Wireline Logging Services Market By Hole Type (Cased Hole Type and Open Hole Type), By Technology (Slickline and E-Line), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

48701

-

July 2024

-

300

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

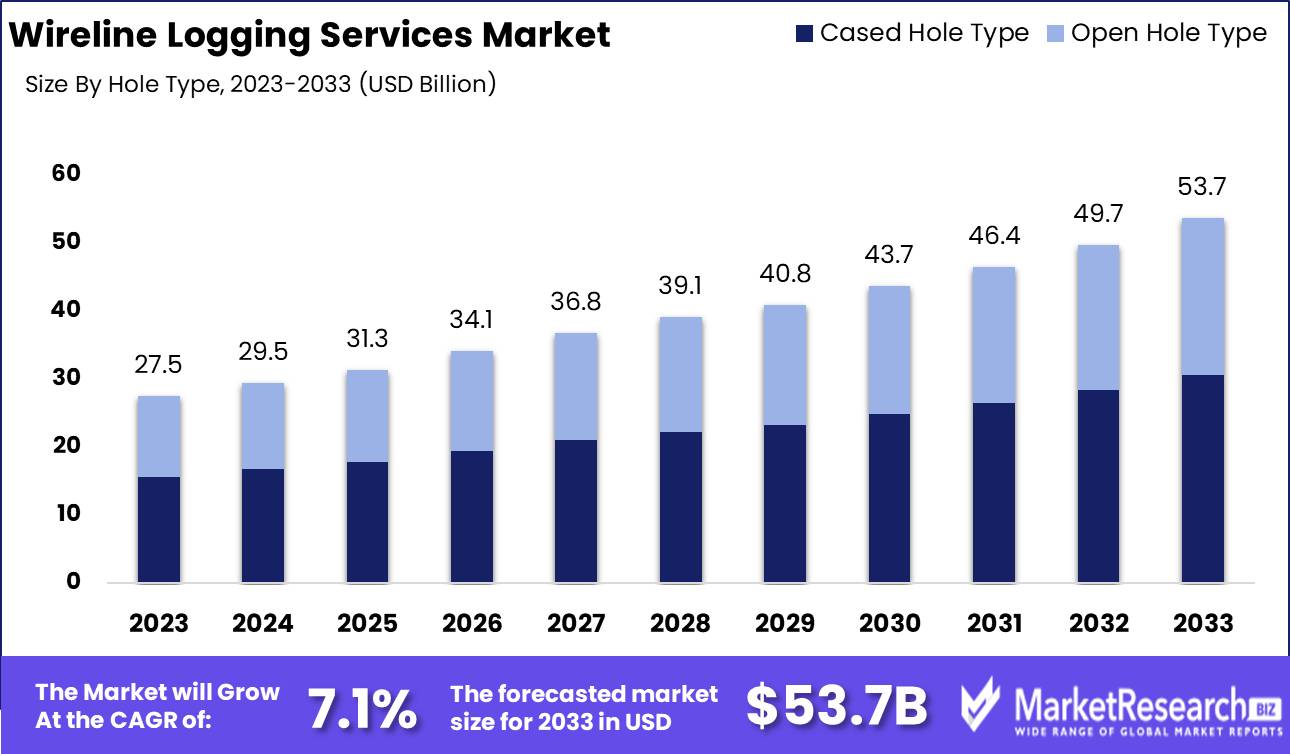

The Wireline Logging Services Market was valued at USD 27.5 billion in 2023. It is expected to reach USD 53.7 billion by 2033, with a CAGR of 7.1% during the forecast period from 2024 to 2033.

The Wireline Logging Services Market encompasses the provision of specialized logging services that involve deploying measurement tools into boreholes via wirelines to gather subsurface geological data. These services are crucial in the oil and gas industry for evaluating and monitoring reservoir conditions, optimizing production, and enhancing drilling efficiency. The market is driven by advancements in logging technologies, increased exploration activities, and the need for accurate reservoir characterization.

The Wireline Logging Services Market is poised for significant growth, driven by multiple compelling factors. The surge in oil and gas exploration activities, particularly in untapped offshore regions, is a major catalyst. As companies seek to exploit these new frontiers, the demand for precise subsurface data has never been higher, positioning wireline logging services as critical for successful exploration and production. Technological advancements are also playing a pivotal role. Continuous improvements in wireline logging technologies are enhancing the accuracy and efficiency of data acquisition, which in turn is propelling market expansion. These advancements not only improve operational efficiencies but also reduce the overall cost of exploration, making them highly attractive to energy companies.

However, the market is not without its challenges. Stringent environmental regulations and policies related to oil and gas exploration activities present significant hurdles. Compliance with these regulations requires substantial investment in environmentally friendly technologies and practices, which can impact profitability. Despite these challenges, the exploration and production from unconventional reserves, such as shale gas and tight oil, present considerable growth opportunities. These reserves are increasingly becoming viable due to technological advancements and high crude oil prices.

Consequently, the wireline logging services market is expected to experience robust growth as companies diversify their exploration portfolios to include these unconventional resources. The confluence of these factors underscores a cautiously optimistic outlook for the market, where innovation and regulatory compliance will be key determinants of success.

Key Takeaways

- Market Growth: The Wireline Logging Services Market was valued at USD 27.5 billion in 2023. It is expected to reach USD 53.7 billion by 2033, with a CAGR of 7.1% during the forecast period from 2024 to 2033.

- By Hole Type: Cased Hole Type dominated the Wireline Logging Services Market.

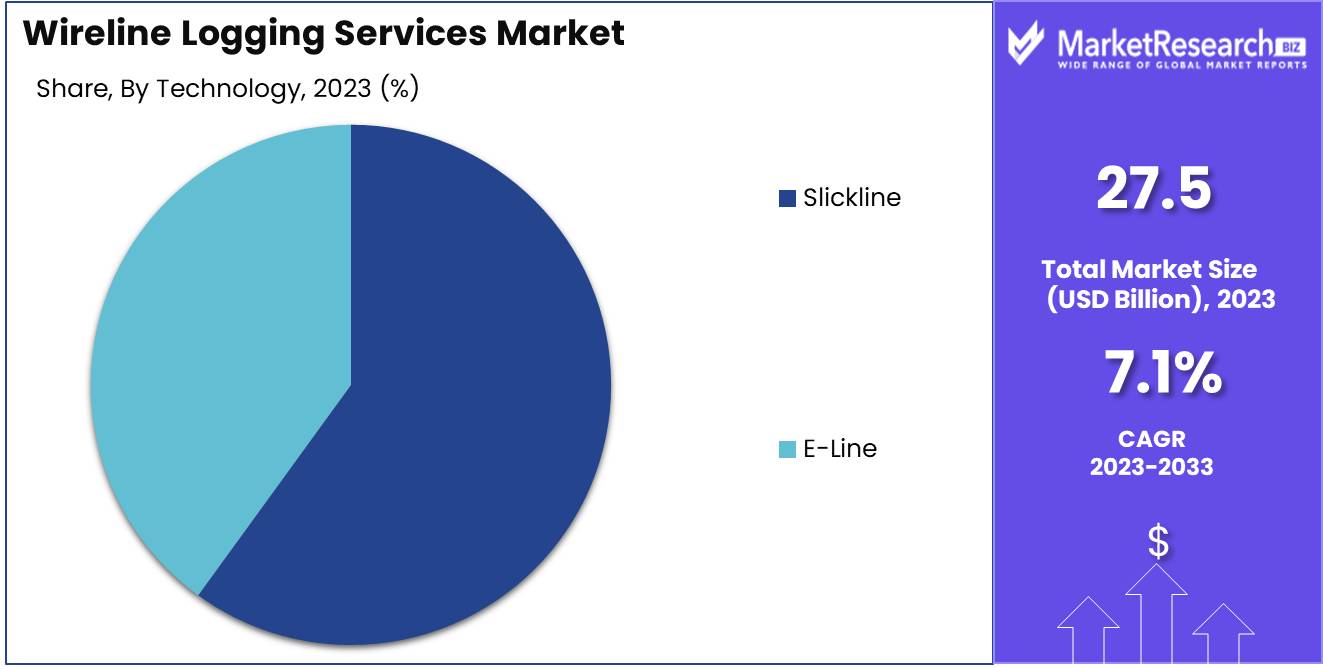

- By Technology: Slickline dominated due to cost-effective, efficient wellbore services.

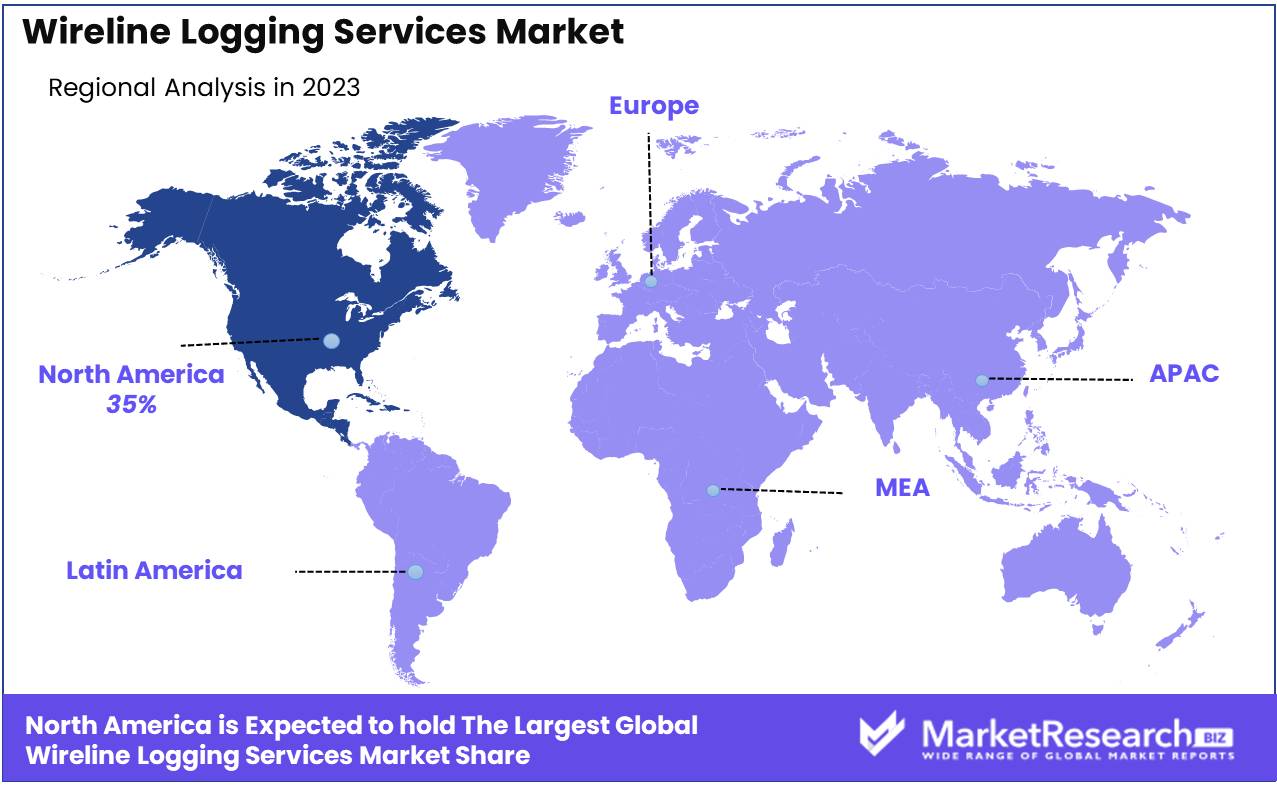

- Regional Dominance: North America leads the wireline logging services market with a 35% largest market share.

- Growth Opportunity: The global wireline logging services market is set for robust growth driven by technological advancements and rising natural gas demand.

Driving factors

Growing Exploration and Production Activities in the Oil and Gas Industry

The global wireline logging services market is significantly bolstered by the intensifying exploration and production (E&P) activities in the oil and gas sector. This uptick in E&P is driven by the need to discover new oil and gas reserves to meet the ever-increasing energy demands. As companies venture into unexplored areas and increase their drilling activities, the demand for wireline logging services, which provide critical data on the subsurface geology, reservoir conditions, and fluid properties, has surged. The comprehensive data acquired through wireline logging is essential for making informed decisions regarding well placement, completion, and production strategies, thereby optimizing the recovery of hydrocarbons and enhancing operational efficiency.

Offshore Investments Propel Wireline Logging Demand

The wireline logging services market is experiencing robust growth due to escalating investments in offshore petroleum production across various regions. Countries are increasingly channeling funds into offshore drilling projects to tap into the vast oil and gas reserves located beneath the ocean floor. Offshore wells typically require more advanced and specialized wireline logging services due to the complex and challenging environments in which they operate. This trend is particularly evident in regions such as the Gulf of Mexico, the North Sea, and offshore Brazil, where substantial capital is being invested in both shallow and deepwater projects. The adoption of sophisticated wireline technologies in these offshore endeavors ensures accurate reservoir evaluation, enhances safety, and improves the overall efficiency of production operations, thereby driving market growth.

Technological Advancements and Real-Time Data Accelerate Market Expansion

The wireline logging services market is poised for significant growth, driven by the rising demand for real-time logging and the adoption of new technologies. Real-time logging enables operators to obtain immediate insights into the subsurface conditions while drilling, allowing for prompt decision-making and operational adjustments. This capability is crucial for optimizing drilling performance, minimizing risks, and reducing non-productive time.

Additionally, the industry is witnessing rapid advancements in wireline logging technologies, including the integration of artificial intelligence (AI), machine learning (ML), and advanced sensors. These innovations enhance the precision and reliability of data acquisition and interpretation, providing operators with a deeper understanding of reservoir characteristics. The deployment of these cutting-edge technologies not only improves operational efficiency but also supports the development of more effective exploration and production strategies, thus driving the market's growth.

Restraining Factors

Diversification of Energy Portfolio and Its Impact on Wireline Logging Services Market

The increasing adoption of alternative energy sources, such as solar, wind, and hydroelectric power, significantly restrains the growth of the wireline logging services market. This shift is driven by global efforts to reduce carbon emissions and dependency on fossil fuels.

This transition impacts the market by reducing the demand for wireline logging in hydrocarbon exploration and production. The energy sector's shift to renewables is expected to grow further, driven by policy support and technological advancements in alternative energy sources, thus continuing to challenge the growth prospects of wireline logging services. Companies operating in the wireline logging market must adapt by diversifying their services to include renewable energy sectors or improving the efficiency and effectiveness of their traditional offerings.

Technological Barriers Hindering the Advancement of Wireline Logging Services

The technological limitations of existing wireline logging tools also serve as a significant restraining factor for market growth. Current wireline logging technologies often face challenges such as limited depth range, resolution constraints, and difficulty in operating under extreme downhole conditions. These limitations reduce the effectiveness of wireline logging in providing accurate and reliable subsurface data, which is crucial for making informed decisions in exploration and production activities.

For example, a report by the Society of Petroleum Engineers (SPE) highlights that conventional wireline tools struggle with high-pressure, high-temperature (HPHT) environments, which are increasingly encountered as exploration activities move to more challenging and deeper reservoirs. This inefficiency leads to increased operational risks and costs, deterring investment in wireline logging services.

Moreover, the market's innovation pace is often slower compared to the evolving complexities of drilling environments. Without significant technological advancements and investments in research and development, these limitations will continue to impede market growth. Companies need to focus on developing more robust and versatile wireline logging tools that can withstand harsh conditions and deliver high-precision data to remain competitive.

By Hole Type Analysis

In 2023, Cased Hole Type dominated the Wireline Logging Services Market.

In 2023, Cased Hole Type held a dominant market position in the By Hole Type segment of the Wireline Logging Services Market. The Cased Hole Type segment, which involves logging operations conducted in wells that are lined with casing, accounted for a significant share of the market. This dominance can be attributed to the extensive use of cased-hole wireline logging in mature oilfields, where it is crucial for monitoring and evaluating the condition of existing wells. The ability to perform various downhole interventions, such as perforation, cement evaluation, and production logging, further bolsters the demand for casedhole services.

Conversely, the Open Hole Type segment, which pertains to logging operations in wells that are yet to be cased, also plays a vital role, especially in the exploration and appraisal stages of well development. Open-hole logging provides critical data for understanding reservoir properties, formation pressures, and fluid characteristics, which are essential for making informed decisions during the drilling process. Despite its importance, the market share of open-hole logging services is comparatively lower due to the higher frequency of case-hole operations in the production phase of oil and gas wells.

By Technology Analysis

In 2023, Slickline dominated due to cost-effective, efficient wellbore services.

In 2023, Slickline held a dominant market position in the "By Technology" segment of the Wireline Logging Services Market. The slackline technology is distinguished by its simplicity and cost-effectiveness, primarily used for delivering mechanical services to the wellbore, such as setting or removing plugs and valves, as well as performing basic downhole measurements. This technology's operational efficiency and reliability have made it a preferred choice in mature oilfields where cost control is paramount. Slickline operations are particularly advantageous in shallow wells, where rapid deployment and low operational costs are critical.

E-Line technology, on the other hand, encompasses electric line services that facilitate more complex operations, including real-time data acquisition and downhole tool manipulation. E-Line's capabilities extend to advanced well diagnostics, perforating, and logging, leveraging its ability to transmit electrical signals to and from downhole tools. This technology is pivotal in providing detailed reservoir information, enhancing the understanding of subsurface conditions, and optimizing production strategies. While E-Line technology is integral to modern, high-tech oilfield operations, its higher costs and complexity have limited its widespread adoption compared to the more straightforward Slickline technology.

Key Market Segments

By Hole Type

- Cased Hole Type

- Open Hole Type

By Technology

- Slickline

- E-Line

Growth Opportunity

Technological Advancements in Well Logging

The wireline logging services market is poised to witness substantial growth in 2024, driven primarily by significant technological advancements in well logging. Innovations such as advanced imaging techniques, high-resolution logging tools, and real-time data transmission capabilities have enhanced the precision and efficiency of subsurface data acquisition. These advancements facilitate better reservoir characterization, more accurate hydrocarbon quantification, and improved decision-making processes for drilling and production operations. Consequently, the adoption of these state-of-the-art technologies is expected to propel market expansion, as operators seek to optimize exploration and production activities in increasingly complex geological environments.

Increasing Demand for Natural Gas

Another critical factor contributing to the growth opportunities in the wireline logging services market is the rising global demand for natural gas. As the world transitions towards cleaner energy sources, natural gas is gaining prominence due to its lower carbon footprint compared to other fossil fuels. The surge in natural gas consumption, particularly in power generation and industrial applications, necessitates increased exploration and production activities. Wireline logging services play a pivotal role in these activities by providing essential data for identifying gas reserves, assessing reservoir potential, and ensuring efficient extraction processes. This escalating demand for natural gas is anticipated to drive investments in wireline logging services, further bolstering market growth.

Latest Trends

Advancements in Sensor Technology

The wireline logging services market is poised to benefit significantly from advancements in sensor technology. Innovations in this area are expected to enhance data accuracy, reliability, and operational efficiency. Cutting-edge sensors with improved sensitivity and durability will enable more precise measurements of subsurface formations. This progression is anticipated to facilitate better decision-making during exploration and production activities, thereby optimizing resource extraction processes. The adoption of advanced sensor technology will likely drive market growth by reducing operational risks and improving the overall performance of wireline logging services.

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) into wireline logging services represents a transformative trend. AI and ML technologies are expected to revolutionize data analysis by automating the interpretation of vast amounts of logging data. This integration will enhance the accuracy of subsurface models and predictions, leading to more efficient exploration and production strategies. The use of AI and ML will also facilitate real-time data processing, enabling prompt and informed decision-making. Consequently, the application of these technologies is projected to significantly improve operational efficiency and reduce costs, thereby bolstering the competitiveness of wireline logging services providers.

Regional Analysis

North America leads the wireline logging services market with a 35% largest share.

The global wireline logging services market is segmented by region, including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America is the dominant region, accounting for approximately 35% of the global market share. This dominance can be attributed to the significant presence of oil and gas exploration and production activities, particularly in the United States and Canada. The technological advancements and high investments in shale gas extraction further bolster the market in this region.

Europe follows, with a market share of about 25%, driven by substantial offshore drilling activities in the North Sea and the presence of major oilfield service companies. The Asia Pacific region, holding around 20% of the market share, is witnessing growth due to increasing energy demand and exploration activities in countries like China and India. The Middle East & Africa region accounts for approximately 15% of the market, supported by extensive oil reserves and ongoing exploration projects in countries such as Saudi Arabia and the UAE.

Lastly, Latin America represents around 5% of the market share, with significant contributions from Brazil and Mexico due to their offshore oil fields and investment in energy infrastructure. Overall, North America's leading position underscores its critical role in driving the global wireline logging services market.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global wireline logging services market is poised for significant growth, driven by key industry players such as Halliburton Company, Schlumberger Limited, and Baker Hughes Company. Halliburton's comprehensive suite of logging services, combined with its advanced technology integration, positions it as a market leader. Similarly, Schlumberger's extensive global footprint and continuous innovation in digital and automation solutions strengthen its competitive edge.

Baker Hughes Company leverages its strong expertise in pressure pumping and reservoir evaluation, enabling efficient and accurate subsurface data collection. Weatherford International plc, known for its diverse product portfolio and strong regional presence, also plays a crucial role in market dynamics. Superior Energy Services, Inc. and China Oilfield Services Limited (COSL) continue to enhance their capabilities, focusing on high-quality service delivery and operational efficiency.

C&J Energy Services, Inc. and Expro Group are expanding their market reach through strategic collaborations and technological advancements. Pioneer Energy Services Corp. and National Oilwell Varco, Inc. maintain a significant market share by offering tailored solutions and robust service networks. Companies like Oilserv Group and Basic Energy Services, Inc. are crucial in meeting the growing demand for wireline services in emerging markets.

Wireline Engineering Ltd., GE Oil & Gas, and Nabors Industries Ltd. contribute to market diversification with specialized offerings. FMC Technologies, Inc. and Welltec A/S lead in innovation, introducing cutting-edge wireline technologies. Archer Limited, Oceaneering International, Inc., and China National Offshore Oil Corporation (CNOOC) continue to invest in research and development, ensuring sustained growth and technological advancements in the wireline logging services market.

Market Key Players

- Halliburton Company

- Schlumberger Limited

- Baker Hughes Company

- Weatherford International plc

- Superior Energy Services, Inc.

- China Oilfield Services Limited (COSL)

- C&J Energy Services, Inc.

- Expro Group

- Pioneer Energy Services Corp.

- National Oilwell Varco, Inc.

- Oilserv Group

- Basic Energy Services, Inc.

- Wireline Engineering Ltd.

- GE Oil & Gas

- Nabors Industries Ltd.

- FMC Technologies, Inc.

- Welltec A/S

- Archer Limited

- Oceaneering International, Inc.

- China National Offshore Oil Corporation (CNOOC)

Recent Development

- In June 2024, Schlumberger and Halliburton announced a partnership to develop new wireline logging technologies aimed at improving real-time data acquisition during drilling operations. This collaboration focuses on enhancing the precision and efficiency of wireline logging in challenging environments.

- In January 2024, Baker Hughes secured two significant contracts from the Abu Dhabi National Oil Company (ADNOC) for providing equipment and oilfield services. These contracts include the delivery of surface wellheads and trees for various upstream projects, with an expected completion timeline within the year.

- In February 2024, Saudi Aramco reported new oil and gas discoveries in the Al-Reesh oilfield, northwest of Dhahran. The company plans to leverage advanced wireline logging services to optimize the development of these new reserves, which are expected to significantly boost their production capacity.

Report Scope

Report Features Description Market Value (2023) USD 27.5 Billion Forecast Revenue (2033) USD 53.7 Billion CAGR (2024-2032) 7.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Hole Type (Cased Hole Type and Open Hole Type), By Technology (Slickline and E-Line) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Halliburton Company, Schlumberger Limited, Baker Hughes Company, Weatherford International plc, Superior Energy Services, Inc., China Oilfield Services Limited (COSL), C&J Energy Services, Inc., Expro Group, Pioneer Energy Services Corp., National Oilwell Varco, Inc., Oilserv Group, Basic Energy Services, Inc., Wireline Engineering Ltd., GE Oil & Gas, Nabors Industries Ltd., FMC Technologies, Inc., Welltec A/S, Archer Limited, Oceaneering International, Inc., China National Offshore Oil Corporation (CNOOC) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Halliburton Company

- Schlumberger Limited

- Baker Hughes Company

- Weatherford International plc

- Superior Energy Services, Inc.

- China Oilfield Services Limited (COSL)

- C&J Energy Services, Inc.

- Expro Group

- Pioneer Energy Services Corp.

- National Oilwell Varco, Inc.

- Oilserv Group

- Basic Energy Services, Inc.

- Wireline Engineering Ltd.

- GE Oil & Gas

- Nabors Industries Ltd.

- FMC Technologies, Inc.

- Welltec A/S

- Archer Limited

- Oceaneering International, Inc.

- China National Offshore Oil Corporation (CNOOC)