3d Printing Gases Market By Type (Argon, Nitrogen, Gas Mixtures, Argon Mixtures), By Function (Insulation, Cooling, Illumination), By Technology (Stereolithography, Laser Sintering, Poly-Jet, Material Jetting, Electron Beam Melting, Others), By Storage (Cylinder & Packaged, Merchant Liquid, Tonnage, Others) By End-use (Automotive, Aerospace & Defense, Consumer Products, Healthcare, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

47048

-

June 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

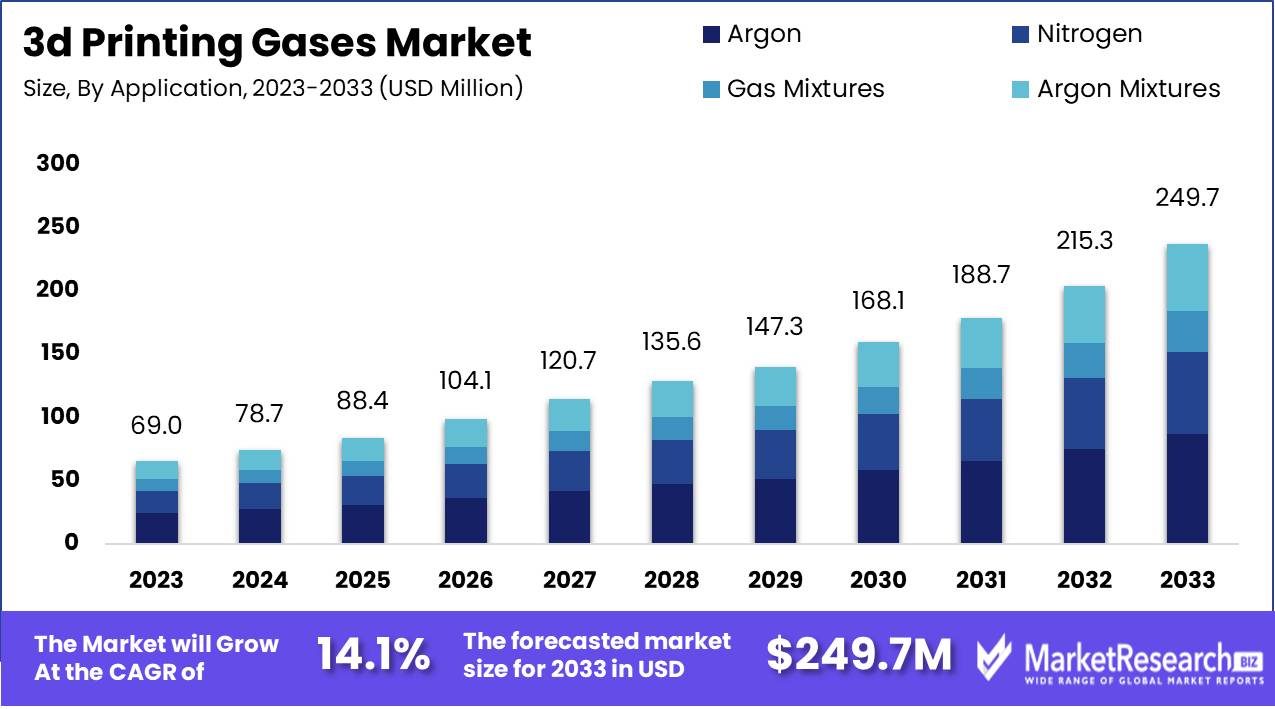

The 3d Printing Gases Market was valued at USD 69.0 Million in 2023. It is expected to reach USD 249.7 Million by 2033, with a CAGR of 14.1% during the forecast period from 2024 to 2033.

The 3D Printing Gases Market encompasses the specialized segment of industrial gases used in additive manufacturing processes. These gases, such as argon, nitrogen, and hydrogen, are crucial for maintaining optimal printing conditions, ensuring material integrity, and preventing oxidation during the printing process. The market is driven by the expanding adoption of 3D printing across various industries, including aerospace, healthcare, and automotive, where precision and material performance are paramount. Innovations in gas delivery systems and the increasing complexity of 3D printed applications are further propelling market growth, highlighting its strategic importance in the advanced manufacturing landscape.

The 3D printing gas market is experiencing robust growth, propelled by several key factors. Primarily, the increasing adoption of 3D printing for prototype applications underscores a significant shift towards rapid and cost-effective product development. This trend is further bolstered by active research and development efforts, which continually enhance the technological capabilities and applications of 3D printing. Notably, the growing feasibility of this technology for small-scale industries presents new opportunities, democratizing access to advanced manufacturing processes that were previously the domain of larger enterprises. Additionally, the expanding application of 3D printing across diverse sectors such as aerospace and automotive is driving the demand for specialized gases, essential for optimizing printing processes and ensuring product quality.

Moreover, emerging markets, particularly in China and India, are becoming pivotal in the global 3D printing landscape. The surge in demand from these regions is driven by their rapidly evolving industrial bases and increasing investment in cutting-edge manufacturing technologies. As these economies continue to modernize, the requirement for high-quality, precise 3D printing solutions grows, subsequently fueling the market for 3D printing gases. This dynamic is compounded by the broadening spectrum of industries leveraging 3D printing, further solidifying the market's growth trajectory.

Key Takeaways

- Market Growth: The 3d Printing Gases Market was valued at USD 69.0 Million in 2023. It is expected to reach USD 249.7 Million by 2033, with a CAGR of 14.1% during the forecast period from 2024 to 2033.

- By Type: Argon dominated 3D printing gases in 2023 with a 67.5% share.

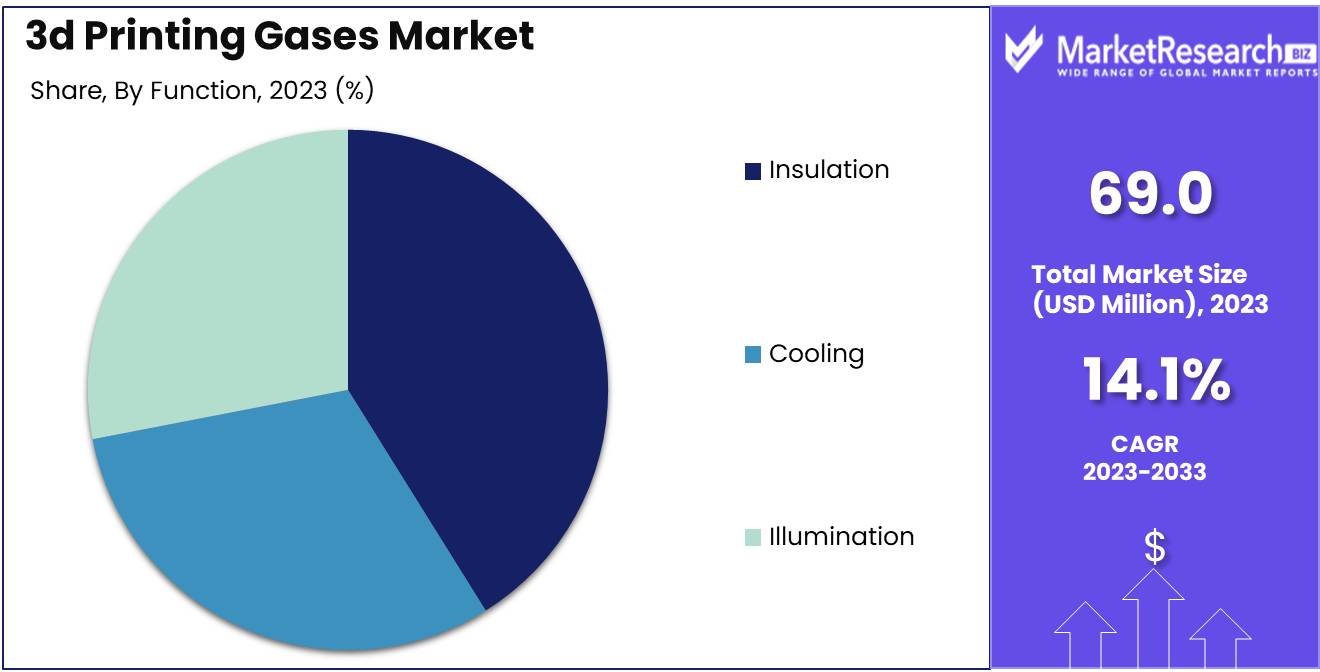

- By Function: Insulation dominated with 41.2%, followed by Cooling and Illumination.

- By Technology: In 2023, Stereolithography dominated the market, capturing over 42.1% share.

- By Storage: Cylinder & Packaged gases dominate the 3D Printing Gases Market capturing more than a 45.6% share.

- By End-User: The Automotive sector dominated, capturing 37.2% of the market.

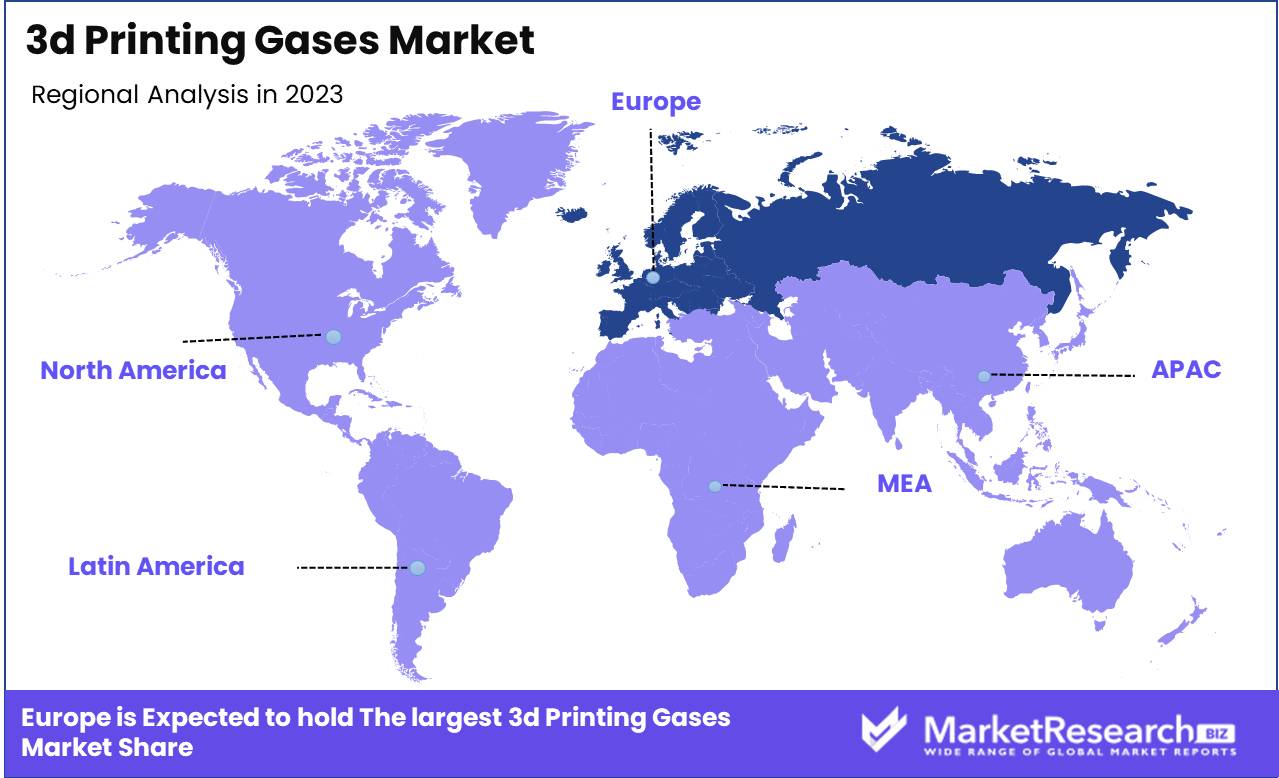

- Regional Dominance: Asia Pacific dominates the 3D printing gases market, holding a 37% share.

- Growth Opportunity: The global 3D printing gas market will thrive due to Industry 4.0 integration and rising inert gas demand.

Driving factors

Accelerated Adoption of 3D Printing Techniques Across the Manufacturing Sector

The increasing emphasis on implementing 3D printing techniques across the manufacturing sector is a primary driver of the 3D printing gases market. As manufacturers strive for more efficient production methods, 3D printing (or additive manufacturing) offers numerous advantages, including reduced material waste, enhanced design flexibility, and faster prototyping. These benefits are propelling manufacturers across various industries automotive, consumer goods, and industrial equipment to integrate 3D printing into their operations. This integration necessitates a reliable supply of 3D printing gases, such as argon, nitrogen, and hydrogen, which are critical for ensuring the quality and integrity of printed components. As a result, the demand for these gases is expected to rise in parallel with the growing adoption of 3D printing technologies.

Surge in 3D Printing Utilization in Healthcare and Medical Devices

The healthcare sector's growing adoption of 3D printing significantly boosts the 3D printing gases market. 3D printing in healthcare enables the creation of customized medical devices, prosthetics, and implants tailored to individual patients' needs. This customization improves patient outcomes and enhances the overall efficiency of medical treatments. The production of these medical devices requires an array of 3D printing gases to maintain the sterility and precision of the printing process.

Furthermore, the development of bioprinting printing tissues and organs demands highly controlled environments facilitated by these gases. As the healthcare sector continues to explore and expand its use of 3D printing, the associated market for specialized gases is poised for substantial growth.

Expanding Application in Aerospace and Defense Sectors

The aerospace and defense sectors are increasingly adopting 3D printing, contributing to the robust growth of the 3D printing gas market. In aerospace, 3D printing allows for the creation of complex and lightweight components that meet stringent industry standards. This capability is crucial for manufacturing parts with intricate geometries that are difficult or impossible to produce using traditional methods.

Similarly, the defense sector benefits from the rapid prototyping and production capabilities of 3D printing, enabling faster development cycles and customization of mission-critical components. Both sectors rely on 3D printing gases to ensure the mechanical properties and structural integrity of printed parts, thus driving demand for these gases. The projected increase in aerospace and defense expenditures on advanced manufacturing technologies will further stimulate the market for 3D printing gases.

Restraining Factors

Fluctuating Gas Prices: A Major Challenge to Market Stability

The volatility of gas prices poses a significant challenge to the growth of the 3D printing gas market. The costs associated with gases such as argon, nitrogen, and carbon dioxide, which are essential in various 3D printing processes, are directly influenced by global market conditions. Price fluctuations can be attributed to several factors, including geopolitical tensions, supply chain disruptions, and changes in production costs.

When gas prices rise unpredictably, it impacts the overall cost structure of 3D printing operations. Manufacturers might face increased expenses, which can lead to higher prices for end-users or reduced profit margins for producers. This volatility makes it difficult for companies to forecast expenses accurately, thereby hindering long-term planning and investment in new technologies or expanded capacity. For instance, a sudden spike in gas prices could force smaller 3D printing companies to scale back operations or delay projects, ultimately slowing market growth.

Competition from Substitute Technologies: A Hindrance to Market Penetration

The 3D printing gas market faces significant competition from substitute technologies, which can dampen its growth prospects. Alternatives such as fused deposition modeling (FDM) and stereolithography (SLA) do not rely on gases to the same extent as powder bed fusion (PBF) and direct metal laser sintering (DMLS) do. These substitute technologies often use different materials and processes that circumvent the need for specialized gases, thereby offering more cost-effective solutions for certain applications.

This competitive pressure is particularly pronounced in industries such as prototyping and small-batch production, where the cost and complexity of using 3D printing gases may not be justified. For instance, FDM and SLA are widely adopted in educational institutions, hobbyist circles, and small enterprises due to their lower operational costs and ease of use. As these technologies continue to advance, they become more capable of producing high-quality parts, thus encroaching on the market share traditionally held by gas-dependent 3D printing methods.

By Type Analysis

Argon dominated 3D printing gases in 2023 with a 67.5% share.

In 2023, Argon held a dominant market position in the "By Type" segment of the 3D Printing Gases Market, capturing more than a 67.5% share. Argon's extensive use is attributed to its inert properties, which prevent oxidation and provide a stable environment during the printing process, thereby ensuring high-quality outputs. Following Argon, nitrogen secured a significant market share due to its cost-effectiveness and versatility in various 3D printing applications. Nitrogen's inert nature also helps in reducing oxidation, albeit less effectively than Argon.

Gas Mixtures, comprising various combinations tailored to specific printing needs, have seen growing adoption. These mixtures can be customized to enhance specific printing characteristics, such as improving layer adhesion or reducing residual stress in the printed parts. Finally, Argon Mixtures, which combine Argon with other gases like CO2 or O2, offer enhanced performance for specialized printing tasks, particularly in metal additive manufacturing. These mixtures optimize the benefits of Argon while addressing specific process requirements, making them a preferred choice for high-precision applications. Collectively, these segments underline the diverse and evolving landscape of the 3D printing gases market.

By Function Analysis

Insulation dominated with 41.2%, followed by Cooling and Illumination.

In 2023, Insulation held a dominant market position in the By Function segment of the 3D Printing Gases Market, capturing more than a 41.2% share. This strong performance is attributed to the growing demand for enhanced thermal properties and protection during the 3D printing process. Insulation gases, such as nitrogen and argon, play a critical role in preventing oxidation and maintaining material integrity, especially for high-value and sensitive printing materials.

Cooling follows as the second major segment, driven by its crucial role in temperature regulation during printing operations. Cooling gases help mitigate the heat generated by the 3D printing equipment, thereby ensuring precision and stability in the final printed products. This function is particularly essential in high-speed and large-scale printing processes where overheating can compromise quality and efficiency.

Illumination is the third significant segment, albeit with a smaller market share. Illumination gases are used to enhance the visibility of the printing process, ensuring accuracy and reducing errors. This is particularly important in intricate and detailed printing tasks where precision is paramount.

By Technology Analysis

In 2023, Stereolithography dominated the market, capturing over 42.1% share.

In 2023, Stereolithography held a dominant market position in the By Technology segment of the 3D Printing Gases Market, capturing more than a 42.1% share. This leading technology leverages photopolymerization to produce high-resolution and precise components, driving its extensive adoption across various industries, including aerospace, healthcare, and automotive. The accuracy and surface finish achievable with stereolithography are unparalleled, positioning it as the go-to technology for prototyping and manufacturing complex geometries.

Laser Sintering follows closely, gaining traction due to its ability to create durable and functional parts from a variety of materials, such as metals and polymers. This versatility makes it particularly valuable in industrial applications where strength and durability are paramount.

Poly-jet technology, known for its high-speed printing and multi-material capabilities, is widely used for creating prototypes and intricate models that require fine details and smooth surfaces. Material Jetting also plays a significant role, particularly in producing high-precision components with excellent mechanical properties, suitable for both prototyping and end-use products. Electron Beam Melting (EBM), though niche, is critical in the aerospace and medical sectors for producing high-strength, lightweight metal parts.

Lastly, Other technologies, including Digital Light Processing (DLP) and Binder Jetting, continue to innovate and expand their applications, contributing to the diverse landscape of the 3D Printing Gases Market.

By Storage Analysis

Cylinder & Packaged gases dominate the 3D Printing Gases Market capturing more than a 45.6% share.

In 2023, Cylinder & Packaged held a dominant market position in the By Storage segment of the 3D Printing Gases Market, capturing more than a 45.6% share. This segment's dominance can be attributed to several key factors. Firstly, the versatility and convenience of cylinder and packaged gases make them highly suitable for various 3D printing applications, ranging from prototyping to large-scale manufacturing. Secondly, the ease of transportation and storage of these gases ensures a steady supply chain, critical for uninterrupted operations in additive manufacturing. Additionally, advancements in packaging technologies have enhanced the safety and efficiency of gas storage, further solidifying this segment's market leadership.

Merchant Liquid gases, while comprising a smaller share, are growing in importance due to their cost-effectiveness for medium to large-scale operations. The Tonnage segment, providing gases in bulk, caters primarily to large industrial applications, offering significant economies of scale. Others, including specialty gases and custom blends, serve niche markets with specific performance requirements. Together, these segments create a diversified market landscape, with Cylinder & Packaged gases setting the benchmark in 2023 through their widespread applicability and logistical advantages.

By End-use Analysis

In 2023, The Automotive sector dominated, capturing 37.2% of the market.

In 2023, The Automotive sector held a dominant market position in the 3D printing gases market within the end-use segment, capturing more than a 37.2% share. This substantial market share is driven by the increasing adoption of 3D printing technologies for prototyping, tooling, and the production of complex automotive components. The precision and efficiency of 3D printing in reducing lead times and material wastage have made it a valuable asset for automotive manufacturers aiming to streamline operations and enhance product innovation.

The aerospace and defense sector, representing another significant segment, leverages 3D printing gases for the fabrication of lightweight, high-strength parts, essential for advanced aerospace applications. The consumer products industry also utilizes 3D printing gases, particularly for customized and small-batch manufacturing, reflecting a trend toward personalized products.

In healthcare, the use of 3D printing gases is expanding, notably in the creation of patient-specific medical devices and implants, improving patient outcomes through tailored healthcare solutions. The "others" category encompasses various industries, including education and research, where 3D printing technologies are utilized for experimental and developmental purposes, contributing to the broader growth of the 3D printing gases market.

Key Market Segments

By Type

- Argon

- Nitrogen

- Gas Mixtures

- Argon Mixtures

By Function

- Insulation

- Cooling

- Illumination

By Technology

- Stereolithography

- Laser Sintering

- Poly-Jet

- Material Jetting

- Electron Beam Melting

- Others

By Storage

- Cylinder & Packaged

- Merchant Liquid

- Tonnage

- Others

By End-use

- Automotive

- Aerospace & Defense

- Consumer Products

- Healthcare

- Others

Growth Opportunity

Integration with Industry 4.0 Technologies

The 3D printing gas market is poised for substantial growth in 2024, driven significantly by the integration with Industry 4.0 technologies. As manufacturing processes become increasingly digital, the demand for precise and efficient production methods escalates. 3D printing, coupled with the Internet of Things (IoT), Artificial Intelligence (AI), and big data analytics, enhances the precision, scalability, and customization capabilities of manufacturing. Gases like argon, nitrogen, and hydrogen play a crucial role in maintaining the quality of printed components by preventing oxidation and contamination during the printing process. The synergy between Industry 4.0 and 3D printing gases offers a pathway to smarter, more efficient production lines, thereby fostering market expansion.

Growing Demand for Inert Gases

The rising demand for inert gases is another pivotal factor propelling the 3D printing gas market. Inert gases, particularly argon and nitrogen, are essential in creating an optimal atmosphere for 3D printing, especially in metal additive manufacturing. These gases ensure the stability and quality of the printed materials by mitigating the risks of oxidation and other chemical reactions that could compromise the integrity of the product. With the increasing adoption of metal 3D printing in industries such as aerospace, automotive, and healthcare, the need for high-purity inert gases is surging. This trend is expected to continue, driving market growth and innovation in gas supply and management solutions.

Latest Trends

Increasing Demand for Inert Gases

The 3D printing industry is experiencing robust growth, significantly driving the demand for inert gases such as argon, nitrogen, and helium. Inert gases are crucial in ensuring high-quality prints by preventing oxidation and maintaining a stable printing environment. As industries such as aerospace, automotive, and healthcare increasingly adopt 3D printing for manufacturing complex parts and prototypes, the need for inert gases is projected to rise. The purity and consistency offered by inert gases enhance the mechanical properties and surface finish of 3D-printed components, making them indispensable for high-precision applications. This trend is anticipated to spur investments in gas production and supply chain optimization to meet the burgeoning demand.

Development of New 3D Printing Technologies

The 3D printing sector is witnessing a wave of innovation, with the development of new technologies that expand the capabilities and applications of 3D printing. Techniques such as Multi-Jet Fusion (MJF), Direct Metal Laser Sintering (DMLS), and Electron Beam Melting (EBM) are gaining traction, necessitating specialized gas mixtures to optimize their performance. These advancements are enhancing the efficiency and speed of 3D printing processes and enabling the use of a broader range of materials. The integration of these cutting-edge technologies is expected to drive the demand for customized gas solutions, tailored to meet the specific requirements of different printing methods. Companies will likely focus on research and development to create innovative gas mixtures that support the evolving landscape of 3D printing technologies.

Regional Analysis

Asia Pacific dominates the 3D printing gases market, holding a 37% share.

The 3D printing gases market exhibits significant regional variability, with distinct trends and growth drivers across North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Asia Pacific dominates the market, accounting for approximately 37% of the global share, driven by robust industrial manufacturing bases, particularly in China, Japan, and South Korea. The region's leadership in electronics, automotive, and consumer goods manufacturing underpins this dominance. North America follows, benefiting from advanced technological adoption and substantial investments in the aerospace and healthcare sectors. The United States, in particular, is a pivotal player due to its strong innovation ecosystem and extensive use of 3D printing technologies in industrial applications.

Europe's market is bolstered by strong automotive and aerospace industries, with Germany, the UK, and France being key contributors. The region's commitment to sustainable and efficient manufacturing processes further accelerates 3D printing adoption. The Middle East & Africa, while still emerging in the 3D printing domain, show promising growth due to increasing investments in infrastructure and energy sectors, particularly in the UAE and Saudi Arabia. Latin America is gradually advancing, with Brazil and Mexico spearheading the market growth through rising adoption in manufacturing and healthcare applications.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global 3D printing gases market in 2024 is set for significant growth, driven by technological advancements and expanding industrial applications. Key players, such as Air Liquide, Air Products and Chemicals, Inc., and Linde PLC, are at the forefront, leveraging their robust portfolios and innovative solutions to cater to the evolving needs of the 3D printing industry.

Air Liquide continues to dominate with its comprehensive range of gas solutions and commitment to research and development. Their strategic focus on sustainability and efficiency aligns with the industry's demand for eco-friendly and cost-effective options. Similarly, Air Products and Chemicals, Inc. has fortified its market position through strategic partnerships and an extensive distribution network, enhancing its ability to meet diverse customer requirements globally.

Linde PLC and Praxair Inc., following their merger, have emerged as a formidable force, combining extensive expertise and resources to drive innovation. Their focus on tailored gas solutions for additive manufacturing underscores their commitment to addressing specific industry challenges.

BASF SE, with its strong chemical foundation, provides critical material innovations that complement gas applications in 3D printing. Meanwhile, companies like Iceblick Ltd. and Iwatani Corporation are making strides with niche offerings and regional strengths, contributing to market diversity.

Market Key Players

- Air Liquide

- Air Products and Chemicals, INC.

- Airgas Inc.

- BASF SE

- Iceblick Ltd.

- Iwatani Corporation

- Linde PLC

- Matheson Tri-Gas Inc.

- Messer Group

- Nippon Sanso Holdings Corporation

- Praxair Inc.

- SOL Group

- The Linde Group

- Universal Industrial Gases

Recent Development

- In March 2024, Air Liquide introduced a new range of high-purity gases designed specifically for additive manufacturing. This move is part of their strategy to cater to the growing market for specialized gases used in 3D printing processes such as laser sintering and stereolithography.

- In January 2024, BASF SE announced the launch of new gas mixtures tailored for metal 3D printing applications. This development aims to enhance the performance and quality of 3D-printed metal parts, reflecting the increasing demand for high-precision manufacturing in sectors like aerospace and automotive.

- In November 2023, BASF SE, a global leader in the chemicals industry, partnered with SK On, a prominent manufacturer of electric vehicle battery cells, to explore collaborative opportunities in the lithium-ion battery market. This partnership is focused on enhancing the use of 3D printing technologies in battery production, particularly in North America and Asia-Pacific.

Report Scope

Report Features Description Market Value (2023) USD 69.0 Million Forecast Revenue (2033) USD 249.7 Million CAGR (2024-2032) 14.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Argon, Nitrogen, Gas Mixtures, Argon Mixtures), By Function (Insulation, Cooling, Illumination), By Technology (Stereolithography, Laser Sintering, Poly-Jet, Material Jetting, Electron Beam Melting, Others), By Storage (Cylinder & Packaged, Merchant Liquid, Tonnage, Others) By End-use (Automotive, Aerospace & Defense, Consumer Products, Healthcare, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Air Liquide, Air Products and Chemicals, INC., Airgas Inc., BASF SE, Iceblick Ltd., Iwatani Corporation, Linde PLC, Matheson Tri-Gas Inc., Messer Group, Nippon Sanso Holdings Corporation, Praxair Inc., SOL Group, The Linde Group, Universal Industrial Gases Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Air Liquide

- Air Products and Chemicals, INC.

- Airgas Inc.

- BASF SE

- Iceblick Ltd.

- Iwatani Corporation

- Linde PLC

- Matheson Tri-Gas Inc.

- Messer Group

- Nippon Sanso Holdings Corporation

- Praxair Inc.

- SOL Group

- The Linde Group

- Universal Industrial Gases