Wireline Services Market By Wireline Type (Electric line and Slickline), By Service (Completion, Well Intervention, Logging), By Hole Type (Cased-Hole and Open Hole), By Location (Onshore and Offshore), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

48240

-

June 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

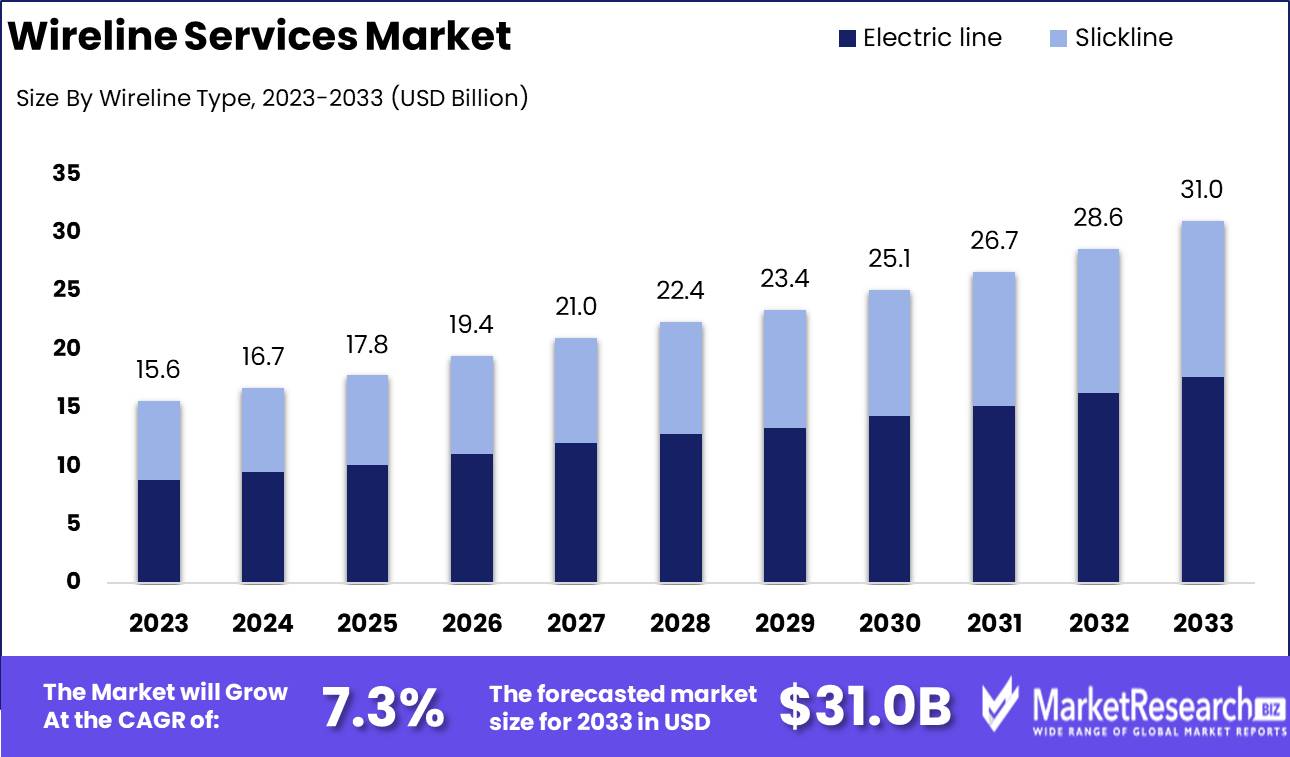

The Wireline Services Market was valued at USD 15.6 billion in 2023. It is expected to reach USD 31.0 billion by 2033, with a CAGR of 7.3% during the forecast period from 2024 to 2033.

The Wireline Services Market encompasses a range of services essential for oil and gas exploration, well intervention, and maintenance operations. These services involve deploying a wireline, a cable that transmits data from downhole sensors to the surface, facilitating tasks such as logging, perforation, pipe recovery, and reservoir evaluation. Driven by advancements in technology, the market is crucial for enhancing operational efficiency, ensuring safety, and optimizing resource extraction. Key players invest in innovative solutions to meet the growing demand for energy and the need for precise data acquisition and real-time decision-making in complex subsurface environments.

The Wireline Services Market is poised for significant growth, driven by several converging factors. The rising global demand for energy has spurred increased oil and gas exploration activities, necessitating advanced wireline services to enhance extraction efficiency and accuracy. Technological advancements in wireline tools, such as improved logging and perforation capabilities, are significantly contributing to this sector's evolution. These innovations not only optimize operational performance but also reduce non-productive time, thereby lowering overall costs.

However, the market faces challenges, particularly the volatility in oil prices, which can lead to fluctuating investment levels in exploration and production. Companies are often forced to recalibrate their strategies based on the prevailing oil price environment, impacting the demand for wireline services.

Moreover, the industry is witnessing a transformative shift with the increased adoption of digital technologies and real-time data analysis. These advancements are revolutionizing wireline operations by providing deeper insights into reservoir conditions and enabling more informed decision-making. For instance, real-time data analytics facilitate immediate adjustments to drilling and extraction processes, enhancing overall productivity and safety. As the industry moves towards greater digital integration, wireline service providers that leverage these technologies will likely gain a competitive edge. In conclusion, while the Wireline Services Market is set to benefit from growing energy demands and technological innovations, stakeholders must navigate the challenges posed by oil price volatility and continuously adapt to the evolving digital landscape to sustain growth and profitability.

Key Takeaways

- Market Growth: The Wireline Services Market was valued at USD 15.6 billion in 2023. It is expected to reach USD 31.0 billion by 2033, with a CAGR of 7.3% during the forecast period from 2024 to 2033.

- By Wireline Type: Electric line Segmentdominated due to advanced real-time data capabilities.

- By Service: Completion dominated the Wireline Services Market by enhancing productivity.

- By Hole Type: Cased-hole Segmentdominated due to extensive use in mature oilfields.

- By Location: Onshore wireline services dominated due to cost and efficiency.

- Regional Dominance: North America leads the wireline services market at 35% due to robust exploration.

- Growth Opportunity: The global wireline services market is set to grow significantly, driven by a focus on operational efficiency and the expansion of deepwater exploration.

Driving factors

Rising Global Demand for Oil and Gas Products Drives Wireline Services Market

The global demand for oil and gas products is a critical driver of the wireline services market. As the world's energy needs continue to expand, driven by industrial growth and urbanization, the necessity for efficient extraction techniques becomes more pronounced. This growing demand propels the need for advanced wireline services, which are essential for optimizing production and ensuring the efficient extraction of hydrocarbons. Wireline services, including logging, perforation, and intervention, are integral to maintaining the productivity and safety of oil and gas operations. This rising demand for energy resources ensures a consistent need for these specialized services, thereby driving market growth.

Increasing Investments in Exploration and Production Activities Enhance Market Potential

Significant investments in exploration and production (E&P) activities are bolstering the wireline services market. As oil and gas companies allocate more capital to discovering new reserves and enhancing existing ones, the demand for wireline services intensifies. These investments are crucial for sustaining the global energy supply and addressing depleting reserves. Wireline services play a pivotal role in exploration by providing crucial data on geological formations and reservoir characteristics, enabling informed decision-making. Moreover, in production phases, wireline interventions are vital for well completion and maintenance, enhancing overall efficiency and output. The uptick in E&P investments directly correlates with increased utilization of wireline services, driving market expansion.

Enhancing Production from Aged Wells: A Catalyst for Market Growth

Improving production from aged wells is a significant contributor to the wireline services market growth. Mature wells, which have been producing for years, often experience a decline in output. To counter this, advanced wireline techniques are employed to rejuvenate production. This includes well intervention services such as re-perforation, water shutoff, and zonal isolation, which are designed to enhance the flow of hydrocarbons and extend the life of the well. This highlights the importance of wireline services in maintaining and boosting production from these aging assets. As operators seek to maximize returns from existing infrastructure, the demand for effective wireline solutions increases, driving market growth.

Restraining Factors

Increasing Adoption of Alternative Technologies: Diversifying Market Preferences

The rapid advancement and adoption of alternative technologies, such as wireless communication and fiber-optic networks, present a significant restraining factor for the growth of the wireline services market. These technologies offer several advantages over traditional wireline services, including higher data transmission speeds, lower latency, and enhanced reliability. For instance, the global fiber-optic network market is projected to grow at a CAGR of 8.5% from 2021 to 2026, reflecting a robust shift towards these newer technologies.

Moreover, the proliferation of 5G technology is further accelerating this trend. With the global 5G services market expected to reach $664.75 billion by 2028, the reliance on wireless communication infrastructures is markedly increasing. This shift diverts investments and consumer preference away from wireline services, challenging the market's growth prospects. Additionally, the integration of IoT devices and smart technologies, which often leverage wireless and fiber-optic networks, underscores the growing preference for these alternatives.

Stringent Environmental Regulations: Compliance Costs and Operational Constraints

Stringent environmental regulations pose another critical challenge to the wireline services market. Governments and regulatory bodies worldwide are enforcing stricter environmental standards to reduce the carbon footprint and environmental impact of various industries, including telecommunications. For example, the European Union's stringent regulations on electronic waste and carbon emissions necessitate significant compliance measures from wireline service providers.

These regulations often result in increased operational costs due to the need for eco-friendly materials, advanced waste management systems, and the implementation of sustainable practices. The necessity to upgrade existing infrastructure to meet environmental standards further exacerbates these costs. A report indicates that the telecommunications sector's energy consumption is growing by approximately 5% annually, emphasizing the need for more sustainable operations. Compliance with these regulations not only incurs direct financial costs but also diverts resources away from innovation and expansion efforts, thereby restraining market growth.

By Wireline Type Analysis

In 2023, The Electric line Segment dominated due to advanced real-time data capabilities.

In 2023, The Electric line held a dominant market position in the By Wireline Type segment of the Wireline Services Market. Electric lines, which incorporate electrical conductors within the wireline, are essential for real-time data acquisition and well-logging. They enable operators to conduct complex downhole operations such as perforation and production logging with high precision. The ability to transmit data instantaneously enhances decision-making, optimizing drilling and production processes. Consequently, the growing demand for advanced well intervention and reservoir evaluation technologies has fueled the adoption of electric lines, positioning them as the preferred choice among service providers and operators alike.

Conversely, slackline, consisting of a single strand of non-electrical wire, is utilized for simpler tasks such as setting or retrieving wellbore equipment and gauges. While it remains a critical component for maintenance and basic intervention activities due to its cost-effectiveness and operational simplicity, it lacks the advanced data transmission capabilities of electric lines. As the industry increasingly leans towards digitalization and real-time analytics, the preference for electric lines has surged, driving significant market share in the wireline services sector. This shift underscores the industry's focus on enhancing operational efficiency and well productivity through technological advancements.

By Service Analysis

In 2023, Completion dominated the Wireline Services Market by enhancing productivity.

In 2023, Completion held a dominant market position in the By Service segment of the Wireline Services Market. Completion services, critical for enhancing productivity and ensuring operational efficiency, witnessed robust demand. The sector's growth was driven by the increasing complexity of well designs and the necessity for precise and efficient well completions to maximize extraction rates. Technological advancements in hydraulic fracturing and multistage completions further propelled the market, making Completion services indispensable for modern oil and gas operations.

Well, Intervention services also saw substantial activity, driven by the need for maintaining and optimizing existing wells. These services, encompassing both planned and corrective maintenance, are vital for extending well life and enhancing production efficiency. Innovations in intervention techniques and tools, such as coiled tubing and snubbing units, facilitated safer and more cost-effective operations, bolstering market growth.

Logging services, essential for obtaining subsurface data and informing drilling decisions, continued to be a cornerstone of the Wireline Services Market. The rise in exploratory activities and the demand for high-resolution downhole data propelled advancements in logging technology, such as real-time data transmission and advanced imaging techniques, ensuring informed decision-making and operational efficiency.

By Hole Type Analysis

In 2023, The Cased-Hole Segment dominated due to extensive use in mature oilfields.

In 2023, Cased-Hole held a dominant market position in the By-Hole Type segment of the Wireline Services Market.This segment's supremacy is attributed to the extensive use of cased-hole services in mature oilfields, where well integrity and detailed reservoir analysis are paramount. Cased-hole logging is essential for providing accurate data on the production capabilities of wells that have already been completed. The technology allows for effective monitoring and maintenance, which is critical for enhancing oil recovery rates and extending the lifespan of wells. As a result, cased-hole services continue to see robust demand, particularly in regions with extensive existing oilfield infrastructure.

In contrast, the Open Hole segment, though significant, represents a smaller portion of the market. Open-hole wireline services are primarily utilized during the initial drilling phase, offering detailed geological data before the well is cased. While essential for identifying potential reserves and planning efficient extraction methods, the use of open-hole services is generally confined to new exploration activities. Given the current focus on maximizing output from existing wells, the market demand for open-hole services remains comparatively lower, yet vital for the strategic expansion of oilfield operations.

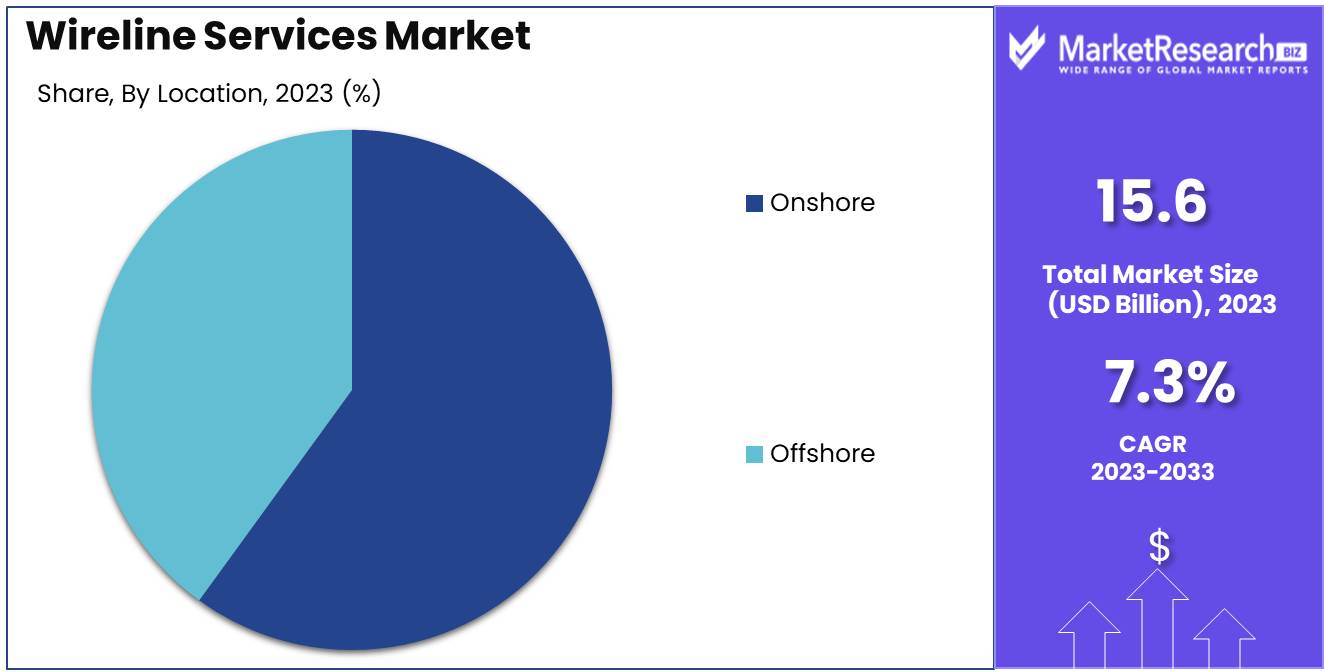

By Location Analysis

In 2023, Onshore wireline services dominated due to cost and efficiency.

In 2023, The Onshore segment held a dominant market position in the by-location segment of the Wireline Services Market. The robust performance of onshore wireline services can be attributed to several key factors. Firstly, onshore operations typically offer lower costs and reduced logistical complexities compared to offshore projects, making them more attractive to operators aiming to optimize expenditures amidst fluctuating oil prices. Additionally, the resurgence of shale gas exploration in regions such as North America has significantly bolstered onshore wireline service demand. Enhanced recovery techniques and the necessity for precise reservoir monitoring have further driven the adoption of these services on land-based rigs.

Conversely, the Offshore segment, while smaller, remains a critical component of the market. Offshore wireline services are indispensable for deepwater and ultra-deepwater drilling activities, where the stakes are higher, and the technological requirements are more advanced. Innovations in subsea technology and the discovery of new offshore reserves, particularly in regions like Brazil and West Africa, are expected to fuel future growth. Despite higher operational costs and challenges associated with harsh environments, offshore wireline services continue to be pivotal in maximizing hydrocarbon extraction and ensuring the efficient operation of offshore platforms.

Key Market Segments

By Wireline Type

- Electric line

- Slickline

By Service

- Completion

- Well Intervention

- Logging

By Hole Type

- Cased-Hole

- Open Hole

By Location

- Onshore

- Offshore

Growth Opportunity

Increasing Focus on Operational Efficiency

The global wireline services market is poised for significant growth, driven by an increasing focus on operational efficiency within the oil and gas industry. Companies are investing heavily in advanced wireline technologies to optimize their drilling and production processes. The integration of real-time data analytics and automation in wireline services enhances decision-making capabilities, leading to improved resource management and cost reduction. This trend is expected to accelerate as companies seek to maximize output and maintain profitability in a competitive market. Moreover, the adoption of digital oilfield technologies, including predictive maintenance and remote monitoring, further underscores the emphasis on operational efficiency. By minimizing downtime and optimizing asset performance, these advancements present a substantial growth opportunity for wireline service providers.

Expansion of Deepwater and Ultra-Deepwater Exploration

The expansion of deepwater and ultra-deepwater exploration activities represents another key growth driver for the wireline services market. With the depletion of easily accessible onshore reserves, major oil and gas companies are turning to offshore fields to meet global energy demands. This shift necessitates advanced wireline services capable of operating in challenging deepwater environments. These include logging, perforation, and well intervention, which are crucial for efficient exploration and production in deepwater settings. As a result, wireline service providers with expertise in these areas are well-positioned to capitalize on the growing offshore exploration market.

Latest Trends

Adoption of Digital Technologies

The wireline services market is set to experience significant transformation driven by the adoption of digital technologies. Companies are increasingly leveraging data analytics, artificial intelligence (AI), and the Internet of Things (IoT) to enhance operational efficiency and decision-making. Digital technologies enable real-time monitoring and predictive maintenance, which reduce downtime and operational costs. This shift is not only improving the accuracy of wireline operations but also enhancing safety protocols by enabling remote monitoring and automation. The integration of digital platforms facilitates seamless communication between field operations and central control units, streamlining workflows and improving response times. As the industry continues to prioritize digitalization, service providers who invest in these technologies are expected to gain a competitive edge through enhanced service delivery and cost efficiency.

Advancements in Wireline Tools and Equipment

Parallel to the digital transformation, advancements in wireline tools and equipment are poised to play a critical role in shaping the market. Innovations in logging tools, including high-resolution imaging and advanced telemetry systems, are providing more accurate and comprehensive subsurface data. These advancements are crucial for improving the precision of well interventions and diagnostics.

Additionally, the development of more durable and efficient equipment is extending the lifecycle of wireline tools, thereby reducing operational costs and environmental impact. Enhanced tools such as fiber optic-based technologies are offering superior data transmission capabilities, further bolstering the effectiveness of wireline services. Companies that prioritize R&D in wireline equipment are likely to lead the market by offering more reliable and advanced solutions that meet the evolving demands of the oil and gas sector.

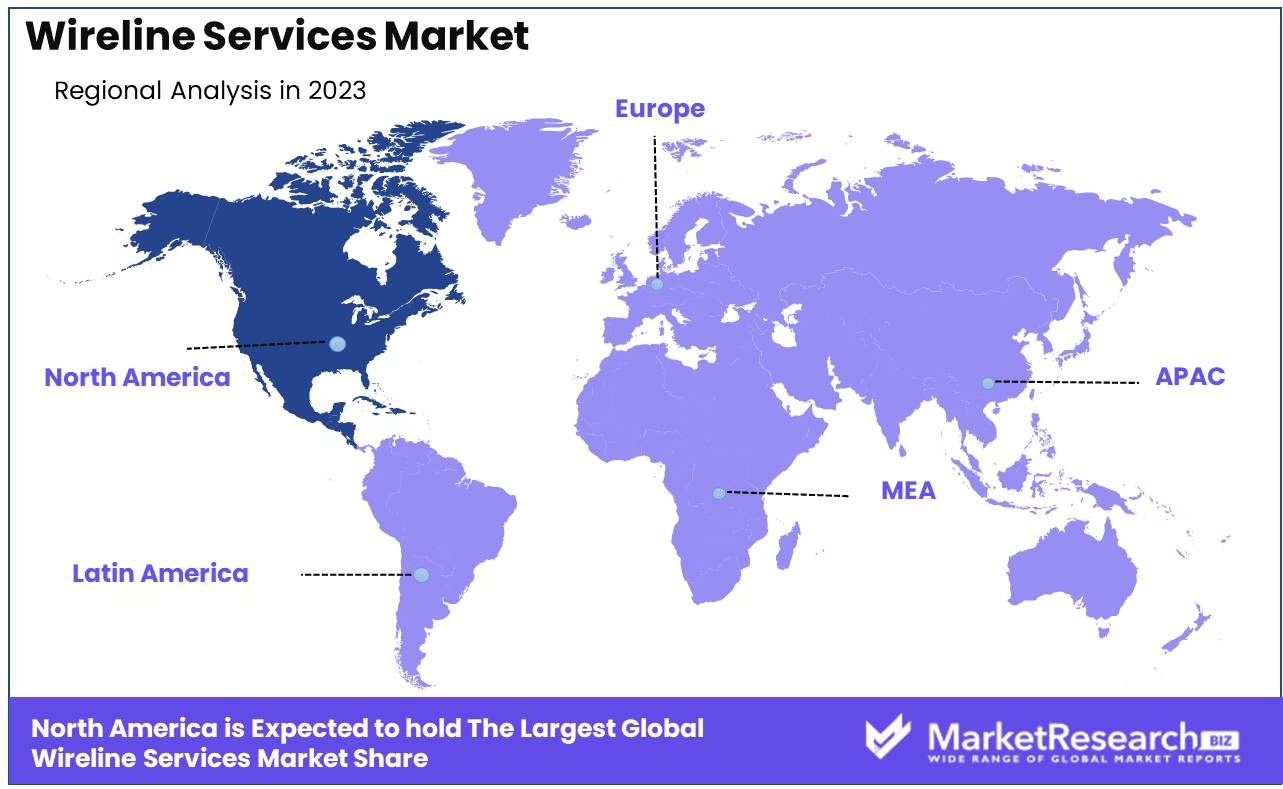

Regional Analysis

North America leads the wireline services market at 35% due to robust exploration.

The wireline services market demonstrates significant regional variances, shaped by distinct factors in North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. North America dominates the global wireline services market, accounting for 35% of the largest market share. This dominance is driven by extensive oil and gas exploration activities, particularly in the United States and Canada. The U.S. alone witnessed a surge in rig counts by 15% in 2023, boosting demand for wireline services.

Europe, contributing around 25% to the market, benefits from ongoing investments in offshore drilling in the North Sea and technological advancements in wireline logging and perforation services. In the Asia Pacific region, which holds roughly 20% of the market share, rapid industrialization and energy demands in China and India are pivotal. China's aggressive shale gas exploration, with an annual increase of 8% in drilling activities, underscores the region’s growth.

The Middle East & Africa, contributing 15%, relies heavily on substantial oil reserves in Saudi Arabia and UAE, coupled with modernization of extraction technologies. Latin America, with a 5% market share, is propelled by Brazil’s offshore pre-salt oil discoveries, which are expected to bolster the regional market through strategic investments in wireline services.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global wireline services market in 2024 is set to be highly competitive, with several key players poised to leverage their technological advancements and extensive industry experience to capture market share.

Baker Hughes Company, Halliburton Company, and Schlumberger Limited continue to dominate the U.S. market, driven by their robust portfolios and innovative wireline technologies. These companies are expected to focus on integrating digital solutions to enhance operational efficiency and data acquisition capabilities, thereby solidifying their market leadership.

Weatherford International Plc and Superior Energy Services, Inc. are likely to leverage their specialized services and broad geographic presence to target niche segments within the wireline services sector. Their emphasis on customized solutions tailored to specific client needs will be crucial in maintaining their competitive edge.

Weir Oil And Gas and Archer Limited in the U.K., along with Siemens and Schneider Electric in Europe, are anticipated to benefit from the increasing adoption of automation and IoT technologies in wireline operations. Their strong engineering expertise and focus on sustainability align well with the industry's shift toward more efficient and environmentally friendly practices.

National Oilwell Varco, Emerson, and FMC Technologies Inc. are expected to drive growth through strategic partnerships and acquisitions, enhancing their service capabilities and expanding their global footprint.

Additionally, companies like Petrofac and Cased Hole Solutions are positioned to capitalize on emerging opportunities in offshore exploration and production activities, particularly in regions like the North Sea and the Gulf of Mexico.

Overall, the wireline services market in 2024 will witness significant advancements driven by technological innovation, strategic collaborations, and a growing emphasis on sustainable practices, with these key players at the forefront of industry transformation.

Market Key Players

- Baker Hughes Company(U.S.)

- Nabors Industries Ltd. (U.S.)

- Halliburton Company (U.S.)

- Weatherford International Plc (U.S.)

- Weir Oil And Gas (U.K.)

- Pioneer Energy Services Corp.(U.S.)

- National Oilwell Varco (U.S.)

- FMC Technologies Inc. (U.S.)

- Emerson (U.S.)

- Siemens (Germany)

- Schneider Electric (France)

- Petrofac (Jersey)

- Archer Limited(U.K.)

- Superior Energy Services, Inc (U.S.)

- Schlumberger Limited (U.S.)

- Cased Hole Solutions (U.S.)

- Weltec (Denmark)

Recent Development

- In March 2024, Halliburton introduced a new wireline logging technology designed to improve data accuracy and operational efficiency in challenging environments.

- In February 2024, INT joined the SLB Digital Platform Partner Program, integrating its IVAAP advanced data visualization platform with Schlumberger's DELFI digital E&P platform to enhance subsurface data management.

- In January 2024, GE Gas Power acquired Nexus Controls from Baker Hughes, emphasizing its lifecycle controls strategy to optimize operations in modern power plants.

Report Scope

Report Features Description Market Value (2023) USD 15.6 Billion Forecast Revenue (2033) USD 31.0 Billion CAGR (2024-2032) 7.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Wireline Type (Electric line and Slickline), By Service (Completion, Well Intervention, Logging), By Hole Type (Cased-Hole and Open Hole), By Location (Onshore and Offshore) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Baker Hughes Company(U.S.), Nabors Industries Ltd. (U.S.), Halliburton Company (U.S.), Weatherford International Plc (U.S.), Weir Oil And Gas (U.K.), Pioneer Energy Services Corp.(U.S.), National Oilwell Varco (U.S.), FMC Technologies Inc. (U.S.), Emerson (U.S.), Siemens (Germany), Schneider Electric (France), Petrofac (Jersey), Archer Limited(U.K.), Superior Energy Services, Inc. (U.S.), Schlumberger Limited (U.S.), Cased Hole Solutions (U.S.), Weltec (Denmark) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Baker Hughes (U.S.)

- Nabors Industries Ltd. (U.S.)

- Halliburton Company (U.S.)

- Weatherford International Plc (U.S.)

- Weir Oil And Gas (U.K.)

- Pioneer Energy Services (U.S.)

- National Oilwell Varco (U.S.)

- FMC Technologies (U.S.)

- Emerson (U.S.)

- Siemens (Germany)

- Schneider Electric (France)

- Petrofac (Jersey)

- Archer Limited(U.K.)

- Superior Energy Services (U.S.)

- Schlumberger Limited (U.S.)

- Cased Hole Solutions (U.S.)

- Weltec (Denmark)