Warehousing And Storage Market By Type (General Warehousing, Refrigerated Warehousing, Specialized Warehousing, Container Freight Stations, Others), By Ownership (Private Warehouses, Public Warehouses, Contract Warehouses), By End-User Industry (Manufacturing, Retail, Food and Beverage, Healthcare, Consumer Goods, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

49267

-

July 2024

-

136

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

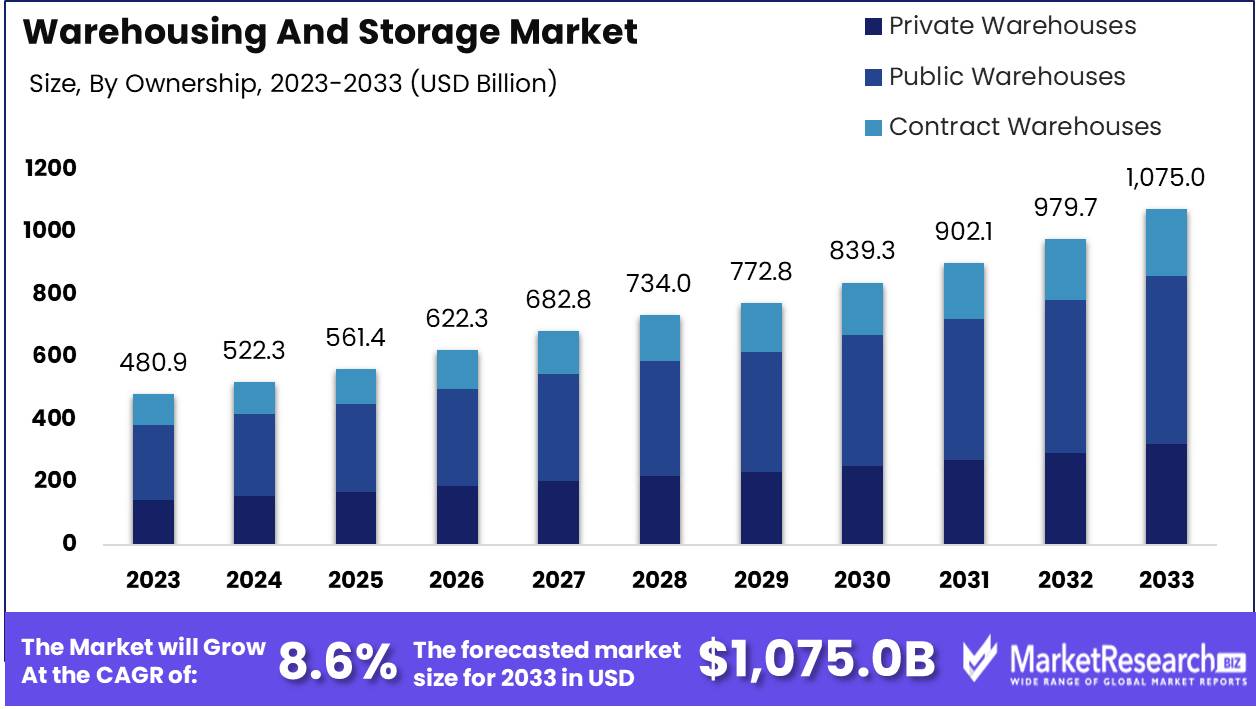

The Global Warehousing And Storage Market was valued at USD 480.9 Bn in 2023. It is expected to reach USD 1075.0 Bn by 2033, with a CAGR of 8.6% during the forecast period from 2024 to 2033.

The Warehousing and Storage Market encompasses the infrastructure, facilities, and services used to store goods and materials. This market includes a wide range of warehousing solutions such as distribution centers, fulfillment centers, cold storage, and third-party logistics providers. Key aspects include inventory management, space optimization, and technological integration to enhance operational efficiency and meet the dynamic needs of various industries.

The Warehousing and Storage Market is undergoing a significant transformation driven by technological advancements and the increasing complexity of supply chains. A prominent example of this evolution is Amazon’s implementation of advanced robotics and artificial intelligence (AI), which has halved order fulfillment times and reduced error rates by over 99.99%. This shift towards automation and smart technologies exemplifies the potential for efficiency gains and cost savings within the industry.

The market’s expansion is supported by extensive networks like Affiliated Warehouse Companies, which operate 130 locations across North America. Their high customer satisfaction ratings underscore the importance of reliable and scalable warehousing solutions in meeting diverse logistical requirements. The ability to provide consistent, high-quality service across a broad geographic footprint is becoming increasingly critical as companies seek to optimize their supply chains and reduce lead times.

Looking ahead, the integration of AI and robotics is expected to continue reshaping the warehousing landscape. Companies that invest in these technologies will likely experience enhanced operational efficiency, reduced labor costs, and improved accuracy in inventory management. Additionally, the trend towards just-in-time inventory and e-commerce fulfillment demands will drive the need for more flexible and responsive warehousing solutions.

To remain competitive, stakeholders in the Warehousing and Storage Market must prioritize innovation and adaptability. By leveraging cutting-edge technologies and expanding their service capabilities, businesses can better meet the evolving needs of their clients and achieve sustainable growth in a rapidly changing environment.

Key Takeaways

- Market Value: The Global Warehousing And Storage Market was valued at USD 480.9 Bn in 2023. It is expected to reach USD 1075.0 Bn by 2033, with a CAGR of 8.6% during the forecast period from 2024 to 2033.

- By Type: General Warehousing holds 40% of the market, offering storage solutions for a wide range of goods.

- By Ownership: Public Warehouses dominate with 50%, accessible to various businesses for short-term or variable storage needs.

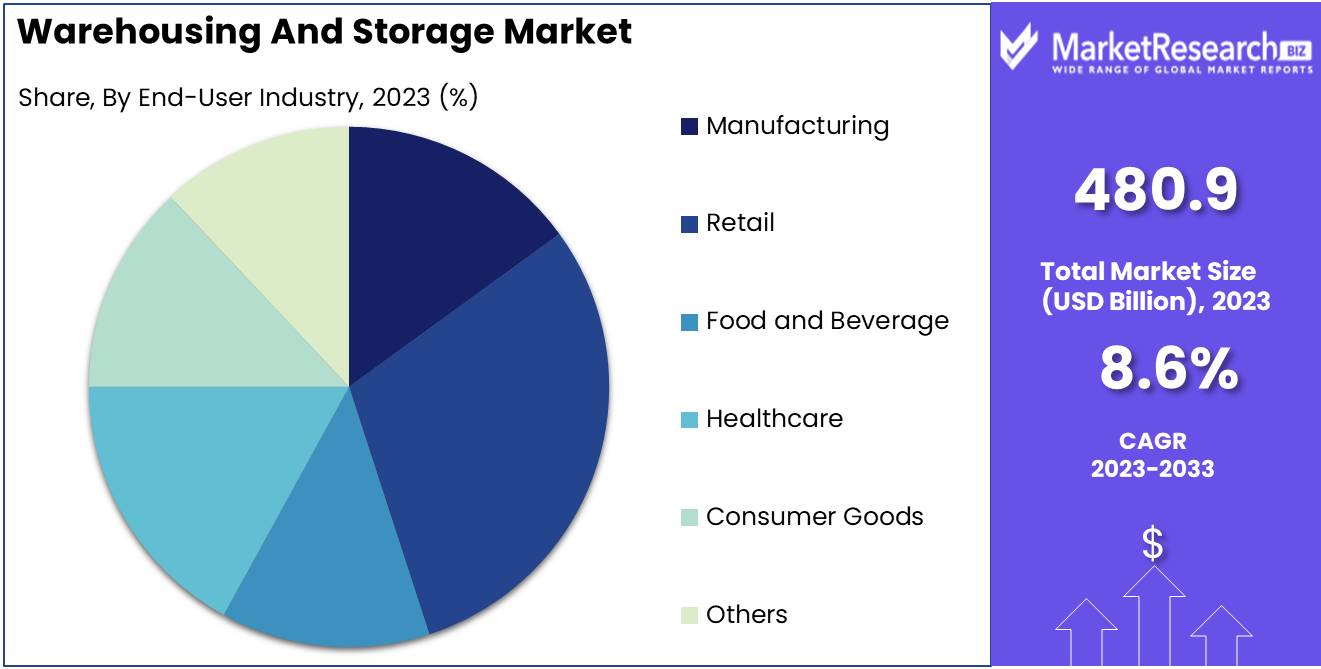

- By End-User Industry: Retail is the largest industry served, comprising 30%, crucial for managing inventory and distribution.

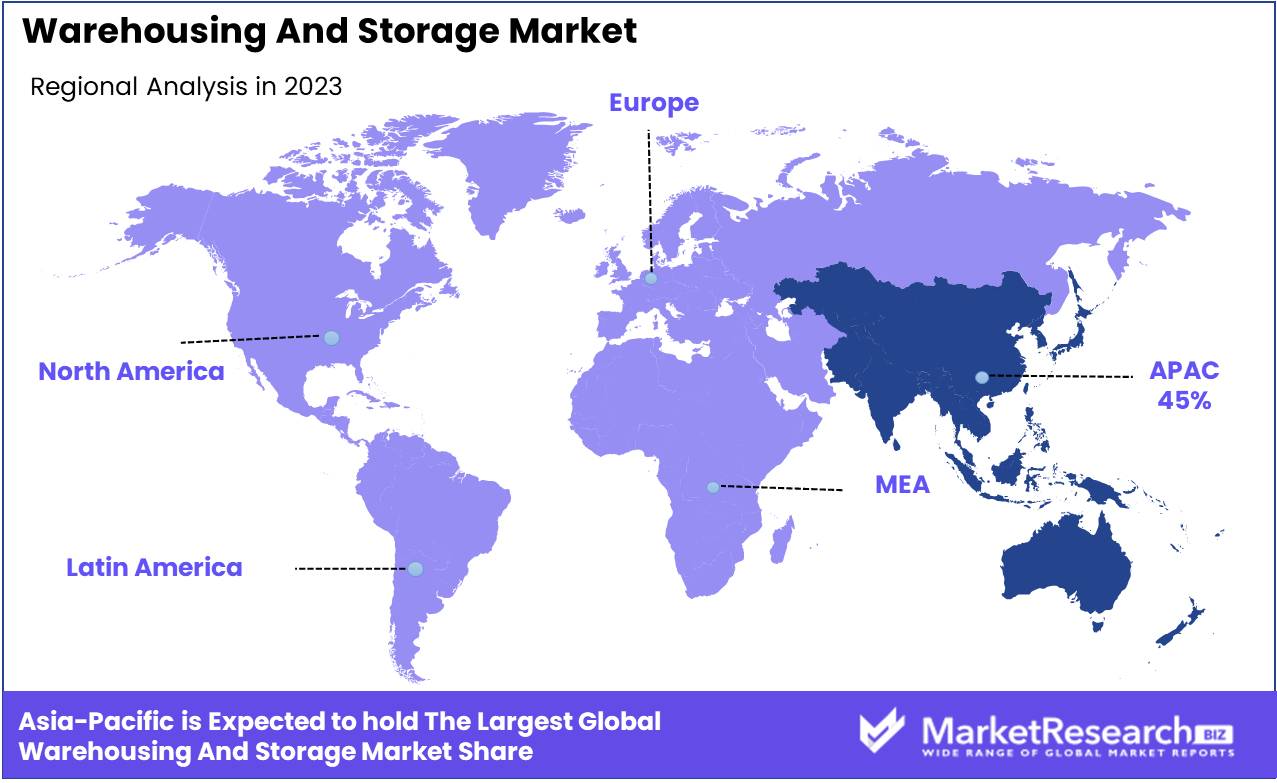

- Regional Dominance: Asia-Pacific leads with a 45% share, fueled by rapid retail and e-commerce growth.

- Growth Opportunity: Implementing automated storage and retrieval systems to enhance efficiency and reduce operational costs presents a substantial growth potential.

Driving factors

Growth in E-Commerce and Retail Sectors

The exponential growth in e-commerce and retail sectors is a primary driver of the warehousing and storage market. The surge in online shopping has significantly increased the demand for efficient warehousing solutions to handle the rapid influx of goods. Companies like Amazon and Alibaba have set new standards for fast and reliable delivery, necessitating expansive and well-organized warehousing networks. According to market data, e-commerce sales are expected to continue their robust growth, further driving the need for sophisticated storage solutions to manage inventory, streamline logistics, and ensure timely deliveries.

Increasing Demand for Cold Storage Solutions

The increasing demand for cold storage solutions is another critical factor propelling the warehousing market. The rising consumption of perishable goods such as food, pharmaceuticals, and biotechnological products necessitates reliable temperature-controlled storage. With the global cold chain market projected to grow significantly, the warehousing industry must expand its capacity to provide advanced cold storage facilities. This includes maintaining stringent temperature conditions to ensure product quality and compliance with safety standards, which is essential for sectors like food and healthcare.

Advancements in Automation and Warehouse Management Systems

Advancements in automation and warehouse management systems (WMS) have revolutionized the warehousing industry, driving significant market growth. The adoption of automated guided vehicles (AGVs), robotic picking systems, and sophisticated WMS software has enhanced operational efficiency, reduced labor costs, and minimized human errors. These technologies enable seamless inventory management, real-time tracking, and optimized space utilization. As companies strive for greater efficiency and cost-effectiveness, the integration of automation in warehousing operations is becoming increasingly prevalent, thereby boosting market expansion.

Restraining Factors

High Operational Costs

High operational costs remain a significant challenge for the warehousing and storage market. Expenses related to labor, energy consumption, and the implementation of advanced technologies contribute to the overall cost burden. For many businesses, especially small and medium-sized enterprises (SMEs), these costs can be prohibitive, limiting their ability to invest in modern warehousing solutions. Strategies to mitigate these costs, such as optimizing energy usage and employing cost-effective technologies, are essential for sustainable market growth.

Space Constraints in Urban Areas

Space constraints in urban areas present another major restraining factor for the warehousing market. The rapid urbanization and high real estate prices in metropolitan regions limit the availability of large, affordable spaces for warehousing. This scarcity forces businesses to either compromise on location or seek innovative solutions such as multi-story warehouses. Addressing these constraints through strategic location planning and vertical storage solutions is crucial for accommodating the growing demand for warehousing in urban settings.

By Type Analysis

In 2023, General Warehousing held a dominant market position in the By Type segment of the Warehousing And Storage Market, capturing more than a 40% share.

In 2023, General Warehousing held a dominant market position in the By Type segment of the Warehousing And Storage Market, capturing more than a 40% share. This significant market share is driven by the broad demand for general warehousing services across various industries. General warehousing facilities offer versatile storage solutions for a wide range of goods, including raw materials, finished products, and consumer goods. The increasing need for efficient inventory management and the growth of e-commerce have further propelled the demand for general warehousing, making it the largest segment in the market.

Refrigerated Warehousing is also a critical segment, particularly for industries requiring temperature-controlled environments, such as food and beverage and pharmaceuticals. However, its market share is smaller compared to general warehousing due to the specialized infrastructure and higher operational costs associated with maintaining refrigerated storage.

Specialized Warehousing caters to specific storage needs, such as hazardous materials, high-value goods, and perishable items. While essential for certain industries, its market share remains limited due to the niche nature of its applications.

Container Freight Stations provide storage and consolidation services for containerized cargo, playing a vital role in the global supply chain. Despite their importance, their market share is smaller than general warehousing because of their specific focus on containerized goods.

Others include various warehousing types such as bonded warehouses and distribution centers that serve specific logistical needs. While collectively important, their market share is relatively modest compared to the dominant general warehousing segment.

By Ownership Analysis

In 2023, Public Warehouses held a dominant market position in the By Ownership segment of the Warehousing And Storage Market, capturing more than a 50% share.

In 2023, Public Warehouses held a dominant market position in the By Ownership segment of the Warehousing And Storage Market, capturing more than a 50% share. Public warehouses are preferred by many businesses due to their flexibility, cost-effectiveness, and ability to accommodate fluctuating storage needs. They allow companies to scale their storage capacity up or down without the need for significant capital investment in dedicated facilities. The wide availability of public warehouses across different regions and their adaptability to various storage requirements further support their leading market position.

Private Warehouses are owned and operated by individual companies to store their own goods. While they offer greater control and customization, their market share is smaller compared to public warehouses due to the higher costs and fixed capacity constraints.

Contract Warehouses operate under long-term agreements with specific clients, providing dedicated storage and logistics services. Although important for certain industries requiring consistent and reliable storage solutions, their market share is less dominant compared to the more flexible public warehousing model.

By End-User Industry Analysis

In 2023, Retail held a dominant market position in the By End-User Industry segment of the Warehousing And Storage Market, capturing more than a 30% share.

In 2023, Retail held a dominant market position in the By End-User Industry segment of the Warehousing And Storage Market, capturing more than a 30% share. The dominance of the retail segment is driven by the exponential growth of e-commerce and the need for efficient storage and distribution solutions to manage high volumes of goods. Retailers require extensive warehousing to handle inventory, process orders, and facilitate quick delivery to consumers.

Manufacturing is another significant end-user of warehousing and storage services, relying on these facilities to store raw materials, components, and finished products. While crucial, the market share for manufacturing is smaller than retail due to the sector-specific nature of its warehousing needs.

Food and Beverage industry relies heavily on both general and refrigerated warehousing to store perishable goods and manage inventory. Despite its importance, the market share is less dominant compared to retail due to the specialized requirements and smaller volume relative to consumer goods.

Healthcare sector requires precise and often temperature-controlled warehousing solutions for pharmaceuticals, medical devices, and supplies. Although critical, its market share is smaller compared to retail, reflecting the specific and high-value nature of its storage needs.

Consumer Goods encompass a wide range of products requiring efficient warehousing and distribution services. This sector is significant but holds a smaller market share than retail due to the broader scope and varying storage requirements.

Others include various industries such as automotive, electronics, and chemicals that utilize warehousing services for their specific needs. While important, their collective market share is relatively modest compared to the dominant retail segment.

Key Market Segments

By Type

- General Warehousing

- Refrigerated Warehousing

- Specialized Warehousing

- Container Freight Stations

- Others

By Ownership

- Private Warehouses

- Public Warehouses

- Contract Warehouses

By End-User Industry

- Manufacturing

- Retail

- Food and Beverage

- Healthcare

- Consumer Goods

- Others

Growth Opportunity

Development of Smart and Automated Warehouses

The development of smart and automated warehouses offers significant growth opportunities for the warehousing and storage market in 2024. Advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning can transform warehouses into highly efficient, self-regulating environments. These smart warehouses can optimize inventory management, predict maintenance needs, and enhance overall operational efficiency. As businesses seek to streamline their supply chains, the demand for these technologically advanced warehouses is expected to rise, driving substantial market growth.

Expansion of Warehousing Services in Rural Areas

Expanding warehousing services in rural areas represents another promising opportunity. Rural regions often lack adequate storage infrastructure, which can hinder local businesses and agricultural activities. By developing warehousing facilities in these areas, companies can support rural economies, reduce transportation costs, and improve supply chain efficiency. This expansion also aligns with the broader trend of decentralizing logistics operations to mitigate the risks associated with urban congestion and high real estate costs.

Latest Trends

Adoption of Robotics and AI in Warehouse Operations

The adoption of robotics and AI in warehouse operations is a key trend shaping the market in 2024. Robotics can automate repetitive tasks such as sorting, picking, and packing, thereby increasing productivity and reducing labor costs. AI enhances decision-making processes by providing predictive analytics, optimizing inventory management, and improving demand forecasting. This integration of robotics and AI not only boosts operational efficiency but also enhances accuracy and scalability, making warehousing operations more agile and responsive to market demands.

Integration of Blockchain for Supply Chain Transparency

The integration of blockchain technology for supply chain transparency is another significant trend in the warehousing market. Blockchain provides a decentralized and immutable ledger that ensures the traceability and authenticity of goods throughout the supply chain. This technology can address issues related to counterfeit products, fraud, and inefficiencies, thereby enhancing trust and reliability. By integrating blockchain, warehousing operations can achieve greater transparency, streamline compliance processes, and improve overall supply chain coordination.

Regional Analysis

Asia-Pacific commands the Warehousing and Storage Market with a 45% share.

In 2023, Asia-Pacific dominated the Warehousing and Storage Market, capturing 45% of the market share. This dominance is driven by rapid industrialization, urbanization, and the booming e-commerce sector in countries like China, India, and Japan. The increasing need for efficient logistics and supply chain management solutions, coupled with significant investments in infrastructure development, supports the market growth in this region.

North America holds a significant market share, driven by the advanced logistics infrastructure and high demand for warehousing solutions from the manufacturing and retail sectors. The United States and Canada lead in the adoption of automated and smart warehousing technologies, further enhancing market growth.

Europe follows with substantial market participation, driven by the robust logistics and transportation sector. Countries such as Germany, France, and the UK have well-established warehousing infrastructure, supporting market expansion.

Middle East & Africa show potential for growth, supported by increasing investments in logistics infrastructure and the expanding retail sector. However, the market share remains modest due to economic constraints and varying levels of infrastructure development.

Latin America is emerging as a growing market, with Brazil and Mexico leading the demand for warehousing and storage solutions. The region benefits from improving logistics infrastructure and increasing industrial activities.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Deutsche Post DHL Group remains a dominant force with its expansive global network and innovative warehousing solutions. Their investment in automation and sustainability initiatives sets them apart in the logistics industry.

XPO Logistics, Inc. leverages advanced technology and robust infrastructure to provide scalable warehousing solutions. Their focus on efficiency and customer satisfaction drives their market leadership.

Ryder System, Inc. offers integrated logistics and warehousing services, emphasizing flexibility and customization to meet diverse client needs.

NFI Industries, Inc. combines warehousing with comprehensive supply chain solutions, focusing on innovation and efficiency to enhance operational performance.

Kuehne + Nagel International AG utilizes its global presence and advanced logistics capabilities to provide seamless warehousing solutions. Their commitment to digital transformation enhances service delivery.

Geodis excels with its customized warehousing solutions and advanced technological integration, ensuring efficient and reliable services for various industries.

United Parcel Service, Inc. (UPS) leverages its extensive logistics network to provide reliable and scalable warehousing solutions. Their focus on innovation and sustainability strengthens their market position.

Nippon Express Co., Ltd. offers robust warehousing solutions with a focus on reliability and efficiency. Their global network and technological advancements enhance service quality.

Mitsubishi Logistics Corporation integrates advanced logistics technologies with warehousing solutions, emphasizing precision and efficiency.

Genco (a FedEx company) provides comprehensive warehousing and supply chain solutions, leveraging advanced technologies to optimize operations and service delivery.

Market Key Players

- Deutsche Post DHL Group

- XPO Logistics, Inc.

- Ryder System, Inc.

- NFI Industries, Inc.

- Kuehne + Nagel International AG

- Geodis

- United Parcel Service, Inc. (UPS)

- Nippon Express Co., Ltd.

- Mitsubishi Logistics Corporation

- Genco

Recent Development

- In April 2024, Prologis Inc. opened a new automated warehouse in Germany, enhancing storage efficiency and reducing operational costs.

- In March 2024, DHL Supply Chain introduced a new temperature-controlled storage solution in the U.S., targeting the pharmaceutical and food industries.

Report Scope

Report Features Description Market Value (2023) USD 480.9 Bn Forecast Revenue (2033) USD 1075.0 Bn CAGR (2024-2033) 8.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (General Warehousing, Refrigerated Warehousing, Specialized Warehousing, Container Freight Stations, Others), By Ownership (Private Warehouses, Public Warehouses, Contract Warehouses), By End-User Industry (Manufacturing, Retail, Food and Beverage, Healthcare, Consumer Goods, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Deutsche Post DHL Group, XPO Logistics, Inc., Ryder System, Inc., NFI Industries, Inc., Kuehne + Nagel International AG, Geodis, United Parcel Service, Inc. (UPS), Nippon Express Co., Ltd., Mitsubishi Logistics Corporation, Genco Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Warehousing And Storage Market Overview

- 2.1. Warehousing And Storage Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Warehousing And Storage Market Dynamics

- 3. Global Warehousing And Storage Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Warehousing And Storage Market Analysis, 2016-2021

- 3.2. Global Warehousing And Storage Market Opportunity and Forecast, 2023-2032

- 3.3. Global Warehousing And Storage Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 3.3.1. Global Warehousing And Storage Market Analysis by By Type: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 3.3.3. General Warehousing

- 3.3.4. Refrigerated Warehousing

- 3.3.5. Specialized Warehousing

- 3.3.6. Container Freight Stations

- 3.3.7. Others

- 3.4. Global Warehousing And Storage Market Analysis, Opportunity and Forecast, By By Ownership, 2016-2032

- 3.4.1. Global Warehousing And Storage Market Analysis by By Ownership: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Ownership, 2016-2032

- 3.4.3. Private Warehouses

- 3.4.4. Public Warehouses

- 3.4.5. Contract Warehouses

- 3.5. Global Warehousing And Storage Market Analysis, Opportunity and Forecast, By By End-User Industry, 2016-2032

- 3.5.1. Global Warehousing And Storage Market Analysis by By End-User Industry: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User Industry, 2016-2032

- 3.5.3. Manufacturing

- 3.5.4. Retail

- 3.5.5. Food and Beverage

- 3.5.6. Healthcare

- 3.5.7. Consumer Goods

- 3.5.8. Others

- 4. North America Warehousing And Storage Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Warehousing And Storage Market Analysis, 2016-2021

- 4.2. North America Warehousing And Storage Market Opportunity and Forecast, 2023-2032

- 4.3. North America Warehousing And Storage Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 4.3.1. North America Warehousing And Storage Market Analysis by By Type: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 4.3.3. General Warehousing

- 4.3.4. Refrigerated Warehousing

- 4.3.5. Specialized Warehousing

- 4.3.6. Container Freight Stations

- 4.3.7. Others

- 4.4. North America Warehousing And Storage Market Analysis, Opportunity and Forecast, By By Ownership, 2016-2032

- 4.4.1. North America Warehousing And Storage Market Analysis by By Ownership: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Ownership, 2016-2032

- 4.4.3. Private Warehouses

- 4.4.4. Public Warehouses

- 4.4.5. Contract Warehouses

- 4.5. North America Warehousing And Storage Market Analysis, Opportunity and Forecast, By By End-User Industry, 2016-2032

- 4.5.1. North America Warehousing And Storage Market Analysis by By End-User Industry: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User Industry, 2016-2032

- 4.5.3. Manufacturing

- 4.5.4. Retail

- 4.5.5. Food and Beverage

- 4.5.6. Healthcare

- 4.5.7. Consumer Goods

- 4.5.8. Others

- 4.6. North America Warehousing And Storage Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.6.1. North America Warehousing And Storage Market Analysis by Country : Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.6.2.1. The US

- 4.6.2.2. Canada

- 4.6.2.3. Mexico

- 5. Western Europe Warehousing And Storage Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Warehousing And Storage Market Analysis, 2016-2021

- 5.2. Western Europe Warehousing And Storage Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Warehousing And Storage Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 5.3.1. Western Europe Warehousing And Storage Market Analysis by By Type: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 5.3.3. General Warehousing

- 5.3.4. Refrigerated Warehousing

- 5.3.5. Specialized Warehousing

- 5.3.6. Container Freight Stations

- 5.3.7. Others

- 5.4. Western Europe Warehousing And Storage Market Analysis, Opportunity and Forecast, By By Ownership, 2016-2032

- 5.4.1. Western Europe Warehousing And Storage Market Analysis by By Ownership: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Ownership, 2016-2032

- 5.4.3. Private Warehouses

- 5.4.4. Public Warehouses

- 5.4.5. Contract Warehouses

- 5.5. Western Europe Warehousing And Storage Market Analysis, Opportunity and Forecast, By By End-User Industry, 2016-2032

- 5.5.1. Western Europe Warehousing And Storage Market Analysis by By End-User Industry: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User Industry, 2016-2032

- 5.5.3. Manufacturing

- 5.5.4. Retail

- 5.5.5. Food and Beverage

- 5.5.6. Healthcare

- 5.5.7. Consumer Goods

- 5.5.8. Others

- 5.6. Western Europe Warehousing And Storage Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.6.1. Western Europe Warehousing And Storage Market Analysis by Country : Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.6.2.1. Germany

- 5.6.2.2. France

- 5.6.2.3. The UK

- 5.6.2.4. Spain

- 5.6.2.5. Italy

- 5.6.2.6. Portugal

- 5.6.2.7. Ireland

- 5.6.2.8. Austria

- 5.6.2.9. Switzerland

- 5.6.2.10. Benelux

- 5.6.2.11. Nordic

- 5.6.2.12. Rest of Western Europe

- 6. Eastern Europe Warehousing And Storage Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Warehousing And Storage Market Analysis, 2016-2021

- 6.2. Eastern Europe Warehousing And Storage Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Warehousing And Storage Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 6.3.1. Eastern Europe Warehousing And Storage Market Analysis by By Type: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 6.3.3. General Warehousing

- 6.3.4. Refrigerated Warehousing

- 6.3.5. Specialized Warehousing

- 6.3.6. Container Freight Stations

- 6.3.7. Others

- 6.4. Eastern Europe Warehousing And Storage Market Analysis, Opportunity and Forecast, By By Ownership, 2016-2032

- 6.4.1. Eastern Europe Warehousing And Storage Market Analysis by By Ownership: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Ownership, 2016-2032

- 6.4.3. Private Warehouses

- 6.4.4. Public Warehouses

- 6.4.5. Contract Warehouses

- 6.5. Eastern Europe Warehousing And Storage Market Analysis, Opportunity and Forecast, By By End-User Industry, 2016-2032

- 6.5.1. Eastern Europe Warehousing And Storage Market Analysis by By End-User Industry: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User Industry, 2016-2032

- 6.5.3. Manufacturing

- 6.5.4. Retail

- 6.5.5. Food and Beverage

- 6.5.6. Healthcare

- 6.5.7. Consumer Goods

- 6.5.8. Others

- 6.6. Eastern Europe Warehousing And Storage Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.6.1. Eastern Europe Warehousing And Storage Market Analysis by Country : Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.6.2.1. Russia

- 6.6.2.2. Poland

- 6.6.2.3. The Czech Republic

- 6.6.2.4. Greece

- 6.6.2.5. Rest of Eastern Europe

- 7. APAC Warehousing And Storage Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Warehousing And Storage Market Analysis, 2016-2021

- 7.2. APAC Warehousing And Storage Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Warehousing And Storage Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 7.3.1. APAC Warehousing And Storage Market Analysis by By Type: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 7.3.3. General Warehousing

- 7.3.4. Refrigerated Warehousing

- 7.3.5. Specialized Warehousing

- 7.3.6. Container Freight Stations

- 7.3.7. Others

- 7.4. APAC Warehousing And Storage Market Analysis, Opportunity and Forecast, By By Ownership, 2016-2032

- 7.4.1. APAC Warehousing And Storage Market Analysis by By Ownership: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Ownership, 2016-2032

- 7.4.3. Private Warehouses

- 7.4.4. Public Warehouses

- 7.4.5. Contract Warehouses

- 7.5. APAC Warehousing And Storage Market Analysis, Opportunity and Forecast, By By End-User Industry, 2016-2032

- 7.5.1. APAC Warehousing And Storage Market Analysis by By End-User Industry: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User Industry, 2016-2032

- 7.5.3. Manufacturing

- 7.5.4. Retail

- 7.5.5. Food and Beverage

- 7.5.6. Healthcare

- 7.5.7. Consumer Goods

- 7.5.8. Others

- 7.6. APAC Warehousing And Storage Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.6.1. APAC Warehousing And Storage Market Analysis by Country : Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.6.2.1. China

- 7.6.2.2. Japan

- 7.6.2.3. South Korea

- 7.6.2.4. India

- 7.6.2.5. Australia & New Zeland

- 7.6.2.6. Indonesia

- 7.6.2.7. Malaysia

- 7.6.2.8. Philippines

- 7.6.2.9. Singapore

- 7.6.2.10. Thailand

- 7.6.2.11. Vietnam

- 7.6.2.12. Rest of APAC

- 8. Latin America Warehousing And Storage Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Warehousing And Storage Market Analysis, 2016-2021

- 8.2. Latin America Warehousing And Storage Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Warehousing And Storage Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 8.3.1. Latin America Warehousing And Storage Market Analysis by By Type: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 8.3.3. General Warehousing

- 8.3.4. Refrigerated Warehousing

- 8.3.5. Specialized Warehousing

- 8.3.6. Container Freight Stations

- 8.3.7. Others

- 8.4. Latin America Warehousing And Storage Market Analysis, Opportunity and Forecast, By By Ownership, 2016-2032

- 8.4.1. Latin America Warehousing And Storage Market Analysis by By Ownership: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Ownership, 2016-2032

- 8.4.3. Private Warehouses

- 8.4.4. Public Warehouses

- 8.4.5. Contract Warehouses

- 8.5. Latin America Warehousing And Storage Market Analysis, Opportunity and Forecast, By By End-User Industry, 2016-2032

- 8.5.1. Latin America Warehousing And Storage Market Analysis by By End-User Industry: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User Industry, 2016-2032

- 8.5.3. Manufacturing

- 8.5.4. Retail

- 8.5.5. Food and Beverage

- 8.5.6. Healthcare

- 8.5.7. Consumer Goods

- 8.5.8. Others

- 8.6. Latin America Warehousing And Storage Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.6.1. Latin America Warehousing And Storage Market Analysis by Country : Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.6.2.1. Brazil

- 8.6.2.2. Colombia

- 8.6.2.3. Chile

- 8.6.2.4. Argentina

- 8.6.2.5. Costa Rica

- 8.6.2.6. Rest of Latin America

- 9. Middle East & Africa Warehousing And Storage Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Warehousing And Storage Market Analysis, 2016-2021

- 9.2. Middle East & Africa Warehousing And Storage Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Warehousing And Storage Market Analysis, Opportunity and Forecast, By By Type, 2016-2032

- 9.3.1. Middle East & Africa Warehousing And Storage Market Analysis by By Type: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Type, 2016-2032

- 9.3.3. General Warehousing

- 9.3.4. Refrigerated Warehousing

- 9.3.5. Specialized Warehousing

- 9.3.6. Container Freight Stations

- 9.3.7. Others

- 9.4. Middle East & Africa Warehousing And Storage Market Analysis, Opportunity and Forecast, By By Ownership, 2016-2032

- 9.4.1. Middle East & Africa Warehousing And Storage Market Analysis by By Ownership: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Ownership, 2016-2032

- 9.4.3. Private Warehouses

- 9.4.4. Public Warehouses

- 9.4.5. Contract Warehouses

- 9.5. Middle East & Africa Warehousing And Storage Market Analysis, Opportunity and Forecast, By By End-User Industry, 2016-2032

- 9.5.1. Middle East & Africa Warehousing And Storage Market Analysis by By End-User Industry: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By End-User Industry, 2016-2032

- 9.5.3. Manufacturing

- 9.5.4. Retail

- 9.5.5. Food and Beverage

- 9.5.6. Healthcare

- 9.5.7. Consumer Goods

- 9.5.8. Others

- 9.6. Middle East & Africa Warehousing And Storage Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.6.1. Middle East & Africa Warehousing And Storage Market Analysis by Country : Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.6.2.1. Algeria

- 9.6.2.2. Egypt

- 9.6.2.3. Israel

- 9.6.2.4. Kuwait

- 9.6.2.5. Nigeria

- 9.6.2.6. Saudi Arabia

- 9.6.2.7. South Africa

- 9.6.2.8. Turkey

- 9.6.2.9. The UAE

- 9.6.2.10. Rest of MEA

- 10. Global Warehousing And Storage Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Warehousing And Storage Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Warehousing And Storage Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Deutsche Post DHL Group

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. XPO Logistics, Inc.

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Ryder System, Inc.

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. NFI Industries, Inc.

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Kuehne + Nagel International AG

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Geodis

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. (US$ Mn & Units)ed Parcel Service, Inc. (UPS)

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Nippon Express Co., Ltd.

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Mitsubishi Logistics Corporation

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Genco

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- 1. Executive Summary

-

- Deutsche Post DHL Group

- XPO Logistics, Inc.

- Ryder System, Inc.

- NFI Industries, Inc.

- Kuehne + Nagel International AG

- Geodis

- United Parcel Service, Inc. (UPS)

- Nippon Express Co., Ltd.

- Mitsubishi Logistics Corporation

- Genco