G.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the nascent 6G Market, a sector anticipated to revolutionize communication technologies, the companies listed are at the forefront of research and development for the next generation of wireless technology. Nokia Corporation, Ericsson, and Huawei Technologies Co., Ltd. are industry pioneers, investing heavily in 6G research initiatives and setting the groundwork for its technological infrastructure. Their strategic positioning emphasizes innovation, network evolution, and the potential for transformative communication solutions, significantly influencing the direction of future wireless technologies.

Qualcomm Technologies, Inc. and Intel Corporation are key players in developing advanced chipsets and processors that will be essential for 6G's enhanced capabilities, reflecting the industry's shift towards more powerful and efficient hardware. Samsung Electronics Co., Ltd. and LG Electronics, with their focus on integrating emerging technologies into consumer electronics, are poised to play crucial roles in bringing 6G capabilities to the mainstream market.

T-Mobile, AT&T Inc., and Verizon Communications Inc., as leading telecommunications providers, are instrumental in testing and deploying 6G networks, showcasing the market's potential for faster, more reliable, and expansive wireless connectivity. Sony Corporation and Apple Inc., with their vast consumer electronics portfolios, are expected to contribute significantly to the development and adoption of 6G-enabled devices.

Market Key Players

- HPE

- Nokia

- Qualcomm Technologies, Inc.

- T-Mobile

- Nokia Corporation

- Sony Corporation

- Ciena Corporation

- Huawei Technologies Co., Ltd.

- Telefonaktiebolaget Lm Ericsson

- Intel Corporation

- Ntt Docomo Inc.

- Zte Corporation

- Google Llc

- Verizon Communications Inc.

- AT&T Inc.

- LG Electronics

- Samsung Electronics Co., Ltd.

- Keysight Technologies

- Apple Inc.

- Cisco Systems, Inc.

- Jio Infocomm Ltd.

Recent Developments

- On March 31, 2024, NTT Docomo, NTT Corp, NEC, and Fujitsu unveiled a 100 Gbps wireless device capable of ultra-high-speed 100 Gbps transmissions in the 100 GHz and 300 GHz sub-terahertz bands.

- On April 15, 2024, a significant breakthrough in wireless communication technology was achieved by a team led by researchers from the University of Glasgow. This breakthrough involved the development of an innovative wireless communications antenna that combines metamaterial properties with advanced signal processing to enhance performance

- On March 29, 2024, NVIDIA introduced the NVIDIA 6G Research Cloud platform, a cutting-edge research platform designed to empower researchers in developing the next phase of wireless technology

- On April 12, 2024, 6G Datacast.tv announced the upgraded Mobile ATSC 3.0 Receiver at the 2024 NAB Show. This innovative device offers a comprehensive solution for broadcasting and receiving high-definition video and audio content over the air, utilizing the advanced capabilities of the ATSC 3.0 standard.

Report Scope

Report Features Description Market Value (2029) USD 10.5 Billion Forecast Revenue (2039) USD 159.7 Billion CAGR (2024-2033) 32.30% Base Year for Estimation 2029 Historic Period 2018-2029 Forecast Period 2029-2039 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By Communication Infrastructure (Wireless, Mobile Cellular, Mobile Broadband, Fixed), By Application (Multisensory XR Applications, Connected Robotics and Autonomous Systems (CRAS), Wireless Brain-Computer Interactions (BCI), Digital Twins, Smart Cities, Internet of Everything (IoE), Blockchain and DLT, Others), By End User (Government, Consumer, Industrial, Enterprise) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape HPE, Nokia, Qualcomm Technologies, Inc., T-Mobile, Nokia Corporation, Sony Corporation, Ciena Corporation, Huawei Technologies Co., Ltd., Telefonaktiebolaget Lm Ericsson, Intel Corporation, Ntt Docomo Inc., Zte Corporation, Google Llc, Verizon Communications Inc., AT&T Inc., LG Electronics, Samsung Electronics Co., Ltd., Keysight Technologies, Apple Inc., Cisco Systems, Inc., Jio Infocomm Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global 6G Market Overview

- 2.1. 6G Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. 6G Market Dynamics

- 3. Global 6G Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global 6G Market Analysis, 2016-2021

- 3.2. Global 6G Market Opportunity and Forecast, 2023-2032

- 3.3. Global 6G Market Analysis, Opportunity and Forecast, By Component , 2016-2032

- 3.3.1. Global 6G Market Analysis by Component : Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Component , 2016-2032

- 3.3.3. Hardware

- 3.3.4. Software

- 3.3.5. Services

- 3.4. Global 6G Market Analysis, Opportunity and Forecast, By Communication Infrastructure , 2016-2032

- 3.4.1. Global 6G Market Analysis by Communication Infrastructure : Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Communication Infrastructure , 2016-2032

- 3.4.3. Wireless

- 3.4.4. Mobile Cellular

- 3.4.5. Mobile Broadband

- 3.4.6. Fixed

- 3.5. Global 6G Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 3.5.1. Global 6G Market Analysis by Application: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 3.5.3. Multisensory XR Applications

- 3.5.4. Connected Robotics and Autonomous Systems (CRAS)

- 3.5.5. Wireless Brain-Computer Interactions (BCI)

- 3.5.6. Digital Twins

- 3.5.7. Smart Cities

- 3.5.8. Internet of Everything (IoE)

- 3.5.9. Blockchain and DLT

- 3.5.10. Others

- 3.6. Global 6G Market Analysis, Opportunity and Forecast, By End User, 2016-2032

- 3.6.1. Global 6G Market Analysis by End User: Introduction

- 3.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End User, 2016-2032

- 3.6.3. Government

- 3.6.4. Consumer

- 3.6.5. Industrial

- 3.6.6. Enterprise

- 4. North America 6G Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America 6G Market Analysis, 2016-2021

- 4.2. North America 6G Market Opportunity and Forecast, 2023-2032

- 4.3. North America 6G Market Analysis, Opportunity and Forecast, By Component , 2016-2032

- 4.3.1. North America 6G Market Analysis by Component : Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Component , 2016-2032

- 4.3.3. Hardware

- 4.3.4. Software

- 4.3.5. Services

- 4.4. North America 6G Market Analysis, Opportunity and Forecast, By Communication Infrastructure , 2016-2032

- 4.4.1. North America 6G Market Analysis by Communication Infrastructure : Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Communication Infrastructure , 2016-2032

- 4.4.3. Wireless

- 4.4.4. Mobile Cellular

- 4.4.5. Mobile Broadband

- 4.4.6. Fixed

- 4.5. North America 6G Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 4.5.1. North America 6G Market Analysis by Application: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 4.5.3. Multisensory XR Applications

- 4.5.4. Connected Robotics and Autonomous Systems (CRAS)

- 4.5.5. Wireless Brain-Computer Interactions (BCI)

- 4.5.6. Digital Twins

- 4.5.7. Smart Cities

- 4.5.8. Internet of Everything (IoE)

- 4.5.9. Blockchain and DLT

- 4.5.10. Others

- 4.6. North America 6G Market Analysis, Opportunity and Forecast, By End User, 2016-2032

- 4.6.1. North America 6G Market Analysis by End User: Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End User, 2016-2032

- 4.6.3. Government

- 4.6.4. Consumer

- 4.6.5. Industrial

- 4.6.6. Enterprise

- 4.7. North America 6G Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.7.1. North America 6G Market Analysis by Country : Introduction

- 4.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.7.2.1. The US

- 4.7.2.2. Canada

- 4.7.2.3. Mexico

- 5. Western Europe 6G Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe 6G Market Analysis, 2016-2021

- 5.2. Western Europe 6G Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe 6G Market Analysis, Opportunity and Forecast, By Component , 2016-2032

- 5.3.1. Western Europe 6G Market Analysis by Component : Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Component , 2016-2032

- 5.3.3. Hardware

- 5.3.4. Software

- 5.3.5. Services

- 5.4. Western Europe 6G Market Analysis, Opportunity and Forecast, By Communication Infrastructure , 2016-2032

- 5.4.1. Western Europe 6G Market Analysis by Communication Infrastructure : Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Communication Infrastructure , 2016-2032

- 5.4.3. Wireless

- 5.4.4. Mobile Cellular

- 5.4.5. Mobile Broadband

- 5.4.6. Fixed

- 5.5. Western Europe 6G Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 5.5.1. Western Europe 6G Market Analysis by Application: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 5.5.3. Multisensory XR Applications

- 5.5.4. Connected Robotics and Autonomous Systems (CRAS)

- 5.5.5. Wireless Brain-Computer Interactions (BCI)

- 5.5.6. Digital Twins

- 5.5.7. Smart Cities

- 5.5.8. Internet of Everything (IoE)

- 5.5.9. Blockchain and DLT

- 5.5.10. Others

- 5.6. Western Europe 6G Market Analysis, Opportunity and Forecast, By End User, 2016-2032

- 5.6.1. Western Europe 6G Market Analysis by End User: Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End User, 2016-2032

- 5.6.3. Government

- 5.6.4. Consumer

- 5.6.5. Industrial

- 5.6.6. Enterprise

- 5.7. Western Europe 6G Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.7.1. Western Europe 6G Market Analysis by Country : Introduction

- 5.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.7.2.1. Germany

- 5.7.2.2. France

- 5.7.2.3. The UK

- 5.7.2.4. Spain

- 5.7.2.5. Italy

- 5.7.2.6. Portugal

- 5.7.2.7. Ireland

- 5.7.2.8. Austria

- 5.7.2.9. Switzerland

- 5.7.2.10. Benelux

- 5.7.2.11. Nordic

- 5.7.2.12. Rest of Western Europe

- 6. Eastern Europe 6G Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe 6G Market Analysis, 2016-2021

- 6.2. Eastern Europe 6G Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe 6G Market Analysis, Opportunity and Forecast, By Component , 2016-2032

- 6.3.1. Eastern Europe 6G Market Analysis by Component : Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Component , 2016-2032

- 6.3.3. Hardware

- 6.3.4. Software

- 6.3.5. Services

- 6.4. Eastern Europe 6G Market Analysis, Opportunity and Forecast, By Communication Infrastructure , 2016-2032

- 6.4.1. Eastern Europe 6G Market Analysis by Communication Infrastructure : Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Communication Infrastructure , 2016-2032

- 6.4.3. Wireless

- 6.4.4. Mobile Cellular

- 6.4.5. Mobile Broadband

- 6.4.6. Fixed

- 6.5. Eastern Europe 6G Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 6.5.1. Eastern Europe 6G Market Analysis by Application: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 6.5.3. Multisensory XR Applications

- 6.5.4. Connected Robotics and Autonomous Systems (CRAS)

- 6.5.5. Wireless Brain-Computer Interactions (BCI)

- 6.5.6. Digital Twins

- 6.5.7. Smart Cities

- 6.5.8. Internet of Everything (IoE)

- 6.5.9. Blockchain and DLT

- 6.5.10. Others

- 6.6. Eastern Europe 6G Market Analysis, Opportunity and Forecast, By End User, 2016-2032

- 6.6.1. Eastern Europe 6G Market Analysis by End User: Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End User, 2016-2032

- 6.6.3. Government

- 6.6.4. Consumer

- 6.6.5. Industrial

- 6.6.6. Enterprise

- 6.7. Eastern Europe 6G Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.7.1. Eastern Europe 6G Market Analysis by Country : Introduction

- 6.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.7.2.1. Russia

- 6.7.2.2. Poland

- 6.7.2.3. The Czech Republic

- 6.7.2.4. Greece

- 6.7.2.5. Rest of Eastern Europe

- 7. APAC 6G Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC 6G Market Analysis, 2016-2021

- 7.2. APAC 6G Market Opportunity and Forecast, 2023-2032

- 7.3. APAC 6G Market Analysis, Opportunity and Forecast, By Component , 2016-2032

- 7.3.1. APAC 6G Market Analysis by Component : Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Component , 2016-2032

- 7.3.3. Hardware

- 7.3.4. Software

- 7.3.5. Services

- 7.4. APAC 6G Market Analysis, Opportunity and Forecast, By Communication Infrastructure , 2016-2032

- 7.4.1. APAC 6G Market Analysis by Communication Infrastructure : Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Communication Infrastructure , 2016-2032

- 7.4.3. Wireless

- 7.4.4. Mobile Cellular

- 7.4.5. Mobile Broadband

- 7.4.6. Fixed

- 7.5. APAC 6G Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 7.5.1. APAC 6G Market Analysis by Application: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 7.5.3. Multisensory XR Applications

- 7.5.4. Connected Robotics and Autonomous Systems (CRAS)

- 7.5.5. Wireless Brain-Computer Interactions (BCI)

- 7.5.6. Digital Twins

- 7.5.7. Smart Cities

- 7.5.8. Internet of Everything (IoE)

- 7.5.9. Blockchain and DLT

- 7.5.10. Others

- 7.6. APAC 6G Market Analysis, Opportunity and Forecast, By End User, 2016-2032

- 7.6.1. APAC 6G Market Analysis by End User: Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End User, 2016-2032

- 7.6.3. Government

- 7.6.4. Consumer

- 7.6.5. Industrial

- 7.6.6. Enterprise

- 7.7. APAC 6G Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.7.1. APAC 6G Market Analysis by Country : Introduction

- 7.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.7.2.1. China

- 7.7.2.2. Japan

- 7.7.2.3. South Korea

- 7.7.2.4. India

- 7.7.2.5. Australia & New Zeland

- 7.7.2.6. Indonesia

- 7.7.2.7. Malaysia

- 7.7.2.8. Philippines

- 7.7.2.9. Singapore

- 7.7.2.10. Thailand

- 7.7.2.11. Vietnam

- 7.7.2.12. Rest of APAC

- 8. Latin America 6G Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America 6G Market Analysis, 2016-2021

- 8.2. Latin America 6G Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America 6G Market Analysis, Opportunity and Forecast, By Component , 2016-2032

- 8.3.1. Latin America 6G Market Analysis by Component : Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Component , 2016-2032

- 8.3.3. Hardware

- 8.3.4. Software

- 8.3.5. Services

- 8.4. Latin America 6G Market Analysis, Opportunity and Forecast, By Communication Infrastructure , 2016-2032

- 8.4.1. Latin America 6G Market Analysis by Communication Infrastructure : Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Communication Infrastructure , 2016-2032

- 8.4.3. Wireless

- 8.4.4. Mobile Cellular

- 8.4.5. Mobile Broadband

- 8.4.6. Fixed

- 8.5. Latin America 6G Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 8.5.1. Latin America 6G Market Analysis by Application: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 8.5.3. Multisensory XR Applications

- 8.5.4. Connected Robotics and Autonomous Systems (CRAS)

- 8.5.5. Wireless Brain-Computer Interactions (BCI)

- 8.5.6. Digital Twins

- 8.5.7. Smart Cities

- 8.5.8. Internet of Everything (IoE)

- 8.5.9. Blockchain and DLT

- 8.5.10. Others

- 8.6. Latin America 6G Market Analysis, Opportunity and Forecast, By End User, 2016-2032

- 8.6.1. Latin America 6G Market Analysis by End User: Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End User, 2016-2032

- 8.6.3. Government

- 8.6.4. Consumer

- 8.6.5. Industrial

- 8.6.6. Enterprise

- 8.7. Latin America 6G Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.7.1. Latin America 6G Market Analysis by Country : Introduction

- 8.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.7.2.1. Brazil

- 8.7.2.2. Colombia

- 8.7.2.3. Chile

- 8.7.2.4. Argentina

- 8.7.2.5. Costa Rica

- 8.7.2.6. Rest of Latin America

- 9. Middle East & Africa 6G Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa 6G Market Analysis, 2016-2021

- 9.2. Middle East & Africa 6G Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa 6G Market Analysis, Opportunity and Forecast, By Component , 2016-2032

- 9.3.1. Middle East & Africa 6G Market Analysis by Component : Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Component , 2016-2032

- 9.3.3. Hardware

- 9.3.4. Software

- 9.3.5. Services

- 9.4. Middle East & Africa 6G Market Analysis, Opportunity and Forecast, By Communication Infrastructure , 2016-2032

- 9.4.1. Middle East & Africa 6G Market Analysis by Communication Infrastructure : Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Communication Infrastructure , 2016-2032

- 9.4.3. Wireless

- 9.4.4. Mobile Cellular

- 9.4.5. Mobile Broadband

- 9.4.6. Fixed

- 9.5. Middle East & Africa 6G Market Analysis, Opportunity and Forecast, By Application, 2016-2032

- 9.5.1. Middle East & Africa 6G Market Analysis by Application: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Application, 2016-2032

- 9.5.3. Multisensory XR Applications

- 9.5.4. Connected Robotics and Autonomous Systems (CRAS)

- 9.5.5. Wireless Brain-Computer Interactions (BCI)

- 9.5.6. Digital Twins

- 9.5.7. Smart Cities

- 9.5.8. Internet of Everything (IoE)

- 9.5.9. Blockchain and DLT

- 9.5.10. Others

- 9.6. Middle East & Africa 6G Market Analysis, Opportunity and Forecast, By End User, 2016-2032

- 9.6.1. Middle East & Africa 6G Market Analysis by End User: Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End User, 2016-2032

- 9.6.3. Government

- 9.6.4. Consumer

- 9.6.5. Industrial

- 9.6.6. Enterprise

- 9.7. Middle East & Africa 6G Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.7.1. Middle East & Africa 6G Market Analysis by Country : Introduction

- 9.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.7.2.1. Algeria

- 9.7.2.2. Egypt

- 9.7.2.3. Israel

- 9.7.2.4. Kuwait

- 9.7.2.5. Nigeria

- 9.7.2.6. Saudi Arabia

- 9.7.2.7. South Africa

- 9.7.2.8. Turkey

- 9.7.2.9. The UAE

- 9.7.2.10. Rest of MEA

- 10. Global 6G Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global 6G Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global 6G Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. HPE

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Nokia

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Qualcomm Technologies, Inc.

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. T-Mobile

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Nokia Corporation

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Sony Corporation

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Ciena Corporation

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Huawei Technologies Co., Ltd.

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Telefonaktiebolaget Lm Ericsson

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Intel Corporation

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Ntt Docomo Inc.

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Google Llc

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. Verizon Communications Inc.

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. AT&T Inc.

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 11.18. LG Electronics

- 11.18.1. Company Overview

- 11.18.2. Financial Highlights

- 11.18.3. Product Portfolio

- 11.18.4. SWOT Analysis

- 11.18.5. Key Strategies and Developments

- 11.19. Samsung Electronics Co., Ltd.

- 11.19.1. Company Overview

- 11.19.2. Financial Highlights

- 11.19.3. Product Portfolio

- 11.19.4. SWOT Analysis

- 11.19.5. Key Strategies and Developments

- 11.20. Keysight Technologies

- 11.20.1. Company Overview

- 11.20.2. Financial Highlights

- 11.20.3. Product Portfolio

- 11.20.4. SWOT Analysis

- 11.20.5. Key Strategies and Developments

- 11.21. Apple Inc.

- 11.21.1. Company Overview

- 11.21.2. Financial Highlights

- 11.21.3. Product Portfolio

- 11.21.4. SWOT Analysis

- 11.21.5. Key Strategies and Developments

- 11.22. Cisco Systems, Inc.

- 11.22.1. Company Overview

- 11.22.2. Financial Highlights

- 11.22.3. Product Portfolio

- 11.22.4. SWOT Analysis

- 11.22.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- List of Figures

- Figure 1: Global 6G Market Revenue (US$ Mn) Market Share by Component in 2022

- Figure 2: Global 6G Market Attractiveness Analysis by Component , 2016-2032

- Figure 3: Global 6G Market Revenue (US$ Mn) Market Share by Communication Infrastructure in 2022

- Figure 4: Global 6G Market Attractiveness Analysis by Communication Infrastructure , 2016-2032

- Figure 5: Global 6G Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 6: Global 6G Market Attractiveness Analysis by Application, 2016-2032

- Figure 7: Global 6G Market Revenue (US$ Mn) Market Share by End Userin 2022

- Figure 8: Global 6G Market Attractiveness Analysis by End User, 2016-2032

- Figure 9: Global 6G Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 10: Global 6G Market Attractiveness Analysis by Region, 2016-2032

- Figure 11: Global 6G Market Revenue (US$ Mn) (2016-2032)

- Figure 12: Global 6G Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 13: Global 6G Market Revenue (US$ Mn) Comparison by Component (2016-2032)

- Figure 14: Global 6G Market Revenue (US$ Mn) Comparison by Communication Infrastructure (2016-2032)

- Figure 15: Global 6G Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 16: Global 6G Market Revenue (US$ Mn) Comparison by End User (2016-2032)

- Figure 17: Global 6G Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 18: Global 6G Market Y-o-Y Growth Rate Comparison by Component (2016-2032)

- Figure 19: Global 6G Market Y-o-Y Growth Rate Comparison by Communication Infrastructure (2016-2032)

- Figure 20: Global 6G Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 21: Global 6G Market Y-o-Y Growth Rate Comparison by End User (2016-2032)

- Figure 22: Global 6G Market Share Comparison by Region (2016-2032)

- Figure 23: Global 6G Market Share Comparison by Component (2016-2032)

- Figure 24: Global 6G Market Share Comparison by Communication Infrastructure (2016-2032)

- Figure 25: Global 6G Market Share Comparison by Application (2016-2032)

- Figure 26: Global 6G Market Share Comparison by End User (2016-2032)

- Figure 27: North America 6G Market Revenue (US$ Mn) Market Share by Component in 2022

- Figure 28: North America 6G Market Attractiveness Analysis by Component , 2016-2032

- Figure 29: North America 6G Market Revenue (US$ Mn) Market Share by Communication Infrastructure in 2022

- Figure 30: North America 6G Market Attractiveness Analysis by Communication Infrastructure , 2016-2032

- Figure 31: North America 6G Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 32: North America 6G Market Attractiveness Analysis by Application, 2016-2032

- Figure 33: North America 6G Market Revenue (US$ Mn) Market Share by End Userin 2022

- Figure 34: North America 6G Market Attractiveness Analysis by End User, 2016-2032

- Figure 35: North America 6G Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 36: North America 6G Market Attractiveness Analysis by Country, 2016-2032

- Figure 37: North America 6G Market Revenue (US$ Mn) (2016-2032)

- Figure 38: North America 6G Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 39: North America 6G Market Revenue (US$ Mn) Comparison by Component (2016-2032)

- Figure 40: North America 6G Market Revenue (US$ Mn) Comparison by Communication Infrastructure (2016-2032)

- Figure 41: North America 6G Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 42: North America 6G Market Revenue (US$ Mn) Comparison by End User (2016-2032)

- Figure 43: North America 6G Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: North America 6G Market Y-o-Y Growth Rate Comparison by Component (2016-2032)

- Figure 45: North America 6G Market Y-o-Y Growth Rate Comparison by Communication Infrastructure (2016-2032)

- Figure 46: North America 6G Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 47: North America 6G Market Y-o-Y Growth Rate Comparison by End User (2016-2032)

- Figure 48: North America 6G Market Share Comparison by Country (2016-2032)

- Figure 49: North America 6G Market Share Comparison by Component (2016-2032)

- Figure 50: North America 6G Market Share Comparison by Communication Infrastructure (2016-2032)

- Figure 51: North America 6G Market Share Comparison by Application (2016-2032)

- Figure 52: North America 6G Market Share Comparison by End User (2016-2032)

- Figure 53: Western Europe 6G Market Revenue (US$ Mn) Market Share by Component in 2022

- Figure 54: Western Europe 6G Market Attractiveness Analysis by Component , 2016-2032

- Figure 55: Western Europe 6G Market Revenue (US$ Mn) Market Share by Communication Infrastructure in 2022

- Figure 56: Western Europe 6G Market Attractiveness Analysis by Communication Infrastructure , 2016-2032

- Figure 57: Western Europe 6G Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 58: Western Europe 6G Market Attractiveness Analysis by Application, 2016-2032

- Figure 59: Western Europe 6G Market Revenue (US$ Mn) Market Share by End Userin 2022

- Figure 60: Western Europe 6G Market Attractiveness Analysis by End User, 2016-2032

- Figure 61: Western Europe 6G Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 62: Western Europe 6G Market Attractiveness Analysis by Country, 2016-2032

- Figure 63: Western Europe 6G Market Revenue (US$ Mn) (2016-2032)

- Figure 64: Western Europe 6G Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 65: Western Europe 6G Market Revenue (US$ Mn) Comparison by Component (2016-2032)

- Figure 66: Western Europe 6G Market Revenue (US$ Mn) Comparison by Communication Infrastructure (2016-2032)

- Figure 67: Western Europe 6G Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 68: Western Europe 6G Market Revenue (US$ Mn) Comparison by End User (2016-2032)

- Figure 69: Western Europe 6G Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 70: Western Europe 6G Market Y-o-Y Growth Rate Comparison by Component (2016-2032)

- Figure 71: Western Europe 6G Market Y-o-Y Growth Rate Comparison by Communication Infrastructure (2016-2032)

- Figure 72: Western Europe 6G Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 73: Western Europe 6G Market Y-o-Y Growth Rate Comparison by End User (2016-2032)

- Figure 74: Western Europe 6G Market Share Comparison by Country (2016-2032)

- Figure 75: Western Europe 6G Market Share Comparison by Component (2016-2032)

- Figure 76: Western Europe 6G Market Share Comparison by Communication Infrastructure (2016-2032)

- Figure 77: Western Europe 6G Market Share Comparison by Application (2016-2032)

- Figure 78: Western Europe 6G Market Share Comparison by End User (2016-2032)

- Figure 79: Eastern Europe 6G Market Revenue (US$ Mn) Market Share by Component in 2022

- Figure 80: Eastern Europe 6G Market Attractiveness Analysis by Component , 2016-2032

- Figure 81: Eastern Europe 6G Market Revenue (US$ Mn) Market Share by Communication Infrastructure in 2022

- Figure 82: Eastern Europe 6G Market Attractiveness Analysis by Communication Infrastructure , 2016-2032

- Figure 83: Eastern Europe 6G Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 84: Eastern Europe 6G Market Attractiveness Analysis by Application, 2016-2032

- Figure 85: Eastern Europe 6G Market Revenue (US$ Mn) Market Share by End Userin 2022

- Figure 86: Eastern Europe 6G Market Attractiveness Analysis by End User, 2016-2032

- Figure 87: Eastern Europe 6G Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 88: Eastern Europe 6G Market Attractiveness Analysis by Country, 2016-2032

- Figure 89: Eastern Europe 6G Market Revenue (US$ Mn) (2016-2032)

- Figure 90: Eastern Europe 6G Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 91: Eastern Europe 6G Market Revenue (US$ Mn) Comparison by Component (2016-2032)

- Figure 92: Eastern Europe 6G Market Revenue (US$ Mn) Comparison by Communication Infrastructure (2016-2032)

- Figure 93: Eastern Europe 6G Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 94: Eastern Europe 6G Market Revenue (US$ Mn) Comparison by End User (2016-2032)

- Figure 95: Eastern Europe 6G Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 96: Eastern Europe 6G Market Y-o-Y Growth Rate Comparison by Component (2016-2032)

- Figure 97: Eastern Europe 6G Market Y-o-Y Growth Rate Comparison by Communication Infrastructure (2016-2032)

- Figure 98: Eastern Europe 6G Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 99: Eastern Europe 6G Market Y-o-Y Growth Rate Comparison by End User (2016-2032)

- Figure 100: Eastern Europe 6G Market Share Comparison by Country (2016-2032)

- Figure 101: Eastern Europe 6G Market Share Comparison by Component (2016-2032)

- Figure 102: Eastern Europe 6G Market Share Comparison by Communication Infrastructure (2016-2032)

- Figure 103: Eastern Europe 6G Market Share Comparison by Application (2016-2032)

- Figure 104: Eastern Europe 6G Market Share Comparison by End User (2016-2032)

- Figure 105: APAC 6G Market Revenue (US$ Mn) Market Share by Component in 2022

- Figure 106: APAC 6G Market Attractiveness Analysis by Component , 2016-2032

- Figure 107: APAC 6G Market Revenue (US$ Mn) Market Share by Communication Infrastructure in 2022

- Figure 108: APAC 6G Market Attractiveness Analysis by Communication Infrastructure , 2016-2032

- Figure 109: APAC 6G Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 110: APAC 6G Market Attractiveness Analysis by Application, 2016-2032

- Figure 111: APAC 6G Market Revenue (US$ Mn) Market Share by End Userin 2022

- Figure 112: APAC 6G Market Attractiveness Analysis by End User, 2016-2032

- Figure 113: APAC 6G Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 114: APAC 6G Market Attractiveness Analysis by Country, 2016-2032

- Figure 115: APAC 6G Market Revenue (US$ Mn) (2016-2032)

- Figure 116: APAC 6G Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 117: APAC 6G Market Revenue (US$ Mn) Comparison by Component (2016-2032)

- Figure 118: APAC 6G Market Revenue (US$ Mn) Comparison by Communication Infrastructure (2016-2032)

- Figure 119: APAC 6G Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 120: APAC 6G Market Revenue (US$ Mn) Comparison by End User (2016-2032)

- Figure 121: APAC 6G Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 122: APAC 6G Market Y-o-Y Growth Rate Comparison by Component (2016-2032)

- Figure 123: APAC 6G Market Y-o-Y Growth Rate Comparison by Communication Infrastructure (2016-2032)

- Figure 124: APAC 6G Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 125: APAC 6G Market Y-o-Y Growth Rate Comparison by End User (2016-2032)

- Figure 126: APAC 6G Market Share Comparison by Country (2016-2032)

- Figure 127: APAC 6G Market Share Comparison by Component (2016-2032)

- Figure 128: APAC 6G Market Share Comparison by Communication Infrastructure (2016-2032)

- Figure 129: APAC 6G Market Share Comparison by Application (2016-2032)

- Figure 130: APAC 6G Market Share Comparison by End User (2016-2032)

- Figure 131: Latin America 6G Market Revenue (US$ Mn) Market Share by Component in 2022

- Figure 132: Latin America 6G Market Attractiveness Analysis by Component , 2016-2032

- Figure 133: Latin America 6G Market Revenue (US$ Mn) Market Share by Communication Infrastructure in 2022

- Figure 134: Latin America 6G Market Attractiveness Analysis by Communication Infrastructure , 2016-2032

- Figure 135: Latin America 6G Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 136: Latin America 6G Market Attractiveness Analysis by Application, 2016-2032

- Figure 137: Latin America 6G Market Revenue (US$ Mn) Market Share by End Userin 2022

- Figure 138: Latin America 6G Market Attractiveness Analysis by End User, 2016-2032

- Figure 139: Latin America 6G Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 140: Latin America 6G Market Attractiveness Analysis by Country, 2016-2032

- Figure 141: Latin America 6G Market Revenue (US$ Mn) (2016-2032)

- Figure 142: Latin America 6G Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 143: Latin America 6G Market Revenue (US$ Mn) Comparison by Component (2016-2032)

- Figure 144: Latin America 6G Market Revenue (US$ Mn) Comparison by Communication Infrastructure (2016-2032)

- Figure 145: Latin America 6G Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 146: Latin America 6G Market Revenue (US$ Mn) Comparison by End User (2016-2032)

- Figure 147: Latin America 6G Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 148: Latin America 6G Market Y-o-Y Growth Rate Comparison by Component (2016-2032)

- Figure 149: Latin America 6G Market Y-o-Y Growth Rate Comparison by Communication Infrastructure (2016-2032)

- Figure 150: Latin America 6G Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 151: Latin America 6G Market Y-o-Y Growth Rate Comparison by End User (2016-2032)

- Figure 152: Latin America 6G Market Share Comparison by Country (2016-2032)

- Figure 153: Latin America 6G Market Share Comparison by Component (2016-2032)

- Figure 154: Latin America 6G Market Share Comparison by Communication Infrastructure (2016-2032)

- Figure 155: Latin America 6G Market Share Comparison by Application (2016-2032)

- Figure 156: Latin America 6G Market Share Comparison by End User (2016-2032)

- Figure 157: Middle East & Africa 6G Market Revenue (US$ Mn) Market Share by Component in 2022

- Figure 158: Middle East & Africa 6G Market Attractiveness Analysis by Component , 2016-2032

- Figure 159: Middle East & Africa 6G Market Revenue (US$ Mn) Market Share by Communication Infrastructure in 2022

- Figure 160: Middle East & Africa 6G Market Attractiveness Analysis by Communication Infrastructure , 2016-2032

- Figure 161: Middle East & Africa 6G Market Revenue (US$ Mn) Market Share by Applicationin 2022

- Figure 162: Middle East & Africa 6G Market Attractiveness Analysis by Application, 2016-2032

- Figure 163: Middle East & Africa 6G Market Revenue (US$ Mn) Market Share by End Userin 2022

- Figure 164: Middle East & Africa 6G Market Attractiveness Analysis by End User, 2016-2032

- Figure 165: Middle East & Africa 6G Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 166: Middle East & Africa 6G Market Attractiveness Analysis by Country, 2016-2032

- Figure 167: Middle East & Africa 6G Market Revenue (US$ Mn) (2016-2032)

- Figure 168: Middle East & Africa 6G Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 169: Middle East & Africa 6G Market Revenue (US$ Mn) Comparison by Component (2016-2032)

- Figure 170: Middle East & Africa 6G Market Revenue (US$ Mn) Comparison by Communication Infrastructure (2016-2032)

- Figure 171: Middle East & Africa 6G Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Figure 172: Middle East & Africa 6G Market Revenue (US$ Mn) Comparison by End User (2016-2032)

- Figure 173: Middle East & Africa 6G Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 174: Middle East & Africa 6G Market Y-o-Y Growth Rate Comparison by Component (2016-2032)

- Figure 175: Middle East & Africa 6G Market Y-o-Y Growth Rate Comparison by Communication Infrastructure (2016-2032)

- Figure 176: Middle East & Africa 6G Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Figure 177: Middle East & Africa 6G Market Y-o-Y Growth Rate Comparison by End User (2016-2032)

- Figure 178: Middle East & Africa 6G Market Share Comparison by Country (2016-2032)

- Figure 179: Middle East & Africa 6G Market Share Comparison by Component (2016-2032)

- Figure 180: Middle East & Africa 6G Market Share Comparison by Communication Infrastructure (2016-2032)

- Figure 181: Middle East & Africa 6G Market Share Comparison by Application (2016-2032)

- Figure 182: Middle East & Africa 6G Market Share Comparison by End User (2016-2032)

- List of Tables

- Table 1: Global 6G Market Comparison by Component (2016-2032)

- Table 2: Global 6G Market Comparison by Communication Infrastructure (2016-2032)

- Table 3: Global 6G Market Comparison by Application (2016-2032)

- Table 4: Global 6G Market Comparison by End User (2016-2032)

- Table 5: Global 6G Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global 6G Market Revenue (US$ Mn) (2016-2032)

- Table 7: Global 6G Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 8: Global 6G Market Revenue (US$ Mn) Comparison by Component (2016-2032)

- Table 9: Global 6G Market Revenue (US$ Mn) Comparison by Communication Infrastructure (2016-2032)

- Table 10: Global 6G Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 11: Global 6G Market Revenue (US$ Mn) Comparison by End User (2016-2032)

- Table 12: Global 6G Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 13: Global 6G Market Y-o-Y Growth Rate Comparison by Component (2016-2032)

- Table 14: Global 6G Market Y-o-Y Growth Rate Comparison by Communication Infrastructure (2016-2032)

- Table 15: Global 6G Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 16: Global 6G Market Y-o-Y Growth Rate Comparison by End User (2016-2032)

- Table 17: Global 6G Market Share Comparison by Region (2016-2032)

- Table 18: Global 6G Market Share Comparison by Component (2016-2032)

- Table 19: Global 6G Market Share Comparison by Communication Infrastructure (2016-2032)

- Table 20: Global 6G Market Share Comparison by Application (2016-2032)

- Table 21: Global 6G Market Share Comparison by End User (2016-2032)

- Table 22: North America 6G Market Comparison by Communication Infrastructure (2016-2032)

- Table 23: North America 6G Market Comparison by Application (2016-2032)

- Table 24: North America 6G Market Comparison by End User (2016-2032)

- Table 25: North America 6G Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 26: North America 6G Market Revenue (US$ Mn) (2016-2032)

- Table 27: North America 6G Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 28: North America 6G Market Revenue (US$ Mn) Comparison by Component (2016-2032)

- Table 29: North America 6G Market Revenue (US$ Mn) Comparison by Communication Infrastructure (2016-2032)

- Table 30: North America 6G Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 31: North America 6G Market Revenue (US$ Mn) Comparison by End User (2016-2032)

- Table 32: North America 6G Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 33: North America 6G Market Y-o-Y Growth Rate Comparison by Component (2016-2032)

- Table 34: North America 6G Market Y-o-Y Growth Rate Comparison by Communication Infrastructure (2016-2032)

- Table 35: North America 6G Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 36: North America 6G Market Y-o-Y Growth Rate Comparison by End User (2016-2032)

- Table 37: North America 6G Market Share Comparison by Country (2016-2032)

- Table 38: North America 6G Market Share Comparison by Component (2016-2032)

- Table 39: North America 6G Market Share Comparison by Communication Infrastructure (2016-2032)

- Table 40: North America 6G Market Share Comparison by Application (2016-2032)

- Table 41: North America 6G Market Share Comparison by End User (2016-2032)

- Table 42: Western Europe 6G Market Comparison by Component (2016-2032)

- Table 43: Western Europe 6G Market Comparison by Communication Infrastructure (2016-2032)

- Table 44: Western Europe 6G Market Comparison by Application (2016-2032)

- Table 45: Western Europe 6G Market Comparison by End User (2016-2032)

- Table 46: Western Europe 6G Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 47: Western Europe 6G Market Revenue (US$ Mn) (2016-2032)

- Table 48: Western Europe 6G Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 49: Western Europe 6G Market Revenue (US$ Mn) Comparison by Component (2016-2032)

- Table 50: Western Europe 6G Market Revenue (US$ Mn) Comparison by Communication Infrastructure (2016-2032)

- Table 51: Western Europe 6G Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 52: Western Europe 6G Market Revenue (US$ Mn) Comparison by End User (2016-2032)

- Table 53: Western Europe 6G Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 54: Western Europe 6G Market Y-o-Y Growth Rate Comparison by Component (2016-2032)

- Table 55: Western Europe 6G Market Y-o-Y Growth Rate Comparison by Communication Infrastructure (2016-2032)

- Table 56: Western Europe 6G Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 57: Western Europe 6G Market Y-o-Y Growth Rate Comparison by End User (2016-2032)

- Table 58: Western Europe 6G Market Share Comparison by Country (2016-2032)

- Table 59: Western Europe 6G Market Share Comparison by Component (2016-2032)

- Table 60: Western Europe 6G Market Share Comparison by Communication Infrastructure (2016-2032)

- Table 61: Western Europe 6G Market Share Comparison by Application (2016-2032)

- Table 62: Western Europe 6G Market Share Comparison by End User (2016-2032)

- Table 63: Eastern Europe 6G Market Comparison by Component (2016-2032)

- Table 64: Eastern Europe 6G Market Comparison by Communication Infrastructure (2016-2032)

- Table 65: Eastern Europe 6G Market Comparison by Application (2016-2032)

- Table 66: Eastern Europe 6G Market Comparison by End User (2016-2032)

- Table 67: Eastern Europe 6G Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 68: Eastern Europe 6G Market Revenue (US$ Mn) (2016-2032)

- Table 69: Eastern Europe 6G Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 70: Eastern Europe 6G Market Revenue (US$ Mn) Comparison by Component (2016-2032)

- Table 71: Eastern Europe 6G Market Revenue (US$ Mn) Comparison by Communication Infrastructure (2016-2032)

- Table 72: Eastern Europe 6G Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 73: Eastern Europe 6G Market Revenue (US$ Mn) Comparison by End User (2016-2032)

- Table 74: Eastern Europe 6G Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 75: Eastern Europe 6G Market Y-o-Y Growth Rate Comparison by Component (2016-2032)

- Table 76: Eastern Europe 6G Market Y-o-Y Growth Rate Comparison by Communication Infrastructure (2016-2032)

- Table 77: Eastern Europe 6G Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 78: Eastern Europe 6G Market Y-o-Y Growth Rate Comparison by End User (2016-2032)

- Table 79: Eastern Europe 6G Market Share Comparison by Country (2016-2032)

- Table 80: Eastern Europe 6G Market Share Comparison by Component (2016-2032)

- Table 81: Eastern Europe 6G Market Share Comparison by Communication Infrastructure (2016-2032)

- Table 82: Eastern Europe 6G Market Share Comparison by Application (2016-2032)

- Table 83: Eastern Europe 6G Market Share Comparison by End User (2016-2032)

- Table 84: APAC 6G Market Comparison by Component (2016-2032)

- Table 85: APAC 6G Market Comparison by Communication Infrastructure (2016-2032)

- Table 86: APAC 6G Market Comparison by Application (2016-2032)

- Table 87: APAC 6G Market Comparison by End User (2016-2032)

- Table 88: APAC 6G Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 89: APAC 6G Market Revenue (US$ Mn) (2016-2032)

- Table 90: APAC 6G Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 91: APAC 6G Market Revenue (US$ Mn) Comparison by Component (2016-2032)

- Table 92: APAC 6G Market Revenue (US$ Mn) Comparison by Communication Infrastructure (2016-2032)

- Table 93: APAC 6G Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 94: APAC 6G Market Revenue (US$ Mn) Comparison by End User (2016-2032)

- Table 95: APAC 6G Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 96: APAC 6G Market Y-o-Y Growth Rate Comparison by Component (2016-2032)

- Table 97: APAC 6G Market Y-o-Y Growth Rate Comparison by Communication Infrastructure (2016-2032)

- Table 98: APAC 6G Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 99: APAC 6G Market Y-o-Y Growth Rate Comparison by End User (2016-2032)

- Table 100: APAC 6G Market Share Comparison by Country (2016-2032)

- Table 101: APAC 6G Market Share Comparison by Component (2016-2032)

- Table 102: APAC 6G Market Share Comparison by Communication Infrastructure (2016-2032)

- Table 103: APAC 6G Market Share Comparison by Application (2016-2032)

- Table 104: APAC 6G Market Share Comparison by End User (2016-2032)

- Table 105: Latin America 6G Market Comparison by Component (2016-2032)

- Table 106: Latin America 6G Market Comparison by Communication Infrastructure (2016-2032)

- Table 107: Latin America 6G Market Comparison by Application (2016-2032)

- Table 108: Latin America 6G Market Comparison by End User (2016-2032)

- Table 109: Latin America 6G Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 110: Latin America 6G Market Revenue (US$ Mn) (2016-2032)

- Table 111: Latin America 6G Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 112: Latin America 6G Market Revenue (US$ Mn) Comparison by Component (2016-2032)

- Table 113: Latin America 6G Market Revenue (US$ Mn) Comparison by Communication Infrastructure (2016-2032)

- Table 114: Latin America 6G Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 115: Latin America 6G Market Revenue (US$ Mn) Comparison by End User (2016-2032)

- Table 116: Latin America 6G Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 117: Latin America 6G Market Y-o-Y Growth Rate Comparison by Component (2016-2032)

- Table 118: Latin America 6G Market Y-o-Y Growth Rate Comparison by Communication Infrastructure (2016-2032)

- Table 119: Latin America 6G Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 120: Latin America 6G Market Y-o-Y Growth Rate Comparison by End User (2016-2032)

- Table 121: Latin America 6G Market Share Comparison by Country (2016-2032)

- Table 122: Latin America 6G Market Share Comparison by Component (2016-2032)

- Table 123: Latin America 6G Market Share Comparison by Communication Infrastructure (2016-2032)

- Table 124: Latin America 6G Market Share Comparison by Application (2016-2032)

- Table 125: Latin America 6G Market Share Comparison by End User (2016-2032)

- Table 126: Middle East & Africa 6G Market Comparison by Component (2016-2032)

- Table 127: Middle East & Africa 6G Market Comparison by Communication Infrastructure (2016-2032)

- Table 128: Middle East & Africa 6G Market Comparison by Application (2016-2032)

- Table 129: Middle East & Africa 6G Market Comparison by End User (2016-2032)

- Table 130: Middle East & Africa 6G Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 131: Middle East & Africa 6G Market Revenue (US$ Mn) (2016-2032)

- Table 132: Middle East & Africa 6G Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 133: Middle East & Africa 6G Market Revenue (US$ Mn) Comparison by Component (2016-2032)

- Table 134: Middle East & Africa 6G Market Revenue (US$ Mn) Comparison by Communication Infrastructure (2016-2032)

- Table 135: Middle East & Africa 6G Market Revenue (US$ Mn) Comparison by Application (2016-2032)

- Table 136: Middle East & Africa 6G Market Revenue (US$ Mn) Comparison by End User (2016-2032)

- Table 137: Middle East & Africa 6G Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 138: Middle East & Africa 6G Market Y-o-Y Growth Rate Comparison by Component (2016-2032)

- Table 139: Middle East & Africa 6G Market Y-o-Y Growth Rate Comparison by Communication Infrastructure (2016-2032)

- Table 140: Middle East & Africa 6G Market Y-o-Y Growth Rate Comparison by Application (2016-2032)

- Table 141: Middle East & Africa 6G Market Y-o-Y Growth Rate Comparison by End User (2016-2032)

- Table 142: Middle East & Africa 6G Market Share Comparison by Country (2016-2032)

- Table 143: Middle East & Africa 6G Market Share Comparison by Component (2016-2032)

- Table 144: Middle East & Africa 6G Market Share Comparison by Communication Infrastructure (2016-2032)

- Table 145: Middle East & Africa 6G Market Share Comparison by Application (2016-2032)

- Table 146: Middle East & Africa 6G Market Share Comparison by End User (2016-2032)

- 1. Executive Summary

-

- HPE

- Nokia

- Qualcomm Technologies, Inc.

- T-Mobile

- Nokia Corporation

- Sony Corporation

- Ciena Corporation

- Huawei Technologies Co., Ltd.

- Telefonaktiebolaget Lm Ericsson

- Intel Corporation

- Ntt Docomo Inc.

- Zte Corporation

- Google Llc

- Verizon Communications Inc.

- AT&T Inc.

- LG Electronics

- Samsung Electronics Co., Ltd.

- Keysight Technologies

- Apple Inc.